What is a payment order?

A payment order is an order from the payer to the bank of his choice, established by the payment document, to transfer funds to the recipient's current account, which is opened in this or another bank.

Citizens who do not have an account with this bank, in accordance with clause 2 of Art. 863 of the Civil Code of the Russian Federation, the described operation is carried out in the same way.

Officially, this document can be prepared both in written and electronic form, but only in the form of an uploaded document to official sources, for example, in the client-bank system.

The payment order must be written or uploaded in 4 copies:

- 1 copy is required to carry out a banking transaction: debiting funds from the payer’s account.

- Copy 2 serves as confirmation of the crediting of funds to the specified account.

- Copy 3 serves as confirmation of the bank transaction.

- 4 copy is returned to the payer upon completion of the transfer in the form of a receipt confirming the acceptance of the operation and its execution.

The payment order is executed strictly within the agreed time frame, maybe even earlier.

After drawing up the document, the bank employee must check that all fields are filled out correctly, and also enter the date when the funds will arrive at the specified account.

The document described can be used to transfer finances:

- to pay loans and accrued interest on them;

- to state budgets and funds;

- for goods received, payment for work performed, for prepayment, etc.

If necessary, the bank has the right to attract other banks to make this payment, for example, if the recipient's account is registered with another bank.

If the payer’s account does not have enough funds or partial payment is provided, then the payment order goes into the category of unpaid on time.

Important: the bank is obliged to inform the payer about all operations performed in accordance with the agreement.

back to menu ↑

How to pay salaries in 2021

All employers are required to pay their employees wages at least every half month.

Salaries must be paid no later than the 15th day after the end of the period for which they were accrued. That is, the deadline for the advance payment is the 30th day of the current month, and for salaries - the 15th day of the next month (Part 6 of Article 136 of the Labor Code of the Russian Federation). This fully applies to wages transferred to the card. Transfer salaries to employees' bank accounts at least every six months (Part 6, Article 136 of the Labor Code of the Russian Federation).

The application indicates the employee's bank account number. The employee has the right to choose the bank to transfer his salary. He must notify the employer of this in writing no later than five working days before payment of wages. This is stated in Part 3 of Article 136 of the Labor Code of the Russian Federation.

How to fill out a document

Filling out a payment order in 2021 will be done in the same way as for taxes due to the fact that from January 1, 2021, the Federal Tax Service will control all insurance premiums.

The table explains in more detail what information to indicate in a specific field and what nuances the payer may encounter.

| Payment order fields | What information to provide |

| Payment order No. (field 3) | Indicate the serial number, which must consist of no more than 6 digits. If you specify from 4 to 6 digits, then the last three should not be zeros. |

| Date (4th field) | The date when the document was drawn up is indicated, for example, 01/3/2017. |

| Type of payment (5th field) | This line is filled in if the document is compiled and sent electronically. You must specify "electronically". If the document is in written form, then this field should simply be skipped. |

| Amount in words (field 6) | The payment amount must be indicated in rubles and kopecks with a capital letter, while rubles are written in capital letters, and kopecks in numbers. Also note that no shortcuts should be made. For example, thirty thousand 47 kopecks. If the amount is back kopecks, then the entry will look like this: Two hundred rubles. That is, there is no need to write “zero kopecks”. |

| Amount (field 7) | Now you need to indicate the amount in numerical form. Please note: rubles must be separated from kopecks with a dash: 1000-40. If the payment amount is equal to an integer, then at the end you must put an equal sign: 1000= |

| 8 field | It is advisable to indicate the full name of the company, but if it is very long, then an abbreviated version is acceptable. We also write the legal address here. Information must begin and end with the sign “//”: //Name and address of the company// |

| 9 field | We write the payer's account details |

| 10 field | We provide information about the bank: full name and location. |

| 11 field | BIC bank |

| 12 field | We write the number of the correspondent bank account |

| 13 field | Now we indicate the details of the recipient's bank. In this field we write the full name and its address. |

| 14 field | BIC bank. |

| 15 field | Recipient's account details. |

| 16th field | Recipient information. In this field we write the name of the body of the Federal Treasury and the tax inspectorate\branch of the Pension Fund\FSS. For example, it may look like this: UFK MF RF for Moscow (Inspectorate of the Federal Tax Service of Russia No. 12 for Moscow) |

| 17th field | The recipient's account to which the agreed amount must be transferred. |

| 18th field | We indicate the type of operation. What exactly to write here, you need to find out from a bank employee, in particular, the standard for payment orders is 01. |

| 19th field | This field is not filled out by you personally; this is done by a bank employee. |

| 20 field | You also do not fill out this field. |

| 21 fields | The order of payment is indicated here. The following values may exist: · 3 – if a payment is made according to the instructions of the Federal Tax Service and other organizations for the purpose of forced payment of debts. · 5 – for independent payments from registered organizations. |

| 22 field | If the recipient determines the need to fill out this line, then the UIN must be indicated. |

| 23 field | The line is filled in only if some additional conditions have been agreed upon and they are provided for in other documents. |

| 24 field | All information that relates to the purpose of the payment, for example, this may be basic data that serves as the basis for making the designated payment. |

| 43 field | A certified seal from the payer-company, if there is none, then you just need to write “b\a” = without a seal. |

| 44 field | All signatures of the persons involved. |

| 45 field | The line is filled in by bank employees. |

| 60 field | Payer's TIN, keep in mind that the first and second numbers should not be zero. If you filled out field 108 or 22, then you can skip this line. |

| 61 fields | Tax Service INN. Here also the first and second numbers should not be zero. |

| 101 fields | Payer status, which is obtained from a bank employee. |

| 102 field | Payer's checkpoint - the first and second numbers must be greater than zero. |

| 103 field | Tax service checkpoint - the rule with zeros remains in force. |

| 104 field | BCC, provided for by order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n. |

| 105 field | OKTMO code |

| 106 field | According to clause 7 of Appendix 2 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n., we write a two-digit code for the basis of payment. |

| 107 field | The frequency of tax payment, for example, can be once a month, quarter, six months, year. |

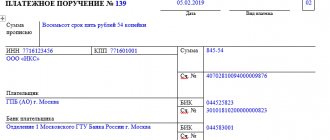

Sample personal income tax payment order in 2021:

back to menu ↑

Changes for 2021

The tax system often undergoes some changes to simplify certain processes.

Each legally registered person is obliged to track these changes, since if the document is filled out incorrectly, the specified operation will not be carried out.

In January 2021, changes regarding filling out payment orders will come into force. This is because all insurance premiums will now be automatically processed by the tax office.

However, there are exceptions - insurance premiums in case of injury to the insured person will be considered by the Social Insurance Fund. So, let's look at the main changes.

In 2021, it was necessary to draw up a separate payment slip for each individual type of contribution; for example, for pension and medical contributions it was necessary to have two separate payment slips.

In 2021, it is planned to introduce one payment system for all types of payments, but more details will become known after the Ministry of Finance approves new BCCs in December.

Important: the payment slip is the main document on the basis of which the bank can transfer funds to the specified details.

All payments (one or more) will need to be prepared according to the tax model. That is, for example, it will not be possible to indicate zeros in fields 106 and 107, as we already mentioned above.

Also, previously it was possible to pay only your own taxes, but now you can pay taxes for other persons, but only if a power of attorney has been issued for you.

Therefore, if you often face the problem of non-payment of taxes, then it is best to issue a power of attorney to a loved one and allow him to make the payment for you.

Therefore, in line 101, in this case, you will need to indicate the number 28. It is possible to indicate a mobile phone as an additional identification of a person.

So, among all the changes, the key ones can be identified:

- Mobile phone number as an additional type of identification.

- Possibility of payment by other persons.

All changes take effect from January 1, 2021, so all online systems will be updated on these dates, and tax officials will inform their clients of the new rules at the time of filling out the document.

back to menu ↑

Transfer to the account of bailiffs

Sometimes the decree on the execution of a court decision does not indicate the second parent as the recipient, but the Office of the Federal Bailiff Service. This situation may arise, for example, when debt is collected, the applicant or child is unable to receive funds either in cash or in non-cash form (no bank card or account), and also if the children are supported by the state. In this case, the recipient of the payment will be the Federal Bailiff Service. But despite the fact that the funds are transferred to a government agency, the payment order when transferring alimony should not be filled in the fields intended for payments to the budget. This is explained by the fact that, in essence, such a payment is not a transfer to the budget (tax, fee), but is simply accumulated by the bailiff service in a special account for further payment to the recipient.

Payment order simplified tax system

Entrepreneurs who operate under a simplified taxation system must pay not only tax, but also an advance payment.

However, you should know that the advance payment is calculated every quarter, and the tax is calculated annually.

Two payments are paid only in whole rubles; if the amount is received with a balance, then it is rounded up.

To calculate the down payment, you need:

- know the income for the reporting period;

- know the amount of insurance premiums for individual entrepreneurs.

After this we use the following formula:

For example, an entrepreneur earned 300 thousand rubles for the period from February 1 to April 30, then he needs to pay an advance payment in the amount of 18,000 rubles, since according to the formula:

300,000 x 6% = 18,000 rub.

However, if by July 31 he can earn another 300,000 rubles. and pays all insurance premiums, which amount to 20 thousand rubles, then the advance payment will have the following meaning:

(300,000 + 300,000) x 6% - 20,000 - 18,000 = 8,000 rubles.

Now let's move on to calculating tax according to the simplified tax system, which is calculated using the following formula:

If, for example, in 2015 a certain entrepreneur’s earnings amounted to 2 million rubles, he also paid an insurance premium of 30 thousand rubles. and advance payments of 35 thousand rubles, then we can calculate the tax using the above formula:

2000,000 x 6% - 30,000 - 35,000 = 55,000 rubles.

All these payments are paid to the tax office, but you can reduce the time and generate a receipt in advance.

First, go to the tax service website:

Go to the “All services” section:

Next in the list, look for the section “Fill out a payment order” and follow it:

We skip the first step, where they ask you to enter the Federal Tax Service code and click the “Next” button:

Now you need to indicate your region, and then your registration address:

In the “Type of payment document” column, you must select “Payment document”:

Next, in the “Payment Type” column, you need to select the following:

The BCC is the same for everyone:

In the “Person Status” column, you must select an individual entrepreneur:

Based on the payment, we indicate the payments for the current year:

The tax period is indicated depending on the type of payment, so for an advance payment we indicate “KV”:

To pay tax, indicate “GD”:

The next field to fill out is your personal information:

Now you need to select a payment method. So, if you choose to pay in cash, you will see a window to download the generated receipt:

To pay using Internet banking, select “Cashless payment”, and then your credit institution:

Please note: payment must only be made from your personal card.

back to menu ↑

Payment order for penalties

If for any reason you fail to pay your tax on time, you will be required to pay a penalty. For this procedure it is necessary to draw up a payment order.

First you need to determine the amount of the accrued penalty; for this we use the formula below:

Please note that the delay begins to be counted from the next day when the tax was due, for example, if the tax payment was due on February 1, then the delay begins to be counted from February 2.

It ends on the day of actual payment, and not on the day the payment order is drawn up.

Here's an example of a calculation:

On January 6, the company paid wages for December 2016. And the company will be able to pay personal income tax on it - 30,000 - only on January 20. The delay will be 14 days. For example, the refinancing rate for this period will be 10%, then we get:

30,000 x 14 days x 1\300 x 10% = 140 rubles.

Now you can proceed to filling out the payment order for penalties. Sample filling:

Some filling details:

- Line 104 – budget classification code;

- Line 105 - in accordance with the new rules, OKTMO is now indicated here;

- You must skip field 110; tax officials will fill it out;

- Line 101 – everyone needs to write “08”;

- Line 21 – according to the new instructions, instead of 3 you need to indicate 5, otherwise the bank will not be able to make the specified payment.

- Line 24 – this contains additional information that was not indicated earlier in the document.

Important: if the payment order contains some errors, the bank cannot transfer funds, then the period of overdue payment increases, and along with it the amount of the penalty.

A payment order for the payment of fines is drawn up in the same way as for penalties.

Sample of filling out a payment order to pay a fine:

Sample of filling out a payment order for payment of property tax:

back to menu ↑

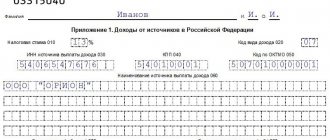

From what income is alimony withheld?

Maintenance for minors is paid from all employee income during work, as well as during absence from work:

- wages;

- bonuses, allowances, and other remuneration for performing job duties;

- vacation pay;

- temporary disability benefits.

Deductions should be made from wages after personal income tax has been deducted.

The types of payments from which child support is not withheld include (Article 101 229-FZ):

- travel expenses and other accountable amounts;

- compensation payments in connection with the use of the employee’s personal property in the interests of the organization. The government List clarifies that we are talking about the use of tools, transport, equipment, other technical means and materials, as well as reimbursement of expenses associated with their use (Resolution of the Government of the Russian Federation dated April 1, 2019 No. 388);

- compulsory social insurance benefits, with the exception of sick leave payments;

- financial assistance in connection with an emergency or the death of a family member.

Payment order for payment of state duty

The state fee is a mandatory payment that is paid if you contact various authorities to carry out some legal transactions.

Let's look at a clear example of filling out a payment order for state fees.

Let’s imagine that ABV LLC submits an application to the Federal Tax Service for payment of an overpayment of property tax, which amounted to 80,000 rubles.

But the inspection does not return the amount within the specified period, then the enterprise submits an application to the Arbitration Court that the actions of the tax service are illegal, and also submits its demand for the return of the overpayment with interest in the amount of 1,000 rubles.

In this case, the company must pay 2 state duties:

- 3 thousand rubles so that the actions of the tax service are declared illegal in accordance with subparagraph. 3 p. 1 art. 333.21 Tax Code of the Russian Federation.

- RUB 3,240 (4% of 80,000 (overpayment) + 1,000 (interest)) – for a request for a refund in accordance with subclause. 1 clause 1 art. 333.21 Tax Code of the Russian Federation.

Thus, the total amount for paying the state duty will be 6,240 rubles.

When ABC LLC draws up a payment order, it will indicate the following data:

- Payer status – “01”;

- Recipient - Federal Tax Service No. 26 (taken solely as an example);

- KBK - 182 1 0800 110 (varies depending on the type of payment; for your specific situation, the contents of this field may differ);

- OKTMO – indicated depending on the location of the court;

- The basis of payment is “TP”;

- In lines 107, 108, 109 – put “0”.

A visual example of filling out a document:

back to menu ↑

Deduction amount

If the parents have not agreed on the amount of child support, then it is collected in court in the amount of:

- quarters of income - per child;

- thirds of income - for two children;

- half of earnings - on three or more.

If a citizen does not comply with the court’s demand voluntarily, then the writ of execution is sent to his place of work. The employer must fulfill it unconditionally.

According to the writ of execution, in addition to current alimony, the resulting debt is collected. The total percentage of such deduction can reach 70% of the employee’s earnings.

Example

Semenov Andrey Petrovich pays, according to the writ of execution for his son, to his ex-wife, Semenova Inna Leonidovna, a payment in the amount of 25% of the income. In May 2021, he received a salary of 30,000 rubles. He did not submit an application for personal income tax deductions. Let's calculate the amount of deduction:

Service for drawing up documents in online form

If you don’t have time to fill out payment forms yourself, then you can use the online form on the PrintPay website.

This option is also convenient because you can create a document anywhere and at any time.

So, let's go to the site:

As you can see, a window for filling out immediately opens, but we advise you to read the filling rules again at the very beginning, which you can find at the bottom of the page:

The window that appears contains all the information that is necessary to correctly fill out the payment order.

Do not forget that in case of even one error, the bank will not be able to complete the transaction, which means there will be a delay in payment.

Therefore, even if you are already familiar with all the rules, do not be lazy to read them again.

In addition, legislation is now making changes and adjustments to this system, so it is very likely that you will have to deal with new rules.

All information in this section complies with government regulations.

To make it easier to find the information you need, select the required field in the photo and look for the relevant information.

For example, we don’t know how to fill line 60:

We are looking for information for this line:

Now let's move on to filling out the document:

For convenience, the system offers an automatic search for the bank's BIC. Just enter the name of the bank you need:

After filling out all the fields, select the payment purpose:

After that, click “Generate” and in a new window your document will be available for you to save.

Check that the data is filled out correctly, and if you find errors, go back and correct them.

The system also offers a quick fill option:

In this case, you are offered a slightly different way of filling out the fields, but in the end you receive the same document. It is believed that the second method is a little simpler.

If you do not trust online systems of this kind, then you can fill out the document directly at the tax office or bank branch.

In this case, the procedure may be delayed, since, for example, to find out information on the BIC, you will need to seek help from one of the employees who may be busy at the moment.

This is the advantage of filling out online - all information is available without queues or waiting.

Every individual entrepreneur or company accounting department is faced with the preparation of the document in question, so it is necessary to constantly monitor all innovations in order to correctly process the payment.

back to menu ↑

What is a payment order in 2021

Methods for transferring alimony and documents for their registration

Child support can be paid in various ways. Each of them has its own advantages and disadvantages that must be taken into account.

You can transfer payments in the following ways:

- Cash. For many people it is the most convenient and accessible method of payment. It has one drawback - people often forget to make a receipt for the transfer and receipt of funds. Therefore, proving the fact of payments can be problematic. With this type of payment, you need to make a receipt; the form to fill out can be found on the Internet. Both parties indicate the full name, passport details, type of payment and the person for whom the payment is made (minor child). The form also contains a link to the basis for payments (agreement, court decision, etc.).

- Transfer through mail, terminal, electronic payment system. Information about the payment must be indicated in as much detail as possible: day, month, year, purpose of payment, person for whom alimony is paid. The more detailed the information, the easier it is for the payer to track the payment if necessary. The disadvantage of this method for many is significant - a commission is charged for money transfers of this type.

- Payments in the accounting department at the place of work. The basis for paying finances from the place of work may be an application from the payer, a court order, an agreement or a writ of execution. In this case, the accountant is responsible for transferring funds. At least once a year and upon dismissal, it is necessary to request a certificate from the employer about payment, so that, if necessary, you can prove the fact of payment.