Organizational and legal forms of doing business

The organizational and legal form of doing business is a parameter that is considered to be something fundamental and unshakable due to the fact that it is determined at the time of registration and is part of the company name itself.

However, over time, the circumstances that influenced the choice made at the very beginning may change, which in turn will entail a likely need to change the status of the organization.

The current legislation provides for several variations of changing the legal form of a company, which actually represents its reorganization in the form of transformation.

For commercial organizations, two of them are the most relevant. A company registered as a limited liability company can transform into a joint stock company, an additional liability company, or a production cooperative (Article 56 of Law No. 14-FZ of February 8, 1998 “On Limited Liability Companies”).

A joint stock company, both open and closed, can in turn become a limited liability company, a production cooperative or a non-profit partnership (Article 20 of Law No. 208-FZ of December 26, 1995 Federal Law “On Joint Stock Companies”).

When making a decision to change the OPF, it is also necessary to take into account the limitations inherent in the form of the newly registered business.

Thus, the minimum authorized capital of a limited liability company or a closed joint-stock company is 10 thousand rubles, and when such a company is transformed into an open joint-stock company, its amount must be at least 100 thousand rubles. Neither LLC, nor CJSC, nor OJSC can have as the sole founder a legal entity, which in turn also consists of one founder.

In addition to a voluntary change in the organizational and legal form, there are situations when this is necessary in order to comply with legal requirements. For example, a limited liability company, if the number of its participants exceeds 50, is obliged to re-register as an open joint-stock company or a production cooperative.

The essence of the transformation

Reorganization of a legal entity can be carried out by decision of its founders (participants) or a body of the legal entity authorized to do so by the constituent documents (Clause 1 of Article 57 of the Civil Code of the Russian Federation).

One form of reorganization is transformation.

The essence of the transformation is that a legal entity of one organizational and legal form ceases to operate, and in its place a new legal entity of a different organizational and legal form is formed.

There are no quantitative changes in participants in civil transactions. All rights and obligations of an organization that has ceased operations are transferred to one legal successor.

Transformation is one of the methods of reorganization in which another legal entity is created with a different organizational and legal form, but with all the rights and obligations of the previous organization.

Changing CJSC to LLC

According to paragraph 1 of Article 57 of the Civil Code, the reorganization of a legal entity can be carried out by decision of its founders (participants) or a body of the legal entity authorized to do so by the constituent documents. This postulate also applies to a joint stock company planning to transform into a limited liability company.

As follows from paragraph 2 of Article 20 of Law No. 208-FZ, a proposal for such a reorganization is made by the board of directors or the supervisory board of the company. This issue is resolved by the general meeting of shareholders of the reorganized joint stock company. In this case, the final decision must contain the following information:

- name, information about the location of the new legal entity created through the reorganization of the company in the form of transformation;

- procedure and conditions of transformation;

- the procedure for exchanging shares of the company for shares of participants in the authorized capital of the LLC;

- instructions on approval of the transfer act with the attachment of the transfer act;

- an instruction on approval of the constituent documents of the legal entity being created with the attachment of the constituent documents.

In addition, the decision must record data on the list of members of the audit commission, collegial executive body, sole executive body or other body in cases where the creation of such a structure is provided for by the charter and law, and its formation is within the competence of the highest management body of the legal entity being created.

Once the decision has been made, the JSC is obliged to notify the tax authority in writing about the start of the reorganization procedure within three days.

The form of the message is presented in the letter of the Federal Tax Service of Russia dated January 23, 2009 No. MN-22-6/64. It must be accompanied by a formalized decision on reorganization. During the same period, it is necessary to notify the Pension Fund and the Social Insurance Fund in writing (clause 3, part 3, article 28 of the Federal Law of July 24, 2009 No. 212-FZ).

Based on paragraph 11 of Article 89 of the Tax Code, in connection with the reorganization, the company may be subject to an on-site tax audit.

Moreover, this audit can be carried out regardless of the time and subject of the previous audit. However, the standard rule that a period of no more than three previous calendar years can be checked remains true in this situation.

In any case, within the next three days after receiving the notification, the tax authorities will enter information that the legal entity is in the process of reorganization into the Unified State Register of Legal Entities. After this, the reorganized joint stock company is obliged to publish a message about its reorganization in the journal “Bulletin of State Registration” twice, with a difference of a month.

