An enterprise, at the request of its employee or on its own initiative, can accrue and pay financial assistance. In this article I want to tell you how to do this in 1C ZUP 8.3, in the form of step-by-step instructions.

Financial assistance refers to one-time payments. In previous versions of the 1C ZUP program, to reflect this type of accrual, there was a document “Registration of one-time accruals to employees of organizations.” Now he's gone. Many people have a question: how to calculate financial assistance? I’ll say right away that there is such a possibility, but initially it is disabled in the system.

Financial assistance for a wedding

Let's look at the calculation of financial assistance for a wedding.

Setting up the accrual type

Let's go to the menu “Salaries and personnel - Directories and settings - Salary settings”.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

Let's go to the "Accruals" link.

Let's create a new accrual type and fill it out:

- We will indicate the name and unique code.

- In the “Personal Income Tax” section, set the “Taxed” option and select income code 2760. This type of income is partially subject to personal income tax, namely, it is not taxed in the amount of up to 4,000 rubles.

- We will indicate the method of reflecting financial assistance in accounting in the “Method of reflection” field.

- In the “Insurance premiums” section, we will set the type of income “Financial assistance, partially subject to insurance premiums.” There are also no contributions up to 4,000 rubles.

- We do not include expenses in income tax.

Calculation of financial assistance for a wedding

The calculation is performed when calculating salaries.

After automatically filling out the document, we will select an employee to accrue financial assistance, click the “Accrue” button and select the desired type of accrual, in this case “Material assistance for a wedding.”

We enter the payment amount, the deduction code is automatically entered and the deduction amount is 4,000 rubles. Click "OK".

The accrual amount in the document has changed.

By clicking on the link in the “Accrued” column, you can see a detailed explanation.

Let's look at the document postings.

Registration of financial assistance in 1C, tax-free

The first step is to create a new type of settlements with employees. Refer to the “Salary and Personnel” section, go to the “Salary Settings” tab.

The “Salary Settings” form will open on a new page. Go to the “Payroll” tab and select “Accruals”. The new program section will provide a list of all available accruals in the organization.

Refer to the “Create” button (located in the top bar of the page).

A form for creating an accrual will be available on a new tab. Start setting up:

- Indicate the name of the payment (in our case, “Financial assistance (tax-free”).

- In the “personal income tax” subsection, check the “Not taxed” box.

- On the insurance premiums tab, select “Income entirely exempt from insurance premiums...” from the drop-down list.

- In the subsection “Income Tax” Fr.

- Specify the method for reflecting accruals for employees in accounting. To do this, open the list and click on the “+” (Add) icon. A form for creating payroll accounting methods will be available in a new window. You can either create a new method or select it from the catalog. In our case, we use “Administration Accruals”.

If you need to create a new method of accounting for an employee's wages:

- In the form that opens, indicate the name (title) of the accounting method.

- Select an account from the list (the directory will open). In this case, account “91.02” (“Other expenses”) is used.

- On the “Other income and expenses” tab, select “Payroll not taken into account...” from the drop-down list.

- In the “Reflection in the simplified tax system” section, select the “Not accepted” option.

In order to save the accounting method, carefully check the specified data and refer to the “Record and close” button. In a similar way, record a new accrual (“Financial assistance (tax-free”).

As soon as a new type of accrual is added to the directory, it can be used to create documents.

We will accrue financial assistance to employee Ivanov I.I. in connection with a fire (emergency situation). The 1C program allows you to make calculations both in a separate document and together with the employee’s basic salary.

In order to accrue financial assistance to an employee using a separate document, go to the “Salaries and Personnel” tab, and then click on the “All Accruals” tab.

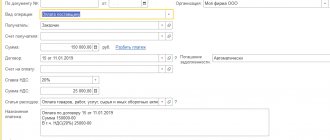

Click on the “Create” button on the top panel of the page, and then select the “Payroll” method. In the form that opens, you must provide the following information:

- The month for which the employee is paid remuneration.

- Organization (can be selected from the drop-down list), department (if necessary).

- Specify an employee using the “Add” button. If you need to calculate remuneration for all employees of the selected department at once, click on the “Fill in” option - the data will be selected automatically.

- After the employee’s data has been transferred to the document, click the “Accrue” button, selecting “Financial assistance (tax-free”) from the drop-down list.

- In the window that opens, manually enter the amount of financial assistance and confirm the operation by clicking the “OK” button.

If all steps are completed correctly, the amount of financial assistance will be displayed in the created document in the “Accrued” section. Please note: the “Contributions” and “Personal Income Tax” sections must be left blank, since withholding does not apply to this payment.

In order to save the entered data, click on the “Post and close” button. You can check the correct formation of postings by accessing the postings window.

In a correctly formed document, financial assistance is taken into account as a debit to the “Other expenses” account. In this case, the amount of the document does not go toward taxation expenses.

Financial assistance at the birth of a child

The procedure for calculating financial assistance for the birth of a child is similar. There are differences in setting up the accrual type.

Setting up the accrual type

Let's create a new type of accrual:

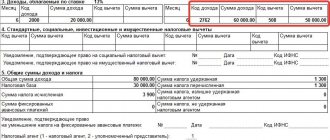

- We set the personal income tax code to 2762 - not subject to personal income tax up to 50,000 rubles.

- Type of income from insurance premiums - Financial assistance at the birth of a child, partially subject to insurance premiums. Also not taxed up to 50,000 rubles.

Calculation of financial assistance at the birth of a child

For accrual, create a document “Salary accrual” and using the “Accrue” button, select the accrual type “Financial assistance for the birth of a child.”

We enter the amount, automatically enters the deduction code and the deduction amount. Click "OK".

Setting up 1C: ZUP for calculating financial aid

To make it possible to calculate financial aid in the program, go to the payroll settings and activate the option for paying income to former employees of the company:

Menu “Settings”->Payroll

Fig.1 Salary calculation

Fig.2 Payments to former employees

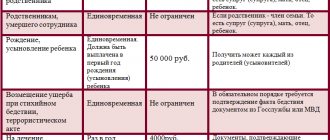

It is worth noting that financial assistance is subject to personal income tax and insurance premiums differently. Therefore, it is necessary to configure the “Types of payments to former employees” directory:

Menu “Payments”->See. See also->Types of payments to former employees

Fig. 3 Types of payments to former employees

To set up payments to employees of an enterprise dismissed due to the onset of retirement, as well as reimbursement to disabled people for the cost of medications, select the appropriate type of payment predefined in the program.

We will set up 1C:ZUP for the correct calculation of financial assistance and its reflection in accounting

*Please note that in case of assistance to a previously dismissed but not retired employee, payment of financial assistance will be made with a deduction of personal income tax in the amount of 13%.

Fig.4 Reimbursement for pensioners

If you have any difficulties setting up the solution, contact our specialists.

Example of postings for payment of financial assistance to an employee

The organization, at the request of the employee, with the attached documents, made a payment to him in connection with the birth of a child in the amount of 30,000 rubles. The attached documents contain a 2-NDFL certificate from the place of work of the employee’s wife, from which it follows that she received the same assistance in the amount of 000 rubles.

Postings:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 91.2 | 73 | Mat charged. assistance in connection with the birth of a child | 30 000 | Order for payment of mat. help Payroll statements |

An enterprise, at the request of its employee or on its own initiative, can accrue and pay financial assistance. In this article I want to tell you how to do this in 1C ZUP 8.3, in the form of step-by-step instructions.

Financial assistance refers to one-time payments. In previous versions of the 1C ZUP program (8.2), to reflect this type of accrual, there was a document “Registration of one-time accruals to employees of organizations.” Now he's gone. Many people have a question: how to calculate financial assistance? I’ll say right away that there is such a possibility, but initially it is disabled in the system.

Postings for calculating financial assistance

To avoid disputes with inspection authorities, it is recommended to establish internal regulations the types of payments equivalent to financial assistance, their amount and the documents that employees must provide in order to receive it.

Mat. assistance will be assigned to the employee upon his written request, based on the order of the manager.

The accrual of this payment to employees of the organization should be reflected by posting: Debit 91.2 Credit 73

.

If payment is made to persons who are not employees of the organization, then the posting looks like this: Debit 91.2 Credit 76

.

The company can make the payment from retained earnings. To do this, it is necessary to hold a meeting of the founders and draw up a decision in accordance with which the money will be paid. To reflect the accrual for this situation, you need to make an entry Debit 84 Credit 73 (76).

The process of transferring funds is reflected by posting: Debit 73 (76) Credit 50 ().

Financial assistance for vacation in 1C: ZUP ed. 3.1

Published 05/14/2020 22:34 Author: Administrator Financial assistance is usually a one-time payment in cash or in kind, which is provided to employees or members of their families, is of a social nature and is not included in wages (see articles 135 and 129 Labor Code of the Russian Federation). This assistance is paid to employees in difficult life situations or in other circumstances at the discretion of the employer. Now, more than ever, such support will be relevant for employees, so we’ll talk about it in the article.

An employer can pay its employees financial assistance, for example, in connection with the following life situations:

1. in connection with retirement;

2. due to illness;

3. due to difficult financial situation;

4. for vacation;

5. in connection with the birth of a child (children);

6. in connection with marriage, etc.

The conditions for the payment of financial assistance, as well as the list of such and the terms of payment, are usually fixed by the employer in a collective agreement or in a local regulatory act, for example, in the regulation on the payment of material assistance or in the regulation on wages. Also, the conditions for payment of such assistance may be specified in the employment contract. Financial assistance can be paid only on the basis of an order from the manager, but in this case there are some risks regarding tax accounting.

The amount of financial assistance may depend on factors such as the employee’s salary, length of service, position, etc.

To receive financial assistance, an employee must write a free-form application indicating the reason for the payment and the amount, and also attach supporting documents (for example, a child’s birth certificate). Then the employer must issue an order for the payment of financial assistance, which specifies the amount, timing and method of payment, as well as the responsible person.

Financial assistance for vacation is not subject to personal income tax and insurance contributions in the amount of no more than 4,000 rubles. per year (see paragraph 28 of Article 217 of the Tax Code of the Russian Federation and subparagraph 11 of paragraph 1 of Article 422 of the Tax Code of the Russian Federation). That is why such payments should not be regular, since otherwise inspectors will consider them a veiled form of employee remuneration (for example, as a hidden bonus).

If such payment is provided for by an employment and/or collective agreement, then the costs of calculating material assistance can be accepted for tax accounting purposes, according to letters of the Ministry of Finance dated 02.09.2014 No. 03-03-06/1/43912, dated 24.09.2012 No. 03- 11-06/2/129. In other cases, such expenses will not be taken into account.

Let us consider in detail how to calculate and pay financial assistance for vacation in the 1C program: Salary and Personnel Management ed. 3.1.

To reflect the accrual of such assistance, you must first enable this functionality in the program. To do this, go to the “Settings” section and select the “Payroll calculation” item. In the window that opens, click on the link “Setting up the composition of charges and deductions.” Next, on the “Financial Assistance” tab, check the “Financial assistance when providing leave” checkbox.

After this setup, the accrual type “Financial assistance for vacation” will become available (it can be viewed in the “Settings” - “Accruals” menu).

This type of accrual can already be used or, if necessary, it can be further configured. Let's look at the possibilities of editing this accrual: double-click on it.

On the “Basic” tab, a formula is set for calculating financial assistance, which can be edited at your discretion.

On the “Taxes, contributions, accounting” tab, you can change the way accruals are reflected in accounting for generating transactions. By default, the checkbox is in the “By employee settings” position. If you check the “As specified for accrual” checkbox, then accrual will be reflected equally for all employees. The account and subaccount are selected from the reference book “Methods of reflecting salaries in accounting.”

Financial assistance for vacation is accrued in the “Vacation” document (menu “Salary” - “Vacation”). On the main tab of the document, you need to check the “Financial assistance for vacation” checkbox.

The calculation of vacation pay and financial assistance is located on the “Accrued (details)” tab. In our case, the amount of financial assistance is equal to the salary - 6,600 rubles.

In the “Withheld” section you can see the amount of personal income tax withheld. In our case, it is equal to 1,099 rubles.

Let's consider the calculation of personal income tax in our example.

Total accrued: 6,600 + 5,855.86 = 12,455.86 rubles

Let us remind you that the amount of financial assistance in the amount of 4,000 rubles is not subject to personal income tax (clause 28 of article 217 of the Tax Code of the Russian Federation).

Personal income tax amount = (12,455.86 – 4,000) * 13% = 1,099 rubles

From the “Vacation” document, by clicking the “Print” – “Detailed calculation of accruals” button, you can view and print the calculation of vacation pay and financial assistance.

There are several ways to pay financial assistance for your vacation.

1. A statement for the payment of vacation pay can be generated from the “Vacation” document itself by clicking the “Pay” button.

2. Payment can be made by creating one of the following documents: “Statement to the cashier”, “Statement to the bank” or “Statement to the accounts” (menu item “Payments”). In this case, you need to select the type of payment “Vacation” and select the document itself according to which the payment will be made, checking the box next to it.

The calculation of insurance premiums for amounts of financial assistance for vacation over 4,000 rubles is made in the “Salary” menu section using the document “Calculation of salaries and contributions” on the “Contributions” tab.

Author of the article: Valentina Nikiforova

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Irina Plotnikova 05/29/2020 07:07 I quote Alena Vostrilova:

It would be interesting to read about the calculation of financial assistance in 1C Enterprise Accounting

Hello, Alena.

Thank you for your interest in our articles. We will definitely prepare the topic you are interested in for publication. Follow the news. Quote +1 Alena Vostrilova 05/21/2020 15:48 It would be interesting to read about the calculation of financial assistance in 1C Enterprise Accounting

Quote

Update list of comments

JComments