Reporting

Accountable money is cash that is issued to a company employee (accountable person) for costs associated with the activities of an entrepreneur or company.

The issuance of money from the cash register in 2021 can be carried out for the following purposes:

- For business expenses;

- For the acquisition of assets;

- For business trip expenses;

- To pay settlements under contracts;

- For expenses of branches and divisions of the organization that are on the general balance sheet.

VAT write-off

The Ministry of Finance believes that VAT can be deducted only on an invoice, the exception is if this is provided for in clauses 3, 6-8 of Art. 171 Tax Code of the Russian Federation. The Code does not provide for the specifics of deducting VAT on retail purchases.

Also, the specified VAT cannot be accepted as expenses for income tax purposes, since clause 2 of Art. 170 of the Tax Code of the Russian Federation does not provide for the possibility of taking into account in the cost of goods (work, services) VAT presented due to the lack of an invoice (Letter of the Ministry of Finance of the Russian Federation dated January 24, 2017 N 03-07-11/3094).

Since the goods were purchased at retail and no invoice was issued, VAT is not deductible. Based on the Receipts document (acts, invoices), you need to create a VAT write-off .

Postings according to the document

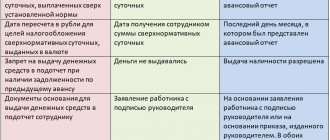

Features of cash withdrawal

- Cash for business trip expenses is issued in the amount based on such expenses.

- Employees who received cash on account must report on the expenditure of the amounts received. They must do this within three days after the expiration of the period for which the cash was issued. If funds were issued for a business trip, no later than three days from the date of return from it. The report occurs by submitting special advance reports to the accounting department on the amounts spent.

- Cash can be issued for reporting only if the person has fully accounted for the funds previously received.

- Transferring received money to third parties is strictly prohibited.

Is a report required for the amount received?

As stated in clause 6.3 of the instructions of the Central Bank of the Russian Federation dated 03/11/2014 No. 3210-U, until 08/19/2017 it was prohibited to issue money if the employee did not provide a report on previously received amounts.

Here the Central Bank made changes to the report. Now money can be issued even if the employee has not repaid the debt on previously issued funds. But this does not mean that employees no longer need to prepare advance reports on the amounts spent. The employee must submit reporting documents on the money spent to the accounting department.

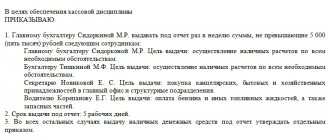

Order for the release of funds

The management of the organization must issue an order that prescribes the procedure for issuing and writing off money for reporting. It should contain the following information:

- List of employees who can receive accountable funds (the position, surname and initials of the employee must be indicated);

- Terms for which cash can be issued;

- The procedure for submitting and approving advance reports.

Employees of the organization to whom the company manager has given the right to receive cash according to the report must be familiar with this order. They will also be required to sign to confirm familiarization.

In addition, a contract on financial liability must be concluded with employees listed in the order.

A sample order can be found in the article.

For how long is cash issued?

An entrepreneur or manager of an organization has the right to decide for himself how long to issue the money. This issue is not regulated by law. The most important thing is that this deadline is indicated in the employee’s application, and the manager fully agrees with this deadline.

As already written above, accountable cash must be returned no later than three days from the end of the period for which the funds were issued. If the application does not indicate for how long the employee receives the cash, it will need to be returned within three days from the date of receipt.

If cash was issued for a long period (for example, several months), the employee has every right not to return it until the end of the appointed period. You can return them ahead of schedule at your own request, or upon dismissal.

Reflection of goals, deadlines and limits on accountable amounts

Accountable money is given to employees of the enterprise for expenses related to the direct activities of the organization. According to paragraph 5 of Directive No. 3210-U, an employee is a person with whom an employment contract or a civil law contract has been concluded. This means that both a full-time employee and an outside contractor can receive money.

In this paragraph of the Regulations, you can give a general description of what expenses the money will be given to employees:

- administrative and economic,

- representative,

- travel allowances

Or it is possible, at the discretion of management, to issue a separate order approving the list of business expenses and the amounts within which funds will be issued. Accountable amounts exceeding those specified in the order must be additionally approved by the manager.

