3-TORG (PM) in 2017–2018: who rents and where

The form in question is called “Information on the retail trade turnover of a small enterprise.”

Retailers completing the report should note that:

- frequency of filling out the form - quarterly (cumulative);

- The report must be completed and sent no later than the 15th day of the month following the reporting quarter.

Submission of information in form 3-TORG (PM) is mandatory for a special category of business entities - small enterprises (SE). Medium, large and micro companies do not need to fill out this form.

For information about who is classified as a small business enterprise, see the material “Small enterprise - criteria for classification in 2021” .

From the general group of small business enterprises, this report is provided by legal entities:

- those engaged in retail trade (sale of goods in small quantities (pieces) through a retail trade network) - a list of such goods is established by TOS (territorial statistical bodies);

- included in the TPS sample (according to the lists posted on their official websites).

If a small enterprise is included in the TPS sample and is at the stage of bankruptcy, it is also required to fill out this form. Such entities are exempt from reporting:

- after completion of bankruptcy proceedings;

- making a record of liquidation in the Unified State Register of Legal Entities.

Read more about the bankruptcy procedure in the article “Liquidation of an LLC with debts to the tax authorities .

The form of this form, valid for the reporting periods 2016–2017, was approved by Rosstat order No. 388 dated 08/04/2016 (Appendix 7).

You can download it on our website.

2016-2017

For the reporting periods of 2021, the 3-TORG (PM) form should be used in the version updated by Rosstat order No. 621 dated September 22, 2017 (Appendix 4).

It is also available for download on our website.

Results

If a small business company retails certain types of food and non-food products, it must report quarterly on the volume of retail turnover and inventory of goods at the end of the reporting period.

Form 3-TORG PM in 2017–2018 is submitted to the territorial statistics body no later than the 15th day of the month following the reporting quarter. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What to follow

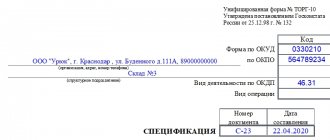

The current form 3-TORG (PM) was approved along with some other statistical forms by Rosstat order No. 388 dated August 4, 2016 (Appendix No. 7). The same document contains mandatory instructions for filling out 3-TORG (PM).

You can download form 3-TORG (PM) for free to fill out using the following direct link:

“Form form 3-bargaining (pm).”

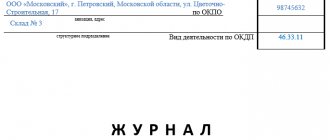

Monthly reporting of statistics on the turnover of wholesale trade of a small enterprise

Monthly PM-torg form - how to fill out? The report “Information on wholesale trade turnover of a small enterprise” is easy to fill out; it contains only one indicator - wholesale trade turnover, which is indicated for several periods:

- for the reporting month;

- for the past month;

- for the same month last year.

When filling out information for the reporting company, you must indicate:

- the full name of the organization and write a short name next to it in brackets;

- index and legal address of the company, if the location differs from registration, then note the actual address;

- OKPO, assigned by statistics, this code can be “seen” in the form of a balance sheet in the organization’s code line.

After filling out the report, it is signed by the head of the company or the official responsible for reporting, the telephone number and date of preparation are indicated - and the report can be considered ready if you know the nuances of the presentation and what income is not considered wholesale turnover for the purpose of filling out this information. This will be discussed further in the article.

The PM-torg form is filled out on a form approved by Rosstat order No. 321 dated July 16, 2015, and is submitted monthly to the territorial statistics body, the deadline for submission is the 4th of the previous month.

Sales speed for UT 11 taking into account the availability of goods

Wholesale trade Retail trade v8 v8::OU UT11 Russia OU Subscription ($m)

Report for the standard configuration “Trade Management” 11.x. Platform 8.3.17.1386. Displays days of availability and absence, balances at the beginning, end of the period and averages, sales, receipts, expenses, sales speed, turnover of goods for the period and turnover at the end of the period. Designed to optimize warehouse logistics (reduce costs) and eliminate product defects (lost profits). Built into additional reports.

1 startmoney

07/28/2020 3710 18 yc_2011 7

Responsibility for the absence of these reports

Taxpayers will have to answer for the lack of reporting documentation under Article 120 of the Tax Code of the Russian Federation. This fact is a case of gross violations of the points specified in the rules for accounting for income and expenses when taxing organizations.

The law stipulates that the employee appointed responsible for recording the facts of the economic life of a retail facility is obliged to ensure the issuance of primary documentation for the timely entry of data into accounting.

