Step-by-step instruction

May 10 Ivanov A.P. received funds on the corporate card for the purchase of fuel and lubricants in the amount of 5,000 rubles.

On May 11, the amount of 2,400 rubles was paid on the card.

On May 15, the amount of 2,400 rubles was paid on the card.

On May 16, Ivanov presented an advance report, according to which he refueled a Ford Mondeo with AI-95 gasoline:

- On May 11, a cash receipt for (60 l.) in the amount of 2,400 rubles. (including VAT 20%);

- On May 15, a cash receipt for (60 l.) in the amount of 2,400 rubles. (including VAT 20%).

Cash receipts with allocated VAT confirming expenses for fuel and lubricants are attached to the advance report.

Let's look at step-by-step instructions on how to make a payment using a corporate card in 1C. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Transfer to a corporate card | |||||||

| May 10 | 55.04 | 51 | 5 000 | Transfer to a corporate card | Debit from current account - Transfer to another account of the organization | ||

| Payment to the supplier from a corporate card | |||||||

| May 11 | 71.01 | 55.04 | 2 400 | 2 400 | Transfer of payment to the supplier | Debiting from a current account - Transfer to an accountable person | |

| Payment to the supplier from a corporate card | |||||||

| May 15 | 71.01 | 55.04 | 2 400 | 2 400 | Transfer of payment to the supplier | Debiting from a current account - Transfer to an accountable person | |

| Employee advance report for the purchase of fuel and lubricants | |||||||

| 16th of May | 10.03.1 | 71.01 | 4 000 | 4 000 | 4 000 | Acceptance of materials for accounting | Advance report - Products tab |

| 19.03 | 71.01 | 800 | 800 | Acceptance for VAT accounting | |||

| 91.02 | 19.03 | 800 | VAT write-off | ||||

| HE.01.9 | — | 800 | Reflection of expenses not taken into account in tax accounting | ||||

In what cases is it more practical to pay through accountable persons?

Cash is used when it is necessary to quickly purchase goods or transfers from the organization’s current account are impossible. For example, an employee bought something at his own expense and needs to reimburse the expenses incurred.

The main purposes of expenses through accountable entities:

- Travel expenses including travel and accommodation.

- Purchase of materials (raw materials for production, office supplies, spare parts for vehicles, consumables for office equipment, etc.).

- Payment for services (mobile communications, translator or notary services, minor repairs of office equipment or transport, and others).

- Payment of state fees to various authorities (courts of all jurisdictions, Gostekhnadzor, traffic police and others).

Transfer to a corporate card

Settlements on the corporate card are accounted for in account 55.04 “Other special accounts” (chart of accounts 1C).

To replenish a corporate current account, complete the document Write-off from the current account transaction type Transfer to another account of the organization in the Bank and cash desk section - Bank statements - Write-off button.

Let's look at the features of filling out the document Write-off from a current account using this example.

A corporate card that is not linked to a current account is entered in the Bank Accounts .

Postings according to the document

The document generates transactions:

- Dt 55.04 Kt - transfer of funds to a corporate card.

Cash withdrawal or transfer to card

In accounting, the issuance/transfer of funds for reporting is reflected by the following entries:

In accounting, the issuance/transfer of funds for reporting is reflected by the following entries:

| Debit | Credit | Description |

| 0 208XX 560 “Increase in accounts receivable of accountable persons” | 0 20134 610 “Retirement of funds from the institution’s cash desk” | Funds in rubles were issued for reporting to an employee of the institution in cash or transferred to his personal bank card |

| 0 20111 610 “Retirement of institution funds from personal accounts with the treasury authority” (for budgetary and autonomous institutions) | ||

| 0 20121 610 “Disposal of funds from an institution to a credit institution” (for autonomous institutions that have an account with a credit institution) | ||

| 1 30405 XXX “Settlements for payments from the budget with the financial authority” (for government institutions) |

The transfer of accountable amounts to an institution's debit card is taken into account slightly differently. In essence, this is a transfer by an institution of funds between its accounts, which means that the accounts receivable of the accountable person will arise only when he pays for goods, work, and services. In accounting, these changes are recorded only after money is written off from the debit card account.

An institution can use its own debit card to issue funds to employees on account. In this case, it must submit two documents to the Federal Treasury authority at the place of service (or other financial authority of the corresponding budget). The first is an application to receive cash transferred to the card (f. 0531243) (clause 11 of Rules No. 10n). This must be done no later than the day before receiving funds.

The second document is a breakdown of the amounts of unused funds (deposited through an ATM or cash point) (f. 0531251). The transcript, signed by the manager and chief accountant, is sent to the treasury on the day the funds are deposited (clause 42 of Rules No. 10n). The institution submits the same transcript in order to return funds to the accounts of the Federal Treasury if they were only partially spent or were not used at all.

In general, an institution can both receive and deposit cash into a debit card account through ATMs or special dispensers. For this kind of settlements between institutions and the Federal Treasury, account 21003 “Settlements with the financial authority for cash” is defined (clause 230 of the Instructions for the Application of the Unified Chart of Accounts).

