The accounting mechanism implemented in 1C Accounting on the chart of accounts is based on the formation of accounting entries for each accounting transaction and necessarily includes a debit account for the transaction, credit and amount. This is the main fundamental difference between accounting programs and other accounting programs, for example, trading or payroll.

To open the chart of accounts in the 1C accounting program, you need to execute through the menu: Enterprise - chart of accounts - chart of accounts . To help the accountant, the chart of accounts form provides sorting by the “Code” and “Account Name” columns, as well as a quick selection based on the first characters entered.

1C Accounting uses a standard chart of accounts approved by the Ministry of Finance of the Russian Federation. For self-supporting organizations, a self-supporting chart of accounts in 1C is used, and for budgetary organizations, accordingly, a budgetary chart of accounts. Due to the fact that budget and self-supporting (aka commercial) accounting are very different, the 1C Enterprise programs for budget and self-supporting accounting are also different.

Accounts in the chart of accounts may include subaccounts. If the 1C 8 account contains subaccounts, then in this case transactions are generated only for subaccounts. In this case, the account itself is highlighted with a yellow background, this is an indication that they should not try to use the account in transactions.

In addition to total accounting of accounts, it is possible to maintain quantitative and currency accounting. To do this, the appropriate accounting types for the account or subaccount must be enabled.

Unlike the 1-C Accounting 8.1 program (configuration edition 1.6), Accounting 8.2 (configuration edition 2.0) maintains accounting and tax accounting for profits on one chart of accounts . Therefore, each 1C 8.2 account has the NU attribute - tax accounting, which allows the account to participate in accounting for income tax calculations. The amounts of accounting and tax accounting entries (BU and NU) are accounted for separately, although they are maintained on the same chart of accounts, and in principle may differ.

Another fundamental difference in the chart of accounts in 1C 8.2 is that the chart of accounts has a new type of accounting, “Accounting by Division,” which replaced the use of the “Division” subaccount in version 8.1. Therefore, those accounts that keep records by division (for example, subaccounts of account 20, account 26 and 25) must have the “Accounting by division” attribute turned on. And in input documents, you should pay attention to the division input, since its input position differs from the usual sub-account input.

What material assets are taken into account on the balance sheet?

Material assets that were transferred or came into the custody of an organization without transferring ownership rights to them, as well as strict reporting forms that are at the disposal of the organization, fall under off-balance sheet accounting of material assets.

The following material assets are subject to accounting on the balance sheet:

- fixed assets leased by the enterprise;

- property received for free use;

- materials and raw materials accepted from suppliers for processing;

- equipment accepted from customers for subsequent installation;

- goods accepted for commission;

- property in safekeeping:

- valuables sent by suppliers to the enterprise by mistake;

- defects from suppliers that have not passed acceptance;

- property released to buyers according to documents, but not actually taken by them from the enterprise.

For material assets that are the property of other economic entities, their balance sheet accounting is already carried out by enterprises and organizations to which they belong by right of ownership, and off-balance sheet accounting of material assets is necessary in order to exclude the possibility of their repeated balance sheet accounting at another enterprise.

Strict reporting forms - diplomas, work books, certificates cannot be taken into account as property belonging to the organization, since they are used to certify important facts, events and rights of third parties, but the organization in whose possession they are until the moment of use is responsible for their controlled expenditure .

The procedure for off-balance sheet accounting of material assets

The movement of material assets behind the balance sheet of an enterprise is carried out by simple transactions and does not involve double entry into accounts; off-balance sheet accounts do not correspond either with balance sheet accounts or with each other. Off-balance sheet accounting of material assets is carried out on the basis of primary accounting documents: claims-invoices, acts of acceptance and transfer of fixed assets, material assets for storage.

Analytical accounting is carried out in the context of the type of valuables, counterparties of the enterprise (owners, suppliers, lessors), storage locations and, in the case of personal liability of specific persons who were entrusted with the storage of the relevant objects.

Reflection of business transactions by postings to off-balance sheet accounts

| Operation | Debit | Credit |

| Obtaining lease of fixed assets | 001 | — |

| Return of previously leased fixed assets to the owner | — | 001 |

| Acceptance of inventory items for safekeeping | 002 | — |

| Return of previously accepted inventory items to the legal owner | — | 002 |

| Receipt of customer-supplied raw materials for processing | 003 | — |

| Disposal of customer-supplied raw materials - manufacturing of products from them | — | 003 |

| Receiving goods on consignment | 004 | — |

| Goods sold under a commission agreement | — | 004 |

| Equipment has been accepted for installation to the customer | 005 | — |

| Completed installation and installation of equipment for the customer | — | 005 |

| Strict reporting forms received | 006 | — |

| Strict reporting forms were used | — | 006 |

| Strict reporting forms are damaged and unusable | — | 006 |

The basis for mandatory write-off from the off-balance sheet accounting of an enterprise is the placement of this property on the balance sheet upon transfer of ownership rights to the object to the organization itself:

- repurchase of leased property from the lessor,

- transfer of ownership rights to material assets previously transferred free of charge,

- payment under the contract for raw materials previously received for processing, etc.

Documentation of the transfer of property from account 21

The forms of primary documents and accounting registers, as well as guidelines for their use, were approved by Order No. 52n of the Ministry of Finance of Russia dated March 30, 2015 (hereinafter referred to as Order No. 52n). Order 52n does not directly provide for a unified form for restoring property on the balance sheet. At the same time, upon receipt of material assets (including fixed assets, inventories), a Receipt Order for acceptance of material assets (non-financial assets) can be issued (f. 0504207). This document serves as the basis for accepting property for accounting and reflecting it on the balance sheet of the institution. In addition, in order to reflect transactions for which unified forms of primary accounting documents are not established, an Accounting Certificate (f. 0504833) is used. Thus, the restoration of property from account 21 on the balance sheet can be formalized by a Receipt Order (f. 0504207) or an Accounting Certificate (f. 0504833). The detailed procedure for documenting transactions should be fixed in the accounting policy. The gratuitous transfer of property is formalized by the Act on the acceptance and transfer of non-financial assets (form 0504101) and the Notice (form 0504805).

