The issuance of money from the cash register of an enterprise is registered by filling out a special document - an expenditure cash order . Let us consider the features of this document and the rules for its execution in more detail.

The issuance of money from the organization's cash desk is a cash transaction. The rules for conducting and processing such transactions are regulated by Directive No. 3210-U, approved by the Bank of Russia dated March 11, 2014. The document is mandatory for all legal entities. The only exception is banking institutions; there is a separate act for them.

Note! Directive of the Bank of Russia No. 3210-U allows organizations with the status of SMP and individual entrepreneurs to use a simplified version of maintaining a cash register and processing its transactions.

The issuance of funds in cash from the organization's cash desk is formalized using cash receipts. They have a single form No. KO-2 , registered on 01/01/1999. The cash order is the primary accounting document, therefore the use of the form established by law is mandatory.

According to Bank of Russia Directive No. 3210-U, registration of consumables is possible on paper or electronically.

Registration procedure

The main provisions for issuing funds for reporting through cash settlement services are established in paragraph 6.3 of Bank of Russia Instructions No. 3210-U dated March 11, 2014. According to the Bank's Instructions, the accountant issuing funds must follow specific rules - details are in the article “How to organize settlements with accountable persons.” The accountant-cashier generates cash settlements for the amount specified in the order for the issuance of money. If you have to spend more, it is possible to reimburse the accountable person. If it is less, the balance is returned to the cashier or deducted from the salary.

How is RKO filled out?

The cash register form is filled out by the cashier when issuing cash to the recipient of the funds.

After this, the completed document is transferred to the accounting department for subsequent accounting. The RKO form is determined by the legislation of the Russian Federation, namely the KO-2 form of 2017. The rules for maintaining accounting documentation establish that a document is valid in the absence of blots or any corrections, as in the sample. This requires that all fields of the form be filled out correctly.

The sample for filling out RKO in 2021 requires the following requirements in the appropriate fields:

- organization - the name of a legal entity according to registration documents, that is, an indication;

- division - in the case of an operating separate branch, department of a legal entity, and also, if it has the authority to issue and conducts an operation of this type, then its full name is indicated;

- number – it is necessary to enter the serial number of the cash register, which is determined by each subsequent document of this type;

- date – enter the day, month and year of document execution;

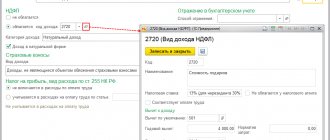

- debit – the account from which funds will be debited to pay cash settlements;

- credit - correspondent account where funds will be transferred;

- amount is the amount that determines the amount of money required to pay for the document, it is indicated in digital form with kopecks;

- designated purpose code - is not always used, only in the case when the individual entrepreneur, as an example, independently determined such a need, that is, he has a classification of operations according to which funds are issued;

- received - data of the person who has the right to receive money upon presentation of documents, where full name and passport data are entered;

- basis - the reason for the issue, which is confirmed by a financial document, that is, indicating its number and date;

- Software – full passport details can be indicated here;

- issued - the details of the cashier, his full name, who issued the document and issued cash, are indicated, as in the sample.

In order to correctly register RKO in 2021, as required by the sample, it is also necessary to register it in a special Registry Book.

The 2021 sample form has approximate data that must be entered into the form.

How to fill out an expense cash order in a sub-report

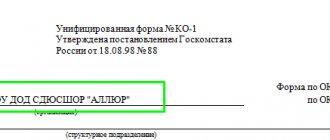

Let's draw up a sample of filling out a cash receipt order in a sub-report using an example. Let's say that an employee of the State Budgetary Educational Institution of Children's and Youth Sports School "ALLUR" P.P. Petrov was given a report of funds in the amount of 15,000 rubles for the purchase of household goods for the needs of the institution. Let's fill out the cash receipt order.

Step 1. First of all, fill in the name of the organization and structural unit. The name may be indicated in an abbreviated version. Then we write the OKPO code. We indicate the date and document number.

IMPORTANT!

Maintain chronological order in the numbering of cash receipts. The auditors recognize such errors as a violation of cash discipline (a fine of up to 50 thousand for an organization and up to 5 thousand for an official).