But punishment can only be incurred for the following violations:

- errors made due to failure to comply with accounting rules;

- late submission of reports to the accounting department;

- failure to comply with the procedure or failure to maintain the established period for storing accounting documentation.

Only persons holding responsible positions in the organization are subject to punishment. This is described in Art. 15.11 Code of Administrative Offenses of the Russian Federation.

Please note that the Code of Administrative Offenses of the Russian Federation does not provide for punishment for the absence of primary documentation.

The rules for preparing a product report in 1C are outlined in the following video instructions:

Who must submit reports?

Not all enterprises have an obligation to provide (see figure):

Don't know your rights? Subscribe to the People's Adviser newsletter. Free, minute to read, once a week.

The following are not exempt from submitting the form:

- small enterprises on a simplified taxation system - they submit reports according to generally accepted rules;

- firms that have worked for an incomplete reporting period are required to submit the PM-torg form, indicating in writing the period of inactivity;

- companies in bankruptcy - only after making an entry about liquidation in the Unified State Register of Legal Entities, the organization is exempt from submitting a report.

Presentation nuances:

- Legal entities provide information at the place of registration; if there is no activity at the location, the company sends a report to the place of activity.

- If the company includes branches and divisions located in different regions, reporting is submitted as a whole for the entire organization at its place of registration.

- The main business company submits a report without taking into account the turnover of subsidiaries and dependent companies, which, in turn, also provide information on their activities in a separate form.

- If the company is in trust management, then the enterprise carrying out management is accountable for it as for an entire property complex.

- Enterprises operating under a simple partnership agreement distribute wholesale trade turnover in proportion to their contributions, unless this contradicts their agreement, and each entity submits a report. If it is impossible to distribute the proceeds, the PM-torg form is submitted by the comrade performing reporting duties.

- If there are no reporting indicators, you should send a letter about this to the statistical office. This must be done every time the form is due, since zero reports are not submitted to Rosstat, and penalties for failure to submit may be assessed (letter of Rosstat dated January 22, 2018 No. 04-4-04-4/6-smi).

Any company can be included in a sample survey organized by a statistical agency. In this case, Rosstat notifies the enterprise in writing of the need to report on this form.

The structure of the report and the procedure for filling it out

Instructions for filling out the form are given in the same Rosstat orders that approved their forms. There are no fundamental updates in the instructions due to changes in the form.

The report consists of:

- from the organizational (introductory) part, filled in with a standard set of information about the reporting company;

- 3 main sections.

Section 1 “Retail trade turnover”

The section is represented by a table of 4 columns and 5 lines. It provides data as of the reporting date in comparison with the same period last year.

Retail trade volume is reflected in actual sales prices, which include:

- trade margin;

- VAT;

- similar mandatory payments.

Data in the report should not include retail trade turnover:

- in the form of the cost of goods sold at retail to firms and individual entrepreneurs;

- catering turnover

The retail turnover reflected in the report includes those transactions that are confirmed by a cash receipt or a document replacing it.

The section contains data:

- on retail trade turnover with detailed data on food products and methods of sale (via the Internet or by post);

- on the stock of goods for sale to the public at the end of the period.

“Distribution trade on UTII: features of the legislation” will tell you about the tax nuances of one of the types of retail trade .

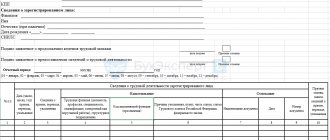

Section 2 “Retail sales and inventories of goods by type”

The second section of the report explains the figures from section 1 on retail turnover and product inventories. Explanations are given in lines 06–82 at the cost of certain types of food and non-food products sold to the population and in stock at the end of the reporting period (meat, fish, dairy products, fresh fruit, vacuum cleaners, refrigerators, televisions, shoes, building materials, medicines, etc. ).

Each product group in the report is listed under the corresponding code from the classifier of products by type of economic activity (OKPD2).

Section 3 “Number of gas stations”

Lines 83–85 of the third section of the report are filled out once a year - only in reporting for the 1st quarter. It includes information on the number of gas stations with details by type of gas station:

- multi-fuel (MTZS);

- gas filling stations (CryoGZS, CNG filling stations, AGZS).

Read about the nuances of using modern cash registers for the retail sale of gasoline in the material “Online cash registers for gas stations from 2021 - explanations .

How to fill out section No. 2?

