Let's look at how to properly maintain separate VAT accounting and what settings to use for this in the 1C: Enterprise Accounting 8 program, ed. 3.0.

No time to read? Cheat sheet on the summary of the article

- Who needs to keep separate VAT records and who doesn’t.

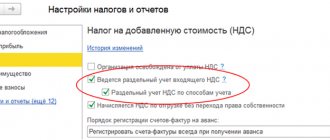

- How to set up separate accounting in 1C in the accounting policy.

- Which method of accounting for PMZ is suitable for separating VAT in different batches of goods?

- How to distribute VAT on fixed assets for separate accounting.

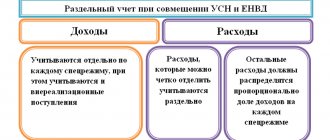

Distribution of VAT for separate accounting

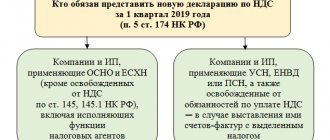

Value added tax amounts presented by suppliers of goods, works, and services must either be deducted (in taxable transactions) or included in the cost of goods and services for calculating income tax (in tax-exempt transactions).

This is indicated in paragraph 4 of Art. 170 Tax Code of the Russian Federation. Moreover, if a company does not maintain separate accounting for VAT, but carries out taxable and tax-exempt activities, then it cannot apply the right to deduct input VAT, nor increase the cost of products by the tax amount (paragraph 6, paragraph 4, article 170 of the Tax Code RF). The same is stated in the letter of the Ministry of Finance dated November 11, 2009 No. 03-07-11/296. The courts also agree with this, as evidenced by the established judicial practice of refusing taxpayers’ claims if they do not keep separate records of VAT (Resolution of the Federal Antimonopoly Service of the West Siberian District dated April 21, 2009 No. F04-2146/2009(4710-A27-19) , F04-2146/2009 (4321-A27-19) in case No. A27-10576/2008).

However, if goods, works, services are used only in relation to taxable transactions, then even in the absence of separate VAT accounting, the taxpayer has the right to exercise the right to deduct for them (letter of the Federal Tax Service dated 02.02.2007 No. ШТ-6-03 / [email protected] ).

ConsultantPlus experts explained the procedure for separate accounting of input VAT:

If you do not have access to the K+ system, get a trial online access for free.

5% threshold

This is another rule that justifies the optional division of input VAT. It is justified in paragraph 9 of paragraph 4 of Art. 170 Tax Code of the Russian Federation. This rule can only be applied by those who have VAT benefits that are timely (quarterly) confirmed.

The 5% rule states : you can ignore input VAT separately if the costs of operations supported by benefits do not exceed 5% of general production costs. In this case, it is allowed to deduct the entire input VAT without including it in the cost of goods, works, and services.

ATTENTION! The 5% rule does not apply to separate accounting of income - it is mandatory to maintain it under appropriate conditions.

If an enterprise conducts only non-taxable transactions and purchases goods (work or services) from another party, the 5% rule is not applicable for this situation: VAT cannot be deducted on these acquisitions (Decision of the Supreme Court of the Russian Federation dated October 12, 2016 No. 305-KG16- 9537 in case No. A40-65178/2015).

For a long time, the application of the 5% rule for UTII payers was controversial - the Ministry of Finance of the Russian Federation in a letter dated 07/08/2005 No. 03-04-11/143 and the Federal Tax Service in a letter dated May 31, 2005 No. 03-1-03/897/ [email protected ] argued that the 5% threshold does not apply to this tax regime. But judicial precedent put an end to this issue, and the Federal Tax Service changed its position, reflecting this in letter dated February 17, 2010 No. 3-1-11 / [email protected] ).

5% threshold in trading activities

The above rule speaks primarily about production costs. But a considerable proportion of organizations and entrepreneurs are not manufacturers, but taxpayers-merchants conducting trading activities. Will this rule be valid for trade?