What off-balance sheet accounts are intended for accounting for inventory items?

The very definition of off-balance sheet accounts specified in the instructions to the Chart of Accounts (Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n) indicates that these are accounts that are not taken into account in the organization’s balance sheet; their indicators are not involved in assessing the financial position of an economic entity. The chart of accounts and its instructions provide for 11 off-balance sheet accounts, 3 of which are intended for accounting for inventory items:

- Account 002 - it records inventory items that are in the organization’s warehouse, but are not already or not yet its property.

- Account 003 is intended to account for raw materials and materials that the manufacturing organization receives from the customer for processing.

- Account 004 is used by commission agent organizations to account for goods accepted under the terms of a commission agreement.

You can get acquainted with the off-balance sheet accounts provided for in the Chart of Accounts and the features of their use in the article “Rules for maintaining accounting records on off-balance sheet accounts.”

The following is typical for all property off-balance sheet accounts: the receipt of assets is reflected only in debit, write-off only in credit, there is no correspondence in off-balance sheet accounts.

How to transfer materials to an off-balance sheet account?

Paragraph 4 clause 5 PBU 6/01 indicates the need for proper accounting of property written off as expenses as inventories. And paragraph 5 of PBU 1/2008 talks about organizing accounting policies in such a way that assets and liabilities belonging to the organization are accounted for separately from others.

However, to account for material assets, the cost of which has already been written off as expenses, there are off-balance sheet accounts 002, 003 and 004. Instructions for using the Chart of Accounts also provide for the possibility of introducing additional off-balance sheet accounts. Thus, to account for materials that continue to be in the organization and used in its business activities, it is possible to provide an additional account on the balance sheet, and the regulations for its use can be fixed in the accounting policies. Such an off-balance sheet account may be account 012 “Material assets in operation.”

In the accounting program “1C: Accounting”, popular among accountants, for example, an MC account with a number of sub-accounts has been introduced for similar purposes:

- MC02 “Working clothes in operation”;

- MC03 “Special equipment in operation”;

- MC04 “Inventory and household supplies in operation.”

After the property is capitalized and put into operation, its value is written off as the organization’s expenses, and the property itself, assigned to the responsible persons, will be listed on the balance sheet. When this property ceases to be used for one reason or another, it will need to be written off from the off-balance sheet account in which it was recorded.

At the same time, analytical accounting of materials is carried out according to nomenclature and storage locations, which makes it possible to control the availability and use of these values, and in the case of additional costs associated with their use, to justify these costs.

When transferring material assets into operation, the relevant documents are issued, for example, a demand invoice (form M-11), and the following entries are made:

- Dt 20, 26, 44 (cost accounts) Kt 10 “Materials”;

- Dt 012 (MC).

In the event of complete depreciation of the property recorded off the balance sheet, or its disposal for other reasons, a document for write-off is drawn up and a posting is recorded on the credit of the off-balance sheet account: Kt 012 (MC).

Regulations for accounting for values recorded on the balance sheet and monitoring them, as well as a list of documents used for these purposes, must be developed by the organization itself and consolidated in its accounting policies.

Reflection of the transfer of property from account 21 to 1C: BGU 8

To restore the balance of fixed assets accounted for in off-balance sheet account 21, use the document Write-off of fixed assets, intangible assets, legal assets with the type of write-off Write-off of own fixed assets in oper. accounting (21) and the flag enabled: Restore to balance . the Restore on balance flag, the Restore on balance tab appears .

On the Fixed Assets, Intangible Assets, Regulatory Assets , fixed assets are selected that are written off from off-balance sheet account 21. On the Balance Restoration , data on fixed assets that are written off from off-balance sheet account 21 are indicated.

On the Accounting transaction , select the standard transaction Write-off of fixed assets with restoration on the balance sheet and in the additional details indicate the full working account 401.10.172. The gratuitous transfer of a fixed asset is formalized by the document Transfer of fixed assets, intangible assets, legal acts with the type of transfer - Transfer of own fixed assets, intangible assets, legal acts on the balance sheet (101, 102, 103) and the standard transaction Gratuitous transfer to organizations of fixed assets, intangible assets, legal acts (401.20.280) .

More on the topic: How to reflect inventory results in an institution’s records?

Published 05/19/2021

How to sell materials from an off-balance account?

To sell property recorded off the balance sheet, its contractual value is determined. When selling, an entry for the sale of other property is generated:

- Dt 62 “Settlements with buyers and customers” Kt 91 “Other income and expenses.”

If an organization operates on OSNO, VAT is charged upon the sale of an asset:

- 91 “Other income and expenses” Kt 68 “Calculations for VAT”.

The disposal of property is carried out according to the credit of the off-balance sheet account of its accounting:

- Kt 012 (MC).

Moreover, the cost of such property is zero due to the fact that it has already been taken into account in the organization’s costs when transferring it into operation. Funds from the sale of this property are the income of the organization.

IMPORTANT! To generate documents for sale and the corresponding entries in the accounting program, it is often necessary to restore the property being sold in the organization’s assets, if the functionality of the program does not provide for transactions for the sale of property recorded off the balance sheet. For this purpose, inventory items to be sold are restored to the account from which they were previously written off, at a symbolic cost - for example, 1 kopeck.

What is usually taken into account?

I propose to consider the most common assets and liabilities that find a place to be reflected on the balance sheet. This list is not a guide to action. These are the most common situations that most companies experience.

