Online stores are enterprises and organizations that trade via the Internet. Sales through online stores refer to electronic retail trade carried out through teleshopping and computer networks (OKVED code - 52.61.2 or OKVED2 code - 47.91). Currently, selling goods via the Internet has become widespread. Using this opportunity significantly reduces the costs of sellers (no need to buy retail premises, equipment, no need to use the services of intermediaries, etc.), makes it possible to set affordable prices for the goods sold. Despite all the “virtuality”, an online store needs to maintain accounting and tax records.

Let's turn to the legislation

The sale of goods remotely is a sale under a purchase and sale agreement concluded on the basis of familiarization of the buyer with the description of the goods proposed by the seller, contained in catalogues, prospectuses, booklets, excluding the possibility of direct familiarization of the buyer with the goods, as well as using the information and telecommunications network "Internet" "(Clause 2 of Article 497 of the Civil Code of the Russian Federation, Decree of the Government of the Russian Federation dated September 27, 2007 No. 612 “On approval of the rules for the sale of goods by remote means”, Article 26.1 of the Law dated February 7, 1992 No. 2300-1 “On the protection of consumer rights” (hereinafter - Law No. 2300-1)).

The website of the online store from which customers will place an order should provide information not only about the full brand name of the seller and its location, but also data about the product: consumer properties, place of manufacture, price, warranty, expiration date, conditions of purchase , method of payment and delivery (clause 2 of article 26.1 of Law No. 2300-1, clause 8 of the Sales Rules).

Shop on the couch

Now you don’t even have to leave your home to fully ensure your existence: any product, from soap to furniture and appliances, will be delivered to the specified address.

Most often, distance trading is carried out using:

- Site.

- TV store.

- Phone.

- Postal delivery.

- Online trading platform (so-called marketplaces).

Depending on the option, you can place an order yourself by registering on the website, placing it over the phone, agreeing to the purchase offer after an advertising call, or placing an order from the seller with delivery through the post office.

In most cases, the sale is carried out directly by the supplier or manufacturer, which allows you to buy the product cheaper. As for marketplaces, this is usually intermediary trading. Among the most well-known on the market are Ozon, Wildberries, Aliexpress and others. The principle of working with them is simple: the site offers the supplier an agency agreement and sells its goods through itself.

There is also another option, when the goods are not transferred to an intermediary, but are shipped from our own warehouse, then the contract may not be an agency one, but for the provision of services (for example, informational - the platform makes it possible to post information about the product, attract buyers and receive payment for this service) .

Since each such agent has its own characteristics of work and requirements, careful study of the proposed contract is the first rule for the seller. Plus, you will still have to monitor the status of product pages on the website and reviews, because the seller himself continues to be responsible for the product, although the buyer gets the impression that the marketplace is responsible for everything.

So how to keep records?

With distance selling, the list of costs differs from the costs of conventional retail stores. For example, there are no costs for renting retail space to serve customers, but warehouse space may be rented. There may be no salespeople on staff, but there are many workers involved in delivering goods. Transport can be either your own or rented, including from employees. A significant share of the expenses of companies engaged in online trading is taken up by advertising, costs of marketing research, delivery, maintaining the website, maintaining a service that accepts orders (including a call center), etc.

Funds that have ended up in the seller’s electronic wallet should be reflected in a special sub-account “Electronic money” to account 55 “Special accounts in banks”. In this case, funds from the electronic wallet will be reflected in the balance sheet form in the line “Cash”.

To account for settlements with the buyer, account 62 “Settlements with buyers and customers” is used. When funds are received into the online store’s current account, it is necessary to make an entry to the debit of account 51 “Current accounts” and the credit of account 55 “Special accounts in banks.”

Revenue from the sale of goods is included in income from ordinary activities. In this case, an entry is made to the debit of account 62 “Settlements with buyers and customers” and the credit of account 90 “Sales”, subaccount “Revenue”.

At the same time, the selling price of the goods is written off from account 41 “Goods” to the debit of account 90 subaccount “Cost of sales”. In addition, a reversal entry is made to the debit of account 90 subaccount “Cost of sales” and the credit of account 42 “Trade margin” for the amount of the trade margin related to the goods sold.