The terms for which the accountable person can receive money are also determined by management and can be simultaneously specified in an order with a list of the purposes for issuing the advance and its limit. The Regulations themselves should indicate that specific deadlines for certain accountable amounts are indicated in a separate order. For cases not specified in the order, a clause should be fixed in the Regulations that defines the general maximum reporting period, for example, no more than a month.

A list of employees entitled to receive money for business expenses will make the accountant’s work easier. It can be presented in this Regulation in the form of a list of positions. It is better to collect specific names in a special list of accountable persons and issue them by a separate order, so as not to re-issue the entire Regulation due to the addition of an additional accountable person to the list.

Find out how to write an order correctly from this article .

Documentation of issue

When issuing accountable funds, the following documents must be drawn up:

- A memo from the initiator of the issuance - it must contain justification that the issuance of money is really necessary. Also, the performer must be registered. If the initiator is the manager of the company, there is no need to draw up this note.

- Management order on accountable employees - it reflects to whom cash can be issued and in what amounts.

- Cash receipts for expenses.

- Specific documents (taking into account the content of work orders). Such documents may be:

- Certificate of an employee sent on a business trip;

- Work assignment;

- Registration book for workers sent on business trips;

- Powers of attorney for payment for goods and work on behalf of the company, books of record of such powers of attorney.

Accountable document flow and new Directive of the Central Bank of the Russian Federation No. 5348-U

From the end of March 2021, when issuing accountable money, companies must be guided by the new rules for cash payments (Instruction of the Central Bank of the Russian Federation dated December 9, 2019 No. 5348-U “On the rules for cash payments”). They did not radically change the previous norms from Directive No. 3073-U dated October 7, 2013, but partially corrected them.

The new instruction prescribes cash payments between companies, individual entrepreneurs and individuals using cash received at the cash desk of a participant in cash payments from his bank account (Central Bank Letter No. 45-19/5013 dated 06/04/2020).

It turns out that it is possible to issue cash on account from cash proceeds, but immediately issuing an unspent accountable advance returned by one employee to the cash desk to another accountable person will become a risky procedure that will attract the attention of controllers. The penalty for such a violation is for officials from 4,000 to 5,000 rubles, for companies from 40,000 to 50,000 rubles. (Part 1 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation).

In such a situation, you will have to first hand over the money to the bank, and then withdraw it and only then give it to the accountant.

Will this procedure affect the accountable document flow? Most likely no. There will be more work for cashiers and accountants to prepare cash receipts and expenses, but the set of documents for the accountant will not change.

Cash withdrawal procedure

The issuance of funds against the report is carried out in several stages:

- Checking the existence of debt for previously provided amounts. It is worth finding out whether the employee has a debt for previously received accountable money. If there is a debt, you cannot issue money.

- Receiving an application.

The employee must write an application addressed to the director of the company to issue him money on account. There is no legally established application form, so it can be drawn up in any form. The main thing is that the text states: the amount of cash issued and the period of issue.

The manager must sign and date the application. Accountable funds cannot be issued without this application.

- Design of consumables.

After the application has been received and signed, you can issue a cash receipt order. The order can be issued by:

- Chief Accountant;

- Accountant or other official (including cashier);

- Company manager (if there is no accountant or chief accountant).

Also, an accountant or chief accountant must sign this document. If none of them is at the workplace, the consumables are signed by the director of the organization.

Read more about the cash receipt order in the article.

- Transferring the order to the cashier.

The cashier is required to check the received consumables. If it is drawn up correctly, then the recipient of the funds must present the cashier with an identity document. After this, accountable funds can be issued from the cash register. The recipient of the money and the cashier must put their signatures on the order.

- Checking the cash book.

It is necessary to make an entry in the cash book about the issued order. In this case, the entries in the cash book must be compared with the information from the orders. This should be done either by an accountant or a chief accountant. If they are absent - the company manager.

Read more about the cash book in the article.

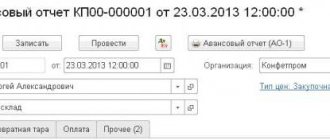

Advance report

The reporting employee must report the funds received. This must be done in the form of an advance report. This report must be provided by the employee to the company manager within three days from the date:

- Expiration of the period for which the money was issued;

- Returning from a business trip;

- Returning to work (from vacation or sick leave).

The report must be accompanied by documents that can confirm the expenses. These documents can be various checks. These reports are submitted either to an accountant or to the chief accountant, and in their absence, to the director of the company.

