Very often, accountants in their work are faced with accounts payable and receivable. They can be both from the organization and from the counterparty. There can be many reasons for their occurrence. This includes incorrect data entry into the program, repayment of debt with another equivalent, etc. Debt, as a rule, is revealed in reconciliation reports.

There are two ways to make mutual settlements and adjustments to debt in 1C 8.3: partial repayment of the debt and full repayment (the debt will be fully repaid). Let's look at the step-by-step instructions.

General information about accounts receivable

Order No. 34n dated July 29, 1998 regulates the formation of receivables. Such amounts that various counterparties owe our organization (enterprises, individuals, budget, extra-budgetary funds, etc.) can be seen in the organization’s balance sheet in the form of a debit balance for accounts 60, 62, 66, 67, 68, 69 , 70, 73, 75, 76.

Thus, debts can arise as a result of:

- sale (shipment) of goods subject to deferred payment

- purchases of products (raw materials) on prepayment

- when overpaying taxes

- issuance of accountable amounts to employees

If the taxpayer has a counter-obligation to a counterparty (accounts payable), doubtful debt is recognized as the part of the debt that exceeds the taxpayer's payables to this counterparty.

Expert of the Legal Consulting Service GARANT O. Tkach

How to Track Debt by Debt Age

You can track the debts of suppliers and buyers by timing. Since receivables are most often generated by a group of buyers, let’s look at the report using its example.

Note! Receivables may also appear for suppliers, for example, when they work on an advance payment basis. Then you can generate a report on them through “Settlements with suppliers”.

Output to report:

Menu “Manager” - subgroup “Settlements with customers” - report “Customers’ debt by debt terms”.

The report form that appears must be configured - click on the “Show settings” button and set:

- Intervals in which you need to generate a report (distribute debts), for example:

- debt period up to 7 days;

- debt period from 8 to 15 days and so on.

Important! You can set any values by adding or deleting rows at intervals in the report settings tab.

- Grouping (similar to accounting reports).

- Selection (similar to accounting reports).

Important! Once the report parameters have been set, you can fix them so that the report can then be automatically built according to the specified principles. To do this, without leaving the settings menu, click the “Save settings” button.

After setting the settings, set the date on which the report should be generated and click “Generate”. In the resulting table, debt data will be divided into columns with designated debt intervals.

The report can be presented in the form of a summary chart for the designated intervals of debt occurrence. To do this, check the box in the report form in the lower left corner:

| V | Diagram |

Read about how to set up accounting policies in 1C here.

If you have access to ConsultantPlus, find out how to analyze accounts receivable. If you don't have access, get a free trial of online legal access.

The role of accounts receivable in an organization

Achieving the main goal of the enterprise may not be fully realized due to the growth of accounts receivable. To overcome this problem, each organization must resolve the issue of reducing accounts receivable, primarily related to monitoring its dynamics.

The program used in many enterprises, 1C, allows you to analyze accounts receivable by generating reports for a certain period.

Based on the Chart of Accounts and the Instructions for its use, the debt can be reflected in the following synthetic accounts: 60, 62, 63, 66, 67, 68, 69, 70, 71, 73, 75, 76, etc. At the same time, analytics are carried out for each account for each buyer, supplier, account, etc.

Results

In 1C there are many options for obtaining data on accounts receivable in the required context. If detail is required (by counterparty, agreement), it is better to use the reports that we presented as accounting. If you need summary data that gives an overall picture and allows you to perform analysis, it is better to use reports from the “Manager” menu.

Sources: Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The procedure for characterizing the status of accounts receivable in 1C

In 1C: Accounting it is possible to check accounts receivable. The section “Accounts receivable and payable” includes reporting for the bank, which is filled out automatically and cannot be edited manually, but only by entering documents into the database in the program.

The section details information on each:

- to the counterparty indicating the TIN

- agreement with the counterparty

- debt from the date of occurrence

Debt is also divided according to terms of execution: long-term (over 12 months) and short-term.

The organization must create reserves for doubtful debts if such debt is considered doubtful, which can be automated in 1C.

For example, let’s take account 60 and 62 based on the 1C: Accounting chart of accounts.

In account 60, analytical accounting is kept for suppliers and contractors (sub-account “Counterparties”) and the basis of calculations (sub-account “Contracts”), and each supplier and contractor is an element of the directory “Counterparties”, and the basis of calculations is “Contracts”. By analogy, analytical accounting is maintained for account 62 - for buyers and customers (sub-account “Counterparties”) and the basis of calculations (sub-account “Agreements”), and each supplier and contractor is an element of the directory “Counterparties”, and the basis of calculations is “Contracts”. This complies with the requirements of the Chart of Accounts.

In the “Agreements” directory, debt is divided into short-term and long-term (according to the details “Date of occurrence of the obligation” and “Date of repayment of the obligation”) and here information is generated on accounts to and from counterparties, as well as existing contracts.

To account for debt, use the “Account balance sheet” report:

| report setup | score 62.1 |

| field “Type of subconto 1” | "Counterparties" |

| field “Type of subconto 2” | "Treaties" |

This reflects the initial balances, turnover and final balances of mutual settlements with customers. If the buyer has a debt, you can see the basis for the formation (invoice or agreement). If there is no need to consider turnover by accounts or contracts, then when setting up the report, the “Type of subaccount 2” field remains blank.

| Counterparty | Agreement (account) | Amount, rub. |

| LLC "Firm" | Invoice No. 01 dated 10/11/2021 | 50000,00 |

| IP Valeeva V.V. | main contract | 5000,00 |

| Total | 55000,00 |

Based on the data obtained, a conclusion is made about the existence and amount of debt.

Accounts receivable are a quickly realizable asset and it is necessary to evaluate their conversion into cash and take into account the share of bad debts according to the average statistical data of previous periods. For example, the amount of accounts receivable is 200,000.00 rubles, including the unpaid amount - 20,000.00 rubles. The share of unpaid debt in the total amount is 10%. This means that according to the “Turnover balance sheet for account 62.1” the conclusion will be that 10% of the debt has not been paid and it is advisable to create a reserve for the next period.

To monitor the payment schedule and maintain settlement and payment discipline, the “Turnover between sub-accounts” report is used to track the repayment of debt during the period between all sub-accounts. In report settings:

| Type of subconto (main) | "Counterparties" |

| "View of subconto (corresponding)" | "Flow of funds" |

| "Subconto" | "Payment to supplier" |

The report will show the amounts of repayment of accounts payable by creditors and the repayment procedure. If, when setting up, instead of “Payment to supplier”, “Receipts from buyers” is indicated, then the report will reflect the receipt of funds from buyers.

Additionally, visualization tools are provided in the form of a “Diagram” report: when setting up the report on the “Data” tab, the account 60.1 is indicated, the type of totals is selected (closing balances, credit, amount), and on the “Diagram” tab the parameters for generating the report are set.

To account for debt, it is necessary to carry out an inventory, usually at the end of the period, and makes it possible to identify debt balances. For this purpose, there is a report “Inventory of settlements with counterparties”: Reports – Specialized – Inventory of settlements with counterparties. The unified form INV-17 or a self-developed form can be used, which is checked with a checkbox on the tab and the relevant inventory information is entered into this form. The debt table is filled in automatically based on the available accounting data entered by clicking the “Fill” button (in this case, both the confirmed and the expired date of obligation are indicated). The “Not confirmed” column must be filled in manually.

Thus, the use of reports in 1C makes it possible to regularly monitor and analyze mutual settlements with buyers and suppliers, assess the status of debt and take measures to optimize it.

What accounts receivable reports are there in 1C?

In the 1C 8 program (hereinafter we will consider this version of the program as the most current and widespread) there are a large number of different reports in which you can see the status of receivables of counterparties.

Conventionally, they can be divided into 2 groups:

- Accounting reports are those reports and documents that are used in everyday practice by accountants who are responsible for keeping accounts or for maintaining records for the enterprise as a whole (chief accountants and deputies). Examples include:

- The turnover balance sheet (hereinafter referred to as the SALT) for the accounts of settlements with counterparties (accounts 60, 62, 76 of the Chart of Accounts, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n). Login to OSV is possible through:

- menu “Desktop” - “SALT by account” (select from the list);

- menu “Purchases and sales” - “Standard reports” - “SALT by account” (select from the list).

Read more about such a report as SALT in the article “Turnover balance sheet - sample filling out 2020”.

By clicking the “Show settings” button in the report form that opens, you can generate a report as you wish in the following sections:

- groupings - by counterparties, contracts, payment documents (for example, issued invoices);

- selection - from the groups listed above, you can select only the counterparties of interest;

- indicators - for example, by expanded balance (convenient for those partners who can have both debit and credit balances at the same time).

- Reconciliation report with the counterparty. Menu “Purchases and sales” - “Settlements with counterparties” - “Settlements reconciliation report”. In this document you can see all the data that is in the accounting for a specific debtor, including the amounts of shipments, payments and offsets.

- Management reports or reports for management. The menu for these reports is called “For Manager”. The menu has subgroups of reports:

- "Settlements with suppliers";

- "Settlements with customers."

These subgroups present summary analytical reports by groups of debts. The creators of 1C considered that they were needed primarily by the management of the enterprise, but nothing prevents other employees from using them. Let's talk about some summary reports in more detail.

ConsultantPlus experts explained what accounts receivable is and how to correctly reflect it in accounting. Get trial access to the system and switch to a ready-made solution.

Answers to common questions

Question No. 1 : Under the assignment agreement, the organization acquired receivables at nominal value. The debtor is an individual entrepreneur who has ceased business activities (excluded from the Unified State Register of Individual Entrepreneurs). Does the assignee have the right to recognize this debt as bad and include it in non-operating expenses?

Answer : It is important to take into account that the extract from the Unified State Register of Individual Entrepreneurs about the termination of the individual entrepreneur does not apply to the basis for recognizing this debt as bad and writing it off as expenses.

Question No. 2 : The organization switched from UTII to OSNO. In the course of activities on UTII, accounts receivable were formed. Under the new regime, does the organization have the right to create a reserve for debt incurred?

Answer : When switching to OSNO, an organization cannot create a reserve for doubtful debts for previously existing debt.

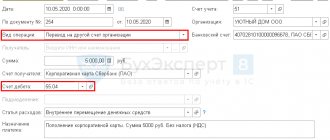

An example of writing off accounts payable in 1C 8.3

In our example, it is necessary to write off a debt of 3,000 rubles, which is owed to the supplier. There may be many reasons, but in this situation they are not particularly interesting to us.

Let's move on to filling out the main part of the document. This can be done automatically using the button of the same name, but keep in mind that there are two of them on the form. In this case, there is no difference, just as with the selected type of operation “Debt transfer”. In other cases, the “Fill” button, which is located at the top of the form, will fill in both accounts payable and accounts receivable.

Manual input is also available here. It is convenient in cases where adjustments are made based on one or two documents.

Everything was filled in correctly automatically. Our receipt of 11 chairs in the amount of 33,000 rubles appeared in the tabular section.

Now we will correct 33,000 rubles to the amount of our debt.

Next, fill out the “Write-off account” tab. In our example, we specified the account as 91.01. In the case where the debt is not with us, but with the counterparty to us, it is necessary to indicate account 91.02.

Inventory of receivables and payables

According to paragraph 27 of the Regulations on accounting and financial reporting in the Russian Federation, before drawing up annual financial statements, you need to make an inventory of all the assets and liabilities of the organization. At the same time, we classify accounts receivable as the property of the organization, and accounts payable as financial liabilities in accordance with clause 1.2 of the Methodological Instructions.

It is necessary to make an inventory and justify the amounts listed in the following accounting accounts in accordance with clause 3.44 of the Methodological Instructions: