Let's consider the features of reflecting in 1C received materials intended for operations not subject to VAT. Using the example of the receipt of souvenir products and their free transfer as part of an advertising campaign, we will analyze:

- what document to use to register the purchase of souvenirs;

- Is it possible to accept incoming VAT for this operation;

- how to arrange the gratuitous transfer of souvenirs for advertising purposes;

- How to reflect the transfer of advertising products in the VAT return.

Step-by-step instruction

The organization entered into an agreement with Karandash LLC for the supply of souvenirs.

February 20 souvenirs Pens with the symbols of the organization (125 pcs.) in the amount of 12,000 rubles. (including VAT 20%) arrived at the warehouse. The cost of one pen is 96 rubles. (including VAT 20%).

On February 22, at the exhibition, as part of an advertising campaign, pens with the symbols of the organization (125 pcs.) were donated free of charge.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Purchasing souvenirs | |||||||

| February 20th | 10.01 | 60.01 | 10 000 | Acceptance of materials for accounting | Receipt (act, invoice) - Goods (invoice) | ||

| 19.03 | 60.01 | 2 000 | Acceptance for VAT accounting | ||||

| 10.01 | 19.03 | 2 000 | Inclusion of VAT in the price | ||||

| Registration of SF supplier | |||||||

| February 20th | — | — | 12 000 | Registration of SF supplier | Invoice received for receipt | ||

| Free transfer of materials | |||||||

| February 22 | 44.01 | 10.01 | 12 000 | Free transfer of souvenirs for advertising purposes | Free transfer | ||

| Reflection of a non-taxable transaction in section 7 of the VAT return | |||||||

| March 31 | — | — | 12 000 | Reflection of a non-taxable transaction in section 7 of the VAT return | Generating records in section 7 of the VAT return | ||

Purchasing souvenirs

Regulatory regulation

Materials, including advertising products, are accounted for at the actual cost of their acquisition (procurement) or accounting prices on account 10.01 “Raw materials and materials” (Chart of Accounts 1C).

In accounting, the actual cost of materials is formed based on the amount of actual acquisition costs (clause 5, clause 6 of PBU 5/01).

In NU, the actual cost of inventories is determined in a similar way: based on the prices of their acquisition and other acquisition costs (clause 2 of Article 254 of the Tax Code of the Russian Federation).

In our example, souvenir products are purchased that cost less than 100 rubles per unit. for further free transfer for advertising purposes. Such an operation is not subject to VAT (clause 25, clause 3, article 149 of the Tax Code of the Russian Federation), therefore, VAT on purchased advertising products cannot be deducted.

If materials are purchased for transactions that are not subject to taxation (exempt from taxation), input VAT is included in the cost of such materials (clause 1, clause 2, article 170 of the Tax Code of the Russian Federation).

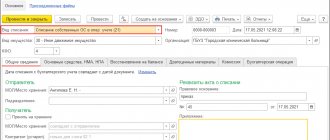

Accounting in 1C

For the purchase of souvenir products, complete the document Receipt (act, invoice) transaction type Goods (invoice) in the section Purchases – Purchases – Receipt (acts, invoices).

In the header of the document please indicate:

- Agreement - a document according to which settlements with the supplier are carried out, Type of agreement - With the supplier .

In our example, payments under the agreement are carried out in rubles PDF; as a result of selecting such an agreement, the following subaccounts for settlements with the supplier are automatically established Receipt (act, invoice)

- Settlement account - 60.01 “Settlements with suppliers and contractors”;

- Advances account - 60.02 “Settlements for advances issued.”

The tabular section indicates:

- Nomenclature - purchased souvenir products from the Nomenclature .

- VAT accounting method - Taken into account in the price .

Postings according to the document

The document generates transactions:

- Dt 10.01 Kt 60.01 - advertising products are accepted for accounting;

- Dt 19.03 Kt 60.01 - VAT accepted for accounting;

- Dt 10.01 Kt 19.03 - input VAT is included in the cost of advertising products.

The document generates movements in the VAT register presented :

- registration entry Receipt on an invoice for the amount of VAT presented;

- registration entry Expense on the invoice for the amount of VAT included in the price.

Consequently, input VAT will not be deducted and the invoice will not be reflected in the Purchase Ledger.

Documenting

The organization must approve the forms of primary documents, including the document on the receipt of materials. In 1C, a Receipt Order in form M-4 is used.