The Ministry of Finance of the Russian Federation, in a letter dated January 29, 2008 No. 03-07-11/37, allowed the 5% threshold to be extended to trade operations, but did not definitely establish this, but only indicated this possibility.

Meanwhile, there are arbitration precedents establishing the refusal of separate accounting due to the “5% rule” for trading activities. The reason is simple: trade, be it wholesale or retail, is not production; “production” accounts are not used to reflect its operations in accounting.

Increase in expenses in the amount of VAT

If the purchased goods (work, fixed assets, services, intangible assets or property rights) will be used only in tax-exempt activities (the list of such operations is specified in paragraphs 1–3 of Article 149 of the Tax Code of the Russian Federation), then the taxpayer has the right to increase their value by the amount of VAT for subsequent calculation of income tax. This is indicated in paragraph. 2 clause 4 art. 170 Tax Code of the Russian Federation.

The same applies to goods that are sold in a place not recognized as the territory of the Russian Federation.

Operations not included in the distribution of input VAT

The law defines a number of revenues that are not included in sales revenue:

- interest on deposits and balances on bank accounts (letters of the Ministry of Finance of Russia dated March 17, 2010 No. 03-07-11/64 and November 11, 2009 No. 03-07-11/295);

- dividends on shares or shares in the authorized capital of business entities (letters of the Ministry of Finance of Russia dated 03.08.2010 No. 03-07-11/339 and 17.03.2010 No. 03-07-11/64);

- discounts on bills (letter of the Ministry of Finance of Russia dated March 17, 2010 No. 03-07-11/64);

- financing funds received by structural divisions, including branches from parent companies (letter of the Ministry of Finance of Russia dated October 27, 2011 No. 03-07-08/298, resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 30, 2012 No. 2037/12);

- amounts received in accordance with changes in the timing of the provision of funds, including the payment of interest, penalties for early repayment of loans and borrowings, changes in interest rates or other terms of loan agreements (letter of the Ministry of Finance of Russia dated September 6, 2018 No. 03-07-11/63806). Read more here.

According to the rules in force since April 1, 2014, issuers of Russian depositary receipts do not take into account the following transactions (paragraph 8, paragraph 4, article 170 of the Tax Code of the Russian Federation, paragraph “a”, paragraph 4, article 3 and part 2, article 6 Federal Law dated December 28, 2013 No. 420-FZ):

- placement and redemption of Russian depositary receipts;

- acquisition and sale of Russian securities related to the placement or redemption of Russian depositary receipts.

Principles of maintaining separate VAT accounting

1. In one type of activity.

When purchasing goods and services that are entirely used in taxable activities, the taxpayer does not have any difficulties in displaying them in tax accounting. Thus, the buyer will be able to fully accept the VAT presented by the supplier for deduction on the basis of clause 1 of Art. 172 and paragraph 4 of Art. 170 Tax Code of the Russian Federation.

If the purchased goods are fully used in tax-exempt activities, then the entire amount of VAT will be attributed to the increase in their value.

2. In several types of activities.

In cases where the purchased goods, fixed assets (FPE), services, intangible assets (ITA), work or property rights will be used in both taxable and VAT-exempt activities, the distribution of VAT for separate accounting will be special. Then part of the tax presented by the supplier can be used as a deduction, and the other part can be used to increase the cost of the purchase.

In order to determine which amount of tax will be used as a deduction and which will go to increase the cost, it is necessary to calculate the proportion (paragraph 4, clause 4, article 170 of the Tax Code of the Russian Federation).

The taxpayer should make an entry about the received invoice in the purchase book only in that part that will be deducted (clause 2, subparagraph “y”, clause 6, clause 23(2) of the Rules for maintaining the purchase book, approved by decree of the Government of the Russian Federation dated December 26, 2011 No. 1137).