The employee to whom the report was submitted must check it for:

- Availability of supporting documents;

- Targeted spending of money;

- Correct execution of the report itself and supporting papers;

- Correspondence of the amounts spent.

The period for verification, approval of the report and final payment is established by the director of the organization. After the report has been approved, the accountable funds are written off from the organization’s balance sheet.

But it's not that simple. There are cases when an employee spent more or less money than he received on the report. Let's figure out what to do in such situations.

- Spent less. In such a situation, in order to accept the money back, the chief accountant must issue a cash receipt order, in which he must reflect the amount being returned.

- Spent more. After the advance reporting has been approved, the overexpenditure is returned to the receipt order officer. The details of this order must be included in the advance report.

A sample receipt order can be found in the article.

A situation may also arise when an employee does not report on the funds received on time and does not return the balance. In this case, the unreturned money can be deducted from his salary. To do this you need:

- Obtain consent from the employee to deduct this amount (if he does not agree, you can recover the money by going to court).

- The manager of the organization must issue a retention order. This must be done within a month from the date of expiration of the return of accountable funds. If this deadline is not met, you will only be able to get your money back through the courts.

- Familiarize the employee with the text of this order.

It should be borne in mind that the amount of deductions should not exceed twenty percent of the employee’s salary. If the debt is greater than this limit, deductions are made from several salaries.

Maximum subreport amount

In accordance with the law, payments under one agreement should not exceed one hundred thousand rubles. It is believed that this limit cannot be exceeded. However, there are still some nuances.

This restriction is established only for settlements under agreements between companies and entrepreneurs. But this limit does not apply to settlements with citizens who are employees of the organization. These calculations include the issuance of cash on account, payment of wages and social benefits.

The main thing is that when making payments to entrepreneurs and companies, employees do not exceed the limit of one hundred thousand rubles.

That is, the head of the organization can issue an account of any amount of funds, within the limits of financial capabilities.

Controversial situations

- An employee urgently needs to receive accountable funds, and the manager of the company is on vacation - either the financial director or an accountant can issue the money, but only with a power of attorney.

- The director orally asked the accountant to give him money - money cannot be given, this can only be done upon a written application.

- An employee needs an amount of more than one hundred thousand rubles - cash can be issued, since the maximum limit applies only to settlements with entrepreneurs and organizations.

- If it is necessary to purchase materials under a civil contract, cash is issued to the contractor - in this case there are no violations of cash discipline, since from June 2021 an employee working under such a contract is considered an employee of the organization.

- The accountant insists that the reporting employee sign an agreement on financial liability - issuing cash on account does not serve as the basis for concluding such an agreement. If the employee does not return the remaining funds, they can be withheld from the employee's salary.

Results

The accounting policy of the organization and local regulations (if any are used) must approve the procedure for mutual settlements with accountable persons. This procedure is accompanied by the execution of a number of documents that must be carefully considered in order to:

- the accountable amounts were perceived as such by the tax authorities and were not treated as the employee’s taxable income;

- expenses were not excluded by controllers from expenses to calculate the tax base for profits;

- the organization was not fined for violating cash discipline.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

A small reminder for accountants

Accountants should always remember the following rules:

- The employee must write an application to receive cash from the cash register.

- The operation to issue funds must be formalized with an expenditure order.

- If funds are not fully spent, they must be returned back to the cashier.

- A new advance cannot be issued until the employee has accounted for the old one.

- One accountable person cannot be given more than one hundred thousand at a time.

- The expenditure of funds must be confirmed by documents (checks, receipts, acts, invoices).

- In order to confirm payment for goods, one cash receipt is not enough; you also need a sales receipt.

- If the money is not returned within the prescribed period, it is withheld from the employee's salary. Personal income tax is charged on the amounts of accountable funds. If controversial situations arise, they must be challenged in court.

Read more about accounting for accountable funds in the article.

Similar articles

- The procedure for conducting cash transactions in 2016-2017

- Order for issuance and issuance of funds for reporting

- Accounting for settlements with accountable persons

- Settlements with accountable persons: postings

- Order for the issuance of accountable amounts (sample)

Calculations with accountable persons

Accountable persons are all, without exception, full-time employees of the organization (working under an employment contract) who have received funds in advance from the cash register. As a rule, cash is issued to the account for upcoming travel expenses, as well as to pay for business office expenses, postal expenses, expenses associated with the purchase of materials for small wholesale in retail trade, and for other business needs.