Account 001 “Leased fixed assets”

A) We reflect the premises that we rent. The basis for the reflection is the acceptance certificate of the premises, which is signed upon conclusion of the contract. Most often, there is no information about the cost of premises in the contract. You can ask the landlord for cost information, but most likely you will be refused. In this case, there is no point in ordering an appraiser for money; you can use a conditional assessment. For example, 1 rub. for each rented square meter. The main thing is to spell out the rules for contingent valuation in accounting policies or corporate accounting principles.

B) Property transferred along with the rented premises, according to the transfer and acceptance certificate. These could be air conditioners, blinds, tables, cabinets, etc.

C) Floor coolers received from suppliers for a fee or as a bonus received for water consumed in 18.9 liter bottles. Accounting is carried out according to the equipment acceptance certificate at the time of receipt of the cooler from the supplier. This act, as a rule, indicates the collateral value at which the cooler is reflected on the balance sheet.

Account 002 “Inventory assets accepted for safekeeping”

Most often, 18.9 liter bottles for coolers are taken into account here. On the day of water delivery, the supplier, in addition to the standard invoice, encloses a receipt invoice for bottles and a consumable invoice (or a combined version). The collateral value of the bottles can be indicated either in these invoices or in the contract.

Another most common example of what is included in account 002 is rugs that belong to a cleaning company. These mats are regularly changed based on acceptance certificates.

Account 006 “Strict reporting forms”

Typically, BSO are taken into account in the conditional valuation, and the quantity to be reflected in accounting is determined by the direct counting method.

Typical transactions that are recorded on account 006:

– check books received by the organization from the bank;

– forms of work books and inserts for them;

– season tickets to be issued;

– blank forms of diplomas and certificates.

Less trivial options for using account 006:

– writs of execution for employees (for which alimony is paid);

– sick leaves (those brought by employees after the sick leave was closed);

– constituent documents (TIN, OGRN, record sheets, etc.).

The usefulness of this accounting lies in the ability to track those responsible for storing these documents.

Account 007 “Debt of insolvent debtors written off at a loss”

The written off receivable is reflected. The period of reflection on the account is within 5 years. The basis for recording will be an accounting certificate and an order to write off the debt.

Account 008 “Securities for obligations and payments received”

The received guarantees, after receiving a document, for example, from a bank, confirming these guarantees, must be reflected in account 008. Most often, companies whose buyers are state-owned companies encounter bank guarantees.

Account 009 “Securities for obligations and payments issued”

In the case where our company is a guarantor, this information should be reflected in account 009, in the amount of this guarantee. The basis for recording information in accounting will be a contract.

Types of off-balance sheet accounts

There are the following off-balance sheet accounts provided for in the Chart of Accounts.

To account for property that does not belong to the organization, off-balance sheet accounts are used:

- 001 “Leased fixed assets.” This account reflects the leased fixed assets at the valuation specified in the agreement;

- 002 “Inventory assets accepted for safekeeping.” If inventory items are received by the company, but under the terms of the contract, ownership of them is transferred to the organization after certain conditions are met (for example, after transfer of 100% of payment), then the company reflects such inventory items on off-balance sheet account 002;

- 003 “Materials accepted for processing.” This account reflects the customer's raw materials and materials accepted for processing (supplied raw materials), which are not paid for by the manufacturer;

- 004 “Materials accepted for commission” This account reflects goods accepted by the commission agent for sale;

- 005 “Equipment accepted for installation.” This account reflects the equipment received by the contractor from the customer for installation.

- To account for the organization's property written off as expenses, off-balance sheet accounts are used:

- 006 “Strict reporting forms.” This account reflects strict reporting forms - receipt books, forms of certificates, diplomas, various subscriptions, coupons, tickets, forms of shipping documents;

- 007 “Debt of insolvent debtors written off at a loss.” This account reflects the debt of insolvent debtors, taken into account on the balance sheet for five years after write-off in case of a change in the property status of the debtors.

To collect information for disclosure in notes to financial statements, off-balance sheet accounts are used:

- 001 “Leased fixed assets”;

- 011 “Fixed assets leased out.” If, under the terms of the lease agreement, the property is taken into account on the balance sheet of the tenant (tenant), then for the owner it is reflected in account 011 “Fixed assets leased”;

- 008 “Securities for obligations and payments received.” Account 008 “Securities for obligations and payments received” is intended to summarize information on the availability and movement of guarantees received to secure the fulfillment of obligations and payments, as well as security received for goods transferred to other organizations (individuals);

- 009 “Securities for obligations and payments issued.” Account 009 “Securities for obligations and payments issued” is intended to summarize information on the availability and movement of guarantees issued to secure the fulfillment of obligations and payments. If the guarantee does not specify the amount, then for accounting purposes it is determined based on the terms of the contract.

At the same time, the Organization can also open off-balance sheet accounts not provided for in the Chart of Accounts.

It should be noted that you should not neglect accounting for business transactions on off-balance sheet accounts, since during a tax audit, goods, fixed assets, etc., not accounted for anywhere, can be regarded as surpluses, which in accounting are classified as non-operating income and on which income tax must be paid .

Chart of accounts in 1C Accounting 8

The accounting mechanism implemented in 1C Accounting on the chart of accounts is based on the formation of accounting entries for each accounting transaction and necessarily includes a debit account for the transaction, credit and amount.

This is the main fundamental difference between accounting programs and other accounting programs, for example, trading or payroll. To open the chart of accounts in the 1C accounting program, you need to execute through the menu: Enterprise - chart of accounts - chart of accounts . To help the accountant, the chart of accounts form provides sorting by the “Code” and “Account Name” columns, as well as a quick selection based on the first characters entered.

1C Accounting uses a standard chart of accounts approved by the Ministry of Finance of the Russian Federation.

For self-supporting organizations, a self-supporting chart of accounts in 1C is used, and for budgetary organizations, accordingly, a budgetary chart of accounts.

Due to the fact that budget and self-supporting (aka commercial) accounting are very different, the 1C Enterprise programs for budget and self-supporting accounting are also different.