The table shows accounting records that reflect these transactions and documents:

| Debit | Credit | Description |

| 0 210 03 560 | 0 201 11 610 | Funds are debited from the institution's personal account to the institution's debit card |

| 0 201 34 510 | 0 210 03 660 | The institution's cash desk received funds cashed through an ATM or bank cash desk from a debit bank card opened for account 40116 |

| 0 208 26 830 | 0 201 34 610 | An amount of cash was issued from the cash register to pay for other work and services. |

| 0 201 23 660 | 0 201 34 610 | Removal of funds from the institution's cash desk when depositing cash using bank cards through an ATM (cash dispensing point, electronic terminal or other device) |

| 0 210 03 560 | 0 201 23 660 | Funds are credited to the institution's account through an ATM using a debit bank card opened for the account |

| 0 201 11 510 | 0 210 03 660 | The unclaimed amount was returned from the institution’s account to the accounts of the Federal Treasury |

Payment to the supplier from a corporate card

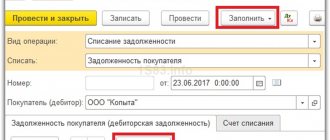

Reflect the payment from a corporate card in the document Write-off from a current account transaction type Transfer to an accountable person in the Bank and cash desk section - Bank statements - Write-off button.

Let's look at the features of filling out the document Write-off from a current account using this example.

Filling out the document:

- Recipient - corporate card holder (accountable person);

- Purpose of payment - decryption of payment from the bank statement on the corporate card.

Until the employee submits documents confirming expenses, reflect all write-offs from the corporate card in account 71.01 “Settlements with accountable persons” as amounts issued for reporting.

Payment by corporate card for transactions in 1C 8.3

Let's consider transactions on a corporate card in 1C 8.3

The document generates transactions:

- Dt 71.01 Kt 55.04 - debiting funds from a corporate card.

Make the second payment using a corporate card in the same way.

Issuance of reports and reflection of transactions in accounting

Who can be reported to?

The accountable person can be an employee of the organization, including the manager and those working under a civil law contract. On the previously controversial issue of the possibility of issuing funds to “contractors,” an explanation was given by the Central Bank of the Russian Federation in 2014 (letter No. 29-R-R-6/7859 dated October 2, 2014).

Despite the fact that the Central Bank is not authorized to give such explanations, the letter included a reference to the Civil Code of the Russian Federation stating that from a legal point of view there is no difference what kind of agreement is concluded between an individual and an employer - labor or civil law. Consequently, the “contractor” is the same employee of the organization and has the right to take money on account.

Some organizations issue an order on a list of possible accountable persons; it may list either positions included in the staffing table or list accountable employees. The law does not require this. But if management wants to limit the circle of accountable persons, money cannot be given to other employees. Any order of the organization is mandatory.

From August 19, 2021, it can be issued on account to employees with arrears of the accountable amount issued earlier. The amendment was introduced by the instruction of the Central Bank of the Russian Federation dated June 19, 2017 No. 4416-U.

It is allowed to issue cash to several employees at the same time. The order is written one for several employees or individually for each.

Employee advance report for the purchase of fuel and lubricants

Fuel and lubricants are accounted for in account 10.03.1 “Fuel in warehouse” at the actual cost of their acquisition (procurement) or accounting prices (1C chart of accounts).

Fill out the employee's advance report with the document Advance report in the Bank and cash desk section - Advance reports - Create button.

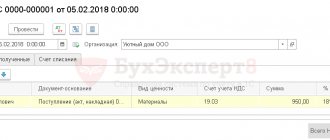

the Advance Report document for this example.

Warehouse is a place where fuel and lubricants are stored. In this example, this will be the car’s gas tank, since fuels and lubricants are immediately filled into the car. Therefore, a similar name for the storage location of fuels and lubricants is entered into the Warehouses .

On the Advances , indicate the previously issued advance, in this case the transaction of writing off funds from a corporate card.

On the Products , specify:

- Document (expense) - primary documents on the basis of which fuels and lubricants are invoiced, in our example this is a cash register receipt (cash receipt);

- Nomenclature - name of fuels and lubricants from the Nomenclature directory.

If VAT is highlighted on a separate line in the cash register receipt:

- VAT rate - the VAT rate indicated on the cash register receipt;

- SF checkbox is not selected;

- The invoice details are not filled in, since the invoice is not issued for retail sales.

In the absence of an invoice, even if VAT is highlighted in the KKM receipt, VAT cannot be deducted (clause 2 of Article 171 of the Tax Code of the Russian Federation).

According to paragraph 1 of Art. 170 of the Tax Code of the Russian Federation, VAT not accepted for deduction must be written off as expenses that do not reduce the taxable base for profit (Letter of the Ministry of Finance of the Russian Federation dated January 24, 2017 N 03-07-11/3094).

Read more about deducting VAT on a cash receipt and accounting for tax expenses

Postings according to the document

The document generates transactions:

- Dt 10.03.1 Kt 71.01 - fuel and lubricants according to the advance report.

- Dt 19.03 Kt 71.01 - VAT on the advance report.