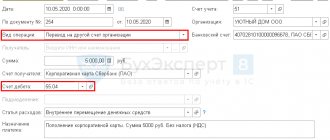

Step 2. Fill out the tabular part of the RKO sub-report (sample). In the “Debit” column, fill in: “Structural unit code”, write down the assigned code, if the institution does not have structural units, put a dash. “Corresponding account, sub-account” is filled in with the corresponding account 0 208 00 000 “Settlements with accountable persons”. “Analytical accounting code” – dash. In the “Credit” column we indicate the loan account – 0 201 34 000 “Cash”. Then we write down the amount in numbers, and also indicate the corresponding target code; in our example, the value “340” is an increase in the cost of inventory.

Step 3. We proceed to filling out the text part of the cash receipt order. In the “Issue” field, indicate the last name, first name and patronymic of the reporting employee. “Base” - we specify the intended purpose of the accountable funds, that is, what the cash was allocated for. “Amount” we write down the amount of the subreport in words. In the “Attachment” field, we fill in the documents on the basis of which the RKO is drawn up, for example, the manager’s order, cost estimate, employee statement, and other documents. Field “By” - fill in the details of the employee’s identification document (passport, power of attorney). “Signatures of the manager and chief accountant” are affixed before the money is issued to the accountable person. The “Received” fields are filled in by the reporting employee and indicate the amount received in words. Date and signature. The finished order is signed by the cashier of the budget institution.

Features of issuing an order for cash expenditure:

- filled out in one copy

- recorded in a special journal ( form KO-3 )

- orders are numbered, with expenses and receipts having separate numbering

- numbering starts anew from January of each calendar year

As a general rule, conducting cash transactions is the responsibility of the cashier .

This process requires careful attention to the presence of the following items:

- Signature of the chief or ordinary accountant on the letterhead. If these staff positions are not available, the signature of the head of the enterprise is required. The signature must correspond to the sample (it is located at the cashier).

- The coincidence of the amounts entered in the document using numbers and in capital form.

- Providing documents confirming the authority of the person.

Identification of the recipient by the cashier:

- verification of the recipient's identity with the presented passport or other document

- request for a power of attorney allowing you to receive funds

- checking the correctness of the power of attorney

Important! Cash issuance is possible only to the person indicated in the company’s power of attorney or consumables.

Issuing money under a power of attorney from an enterprise requires the cashier to check the following data:

- verification of recipient documents

- reconciliation of his documents with the data specified in the power of attorney (last name, first name, patronymic are subject to verification)

- checking the documents of the person receiving money under a power of attorney

The power of attorney must be attached to the consumable. In the case when a document is issued for receiving not one, but several payments, or is required for presentation in different organizations, a copy is made of it. After this, the cashier assures her in the manner that she was accepted into the individual entrepreneur at the enterprise.

A certified copy of the document is attached to the order. The original is kept by the organization's cashier. At the end of the last operation, the original is applied to the cash register.

When the cashier has given out the money, he is required to sign the order. The electronic document is signed accordingly (this is regulated by clause 6.2 of Directive No. 3210-U). The cashier also signs the consumables.

You are allowed to fill out the consumable by hand or by printing. No corrections are made to the paper order.

An electronic order requires a special signature, this is regulated by the requirements of the Federal Law “On Electronic Signature” No. 63-FZ dated 04/06/2011. Changes can be made to an already issued order before it is signed.

Features of filling out an order

The expense cash order contains the following data:

- Supplier name

- details of the power of attorney with the surname, first name, patronymic, passport details of the representative

Not having all the data is dangerous. The presence of a power of attorney to receive funds without the signature of a cash receipt order by a representative of the supplier does not confirm the fact of receipt of money.

It is prohibited to do the following:

- receive a cash register receipt or a receipt for a receipt order from the supplier’s representative

- indicate the details of these documents in the lines “application”, “ground”

- attach the available documents to the consumables

These actions will not replace the signature of the person receiving the funds on the expenditure order. They do not replace giving the cashier a power of attorney.

An example of filling out a cash receipt order

Information about the completed order must be entered into the cash book. In column 2, the cashier enters the last name, first name, patronymic of the representative, as well as power of attorney data and the name of the supplier. A note must be made indicating under which agreement, for which goods, and under which invoice the funds were transferred.