Cash funds are issued according to cash receipts and must be spent strictly for their intended purpose. In addition, accountable funds cannot be attributed to the income of an individual - an employee of the company. In this case, the expenses of the accountable person made in foreign currency are recalculated into rubles at the exchange rate of the Central Bank of the Russian Federation established on the date of approval of the advance report.

Settlements with accountable persons presuppose, firstly, insignificant amounts of money entrusted to employees in order to implement the intermediary functions of the organization, and secondly, the impossibility of their implementation in a non-cash manner. All transactions involving settlements with accountable persons are characterized by a limited, pre-known list and a fairly high degree of regularity in their execution.

Among the internal organizational documents used in settlements with accountable persons are lists of accountable persons approved by the management of the enterprise, estimates of entertainment expenses, orders for approving these estimates, advance reports, as well as report logs. In addition, if there have been cases of employees being sent on business trips at the enterprise, the corresponding management orders must also be available. In turn, the internal control system, among other things, must necessarily include fundamental principles that determine the procedure for making calculations, formally enshrined in the accounting policies of the organization.

Cash transactions here are formalized using standard interdepartmental forms of primary accounting documentation for enterprises and organizations. Cash issuance from the cash registers of enterprises is carried out according to cash outgoing orders of the unified form N KO-2 or properly executed other documents, including pay slips, applications for the issuance of money and invoices, with the imposition of a stamp on these documents with the details of the outgoing cash order.

The issuance of cash on account for expenses associated with business trips is made within the limits of the amounts due to business travelers for these purposes. Documents for the issuance of money are signed by the manager, chief accountant of the enterprise or other authorized persons. When issuing money according to an expense cash order, the cashier requires the presentation of a passport or other document identifying the recipient, writes down the name and number of the document, by whom and when it was issued.

Based on the funds received, accountable persons must draw up an advance report with supporting documents for the purchased goods. Supporting documents include sales receipts and travel tickets, which are presented to the accountant. If the purchased goods are not capitalized, the accountable amount is included in the total annual income of the accountable person. At the same time, the very procedure for issuing and reporting on the use of accountable amounts is established by order of the head of the organization.

Employees who received cash on account are required, no later than three working days after the expiration of the period for which they were issued, or from the day of their return from a business trip, to submit a report on the amounts spent to the accounting department of the enterprise and make a final payment for them. The form of the advance report is unified and is given in Resolution of the State Statistics Committee of Russia dated August 1, 2001 N 55 “On approval of the unified form of primary accounting documentation N AO-1 “Advance report”. The issuance of cash on account is subject to the full report of the specific accountable person on the advance previously issued to him. The report is checked by the accounting department.

The verified expense report is approved by the manager or an authorized person and accepted for accounting. The balance of the unused advance is handed over by the accountable person to the organization's cash desk using a cash receipt order in the prescribed manner. Overexpenditure on the advance report is issued to the accountable person according to the cash receipt order. Based on the data of the approved advance report, the accounting department writes off accountable amounts in the prescribed manner.

The system of intra-organizational control over settlements presupposes the presence of a list of employees approved by the manager who have the right to receive accountable funds, an approved procedure for submitting written applications for the issuance of funds indicating the reasons for such issuance, and compliance by the enterprise’s employees with the established deadlines for reporting on amounts issued, as well as return deadlines remaining funds.

In addition, we can talk about any control only if the enterprise has no overdue debt on accountable funds, compliance with the ban on issuing funds to employees who have not reported on previously received amounts, analytical accounting of travel and hospitality expenses, registration of appropriate supporting documents attached to advance reports, as well as endorsement of advance reports.

Now regarding business trips. A business trip is a trip by an employee by order of the head of an enterprise to carry out an official assignment outside the place of permanent work. In the case when a citizen is sent on a trip by an enterprise with which he does not have an employment relationship and, therefore, is not administratively subordinate to the head of this enterprise, such a trip cannot be considered a business trip. Sending an employee on a business trip is formalized by issuing him a travel certificate issued on the basis of an order.

Business travel expenses are recognized as costs associated with production management and form expenses for ordinary activities. Recognition of travel expenses as expenses incurred by an organization in accordance with the rules for the formation in accounting of information on expenses of commercial organizations is carried out on the basis of the Accounting Regulations “Organization Expenses” (PBU 10/99), approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n.