The form can be printed by clicking the Print button – Receipt order (M-4) of the document Receipt (act, invoice) . PDF

Accounting for VAT on purchased materials when applying the simplified tax system

The entrepreneur applies the simplified tax system. Type of activity - production of cabinet furniture according to orders for offices, retail enterprises, etc. Recently, materials for the manufacture of furniture have to be purchased from organizations that are VAT payers, which is reflected in the accompanying documents (invoices, invoices, checks). How can we supply such materials to the parish?

Does our price increase by the amount of VAT? How to correctly reflect the cost of materials written off for production in the Income and Expense Book? Is it necessary to keep separate records of materials purchased with VAT and materials without VAT on the accompanying documents? And if VAT was not highlighted as a separate line in the Income and Expense Book, what sanctions could be applied, what consequences could there be?

First of all, we note that the procedure for accounting for “input” VAT on materials in expenses when calculating the single tax under the simplified tax system is a subject of disagreement between taxpayers and inspectors.

According to paragraphs 5 and 8 p. 1 art. 346.16 Tax Code of the Russian Federation

when determining the object of taxation for a single tax, the taxpayer reduces the income received by material expenses, as well as by expenses in the form of the amount of VAT on paid goods (work, services) purchased by the taxpayer and subject to inclusion in expenses.

You purchase materials under a supply agreement, under which they are considered goods.

Consequently, expenses under the simplified tax system take into account VAT on materials purchased and paid for by you, the cost of which is subject to inclusion

included in expenses.

The procedure for recognizing expenses is established by Art. 346.17 Tax Code of the Russian Federation

.

In accordance with paragraph 2 of Art. 346.17 Tax Code of the Russian Federation

Expenses are recognized as taxpayer expenses

after they are actually paid

.

Payment for goods

(works, services) and (or) property rights, the

termination of the obligation

of the taxpayer - the purchaser of goods (works, services) and (or) property rights to the seller, which is directly related to the supply of these goods (performance of work, provision of services) and (or) is recognized. transfer of property rights.

At the same time, Art. 346.17 Tax Code of the Russian Federation

For

some types

of expenses,

special conditions

for taking them into account for the purpose of calculating the single tax.

In particular, the costs of purchasing raw materials and materials are taken into account as expenses as these raw materials and supplies are written off for production.

However, in relation to the “input” VAT

, including “input” VAT on materials, special conditions for including it in the composition of expenses of the Tax Code of the Russian Federation

have not been established

.

Therefore, VAT amounts on paid materials should be recognized as expenses as a general rule.

, established by

paragraph 2 of Art.

346.17 of the Tax Code of the Russian Federation , -

after their actual payment

, that is, immediately after payment (including VAT) for materials to the supplier is made.

But tax authorities, led by the Ministry of Finance of the Russian Federation, believe that the amount of value added tax paid by the taxpayer when purchasing materials should be taken into account when determining the tax base for the single tax in the part related to the cost of paid materials written off for production

.

When drawing their conclusions, officials rely on the fact that in paragraphs.

8 clause 1 art. 346.16 of the Tax Code of the Russian Federation talks about accounting for VAT amounts

on goods subject to inclusion in expenses as expenses

.

Officials understand the words “to be included in expenses” as “actually included in expenses.”

And since the costs of purchasing materials are taken into account for the purpose of calculating the single tax as materials are written off for production, the “input” VAT on materials should be taken into account only when these materials are written off for production.

At the same time, the words “for goods to be included in expenses”, based on their literal reading, mean only the potential

accounting for the cost of goods (which are materials for you) in expenses.

In addition, paragraph 1 of Art. 346.16 Tax Code of the Russian Federation

establishes only

a list

of expenses, and

the procedure

for accounting for expenses is defined in

paragraph 2 of Art.

346.17 of the Tax Code of the Russian Federation , which does not stipulate special conditions for accounting for “input” VAT in expenses.

If you adhere to the option of accounting for “input” VAT, which follows from the norms of the Tax Code of the Russian Federation (inclusion of VAT in expenses regardless of the moment materials are released into production), then you do not need to keep separate records of materials purchased with VAT and materials purchased without VAT

, since you do not need to track which materials (purchased with VAT or without VAT) were released into production.

highlight VAT

in the Book of Income and Expenses, since, firstly, VAT and the cost of materials are two different types of expenses, and secondly, the moment of accounting for these expenses most likely will not coincide: you will take into account VAT immediately after paying for materials, and the cost you will reflect the materials themselves as the materials are released into production.

