The cost of all inventories (materials, finished products, goods, work in progress), including those taken into account as deferred expenses, is shown on line 1210 of the balance sheet. The list of objects that must be reflected in this line is established by paragraph 20 of PBU 4/99. It is not necessary to provide a breakdown of reserves by type.

If the current market value of inventories decreases at the end of the year, the company is obliged to accrue a reserve. Its creation is taken into account on account 14 “Reserves for reduction in the value of material assets.” In the balance sheet, the value of inventories is shown minus the amount of the corresponding reserve.

Let's find the actual cost of finished products

- D 20 K 10 (51, 60, 69, 70, 96, etc.) - direct costs for the manufacture of products (performance of work, provision of services) of the main production - directly related to the manufacture of products, works, services.

— D 25 K 10 (51, 60, 69, 70, 96, etc.) – expenses for maintenance and management of a structural unit of the organization (shop, production, workshop, etc.).

- D 26 K 10 (51, 60, 69, 70, 96, etc.) - expenses for general maintenance and organization of production and management in general (general business expenses).

- D 97 K 51 (60, 76, etc.) - expenses incurred in the reporting period, but related to future periods.

— D 96 K 10 (23, 60, 69, 70, etc.) – expenses incurred from the created reserves (for repairs of fixed assets, payment of employee vacations, etc.).

Stage 2. Costs are distributed according to their intended purpose after the end of the reporting period. First of all, the costs of auxiliary production are distributed. The actual cost of products (work, services) of auxiliary production, reflected in the debit of account 23, is written off from the credit of account 23 to the debit of accounts 25, 26, 29.

Deferred expenses are written off from the credit of account 97 to the debit of accounts 25, 26 in the share related to the reporting period.

Reserves for upcoming expenses and payments are being formed in accordance with planned calculations (D 25 (26) K 96).

General production and general business expenses are distributed between individual types of products, works and services. The basis for the distribution of these costs can be: wages of production workers, direct costs, etc.

General business expenses can also be written off with the total amount of credit 26 to debit 20, if the actual cost of each type of product is not determined by the enterprise. General production costs are distributed similarly.

Expenses recorded on accounts 25 and 26 are written off at the end of the reporting period to debit 20 from credit 25, 26.

In accordance with PBU 10/99, organizations can adopt in their accounting policies the procedure for writing off general business expenses directly to debit 90 from credit 26. Losses from defects are also written off from credit 28 to debit 20.

Upon completion of this stage, account 20 collects all direct and indirect costs for the production of products (works, services) for the reporting period.

3 (final) stage. The actual production cost of manufactured products is determined. To calculate it, work in progress at the end of the period is determined, that is, products that have not passed all stages of processing, testing, acceptance, and are incomplete.

To determine work in progress, it is necessary to know the number of products, parts, blanks remaining in the shops at the end of the period unfinished processing, and the procedure for evaluating these products, parts of blanks. This quantity of products is identified through an inventory of work in progress. The cost of work in progress is assessed by cost items depending on the type of production.

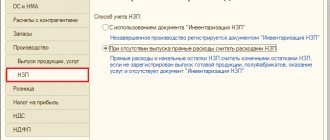

To calculate income tax (Article 319 of the Tax Code of the Russian Federation), the procedure for assessing work in progress is established by the taxpayer independently.

The actual production cost of finished products (work, services) (Сг.п) is calculated as follows: Сг.п = Сн.п.н. Zf. - Ov. – Arr. – S.p.k.,

where Sn.p.n., Sn.p.k. – value of work in progress at the beginning and end of the reporting period, respectively, rub.; Zf. – actual costs of production for the reporting period, rub.; Waste – returnable waste, rub.; – actual cost of the final defect, rub.

Actual net worth of finished products = WIP in costs of the reporting period (D 20) – WIPk, where

WIPv – cost of work in progress at the beginning of the reporting period; WIPk – cost of work in progress at the end of the reporting period.

1st option – to account 43 “Finished products”;

2nd option – to account 40 “Release of products (works, services)”.

Write-off of cost.