Operations included in expenses when distributing input VAT

In order to distribute the input tax, the cost of shipped goods (work, services) must include goods (work, services) sold on the territory of the Russian Federation and abroad (determination of the Supreme Arbitration Court of the Russian Federation dated June 30, 2008 No. 6529/08).

General business expenses for non-taxable operations on the territory of the Russian Federation must be taken into account in the cost of goods (work, services) that form these expenses. These amounts are not accepted for deduction (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 5, 2011 No. 1407/11).

The use of another, different from the regulated clause 4.1 of Art. 170 of the Tax Code of the Russian Federation, the methodology for drawing up the proportion is illegal (resolution of the Federal Antimonopoly Service of the East Siberian District dated March 20, 2009 No. A33-7683/08-F02-959/09).

Features of calculating proportions for separate VAT accounting

1. Tax period.

The proportion is determined based on data from the tax period, which is a quarter (letters from the Ministry of Finance dated November 12, 2008 No. 03-07-07/121 and the Federal Tax Service dated May 27, 2009 No. 3-1-11 / [email protected] ). The VAT received from the supplier should be distributed in the tax period when the goods were accepted for registration (letter of the Ministry of Finance dated October 18, 2007 No. 03-07-15/159).

The exception is fixed assets and intangible assets that were registered in the first or second month of the quarter. The taxpayer has the right to distribute VAT in accordance with the proportion on these assets based on the results of the month when they were reflected in accounting in connection with their acceptance (subclause 1, clause 4.1, article 170 of the Tax Code of the Russian Federation).

In addition, special rules when calculating proportions apply to:

- operations with financial instruments of futures transactions (subclause 2, clause 4.1, article 170 of the Tax Code of the Russian Federation);

- clearing operations (subclause 3, clause 4.1, article 170 of the Tax Code of the Russian Federation);

- operations to provide a loan in securities or money, REPO operations (subclause 4, clause 4.1, article 170 of the Tax Code of the Russian Federation) or the sale of securities (subclause 5, clause 4.1, article 170 of the Tax Code of the Russian Federation).

2. Formula.

In order to understand how separate VAT accounting is carried out, you should familiarize yourself with the following formulas:

PNDS = SNDS / Commun.

where PVT – proportional VAT to be deducted;

SNDS – the total value of revenue for goods shipped as part of taxable transactions;

Total – the total amount of goods shipped during the reporting period.

VAT = Sneobl / Commun.

VAT – the amount of VAT allocated to increase the cost of goods;

Sneobl - the cost of goods shipped as part of tax-exempt transactions;

Total – the total amount of goods shipped during the reporting period.

See also the material “It is explained how to calculate the proportion for separate accounting if there has been a sale of securities .

The above formulas are derived on the basis of the norms contained in clause 4.1 of Art. 170 Tax Code of the Russian Federation. In this case, when calculating the proportion, one should not take into account those receipts that cannot be recognized as revenue from the sale of goods. This:

- interest on deposits (letter of the Ministry of Finance dated March 17, 2010 No. 03-07-11/64);

- dividends on shares (letter of the Ministry of Finance of Russia dated March 17, 2010 No. 03-07-11/64);

- discounts on bills (letter of the Ministry of Finance of Russia dated March 17, 2010 No. 03-07-11/64);

- amounts received in the form of penalties associated with changes in loan terms (letter of the Ministry of Finance dated July 19, 2012 No. 03-07-08/188);

- financing received by the division from the parent company (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 30, 2012 No. 2037/12);

- transactions of issuers of depositary receipts of Russia for the placement of these receipts, as well as for the purchase and sale of securities related to receipts (paragraph 8, clause 4, article 170 of the Tax Code of the Russian Federation).

When calculating the total amount of goods shipped for the reporting period, sales should be taken into account both in Russia and abroad (determination of the Supreme Arbitration Court of the Russian Federation dated June 30, 2008 No. 6529/08).

It is impossible to use other formulas to calculate proportions - for example, based on the area of premises used for taxable and tax-exempt activities (Resolution of the Federal Antimonopoly Service of the East Siberian District dated March 20, 2009 No. A33-7683/08-F02-959/09) .

