Non-profit organizations are those that do not have the goal of making a profit from their activities. Their work has a social orientation. They are created to perform any cultural, religious, scientific and other tasks. In this article we will look at how accounting and tax accounting is carried out in a non-profit organization.

The activities of such associations are regulated by the chart of accounts, certain accounting regulations, as well as the following regulatory documents:

- Law on Accounting No. 402-FZ;

- Civil Code (Civil Code of the Russian Federation);

- Law “On Non-Profit Organizations” No. 7-FZ of January 12, 1996;

- Law “On Public Associations” No. 82-FZ of May 19, 1995.

Features of accounting in non-profit organizations

Non-profit organizations (NPOs) maintain accounting and prepare reports in accordance with the legislation of the Russian Federation. To maintain it, management is obliged to introduce the position of an accountant or draw up an agreement for the relevant services with another company.

Operations related to the activities prescribed in the Charter and entrepreneurship are carried out separately. Income and cost accounts are presented in the table. (click to expand)

| Activity | Check |

| Non-profit | 86 “Targeted financing” |

| Entrepreneurial major | 90 "Sales" |

| Other entrepreneurial | 91 “Other income and expenses” |

Unlike commercial companies, an NPO engaged in entrepreneurship does not have the right to distribute the income received during the period between participants. Profits must be used exclusively to fulfill the statutory goals of the association. The following entry occurs in the accounting:

Dt 90 Kt 99 - reflects the profit received at the end of the reporting period.

At the end of the year 99 close:

Dt 99 Kt 84 - net profit for the year is taken into account;

Dt 84 Kt 86 - financing of statutory work.

If the commercial activities of the NPO resulted in losses, make the following entries:

Dt 99 Kt 90 - loss for the period (month) is taken into account;

Dt 84 Kt 99 - annual loss is reflected.

The loss is covered from certain sources. For example, from the reserve fund, from last year’s profit, additional investments of participants, etc.

The following entries take place:

Dt 76 Kt 84 - the loss is repaid through membership fees;

Dt 86 Kt 84 - due to last year’s profit;

Dt 82 Kt 84 - from the reserve fund.

Example No. 1. Write-off of business results

NPO "Barrier" provides services for a fee. For 2021, income amounted to 614 thousand rubles, expenses - 389 thousand rubles.

Postings are made throughout the year:

Dt 62 Kt 90,614,000 - revenue from business is taken into account;

Dt 90 Kt 20,389,000 - the cost of services has been written off;

Dt 90 Kt 99,225,000 - the result of the association’s work is taken into account.

At the end of the year, the accountant will write:

Dt 99 Kt 84,225,000 - profit written off;

Dt 84 Kt 86,225,000 - annual profit added to target amounts.

An NPO can take property into account as fixed assets if the following conditions are met:

- Application in the work established by the Charter, for the needs of management or entrepreneurship;

- Application for a period exceeding one year;

- Donation or transfer of ownership to other persons is not provided for.

The object is assessed at market value at the time of registration. The cost of fixed assets is reflected by the entry: Dt 08 Kt 86.

For fixed assets, NPOs charge depreciation instead of depreciation, like commercial companies. The data obtained is used when calculating property tax based on the annual average value of fixed assets (Article 375 of the Tax Code of the Russian Federation).

The amount of depreciation is shown on the off-balance sheet account, and fixed assets are shown on the balance sheet at their original cost. Otherwise, the asset will not be equal to the liability. A feature of the accounting of fixed assets received from earmarked funds is the use of accounts. 83. In the balance sheet, its balances are reflected in the line “Real estate and movable property fund”.

How non-profit organizations account for fixed assets

The conditions under which non-profit organizations accept fixed assets for accounting differ from the rules for commercial structures. Here are the criteria for a fixed asset for non-profit organizations:

- period of use of the object – more than 12 months;

- the organization does not plan to sell the property;

- the object is intended for the statutory, entrepreneurial activities of the organization or for its management needs.

Such conditions are written in paragraph 4 of PBU 6/01.