The second section is intended to decrypt the information specified in line No. 1 of the first section. In lines 6 to 82 you need to classify products by product groups in price terms:

- lines 6-11 are devoted to the classification of meat products depending on the type of animal, living environment and method of partial or complete preparation for consumption;

- lines 13-15 are for the classification of edible oils;

- line No. 16 contains data on retail sales and inventories of margarine products;

- lines 17-19 are devoted to fermented milk products;

- line No. 23 contains the classification of goods sold and stocks of sugar, as well as sugar substitutes;

- lines No. 24 and 28 indicate stocks of flour and flour product concentrates;

- line No. 25 contains information about stocks of tea, coffee, cocoa, capsules for coffee machines, as well as coffee and tea gift sets;

- in line 29 an entry is made about the supply of cereals and baby food;

- line No. 31 contains the classification of stocks of crackers, bread, croutons and other bakery products;

- line No. 35 contains information about alcoholic beverages;

- line No. 36 is dedicated to stocks of fruit and vegetable juices, water and other non-alcoholic drinks;

- line No. 38 reflects information on sales and stocks of chewing gum, spices, herbs, biological and food additives;

- line No. 40 must include all perfumes and cosmetics, not including soap;

- lines 42-47 are intended to reflect inventories of household appliances;

- line No. 49 indicates data on equipment and footwear intended for sports, not including boots and sportswear;

- lines 50-53 contain information about stocks of computer equipment, accessories for them, mobile phones, as well as cameras and all necessary accessories for them;

- line No. 54 contains data about bicycles;

- line No. 55 is dedicated to books;

- lines 60-64 indicate stocks of clothing, excluding leather and sportswear, as well as special sports shoes;

- line 65 reflects information about stocks of construction materials;

- line 67 contains data on medical equipment and medicines;

- line No. 69 contains information about jewelry made of stones and metals;

- lines 70-74 indicate stocks of motor fuel, which are sold through gas stations;

- line 76 contains information about car parts, not including radios;

- line 77 indicates inventory data for motorcycles, mopeds, scooters, snowmobiles and ATVs;

- in line No. 82 it is necessary to indicate stocks of non-food products.

Reflecting the stocks of alcoholic beverages in all stores and warehouses where they are stored.

Sample report on retail turnover

Let's look at an example of how to fill out form 3-TORG (PM).

LLC "Molochnaya Dolina" is a small enterprise engaged in the sale of dairy products to the population. In 2021, through a network of retail stores, Molochnaya Dolina LLC sold milk, fermented baked milk, kefir, sour cream, cottage cheese and cheese in the amount of RUB 12,341,000. Inventories of dairy products as of December 31, 2017 amounted to RUB 4,987,670 in value equivalent.

When registering 3-TORG (PM), a company is required to fill out the introductory part, section 1 and 3 explanatory lines from section 2 (17–21), taking into account the following detail:

| Report line | Name of product | Product group details |

| 17 | Dairy | Data on retail sales and inventories of dairy products |

| 18 | Of them: Drinking milk | Retail and Inventory Data:

|

| 19 | Dairy drinks | Sales value and inventory data:

|

| 20 | Fat cheeses | Information about retail sales of cheese |

| 21 | Canned milk powder, freeze-dried | Cost of sold powdered and freeze-dried milk and its balance at the end of the quarter |

See below for a sample report filled out using this data.

What applies to wholesale trade?

Wholesale trade for the purpose of filling out the main indicator in line 01 of the PM-trading form is considered to be:

- the cost of goods shipped with the obligatory completion of an invoice;

- proceeds from goods sold purchased for subsequent sale to legal entities and individual entrepreneurs for further use or resale;

- if the turnover includes the sales price with a markup, VAT, excise tax, customs duty, and all mandatory payments;

- for commission agents (agents) - remuneration if they carry out activities in the interests of another person (principal, principal) is reflected with value added tax at the actual cost;

- for principals - the turnover of trade carried out by the principal (principal) on the basis of commission agreements or agency agreements is indicated at the cost of goods sold.

Turnover on line 01 is indicated in thousands of rubles with one decimal place after the decimal point.

The following is not considered a wholesale sale for the purpose of completing this statistical report:

- sales of products to the public, since this is retail trade;

- revenue from the sale of fuel cards, telephone cards, communication services, as well as from the sale of lottery tickets;

- the cost of utilities provided to the population and enterprises (gas, water supply, electricity).