The amount of agency fees due to the electronic payment system (EPS) (minus refundable VAT) is recognized as an expense for ordinary activities and is reflected in sales expenses by an entry in the debit of account 44 “Sales expenses” and the credit of account 76 “Settlements with various debtors and creditors "

It is important to know

When selling goods, the organization is obliged to print out and issue a cash register receipt to the buyer no earlier than five minutes before the actual purchase. In case of distance selling, the organization is obliged to use cash register systems directly at the time of payment for goods (letter of the Federal Tax Service of Russia dated July 10, 2013 No. AS-4-2/12406).

When selling goods through an online store, there are the following payment methods to customers:

- payment in cash to the courier. The buyer pays in cash for the goods to the courier, who, in turn, issues a cash register receipt;

- payments via bank card. The seller must register in the electronic payment system and enter into an Internet acquiring agreement with the servicing bank, on the basis of which the credit institution will open a special account for the seller, where funds from buyers will be received;

- transfers using EPS. To use this payment system, the seller must register in the selected electronic payment system (Webmoney, Yandex Money, Rupya, LigPay, etc.) and enter into an intermediary agreement with the agency, which will subsequently carry out the transfer of electronic money. Next, the seller places information on his website for buyers about which system they should use to make payments for the goods;

- payment by cash on delivery upon delivery of goods by mail. The seller transfers the goods to the postal service. The money that the buyer deposits at the post office cash desk upon receipt of the goods is processed by the postal service employee as a payment to the seller of the goods. Next, the money is transferred to the seller by bank transfer. If the seller receives a money transfer in cash, upon receipt, he must capitalize the cash proceeds in the general manner and print the receipt using cash register equipment.

Let's take a closer look at them.

Accounting and tax accounting of trade via the Internet

The principles of accounting are the same, in general, for any activity and do not change depending on the type of trade - through a store, a counter or from a website. Partly, the features of accounting will depend on the established taxation system and, first of all, on accounting policies.

The simplified tax system is often used by small businesses, so it is typical for them to use a simplified accounting system. This means that it is not necessary to apply some PBUs in whole or in part; you can use an abbreviated chart of accounts and keep simpler accounting. Organizations that do not meet the criteria for using simplified accounting often work at OSNO; they will have to experience the full power of bureaucracy.

You can read more about accounting in trade in the articles “Features of accounting in trade” or “How to keep records of receipt of goods.” There are many similar articles on Assistant, and you will find the information you need in them, so I won’t repeat them.

It is worth dwelling only on the specific costs that an online store incurs and their accounting:

- Website creation.

- Costs of maintaining the site.

- Delivery operations by courier and acceptance of payment by him.

Creation of intangible assets

The creation of a website, when a company receives exclusive rights to use it, refers to the creation of an intangible asset (intangible asset). Moreover, in accounting, intangible assets are accepted as depreciable property, regardless of cost. In the control unit, the wiring will look like this:

BASIC

- D 08 K 60 – reflects the creation of a store website by a specialized organization.

- D 19 K 60 – VAT reflected.

- D 04 K 08 – after the site is put into operation.

- D 44 K 05 – depreciation.

simplified tax system

Likewise, only the VAT amount is included in the cost of the asset, and not allocated.

It is advisable to set the useful life of intangible assets the same in accounting and accounting records, then keeping records (especially on OSNO) will be much easier. It is determined, as a rule, on the basis of an agreement with the copyright holder. The specifics of the definition of PPI are specified in paragraph 2 of Art. 258 Tax Code of the Russian Federation.

As for tax accounting, it depends on the value of the object and the taxation system. In the general system, intangible assets worth more than 100,000 are included in expenses in parts (depreciation), and with a smaller value - at a time (clause 26, clause 1, article 264 of the Tax Code).

On the simplified tax system, such costs are also included in expenses (clause 2, clause 1, article 346.16 of the Tax Code of the Russian Federation) from the moment they are registered (of course, we are talking about “income-expenditure” simplification). To do this, the service for creating a website must not only be provided and documented, but also paid for. The write-off will take place according to a different scheme: in equal parts throughout the year (every quarter), i.e. by analogy with fixed assets.