If an NPO has acquired or received free of charge (as a gift) an object that is intended for transfer to third parties, it is not included as a fixed asset. These assets are taken into account as part of materials.

Accounting entries for the receipt of fixed assets will vary depending on how they were received: for a fee or free of charge.

Simplified taxation in non-profit organizations

NPOs have the right to apply simplified taxation. They can choose the simplified tax system upon creation by submitting a corresponding application to the tax office, or switch to the regime during the management process. Restrictions on the use of the simplified tax system are presented in the table.

| Index | Limitation |

| State | No more than 100 people |

| Income for 9 months | Not higher than 45 million rubles. |

| Residual value of funds | Less than 100 million rubles |

| Branches | None |

| NPO is not a manufacturer of excisable products | |

Organizations on the simplified tax system submit a single simplified declaration to the inspectorate every year. They are exempt from paying income taxes, property taxes and VAT. NPOs use a simplified method to calculate the single tax. When taxed “by income”, it is equal to 6% of all income received. With the object “income minus expenses” - 15% of the difference, and if there is no difference - 1%. (see → NPO taxation, rates in 2021)

Revenues used for statutory purposes are not subject to a single tax. This applies to grants, membership fees, donations, and subsidies for targeted needs. Simplified NPOs are required to account for income and expenses of available target amounts separately.

Under this system, the manager has the right to perform the duties of the chief accountant and not resort to the services of other organizations for accounting. The transition to the simplified tax system is beneficial for non-profit organizations engaged in the sale of goods, work for a fee and having taxable property on their balance sheet.

What entries are made when selling fixed assets?

The accounting records for the sale of a fixed asset depend on the NPO taxation system. A set of wiring for the general and simplified system is in the tables below.

Postings when selling fixed assets to non-profit organizations under the general taxation regime

| Contents of operation | Debit | Credit | Sum | Primary document |

| Listed per OS object | 60 | 51 | 60 000 | payment order, bank statement |

| Supplier's invoice accepted | 08 | 60 | 50 847,46 | invoice |

| The amount of VAT on the acquired fixed asset is reflected | 19 | 60 | 9152,54 | invoice |

| The amount of VAT is included in the price of the object | 08 | 19 | 9152,54 | accounting information |

| The object is included in fixed assets | 01 | 08 | 60 000 | act of acceptance and transfer of fixed assets |

| The source of financing for the acquired fixed asset is reflected | 86-2 | 83 | 60 000 | accounting certificate, estimate of income and expenses |

| Accrued depreciation during the operation of the OS object | 010 | 21 000 | accounting certificate-calculation | |

| The buyer's debt for the asset being sold is reflected | 76 | 91-1 | 64 900 | contract, invoice |

| The amount of VAT payable to the budget has been accrued [(64 900 – 60 000) × 18/118] | 91-3 | 68 | 748 | invoice, calculation |

| The original cost of a retiring fixed asset has been written off | 83 | 01 | 60 000 | act of acceptance and transfer of fixed assets |

| Received funds from the OS buyer | 51 | 76 | 64 900 | bank statement |

| The financial result from the sale of an asset has been identified (without taking into account other operations) [64 900 – 748] | 91-9 | 99 | 64 152 | accounting certificate-calculation |

Postings for the sale of fixed assets to non-profit organizations in a simplified manner

| Contents of operation | Debit | Credit | Sum | Primary document |

| Listed per OS object | 60 | 51 | 60 000 | payment order, bank statement |

| Supplier's invoice accepted | 08 | 60 | 50 847,46 | invoice |

| The amount of VAT on the acquired fixed asset is reflected | 19 | 60 | 9152,54 | invoice |

| The amount of VAT is included in the price of the object | 08 | 19 | 9152,54 | accounting information |

| The object is included in fixed assets | 01 | 08 | 60 000 | act of acceptance and transfer of fixed assets |

| The source of financing for the acquired fixed asset is reflected | 86-2 | 83 | 60 000 | accounting certificate, estimate of income and expenses |

| Accrued depreciation during the operation of the OS object | 010 | 21 000 | accounting certificate-calculation | |

