Have you ever encountered a situation where the “Demand-invoice” document is not posted or transactions are generated with a zero amount? Let's simulate a typical situation that an accountant may encounter - and step by step we will analyze the possible causes of the error.

- Error 1: lack of materials in the warehouse and invoice time

- Error 2: difference in receipts and write-offs

- Error 3: duplicate items

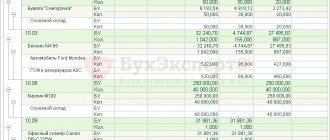

Let’s create a “Request-invoice” document and indicate in the “Materials” tabular section:

- Cocoa powder, quantity 1000, account 10.01

- Whole milk, quantity 200, accounting account 10.01

- Sugar, quantity 500, accounting account 10.01.

How to simplify warehouse accounting?

Any business organization has to write off goods in the warehouse from time to time.

This may be preceded by various reasons: damage to goods, loss of their consumer qualities, obsolescence, as well as lack of demand for it in the market. All goods must be accounted for, and their movement is carried out in accordance with regulations. The primary documentation reflects the receipt of goods and materials, their movement and release, which has a quantitative and cost expression. All primary documents are drawn up in accordance with the requirements of the Regulations on Accounting and Reporting of the Russian Federation containing mandatory or additional details.

Cloud automation system for warehouse accounting. Increase work efficiency, reduce losses and increase profits! Try for free {amp}gt;{amp}gt;

The correctness of the receipt and write-off of goods, as well as the preparation of reports, must be monitored by an accountant. The goods should not leave the warehouse without paperwork. All reports of materially responsible persons on the movement of goods are stored for 3 years.

To take into account identified deficiencies in tax accounting, there is a provision of the Tax Code. To reflect shortages that do not exceed the norms of natural loss, there is clause 2, clause 7, article 254 of the Tax Code of the Russian Federation. This provision does not apply to shortages or damage during transportation and storage of goods. When collecting shortfalls from guilty persons, clause 3 of Article 250 of the Tax Code of the Russian Federation is provided.

- inventory list

- certificate confirming the shortage

- commission conclusion

- explanatory letter.

If these documents are available, the amount of the shortage is taken into account in full as part of the organization’s expenses. As the main production department, the warehouse influences the operation of the entire company, as well as its competitiveness. To improve customer service, it is necessary to automate it.

Warehouse automation reduces time and labor costs for order picking, improves quality (eliminates mis-grading and incomplete picking), allows for the best use of warehouse space, organizes and optimizes the work of warehouse workers, the movement of goods and document flow, and ensures transparency and controllability of supply chains.

A set of warehouse management system tools will allow you to make the right decisions and make the most efficient use of company resources.

Business automation software Class365 is an indispensable assistant in working with warehouse operations. The online solution allows you to work anywhere, from any device with Internet access, without being tied to a work computer.

Features of Class365 for warehouse accounting:

- acceptance, write-off, inventory, revaluation of goods 2 times faster

- automatic issuance of accounting and accompanying documents, invoices, orders

- 1-click reports, analysis of illiquid goods

- control of an unlimited number of warehouses

- batch accounting

- address storage of goods

- control of product shelf life

Thus, working with the warehouse can be much faster and easier. To do this, you just need to register in the Class365 online program and receive a link to log into your account.

Absolutely free of charge, you will be provided with functionality for automating warehouse operations, financial and trade accounting, working with clients (built-in CRM module) and an online store.

You can control your entire business in ONE program!

Features of the procedure

The company's values are the following:

- Raw materials.

- Finished goods.

- Unfinished products.

Write-off involves the official deregistration of objects. The procedure is carried out in the presence of these circumstances:

- Launch of raw materials into production.

- Defects.

- Loss of quality due to unforeseen circumstances (for example, flood, fire, hurricane).

- The service life has expired.

- Obsolescence of equipment.

- Depreciation of assets.

The detection of such circumstances is usually the responsibility of asset managers. Write-off is carried out when keeping valuables on the register is no longer profitable. Sometimes the presence of valuables can lead to losses for the company. Therefore, write-off is a procedure that can be profitable. In addition, it is needed to prevent abuse by employees working with valuables.