3. Amount excluding VAT.

To calculate the proportion, it is necessary to take the cost of shipped goods excluding VAT (letter of the Ministry of Finance dated August 18, 2009 No. 03-07-11/208, Federal Tax Service of Russia dated March 21, 2011 No. KE-4-3/4414). It is necessary to take into account that the established judicial practice fully supports the conclusions of the financial department and controllers.

Officials, the Presidium of the Supreme Arbitration Court of the Russian Federation and lower arbitration courts justify their decisions by the fact that separate accounting for VAT should be in comparable values. Moreover, when calculating both VAT-taxable and non-taxable transactions.

At the same time, some judges do not see in Art. 170 of the Tax Code directly indicates that when calculating the proportion, the amount of VAT must be excluded, and decisions are made in favor of taxpayers who do not agree with the position expressed above.

What if there is temporarily no income?

In practice, sometimes there are certain periods when the company does not conduct business operations that generate income, while expenses are still incurred. This is often observed, for example, among newly registered organizations. It happens that among expenses transactions there are both VAT taxable and preferential ones. Is it necessary to divide such expenses in accounting? After all, there was no actual sale of goods and services.

Until 2015, the Ministry of Finance of the Russian Federation allowed in such cases to neglect separate accounting due to the lack of transactions with VAT benefits. However, in 2015, he voiced a different position regulating separate VAT accounting in such “non-shipment” periods.

Methodology for separate VAT accounting

In ch. 21 of the Tax Code of the Russian Federation does not prescribe the methodology for separate VAT accounting, so taxpayers determine it independently. In practice, enterprises consolidate methodological recommendations for separate VAT accounting in their accounting policies.

If an enterprise actually uses separate accounting for VAT, but this is not reflected in the rules for its maintenance in the accounting policy, then it is possible to challenge the likely denial of the tax authorities’ right to deduction in court. In this case, it is only necessary to provide evidence that such a division is carried out when accounting for VAT.

However, there is also negative judicial practice for taxpayers who could not prove that separate accounting is maintained (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated July 20, 2011 No. F03-2961/2011). Therefore, you should not ignore the reflection of the rules of separate accounting in the accounting policy.

For information on what to do if there was no shipment in a certain period, see the material “Separate accounting of VAT in non-income periods is carried out according to the taxpayer’s rules .

Accuracy of accounting policies for VAT accounting

The organization is authorized to choose the system for introducing separate accounting. Naturally, the adopted standards should be recorded in the accounting policy (clause 2 of article 11 of the Tax Code of the Russian Federation).

But there may be some incidents that should be taken into account related to VAT benefits and the 5% rule. It is not known exactly how costs will be distributed across activities. This will only be clear based on the results of the quarter. What if the 5% threshold is exceeded and separate accounting was not maintained? You will have to restore it, and in some cases also adjust tax returns, which is expensive and inconvenient. Therefore, you need to make a decision whether to stipulate this norm in the accounting policy or not, and if not, then not to use it, even if such a threshold does arise.

Accounting policies are established for a one-year period. But what if an organization has VAT-free activities after it has been submitted to the tax authorities? Give up the opportunity to save money by avoiding separate accounting? No, you can formulate and provide an addition to the accounting policy : this will not be considered a change in it, because such operations arose for the first time, and at the beginning of the reporting period they were not provided for (clause 16 of PBU 1/98 “Accounting policy of the organization”, approved by order of the Ministry of Finance Russia dated December 9, 1998 No. 60n).

FOR YOUR INFORMATION! The accounting policy should list the types of activities that the organization is engaged in: separately - taxable and non-taxable VAT.

