SZV-K report to the Pension Fund of Russia

Back in 2021, the Pension Fund approved a reporting form on employee experience and explained what this form is and who submits the SZV-K. This reporting form is provided by the following categories of policyholders:

| Who submits the form | What information is included in the report? |

| Russian policyholders who received an individual request from representatives of the Pension Fund of Russia | Information that should be included in the form concerns the length of service of individuals for periods up to and including December 31, 2001 |

| Russian insurers operating in the territory of the Republic of Crimea or the city of Sevastopol | In the report, include information about the length of service of Russian citizens working for you who, as of March 18, 2014, permanently resided in the specified territories |

Many accountants and HR department employees are familiar with this form of reporting. Information was provided to the Pension Fund in 2003 and 2004 using a similar form. The reporting information reflected the length of service of employees until the end of 2001.

IMPORTANT!

From 02/11/2020, the new unified form SZV-K is used. The form and instructions for filling out are established by Resolution of the Board of the Pension Fund of the Russian Federation dated September 27, 2019 No. 485p. OKUD code is not provided.

How is the STD-R form provided?

Employees themselves choose how to obtain information: on paper or in the form of an electronic document. The paper STD-R will have to be certified with the signature of the manager or authorized representative and the seal of the organization, if available, and the electronic one - with an enhanced qualified electronic signature.

In the program “1C: Salaries and personnel of government institutions 8”, ed. 3.1, to submit the STD-R form to an employee, use the following functionality: section “Personnel” – “Electronic work books” – “Create” – “Information on work activity, STD-R”

.

In the created document, you must select the employee to whom you want to provide information. The report form will be filled out automatically, provided that for this event there is a completed SZV-TD form, where the “Document accepted by the Pension Fund of Russia (not edited)”

.

Due date in 2021

There are no uniform deadlines for submitting the report. The Pension Fund of Russia decides who submits the SZV-K report and when in 2021, sends requests to these organizations with the requirement and deadlines. In a standard situation, one month is allocated for the formation and provision of information. But there are urgent requests when several days are given to collect and send information. The letter from the Pension Fund always indicates a specific deadline for providing data, please adhere to it.

IMPORTANT!

There is one exception! If you operate in the territory of the Republic of Crimea or the city of Sevastopol, submit information no later than December 31, 2021 (Part 1, 2, Article 6.1 of the Federal Law of July 21, 2014 No. 208-FZ).

The SZV-K form can be submitted both electronically and on paper. But we recommend submitting information electronically via secure communication channels. Information about the length of service will quickly be transferred to the individual personal account of the insured person.

How to fill out SZV-K

The form consists of the following sections:

- Information about the insured person. Includes: SNILS, full name, date of birth and place of residence. This information is filled in based on your passport and insurance certificate. For the “territorial living conditions” indicator, an empty value is acceptable in the absence of supporting documents.

- Type of reporting form. Select from the suggested types and check the box. Initial - when submitting information for the first time, corrective - when changing the information of the original SZV-K about the length of service or other information about the insured person, canceling - to cancel previously provided information.

- Periods of activity. The section includes information about the periods of work experience of the insured person until December 31, 2001, based on the work record book. Fill in the name of the organization, activity code (required). To determine it, we use Appendix No. 1 of the Pension Fund Resolution No. 485p.

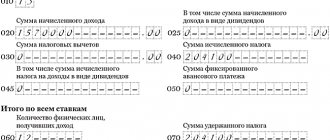

Let's look at a clear example of filling out SZV-K. The conditions for filling out are as follows:

GBOU DOD SDYUSSHOR "ALLUR" received a notification from the Pension Fund of the Russian Federation about the provision of information on employee Sergeev Sergey Sergeevich. According to the work book records, there is information that Sergeev S.S. works at the GBOU DOD SDYUSSHOR "ALLUR" in the position of "building maintenance worker":

- the employment contract with GBOU "ALLUR" was concluded on August 21, 2014;

- from 03/23/1980 to 03/25/1985 - work as a “turner” at the Stroyka enterprise (an area equated to the regions of the Far North);

- from 03.03.1986 to 04.11.1988 - work as a “general worker” at the Chaika enterprise (region of the Far North);

- from 11/14/1988 to 04/01/1999 - work as a “gas cutter” at the enterprise “Plant No. 12” (the position is classified as work with difficult working conditions).