Accounts in the chart of accounts may include subaccounts. If the 1C 8 account contains subaccounts, then in this case transactions are generated only for subaccounts. In this case, the account itself is highlighted with a yellow background, this is an indication that they should not try to use the account in transactions.

In addition to total accounting of accounts, it is possible to maintain quantitative and currency accounting. To do this, the appropriate accounting types for the account or subaccount must be enabled.

Unlike the 1-C Accounting 8.1 program (configuration edition 1.6), Accounting 8.2 (configuration edition 2.0) maintains accounting and tax accounting for profits on one chart of accounts . Therefore, each 1C account is 8.

2 has the NU sign - tax accounting, which allows the account to participate in accounting for income tax calculations.

The amounts of accounting and tax accounting entries (BU and NU) are accounted for separately, although they are maintained on the same chart of accounts, and in principle may differ.

Another fundamental difference in the chart of accounts in 1C 8.2 is that the chart of accounts has a new type of accounting, “Accounting by Division,” which replaced the use of the “Division” subaccount in version 8.1.

Therefore, those accounts that keep records by division (for example, subaccounts of account 20, account 26 and 25) must have the “Accounting by division” attribute turned on.

And in input documents, you should pay attention to the division input, since its input position differs from the usual sub-account input.

Subconto accounts in 1C

The 1C business transaction accounting mechanism can maintain not only quantitative and total account accounting (synthetic accounting), but also analytical accounting for various types of analytics. Analytical accounting objects in 1-C are called subconto.

Subconto accounts are types of analytical measurements for which additional accounting is maintained and for which reports can be obtained. Directories (items, counterparties, cost items, contracts, etc.) are most often used as subaccounts or subaccounts.

), less often - documents (example: materials receipt documents are used to organize batch accounting of goods and materials, when receipt documents participate in the role of a subconto - batch).

In principle, any configuration objects can be used as a subconto, for example, it is possible to use a simple string of text or an enumeration.

For each account or subaccount, a separate subaccount is set. Even several subaccounts of one account can have different subaccounts.

Accordingly, analytical reports of these sub-accounts will be generated using different analytics. Each subaccount has its own settings for quantitative and total accounting.

It is possible to set up a subconto with only quantitative or total measurement.

Separately, it should be noted the sign of the reverse subconto - sign (about). Accounting for the turnover sub-account is carried out only by turnover without calculating the balances for this sub-account. If you create a balance sheet for such a subconto, you can see a slightly strange report: on the lines of the subconto there are debit and credit turnovers, but there is no balance, although the turnovers are not equal to each other.

For some accounts this approach is justified. For example, cost items for subaccounts of the 20th account. Cost items are closed at the end of the month by turnover. If each item is closed individually for each division and product group, then the volume of transactions and the time for calculating the “Month Closing” document will increase significantly.

In the standard configuration of Accounting 1C of a self-supporting organization, the chart of accounts provides no more than three sub-accounts for each account. In budget accounting - no more than five.

A brief or detailed chart of accounts of an accounting account in 1C can be printed using the “Print” button in the upper right corner of the chart of accounts form.

For detailed analytical reports, the “Subconto Analysis” and “Subconto Card” reports are provided.

Off-balance sheet accounts in 1C

In addition to balance sheet accounts, the chart of accounts in 1C uses off-balance sheet accounting accounts. Off-balance sheet accounting is used for auxiliary accounting purposes by the program itself and for maintaining any quantitative and total additional types of user accounting.

For example, work clothes issued to employees are written off as accounting expenses at the time of issue and actually fall out of accounting, but are essentially used by the employee throughout the year. So, on the off-balance sheet account MTs.02 you can track the availability of this workwear.

Off-balance sheet accounts are not required to fulfill the balance condition; they can only be used for debit or only for credit. Receipts and debits from an off-balance sheet account can be carried out using 1C documents, if such an operation is provided, or through manual transactions.

If necessary, you can add any off-balance sheet 1C account and maintain off-balance sheet accounting for your own needs without fear of violating the correctness of accounting in the program.

All standard 1C 8 reports work with off-balance sheet accounts in the same way as with balance sheet accounts. Thus, you can generate any reporting on off-balance sheet accounts using standard 1C tools: on turnovers and transactions, on subaccounts and receive details (transcripts) from report cells.

Important : all accounts of the standard 1C chart of accounts and many sub-accounts are used in the program’s built-in accounting mechanisms, so it is not recommended to delete them or change settings.

A full video lesson on working with the chart of accounts can be downloaded on the trial lessons page.

Off-balance sheet accounting of fixed assets

Fixed assets need to be taken into account off the balance sheet in several cases.

Fixed assets worth up to 40,000 rubles

Perhaps the most common situation for accounting for fixed assets off the balance sheet is accounting for assets worth up to 40,000 rubles.

Let us remind you that fixed assets no more than 40,000 rubles can be written off at a time as expenses in accounting (clause 5 of PBU 6/01). First, such assets are credited to the inventory account (account 10), and then written off to cost accounts (accounts 20, 25, 26, etc.). When writing off low-value fixed assets from the balance sheet, the question arises of control over the safety of property. This is where off-balance sheet accounts come in handy.

The chart of accounts does not provide an off-balance sheet account for recording assets written off the balance sheet. The company has the right to independently introduce a new off-balance sheet account by assigning a code to it (for example, account 015 “Property worth up to 40,000 rubles”). Information about created off-balance sheet accounts should be reflected in the accounting policies of the enterprise.

Example. The company purchased a chair for the director at a cost of 24,780 rubles, including VAT of 3,780 rubles. According to the accounting policy, the company writes off such assets to off-balance sheet account 015. The postings will be as follows:

Debit 10 Credit 60 - 21,000 - chair was capitalized as part of inventories

Debit 19 Credit 60 - 3,780 - VAT allocated

Debit 68 Credit 19 - 3,780 - VAT taken for deduction

Debit 44 Credit 10 - 21,000 - the cost of the chair is included in the costs of the trading company

Debit 015 - 21,000 - the chair is included in the balance sheet

When the chair becomes unusable, it should be written off off-balance sheet with the following posting:

Credit 015 – 21,000

When conducting an inventory, off-balance sheet accounting data should also be taken into account.

Fixed assets under a rental or leasing agreement

Off-balance sheet accounts will be needed by tenants and landlords. Keeping records of rented objects is prescribed by paragraph. 7 clause 32 PBU 6/01. In appendices to the financial statements, the accountant is also required to disclose information about leased fixed assets (clause 27 of PBU 4/99). The absence of off-balance sheet accounting for a significant share of such objects can lead to fines (Article 15.11 of the Code of Administrative Offenses of the Russian Federation, Article 120 of the Tax Code of the Russian Federation).

Tenants rent various objects - from office space to industrial equipment. Based on a rental or leasing agreement, the tenant (lessee) must register the received fixed assets. For this purpose, a special account 001 “Leased fixed assets” is provided. The lessee takes into account the received property on its balance sheet if the agreement stipulates that the property is taken into account on the lessor's balance sheet.

Leased objects are accepted for off-balance sheet accounting at the price specified in the contract. The lack of property value in the lease agreement is not an obstacle to reflecting the property off the balance sheet. Analytical accounting is usually carried out by types of fixed assets and lessors.

When a leased fixed asset is received, the following posting is made:

Debit 001

When disposing of a leased property (returning it to the lessor), you need to make a reverse entry:

Credit 001

Off-balance sheet accounting will confirm the appropriateness of lease payments transferred to the lessor. With reliable off-balance sheet accounting, the lessee will be able to reasonably write off the amount of lease payments as expenses.

Lessors also keep records of fixed assets if, under the terms of the agreement, the property is taken into account on the balance sheet of the tenant (lessee). Account 011 “Fixed assets leased out” is intended for accounting.

About setting up accounts in the 1c program: accounting 8.3

Every commercial company, organization and individual entrepreneur is required to carry out accounting on the basis of the chart of accounts established by the Ministry of Finance of the Russian Federation. It is the basis for building an accounting system for any business entity. In the 1C 8.3 software product, the chart of accounts is a pre-installed application configuration object.

How 1C 8.3 implements the ability to expand the chart of accounts

In the process of work of commercial companies and individual entrepreneurs, there is often a need to expand the standard list and create your own working chart of accounts.

The legislation allows for detailed unified accounts for the convenience of users. In the 1C 8 software product.

3, this right is implemented by the ability to create sub-accounts with additional 3-level analytics of each in the form of a sub-account.

Each subaccount is a second-order account.

Let us give an example of the use of subaccounts in relation to account 01 “Fixed Assets”.

You can organize detailed analytical accounting according to the criterion of the structure of fixed assets, assigning each type of object its own subaccount:

- 01.01 – OS for production purposes;

- 01.02 – other production operating systems;

- 01.03 – non-production objects;

- 01.04 – productive livestock;

- 01.05 – perennial plantings;

- 01.06 – plots of land;

- 01.08 – other household equipment;

- 01.09 – leased operating systems;

- 01.10 – other assets classified as fixed assets;

- 01.11 – retired OS;

- 01.12 – fixed assets with unregistered ownership rights and others.

Subcontos in 1C 8.3 are analytical additional reference books necessary to ensure completeness of accounting. Up to three subaccounts can be applied to each subaccount. For example, the “Raw Materials and Supplies” subaccount allows you to set up accounting by batch, item, and storage location.

When setting up accounts, you need to understand that the own working charts of accounts created by a commercial company have a close connection with the settings and settings of the 1C 8 software product.

3 and affect its functionality.

Therefore, frequent and unsystematic changes to pre-installed application configuration objects can lead to its incorrect operation, for example, in closing periods or generating reliable reports.

Where to find and how to set up accounting accounts in 1C 8.3

In the “Main” section there is a “Chart of Accounts” tab.

Step 1: Basic settings for the working chart of accounts

A table appears on the screen with fields available for filling:

- the first columns are the code and name of each account;

- For accounts, 3 subconto columns are available for filling;

- “Type” of account, where one of three characteristics is indicated – active (A), active-passive (AP) or passive (P);

- in the column titled "Val." it is necessary to put a check mark if accounting is maintained in foreign currency (if accounting is kept only in rubles, then there is no need to make a mark);

- if the account provides for quantitative accounting of objects, then you must tick the “Quantity” field;

- to set up accounting by department, you need to make a mark (check the box) in the “Additional” field;

- marked o indicates the need for the account to participate in the generation of data for tax accounting, which in the 1C 8.3 program is maintained in parallel with accounting;

- mark in the form of a tick in the “Zab.” indicates a sign of an off-balance sheet account;

- the special “Quick Select” field is intended for entering text to help the accountant, if necessary, quickly find the required account.

Step 2: Set up accounts

To configure, you need to go to another window in the “Chart of Accounts” section, selecting the “Plan Settings” tab, and check/uncheck the necessary boxes. Here, the available settings include accounting options:

- the amount of value added tax on purchased goods and materials (if the accounting policy of the enterprise provides for separate accounting of this tax, then in the “By accounting methods” field there should be a checkmark; if not, the checkbox should be unchecked; data can be grouped by counterparties and invoices received - invoices);

- inventories (inventory accounting can be carried out by batches and by warehouse; in warehouse accounting, the program allows you to select accounting parameters only by quantity or by quantity and cost);

- retail goods (the software product provides accounting options for turnover by item items and according to value added tax rates);

- cash flow (if the company does not need to analyze itemized DDS, the corresponding mark can be removed);

- settlements with personnel (users are given the opportunity to choose accounting in the context of data for each employee or in the form of a summary for the entire payroll);

- costs (the option allows you to set up accounting by individual divisions or in the format of an enterprise summary).

After finishing setting up each position, you should use the “Record and close” command.

Off-balance sheet accounting of materials and equipment

In addition to fixed assets and goods, other material assets can be taken into account on the balance sheet.

Inventory in safekeeping

In some cases, buyers cannot account for material assets on balance sheet accounts. In this case, records should be kept.

Invoice 002 is needed if the buyer accepted inventory items for storage when:

- receiving goods and materials from suppliers for which the organization legally refused to accept invoices of payment requests and pay them;

- receiving from suppliers unpaid inventory items that cannot be used under the terms of the contract until they are paid;

- receipt of goods and materials, the ownership of which has not been transferred to the organization, etc.

Note! VAT deduction cannot be claimed while inventory items are taken into account on the balance sheet (letter of the Ministry of Finance of Russia dated August 22, 2016 No. 03-07-11/48963).

Suppliers can also take into account inventory items on account 002 if the goods are paid for, but not removed by the buyer for reasons beyond the control of the organizations.

Provided raw materials

If a company works with customer-supplied raw materials, then account 003 “Materials accepted for processing” is used for accounting. Most often, they work with customer-supplied raw materials during the construction of facilities. In this case, the customer’s building materials are used to complete the work. Also, customer-supplied raw materials are used in the production of products for the customer. While the manufacturing process is underway, customer-supplied materials are accounted for in account 003.

Reception of customer-supplied raw materials is reflected in the debit of account 003, disposal (return of remaining raw materials or manufactured products) is reflected in the credit of account 003. Analytical accounting in account 003 is carried out by customers, types, grades of raw materials and materials and their locations.

Installation equipment

When installing equipment owned by the customer, contractors keep records of the equipment in account 005 “Equipment accepted for installation.”

Acceptance of equipment for installation is reflected in the debit of account 005; write-off of equipment from accounting after installation and delivery of it to the customer is reflected in the credit of account 005. Analytical accounting is carried out for customers, objects, and components of the equipment being installed.

Recording property in off-balance sheet accounts will help control its safety. Also, such accounting will increase the vigilance of financially responsible persons and help the company avoid fines.

Why are off-balance sheet accounts needed?

Off-balance sheet accounts are provided for by the chart of accounts approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n. There are 11 such accounts in total. They are created to control certain business transactions, assets that are not owned by the organization, as well as contingent rights and obligations. The information on such accounts does not determine the financial position of the company, since it is not data for the balance sheet.

Double entry rules do not apply to such accounts. To reflect the movement on them, a simple entry is made: either by debit for inflows, or by credit for outflows. Let's look at a simple entry using an example.

Example

Kaleidoscope LLC purchased raw materials in the amount of 277,300 rubles. (incl. VAT 18% - RUB 42,300) November 1, 2021. Upon receipt, the warehouse manager discovered that the goods were worth 11,328 rubles. (incl. VAT 18% - 1,728 rubles) came with a defect. According to the contract, the buyer has the right not to accept defective goods, and the supplier is obliged to remove them from the buyer’s warehouse within 3 days. The parties drew up a statement of discrepancies upon acceptance of the goods. The supplier delivered the goods within the stipulated time frame. The following entries were reflected in the accounting of Kaleidoscope LLC.

November 1, 2021:

Dt 10 Kt 60 - 225,400 rubles, high-quality raw materials have been capitalized;

Dt 19 Kt 60 - 40,572 rubles, input VAT is reflected;

Dt 76 subaccount “Calculations for claims” Kt 60 - 11,328 rubles, a claim was submitted to the supplier;

D 002 - 11,328 rubles, defective raw materials remaining in the warehouse of Kaleidoscope LLC are reflected off the balance sheet.

November 4, 2021:

K 002 - 11,328 rubles, defective raw materials were removed by the supplier from the warehouse of Kaleidoscope LLC.

Chart of accounts 1C

chart of accounts is built on the principle of the chart of accounts approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n.

After reading the article you will learn:

- how the chart of accounts is presented in 1C;

- about basic settings for accounts;

- Is it worth adding new accounting accounts to the Chart of Accounts ?

The chart of accounts in 1C is valid for all organizations and allows you to maintain accounting, tax and off-balance sheet accounting. It is located in the Main - Settings - Chart of Accounts section.

The chart of accounts is presented in the form of a table of accounts, subaccounts and their characteristics.

By default, accounting accounts (if they are not off-balance sheet accounts) are used to maintain accounting records. For this purpose, both debit and credit must be filled in in the postings: 1C monitors double entry control.

NU in 1C is maintained on BU accounts. For such accounts, the Tax (income tax) , column NU .

Read more about organizing NU in 1C

For off-balance sheet accounting, separate accounts with the Off-Balance Sheet (Ob.)

Unlike accounting, when reflecting transactions for off-balance sheet or tax accounting, only debit or only credit can be filled in.

In 1C there is an auxiliary account that is not used in the regular chart of accounts - 000. It is used to enter initial balances. After all balances have been entered, the amount for this account should be zero.

Account code

The account code has a three-level system and is indicated in the format : ХХХ.ХХ.Х.

For example:

Not all accounts are used in transactions. For hierarchical accounts, for example, 10, 41, etc., you need to use the accounts of the last levels, for example: 10.01, 10.11.1, 41.01.

In the account card for hierarchical accounts, the Account is a group checkbox is selected and cannot be selected in transactions .

For convenience, hierarchical accounts are highlighted in the accounts table.

Analytical accounting

Analytical accounting in 1C is organized using Subconto. You can set no more than 3 types of analytics for each account.

Account type

All accounts in 1C, as in the regular chart of accounts, are divided into active (A), passive (P) and active-passive accounts (AP). The account type is displayed in the Type .

For active accounts, income is reflected as a debit, expenses - as a credit. If the balance is reflected on the loan, it will be an error.

For passive accounts, the opposite is true: we receive credit, we spend debit, and the error will be the final debit balance.

Active-passive accounts can have a balance of both debit and credit.

Currency accounting

Currency accounting involves accounting for settlements both in rubles and in foreign currency.

Find out more How to capitalize imported goods

Total and quantitative accounting

By default, total accounting is kept for accounts, but for some accounts it is necessary to see not only the amount, but also the quantity, for example, for inventory accounts.

Quantitative accounting (column Kol. ) is determined in the account card and allows you to keep records in physical terms for all Subcontos . Total accounting, in contrast to quantitative accounting, is determined separately for each sub-account.

Accounting by department

Accounting for the detailing of costs by department (column Subdiv. ) is established by setting up the chart of accounts and is effective immediately for all costs.

Printing the Chart of Accounts

1C has flexible settings for printing the Chart of Accounts . You can print it:

- Click the Print in the form of: a simple list in the form of a predefined table of accounts;

- list with descriptions of accounts;

- Click the More button - Display a list in the form of: a list of all or only selected accounts with the additional option of choosing to print certain columns of the Chart of Accounts .

Account in 1C

Is it possible to add new accounts (subaccounts) to Chart of Accounts ?

Yes, you can make adjustments the Chart of Accounts Create . However, BukhExpert8 advises to treat the possibility of adding new accounts with caution, as this may cause accounting errors.

It happens that developers add new accounts to the standard Chart of Accounts with the code that the user used. This can lead, at a minimum, to double billing when updating the 1C program. At most, it leads to data loss.

It is safest to add off-balance sheet accounts to the Chart of Accounts .

How to analyze account data in 1C?

For the analysis of accounting, accounting and off-balance sheet accounting, various reports are provided that allow you to analyze data from all sides. You can find them in the Reports – Standard reports section.

See also:

If you are a subscriber to the BukhExpert8 system, then read additional material on the topic:

If you haven't subscribed yet:

Activate demo access for free →

or

Subscribe to Rubricator →

After subscribing, you will have access to all materials on 1C Accounting, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Features of accounting for material assets in off-balance sheet accounts

For inventory items reflected on the balance sheet, the chart of accounts provides the following accounts:

- 002 - “Inventory and materials accepted for safekeeping”;

- 003 - “Materials accepted for processing”;

- 004 - “Goods accepted for commission.”

In the first example, we have already considered the option of using account 002. In addition to reflecting unaccepted goods on it, you can also use it to show goods for which, for some reason, ownership has not been transferred (for example, the condition for the transfer of rights is payment, it has not yet been made , but delivery to the buyer’s warehouse has already occurred). The concept of “responsible storage” is specified in Art. 514 Civil Code of the Russian Federation. An important condition for responsible storage is that the buyer must monitor the safety of the received valuables. This is why off-balance sheet accounting is needed; it allows you to control the availability and transfer to the supplier of inventory items not accepted on the balance sheet.

Transactions on toll processing are also common. In such interactions, the customer gives the processor his raw materials and pays for services for their processing into a finished product or semi-finished product. After the work has been completed, the processed raw materials are returned by the processor back to the customer. In this case, it is also important to monitor the safety and movement of customer-supplied raw materials. This problem is solved using account 003. Let's consider a similar situation using an example.

Example

Pomoschnik LLC received from Fermer LLC customer-supplied raw materials in the form of beef half-carcasses in the amount of RUB 2,560,000. for processing into semi-finished meat products. The cost of work by Pomoschnik LLC amounted to 531,000 rubles. (incl. VAT 18% - RUB 81,000).

During production, our own materials were used to package goods in the amount of 54,000 rubles, workers' salaries amounted to 216,000 rubles, insurance premiums - 65,232 rubles, the amount of depreciation of machines was equal to 13,000 rubles.

Pomoschnik LLC reflected the following entries in its accounting:

D 003 - 2,560,000 rubles, raw materials accepted for processing;

Dt 20 Kt 10 - 54,000 rubles, the cost of own packaging material is written off;

Dt 20 Kt 70 - 216,000 rubles, staff salaries are reflected;

Dt 20 Kt 69 - 65,232 rubles, insurance contributions for staff salaries are reflected;

Dt 20 Kt 02 - 13,000 rubles, depreciation is reflected;

Dt 62 Kt 90.1 - 531,000 rubles, revenue from processing services is shown;

Dt 90.3 Kt 68 - RUB 81,000, VAT charged on revenue;

Dt 90.2 Kt 20 - 348,232 rubles, the cost of services is written off;

Dt 90.9 Kt 99 - 101,768 rubles, the financial result of the transaction has been determined;

Kt 003 - 2,560,000 rubles, the cost of processed raw materials is written off.

Read more about accounting for transactions with raw materials supplied by customers in the article “Transactions with raw materials supplied by customers in accounting.”

For commission agents selling non-own goods, account 004 is provided. It is used according to a similar scheme. When the commission agent receives goods from the principal for their sale, entry Dt 004 is made; when these goods are shipped to the buyer, they are recorded in accounting in Kt 004 at the prices indicated in the acceptance certificates.

We also note the importance of organizing analytical accounting for the considered off-balance sheet accounts. Analytics is carried out by types of inventory items, by counterparties (suppliers, vendors, consignors), and storage locations.

Off-balance sheet accounting is provided to control the availability and safety of material assets that do not belong to the organization, but for which it is responsible to third parties. Entries on such accounts are made according to a simple scheme.

For information on how materials that are the property of an organization are accounted for, read the article “Accounting entries for accounting for materials.”

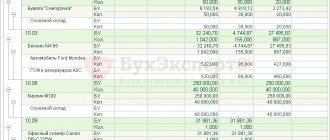

Chart of accounts 1C 8.3 (Accounting 3.0)

The computer program 1C Accounting 8.3 is used for accounting. It implements a standard general chart of accounts for accounting, which was approved by the Ministry of Finance of the Russian Federation (Order No. 94n dated October 31, 2000). But its use in the program has its own characteristics. Let's look at them in this article.

The chart of accounts is available in 1C 8.3, located in the “Main” section (subsection “Settings”). The accounts are arranged in the form of a table, which displays the code, name, characteristics of each account, and sections of analytical accounting:

Subaccounts and account characteristics

Many accounts have subaccounts subordinate to them. Thus, account 01 (Fixed assets) is subordinated to the following subaccounts: 01.01 (fixed assets in the organization), 01.03 (Leased property) and others. If an account has subaccounts, then it cannot be used in transactions in the program; only subaccounts subordinate to it can be used. If an account does not have subaccounts, then it is used in postings.

Accounts may have the following characteristics:

- View . The account can be active (A), passive (P) or active-passive (AP).

- Currency accounting (Val.) The attribute is set for accounts on which funds in foreign currency are recorded.

- Quantitative accounting (Qty.) The attribute is established for such accounts on which, in addition to total accounting, quantitative accounting is maintained. For example, account 10 (Materials), account 41 (Goods) and others. Standard accounting reports for these accounts display the amount and quantity.

- Accounting by divisions (Sub.) If this checkbox is checked, account postings are made by division.

- Sign of tax accounting for income tax (IT). Used when the organization applies PBU 18/02. If this attribute is set, account transactions are reflected not only in accounting, but also in tax accounting.

- Sign of off-balance sheet accounting (Zab.). Established for off-balance sheet accounts, such as “Leased fixed assets”, “Inventory and materials accepted for safekeeping” and others. Account 001, used for entering initial balances, is also off-balance sheet.

Get 267 video lessons on 1C for free:

Subconto - analytical accounting

For analytical accounting of accounts, the so-called subcontos are used. Directories or documents act as subcontos. An account can have no more than three subaccounts. For example, account 01.01 has one sub-account - the directory “Fixed Assets”, all movements on this account are made in the context of fixed assets, accounting reports are also generated for fixed assets.

Setting up a chart of accounts in 1C

You can add a subaccount to the chart of accounts 1C 8.3 from the account card. However, please note that in 1C you cannot add additional subaccounts to all accounts. And the correctness of filling in documents must be additionally monitored.

In version 3.0.43.162, the program added the “Chart of Accounts Setup” tool (available from the “Chart of Accounts”). Here you can select analytics parameters for accounting for VAT, inventories, retail goods, cash flow, settlements with personnel, costs:

To configure, you need to click the appropriate link. For example, the image shows that inventory is currently accounted for only by item. If you also need to keep records of batches (receipt documents) and/or warehouses, you should click the link and specify the necessary parameters in the window that opens:

At the same time, the subaccounts “Parties” and “Warehouses” will be added to the corresponding accounts in 1C 8.3:

In earlier versions of the program, setting up analytical accounting is available through the “Accounting Parameters” form (section “Main”, subsection “Settings”).

Predefined accounts

By default, the program has already filled in the chart of accounts; all accounts in it are predefined (i.e., installed during configuration). This is displayed on the icons of the accounts - next to the “airplane” there is a “circle”. Predefined accounts cannot be changed (except for adding subaccounts). The user has the ability to create new accounts.

It is recommended that only an experienced specialist handle creating new accounts or adding subaccounts.

Account settings

In order for accounting accounts to be filled in documents automatically, by default the program has settings for some accounting sections - for example, item accounting accounts, accounts for settlements with counterparties, etc. You can view or change them directly from the Chart of Accounts:

Other accounting account settings are available by clicking the “More” button.

Additional Information. The “Account Description” button is used to view information about this account. By clicking the “Transaction Journal” button, you can view transactions for the selected account:

Unfortunately, we are physically unable to provide free consultations to everyone, but our team will be happy to provide services for the implementation and maintenance of 1C. You can find out more about our services on the 1C Services page or just call +7 (499) 350 29 00. We work in Moscow and the region.

Off-balance account

An off-balance sheet account is an account designed to summarize information about the presence and movement of values that do not belong to a business entity, but are temporarily in its use or disposal, as well as to control individual business transactions. The concept of “off-balance sheet account” is also synonymous. The latter is most often used in relation to credit institutions.

Off-balance sheet accounts include:

- reserve funds of notes and coins

- borrowers' obligations

- payment documents submitted to the bank for collection (to receive payments)

- valuables accepted for storage

- strict reporting forms, check and receipt books, letters of credit for payment, etc.

Accounting for these values is carried out using a simple system and is not taken into account when drawing up the balance sheet. Off-balance sheet accounts do not correspond with balance sheet accounts. In accounting theory, off-balance sheet accounts also do not correspond with each other, however, in modern accounting programs it is generally accepted that off-balance sheet accounts can correspond with each other.

Organizations in the Russian Federation (except for credit or budget organizations) use the following off-balance sheet accounts in accordance with the Chart of Accounts for accounting the financial and economic activities of organizations:

- Account 001 “Leased fixed assets”

- Account 002 “Inventory assets accepted for safekeeping”

- Account 003 “Materials accepted for processing”

- Account 004 “Goods accepted for commission”

- Account 005 “Equipment accepted for installation”

- Account 006 “Strict reporting forms”

- Account 007 “Debt of insolvent debtors written off at a loss”

- Account 008 “Securities for obligations and payments received”

- Account 009 “Securities for obligations and payments issued”

- Account 010 “Depreciation of fixed assets”

- Account 011 “Fixed assets leased out”

An organization can supplement the list of these accounts and apply them in accounting if it describes their characteristics in its accounting policies.

> See also

- Balance account