Debit 90 “Sales” subaccount “Cost of sales” Credit 43 “Finished products” - the cost of finished products in planned accounting prices is written off.

Classification of accounts by purpose and structure. Characteristics of matching accounts. Basic operations and accounting entries for the formation of financial results from the sale of products.

Operating accounts, business process accounts.

Comparing accounts are designed to calculate the financial results of both individual business processes and the enterprise as a whole by comparing debit and credit turnover recorded on these accounts. This is done by comparing debit and credit turnover for a particular account.

1) Operational-resulting accounts are intended to summarize information about individual processes of the enterprise’s economic activity, as well as determine the financial result for each of them.

These include accounts: 90 “Sales”, 91 “Other income and expenses”.

The debit of these accounts records: the cost of sold products, works, services; residual value of fixed assets and book value of other current assets; expenses associated with the disposal of assets, as well as fines, penalties, penalties and interest paid. The credit of accounts 90 and 91 reflects revenue and income from other operations. By comparing debit and credit turnovers, profit or loss from sales (account 90) and other operations (account 91) is determined.

These accounts do not have a balance; the balances received from them are written off monthly and included in the financial results from sales and other operations from subaccount 9 to the debit or credit of account 99 “Profits and losses”.

These accounts record expenses and income from operations related to the sale of products, performance of various works, provision of services, disposal of fixed assets, intangible assets, securities, and materials.

2) Financial-resulting accounts are intended to determine the financial result of the organization’s economic activities. An example is active-passive account 99 “Profits and losses”, as well as account 98 “Deferred income” and account 848 “Retained earnings (uncovered loss)”. Account 99 reflects the financial result (profit or loss) from the sale of various property items and other operations (operating and non-operating income, reduced by the amount of operating and non-operating expenses). On the credit side of account 99, profits are recorded, and on the debit side, losses are recorded.

By comparing the turnover of debit (loss) and credit (profit), the final financial result is determined: the credit balance shows profit, the debit balance shows loss.

Accounting for production costs and calculating the cost of finished products are carried out by various methods and methods, the use of which depends on the type of production, the presence of work in progress, the characteristics of the products produced, the quantity of products produced, etc. The calculation method assumes a certain system of accounting for production costs, in which the actual cost of everything is determined output and unit of production.

Attention

The main methods of cost accounting are order-by-order and process-by-process methods. The remaining methods, as a rule, are variations of the above-mentioned models.

In those industries where a unit of production has certain characteristic properties and is easily identified, the custom method is used.

Receipt of materials free of charge

If your company received materials free of charge, then determine their cost based on the market price for such property. In tax accounting, the cost of such materials cannot be less than the cost of their acquisition according to the transferring party (Clause 8 of Article 250 of the Tax Code of the Russian Federation).

The amount of VAT on such materials paid by the transferring party is not accepted for tax deduction. It increases their initial cost.

The cost of materials received free of charge is reflected by posting:

Debit 10 Credit 91-1

— materials received free of charge.

The cost of material assets received free of charge from another organization or individual is taken into account in income tax income. The tax must be paid based on the results of the period in which the materials were capitalized.

The exception is assets received by the company from an individual or organization that has a share of more than 50% in the authorized capital of your company.

Likewise, if your company has a share in the authorized capital of the transferring party exceeding 50%. In this case, the received property is not subject to income tax if it is not transferred to third parties within a year from the date of its receipt. EXAMPLE 13. HOW TO ACCOUNT FOR MATERIALS RECEIVED FREE OF CHARGE

In December of the reporting year, Aktiv JSC received materials free of charge from an individual who is not its shareholder.

Their market price was 860,000 rubles. (including VAT). The Asset accountant must make the following entry: Debit 10 Credit 91-1

- 860,000 rubles. – materials received free of charge at the market price are capitalized. In the balance sheet of “Asset” for the reporting year, line 1210 should reflect the market price of materials in the amount of 860 thousand rubles. When calculating income tax for the reporting year, the cost of materials (860,000 rubles) is taken into account as part of non-operating income.