If you decide to take into account “input” VAT according to the recommendations of the tax authorities, then you will have to organize the accounting of materials in such a way that you can determine which materials (purchased with VAT or without VAT) were released into production. After all, otherwise you will not be able to determine at what point the “input” VAT can be recognized as an expense.

As for the allocation of VAT in the Book of Income and Expenses as a separate line, then, on the one hand, “input” VAT and material expenses are different types of expenses. Therefore, as a rule, they are reflected in the Book of Income and Expenses in separate lines.

But on the other hand, neither the Tax Code nor the Procedure for filling out the Book of Income and Expenses of organizations and individual entrepreneurs applying the simplified taxation system, approved by Order of the Ministry of Finance of the Russian Federation dated December 30, 2005 No. 167n, provides

that VAT and the cost of materials released for production must be reflected in the Book of Income and Expenses

on separate lines

. This means that no sanctions can be applied for “violating” this unspecified rule.

Even the Ministry of Finance of the Russian Federation, in a letter dated June 26, 2006 No. 03-11-04/2/131 (published in No. 27 “A-E”), came to the conclusion that since the amounts of value added tax on purchased raw materials and supplies are taken into account When calculating the single tax only in the part related to the cost of these raw materials and materials written off for production, taxpayers can take into account when taxing the cost of raw materials and materials, taking into account value added tax

.

In this case, VAT will not be shown as a separate line in the Income and Expense Book.

True, in this letter the Ministry of Finance of the Russian Federation explained the procedure for accounting for “input” VAT based on materials from public catering organizations

.

But these conclusions of officials are quite applicable to other industries.

Now let's talk about whether your price (as we understand - the price of your finished product) should increase by the amount of VAT.

Since “input” VAT is included in expenses when calculating the single tax, from an economic point of view it does not matter for you whether you purchased materials with or without VAT.

The main thing for you is the final cost of materials, which you pay to the materials supplier.

For example, you bought materials from one supplier for 11,800 rubles. (including VAT 1800 rubles), and from another supplier - the same amount of similar materials for 11800 rubles. (without VAT).

By producing furniture both from the materials of the first supplier and from the materials of the second supplier, and selling the furniture for the same price, you will receive the same economic result, since in both the first and second cases the entire amount spent on the purchase of materials (11,800 rubles) will be taken into account in expenses when calculating the single tax.

Taxpayers who use the simplified tax system are not recognized as VAT payers ( clause 2.3 of article 346.11 of the Tax Code of the Russian Federation

).

Therefore, regardless of whether the materials for furniture production were purchased with or without VAT, you should not charge or present VAT to your customers in addition to the price of the furniture.

Registration of SF supplier

Input VAT cannot be deducted, even if the 5% rule is observed, since materials were purchased only for transactions not subject to VAT (clause 2 of Article 171 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated October 2, 2017 N 03-07-11 /63926, dated 10/05/2017 N 03-07-11/65098).

BukhExpert8 advises: regardless of the fact that the invoice is not registered in the Purchase Book, register it in 1C in case in the future the VAT accounting method .

To register an incoming invoice from a supplier, you must indicate its number and date at the bottom of the Receipt document form (act, invoice) and click the Register .

The Invoice document received is automatically filled in with the data from the Receipt document (act, invoice) .

- Operation type code : “Receipt of goods, works, services.”

The document does not generate postings according to BU and NU.

Tax deductions for VAT when paying for goods with borrowed funds

The company received funds under short-term and long-term loan agreements.

Goods and materials were purchased with borrowed money.

Was VAT legally deductible on received invoices, since the money has not yet been returned to the lender?

The Constitutional Court of the Russian Federation in its Determination No. 169-O dated 04/08/2004 indicated that in the case of payment of VAT amounts accrued by suppliers using property

(including cash and securities) received by the taxpayer

under a loan agreement

, despite the fact that the taxpayer-borrower alienated the borrowed property (including borrowed cash and borrowed securities) in payment of VAT amounts accrued by suppliers, the transfer of property begins to meet the second , a more important mandatory feature that allows accrued tax amounts to be deducted, namely the sign of the reality of costs, only

at the time the taxpayer fulfills his obligation to repay the loan amount

.

