You can be involved in work on weekends without the consent of the employee:

- to prevent an industrial accident, catastrophe or natural disaster;

- to prevent accidents, destruction or damage to property;

- to perform work the need for which is due to the introduction of a state of emergency, urgent work under emergency circumstances.

Creative workers from cinema, theater, media, etc. can be recruited to work on weekends and holidays according to the rules established by the collective agreement.

On this topic:

Will time off for working on a weekend affect my salary?

In other cases, employment on weekends and holidays is permitted with the written consent of the employee and taking into account the opinion of the trade union.

Disabled people and women with children under three years of age can be recruited to work on weekends and holidays only with their consent, unless such work is prohibited for medical reasons.

These employees must be informed in writing of their right to refuse to work on a weekend or holiday.

We pay for the New Year holidays 2020-2021 correctly

Let's look at one example that helps you understand how to pay for holidays, even if they are only part of the schedule.

There is a schedule according to which a subordinate works 12 hours for 16 days. Of the total, two holidays stand out. The rate for one hour of work is 150 rubles.

Two days with 12 hours of work are paid using the double tariff. We multiply 150 by 24 and multiply by 2. The result is 7200.

Such increases are permissible for employees representing one of the following categories:

- When using the piecework payment option. That is, when the determining factor is the actual quantity of services and goods produced.

- With daily or hourly rates.

- Workers who receive a standard salary.

If an enterprise’s internal documents indicate a smaller amount of payment for holidays than usual, this is a direct violation of current legal requirements. Such decisions are easy to appeal when going to court.

In this case, an employee can choose to receive additional rest if he not only works on weekends and holidays, but also exceeds the established standards for labor results.

First of all, we note that the day before the holiday, employees work 1 hour less (Article 95 of the Labor Code of the Russian Federation). For example, with an 8-hour working day on a holiday, employees can work for 7 hours and then go home. If the employer demands to work 8 hours, then the eighth hour of the employee’s work will become overtime. You will either have to pay it at one and a half times the rate, or give the employee additional rest time of 1 hour.

Increased holiday pay for a shift work schedule is assigned from 00:00 to 24:00 on an official holiday. The previous day is considered pre-holiday.

If according to the work schedule the shift falls on a pre-holiday day, then it will be paid at the standard rate. Legislators did not provide any exceptions. But there is one important nuance. The work shift on the day before the holiday is shorter by one hour. Such standards are provided for in Article 95 of the Labor Code of the Russian Federation.

It is not always possible to shorten a work shift. In an enterprise with uninterrupted operation, such a situation is unacceptable. What to do?

If shortening the work shift on a pre-holiday day is not possible, then the employer is obliged to provide subordinates with additional rest time. Or, by agreement with the employee, pay for overtime at an increased rate. It is important that the employee’s consent to replace rest with additional payment is documented.

Example.

From specialists Bukashka A.B. and Zhuchkova P.P. The shift fell on March 7th. It is not possible to reduce working hours. Zhuchkov demanded additional time off; for the day he worked on March 7, he was paid at the usual rate.

The bug decided to get an extra payment. He was paid double for an hour of overtime, as agreed with the employer.

Work on Saturday and Sunday cannot be equated to work on a day off by a person working on a shift schedule. For him, days off are determined solely taking into account shifts.

Work schedules are approved once at the end of the year and immediately for the entire next year.

Employees must be familiar with them by signature.

When a person working according to such a schedule goes out to work on Saturday and Sunday, he is paid in a single amount. Only holidays that are approved national holidays are subject to double payment.

In accordance with the norms of Article 112 of the Labor Code of the Russian Federation, piece workers and employees receiving wages at tariff rates are paid additional remuneration for the New Year holidays. The amount and procedure for payment of remuneration is determined by the employment contract or regulations on remuneration. In such organizations, local regulations, an employment contract or a collective agreement establish the procedure for calculating the average salary in months that fall on non-working holidays. These are increased rates and surcharges. Are salaried employees paid for New Year holidays? Yes, as usual. All employees receiving a salary must be paid for January 2021 in the same amount as in other calendar months. For workers on a piecework basis, the salary for January does not differ from other calendar months due to the recalculation of the cost of the shift.

Who should not be called on holidays?

Some categories of citizens cannot be involved in work outside normal hours. So, in particular, Article 268 of the Labor Code of Russia prohibits calling minor workers on holidays. The same norm, but in relation to pregnant employees, is given in Art. 259 of the same code of laws.

Also, workers who have certain limitations due to poor health or life circumstances cannot be disturbed. This category includes:

- mothers with children under 3 years of age;

- single parents (or guardians) who have children under 5;

- disabled people;

- citizens caring for sick relatives (after presenting a medical report confirming that a loved one is not able to care for themselves);

- persons who are dependent on disabled children.

It is permissible to call these people at odd hours only in emergency situations, and even then only with their consent.

Payment on holidays and weekends with a shift schedule of the Labor Code of the Russian Federation 2021

The Labor Code does not contain a ban on granting leave during the holidays - from January 1 to January 10, 2021, but it must be taken into account that it is extended by the number of non-working days falling on it. According to Art. 120 of the Labor Code of the Russian Federation, non-working holidays falling during the period of the annual main or annual additional paid rest are not included in the number of calendar days of vacation. Let's say an employee takes vacation from January 1 to January 14, 2021 and does not indicate the date of return to work and the number of days of vacation. In this case, his vacation is automatically extended by the number of non-working holidays - by eight days. That is, according to the Labor Code, the employee’s rest will last until January 22, and he must appear at work on January 23, 2021. To avoid conflict situations and misunderstandings, we recommend specifying the number of days and date of return to work in the application.

In accordance with Article 136 of the Labor Code of the Russian Federation, payment for vacation is made no later than three days before its start. Thus, payment for vacations falling during the New Year holidays occurs strictly until December 29, 2020. Payment for New Year's holidays with a shift schedule in 2021 or when working on a salary when going on vacation is not provided. The employee receives only the required vacation pay.

The long-awaited time for Russians will soon come - the month when the whole country celebrates not only public holidays, but also church holidays - Christmas. January has the largest number of non-working days. The last working day of 2021 is Thursday, December 31st. The New Year holidays will last until January 10 inclusive. We start work on January 11, 2021. The production calendar for 2021 stipulates which days in January are paid double - from January 1 to January 10, if the employee is forced to work during this period.

January, like May 2021, are the optimal months for those who want to relax more; they are filled with holidays and have significantly fewer workers. According to the law, if vacation days fall on public holidays, they are not counted as vacation days. That is, if part of the vacation falls on January 1-8, vacation pay will not be paid for these days, but they will not be considered part of the vacation. That is, if the “vacation” is from January 1 to January 13, then only two vacation days will be spent, but vacation pay will only be paid for Thursday and Friday after January 8. Priority in getting days off due to vacation days on January 9 and 10 will be given to parents of children and disabled people. Vacation pay, if the vacation begins on January 9, 2021, must be paid three days in advance, that is, until December 29. But this does not mean that the employer is not obliged to compensate wages for public holidays.

How are New Year holidays paid for in 2021?

All official holidays are specified in Article 112 of the Labor Code of the Russian Federation. As for the New Year holidays, the non-working holidays in January are as follows:

- 1, 2, 3, 4, 5, 6 and 8 - New Year holidays;

- 7 - Nativity of Christ.

Remember these dates so that you understand which days in January are paid double if you have to work during the New Year holidays.

State employees often work on holidays, medical workers are periodically called on duty, and accounting employees need to go out to close the year. The Labor Code of the Russian Federation stipulates whether New Year holidays are paid in state institutions - yes: in a single amount if the employee did not work, and in a double amount if he was involved in work. Labor rules apply to all categories of workers, and public sector employees are no exception. Forced work on weekends and holidays is rewarded double.

The current labor legislation stipulates that work on weekends or holidays is subject to increased pay. According to Article 153 of the Labor Code of the Russian Federation, the employer is obliged to pay for work on holidays an amount of no less than double the person’s basic pay.

It is not prohibited to establish additional payments to employees in a larger volume. If the financial capabilities of the enterprise allow it, then its multiplicity, which differs from the norms of the Labor Code of the Russian Federation, should be fixed in local regulations for the organization: in a collective agreement or regulations on remuneration. It is impossible to establish an additional payment less than that stipulated in Article 153 of the Labor Code of the Russian Federation.

Instead of double pay, the employee has the right to demand additional time off and work on a holiday to receive time off. If time off is provided, double payment is not made. As a result, the employee receives payment for work on a day off as for a regular working day (in a single amount), and also gets an extra day off.

IMPORTANT!

Personal income tax will be withheld from wages for working during the New Year holidays. The accountant will also have to calculate insurance premiums.

Salary workers have a similar situation. Salary is a fixed salary. Salaried employees are paid wages for January 2021 in the same amount as in other months, despite the fact that there are fewer working days in January. For this purpose, the production calendar has established a standard working time of 120 hours in January 2021.