Basic requirements of the Bank of the Russian Federation

Changes in the use of cash register systems, in particular, the introduction of online cash registers, entailed a number of adjustments in the procedure for recording cash transactions (instruction No. 4416-U dated June 19, 2017, which came into force on August 19, 2017). The procedure for conducting cash transactions with cash on the territory of the Russian Federation is established by the Bank of Russia. It is uniform and mandatory for legal entities.

It is necessary to establish a limit on the cash balance in the cash register by administrative document (order), which is calculated using a formula in accordance with the instructions of the Bank of Russia.

IMPORTANT!

Small businesses and individual entrepreneurs, in accordance with the letter of the Federal Tax Service of Russia dated 07/09/2014 No. ED-4-2/13338, have the right not to set a cash balance limit.

All cash transactions are documented with cash documents and reflected in the cash book. Operations for the receipt and expenditure of cash are recorded as receipt or expense cash orders (you can create one receipt and one expense order after the end of the shift).

Receipts and withdrawals of cash are reflected in the cash book, entries are made in it for each incoming and outgoing order. At the end of the working day, the cashier checks the cash in the cash register with the balance in the cash book and certifies the entries in it with a signature. If there is no movement of money through the cash register during the day, no entry is made in the book.

How are transactions processed?

According to the rules of the Bank of the Russian Federation, registration of cash settlements, cash registers and cash books is carried out on paper or in electronic form. Electronically executed documents cannot be corrected after signing. It is allowed to make corrections to paper documents by indicating the date of correction, signatures of the persons who compiled the corrected document with surnames and initials. The chief accountant oversees the maintenance of the book.

IMPORTANT!

Individual entrepreneurs have the right not to draw up cash documents and not to maintain a cash book (clause 4.1 of Bank of Russia instructions 3210-U).

Cash transactions are carried out by a cashier appointed from among the employees of a legal entity or individual entrepreneur, or by the manager himself. Familiarization with responsibilities and rights is carried out against signature. The cashier has a seal with details (to confirm the transaction) and sample signatures of persons who are authorized to sign cash documents.

Let's take a closer look at the procedure for processing cash withdrawal operations from the cash register:

- depositing cash proceeds to a bank account;

- issuing wages and other payments to employees;

- issuance of accountable amounts, etc.

Stamp instead of receipt order m 4, sample

When receiving materials from the supplier, the purchasing company must issue a primary accounting document confirming not only the receipt and receipt of materials, but also their receipt. Such a document is usually a receipt order. The company has the right to develop the form of this document independently in compliance with the necessary requirements or use the unified M-4 form. This document is filled out upon receipt of materials in a single copy by the financially responsible person on the part of the purchasing company. For example, this could be a storekeeper or warehouse manager.

Application of the KO-2 form and documentation samples

Form KO-2 is completed in all cases when cash is issued from the cash register. When preparing a document, it is necessary to take into account the following features of their preparation:

- when depositing cash at the bank, be sure to indicate this fact in the column intended to reflect the purpose. So, opposite the line “Base” you will need to indicate “Collection”;

- When issuing money on account, it is necessary to take into account a certain procedure for providing cash.

First of all, the recipient fills out an application that reflects the direction of use of the amount received, as well as its size and duration of the period until which the remaining amount must be returned to the cash desk, and reporting documentation for the amount spent is provided;

Registration of form KO-2 - when funds are issued for personal use and are intended for expenses for an employee (allocation of funds for a business trip), in this case, in the “Base” column they write “For personal needs”;

- When issuing cash needed to be used for the needs of the organization, the purpose for which it will be used is always given. The wording must completely coincide with any of the list of acceptable ones (in accordance with instructions 1843-U);

- if the company is registered as an individual entrepreneur, even in the absence of employees, the expenditure of funds from the cash register must be documented. That is, if physical a person issues funds to himself for any purpose, then he must draw up a cash settlement.

Results

The form of expense cash orders is approved by law and is mandatory for use by all business entities. An exception is made only for individual entrepreneurs - subject to a number of conditions. Banking organizations have their own form of cash settlement.

For the latest changes in the procedure for conducting cash transactions, read the article “Procedure for conducting cash transactions in 2020-2021.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.