Thus, the Court concluded that the right to deduct VAT amounts

, paid by the buyer using borrowed funds, arises from the buyer only

after the return of borrowed funds

.

On November 4, 2004, the Constitutional Court of the Russian Federation issued a new Determination No. 324-O, in which it indicated that from the Determination of April 8, 2004 No. 169-O it does not follow that the taxpayer in any case does not have the right to make a tax deduction

, if the amount of value added tax was paid by him to the supplier of goods (works, services) as part of the price, in particular in cash (including until the taxpayer fulfills the obligation to repay the loan).

The right to deduct tax amounts presented to the taxpayer and paid by him when purchasing goods (work, services) cannot be granted if the taxpayer does not incur real costs

to pay the amounts of value added tax accrued by the supplier, that is, if the property acquired under a compensated transaction, by the time it is transferred to the supplier in payment of the accrued tax amounts, not only has not been paid or has not been paid in full, but is

clearly not subject to payment in the future

.

That is, the restriction of the right to deduct VAT amounts paid using borrowed funds applies only to unscrupulous taxpayers

.

Tax authorities have always been against the deduction of VAT amounts paid with borrowed funds.

But the Ministry of Finance of the Russian Federation on June 28, 2004, in letter No. 03-03-11/109, indicated that taking into account the fact that, on the basis of clause 1 of Art. 807 of the Civil Code of the Russian Federation

the funds received by the borrower under the loan agreement are his property; the amounts of value added tax actually paid by the taxpayer

using borrowed funds are subject to deduction

.

Since until 2006, in order to apply VAT tax deductions, the fact of payment of

VAT amounts

, then if the transaction you specified occurred in 2005, in the event of a dispute with the tax inspector, you should be guided by the above regulatory documents.

Since 2006 the situation has simplified.

Taking into account the changes made to Chapter 21 of the Tax Code of the Russian Federation, taxpayers can apply a tax deduction for VAT from January 1, 2006, regardless of the fact of payment of tax amounts

, except for cases specifically provided for in

Articles 171, 172 of the Tax Code of the Russian Federation

.

Tax amounts presented to the taxpayer upon acquisition of goods (work, services), property rights on the territory of the Russian Federation after registration of these goods (work, services), property rights are subject to deductions.

and in the presence of relevant

primary documents

.

Thus, since in 2006 the fact of payment by the buyer of the VAT amounts presented by the supplier does not matter for the purposes of applying tax deductions, it also does not matter from what funds (own or borrowed) the VAT will be paid

.

When importing goods

(imported into the customs territory of the Russian Federation) payment of VAT is required to apply a tax deduction.

However, taking into account the position of the Constitutional Court of the Russian Federation, payment of VAT using borrowed funds in this case will also not affect the right to apply the deduction

.

Free transfer of materials

The gratuitous transfer of souvenirs is considered advertising expenses. For tax accounting purposes, these expenses are normalized (clause 4 of Article 264 of the Tax Code of the Russian Federation).

Advertising expenses associated with the costs of selling products, works and services are reflected in accounting according to Dt 44.01 “Distribution costs in organizations engaged in trading activities” (Chart of Accounts 1C).

Transfer of goods worth less than 100 rubles. per unit for advertising purposes is not subject to VAT (clause 25, clause 3, article 149 of the Tax Code of the Russian Federation).

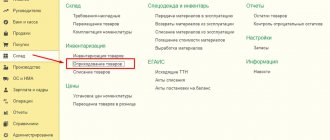

Document the free transfer of materials to an indefinite number of persons with the document Free transfer in the section Sales - Sales - Free transfer.

In the document please indicate:

- Recipient - not filled in, since the transfer is carried out to an indefinite number of persons;

- Operation code - 1010275 “Transfer of goods (work, services) for advertising purposes”;

- A pen with the symbols of the organization : promotional items donated free of charge, selected from the Nomenclature ;

- Price - purchase price (Letter of the Ministry of Finance of the Russian Federation dated July 20, 2017 N 03-07-11/46167);

- % VAT - Without VAT : materials with a unit cost of less than 100 rubles. VAT is not assessed (clause 25, clause 3, article 149 of the Tax Code of the Russian Federation).

