Source: Magazine “Institutions of Culture and Art: Accounting and Taxation”

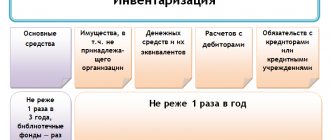

One of the internal control measures is to carry out an inventory of property and settlements in an institution, thanks to which the actual availability of property is revealed, it is compared with accounting data, and the completeness of the reflection of settlements and obligations in accounting is checked. In this article, we will consider what documents are used to prepare an inventory, the procedure for filling them out and correcting errors, as well as the procedure for reflecting the results identified during the inventory in accounting.

Why is an inventory needed?

The work process is impossible without the use of property assets.

Even if the institution is small or has only one employee, inventory items will definitely be used during work - furniture, computers and components, office supplies. An audit of valuables located in the work area may be needed for various purposes:

- to check the availability and condition of the property used;

- as part of the inventory, which is carried out throughout the institution;

- when selling specific assets from the office under a purchase and sale agreement.

As a result of the inspection, a special document is drawn up - an inventory of the property in the office. Inventory includes the procedure for analyzing the inventory of property in a specific premises.

The inventory compiled based on the results of the inspection is an act that includes information about the availability and current operational condition of the assets used in the office.

When conducting an audit, responsible employees appointed by order include in a special act data on all items and their quantity in the office. Computers, furniture, and household appliances are reflected.

How is an inventory carried out?

As part of the inventory, the enterprise is faced with the need to carry out a number of sequential actions:

- Determination of the composition of the inventory commission (minimum 2 people). The list of members must be certified by order (resolution, order) of the head. Preference is given to managers, employees who prepare payroll, that is, accountants, lawyers, engineers and other employees. Financially responsible persons are not included in the commission, but their presence at the inventory is required.

- Collection of the latest incoming and outgoing documents . The papers are certified by the chairman of the commission. Based on them, the accounting department determines the balance of financial assets at the beginning of the audit.

- Receiving receipts from financially responsible persons . To be completed before the inspection begins. It is a kind of guarantee that all financially responsible employees have prepared and submitted statements of expenses and income to the accounting department, or have transferred all available assets to the commission.

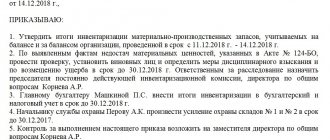

- Checking and documenting the presence, condition and valuation of property . The commission checks the quantity of real goods, compliance with quality standards, shelf life and storage. The results are recorded on an INV-3 format form (inventory of the actual availability of material values). The inventory list must be filled out in two copies: one form for the accounting department, the second for the financially responsible person.

- Reconciliation of the actual result of the inspection with accounting data . All surpluses and shortages are documented by the accountant in a reconciliation sheet, where discrepancies identified during the inventory are recorded. It is compiled in relation to those assets for which the actual data differs from the accounting data.

- Summing up, approving and reflecting them in reports . The commission transfers to the head the INV-3 inventory for accounting for assets identified by the audit, as well as a protocol with data on the meeting.

See also: Best books for sales managers

Which form to use

The formal form of the updating document is not unified and is not fixed by current legislation. Therefore, each organization has the right to develop and use its own form, which can include information in accordance with the organizational needs and industry specifics of each specific enterprise. The main thing is to consolidate the form of the act in the accounting policies and other local regulations of the institution.

It is also possible to use a unified form that is used for inventory of fixed assets - the second page of the INV-1 form. When choosing this form, remember that the last two columns must be filled out by an accounting employee. These columns indicate the number and value of assets according to accounting.

The simplest option to process audit information is an inventory in the form of a table that lists property assets, their quantity and technical condition.

Documentation of inventory

To complete the inventory, inventory inventory forms approved by Order of the Ministry of Finance of the Russian Federation dated December 15, 2010 No. 173n .