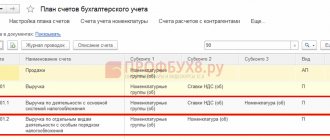

How to maintain separate VAT accounting: postings

It is necessary to open second-order subaccounts to account for VAT received from suppliers. Thus, subaccount 19-1 will collect VAT on goods (services, fixed assets, intangible assets) that are used in both types of activities. 19-2 proposes to accumulate VAT on goods that will be used in taxable activities. Subaccount 19-3 will take into account VAT, which will subsequently increase the cost of goods used in tax-exempt activities.

Example of postings when capitalizing a fixed asset:

May

Dt 08 Kt 60 (equipment accepted from the supplier) - 60,000 rubles.

Dt 19-1 Kt 60 (input VAT included) - 10,800 rubles.

Dt 60 Kt 51 (money transferred to the supplier) - 70,800 rubles.

Dt 01 Kt 08 (equipment accepted for registration) - 60,000 rubles.

June

Dt 44 Kt 02 (depreciation is calculated using the straight-line method, the useful life of the equipment is 4 years) - 1,250 rubles.

March

Dt 19-2 Kt 19-1 (VAT, which will be used as a deduction) - 7,000 rubles.

Dt 19-3 Kt 19-1 (the amount of VAT that will go to increase the cost of equipment) - 3,000 rubles.

Dt 68 Kt 19-2 (VAT accepted for deduction) - 7,000 rubles.

Dt 01 Kt 19-3 (increase in the book value of equipment) - 3,000 rubles.

Dt 44 Kt 02 (additional depreciation for June) - 62.5 rubles.

Dt 44 Kt 02 (depreciation for July) - 1,131.25 rubles.

Determining the proportion when purchasing fixed assets and intangible assets

The distribution of input VAT when purchasing an item of fixed assets and intangible assets can be carried out in a simplified manner if the item was taken into account in the 2nd or 3rd month of the quarter.

The simplified procedure involves drawing up a proportion based on the cost of shipped goods (work, services), taxable or non-taxable with VAT, and the total cost of goods (work, services) for 1 month, and not for the entire tax period (clause 1, clause 4.1, article 170 Tax Code of the Russian Federation).

ATTENTION! In a quarter in which the share of expenses on non-taxable transactions does not exceed 5% of the total amount of expenses, “input” VAT may not be distributed.

Read more about the nuances of applying the 5% rule for separate accounting of input VAT in the ready-made solution from ConsultantPlus. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Example 2

In January 2021, Udacha LLC purchased a machine worth RUB 5,420,100, including VAT RUB 903,350. The equipment is used in activities subject to and non-taxable with VAT. The following turnover was achieved during the quarter:

- in January, the total cost of shipment was 3,150,000 rubles, of which 2,800,000 rubles. - VAT included;

- in February, the total cost of shipment was 3,890,400 rubles, of which 3,500,000 rubles. - VAT included;

- in March, the total cost of shipment was 3,990,000 rubles, of which 3,700,000 rubles. - VAT included.

To determine the amount of VAT accepted for deduction on the machine, we will draw up the proportion for January:

2 800 000 / 3 150 000 = 0,89.

The amount of VAT accepted for deduction will be 903,350 * 0.89 = 803,981.50 rubles. The remaining amount is RUB 99,368.50. (903,350 - 803,981.50) will be included in the cost of the equipment.

Next, we will consider another example of accounting for input VAT when purchasing equipment used in taxable and non-taxable activities, and we will provide the necessary accounting entries.

Example 3

On January 13, 2021, Consult LLC purchased a computer worth 80,000 rubles, including VAT of 13,333.33 rubles. The equipment will be used in both non-taxable and VAT-taxable activities. For the first quarter of 2021, total sales revenue amounted to 850,000 rubles, including revenue from transactions not subject to VAT - 150,000 rubles.

Since the equipment is used in operations subject to and non-taxable with VAT, the amount of VAT is subject to proportional distribution (clause 8 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n, clause 4 of Art. 170 of the Tax Code of the Russian Federation).

To determine the amount of VAT accepted for deduction, a proportion is drawn up:

(850 000 — 150 000) / 850 000 = 0,82.