On the Cost Account , fill in:

- Cost account - 44.01 “Distribution costs in organizations engaged in trading activities”;

- Cost items - an item with the expense type Advertising expenses (standardized) .

The type of expense indicated by the Cost Item influences whether the amount for this item will be reflected in the Tax Code, and what line it will occupy in the income tax return.

Read more about the directory Cost Items for Tax and Accounting

Read more How standardized advertising expenses are recognized in NU

Postings according to the document

The document generates the posting:

- Dt 44.01 Kt 43 - the cost of souvenirs is included in advertising costs.

Documenting

The organization must approve the forms of primary documents, including documents for the transfer of souvenir products to an indefinite number of persons. In 1C, the Requirement-invoice in form M-15 is used.

The form can be printed by clicking the Print button – Request-invoice (M-15) of the document Free transfer . PDF

Registration

According to the inspectors, VAT needs to be restored in a number of cases.

For example, in case of theft, destruction, confiscation of goods, etc.

Officials claim that the “input” VAT in these cases is subject to restoration, since stolen (destroyed, confiscated, etc.) goods are no longer used in activities subject to VAT (letters of the Ministry of Finance of the Russian Federation dated July 4, 2011 No. 03-03 -06/1/387, Federal Tax Service of Russia for Moscow dated November 25, 2009 No. 16-15/123920.1).

However, arbitration courts take a different point of view. The Code obliges people to pay only legally established taxes. This means that the restoration of VAT, previously legally accepted for deduction, must be provided for by law. Cases in which it is necessary to restore the tax are listed in paragraph 3 of Article 170 of the Tax Code. This list is closed. Consequently, the obligation to restore VAT amounts not provided for by the code is illegal (decisions of the Supreme Arbitration Court of Russia dated May 9, 2011 No. 3943/11, dated October 23, 2006 No. 10652/06).

Not mentioned in paragraph 3 of Article 170 of the Tax Code is the disposal of property as a result of a fire. On this basis, in a letter dated May 21, 2015 No. GD-4-3/8627, the Federal Tax Service of Russia concluded that the VAT previously accepted for deduction on burnt property does not need to be restored.

However, in most cases, officials interpret the provisions of the Tax Code regarding the restoration of VAT in their favor. In a letter dated August 17, 2015 No. 03-07-11/47347, the Ministry of Finance expressed the opinion that if the goods were not delivered and the advance payment was not returned, the VAT accepted for deduction when transferring the advance must be restored at the time of writing off the receivables.

Financiers justify their position by the fact that tax amounts on goods that are used to carry out only transactions subject to VAT are subject to deductions (clause 2 of Article 171 of the Tax Code of the Russian Federation). But if the goods are not used in transactions subject to this tax, then the VAT deduction cannot be applied.

Since in the situation under consideration the delivery of goods did not take place, therefore, there are no grounds for deducting VAT. According to the Ministry of Finance, the buyer must restore the VAT accepted for deduction when transferring an advance payment to the supplier for the upcoming delivery of goods.

This is done when writing off receivables that arose in connection with the transfer of an advance payment to the supplier, financiers note.

However, based on a literal reading of paragraph 3 of Article 170 of the Tax Code, VAT restoration in the case under consideration is not required. After all, this situation is not mentioned in the closed list of tax restoration options listed in this norm.

Thus, the Tax Code does not provide for the write-off of receivables in the amount of the advance paid for a failed delivery as a basis for VAT restoration.

However, if the buyer does not restore the tax, claims may arise from inspectors. The taxpayer will have to defend his position in court, but given the established arbitration practice, the likelihood of the dispute being resolved in his favor is quite high.

Here are examples of arbitration cases lost by tax authorities:

- The tax inspectorate demanded that the company restore VAT, previously accepted for deduction, on the stolen property. However, judges of all instances considered this requirement illegal and refused the tax authorities (resolution of the Federal Antimonopoly Service of the Moscow District dated November 16, 2010 No. KA-A40/13770-10);

- The decision of the tax inspectorate regarding the additional assessment of VAT, penalties and fines was recognized as illegal, since such a basis as write-off or destruction of inventory items as a result of expiration is absent in paragraph 3 of Article 170 of the Tax Code (resolution of the Federal Antimonopoly Service of the Far Eastern District dated December 27, 2010 No. Ф03-8694/2010);

- the judges decided that (resolution of the Federal Antimonopoly Service of the Volga District dated January 27, 2011 in case A55-7952/2010);