***

Statistical reporting in the PM-torg form is mandatory for small wholesale businesses (except micro-enterprises). Retail trade organizations do not submit this report. When completing the main indicator, you must include turnover, which is considered wholesale only for the purpose of completing this report form. This information is submitted to Rosstat monthly on the 4th of the previous month.

The Federal State Statistics Service collects information on the turnover of small enterprises engaged in wholesale trade. To collect such information, Rosstat Order No. 321 dated July 16, 2015 (as amended on August 28, 2017) approved the monthly PM-torg form. Data is filled in for the organization as a whole, that is, for all “isolations” (branches and structural divisions), regardless of their location.

PM-trading – who submits this report? This form is submitted by all legal entities - small businesses (with the exception of micro-enterprises) engaged in wholesale trade. provide information on trade turnover on a general basis. If the organization is temporarily not operating, but trade was still carried out for part of the reporting period, it is necessary to submit information about turnover in the general manner (indicating the date of suspension of activity).

PM-bargaining – due date: until the 4th day of the month following the reporting month (inclusive). The organization fills out the current form for providing information and submits it to the territorial body of Rosstat at its location. If the activity is not carried out at the location, then the form must be submitted to the place where the activity is actually carried out.

Control ratios

Correct completion of 3-TORG (PM) requires the following conditions to be met:

- page 01 ≥ page 02 (columns 3-4);

- page 01 ≥ page 03 (gr. 3-4);

- page 01 ≥ page 04 (gr. 3-4);

- page 01 MINUS page 02 (gr. 3 and 4) = page 39 + 40 + 41 + 42 + 45 + 48 + 49 + 50 + 51 + 52 + 53 + 54 + 55 + 56 + 57 + 58 + 59 + 60 + 61 + 62 + 63 + 64 + 65 + 66 + 67 + 68 + 69 + 70 + 71 + 72 + 75 + 76 + 77 + 78 + 82 (gr. 4 and 5);

- page 02 (gr. 3 and 4) = 06 + 11 + 13 + 17 + 22 + 23 + 24 + 25 + 27 + 28 + 29 + 30 + 31 + 32 + 33 + 34 + 35 + 36 + 37 + 38 (gr. 4 and 5);

- page 05 (gr. 3 and 4) = 06 + 11 + 13 + 17 + 22 + 23 + 24 + 25 + 27 + 28 + 29 + 30 + 31 + 32 + 33 + 34 + 35 + 36 + 37 + 38 + 39 + 40 + 41 + 42 + 45 + 48 + 49 + 50 + 51 + 52 + 53 + 54 + 55 + 56 + 57 + 58 + 59 + 60 + 61 + 62 + 63 + 64 + 65 + 66 + 67 + 68 + 69 + 70 + 71 + 72 + 75 + 76 + 77 + 78 + 82 (gr. 6 and 7);

- page 06 (for all columns) ≥ 07 + 08 + 09 + 10;

- page 11 (for all columns) ≥ page 12;

- page 13 (for all columns) ≥ 14 + 15 + 16;

- page 17 (for all columns) ≥ 18 + 19 + 20 + 21;

- page 25 (for all columns) ≥ page 26;

- page 42 (for all columns) ≥ page 43 + 44;

- page 45 (for all columns) ≥ page 46 + 47;

- page 72 (for all columns) ≥ page 73 + 74;

- page 78 (for all columns) ≥ page 79 + 80 + 81;

- page 83 ≥ page 84 + 85.

Responsibility for violation of the delivery procedure

Companies that did not have time or forgot to submit a report bear administrative liability under the Code of Administrative Offenses of the Russian Federation. Similarly, fines are provided for false information in the report.

For the first violation, legal entities face a fine of 20 to 70 thousand rubles, and for repeated cases the fine increases significantly and ranges from 100 to 150 thousand rubles.

During the coronavirus pandemic, Rosstat canceled liability measures. Thus, in May 2021, the measures provided for in Article 13.19 of the Code of the Russian Federation on Administrative Offenses are not applied. This is due to the continued high alert regime in a number of regions of Russia.

3-TORG (PM) 2017: procedure for compiling the 2nd section

The second section of the form, in fact, is a detailed breakdown of data on the positions of product groups combined in the 1st section of the 3-TORG (PM) form. below for free. We offer a sample of filling out 3-TORG (PM):

When drawing up a report, it is important to remember to link the information provided, i.e. the control numbers of the first section must be deciphered by the positions of the second, as in the example given. A sample of filling out form 3-TORG (PM) demonstrates the equality of the amounts in the columns of the second section with the total figures of columns 01 and 05 of the first section of the report.