| The buyer's debt for the asset being sold is reflected | 76 | 91-1 | 64 900 | contract, invoice |

| The original cost of a retiring fixed asset has been written off | 83 | 01 | 60 000 | act of acceptance and transfer of fixed assets |

| The amount of depreciation accrued during the operation of the asset has been written off | 010 | 21 000 | accounting certificate-calculation | |

| Received funds from the OS buyer | 51 | 76 | 64 900 | bank statement |

| The financial result from the sale of an asset has been identified (without taking into account other operations) | 91-9 | 99 | 64 900 | accounting certificate-calculation |

| Single tax charged for simplification (64 900 × 6%) | 99 | 68 | 3894 | accounting certificate-calculation |

Reporting of non-profit organizations

The composition of the reporting forms differs depending on the types of activities of the NPO. The differences are shown in the table.

| Activity | Reports | Frequency of delivery |

| a commercial | balance sheet how to fill out form 1; profit and loss how to fill out form 2; changes in capital (form 3); movement of money (f. 4); how to fill out form 4 appendix to the balance sheet (form 5); intended use of funds (form 6); explanatory note. | Quarterly |

| Non-profit | Forms No. 1, 2, 6. | Once a year |

In addition to accounting, NPOs submit tax returns for the following:

- VAT;

- property tax;

- income tax;

- land tax;

- transport tax.

Property tax is calculated based on its value according to the cadastre (Article 346.11 of the Tax Code of the Russian Federation). NPOs provide data on the average number of staff and 2-NDFL certificates. NPOs submit Form 4-FSS quarterly to the social insurance fund, and RSV-1 calculations to the pension fund. Read also the article: → “Calculation using the RSV-1 form (reporting for employees to the Pension Fund of Russia).” Form 1-NKO is submitted to the statistical office. It contains data about the work of the organization. Short Form No. 11 is submitted annually and includes data on the availability and movement of fixed assets.

Three forms are submitted to the Ministry of Justice:

- OH0001 - data on the management and nature of the activities of the NPO;

- OH0002 - expenditure of targeted funds and use of assets;

- OH0003 - filled out on the website of the Ministry of Justice.

Information on the personnel of the governing bodies of a non-profit organization (Form No. ON 0001)

Report on the expenditure of funds by a non-profit organization and on the use of other property, including those received from international and foreign organizations, foreign citizens and stateless persons (Form No. ON 0002)

Report on the volume of funds and other property received by a public association from international and foreign organizations of foreign citizens and stateless persons on the purposes of their expenditure or use and on their actual expenditure or use (Form No. ON 0003)

These forms are submitted only by those organizations whose annual receipts exceed 3 million rubles, there are receipts from foreign individuals and companies, or if there are foreigners among the NPO participants.

Receipt of targeted funds

Transactions of receipt of target funds should be correctly reflected.

The program provides two methods for receiving targeted funds:

- Cash method.

- Accrual method.

If you need to reflect the receipt of the CA directly to account 86, then the Cash method is used. If the reflection is carried out through accrual to the account of settlements with the counterparty, then in this case it is necessary to use the Accrual Method.

IMPORTANT

: when receiving targeted funds, it is necessary to indicate “Purpose of targeted funds” and “Source of receipt”.

- Cash method

.

When using the “Cash method” in the receipt documents “Cash receipt” or “Receipt to the current account” with the transaction type “Target receipt”, the “Cash method” checkbox is checked. In this case, target funds are credited directly to account 86.

If, when reflecting the receipt of the CA to account 86, you use not the Cash method, but the accrual method, then in the document it will not be possible to indicate “Purpose of target funds,” which will subsequently lead to errors in accounting.

- Accrual method

.

When using the “Accrual method” in the receipt documents “Cash receipt” or “Receipt to the current account”, the “Cash method” checkbox is not checked.

First, the receipt of the CA is registered in the account for settlements with counterparties, for example, 78.86.

Then, to reflect the receipt of amounts to the target financing account 86, it is necessary to create a document “Accrual of sources of target financing”.

The document can be created using the “Create based on” button.