- The tax inspectorate demanded that the company restore VAT on goods not used in taxable transactions due to defects. By Resolution of the Federal Antimonopoly Service of the Volga Region dated November 30, 2010 No. A55-33697/2009, the decision of the tax authorities was declared invalid;

- The tax inspectorate demanded that the organization restore VAT on goods lost due to the fire. Judges of three instances recognized such a requirement as illegal, and the corresponding decision of the inspectorate as invalid (resolution of the Federal Antimonopoly Service of the Moscow District dated December 25, 2013 No. F05-16440/2013 in case No. A40-34818/13);

- the organization purchased goods for resale and claimed the VAT claimed as a deduction. However, then an independent examination was carried out in relation to part of the goods, during which it was established that the goods were illiquid. Unliquid goods are written off and sent to a landfill. The tax inspectorate demanded that the organization restore VAT on these goods. However, the court sided with the company (resolution of the Federal Antimonopoly Service of the North Caucasus District dated May 7, 2014 No. A32-18211/2012).

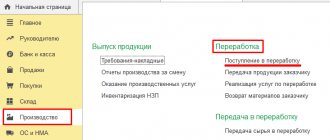

Reflection of a non-taxable transaction in Section 7 of the VAT Return

The gratuitous transfer of advertising products as a non-taxable transaction must be reflected in section 7 of the VAT return under code 1010275 (Appendix No. 1 to the Procedure for filling out a VAT tax return, approved by Order of the Federal Tax Service of the Russian Federation dated October 29, 2014 N ММВ-7-3/ [email protected] ).

To carry out transactions not subject to VAT, it is necessary to organize separate accounting of incoming VAT (clause 4 of Article 170 of the Tax Code of the Russian Federation).

To automatically reflect non-taxable transactions in section 7 of the VAT return, create the document Formation of entries in section 7 of the VAT return in the section Operations – Period closure – Regular VAT transactions.

Enter a non-taxable transaction using the Fill .

In the tabular section, check:

- Operation code - 1010275 “Transfer of goods (work, services) for advertising purposes”;

- Supporting documents - a list of supporting documents, indicating the Type of document, its Number and Date ;

- Sales amount (Column 2) - 12,000 (cost of souvenir products donated free of charge);

- VAT (Column 4) - Direct - 2,000 (the amount of VAT included in the cost of souvenirs).

When posting a document, you need to distribute VAT using the Distribute VAT .

If the purchased product, work, or service is used both in preferential transactions and in those subject to VAT, then the input tax should be distributed between them. After this, the VAT column will be filled in (Column 4) - Distributed .

In this example, all VAT on advertising products should be attributed to a preferential transaction, so the VAT column (Column 4) – Direct . The distribution of VAT will not affect the result, and this action is only necessary to process the document.

VAT declaration

A VAT-free transaction is reflected in the VAT return: PDF

- in Section 7 “Transactions not subject to taxation...”.

Submission of a register of supporting documents

If the operation is not subject to VAT under Art. 149 of the Tax Code of the Russian Federation, the tax authority has the right to request from the taxpayer Explanations of transactions (for each transaction code) for which tax benefits are applied (clause 6 of Article 88 of the Tax Code of the Russian Federation)

Recommended form of explanations (Letter of the Federal Tax Service of the Russian Federation dated January 26, 2017 N ED-4-15/ [email protected] ):

- Register (Appendix No. 1 to the Letter of the Federal Tax Service).

- List and forms of standard agreements used by the taxpayer when carrying out transactions using the corresponding codes.

To automatically fill out the register in the Operation Code of Section 7 of the VAT return, indicate:

- checkbox The operation is not subject to taxation (Article 149 of the Tax Code of the Russian Federation) ;

- checkbox Included in the register of supporting documents ;

- Type of non-taxable transaction for filling out the register of supporting documents.

The transaction code for section 7 of the VAT declaration can be opened directly from the Gratuitous transfer or through the Main menu - All functions - Directories - Transaction codes for section 7 of the VAT declaration.

Create a register of supporting documents in the section Reports – VAT – Register for section 7 of the declaration. PDF

See also:

- How to keep separate accounting of incoming VAT in 1C if there are transactions subject to VAT and non-taxable transactions?

- Procedure for maintaining separate accounting

- Methodology for separate accounting in 1C

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge