Legal entities and individual entrepreneurs are allowed to use several special modes simultaneously if their activities are carried out in different directions. When combining the simplified tax system with UTII, entrepreneurs have an obligation to separate all accounting transactions according to their belonging to the segment of work in a specific tax regime. Both taxation systems are characterized by the procedure of calculation and subsequent payment of a single tax, but the objects of taxation differ.

USNO + UTII: what to consider when organizing separate accounting ?

Why do you need separate accounting of income and expenses when combining two special modes?

If a taxpayer applies two taxation regimes in his activities at once - the simplified tax system and the UTII, then, according to clause 8 of Art.

346.18, he must keep separate records of income and expenses for them. ATTENTION! Starting from 2021, UTII will cease to be valid throughout the country. But a number of subjects have decided to abandon the special regime now. See here for details.

Well-organized separate accounting of the simplified tax system and UTII allows you to easily track the amount of income received under the simplified system. And this is necessary, because if the taxpayer has large turnover, then he needs to monitor quarterly whether the income does not go beyond what is allowed for the simplified tax system. Otherwise, he will be forcibly transferred to the general taxation regime (clause 4.1 of Article 346.13 of the Tax Code of the Russian Federation), and since the declaration is submitted at the end of the year, then from the beginning of the quarter in which the excess occurred, additional taxes and penalties will be charged to him.

It is necessary to organize separate accounting in the field of remuneration payments to employees of the enterprise. In this way, insurance premiums are “divided” according to special regimes. This is necessary for the following reasons:

- with the simplified tax system with the object “income” and UTII, the accrued tax can be reduced on them (clause 3.1 of article 346.21 of the Tax Code of the Russian Federation, clause 2 of article 346.32 of the Tax Code of the Russian Federation, respectively).

- under the simplified tax system with the object “income minus expenses”, they are taken into account in expenses.

The taxpayer should keep separate records of employees, dividing them by type of activity.

More information about the procedure for maintaining separate accounting can be found in the material “The procedure for separate accounting under the simplified tax system and UTII .

How does the IP think?

Why should I keep any records, I don’t have to do it. Yes, I keep KUDIR on the simplified tax system, but why keep records on UTII if the tax is still not on real income? What's the result? But in the end, sooner or later there comes a time when separated information is required. The simplest example is that you need to divide your insurance premiums to reduce taxes on them. And without separate accounting data, you will not be able to do this correctly. To be honest, I don’t understand entrepreneurs who don’t keep any records at all. Even if you are on UTII and are not required to maintain KUDIR, you still need to record income/expenses for yourself.

How to properly keep separate income records

To correctly calculate tax under the simplified tax system, neither income nor expenses incurred as part of activities carried out using UTII can be taken into account. According to paragraph 10 of Art. 346.6, paragraph 8 of Art. 346.18, paragraph 7 of Art. 346.26 of the Tax Code of the Russian Federation, they should be taken into account separately.

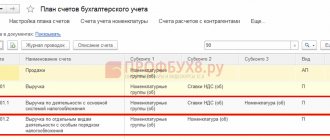

In accounting, you need to enter into the working chart of accounts additional subaccounts designed to reflect income and expenses by type of activity. In addition, separate sub-accounts will be needed for those operations that were carried out outside the framework of both regimes.

The organization of separate accounting is clearly shown in ConsultantPlus using a practical example.

Get trial access to K+ and see the solution proposed by experts.

The mechanics of separate income accounting are simple: you need to take into account revenue for each type of activity separately. Thus, income from UTII should include not only revenue received from sales, but also other income within this type of activity. The Ministry of Finance of Russia in letters dated 02/16/2010 No. 03-11-06/3/22 and dated 01/28/2010 No. 03-11-06/3/11 indicated that the term “other income” means income received for that the taxpayer has fulfilled certain conditions of the suppliers (discounts, premiums, bonuses). In such circumstances, the condition must be met that the income was received within the framework of UTII. Similar requirements are contained in the letter of the Ministry of Finance dated May 22, 2007 No. 03-11-04/3/168 in relation to income in the form of surpluses discovered during internal audits and penalties awarded to the taxpayer for late payments to its debtors.

