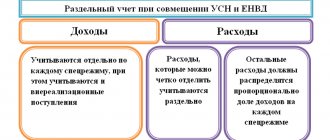

In the case of combining the tax regimes of UTII and the simplified tax system, it is necessary to organize separate accounting of property, liabilities and business transactions in relation to UTII and the simplified tax system (clause 7 of article 346.26 of the Tax Code of the Russian Federation), as well as to organize separate accounting of income and expenses under different tax regimes (clause .8 Article 346.18 of the Tax Code of the Russian Federation). In this article we will study how to maintain separate accounting of the simplified tax system and UTII in 1C 8.3 Accounting. Let's look at step-by-step instructions for setting up separate accounting when combining simplified taxation system and UTII in the 1C 8.3 program.

Responsibility for “ignorance” of separate accounting is not provided for in the Tax Code of the Russian Federation, but this may lead to the fact that the object of taxation for UTII and the tax base according to the simplified tax system will not be correctly determined. Consequently, the amount of calculated taxes will be distorted, additional taxes, penalties and fines will be charged/

Separate accounting also ensures the correct determination of the amount of income that is received within the framework of the simplified tax system to control the maximum amount for the year.

Why distribute costs when combining special modes?

Often, companies and individual entrepreneurs simultaneously use 2 taxation regimes - simplified tax system and UTII.

Each of these regimes has its own characteristics for calculating the taxable base, therefore, when combining special regimes, the law provides for the requirement to maintain separate records of income and expenses received and incurred within each regime. In addition to organizing separate accounting of indicators, firms and individual entrepreneurs combining the simplified tax system with UTII are required to make special distribution calculations - with their help, expenses that are not directly related to the activities of the simplified tax system or UTII are divided.

This way ensures the correct formation of tax bases for each of the special regimes used.

To organize separate accounting and implement distribution procedures, it is necessary:

- prescribe in the accounting policy algorithms for the distribution of expenses related to both applicable tax regimes;

- generate accounting data in such a way that it is possible to reliably determine the taxable bases according to the simplified tax system and UTII.

How to draw up an accounting policy for various tax regimes, read the materials prepared by specialists on our website.

When combining the simplified tax system with UTII in the accounting policy, it is necessary to provide for a number of significant points (base and distribution period, distribution algorithm, etc.) - we will talk about them in the following sections.

Instructions for setting up separate accounting when combining simplified taxation system and UTII in 1C 8.3 Accounting

The algorithm for maintaining separate accounting is not defined in the Tax Code of the Russian Federation, so it must be developed independently and prescribed in the accounting policy.

Persons combining modes must organize separately:

- Accounting for income received from activities on UTII and from activities on the simplified tax system;

- Accounting for costs aimed at the simplified tax system, activities on UTII, as well as those distributed between UTII and the simplified tax system.

- Separate accounting of costs aimed at paying employees and insurance premiums from them.

Base for distribution of general business expenses

If activities within the framework of the simplified tax system and UTII are carried out in the same premises, such common expenses arise as:

- rent;

- payment for electricity, heat and water;

- payment for communication and Internet services;

- other general business services.

They relate simultaneously to the activities of the simplified tax system and UTII and for tax purposes require differentiation.

What is the basis for such a division? Officials of the Ministry of Finance and tax authorities express the following position on this topic - total expenses when combining regimes should be distributed in proportion to the shares of income received under the simplified tax system and UTII, respectively. The basis for this conclusion is clause 8 of Art. 346.18 Tax Code of the Russian Federation.

This method is based on the use of the following calculation formulas:

- determination of the cost distribution coefficient from the simplified tax system (USN):

KUSN = DUSN / (DUSN + DENVD),

Where:

DUSN and DENVD - income from activities on the simplified tax system and UTII, respectively;

Attention! Hint from ConsultantPlus What income should be included in the calculation of the proportion This issue is not regulated in the Tax Code of the Russian Federation. In our opinion, you can include... in the calculation (see K+ for more details).

- calculation of the amount of general business expenses (OKH) attributable to activities under the simplified tax system (OKH STS):

OHR USN = OHR × KUSN.

At the same time, when determining a simplified tax (income minus expenses), only those expenses can be distributed and recognized that:

- paid,

- are included in the acceptable list of simplified taxation expenses.

“List of expenses under the simplified tax system “income minus expenses” will introduce you to the list of allowable expenses .

When applying these formulas, it is necessary to take into account an important condition related to the period of distribution of expenses - learn about this in the next section.

