Who has the right to receive money

Accountable amounts are money that is given to employees to carry out company instructions.

New reporting rules have been established relatively recently - from August 19, 2021, with the adoption of a new edition of Bank of Russia Directive No. 3210-U. Employer, according to Part 1 of Art. 19 Federal Law dated December 6, 2011 No. 402-FZ “On Accounting”, is obliged to organize and maintain internal control of the facts of economic activity. The procedure for monitoring the issuance of money to accountable persons is determined by the head of the company. He issues an order with a list of persons entitled to receive funds from the organization’s cash desk.

Accountable persons are persons to whom an organization or individual entrepreneur gives money to carry out instructions and who are obliged to provide a report on their use. They are any employees of the enterprise.

Is it possible to do without an order?

The presence of an order on accountable persons is not strictly mandatory ; however, if the enterprise uses the practice of transferring funds to employees on account (and without this, the activities of any organization are practically impossible), it is better to stock up on this document. Otherwise, as a result of a sudden inspection by the tax service or labor inspectorate, sanctions from regulatory structures in the form of a fine, which can be imposed both on the legal entity itself and on its director, cannot be ruled out.

How to receive the money

Before the introduction of the amendments, in order to receive money, the employee sent an application to the accounting department or human resources department, which indicated the required amount and an explanation of what it would be spent on.

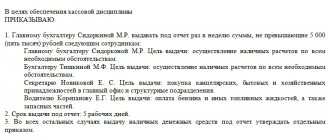

But in 2021, from August 19, it has become easier to issue reports to employees. The changes are provided for by the instruction of the Central Bank of the Russian Federation dated June 19, 2017 No. 4416-U. From August 19, 2007, it is not necessary to submit an application. To issue money, an order or other administrative document of the company on behalf of the director is sufficient. The form of such a document is arbitrary. But it must contain the following details:

- FULL NAME. faces;

- document registration number;

- amount of cash;

- the period for which cash is issued; appointment (optional);

- director's signature and date.

It is allowed to carry out settlements with accountable persons using a new sample of statements:

How to place an order

In terms of design, the order is also quite variable: it can be created in handwritten format or printed on a computer using a standard A4 (or even A5) sheet or company letterhead. In this case, the order must be certified by the autograph of the head of the company or another person authorized to endorse such documents.

In addition, everyone who is mentioned in it must leave their signatures under the order: the reporting employees themselves, as well as the employees responsible for implementing the order - by this they indicate that they have read and agree with the document.

It is not necessary to certify the order with a seal, because from 2021, the norm for the use of seals and stamps by legal entities has ceased to be a legal requirement.

The order is usually written in a single copy and, during the period of validity, is contained together with other regulatory and administrative papers of the enterprise. After the relevance of the order is lost, it is transferred for storage to the archive, where it lies until the expiration of the legally established period, then it, along with other outdated documents, can be sent for disposal.

What amount should I report?

In Russia, payments in rubles that are carried out within the framework of one agreement should not exceed 100,000 rubles.

This is indicated in paragraphs 5 and 6 of the instructions of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U. It is believed that this limit cannot be exceeded. But there are also nuances. This limit on expenses is established only for settlements with other organizations and individual entrepreneurs (see clause 6 of the instructions of the Central Bank of the Russian Federation No. 3073-U). But it does not apply to settlements with individuals who are employees of the enterprise. This includes wages, social benefits, personal needs of the head of the organization and the issuance of funds. Taking this into account, issuing a larger amount is not a violation of cash discipline.

Is a report required for the amount received?

As stated in clause 6.3 of the instructions of the Central Bank of the Russian Federation dated 03/11/2014 No. 3210-U, until 08/19/2017 it was prohibited to issue money if the employee did not provide a report on previously received amounts.

Here the Central Bank made changes to the report. Now money can be issued even if the employee has not repaid the debt on previously issued funds. But this does not mean that employees no longer need to prepare advance reports on the amounts spent. The employee must submit reporting documents on the money spent to the accounting department.

Report deadlines

As stated in clause 6.3 of the instructions of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U, the employee is obliged to provide a report on the amounts received no later than three working days after the expiration of the period for which these amounts were issued.

But the new requirements for the preparation of accountable amounts do not establish a specific period during which an employee must submit a report on the money spent. It is indicated in the employer's order. If the return period is not established, the employee submits the report on the same day on which he received them. This is indicated in the letter of the Federal Tax Service dated January 24, 2005 No. 04-1-02/704.

But for travel expenses there are special conditions for the advance report. According to clause 26 of the regulations, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749, the employee is obliged to report on them within 3 working days from the date of return.

Procedure for checking and approving advance reports

In this part of the Regulations, it is necessary to reflect the main points related to the advance report, after the preparation of which the employee, together with the primary documents attached to the report, submits it to the accounting department. In particular, these:

- The accountant fills out a receipt for the advance report and gives it to the employee.

- It is advisable to describe how the report itself and the documents attached to it are verified. Primary documents must contain the necessary details, correspond to the purpose and match the amount. Documents filled out incorrectly will not be accepted for accounting and will be reimbursed to the accountant.

- After checking and filling out his part of the report, the accountant sends the document for signature to the chief accountant, and then to the manager for approval.

- The period during which the report must be checked and approved, as well as the amounts for this analytical account must be closed, must be indicated in the Appendix. For example, a week is given to check and approve a report, and 2 business days are given to issue overruns or deposit the balance into the cash register after approval by the manager. If the balance of the account is not returned within the specified period, the enterprise has the right to withhold this debt from the salary of the accountable person in accordance with the law (Article 137.138 of the Labor Code of the Russian Federation).