The rules are the same for everyone. Here's how New Year's holidays are paid with a salary in 2021:

- Not less than a single rate, if work on a weekend or non-working holiday was carried out within the monthly working hours.

- When working beyond normal working hours, overtime pay is added to the salary - for the first 2 hours, accrual is made at one and a half times, for subsequent hours - at double (Article 152 of the Labor Code of the Russian Federation).

Despite the reduction in the number of working days (there are only 15 left), this does not affect the salary. If the employee works the required days, he will receive his regular salary. This rule is established in Art. 112 of the Labor Code of the Russian Federation, the presence of holidays in a month cannot serve as a basis for reducing the earnings of salaried employees.

Employees on other systems for holidays on which they did not work are paid remuneration in the amount and manner established by internal regulations.

Payment for holidays in January 2021 with a shift schedule is made based on these standards:

- a separate order on employment on holidays is not issued, since the procedure for organizing work is fixed in the internal labor regulations and a separate schedule;

- Based on general rules, work on holidays with a shift schedule is at least double the normal rate. An increased size can be installed within the enterprise.

Thus, the employer can decide how to pay for holidays in January 2021 for shift personnel, but he cannot pay less than the double tariff rate.

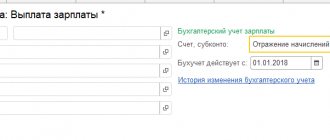

Vacation pay calculation

Sick leave calculation

Income tax calculation

Subscription to the electronic magazine “Chief Accountant. Salary"

Subscription to the print magazine “Chief Accountant. Salary"

Set “ETALON. Salary"

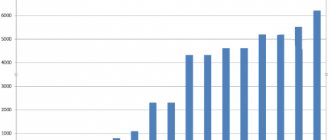

The production calendar for 2021 in January has 15 working days and:

- 120 working hours with a 40-hour work week,

- 108 – at 36 hours,

- 72 – at 24 hours.

For employees who were involved in work on non-working holidays (from January 1 to January 8), as well as on weekends (January 9 and 10), calculate their salary in January 2021 in accordance with Art. 153 Labor Code of the Russian Federation:

- for piece workers - no less than double piece rates;

- for those whose work is paid at daily and hourly tariff rates - not lower than double the daily or hourly tariff rate;

- “salary earners”: not less than a single daily or hourly rate in excess of the salary, if the work was carried out within the monthly working hours;

- in an amount not lower than double the daily or hourly rate in excess of the salary - when working in excess of the monthly working hours.

An employee who worked on these days and decided to take a day off is paid at a single rate.

Working conditions on weekends and holidays

Weekly rest and holidays free from work are an inalienable right of employees, but sometimes the production process requires their presence at the workplace on weekends and holidays.

According to Parts 2 and 4 of Art. 113 of the Labor Code of the Russian Federation, the employer can involve employees in work, subject to their consent and taking into account the opinion of the trade union (if there is one), if there is a need to perform unforeseen urgent work and the further functioning of the organization depends on this. In some situations, employees’ consent to work on weekends and holidays is not required - these are listed in Part 3 of Art. 113 Labor Code of the Russian Federation:

- An accident or disaster is a complex situation that may require the help of a large number of people. An employer can involve employees on days off both to prevent a dangerous situation and to eliminate its consequences.

- The need to prevent accidents and property damage, which requires coordinated and prompt work of the team.

- A threat to the life and well-being of the people, an emergency situation or a military threat.

Important! By virtue of Part 7 of Art. 113 of the Labor Code of the Russian Federation, even in such difficult situations, hiring disabled people and mothers of young children to work on weekends is permissible only on the condition that this does not affect their health. In this case, the employer must obtain a medical certificate and notify each employee in writing of the right to refuse work on a day off.

How are holidays paid under the Labor Code in January 2021?

In January of this year, Russians began to rest on the first of the month and will stay at home until the 10th inclusive. Until January 8 there were holidays, and two more days were regular weekends, Saturday and Sunday. Therefore, for many, at the end of the year, it was not entirely clear how such days off would affect wages, and which days should be paid at double the rate.

In January of this year, Russians began to rest on the first of the month and will stay at home until the 10th inclusive. Until January 8th there were holidays and two more days - regular weekends (Saturday and Sunday). Therefore, at the end of 2021, it was not entirely clear to many how such days off would affect wages and which days should be paid double.