It may happen that wholesale trade is carried out using the simplified tax system, and retail trade is carried out using UTII. Then the already mentioned discounts, premiums and bonuses are allowed to be attributed to income that is subject to UTII. Naturally, subject to the principles of separate accounting. However, in the letter of the Ministry of Finance of Russia dated September 12, 2008 No. 03-11-04/3/430 there is a very noteworthy clause. It says that if income received in the form of discounts, bonuses or bonuses cannot clearly be attributed to one type of activity, then they cannot be distributed among types of activity.

It should be noted that the specified letter mentions UTII and the general taxation system. However, there are no obstacles to the application of clarifications for another combination of regimes - UTII and simplified tax system.

If the activity is carried out only within the limits of UTII, then the indicated income can be safely taken into account within the framework of this special regime. Confirmation of the thesis can be found in letters of the Ministry of Finance of Russia dated July 1, 2009 No. 03-11-06/3/178, dated May 15, 2009 No. 03-11-06/3/136.

Read about what types of activities the simplified tax system can be used for here.

Accounting is being kept!

Thus, the first thing that needs to be recorded in the accounting policy, both in the simplified tax system section and in the UTII section, is that the enterprise maintains separate accounting for “general” costs.

In the section revealing the taxation rules under the simplified tax system, you can write, for example, the following:

Order

on the adoption of accounting policies at the enterprise

Order No. 80 “30” December 2009

Section I. Simplified taxation system.

If, along with activities subject to a single tax under the simplified tax system, business activities taxed by UTII are carried out, separate accounting is ensured by using the appropriate subaccounts of the enterprise’s working chart of accounts, as well as analytical and synthetic accounting registers in the context of taxable and non-taxable under the simplified tax system business transactions, property and liabilities.

And in the UTII section you can place a similar phrase:

Order

on the adoption of accounting policies at the enterprise

Order No. 80 “30” December 2009

Section II. A single tax on imputed income.

If, along with activities subject to a single tax on imputed income, other types of business activities are carried out, separate accounting is ensured by using the appropriate subaccounts of the enterprise’s working chart of accounts, as well as analytical and synthetic accounting registers in the context of taxable and non-taxable UTII economic entities transactions, property and liabilities.

How to properly maintain separate cost accounting

Separate accounting of income, based on the above, is not difficult. Taking into account costs, everything is much more complicated. Especially if the simplified tax system with the object “income minus expenses” is used with UTII. Let's take a closer look at this combination.

When combining the mentioned tax regimes, expenses that cannot be attributed directly to each of the regimes, in accordance with clause 8 of Art. 346.18, paragraph 10 of Art. 346.6 of the Tax Code of the Russian Federation, should be distributed in proportion to the income attributable to these types of activities.

In practice, however, the taxpayer faces two questions:

- What income is meant when determining shares - all or just revenue?

- What period is taken to determine the proportion?

Let's try to figure this out.

Income taken into account when determining the proportion

It is believed that the most correct decision would be to choose revenue for each type of activity as income for calculating the proportion. The income referred to in Art. 251 of the Tax Code of the Russian Federation, and then non-operating income will not participate in determining the proportion. The letter of the Ministry of Finance of Russia dated November 23, 2009 No. 03-11-06/3/271 is also aimed at this decision.

It seems legitimate to apply this approach to income related to the sale of used property and other similar income.

Let us recall that revenue under the simplified tax system and UTII is determined as follows:

- under the simplified tax system, the cash method is used in accordance with clause 1 of Art. 346.17 of the Tax Code of the Russian Federation (see also letter of the Ministry of Finance of Russia dated January 17, 2008 No. 03-11-04/3/5);

- for UTII, accounting data is taken according to letters of the Ministry of Finance of Russia dated April 28, 2010 No. 03-11-11/121 and dated January 17, 2008 No. 03-11-04/3/5.

Nevertheless, when determining the proportion of income, specialists from the Ministry of Finance in a number of letters (for example, dated April 28, 2010 No. 03-11-11/121 and dated November 23, 2009 No. 03-11-06/3/271) recommend using the cash method and for UTII.

Let us add that there is another tax regime - the Unified Agricultural Tax, which provides for the cash method when determining income. Apparently, when combining this special regime and UTII, it will be possible to use the approach described above to determine the proportion.

Tax on previously received income

Situation: should a simplified organization pay a single tax on income received from the sale of goods last year, if last year the organization was engaged only in wholesale trade, and this year the organization began to engage in retail trade, which is subject to UTII?

Answer: yes, it should.