How to determine the actual production cost of manufactured finished products

In the previous article, we looked at what the cost of production consists of and found out that the full cost includes the costs of producing finished products and their subsequent sale. In addition, we briefly became acquainted with the concept of product costing. In this article we will take a closer look at how production costs are calculated and production costs are accounted for.

Attention: The main methods of cost accounting are order-by-order and process-by-process methods. The remaining methods, as a rule, are variations of the named models. In those industries where a unit of production has certain characteristic properties and is easily identified, the custom method is used.

ImportantMethod of summing up costs The essence of the method is as follows: for each individual type of product, the balance of work in progress at the beginning of the month is determined, which is added to the monthly amount of actual production costs, losses from defects and the balance of work in progress at the end of the month are subtracted from the resulting amount.

The resulting value will be the actual production cost of a particular type of finished product. Formula for calculating the cost of production by the cost summation method: Actual cost. = Unprepared start of month expenses per month – losses from defects – undeclared production last month. After this, you can calculate the unit cost by dividing the actual cost by the number of units of production. Accounting entries The resulting cost is written off from the credit account. 20 to the debit of the account. 43 or 40.

Important

Cost summation method The essence of the method is as follows: for each individual type of product, the balance of work in progress at the beginning of the month is determined, which is added to the monthly amount of actual production costs, losses from defects and the balance of work in progress at the end of the month are subtracted from the resulting amount. The resulting value will be the actual production cost of a particular type of finished product.

Accounting entries The resulting cost is written off from the credit account. 20 to the debit of the account. 43 or 40.

Write-off of indirect general business expenses can be performed as follows:

- by distribution between individual types of products (costing objects);

- by writing off expenses in full at the end of the month.

If an organization distributes general business expenses between types of products, then the same methods are used for write-off as for general production expenses. If an organization writes off all accumulated costs in full, then they can be included in other expenses, entry D90/2 K26.

Now, to calculate the cost, all that remains is to take into account the costs associated with correcting the defects; for this, the losses from defects accumulated in debit 28 of account are written off to the debit of account 20 (entry D20 K28). Now all direct and indirect costs associated with production are collected in the debit of the account.

WIP at the beginning of the month costs for the month (turnover on D-t) - - WIP at the end of the month - - returnable materials (10 - 20) - - cost of final defects (28-20). ACCOUNT 25 - “General production costs” - in relation to the balance sheet - active, according to classification - collecting and distribution, additional account.

Has no balance. Debit 25 of the account collects expenses during the month. Under Credit 25 accounts at the end of the month, costs are distributed to accounts 20 and 23 in proportion to the wages of production workers and to account 28 if there was a defect in production.

At the same time, correspondence is drawn up: D. 20 K. 25 - general production costs are written off for the needs of the main production D. 23 K. 25 - general production costs are written off for the needs of auxiliary production D. 28 K.

CALCULATION OF DEVIATIONS Account 10 Account 16 Balance at the beginning of the month of materials in the enterprise's warehouse Received into the warehouse during the month (turnovers according to account D) 200,0000 20,000 TOTAL0 Coefficient of ratio of deviations to the cost of materials = 30,000: 600,000 = 0.05 Materials consumed for the month (turnovers according to K accounts) 4) Balance at the end of the month 500,000 600,000 - 500,000= =100,000 500,000 x 0.05= 25,000 D. 20 K.

Write-off of materials

Materials can be supplied to the needs of various departments of the company - main, auxiliary or service production, for use for administrative, managerial or general production purposes.

For the cost of materials sold, make the following entry:

Debit 20 (23, 29, 25, 26) Credit 10

- materials written off.

When using materials to sell finished products and goods, make a note:

Debit 44 Credit 10

— the cost of materials used in the process of selling products (goods) is written off.

The organization can donate excess materials free of charge.

The cost of donated materials is subject to VAT.

This operation is reflected in accounting records:

Debit 91-2 Credit 10

— materials donated free of charge are written off;

Debit 91-2 Credit 68, subaccount “VAT calculations”

— VAT is charged on materials donated free of charge;

Debit 99 Credit 91-9

— loss from the gratuitous transfer of materials is reflected (at the end of the month).