If a holiday falls on a weekend, it is moved to the next working day after the holiday or to a completely different date during the year. In January 2021, these are two days: January 2 and 3. According to the Decree of the Government of the Russian Federation dated October 10, 2020 No. 1648 “On the postponement of weekends in 2021”, from Saturday, January 2, the non-working day will be moved to Friday, November 5, and from Sunday, January 3, to Friday, December 31.

Work on holidays is subject to double pay. But in this case, holidays mean only memorable dates mentioned in the Labor Code of the Russian Federation or regional laws.

Thus, holidays in January 2021, paid double, in accordance with Art. 112 of the Labor Code of the Russian Federation, this is:

- from January 1 to 6 and 8 – New Year holidays (officially appeared in Russia since 2005);

- January 7 is Christmas according to the Orthodox calendar, since this denomination is considered predominant in Russia.

If holidays are introduced in the constituent entities of the Russian Federation, they are also subject to all the guarantees specified in the Labor Code of the Russian Federation, since labor legislation is formed in Russia at the level of the federation and regions.

Important! The employee’s consent, except in cases of force majeure, to work on holidays must be obtained from him in writing (Article 113 of the Labor Code of the Russian Federation).

On January 9 and 10, 2021, how will workers be paid? At what rate?

Not all fields are filled in

Salaries for January will remain the same, which is regulated by the relevant law, Article 112 of the Labor Code of the Russian Federation, which states that wages should remain the same.

Piece-rate employees can count on additional payments if they go to work on holidays or weekends, but only for the specified period. As a rule, all payment terms are stipulated in the employment contract, which each employee is required to sign upon hiring.

Wages on weekends and holidays have a double tariff. This means that if you have to go to work on a day off, your wages will be calculated at a double rate. Part-time hours worked are charged hourly, in accordance with the weekly working time standard.

Due to the large number of weekends and holidays, the following standards are established in January:

- 120 hours – with a 40-hour work week;

- 108 hours – with a 36-hour work week;

- 72 hours – with a 24-hour work week.

Salaries are calculated during the New Year holidays, so the payment schedule will be shifted. For December, most employees will receive wages between December 28 and December 31. Payment for days worked in January will be included in the January salary and will be transferred in February 2021.

The procedure for calculating earnings in the situation under consideration is determined by the form of remuneration. If we are talking about piecework payment, the calculation is carried out depending on the number of products produced by the employee on a holiday and the payment per unit. When working in shifts, the salary and the number of shifts worked are taken into account. When an employee works by the hour, the calculation is carried out depending on the hours worked and the payment per hour, etc. For comparison, several cases can be considered separately.

Situation 1. Let's say an employee is paid by the hour (for each hour worked, relatively speaking, 100 rubles). He worked a certain number of hours on a holiday (for example, 5 hours). To find out the amount of payment for 5 hours worked, you need to multiply the payment for 1 hour by 5 (100 Russian rubles * 5 = 500 Russian rubles). It turns out that on a normal weekday in 5 hours. he will be paid 500 rubles for his work. rub. But since the employee worked these 5 hours. on a holiday, they will pay him twice as much: 500 rubles. rub. * 5 = 1,000 RUR rub.

Situation 2. A pieceworker’s earnings for a holiday are calculated differently. Let's say he is paid 19 RUR for each part manufactured. rub. During the holiday he made 114 parts. It is necessary to calculate the amount that he should be paid for these parts. The total is: 114 children. * 19 ros. rub. = RUR 2,166 rub. This is the amount that the employee must be paid for making parts during the holiday.

Situation 3. The earnings of a shift worker for a holiday are calculated in relation to the production rate. If it is, for example, 10 shifts per month (with a salary of 20 Russian rubles), and one of them falls on a holiday, then the employee must be paid the entire salary (20 thousand Russian rubles) plus an additional payment for the holiday. Actually, the additional payment is calculated as follows: 20,000 RUR. rub. / 10 shifts = 2,000 RUR rub. In total, the employee must be paid for the month: RUR 20,000. rub. + 2,000 RUR rub. = RUR 22,000 rub.

It is self-evident that in all situations, earnings for working on a holiday are doubled. This is the minimum wage that employers must pay to people who worked on public holidays. It should be taken into account that the payment for the holiday is calculated everywhere without providing time off. At the same time, employers have the right to set higher pay, fixing all its amounts locally, in internal regulations.