It is not possible to simply write off assets. This is a procedure that is strictly regulated by law. In particular, the manager needs to form a commission specifically responsible for write-offs. It is formed on the basis of the order of the manager. The commission usually includes specialists from different departments: the chief accountant, financially responsible employees.

Material write-off act: right or obligation

In accordance with paragraph 1 of Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”: “Every fact of economic life is subject to registration as a primary accounting document.” The act of writing off materials is such a primary accounting document and is used to confirm the fact of consumption of material reserves.

Current questions: is it possible to write off materials (for example, office supplies) for current and other needs, without a write-off act, and whether the formation of a write-off act is the right or obligation of a business entity.

From the literal interpretation of the guidelines for accounting of inventories (MPI), approved. By order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, it follows that an act must be drawn up if the document for the release of materials from the warehouse does not indicate the purpose of the write-off (clause 98 of the Methodological Instructions).

At the same time, materials from inspections of the activities of organizations confirm that the formation of an act is mandatory. As an example, we can cite the materials posted on the official information portal of the Municipal District (Head’s Report for 2015).

Let us add that the act of writing off materials is also documentary evidence of expenses for profit tax purposes (clauses 1, 2 of Article 272 of the Tax Code of the Russian Federation).

According to the Methodological Instructions, the specific procedure for drawing up a materials consumption report is established by the organization. The expense report indicates the name, quantity, accounting price and amount for each name of actually consumed materials, the name of the product for the manufacture of which they were used, or the name of the costs. In practice, some business entities draw up a document on the write-off of materials once a month.

The 1C:Accounting 8 program implements a more careful approach - drawing up an act for each fact of writing off materials.

We invite you to familiarize yourself with: Voluntary payment of alimony with or without agreement

The fact is that specialists from regulatory agencies do not always agree with monthly frequency, and companies often have to defend the legality of this approach in court. Despite the existence of positive judicial practice (see, for example, Resolution of the Federal Antimonopoly Service of the Moscow District dated September 13, 2004 No. KA-A40/8081-04), sometimes it is better to use an approach that avoids litigation.

In case of shortage of goods

Shortages that arise for various reasons: due to theft, abuse of materially responsible persons, accounting errors, natural loss, misgrading and other factors are identified as a result of an inventory, which allows you to control the safety of property and the efficient use of resources.

An example of writing off goods in the Class365 system

To carry out this procedure, a materials write-off act is filled out. This specific document transfers the materials used to the category of unused materials. The text block should decipher the reason for drawing up the act, which indicates the name, units of measurement, quantity, price and the immediate reason why the goods are transferred to another category. Documents based on the results of the inventory must be signed by all members of the commission and approved by the head.

Write-off of balances from the warehouse is carried out using the “cost of each unit” method, that is, it must be written off at the cost at which it was purchased. Some entrepreneurs establish a method suitable for their accounting policies. When closing or reprofiling a trading organization, unsold balances are also subject to write-off.

The cost of warehouse balances is calculated using three methods:

- on average - used in synthetic accounting and when maintaining inventory records manually;

- batch - used in analytics, is more complete and accurate, includes FIFO, LIFO, manual and combined accounting methods;

- at fixed prices – used for retail trade.

Examples of malfunctions of various equipment

The list of typical reasons for writing off computer equipment for this article was provided by Profit LLC.

Profit LLC has been operating in St. Petersburg and Leningrad Region since 2005. The cost of work to assess the technical condition of fixed assets with the issuance of a write-off act starts from 250 rubles. for one piece of equipment.

Work with Customers under decommissioning and disposal agreements is carried out by the head of the technical department, Shorin Roman Viktorovich - tel. +7 (921) 352-88-88, E-mail

If you have any questions, you can ask them in the comments to this article, we will definitely answer them.

Computer malfunctions for write-off

- motherboard failure,

- significant corrosion of printed tracks,

- mechanical damage to elements,

- hard drive is faulty

- the controller has failed,

- there are unreadable sectors on the surface,

- the video card is faulty,

- processor does not start,

- the power supply does not start,

- the pulse transformer has failed,

- Computer repair is not advisable due to the incompatibility of computer components with modern software.

Printer faults for write-off

- the power supply is faulty,

- the power transformer has failed,

- control board is faulty,

- the carriage drive belt is torn,

- broken carriage cable,

- failure of the printer print head,

- formatter board malfunction,

- The motor of the cartridge carriage drive unit is faulty.