The loss from the gratuitous transfer of materials is not included in expenses when determining the tax base for income tax (clause 16 and clause 19 of Article 270 of the Tax Code of the Russian Federation).

Materials are assessed upon disposal in one of three ways:

- FIFO;

- at average cost;

- at the cost of each unit.

The specific method of writing off materials should be established in the accounting policies of your company. Different assessment methods can be used for different types of materials.

FIFO method

This method assumes that materials that arrived earlier than others are transferred to production first.

If the materials were purchased in batches, then it is understood that the first batch is transferred to production first, then the second, etc. If there are not enough materials in the first batch, then some of the materials from the second are written off.

EXAMPLE 14. HOW TO WRITE OFF MATERIALS USING FIFO METHOD

Zenit LLC bought M-150 brand brick to carry out repair work.

The bricks were purchased in three batches of 10,000 pieces each. The first batch was purchased on January 1 at a price of 35,000 rubles. (without VAT). The second one is on February 3 at a price of RUB 36,667. (without VAT). The third – March 2 at a price of 39,167 rubles. (excluding VAT). 25,000 bricks were written off for repair work. The work was carried out in March. When using the FIFO method, the accountant needs to write off: - 10,000 bricks from the first batch worth 35,000 rubles; - 10,000 bricks from the second batch worth 36,667 rubles; - 5,000 bricks from the third batch worth 19 584 rub. (RUB 39,167 × 5,000 pcs.: 10,000 pcs.). The total cost of the brick to be written off will be RUB 91,251. (35,000 + 36,667 + 19,584). When writing off bricks, you must make the following entry: Debit 20 Credit 10

- 91,251 rub. – the brick was written off for repair work.

Average cost method

When writing off valuables using this method, the accountant needs to determine the average cost per unit of materials. This monthly average is determined by the formula:

To determine the cost of materials to be written off, the average unit cost is multiplied by the total amount of materials written off.

EXAMPLE 15. HOW TO WRITE OFF MATERIALS AT AVERAGE COST

Zenit LLC bought M-150 brand brick to carry out repair work.

The bricks were bought in three lots of 10,000 pieces each. The first batch was purchased on January 1 at a price of 35,000 rubles. (without VAT). The second one is on February 3 at a price of RUB 36,667. (without VAT). The third – March 2 at a price of 39,167 rubles. (excluding VAT). 25,000 bricks were written off for repair work. The work was carried out in March. When using this method, the accountant needs to determine the average cost per unit of materials (one brick). It will be: (35,000 rub. + 36,667 rub. + 39,167 rub.): (10,000 pcs. + 0,000 pcs. + 10,000 pcs.) = 3.69 rub./pc. Cost of brick to be written off , will be: 3.69 RUR/piece. × 25,000 pcs. = 92,250 rubles. When writing off a brick, you must make the following entry: Debit 20 Credit 10

- 92,250 rubles. – the brick was written off for repair work.

Calculation and costing of product costs

The repayment of the cost of special equipment (special clothing) during the useful life is reflected 20, 23, 25, 26 10-11 7. Deductions were made for the formation of reserves for upcoming expenses 20, 23, 25, 26 8.

Travel expenses were written off 20, 23, 26 9. Invoices for consumed electricity, gas, water, etc. were accepted: - VAT was taken into account 20, 23, 25, 26 19 60 60 10. Semi-finished products of own production were released into production 10.4.

Info

Valuation and accounting of work in progress inventories Continuation of table. 10.1 Contents of the transaction Corresponding accounts Debit Credit 11. Rent accrued: - VAT included 20, 23, 25, 26 19 60 60 12.

Products (work, services) of auxiliary production were written off for the main production 13. Part of the production costs of future periods relating to the reporting period 20, 23, 25, 26 14 was written off.

To create a successful enterprise, it is not enough to choose a direction and come up with an idea. The main thing is to draw up a reasonable business plan with a calculation of all expenses and expected revenues. Once clarity is achieved on these indicators, you can move on to its implementation.