That is, the share of transactions subject to VAT is 82%.

VAT accepted for deduction is equal to 13,333.33 * 0.82 = 10,933.33. (Clause 1, Clause 2, Article 171, Paragraph 1, 3, Clause 1, Article 172 of the Tax Code of the Russian Federation).

The amount of VAT included in the cost of equipment: 13,333.33 * 0.18 = 2,400 rubles.

To account for VAT on account 19, you must open the following subaccounts:

- 19-1-1 - VAT on fixed assets used in VAT-taxable and non-VAT-taxable transactions;

- 19-1-2 - VAT on fixed assets used to carry out operations subject to VAT;

- 19-1-3 - VAT on fixed assets used to carry out operations not subject to VAT.

Accounting entries for the acceptance of fixed assets for accounting as of January 13, 2021 will be as follows:

Dt 08 Kt 60 - 66,666.67 rub. (OS object purchased);

Dt 19-1-1 Kt 60 - 13,333.33 rub. (input VAT on the purchased OS is reflected);

Dt 60 Kt 51 - 80,000 rub. (payment for the OS object is listed);

Dt 01 Kt 08 — 66,666.67 rub. (the object was put into operation).

The posting for calculating depreciation using the straight-line method as of 02/28/2021 is as follows:

Dt 20 (44) Kt 02 - 1,454.1 rub. (depreciation accrued for February).

Since the useful life of the computer is 4 years, the amount of depreciation is 1,454.1 rubles.

The accounting entries for the distribution of VAT, compiled on March 31, 2021, are as follows:

Dt 19-1-2 Kt 19-1-1 - 10,933.33 rubles (input VAT subject to deduction is reflected);

Dt 19-1-3 Kt 19-1-1 - RUB 2,400.00 (input VAT included in the cost of the fixed asset is reflected);

Dt. 68 Kt. 19-1-2 — 10,933.33 rub. (input VAT is accepted for deduction);

Dt 01 Kt 19-1-3 — 2,400.00 rub. (input VAT is included in the cost of the fixed asset);

Dt 20 (44) Kt 02 — 45.76 rub. (added depreciation for February 2021);

Dt 20 (44) Kt 02 — 1499.86 rub. (accrued depreciation for March 2021).

When is it possible not to maintain separate VAT accounting?

Sometimes situations may arise when a taxpayer carries out taxable and tax-exempt transactions, but he does not have the obligation to maintain separate VAT records.

1. The 5% rule.

Until 2021, taxpayers could not keep separate tax records in those tax periods when the total expenses for operations exempt from VAT (not subject to VAT) are less than or equal to 5% of the total value of all expenses for the production process. During these periods, all amounts of VAT claimed by suppliers were subject to deduction in full. Since 2021, maintaining separate records has become mandatory in such periods. At the same time, the opportunity to deduct the entire tax in them remained.

It is important to remember that when calculating indicators, it is the costs of conducting non-taxable transactions that are used, and not the revenue from such activities (letter of the Ministry of Finance dated September 8, 2011 No. 03-07-11/241). At the same time, when calculating the 5% barrier, expenses for all VAT-free transactions are taken into account, and not for just one (letter of the Federal Tax Service dated August 3, 2012 No. ED-4-3 / [email protected] ).

2. Other cases.

The courts also recognize the right of taxpayers not to keep separate records:

- if the goods were immediately purchased for purposes not subject to VAT, but subsequently their purpose was changed (determination of the Supreme Arbitration Court of the Russian Federation dated June 26, 2008 No. 8277/08);

- if promissory notes of third parties are presented for redemption, taking into account the fact that the main activity subject to VAT is also carried out.

In this case, the Federal Antimonopoly Service of the Moscow District sided with the taxpayer, indicating that he should not keep separate records, since neither general administrative nor production expenses can be included in the costs of purchasing bills of exchange. In addition, in paragraph 4 of Art. 170 of the Tax Code of the Russian Federation does not mention transactions related to the circulation of securities - only commodity transactions (Resolution of the Federal Antimonopoly Service of the Moscow District dated September 23, 2009 No. KA-A40/9481-09).