Monitor faults for write-off

- loss of kinescope emission,

- The switching power supply has failed,

- the tracks on the printed circuit board are burnt out,

- oxidation of contact groups,

- line scan unit is faulty,

- electrical breakdown of a line transformer,

- matrix is faulty,

- failure of the inverter module,

- malfunction of backlight lamps,

- there are dead pixels,

- control board is faulty,

- the power supply starts up.

Laptop faults for write-off

- microcrack on the motherboard,

- the controller power circuit is faulty,

- hard drive malfunction,

- the controller has failed,

- there are unreadable sectors on the surface of the hard drive,

- the power supply burned out,

- the pulse transformer has failed,

- mechanical damage to the power connector, keyboard keys,

- matrix damage,

- burnout of the inverter board,

- the inverter is faulty,

- short circuit of the pulse transformer.

Reasons for writing off an electric kettle

- the heating element has failed (broken circuits of the spiral),

- the seal of the housing is broken,

- Thermocouple and switch malfunction.

UPS faults for write-off

- the inverter is faulty,

- breakdown of power transistors,

- failure of the pulse converter,

- control board is faulty,

- interturn short circuit in a transformer.

TV malfunctions for write-off

- interturn short circuit in a line transformer,

- the frame scanning unit is faulty,

- broken filament of the kinescope,

- line scan unit is faulty,

- electrical breakdown of a line transformer,

- switch board is faulty

- interturn short circuit of the transformer in the power supply,

- failure of the backlight lamp,

- processor board defect,

- oxidation of matrix control cable connectors.

Refrigerator faults for write-off

- the compressor has failed,

- the engine is faulty,

- The radiator seal is broken,

- door seals have dried out,

- damage to freon pipes.

Air conditioner faults for write-off

- the control unit has failed,

- The power controller does not start,

- the pump motor is faulty,

- the tightness of the supply pipes is broken,

- broken freon line circuits,

- damage to heat exchanger radiators.

Scanner faults for write-off

- the control board is faulty,

- the control controller is faulty,

- the carriage drive gearbox is faulty,

- wear of gear teeth and shaft seats,

- The scanning element is faulty.

Reasons for writing off a vacuum cleaner

- the engine failed,

- the tightness of the hoses is broken,

- brush wear,

- damage to the housing and rollers.

Reasons for decommissioning drills and screwdrivers

- the engine failed,

- rotor coil breakage,

- gearbox is faulty

- gears and drive shafts are worn out,

- mechanical damage to the clamping mechanism.

Reasons for decommissioning a water heater

- the heating element has failed,

- open circuit of the heating element,

- the control unit is faulty,

- The seal of the housing is broken.

Reasons for decommissioning a heater

- the heating element has failed,

- The radiator seal is broken.

Cell phone malfunctions for write-off

- The radio channel unit has failed,

- oxidation of the processor board,

- processor failure,

- keyboard is faulty,

- buttons sticking,

- microphone is faulty

- speaker is faulty

- the display is broken,

- mechanical damage to the screen matrix.

Malfunctions of a USB flash drive for write-off

- is not recognized by the computer as a result of failure of the controller chip,

- mechanical damage to the board,

- oxidation of contact groups,

- connector damage.

Reasons for decommissioning a plotter

- Plotter power supply faulty,

- control panel is faulty

- failure of the controller board,

- the ink supply system is faulty,

- pump failure,

- destruction of ink supply tubes,

- the carriage drive unit is faulty,

- print head failure,

- failure of the plotter controller board as a result of ink getting onto the contact groups from a leaking cartridge.

Reasons for writing off the copier

- the power supply is faulty,

- failure of the high-voltage unit,

- The thermoblock drive has failed,

- wear of the Teflon and rubber shafts of the fuser block,

- the heater drive motor is faulty,

- wear of paper path mechanisms,

- board is faulty

- formatter board malfunction,

- broken corotron filaments,

- oxidation of microcircuits on the controller board,

- failure of the interface board.

Reasons for writing off printing equipment

- image transfer tape is worn out,

- the power transformer of the power supply is faulty,

- conveyor unit malfunction,

- failure of the image forming unit,

- deformation of the main drive shafts,

- switch board is faulty

- failure of the control controller.