The main part of the costs is the cost of finished products, to calculate which you need to have special knowledge and skills. Cost calculation is also necessary for existing businesses, especially when optimizing costs (after all, you need to know their composition and structure, understand what they affect). Different companies will have different costs.

Depending on the range of expenses, there are three types of costs: full, incomplete workshop and production. But it is not at all necessary that all of them will be involved in the calculations. Each businessman independently decides what costs and other indicators to include in his analysis. For example, the cost of finished products is not included in the calculation of taxes, since they do not depend on it.

However, the cost of goods must necessarily be reflected in the accounting reports, so all costs that affect it should be included in the accounting policy of the enterprise.

You can calculate both the total cost of production and the cost for one specific category of goods. In the second case, the resulting value will need to be divided by the number of units of finished products to determine the cost per product.

To produce one copy of a product, the company will have to spend a certain amount of money on raw materials, equipment, consumables, fuel and other types of energy, taxes, pay employees and incur some costs associated with the sale of finished products. The sum of these costs will be the unit cost of the product.

In accounting practice, two methods are accepted for calculating the cost of finished products for the purposes of production planning and calculating the finished commodity mass:

- Calculation of the cost of the entire mass of products based on economic elements of costs.

- Calculation of the cost of one unit of goods through costing items.

All money spent by the company on the production of products (until the batch of finished products is placed in the warehouse) constitutes the net factory cost. However, it does not include the sale of goods, which should also be taken into account. Therefore, the full cost of finished products also includes the costs of loading and delivery to the customer - wages of loaders, crane rental, transportation costs.

Cost calculation shows how much money was spent directly on the production of the goods in the workshop, and how much was spent on its transportation after leaving the factory. The obtained cost values will be useful in the future, at other stages of cost accounting and analysis.

There are several types of product costs:

- workshop;

- production;

- full;

- individual;

- industry average.

Having calculated each of them, we obtain material for analyzing all stages of the production cycle, which will help, for example, to find opportunities to reduce the cost of production without losing the quality of the product.

To calculate the cost per unit of finished products, all costs are combined into items. Indicators for each product item are recorded in a table and summarized.

Calculation of the cost of finished products taking into account costs

The industry specifics of production greatly influence the cost structure of the final product or service. Each industry has its own predominant production costs. These are the ones you need to pay special attention to when looking for ways to reduce costs and increase profitability.

Each type of expense present in the calculations has its own percentage share, indicating whether this type of expense is a priority or additional. All costs, grouped by item, form the cost structure, and their positions reflect their share of the total amount.

The share occupied by one or another type of cost in the total amount of expenses is influenced by:

- place of production;

- application of innovations;

- the level of inflation in the country;

- concentration of production;

- change in the interest rate on loans;

- other factors.

Obviously, the cost of finished products will constantly change, even if you produce the same product for many years in a row. This indicator must be carefully monitored, otherwise the company may go bankrupt. You can analyze the cost and quickly reduce production costs by estimating the costs listed in the costing items.

Typically, companies use a calculation method for calculating the cost of finished products, semi-finished products or services. This is a calculation per commodity unit manufactured at an industrial enterprise (for example, the cost of supplying one kW/h of electricity, one ton of rolled metal, one ton/km of freight transportation). The standard unit of measurement in physical terms is taken as the calculation unit.

Recommended articles to read:

- Types of clients in sales: how to find an approach to each

- Sales development strategies: from theory to practice

- How to develop confidence in communicating with clients

To produce products, raw materials and additional materials, equipment, and the work of maintenance personnel, managers and other employees are required. Therefore, various expense items can be used in calculations. For example, you can calculate the workshop cost of production on the basis of direct costs alone; other indicators will not be involved in the analysis.

To begin with, all existing expenses are grouped according to similar characteristics, which makes it possible to accurately determine the amount of production costs for one economic component. They can be grouped according to parameters such as:

- types of manufactured products;

- economic homogeneity;

- ways to add a product to the cost price;

- purpose of expenses;

- quantity in production volumes, etc.