Depending on the object of accounting, the following forms are used: 1) inventory inventory of securities (form 0504081). When filling it out, indicate the name of the security and its issuer, as well as the series and number; the par value of a unit of a security, the code of the currency in which the security is denominated, the exchange rate of the Central Bank of the Russian Federation on the date of the inventory; the number of securities owned by the institution; the nominal value of the existing package of securities in foreign currency (in ruble equivalent, calculated at the rate specified in the inventory), in rubles; initial cost of securities in rubles;

2) inventory list of balances on cash accounts (f. 0504082). The form contains the following information: name of the credit institution, account number in it, currency code according to OKV, cash balance as of the inventory date in foreign currency, exchange rate of the Central Bank of the Russian Federation as of the inventory date and account balance as of the inventory date in rubles. In addition, it must contain a record of confirmation by the beginning of the inventory of data on the availability of funds with bank statements;

3) inventory list of debt on credits, borrowings (loans) (f. 0504083). This form is filled out by type of debt by borrower and loan agreement according to the corresponding accounting account numbers. The inventory provides information on the amount of debt in rubles and in foreign currency: on the principal debt, on accrued and unpaid interest, on penalties for misuse of funds, on fines (penalties) for late repayment and non-payment of interest, as well as the amount of debt confirmed debtors; amount of debt not confirmed by debtors; amount of overdue debt (with an expired statute of limitations);

4) inventory list (matching sheet) of strict reporting forms and monetary documents (f. 0504086). This inventory is compiled by type of document and financially responsible person, indicating the location of the inventory, with a receipt from the financially responsible person. When completing it, the following is indicated: name and codes of strict reporting forms; unit of measurement; information about actual availability (price, quantity); information according to accounting data (quantity, amount); information on inventory results (for shortages and surpluses - quantity and amount);

5) inventory list (matching sheet) for objects of non-financial assets (form 0504087). This form is drawn up for financially responsible persons, indicating the location of the inventory and with a receipt from the financially responsible person. It indicates the name and code of the accounting object; inventory number; unit of measurement; information about the actual availability of the accounting object (price, quantity); information according to accounting data (quantity, amount); information on inventory results (for shortages and surpluses - quantity and amount);

6) inventory list of cash (f. 0504088). This form indicates information about the availability of funds in the institution’s cash desk actually and according to accounting data (in numbers and in words); information on shortages and surpluses identified as a result of the inventory; numbers of the latest incoming and outgoing cash orders;

7) inventory list of settlements with buyers, suppliers and other debtors and creditors (f. 0505089). The inventory provides information on receivables (payables); name of the debtor (creditor), in the case of reflecting settlements for mandatory payments to the budgets of the budget system of the Russian Federation, data on the amount of the institution's debt for payments (overpayments for payments to budgets) are reflected by type of payment in the context of the corresponding budgets of the budget system of the Russian Federation to which the debt is subject to transfer; accounting account number; the total amount of debt according to accounting data, including those confirmed by debtors (creditors), not confirmed by debtors (creditors), as well as the amount of debt with an expired statute of limitations;

9) inventory list of payments for receipts (f. 0504091). The inventory reflects information based on accounting data, the accounting account number, the total amount of the payer’s debt (“total”), including those confirmed by the debtor, not confirmed by the debtor, as well as the amount of debt with an expired statute of limitations.

Separate inventories are drawn up for property held in custody, rented or received for processing.

A separate inventory is also compiled for fixed assets that are not suitable for use and cannot be restored, indicating the time of commissioning and the reasons that led these objects to be unusable (damage, complete wear and tear, etc.).

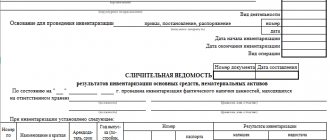

Discrepancies identified during the inventory with accounting data for each accounting object in quantitative and monetary terms are entered in the statement of discrepancies based on the inventory results (f. 0504092).

Based on this statement, a report on the results of the inventory is left (f. 0504835).

How to compose correctly

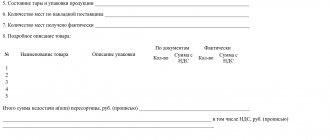

The property inventory is formed in compliance with a number of rules:

- We indicate the title of the document and the name of the audit object - office, office or office space.

- Enter the inspection date.

- We write down the number of the object (office or room). If necessary, you can reflect the address of the office building.

- We compose the tabular part. It is recommended to add columns: serial number, name of the item, its characteristics, record of the current condition in the following form: excellent, good, satisfactory, unsatisfactory.

- If necessary, at the end of the table we reflect important additions about the procedure and objects.

You can use this sample office inventory.

| No. | Property name | Quantity | Condition of the property |

| 1 | Blackboard | 1 | good |

| 2 | Blinds | 4 | good |

| 3 | TSO stand | 1 | good |

| 4 | Book shelf | 5 | good |

| 5 | Table 1-pedestal | 1 | good |

The authenticity of the information must be confirmed by the signatures of the responsible persons. The act is signed by the employee who conducted the audit and drew up the document, the employee who directly works on the premises. At the end, the date and visa of the property owner are indicated.

When drawing up the act, one more rule must be taken into account: for transparency, the inspection must be carried out in the presence of an employee working in this office, or another employee in the absence of the owner at the workplace.

Let's sum it up

Taking an inventory of commodity assets is a long and monotonous work, during which even an attentive worker can make mistakes and miscalculate. To reduce the risk of inaccuracies, firms allow control checks on the authenticity of inventory. For this purpose, an independent employee is elected, for example a chief accountant, who double-checks the availability of valuables in the warehouse. In the case of a control audit, the full name of the specialist, the date of inspection and signature are placed at the bottom of the second sheet of the form.

Correct execution of documents accompanying the audit (whether it is an inventory or a cash register inventory report) is a guarantee of accurate results following the audit. Additional control, the presence of financially responsible persons, reconciliation with accounting data - all this allows the company to make a real assessment of material assets, make sure that they are stored correctly, identify assets that need to be written off, and thereby “unload” the warehouse.

Where to store

Each institution determines the rules for storing audit forms independently, in accordance with the procedure and nomenclature in force in the organization.

Documentation on the inventory of movable property and goods and materials is stored in the organization for five years, and documents and inventories of assets and liabilities must be stored in the institution indefinitely (Article 427 of the List from Order of the Ministry of Culture No. 558 of 08/25/2010, part 1 of Article 29 402 - Federal Law dated December 6, 2011). The period is counted starting from January 1 of the year following the inspection and compilation of registers.

Sample of filling out form 0504087 in 2021

This form of inventory list is formed based on the results of the inventory of materially responsible persons of the organization for compliance of the actual availability and declared characteristics of fixed assets with accounting data.

Another innovation is the appearance on page 2 of the inventory list of columns 8 “Status of the accounting object” and 9 “Target function of the asset”.

Step 4. The results of such recalculation are documented in an act drawn up by the commission in form No. INV-15, approved. Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88. The act is printed in two copies, all members of the commission and the MOL put their signatures on them.

Column 5 reflects the price (estimated value) of the inventory item. In order to fill out this column, it is clarified that if an inventory of material assets intended for sale is carried out, then the price of the product or product is indicated; if a surplus is identified, the estimated value of the object is indicated.

Step 4. The results of such recalculation are documented in an act drawn up by the commission in form No. INV-15, approved. Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88. The act is printed in two copies, all members of the commission and the MOL put their signatures on them.

At the end of 2021 Microenterprise has a statutory capital of 1,000 thousand. UAH and Resolution (not yet registered in the EDR) about additional deposit - 500 thousand. UAH Z cich 500 thousand. UAH actually paid 430 thousand UAH, not paid 70 thousand. UAH

Inventory form 2021 in a budgetary institution changes

Financial obligations include:

- accounts payable, accounts receivable;

- credits, loans;

- reserves

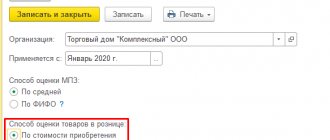

I hope that the material in this article will be useful to you and you will be able to use this information in your future work in the 1C: BGU rev.1.0 program.

Reflect the actual presence of backlogs (parts, assemblies, assemblies) and unfinished production and assembly of products that were in production. Inventory materials that have not been processed are reflected in standard form No. M-21 (No. Inv.-3).

Responsible persons can be both persons responsible for the safety of property and persons with full financial responsibility.