Reasons for writing off a cartridge

- the transfer unit is faulty,

- shaft contacts are destroyed,

- the axes of the magnetic shaft drive gears are broken,

- the tightness of the mining bunker is broken,

- the cartridge chip is faulty,

- The contact group of the cartridge has failed.

Reasons for discharging the battery

- the terminals of the contact groups have failed,

- significant corrosion due to leakage of electrolyte,

- the seal of the housing is broken,

- the battery life has been exhausted,

- increased self-discharge,

- sulfation,

- breakage and short circuit of plates.

Reasons for writing off a calculator

- mechanical damage (keys sticking) to the keyboard,

- the indicator is broken,

- The controller board has failed,

- indicator is faulty,

- There is no backlighting for some elements.

Reasons for decommissioning a lamp

- destruction of the lamp socket,

- significant deformation due to heating,

- the mounting bracket is damaged.

Reasons for writing off an exercise bike

- the gearbox has failed,

- gears and drive shafts are worn out,

- broken axles,

- significant deformation of the body,

- failure of the control and indication board.

Reasons for writing off furniture

- deformation of furniture elements as a result of moisture,

- significant surface damage as a result of thermal overheating,

- deformation of the seats of the connecting elements,

- mechanical damage to hinges and damage to fastening points,

- the appearance of a network of cracks on the surface,

- wear of the fastening elements of the drawers and legs,

- destruction of elements of supporting structures,

- deformation of the seat and back,

- gas lift malfunction,

- wear of the piastres and the swing mechanism,

- damage to the crosspiece structure.

Form of act for write-off of materials

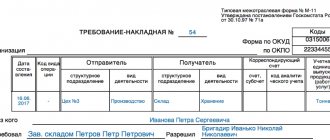

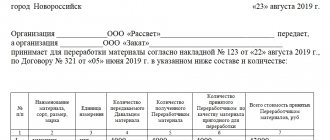

To write off materials in the 1C:Accounting 8 version 3.0 program, you must fill out and post the document Requirement-invoice (menu Warehouse - Requirement-invoice or Production - Requirement-invoice), fig. 1.

Rice. 1. Formation of a printed form of the “Act for write-off of materials”

The norms of the current legislation of the Russian Federation have approved unified forms of documents for processing the release of materials from the warehouse to the production workshop. This is a limit intake card in form No. M-8 or a demand invoice in form No. M-11 (Resolution of the State Statistics Committee of the Russian Federation dated October 30, 1997 No. 71a).

Note: From 01/01/2013, the forms of primary accounting documents contained in albums of unified forms of primary accounting documentation are not mandatory for use. At the same time, they can be used for accounting. Organizations can also develop forms on their own or use the accounting recommendations provided by accepted bodies of non-state accounting regulation (see.

, for example, information from the Ministry of Finance of Russia No. PZ-10/2012). 1C:Enterprise implements most unified forms of primary accounting documents. Therefore, organizations can use the forms contained in the program, enshrining in their accounting policies the use of forms from albums, approved. Resolutions of the State Statistics Committee of Russia.

However, these documents are not enough. And before the introduction of the new functionality, users had to additionally fill out an act for writing off materials: manually copy the data into the appropriate non-unified form.

Starting from version 3.0.69 in “1C: Accounting 8”, a printed form of the act for writing off materials (proposed) is available from the document Requirement-invoice (button Print - Act for writing off materials), see fig. 1.

The form of the act for writing off materials is approved by a separate order of the manager or as an annex to the accounting policy. To implement this rule in the program, the form of the Certificate for write-off of materials has been added to the list of forms of primary documents in the printed form of the accounting policy (Main - Accounting policy - Print).

Error 2: difference in receipts and write-offs

The second error is related to the nomenclature “Whole milk”. We open the “Subconto Analysis” report with the settings set for the item of interest to us. Thanks to the report, we will see the second error: the receipt of items is reflected in account 41.01 “Goods in warehouses,” but the write-off occurs from account 10.01 “Raw materials and supplies.” Here you need to figure out where the mistake was made. If this is a product, then it must be written off as a product. If it is a material, then it is like a material. If an error was made upon admission, then there are two options:

- If an error was made in the current reporting period, then you can simply go to the document “Receipt (act, invoice)” and change the details of the tabular part “Account” to 10.01 “Raw materials and materials”.