The purpose of classifying cost items based on general characteristics is to identify specific objects or places where costs arise.

Grouping based on economic homogeneity is carried out in order to calculate the total costs per unit of output, which are made up of:

- raw materials, basic materials;

- additional components;

- fuel, energy payments;

- taxes;

- depreciation of equipment, wages of workers;

- other costs.

This list of economic elements is the same for all industrial sectors and is used everywhere, so we have the opportunity to compare the cost structure for the production of goods by different enterprises.

In order to profitably sell your products, you need to accurately determine their cost. Finished products are goods that have passed all stages of technological processing and control checks (the rest are classified as work in progress).

There are two methods to calculate the actual cost of a product. In order to use the first one, you must:

- take into account all direct costs and other costs;

- evaluate the product.

- Finished products are part of inventories intended for sale and are reflected in account 43 with a characteristic name. It can be assessed on the basis of cost - planned production or actual.

The costs included in the cost of finished products can be absolutely all costs that make up the production cost of the product, or only direct costs (this is relevant when indirect costs are written off from account 26 to account 90).

- In practice, few people set the price for a product based on its actual production cost. This calculation method is practiced by small companies that produce a limited range of products. In other cases, it turns out to be too labor-intensive, because the actual cost of the consignment becomes known only at the end of the reporting month, and the products are sold during it. Therefore, a conditional valuation of products is usually used based on their selling price (not including VAT) or the planned cost.

- You can calculate based on the selling price, but only if it does not change during the reporting month. In other situations, accounting is carried out according to the planned cost of finished products, which the planning department calculates based on the actual cost for the previous month, adjusted in accordance with the forecast of price dynamics (the accounting price is obtained).

- Manufactured goods are written off from the credit of account 23 to the debit of account 26, and the cost of products already shipped to the buyer is written off from credit 26 to debit 901. After the actual production cost is calculated at the end of the month, the difference between it and the accounting price is calculated, and also deviations relating to the sale of goods.

When calculating cash costs, various factors should be taken into account, relying primarily on cost (the sum of the enterprise’s costs for producing products), since the amount of profit and the measures that should be taken to increase profitability directly depend on it.

Accounting for work in progress and finished goods

General production and general business expenses are distributed between individual types of products, works and services. The basis for the distribution of these costs can be: wages of production workers, direct costs, etc.

General business expenses can also be written off with the total amount of credit 26 to debit 20, if the actual cost of each type of product is not determined by the enterprise. General production costs are distributed similarly.

Expenses recorded on accounts 25 and 26 are written off at the end of the reporting period to debit 20 from credit 25, 26. In accordance with PBU 10/99, organizations can adopt in their accounting policies the procedure for writing off general business expenses directly to debit 90 from credit 26.

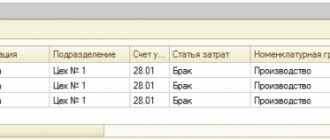

Losses from marriage are also written off from credit 28 to debit 20.

How to calculate the actual cost of finished products: formula

Despite the ease of recording the actual cost of a product in accounting, large companies rarely use this method. The fact is that the actual cost of a GP can only be calculated at the end of the reporting month, when all costs are collected in the appropriate accounts. Therefore, when applying this algorithm, it is difficult to accurately determine the cost of the released product to transfer it to the warehouse within a month, which is simply inconvenient.

More often, to determine the actual cost of accounting objects, a normative method is used, based on the preparation of calculations according to the norms in force at the beginning of the year, and subsequent adjustments to identified deviations from the norms. The planned cost is the estimated price of a unit of goods in accounting prices, which is a kind of standard of cost, but allows one to more accurately determine the real cost of the enterprise throughout the reporting period and is adjusted at the end of the month.

Sfact = Cpl ± O, where Cpl is the planned cost, and O is the deviation of the actual cost from the planned one, i.e. from established standards: (-) savings, ( ) – overexpenditure.

With the process-by-process method, production costs are recorded for individual processes in the manufacture of products as an integral part of the entire production process. This method is used when the production of a product consists of a sequence of continuous or repetitive operations or processes, and the cost of production is determined at each stage of production, operation or process.

Determination of the actual cost of materials consumed

The value of the cost directly depends on the volume and quality of products, as well as on the level of rational use of raw materials, equipment, supplies and employee working time. The cost indicator is the basis for determining the price of a manufactured product.

In the article we will talk about the specifics of calculating the cost indicator, and also use examples to consider the methodology for determining the cost of production. Content

- 1 Concept of cost

- 2 Types of product costs

- 3 Calculation of production costs using examples 3.1 Calculation of production costs

- 3.2 Calculation of cost by allocating costs

The concept of cost The cost understands the current costs incurred by the organization for the production and sale of products.

The main area of application of the custom method is individual and small-scale production, as well as auxiliary production. In other cases, the process-by-process method is more preferable. The main area of application of the process method is mass production with sequential processing of raw materials into the finished product.

With the order-to-order method, production costs are recorded for individual production orders. At the same time, direct expenses reflected in the debit of account 20 “Main production” in correspondence with the credit of accounts for accounting for settlements with personnel for wages, inventories, etc., are taken into account in the cost of specific orders.

The main area of application of the custom method is individual and small-scale production, as well as auxiliary production. In other cases, the process-by-process method is more preferable. The main area of application of the process method is mass production with sequential processing of raw materials into the finished product.

With the order-to-order method, production costs are recorded for individual production orders. At the same time, direct expenses reflected in the debit of account 20 “Main production” in correspondence with the credit of accounts for accounting for settlements with personnel for wages, inventories, etc., are taken into account in the cost of specific orders.

View more:

- Article 126 of the Tax Code of the Russian Federation Is it often punished under paragraph 1 of Art. 126 Tax Code of the Russian Federation?P. 1 tbsp. 126 Tax Code of the Russian Federation...

- OKVED rental of premises Transactions with real estate for a fee or on a contractual basisSubclass 68.3 contains two groups of codes: ...

- Double taxation in Russia Double taxation Double taxation is the simultaneous imposition of the same taxes on income in different countries. Double taxation is caused by...

- Tax Code Article 88 Article 88. Desk tax audit1. A desk tax audit is carried out at the location of the tax authority on…

- Finished products are reflected in the balance sheet

Contribution of materials to the authorized capital

If your company received materials as a contribution to the authorized capital, you must record them on the balance sheet at the cost agreed upon between the founders (participants).

The monetary valuation of a non-monetary contribution to the authorized capital of a business company must be carried out by an independent appraiser (Clause 2 of Article 66.2 of the Civil Code of the Russian Federation).

note

The party transferring materials as a contribution to the authorized capital is obliged to restore the previously deductible VAT on materials and pay it to the budget.

The receiving party can accept this tax as a deduction (clause 1, clause 3, article 170 of the Tax Code of the Russian Federation). Her VAT amount increases her additional capital. EXAMPLE 12. HOW TO ACCOUNT MATERIALS AS A CONTRIBUTION TO THE AUTHORIZED CAPITAL

One of the founders of Passive LLC is Aktiv JSC.

In the reporting year, “Active” transferred materials to “Passive” as a contribution to the authorized capital. The nominal value of the share is 90,000 rubles. The cost of materials, agreed upon between the founders and confirmed by an independent appraiser, also amounted to 90,000 rubles. The amount of VAT recovered by “Asset” and indicated by it in the transfer documents is 18,000 rubles. The accountant of “Liability” made the following entries: Debit 75-1 Credit 80

- 90,000 rubles.

– the debt of “Aktiva” for its contribution to the authorized capital is reflected; Debit 10 Credit 75-1

- 90,000 rub.

– received materials for the contribution to the authorized capital; Debit 19 Credit 83

- 18,000 rub.

– VAT on materials is taken into account; Debit 68, subaccount “Calculations for VAT” Credit 19

- 18,000 rubles. – VAT on materials is accepted for deduction. In the Liability balance sheet for the reporting year, line 1210 will indicate the cost of materials in the amount of 90 thousand rubles.