If this year the organization has not lost the right to use the simplified tax regime, it must pay a single tax on payments received for goods that were sold in bulk last year. The payment amount must be included in income in the tax period in which the funds were received into its current account or cash register. That is, this year. This conclusion follows from the provisions of paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation. Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated July 24, 2008 No. 03-11-04/2/113.

The period within which the proportion is determined

The Ministry of Finance in letters dated 04/28/2010 No. 03-11-11/121, dated 11/23/2009 No. 03-11-06/3/271 explains that when determining the proportion of income within the framework of UTII, as well as for the simplified tax system with the object “income minus expenses” should be determined on an accrual basis from the beginning of the year. The tax period is not taken as a guideline here, since for UTII it is equal to a quarter, and for the simplified tax system it is equal to a year.

Let us note that this instruction strongly diverges from previously published letters from the same Ministry of Finance dated November 20, 2007 No. 03-11-04/2/279, dated October 15, 2007 No. 03-11-04/3/403. In them, ministry specialists insisted that expenses should be determined every month based on revenue and monthly expenses.

But now we have finally settled on an annual cycle of calculating expenses on an accrual basis.

Read about the features of combining UTII and simplified tax system in the material “Features of combining the UTII and simplified tax system modes at the same time .

How to keep separate records of insurance premiums when combining two special regimes

Employers using UTII and the simplified tax system are no exception: they must pay insurance premiums for all employees. The tax regime does not play a role here. Moreover, individual entrepreneurs are required to pay insurance premiums for themselves.

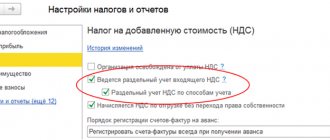

The need for separate accounting of insurance premiums is determined by the following points:

- at UTII, according to clause 2 of Art. 346.32 of the Tax Code of the Russian Federation, and the simplified tax system with the object “income”, according to paragraph. 2 p. 3 art. 346.21 of the Tax Code of the Russian Federation, the amount of accrued tax can be reduced by the amount of insurance premiums;

- under the simplified tax system with the object “income minus expenses”, according to subparagraph. 7 clause 1 art. 346.16 of the Tax Code of the Russian Federation, as well as under the Unified Agricultural Tax, in accordance with subparagraph. 7 paragraph 2 art. 346.5 of the Tax Code of the Russian Federation, the amounts of insurance premiums are taken into account in expenses.

In other words, insurance premiums must be broken down by type of activity. This is usually achieved by separately accounting for income payments to employees of the enterprise. It’s not difficult to organize: you need to keep separate records of workers involved in a particular activity. Moreover, it must be maintained regardless of the use of the physical indicator “number of employees” in UTII.

In accounting, for 2 accounts - 70 “Settlements with personnel for wages” and 69 “Calculations for social insurance and security” - subaccounts are created into which accrued income and the amounts of insurance contributions related to them will be distributed by type of activity. Accounting for accruals will need to be kept for three categories of employees:

- for those employed in activities that are subject to UTII;

- engaged in activities for which the simplified tax system is applied;

- workers engaged in both types of activities.

Data for the first 2 categories will go directly to a specific type of activity, and the 3rd category will require distribution.

Employees are questionable

In practice, it is often unclear how to keep separate records of insurance premiums if employees cannot be divided by type of activity. Then one of three methods is used.

- The essence of the first method is that the amounts of insurance premiums are distributed proportionally according to the available share of income received by the company under the UTII or simplified tax system. When calculating UTII and simplified tax system “income”, contributions must be distributed in the same way as general expenses.

- The second method is based on the distribution of contributions in proportion to the received revenue parameter. The distribution in this situation should be monthly.

- The third method is based on distribution, which is rare today, in proportion to the specific gravity of payments. That is, income paid to employees is distributed in proportion to the revenue received from a specific activity relative to the total within the two regimes.

Results

The simultaneous application of the simplified tax system and UTII requires the taxpayer to organize separate accounting of income and expenses related to each of these regimes. Moreover, in this situation, accounting for both income (which correlates well with types of activity) and expenses (which cannot always be directly attributed to a specific type of activity) acquires its own characteristics.

Expenses that are not directly attributable to one of the special regimes must be distributed. This will make it possible not only to reliably determine their value taken into account under the simplified tax system with the object “income minus expenses”, but also to correctly calculate the amounts by which the accrued tax amounts can be reduced under the simplified tax system “income” and UTII.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.