Editor of the international department Elita Adelaida Vasilievna has been working at Proekt LLC since 01/15/2021. The monthly salary of the employee is 30,000 rubles. rub. In March 2021, Elita A.V. worked fully for 20 days. This means that for March 2021 she must be paid the entire salary (30 thousand Russian rubles), since in March there are only 20 workers. days, 31 cal. days, 11 days off (see production calendar for 2021).

In addition, the editor was involved in work on March 8 (a holiday). According to the Labor Code of the Russian Federation, Adelaide Vasilievna was paid for work on the holiday at double the rate. This amount is calculated as follows: 30,000 / 20 days. * 2 = 3,000 RUR rub. Total for March 2021, editor Elita A.V. received: 30,000 + 3,000 = 33,000 RUR. rub.

In this situation, the employee has the right to ask for paid time off for work on March 8. If it had been provided, then the work would have been paid for the holiday without doubling the amount (30,000 / 20 * 1 = 1,500 Russian rubles).

Calculation of wages for weekends and holidays with a piecework wage system

The law requires piece workers to be paid double rates on weekends. Here is an example of calculating payment on weekends.

For example, seamstress V.P. Mikhailova sewed 50 men's suits in April. At the same time, she went to work twice on Saturday and once on Sunday, making 7 suits during these days. Her earnings for one finished suit is 500 rubles.

First of all, it is necessary to calculate the seamstress’s earnings for April without taking into account work on weekends:

(50 – 7) × 500 = 21,500 rub.

Next, we calculate the payment for work on weekends:

500 × 7 × 2 = 7000 rub.

Now you can calculate the seamstress’s earnings for April:

21,500 + 7000 = 28,500 rub.

The Ministry of Labor has determined the schedule of weekends and holidays for 2021

Error 1. Payment for the work of a shift worker has some features that must be taken into account for correct calculation and calculation of earnings.

If the shift coincides with a weekend, then it must be paid as a regular weekday. But when it coincides with a holiday, the payment increases, that is, it is charged twice the amount, but not less. It should also be taken into account that if this work falls within the standard working hours for the period under review, then time off with a single payment to the shift worker is not provided.

Question No. 1: The manager of the supply department did not work the holiday (February 23) in full. How will he be paid for this day?

If you do not work the entire day (or shift), then payment is also made at an increased rate, but only in proportion to the time worked.

Question No. 2: The security guard worked the entire holiday with the transition to the night of the next day, namely: from 17.00 (02.23.2021) to 8.00 (02.24.2021). How to calculate his earnings for this time? The organization's accounting department charges 20% of the hourly rate for night time. tariff rate.

Calculation of earnings to be paid is carried out taking into account the following points.

First: the period from 17.00 to 22.00 (02/23/2021) is paid double, since we are talking about work on a holiday (daytime).

Second: 2 hours (the period from 22.00 on the holiday 02/23/2021 to 00.00 on a regular working day 02/24/2021) is also paid in double amount with an additional payment of 20%.

Third: work at night for the next day, 02.24.2021 (from 00.00 to 6 am) is paid without doubling, as usual, but with a 20% surcharge.

Fourth: the remaining 2 hours of daily work (from 6.00 to 8 am on 02.24.2021) are paid in the usual way.

The long-awaited time for Russians will soon come - the month when the whole country celebrates not only public holidays, but also church holidays - Christmas. January has the largest number of non-working days. The last working day of 2021 is Thursday, December 31st. The New Year holidays will last until January 10 inclusive. We start work on January 11, 2021. The production calendar for 2021 stipulates which days in January are paid double - from January 1 to January 10, if the employee is forced to work during this period.

Salary consists of several parts - salary, additional payments, allowances and bonuses. Payment is made taking into account additional charges:

- If the compensation, incentive and bonus parts are fixed in the employment contract and are transferred on an ongoing basis (every month), then they will be taken into account when calculating salaries for January 2021.

- If the collective and labor agreements indicate that bonuses are paid periodically and at the discretion of the manager, then bonuses will be included in the January salary by his decision.

IMPORTANT!

The regulations on wages stipulate how, according to the labor law, wages are paid before the new year: if local regulations establish bonuses, additional payments and allowances, then wages for December are calculated along with such compensations. Money is transferred to employees before the last working day in December (December 31, 2020), if the advance was paid before December 23. If the advance was sent on December 24 or later, then the December salary will be sent on the first working day after the holidays - 01/11/2021.

Payment for a holiday is calculated based on the salary or tariff rate, and allowances and additional payments are not taken into account. With the exception of employees who work in harmful and dangerous working conditions. When calculating pay for a holiday, not only the salary is taken into account, but also additional payments established in connection with harmful working conditions.