Checking the correct distribution of expenses

In modern practice, accounting calculations are carried out using special software. The calculation of the proportion for separate accounting is also automated. To check the final data, it is convenient to create special tables from which the entire calculation will be visible: separately for transactions subject to VAT and for non-taxable ones. The table will summarize the main indicators used to calculate the proportion:

- acquisition/sale expenses – transactions not subject to taxation (it is better to list all their types);

- qualifying expenses for taxable transactions;

- total line of direct expenses;

- mixed group of expenses (also list);

- summation.

In order to maintain separate VAT accounting correctly and when it is really necessary, you need to constantly monitor the updating of current information. The rules for maintaining separate accounting for VAT are directly related to updates in the Tax Code of the Russian Federation, which happens constantly, and recently - especially intensively.

Results

The obligation to maintain separate accounting requirements for VAT suppliers arises if the taxpayer carries out both taxable and non-taxable activities. The conditions and principles for maintaining such records are specified in paragraphs. 4 and 4.1 art. 170 of the Tax Code of the Russian Federation, but taxpayers determine its methodology independently.

If an enterprise purchases materials, goods or services that will subsequently be used for both activities, then the proportion according to which the input VAT will be divided should be calculated.

In this case, part of the tax will be used as a deduction when accounting for transactions subject to VAT, and the other share will go to increase the value of assets that were used in transactions not subject to VAT. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Fifthly , decide on the tool (software) and resource accounting algorithm. Currently, the most common programs and “1C: Accounting 8 KORP” do not provide end-to-end analytics for accounts of inventories, non-current assets, accounts of goods, products, cash, accounts of mutual settlements with counterparties and other accounting accounts . You can encode analytical accounting accounts, for example: the first-order subaccount includes the order number (or government contract identifier), the second-order subaccount includes details by type of cost, etc. You can use directories such as: - Item groups - Warehouses - Future expenses periods - Fixed assets To account for mutual settlements with counterparties, use the subaccount detail “Counterparty Agreements”. The most difficult thing is to collect data into a report on the execution of a government contract.

Organizations implementing the State Defense Order, in which military representative offices of the Ministry of Defense of the Russian Federation have been established (military acceptance), provide a report on the execution of the state contract in the form of an electronic document every month no later than the 25th day of the calendar month following the reporting month (rules in Order of the Ministry of Defense of the Russian Federation dated October 8, 2021 No. 554, format in Order of the Ministry of Defense of the Russian Federation dated November 19, 2018 No. 670, terms in Order of the Ministry of Defense of the Russian Federation dated November 21, 2019 No. 686). Other organizations submit a report at the request of the Ministry of Defense on paper. The request is considered received after 10 days from the date of its sending to the address specified in the Unified State Register of Legal Entities.

The ability to automatically generate and upload a report is implemented: - 1C: ERP Enterprise Management 2 - 1C: Integrated Automation 8, edition 2 Manual filling of the reporting form with uploading in the format of the Ministry of Defense of the Russian Federation: - 1C: Integrated Automation 8, edition 1.1 - 1C: Manufacturing Enterprise Management 8, edition 1.3 - 1C: Enterprise Accounting 3.0 - 1C: Enterprise Accounting CORP 2.0 and 3.0 - 1C: Government Accounting 1.0 and 2.0 - 1C: Taxpayer 8

A qualified signature certificate (GOST R 34.10-2012) and an associated private key container are required. Digital signature file - message.sign.

Sixth , consolidate the procedure for separate accounting in the accounting policy. A well-drafted accounting policy will help confirm not only the fact of separate accounting, but also the correctness of the intended use of budget funds.