- Dt 91.02 Kt 19.03 - write-off of VAT on other expenses.

- Dt NE.01.9 - expenses not taken into account in the NU.

Documenting

The organization must approve the forms of primary documents, incl. document Advance report. In 1C, an Advance report in the AO-1 form is used.

The completed document can be printed by clicking the Print button - Advance report (AO-1) from the document Advance report . PDF

We looked at how to make a payment using a corporate card in 1C.

Report for sub-report

The employee must report for the funds issued in a strictly defined manner. First of all, pay attention to the deadline: the report is submitted to the accounting department no later than three working days from the moment the employee returns to work or from the end of the period for which the money was allocated.

An employee can submit a report in one of two options:

- advance report in form 0504049 with attached primary documents (tickets, checks, etc.);

- statement or cash order - if accountable funds were allocated for payments to individuals (salaries, fees, etc.).

On the front side of the advance report, the employee fills out information about himself: full name, personnel number, position, structural unit. On the reverse side, in columns 1 to 6, in separate entries, based on primary documents, he enters data on the funds spent: amount, expense item, date and number of the supporting document. Primary documents must be attached to the expense report and numbered in the same order as the entries in the report.

The accountant or manager accepts the report. Each institution establishes its own procedure and timing for reviewing the report as part of its internal accounting policy; legislation does not regulate this point.

Having received the advance report from the employee, the accountant checks whether it is filled out correctly and whether all documents are attached. Data on expenses that the institution accepts for accounting are entered in columns 7–10. Opposite each amount is the analytical account number.

The accountant reflects the expenses accepted by the institution for accounting as follows:

| Debit | Credit | Description |

| 0 10500 340 “Increase in the cost of inventories” | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | Expenses accepted by the institution for accounting using funds issued on account |

| 0 10600 000 “Investments in non-financial assets” | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | |

| 0 30200 000 “Settlements for accepted obligations” | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | |

| 0 40120 000 “Expenditures of the current financial year” | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | |

| 0 10900 000 “Costs for the production of finished products, performance of work, services” | 0 208XX 660 “Reduction of accounts receivable of accountable persons” |

A situation may arise when the employee did not spend all the funds or, on the contrary, invested his own. In the advance report, he enters these amounts in the Remaining/Overexpenditure column. In accounting, this will be reflected as a debt of the reporting person or institution. The overexpenditure is recorded and reimbursed to the employee in the same manner as the advance payment, and to return the balance, the accountant creates a record using one of the options:

| Debit | Credit | Description |

| 0 20134 510 “Receipts of funds to the institution’s cash desk” | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | Accountable funds were returned to the institution's cash desk |

| 0 20111 510 “Receipts of funds from the institution from personal accounts in the treasury body” (for budgetary and autonomous institutions) | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | Accountable funds were returned to the institution’s personal account |

| 0 20121 510 “Receipts of funds from an institution in a credit institution” (for autonomous institutions that have an account in a credit institution) | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | Accountable funds were returned to the institution’s personal account |

| 1 30405 000 “Settlements for payments from the budget with the financial authority” (for government institutions) | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | Accountable funds were returned to the institution’s personal account |

How to take into account debt and collect it from accountable persons

The accountant may have difficulties taking into account accountable amounts if the employee did not submit a report on time for the money spent or did not return the remaining funds from payment for goods/services/work to the institution's cash desk.

If an employee is forced to return accountable amounts, the institution can recover them based on the order of the manager (Article 243 of the Labor Code of the Russian Federation). The time to make a decision is one month after the end of the period established for the return of the advance payment and submission of the report. Please note: the employee must familiarize himself with the order and give his consent to the collection in writing, otherwise the issue of returning the imputed amounts will be resolved in court.

The maximum allowable amount of deduction should be observed (Article 138 of the Labor Code of the Russian Federation) - no more than 20% of wages minus personal income tax.

In accounting, debt collection entries will look like this:

| Debit | Credit | Description |

| 0 30403 830 “Reduction of accounts payable for deductions from wage payments” | 0 20800 660 “Reduction of accounts receivable of accountable persons” | Reflected deduction from wages |

If at any stage the procedure is violated, the issue of return of funds by the accountable person is resolved through the court. The court may decide not in favor of the institution, then the penalty will be considered unfounded. In this case, the accountant writes off the amount as unrealistic for debt collection based on the certificate (f. 0504833).

These transactions in accounting will look like this:

| Debit | Credit | Description |

| 0 40120 273 “Extraordinary expenses for operations with assets” or 0 20930 560 “Increase in accounts receivable for damage to compensate for the costs of the state, state (municipal) institutions” | 0 20800 000 “Settlements with accountable persons” | The debt of an accountable person has been written off based on a court decision |

| ZB 04 “Debt of insolvent debtors” | Reflected on the balance sheet by a simultaneous operation |

The write-off date will be the date of the court order. If the litigation continues or the debtor repays the amount, the debt must be written off from the off-balance sheet account.

To record such situations, the Funds and Settlements Accounting Card (f. 0504051) is used. The data in it is presented by debtor and by type of payment.