Only the hours worked by the employee are paid for the holiday, that is, it is determined how many hours (from 0 to 24) were worked on that day.

Work on holidays is marked on the report card with the abbreviation “RV”. When calculating wages, all days marked in this way are paid twice. The following formula is used for calculation:

Orv = O / Nm x V x 2, where

ORV - payment for work on days off;

O – salary;

N – standard working hours per month;

В – time that the employee worked on the day off.

If an employee chooses another day of rest, this is marked on the timesheet with the abbreviation “B” and is not paid.

Let's take a closer look at an example:

Ivanov I.I. works in . Ivanov’s salary is 30,000 rubles. On February 23, 2021, Ivanov went to work on a public holiday and worked 6 hours. The wage regulations of Continent LLC provide for payment for work on a holiday in double the amount based on the salary. Let's calculate the employee's salary for February 2018:

Based on the work time sheet in February, 19 working days (152 hours). Ivanov worked 19 days according to schedule (152 hours) and 1 day (6 hours) - work outside the schedule.

For February the salary will be:

(30,000 / 19 x 19) + (30,000 / 152 x 6 x 2) = 32368.42

Now let’s look at an example where an employee has hourly recording of working hours:

Petrov O.P. works at LLC Continent as a part-time employee. He works 4 hours a day and his salary is 15,000 rubles. Petrov worked on the day off February 23, 2021 for 3 hours. Let's calculate his salary for February:

In February, Petrov’s norm is 19 working days (76 hours). Petrov worked 20 days (79 hours), of which 19 days (76 hours) were on schedule and 1 day (3 hours) was off schedule.

(15,000 / 76 x 76) + (15,000 / 76 x 3 x 2) = 16,184.21 rubles.

How the organization pays for work on a holiday is established in the labor or collective agreement, or in the regulations on remuneration. If it is necessary to make changes to regulatory documents, companies proceed as follows: after negotiations with employee representatives, an additional agreement to the collective agreement is drawn up, after which the additional agreement is sent to the labor inspectorate for registration, and then the additional agreement is presented to the organization’s employees under the signature.

If payment for work on a holiday is established in the wage regulations, then an order is issued to change it. There is no special form for such an order; the main thing is that an acquaintance sheet is attached to it, on which all employees put their signature confirming familiarization.

If the conditions for payment for a working holiday are provided for in the employment contract, then when changes are made, an additional agreement to it is drawn up.

Wording on remuneration on a holiday or day off in regulatory documents.

| Article 153 of the Labor Code of the Russian Federation | “Payment on weekends and non-working holidays” |

| Article 5.27 of the Code of Administrative Offenses of the Russian Federation | “Violation of labor legislation and other regulatory legal acts containing labor law norms” |

| Article 44 of the Labor Code of the Russian Federation | “Amendment and addition to the collective agreement” |

This day falls on Thursday. Therefore, it will be working, but reduced by one hour. School holidays in the state begin on Monday 28 December. Vacations also begin at universities during this period. But students can relax carefree if they pass the exam. Because until December 31st is the reserve time planned for retaking subjects for those who were unable to successfully complete the session the first time.

During this period, the Russian Government announces long weekends. This is a great opportunity to organize a trip to a resort or just go out into the countryside, visit your family and friends, or simply spend time with your family.

Despite the fact that such a long period is convenient and popular with many residents of the country, every year there are proposals to shorten the January holidays. These statements make you think about the question: “how do people vacation in Russia in January 2021?”

We will have a 10-day vacation from January 1st to January 10th. The first working day is January 11th.

In the first month of 2021, holidays and weekends were very conveniently combined, which made it possible to have a long holiday period. You can safely think about how to carry it out effectively with maximum benefit.

The production calendar can tell Russians in detail how they are relaxing in January 2021. This is an official document approved by the Government of the Russian Federation. It indicates all working hours for the month, that is, working days, shortened days, weekends and holidays.

In the first month of 2021 there will be 15 working days and 16 weekends. There are no shortened days.

Based on this calendar, a work schedule for the week was drawn up. This time it corresponds to: 40, 36 and 24 hours a week. And working hours per month: 120, 108 and 72 hours. To calculate all data, a five-day working week was taken as a basis.

For the convenience of celebration, many working days are moved to Saturdays of the next month. In 2021, there are also transfers of days from January to other previous or future months. We show which dates will be shifted and by what date. Transfers planned:

- 02.01 to 05.11.2021;

- 03.01 to 31.12.2021.