Period of distribution of expenses when combining UTII and simplified tax system

The Tax Code does not establish a period for the distribution of expenses when combining the simplified tax system and UTII. The Ministry of Finance of the Russian Federation recommends distributing expenses not related to specific types on a monthly basis based on revenue (income) and expenses for the month. Then the expenses calculated based on the results of each month are summed up on an accrual basis from the beginning of the year until the reporting date (see letters of the Ministry of Finance of the Russian Federation dated August 27, 2014 No. 03-11-11/42698, dated March 17, 2008 No. 03-11-04/3/121) .

We'll show you what this might look like with an example.

Example

| Period | Income from activities subject to the simplified tax system | Income from activities subject to UTII | Distribution coefficient | General running costs, | ||

| Total | Attributable to activities subject to simplified taxation system | Attributable to activities subject to UTII | ||||

| 1 | 2 | 3 | 4 = 2 / (2 + 3) | 5 | 6 = 5 × 4 | 7 = 5 – 6 |

| January | 680 000 | 190 000 | 0,782 | 220 000 | 172 040 | 47 960 |

| February | 790 000 | 260 000 | 0,752 | 380 000 | 285 760 | 94 240 |

| March | 980 000 | 173 000 | 0,850 | 405 000 | 344 250 | 60 750 |

| Total for 1 quarter | 2 450 000 | 623 000 | — | 1 005 000 | 802 050 | 202 950 |

Separate accounting of income when combining simplified taxation system and UTII in 1C 8.3

In case of combining UTII and simplified tax system, the taxpayer is obliged to carry out separate accounting of income received :

- from activities on the simplified tax system;

- from activities on UTII.

Separate accounting of income must be maintained to determine:

- tax base when calculating the simplified tax system;

- shares of income under the simplified tax system and UTII in the total volume of income for the purpose of dividing expenses.

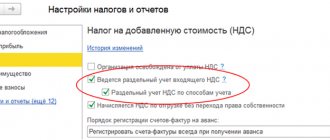

In 1C 8.3 Accounting ed. 3.0 there are various sub-accounts for accounting for income under UTII and simplified tax system:

- for the simplified tax system – second-order subaccounts ending in 1;

- 01.1 – Revenue under the simplified tax system;

- for UTII – second-order subaccounts ending in 2;

- 01.2 – Revenue with UTII:

Income accounts in 1C 8.3 are entered in the document “Sales (acts, invoices)”:

The share of income from activities under the simplified tax system for the purpose of dividing expenses in the total amount of income is determined by the formula:

What method is used to determine income?

To determine income under the simplified tax system, the cash method is used. When UTII is used, accounting data is used using the cash method.

In the same way, in 1C 8.3, to calculate the share of income, the amount of income is determined, that is:

- income under the simplified tax system can be determined on the basis of column 4 of the “KUDiR” Report, and in the “KUDiR (Section I)” register this is the column “Income” (column 5):

- income for UTII is determined according to accounting data using the cash method - this is the column “UTI Income” in the register “KUDiR (section I)” (Universal report, according to the same register):

For what period are incomes taken into account?

Income is determined:

- for the simplified tax system – on an accrual basis for the year;

- for UTII - per quarter.

For comparability of indicators, the Ministry of Finance advises in letter dated November 26, 2015 N 03-11-11/68786 to consider income as an accrual total both under the simplified tax system and under UTII.

In 1C 8.3, income is considered a cumulative total from the beginning of the year, and when calculating the share of income, an adjustment occurs every quarter.

You can see in 1C 8.3 Accounting how the share of income was calculated in the report “Analysis of accounting according to the simplified tax system” - link “Distributed expenses of the simplified tax system / UTII”:

The coefficient in 1C 8.3 is calculated for UTII.

What is the composition of income?

According to clarifications of the Ministry of Finance dated April 28, 2010 No. 03-11-11/121, the are taken into account as income under the simplified tax system and under UTII :

- income from sales (Article 249 of the Tax Code), non-operating income (Article 250 of the Tax Code), except for income not taken into account in the National Tax Code (Article 251 of the Tax Code).

If “other income” is received, for example, in the form of bonuses, bonuses and it cannot be attributed to a specific regime (UTII or simplified tax system), then it must also be divided according to the separate accounting method. “Other income” in 1C 8.3 is not automatically distributed. It must be distributed manually according to the principle established in the accounting policy and entered into the program as separate entries.

For more details on how income is reflected under the simplified tax system in 1C 8.3 and how to avoid mistakes when reflecting the costs of purchasing an OS, see our video:

Where to get data for a reasonable distribution of expenses

Each figure involved in tax calculations and that can affect the final tax amount requires documentary confirmation. In a situation where the simplified tax system and UTII are combined, there is no common universal register containing the information necessary for calculating taxes.

To reflect expenses and income, as well as for a reasonable distribution of expenses when combining special regimes, you can choose one of the following methods for documenting “tax” information:

- book of accounting of income and expenses (for the simplified tax system) - simplifiers are required to enter income and expenses in this book, so you can use this data when distributing expenses;

For an example of filling out the KUDiR, see the material “How to keep a book of income and expenses under the simplified tax system (sample)?” .

- specially designed registers for recording income and expenses (for UTII) - since the calculation of UTII does not depend on expenses incurred and income received, there is no separate book for recording these indicators, so you can group the necessary data in separate tables;

- accounting data - both simplifiers and imputators, who are legal entities, are required to keep accounting, and with the correct construction of analytics (we will talk about this later), the necessary information can be taken from the accounting registers.

Detailed analytics is of great importance for obtaining reliable data on income and expenses and their further application in the distribution algorithm. The use of specific subaccounts and the degree of their detail for each company has its own characteristics depending on the specifics of their activities, cost structure, etc.

As an example, we can offer the following construction of analytical accounts:

| Index | Activities | |

| simplified tax system | UTII | |

| Revenue | 90.1/1 “Revenue from simplified taxation system activities” | 90.1/2 “Revenue from UTII activities” |

| Expenses taken into account without distribution | 44.1/1 “Sale expenses for simplified taxation system activities” | 44.1/2 “Sale expenses for UTII activities” |

| Allocable expenses | 44.1/3 “Common expenses for the simplified tax system and UTII” (in analytics by type of expense) | |

The information reflected in the accounting accounts must be reliable, and accounting is organized taking into account legally established requirements.

We create methods of accounting for salaries (reflection of postings)

The next important step. Set up payroll accounting methods. These settings affect the formation of accounting entries.

Go to the “Salary and Personnel” section and select “Salary Settings”:

Here we open the item “Salary accounting methods”:

Our task is to create in this directory three methods of accounting for wages: “Payment according to UTII”, “Payment for labor under the simplified tax system” and “Payment for labor under the simplified tax system-UTI”.

The first method is needed for the seller, the second for the photographer, and the third for the director (you remember that it is half on the simplified tax system and half on the UTII):

Here's how to fill out the salary accounting method “UTII wages”:

Here we have chosen account 44 as the cost account and indicated the cost items for each activity. We created these articles in the previous step.

Here's how to fill out the salary accounting method "STS":

Here we have chosen account 20 as the cost account and indicated the cost items for each activity.

Finally, here’s how to fill out the salary accounting method “Payment of the USN-UTII”:

We entered cost account 26 and again selected the appropriate cost items.

The general meaning of these methods is only to indicate the correct cost accounts and cost items we have created. Let's move on.

Insurance premiums for employees: how to distribute expenses

We will consider the distribution of costs for paying insurance premiums when combining the simplified tax system and UTII separately for companies and individual entrepreneurs.

“Insurance” expenses are distributed by the company

When allocating the costs of paying the company's insurance premiums, the following must be taken into account:

- if employees are engaged in activities subject to the simplified tax system “income minus expenses”, all paid contributions are taken into account when calculating the tax;

- if employees are engaged only in activities subject to the simplified tax system “income” or only UTII, paid contributions reduce the calculated tax, but not by more than half;

- if employees work in activities subject to UTII and simplified taxation system (with any object of taxation), insurance premiums paid for employees participating simultaneously in simplified taxation system and UTII activities are subject to distribution in proportion to income (see also letter of the Ministry of Finance dated December 12, 2018 No. 03- 11-11/90484).

For examples of calculating insurance premiums when applying the simplified tax system and UTII, see the materials posted on our website:

- “How can a “simplified man” reduce the single tax on insurance premiums?”;

- “The procedure for reducing UTII by the amount of mandatory insurance contributions”.

“Insurance” expenses are distributed by individual entrepreneurs

From 01/01/2017, when combining UTII and simplified tax system, insurance premiums paid by individual entrepreneurs both for themselves and for employees who cannot be attributed to a specific type of business activity are distributed between these types of activities in proportion to income. That is, now the insurance premiums of individual entrepreneurs, paid for themselves and for employees when combining UTII and simplified tax system, are distributed in the same way as organizations.

Until 2021, regulatory authorities believed that individual entrepreneurs who have employees and use UTII can reduce the imputed tax by the amount of insurance premiums paid for employees, and do not have the right to reduce UTII by the amount of insurance fixed payments paid for themselves.