Such a message, in accordance with the requirements of paragraph 6.1 of Article 15 of Law No. 208-FZ, must contain the following information:

- full and abbreviated names, information about the location of each company participating in the reorganization;

- full and abbreviated names, information about the location of each company created (continuing activities) as a result of the reorganization;

- form of reorganization;

- a description of the procedure and conditions for the creditors of each legal entity participating in the reorganization to submit their claims, including an indication of the location of the permanent executive body of the legal entity, additional addresses to which such claims can be submitted, as well as methods of communication with the reorganized company (telephone numbers, faxes, email addresses and other information);

- information about persons performing the functions of the sole executive body of each legal entity participating in the reorganization, as well as legal entities created (continuing activities) as a result of the reorganization;

- information about persons intending to provide security to creditors of the reorganized company, as well as about the conditions for securing the fulfillment of obligations under the obligations of the reorganized company (if there are such persons).

Another requirement is that within five working days after sending the notice of the start of the reorganization, notify in writing, indicating (at least) the above information, all known creditors (clause 2 of article 13.1 of Law No. 129-FZ of August 8, 2001 “On state registration of legal entities and individual entrepreneurs").

Only if there is evidence of notification to creditors, the registering authority will make appropriate entries in the register on the creation of a new company and on the termination of the activities of the old one (Clause 6, Article 15 of Law No. 208-FZ).

Registration of a new legal entity created through reorganization is carried out on the basis of an application in form No. P12001, recommended in the letter of the Federal Tax Service of Russia dated June 25, 2009 No. MN-22-6 / [email protected]

The following package of documents must be submitted along with the application:

- constituent documents of a new legal entity created through reorganization in the form of transformation in two copies;

- decision of the general meeting (or the sole participant/shareholder) on the transformation of the enterprise;

- a transfer act containing information about the legal succession of the new company for absolutely all existing (including disputed) obligations of the reorganized company;

- a receipt for payment of state duty in the amount of 4 thousand rubles;

- evidence of the transfer of information to the Pension Fund if its submission is required by law;

- evidence of sending letters notifying creditors of the reorganization in the form of transformation.

In the process of transforming a joint stock company into a limited liability company, the shares of the joint-stock company are exchanged for shares in the authorized capital of the LLC. The shares will then be cancelled.

On the day of filing documents for registration of a new company, this fact must be reported to the registrar who maintains the register of owners of securities of the joint stock company ending its activities. This is done on behalf of the JSC.

Upon making the corresponding entry in the Unified State Register of Legal Entities, namely on the same day, this information must be duplicated in a message sent to the registrar by the created limited liability company (clause 8.3.7 of the Standards for the issuance of securities and registration of securities prospectuses”, approved by the Order of the Federal Financial Markets Service of the Russian Federation dated January 25, 2007 No. 07-4/pz-n (as amended on July 20, 2010)).

On the same day, that is, from the moment of state registration of the new legal entity, the reorganization is considered completed.

Restrictions

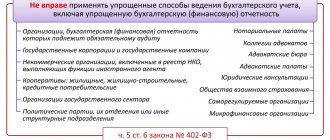

It must be remembered that commercial organizations cannot transform into non-profit organizations, and LLCs and joint-stock companies cannot transform into partnerships or state enterprises.

An LLC has the right to transform into a company of another type, a business partnership or a production cooperative (Clause 1, Article 56 of the Federal Law “On Limited Liability Companies”). For an LLC, a change in the organizational and legal form is necessary when the number of its participants exceeds 50. In this case, you need to re-register as a PJSC or a production cooperative.

A JSC has the right to transform into an LLC or a production cooperative, as well as into a business partnership (Article 20 of the Law “On Joint-Stock Companies”).

When deciding on transformation, it is necessary to take into account other restrictions inherent in the form of the newly registered business.

Thus, the minimum authorized capital of LLCs and JSCs is 10,000 rubles, PJSC - 100,000 rubles.

Neither LLC, nor JSC, nor PJSC can have a legal entity consisting of one founder as the sole founder.

Transfer deed

When reorganizing in the form of transformation, it is not necessary to draw up a transfer act. This was indicated by Federal Tax Service officials in a letter dated March 14, 2016 No. GD-4-14 / [email protected]

From the provisions of Article 58 and paragraph 2 of Article 59 of the Civil Code, it follows that the transfer act must be submitted to the registration authority in connection with reorganization in the form of division and allocation.