If a site as an intangible asset is created independently, then the postings will remain virtually unchanged. Just instead of D 08 K 60 it will be: D 08 K 76,70,69,10. Another situation is if the creation of a site does not entail the transfer of rights to it. Then such an asset does not belong to intangible assets.

On OSNO it is taken into account in other expenses, and in accounting it is reflected in the following entries:

- D 97 K 60 – expenses for the acquisition of non-exclusive rights are reflected. Write-off will occur during the period of use determined by agreement with the copyright holder.

- D 19 K 60 – VAT is reflected.

- D 68 K 77 – temporary differences are reflected. Appears if the object costs less than 100,000, because in the accounting system it is accounted for as a depreciable asset, but in the accounting system it is not.

Under the simplified tax system , the operation is simpler and is reflected as sales expenses: D 44 K 60. In tax accounting using the simplified tax system, in this case, the expense is written off at a time according to paragraphs. 19 clause 1 art. 346.16 Tax Code.

Current expenses

As for the costs of maintaining the site, this includes modifications, changes to the texture, adding new pages, design, as well as payment for a domain name (website address on the network, for example, assistentus.ru) and hosting (this is actually the provision of space for placement and storage site files, postal service, ensuring their safety and recovery capabilities).

According to the Ministry of Finance, such costs must be included evenly throughout the entire useful life of the site in both accounting and tax accounting. In this case, the following entries are indicated in the accounting:

- D 97 K 60 (76) – cost of services provided.

- D 26 (25, 44.20) K 97 – monthly during the SPI.

Alternatively, an accounting policy could include the ability to recognize expenses over the period for which the hosting or domain is provided (usually 12 months).

Cash payment

If goods are sold through an online store for cash on the basis of Article 2 of Federal Law No. 54-FZ dated May 22, 2003 “On the use of cash register equipment when making cash payments and (or) payments using payment cards,” the use of cash registers is mandatory (letter of the Ministry of Finance of Russia dated September 27, 2013 No. 03-01-15/40098).

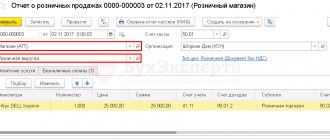

Example 1

On October 11, 2014, Copy Plus LLC sold goods through an online store.

Individual buyers ordered through an online store a printer worth 10,400 rubles (including 18% VAT - 1,586.44 rubles) and an electronic book worth 5,999 rubles (including 18% VAT - 915.10 rubles .). Delivery costs are included in the price of goods. Delivery of goods is carried out by a courier, who issues a cash register receipt to the buyer at the time of payment for goods and accepts cash. The proceeds were handed over by courier to the organization’s cash desk on October 11, 2014. In accordance with the accounting policy, goods are accounted for at sales prices using account 42 “Trade margin”, which is calculated at the end of the month. The following entries will be made in the accounting records of Copy Plus LLC: DEBIT 50 CREDIT 90 subaccount “Revenue”

- 16,399 rubles.

– retail revenue received in cash from sales of products is reflected; DEBIT 90 subaccount “VAT” CREDIT 68

- 2501.54 rubles.

(RUB 16,399 x 18/118) – VAT is charged on the amount of revenue; DEBIT 90 subaccount “Cost of sales” CREDIT 41

- 16,399 rub.

– the cost of goods is written off at retail price; DEBIT 90 subaccount “Cost of sales” CREDIT 42

— (-2779.49) rub. – the trade margin on goods sold is calculated (at the end of the month).

Please note: when selling goods, the organization is obliged to print out and issue a cash register receipt to the buyer no earlier than five minutes before the actual purchase. During distance selling, the organization is obliged to use cash register systems directly at the time of payment for goods. A fine is provided for violating the above procedure.

Payment by bank card

It is enough for the selling organization to enter into an agreement with one of the processing centers in order to be able to accept payments from buyers who pay with bank plastic cards.

The basis for using electronic payment services is an Internet acquiring agreement, on the basis of which the bank transfers a certain part of the funds to the current account of the client organization. The bank receives a commission for carrying out transactions. Every day, the bank sends the seller a statement of transactions performed during the day (transaction report). After receiving a statement with the amount of paid goods, the seller delivers it to the buyer.

The transfer of funds is regulated by Federal Law dated June 27, 2011 No. 161-FZ “On the National Payment System”. The transfer of funds is carried out within no more than three working days starting from the day the funds are written off from the payer’s bank account.

On a note

The acquiring bank's services for conducting settlements are not subject to VAT (subclause 3, clause 3, article 149 of the Tax Code of the Russian Federation).

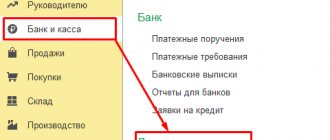

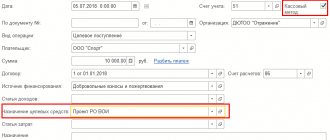

Since funds arrive in the organization’s current account for more than one day, in accounting, to control the movement of money, account 57 “Transfers in transit” subaccount “Sales on payment cards” is used in accordance with the Instructions for using the chart of accounts (approved by order Ministry of Finance of Russia dated October 31, 2000 No. 94n). Settlements with the acquiring bank can be accounted for on account 76 “Settlements with various debtors and creditors.”

Payment by credit card must be reflected as an advance payment.

This must be taken into account when calculating the amount of VAT. Example 2

On October 1, 2014, Vector LLC received payment from customers through an electronic payment system using bank cards for tracksuits in the amount of 46,830 rubles (including 18% VAT - 7,143.56 rubles).

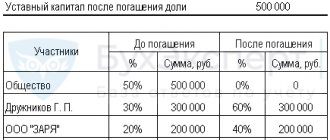

An Internet acquiring agreement was concluded with the servicing bank, on the basis of which the amount of proceeds for the goods sold is transferred to the organization’s current account, minus remuneration. The remuneration amount is 1.2% of the amount of revenue received. After receiving a statement confirming that the buyer has paid for the ordered goods, the selling organization delivers the goods to the buyer. The organization's accounting policy stipulates that goods are accounted for at sales prices using account 42 “Trade margin”. The following entries will be made in the accounting records of Vector LLC: DEBIT 57 subaccount “Sales by payment cards” CREDIT 62 subaccount “Advances received”

- 46,830 rubles.

– reflects the prepayment received from the buyer for goods using a bank card; DEBIT 76 subaccount “VAT on advances received” CREDIT 68 subaccount “VAT”

- 7143.56 rubles.

(RUB 46,830 x 18/118) – VAT is charged on the amount of revenue; DEBIT 51 CREDIT 57 subaccount “Sales by payment cards”

- 46,830 rubles.

– funds have been received into the current account; DEBIT 91 subaccount “Other expenses” CREDIT 57 subaccount “Sales by payment cards”

- 561.96 rubles.

– the services of the acquiring bank are taken into account; DEBIT 62 subaccount “Settlements with customers” CREDIT 90 subaccount “Revenue”

- 46,830 rubles.

– retail revenue from the sale of goods is reflected; DEBIT 90 subaccount “VAT” CREDIT 68 subaccount “VAT”

- 7143.56 rubles.

(RUB 46,830 x 18/118) – VAT is charged on the amount of revenue; DEBIT 90 subaccount “Cost” CREDIT 41

- 46,830 rub.

– the cost of goods is written off at retail price; DEBIT 62 subaccount “Advances received” CREDIT 62 subaccount “Settlements with customers”

- 46,830 rubles.

– offset of the buyer’s advance; DEBIT 68 subaccount “VAT” CREDIT 76 subaccount “VAT on advances received”

- 7143.56 rubles. – VAT deduction on the advance received.

Please note: the services of the acquiring bank for making payments are not subject to VAT (subclause 3, clause 3, article 149 of the Tax Code of the Russian Federation). Consequently, the cost of bank services does not include “input” VAT.