This is what a sample looks like on how to fill out the SZV-K according to these conditions:

Labor activity: territorial and special conditions

Fill out the column “Territorial conditions (code)” of the table in accordance with Appendix 1 to the Instructions, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p. For insured persons working in territories classified as regions of the Far North and equivalent areas, indicate the size of the regional coefficient established centrally for the salaries of employees of non-production industries in these areas. Specify this coefficient as a number with a fractional part separated by commas (for example, “ISS 1.7”).

Fill out the column “Special working conditions (code)” of the table in accordance with Appendix 1 to the Instructions, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p.

There are two cases when in this column you need to indicate not one code, but two. In this case, the second one is written on the line below.

The first case: an employee performs work that gives him the right to early assignment of an old-age pension in accordance with Lists No. 1 and No. 2, approved by Resolution No. 10 of the USSR Cabinet of Ministers of January 26, 1991. Here, indicate the code of the corresponding List position.

Second case: the right to early retirement arises in accordance with subparagraph 11 of paragraph 1 of Article 27 of the Law of December 17, 2001 No. 173-FZ. For such an employee, it will be necessary to additionally indicate the profession code in accordance with Appendix 1 to the Instructions, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p.

Features of filling for Crimea and Sevastopol

The updated instructions for filling out the SZV-K for Crimea provide a special procedure for filling out the report. For policyholders operating in the territory of the Republic of Crimea or the city of Sevastopol, include in the form information about the length of service for the periods:

- up to December 31, 2014 inclusive - if you brought the constituent documents into compliance with the legislation of the Russian Federation within the period established by law and submitted an application to enter information into the Unified State Register of Legal Entities;

- up to 12/31/2015 inclusive - in other cases.

Checking SZV-TD

To check the SZV-TD, you should use the PFR - PD software program:

You can download it from the link - https://www.pfrf.ru/strahovatelyam/for_employers/software/

After installing the PD software, to launch a check from 1C with third-party programs, click the Check – Check upload button in SZV-TD .

In the form that opens, click on the link Setting up programs . You will need to indicate the path where the PD software program was installed.

In the future, when you click the Check – Check upload button, the uploaded files will be checked using SZV-TD a third-party program.

How to fill out SZV-K if you have no experience

If a request has been received from the territorial branch of the Pension Fund for a dismissed employee or for an employee who does not have entries in the work book for the required period, then there is no need to fill out information. In this case, prepare a letter of refusal, in which you describe in detail the reason why it is not possible to provide information. Let's look at the situation using an example.

An official request from the Pension Fund for Irina Yuryevna Pegova.

Pegova I.Yu. worked at the State Budget Educational Institution of Children's and Youth Sports School "ALLUR" in the position of "wardrobe attendant" in the period from 07/15/2013 to 06/22/2017. Dismissed at her own request by order of the director No. 102 dated 06/22/2017 based on a statement b/n dated 06/07/2017.

Storage periods and responsibility

Documents containing individual information about experience must be stored for at least 75 years (Article 22.1 125-FZ and Article 905 of Order No. 558 of the Ministry of Culture). If reporting forms are prepared and submitted electronically, arrange for documentation to be stored in electronic format. Reflect the procedure in the accounting policy, familiarize the responsible persons with signature.

The official request from TOPFR indicates not only the latest deadlines for providing information, but also the responsibility provided for failure to provide or for indicating erroneous data. For example, refusal to provide, incomplete provision or distortion of information in the SZV-K form threatens officials of the institution with an administrative fine. Its size is 300-500 rubles. (note to Article 2.4, Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation).

At the same time, the size of the pension is determined based on the data provided. If you provide incorrect data that will lead to the assignment of an inflated pension, the Pension Fund has the right to sue for compensation for material damage (Article 25 173-FZ), so it is important to provide reliable information.

Labor activity: other periods counted in the insurance period

In the SZV-K form, you also need to indicate other periods counted in the insurance period. These include:

1) the period of military or other service equated to military service in accordance with the Law of the Russian Federation of February 12, 1993 No. 4468-1. At the same time, the time of study in military educational institutions of vocational education is also considered a period of military service (clause 2 of article 35 of the Law of March 28, 1998 No. 53-FZ). Depending on the duration and results of training (including expulsion from an educational institution), this time may be counted differently towards the service life (clause 4 of article 35 of the Law of March 28, 1998 No. 53-FZ). In this case, the final period of service is reflected in the military ID. It is this that the employer should indicate when filling out the SZV-K form;

2) the period of receiving sick leave benefits for temporary disability;

3) the period of care of one of the parents for each child until he reaches the age of 1.5 years (but not more than 4.5 years in total);

4) periods:

- receiving unemployment benefits;

- participation in paid public works;

- moving (resettlement) in the direction of the state employment service to another area for employment;

5) the period of detention of persons who were unjustifiably prosecuted, unjustifiably repressed and subsequently rehabilitated, and the period of serving their sentences in places of imprisonment and exile;

6) the period of care of an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80 years;

7) the period of residence of spouses of military personnel performing military service under a contract, together with their spouses, in areas where they could not work due to lack of employment opportunities, but not more than five years in total;

period of residence abroad for spouses of employees sent:

period of residence abroad for spouses of employees sent:

- to diplomatic missions and consular offices of Russia;

- to permanent missions of Russia to international organizations;

- to Russian trade missions in foreign countries;

- to representative offices of federal executive bodies, state bodies under federal executive bodies or as representatives of these bodies abroad, as well as to representative offices of Russian government agencies (state bodies and government agencies of the USSR) abroad;

- to international organizations according to the list approved by Decree of the Government of the Russian Federation of November 26, 2008 No. 885.

Reflect the periods specified in paragraph 8 in the SZV-K form according to their actual duration, but not more than five years in total.

The periods listed in paragraphs 1–8 should be reflected in the SZV-K form in cases where they were preceded and (or) followed by periods of work (regardless of their duration) specified in Article 10 of the Law of December 17, 2001 No. 173-FZ. In this case, the time gap between the end of such periods and the beginning of work activity does not matter.

An example of how the insurance period of a woman who first found work after the birth of a child is reflected in the SZV-K form

The first entry in A.P.’s work book Ivanova dated September 30, 2000. In 1998, Ivanova gave birth to a child. The certificate indicates the date of birth - February 1, 1998. The insurance period for assigning a labor pension includes the period of caring for a child until he reaches the age of 1.5 years. This period is determined on the basis of the birth certificate - from February 1, 1998 to July 31, 1999. Despite the fact that more than a year has passed between the end of the child care period and the start of work, this period is reflected in the SZV-K form on the basis of the child’s birth certificate.

This follows from the provisions of paragraph 3 of Article 2, Articles 10, 11 of the Law of December 17, 2001 No. 173-FZ, paragraph 2 of the Rules approved by Decree of the Government of the Russian Federation of October 2, 2014 No. 1015, paragraph 3 of paragraph 2 of the resolution of the Constitutional Court of the Russian Federation dated July 10, 2007 No. 9-P and paragraph 3 of paragraph 2.1 of the ruling of the Constitutional Court of the Russian Federation dated November 20, 2007 No. 798-O-O.

Specify the type of period (code) in accordance with Appendix 1 to the Instructions, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p. For example, for the period of military service the code “SERVICE” is provided.