When a legal entity of one organizational and legal form is transformed into a legal entity of another organizational and legal form, the rights and obligations of the reorganized legal entity in relation to third parties do not change (clause 5 of Article 58 of the Civil Code of the Russian Federation). An exception is obligations in relation to founders (participants).

The implementation of legal succession during reorganization in the form of transformation on the basis of a transfer deed is not provided for by law.

When is reorganization of a legal entity necessary?

The holding of this event on a voluntary basis may be due to various factors. For example, the presence of large payables or tax debts, modernization of the production process, acquisition of new equipment (if the reorganized entity does not have enough own funds for this), business expansion, when one company grows by merging with another.

Reorganization of a person in the form of division or spin-off may occur when further cooperation of several co-founders becomes impossible, etc.

In each specific case, changing the commercial structure has different motives. However, almost always the founders who initiated it strive to increase the profitability of the business and strengthen their position in the market.

Forced reorganization is most common in antimonopoly law; it is initiated by the Federal Antimonopoly Service.

There are two reasons why the authorized body initiates the procedure for dividing or separating legal entities. They are reflected in Art. 34, 38 Federal Law “On Protection of Competition”.

New TIN

If a company changes its organizational and legal form, then the tax authorities assign a new TIN to the newly formed legal entity.

After all, the transformation of a legal entity (change of organizational and legal form) is one of the forms of reorganization. As a result of the reorganization, a new legal entity arises.

In the event of a change in the organizational and legal form, the TIN of the “old” organization is invalidated, and the newly established legal entity is assigned a new TIN (see letter of the Ministry of Finance dated May 12, 2010 No. 03-02-07/1-232).

In connection with the new TIN, the company needs to put its entire contractual base in order.

Changes to the Unified State Register

As a result of the transformation of a legal entity, there is no transfer of rights in the order of succession. When a legal entity is transformed, there is no change in its rights and obligations in relation to other persons (Clause 5 of Article 58 of the Civil Code of the Russian Federation). Succession from one person to another, and, accordingly, state registration of the transfer of ownership of real estate from the reorganized person to the transformed person is not required. Therefore, with regard to the ownership of real estate, it is not supposed to be registered, but to make changes to the Unified State Register of Real Estate (Determination of the Armed Forces of the Russian Federation dated October 23, 2021 No. 302-KG17-14848; Letter of the Ministry of Finance dated February 13, 2021 No. 03-05-04-03/ 8828).

When reorganizing a legal entity in the form of transformation, appropriate changes are simply made to the Unified State Register.

Reorganization of a legal entity - procedure for carrying out the procedure

Regardless of the chosen method, the reorganization of a legal entity is a sequence of identical actions. The only thing that will distinguish them is the grounds for implementation and legal consequences (the emergence of one or more business entities).

- Making a decision on the reorganization of a legal entity.

The participants confirm their expression of will in the minutes of the general meeting (if there are several of them) and the decision of the sole founder (if there is only one). In the case of forced restructuring, the documentary basis is a resolution of the authorized body.

- Drawing up a plan for the reorganization of a legal entity.

The plan is not a mandatory document. It is compiled by the initiators on their personal initiative. It sets the deadlines for intermediate and final events. At the same stage, the assets of the enterprise are assessed and the property is inventoried.

- Alert

The notice of reorganization with the attached decision is submitted to the local branch of the Federal Tax Service no later than 3 days after the documentary justification is approved by the persons who issued it. The tax department makes an entry in the Unified State Register of Legal Entities indicating that reorganization has begun in relation to this company.

This document can be drawn up by the head of the company or a specialist authorized by a power of attorney. During a merger, this must be done by the director of the company that last approved the decision or his representative.

If the notice is given by a trustee, the director's signature must be notarized. A power of attorney is attached to the documents. When applying electronically, signature certification is not required, since the originator is identified using an enhanced digital signature.

Within 5 working days after approval of the decision, the company notifies creditors of the start of the reorganization procedure.

You can get a free consultation on business reorganization issues from our lawyers. You can submit your application using the form below:

To get a consultation

*You will receive answers to all your questions and learn about all possible options for reorganizing a legal entity.