And most importantly , separate accounting should be not only “on paper”, but also real: in the warehouse, in production, etc. Separate accounting should allow, if necessary, to determine who exactly manufactured the components (which batch), where the components were stored before they were transferred to production. That is, it is necessary to ensure special labeling of raw materials, materials, and PKI. State Defense Order algorithm here

Oddly enough, experienced chief accountants who have their own view of accounting. accounting, during the State Defense Order inspection they are very surprised. It seemed that they had done separate accounting “as it should”, and as a result they received a resolution to initiate a case of an administrative offense with the resolution: “An analysis of the documents provided showed that the LLC does not keep separate records of the results of financial and economic activities in accordance with Resolution No. 47 of January 19. 1998." This happens because in the state defense order, separate accounting is a kind of ritual. Separate accounting should not only exist, it should be accounting in which certain procedures are followed, “dancing with a tambourine”, regarding: - maintaining separate accounting of state defense orders in the accounting program; — wording in accounting policies; — composition and requirements for the preparation of primary documents and document flow; — drawing up planned and reporting cost calculations, expense declarations; — justification (rationing) of costs; — distribution of overhead and commercial expenses (taking into account changes in 2021); — profit standards (profitability); — report on the execution of the government contract; — preparation and defense of basic economic standards of the State Defense Order, etc.

It is good to create separate accounting of state defense orders after consulting with a specialist. The amount of work is large. It’s better to immediately understand exactly where and how to apply efforts, so as not to redo it in the future.

STC APB. Support of state defense orders.

We work from 8:00 to 19:00 Moscow time. You can request a contract by email [email protected] by phone. +7 , or Contacts

A complete list of legislative acts on the responsibility of State Defense Order performers is here.

Participants in state defense procurement carried out through tenders with limited participation, two-stage tenders, closed tenders with limited participation, closed two-stage tenders or auctions are required to provide a certificate of absence from the head , members of the collegial executive body, or person performing the functions of the sole executive body , chief accountant, a criminal record under Articles 201.1, 238, 285, 285.4 and 286 of the Criminal Code of the Russian Federation , issued no earlier than 90 days before the deadline for filing an application for participation in the procurement (Resolution dated July 18, 2019 N 932).

State Defense Order algorithm

Typical errors and inaccuracies in accounting policies and separate accounting of State Defense Orders and State Defense Orders 2021.

STC APB.

Support for State Standards and State Defense Orders: answers to complex questions, contractual documents, forms, reports and calculations, actions during verification, recommendations for separate accounting in 1C: Accounting, etc.

Support for State Defense Orders: answers to complex questions, contractual documents, forms, reports and calculations, actions during verification, recommendations for separate accounting in 1C: Accounting, etc.

STC APB

[email protected] ,+7 .

A government contract often comes with treasury support. How to open a personal account with the treasury, how to make payments and withdraw cash balances here.

How to justify the costs of materials, components, and services here. How to justify labor intensity here List of regulatory documents of the State Defense Order. Answer to the questions: “What to do if products are supplied under the state defense order from existing stocks? How to work with a special account? here Timesheets broken down by project and employee category here

Everyone somehow forgets that there are many benefits for small and medium-sized enterprises (SMB), including those in the state defense order. And this is the vast majority of companies. Who belongs to this category of business, where you can get information about financial support (more than 1,500 types of subsidies ), here. Answers to questions regarding procurement: - who should purchase from SMP and in what volume; — benefits in securing the application; — benefits in ensuring the execution of the contract; — dumping benefits; — benefits when paying; — maximum fines, etc. Here.

You can find out how small businesses can integrate into the technological chain of defense industry enterprises in the process of conversion and import substitution here.

State Defense Terms and Definitions. General provisions here.

State Defense Terms and Definitions. Pricing here.

State Defense Terms and Definitions. Separate accounting here.

What if we grow not only through state defense orders? What to do to get more income , actively develop and expand, without getting entangled in unreasonable debts and loans, you can find out here. Read it, take a break... We promise it will be useful.