When an employer pays a taxpayer expenses for business trips both within the country and abroad, the income subject to taxation does not include daily allowances paid within the limits established in accordance with current legislation, as well as actually incurred and documented targeted expenses for travel to destinations and back, fees for airport services, commission fees, expenses for travel to the airport or train station at places of departure, destination or transfers, for luggage transportation, expenses for renting living quarters, payment for communication services, obtaining and registering a service foreign passport, obtaining visas, as well as costs associated with exchanging cash or a bank check for cash foreign currency.

If the taxpayer fails to provide documents confirming payment of expenses for renting residential premises, the amounts of such payment are exempt from taxation within the limits established in accordance with the law. That is, no more than 700 rubles for each day of a business trip in the Russian Federation and no more than 2,500 rubles for each day of a business trip abroad.

At the same time, the same taxation procedure applies to payments made to persons under the authority or administrative subordination of the organization (if there is an employment contract), as well as members of the board of directors or any similar body of the company arriving to participate in a meeting of the board of directors, board or other similar body of this company.

It should be remembered that travel expenses to and from the business trip are included in the organization’s expenses without VAT. Travel expenses, in particular, include the cost of travel to and from the place of business trip by air, sea, rail, road transport, including the cost of advance ticket sales and fees for the use of bedding and the cost of renting living quarters. Tax deductions are made on the basis of invoices issued by sellers when the taxpayer purchases goods and services and confirming the actual payment of tax amounts. In addition, tax amounts are subject to reimbursement within the limits established by law.

In this case, these deductions are made on the basis of travel documents of the established form. A travel ticket, in which the tax amount is highlighted as a separate line, is the basis for deducting VAT amounts paid on travel services to and from the place of business travel, without an invoice. Airlines are not required to issue invoices here.

Amounts of VAT paid when transporting employees of an organization by rail using a rotational method of organizing work are accepted for deduction on the basis of railway tickets, in which the amount of VAT is highlighted as a separate line. The same applies to electronic travel tickets. However, here it is necessary to take into account that a deduction is possible only if the VAT is specifically separated from the total cost of the ticket and presented in numbers. In those cases where VAT is simply mentioned on the ticket (including VAT), serious difficulties may arise in obtaining a deduction.

Another common type of settlements with accountable persons is settlements for entertainment expenses. Representation expenses include the taxpayer's expenses for the official reception and service of representatives of other organizations participating in negotiations in order to establish and maintain mutual cooperation, as well as participants arriving at meetings of the board of directors.

Entertainment expenses include the costs of holding an official reception for these persons, transporting these persons to the venue of the entertainment event and back, buffet service during negotiations, and paying for the services of translators who are not on the taxpayer’s staff. This does not include expenses for organizing entertainment, recreation, prevention or treatment of diseases. In this case, entertainment expenses during the reporting period are included in other expenses in an amount not exceeding 4 percent of the taxpayer’s expenses for wages for this reporting period.

The synthetic accounting registers where transactions with imprest amounts are reflected are the general ledger, the cash flow statement in Form No. 4 and the balance sheet line “other receivables, payments for which are expected within 12 months,” order journal No. 7 and other accounting registers for account 71.

According to Order of the Ministry of Finance No. 94n dated October 31, 2000, which approved the Chart of Accounts and Instructions for its application, analytical accounting of settlements with accountable persons must be maintained for each amount issued for reporting.

For this purpose, in order to summarize information on settlements with employees for the amounts issued to them on account for administrative, economic and other expenses, organizations use account 71 “Settlements with accountable persons”. For the amounts issued for the report, account 71 “Settlements with accountable persons” is debited in correspondence with the cash accounts. For the amounts spent by accountable persons, account 71 “Settlements with accountable persons” is credited in correspondence with the accounts that record expenses and acquired values, or other accounts depending on the nature of the expenses incurred.

Accountable amounts not returned by employees on time are reflected in the credit of account 71 “Settlements with accountable persons” and the debit of account 94 “Shortages and losses from damage to valuables.” They are written off from account 94 “Shortages and losses from damage to valuables” either to the debit of account 70 “Settlements with personnel for wages” if they can be deducted from the employee’s wages, or to the debit of account 73 “Settlements with personnel for other operations” , if there is no possibility of deduction from the employee’s salary.