Important! Recommendation from “ConsultantPlus” To withhold an unreturned amount from an employee’s salary, you need to: 1) draw up an order from the manager about withholding in any form. This must be done no later than... (for more details, see K+). Get trial access to K+ for free .

How to correctly reflect the return in accounting, read the article “Return by an accountable person of the amount of an unspent advance .

- If during the period for which accountable funds were issued, the employee did not purchase anything, then within the period specified in the Regulations the money in full must be returned to the organization.

- If an enterprise is active, as a result of which accountable amounts are regularly issued to a large number of employees, then for control and accounting it is recommended to carry out an inventory of settlements with accountable persons several times a year. This issue should also be covered in the Regulations.

For settlements with accountable persons regarding travel expenses, it is recommended to issue a separate Regulation on business trips, which should consider all the nuances of travel expenses and possible disagreements with accountable persons and tax authorities.

A sample of such Regulations can be found at the link.

What to consider in 2021

When accepting the report, take into account changes in the design of cash receipts and BSO.

From 07/01/2019, the cash register receipt or BSO issued instead includes information about the name of the buyer (organization or individual entrepreneur) and his tax identification number. When preparing documents using the new reporting templates from August 19, 2017, remember:

1. If the accountable person has been given a power of attorney to purchase goods and services in the interests of the organization and he has presented it to the seller, then the seller is obliged to reflect this data in the issued cash receipt.

2. If the seller is not able to reliably establish that an individual is acting in the interests of a certain organization, then he is not obliged to comply with this requirement for issuing a check. In this case, the buyer for the seller is the individual himself. And the cashier's check is issued in the usual manner.

We are changing the regulations on conducting cash transactions

Since adjustments have been made to the procedure for issuing money, changes in accountable amounts in 2021 also affected documentation.

Enterprises should update their regulations on working with imprest amounts. Employees have the right to receive accountable funds in cash at the enterprise's cash desk. It is also allowed for the company to issue money to a bank card, including to the employee’s salary card (see instruction No. 3073-U, letter of the Ministry of Finance of Russia dated July 25, 2014 No. 03-11-11/42288). To make this possible, the procedure for settlements with reporting employees should be recorded in the company's accounting policies.

Money is issued through the cash desk in accordance with the following requirements:

1. When preparing cash documents, the accountant must be guided by the provisions of instructions No. 3210-U.

2. Money is issued to an accountable person on the basis of an order (or other administrative document) or upon his written application. As stated in the letter of the Central Bank of the Russian Federation dated September 6, 2017 No. 29-1-1-OE/2064, the order is signed by the director, indicating the date and registration number.

3. The period for which accountable funds are issued is established in the administrative document for their issuance. The report period (paragraph 2, clause 6.3 of instructions No. 3210-U) is 3 days. During this time, the accountable is obliged to report or return the money to the organization.

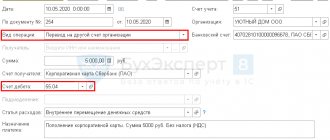

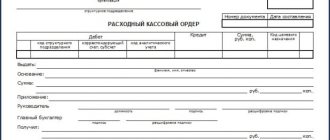

4. The issuance of money for reporting from the cash register is formalized by an expense order. Return of balances of accountable amounts - receipt orders. Money can also be issued for reporting by transferring it to the applicant’s bank card (letter of the Ministry of Finance dated August 25, 2014 No. 03-11-11/42288). It is allowed to return the money to the accountable by transferring funds to the company's current account. The possibility of non-cash accountable payments is fixed in the accounting policy.

5. There is no limit on the amounts that can be reported. The enterprise has the right to issue money to the accountable person in any amount. The settlement limit (RUB 100,000 per agreement) must be taken into account only when making payments between enterprises. In this regard, there have been no changes for accountable persons.

6. Issuing money on account to a person who has a debt on accountable amounts is not a violation of the law from 08/19/2017.

7. Organizations and individual entrepreneurs have the right to issue money on account not only to those employees who work on the basis of a permanent employment contract, but also to those who are in civil legal relations with the enterprise (letter of the Central Bank of the Russian Federation dated October 2, 2014 No. 29-1-1 -6/7859).

8. Issue from the cash register to the account is documented by posting Dt 71 Kt 50. When transferring funds to a card - posting Dt 71 Kt 51.

Main rules

Let's summarize what has been said:

1. Any amount is issued for the report.

2. From August 19, 2017, in order for an employee to receive an accountable payment, an order from the head of the company is sufficient. It is not necessary to write an application.

3. Previously, before submitting a report for the previous amount, an employee could not receive an accountable amount; now the answer to the question: is it possible to issue money for an accountable amount if the employee has not accounted for the previous one? Yes, it is possible.

4. Accountable amounts may be transferred to bank cards.

5. As of August 19, 2017, local acts on settlements with accountable persons have been updated.

The concept of accountable money

Any funds issued by an accountant or cashier of a company to any of the employees in advance (i.e. in advance) to pay for any needs related to the activities of the enterprise are called accountable .

The law does not establish limits for the amounts issued for reporting, so they are determined at each enterprise individually, depending on existing capabilities and needs.

At the same time, all expenses incurred in the form of subaccounting must be economically justified and caused by real need.