The document must indicate the source and purpose of the targeted funds. Postings Dt 76.86 Kt 86 are generated:

Accounting for funds in accounts

To record, store, and use cash, NPOs must use a cash register. The cash balance limit is mandatory and is pre-agreed with the credit institution providing services to the entity.

Cash transactions are carried out using cash registers if the organization is engaged in trade or provides services. To accept contributions, donations, and other receipts from individuals, cash register equipment is not needed. Cash transactions are completed using standardized document forms.

NPO participants deposit money into the cash register or into the organization’s account. This procedure must be determined by the head or the Charter of the association.

Receipt of contributions from members of the association is formalized as follows: Dt 50 (51, 52, 55), Kt 86 - the receipt of target funds to the cash desk (account) is reflected. The cash register inventory is carried out in accordance with the legislation of the Russian Federation.

see also

Bankruptcy of individuals and legal entities: similarities and differences

Help with joining an SRO

The amount of debt that will not be issued abroad in 2021

Accounting for intangible assets

Intangible assets (IMA) are accounted for in non-profit organizations on the basis of PBU 14/2007. When accepting them for accounting, the period of planned use for solving the statutory tasks of the organization is established. This period is subject to annual review and clarification. If there are adjustments, they are reflected in accounting and reporting forms at the beginning of the year as changes in estimates.

Depreciation on intangible assets is not accrued in non-commercial organizations, even when they are used in commercial activities (clause 24 of PBU 14/2007). If intangible assets are acquired using business income, then depreciation is allowed.

For example, if you create your own computer program, the postings will be as follows:

Dt 08.5 KT 10, 70, 69 - the costs of creating the product are taken into account;

Dt 04 Kt 08.5 - the program is registered as an intangible asset;

Dt 86 Kt 83 - target amounts were used to create intangible assets.

Where in the balance sheet and its explanations do non-profit organizations reflect fixed assets?

In the Balance Sheet, the value of fixed assets of non-profit organizations is reflected in section 1 in the line “Fixed Assets”. This must be done at the full original cost. Do not reduce it by the amount of wear.

In the explanations to the Balance Sheet, the value of fixed assets of non-profit organizations is reflected in Section 2 “Fixed Assets”, Table 2.1 “Availability and Movement of Fixed Assets”. However, in this NPO table, the columns “Accumulated depreciation” and “Accrued depreciation” are renamed “Accumulated depreciation” and “Accrued depreciation”, respectively. That is, unlike the balance sheet, the table shows both the full original cost and accrued depreciation.

This is stated in Note 6 to Appendix 3 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010.

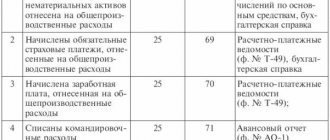

Postings and decoding of operations

Account 86 is used in the following main business transactions.

| Debit | Credit | Explanation of the operation |

| 86 | 20, 26 | Target amounts spent |

| 83 | Amounts spent are included in additional capital | |

| 98 | Target amounts added to future expenses | |

| 07 | 86 | Equipment for statutory events taken into account |

| 08 | Contribution to non-current assets reflected | |

| 10, 11 | Materials (animals) were capitalized as a target receipt | |

| 15 | Inventory taken into account for events according to the Charter | |

| 20 | The main production facility was received | |

| 41 | Goods transferred for targeted programs are taken into account | |

| 76 | Financing accrued |

How to write off fixed assets

The Russian Ministry of Finance recommends writing off fixed assets that can no longer be used in the accounting of non-profit organizations as follows. Reduce the indicators for the groups of articles “Fixed assets” and “Fund of real estate and especially valuable movable property”. At the same time, reduce the amount of wear and tear.

| Contents of operation | Debit | Credit | Sum | Primary document |

| Fixed assets purchased using targeted proceeds or received free of charge have been written off | 83 | 01 | 45 000 | Accounting information |

| Depreciation written off | – | 010 | 45 000 | Accounting information |

This procedure is prescribed in paragraph 6 of the information of the Ministry of Finance of Russia PZ-1/2015.