- If the error was made earlier, then we will use the document “Movement of goods” in the “Warehouse” section.

After correcting the error, we will forward the “Demand-invoice” document. We go into the postings and see that according to the “Whole Milk” nomenclature, the amount was also written off.

Separate details of the act for write-off of materials

Date and number

In the 1C: Accounting 8 program, edition 3.0, in the act of writing off materials, a standardized type of primary documents is implemented, indicating the date and document number. The date of the document is indicated according to the date of formation of the act.

Article 9 of Law No. 402-FZ does not contain requirements regarding the number of the primary accounting document as a mandatory detail. Therefore, even if the serial numbering in acts of write-off of materials is violated, this document can be recognized as complying with the law (see, for example, the Decision of the Arbitration Court of the Vologda Region dated April 27.

We suggest you read: Registration of rights to an apartment by inheritance

Spending goals

As a general rule, the act of writing off materials is drawn up in any form. The main thing is that it shows which department used the materials, what materials, and in what quantities. This directly follows from the norms of paragraph 2 of Article 9 of Law No. 402-FZ, which states that the mandatory details of the primary accounting document are the content of the fact of economic life and the value of the natural and (or) monetary measurement of the fact of economic life, indicating the units of measurement.

When filling out the Purpose of Consumption fields in the Request-Invoice document, the corresponding data will be automatically transferred to the printed form of the Materials Write-off Certificate. At the same time, the relevant question is whether this field is mandatory and whether there are any violations in the case of drawing up an act for writing off materials without indicating the purpose of their use.

Not a single regulatory legal act states that failure to indicate the purpose of using materials in the act is a violation. At the same time, since the act must be formed after the fact of using the materials, the purposes and purpose of their write-off at the time of the formation of the act must be clear. Therefore, it is more logical to fill in this field.

In addition, indicating the specific purposes for using materials will facilitate the process of proving the amount of expenses of the accounting entity in disputes with third parties. For example, based on the materials of one of the cases in the trial, the court found that the main part of the expenses taken into account by the taxpayer when calculating the tax base for income tax for the audited period consisted of expenses for carrying out repair and general construction work.

At the same time, when checking the use and expenditure of inventory items, it was found that a significant part of the acts for writing off materials is impersonal in nature. From their contents it was impossible to determine for which object and for which specific work the material assets were spent.

The acts for writing off materials stated that members of the commission (two people) inspected the materials and determined that they should be written off as production costs, followed by a list of materials, their quantity and amount. The court concluded that it was not possible to determine the exact amount of costs for certain types of work, and the taxpayer lost the case with the tax inspectorate (see, for example, Resolution of the Fifteenth Arbitration Court of Appeal dated May 7, 2009 No. 15AP-1477/2009 in case No. A53-19371/2008).

The Certificate of Write-off of Materials indicates the cost and amount of written-off materials, calculated when posting the Request-Invoice document.

The chosen method is always the same for accounting purposes and for profit tax purposes.

If the method for estimating inventories is Average, then the procedure for calculating the cost of materials depends on the settings for posting documents (section Administration - Posting Documents). If the Calculations are performed switch is set to:

- When posting documents - when posting Requests-invoices, entries for writing off the cost of materials are formed based on the cost prevailing at the time of issue (based on the average moving cost);

- When closing the month - when carrying out the Request-invoice, postings for writing off the cost of materials are generated at planned prices or with zero cost if planned prices are not specified.

At the end of the month, when performing the routine operation Adjustment of the cost of items included in the Closing of the month processing, the cost of materials is adjusted to the weighted average.

Thus, the cost of written-off materials indicated in the Certificate of write-off of materials (accounting price) may differ from the actual cost of materials, which does not contradict the Methodological Instructions.

Signatures

1C accounting solutions provide the ability to generate an act signed by a commission or an individual entity.

An individual entrepreneur signs the act himself. In order for the generated act to have only one line for signature, the Composition of the Commission form (link Commission from the Request-Invoice document) does not need to be filled out. Also, if only one line is filled in the composition of the commission, then the lines Chairman of the commission and Members of the commission are not displayed in the generated write-off act. Only full name will be indicated. and the position of the person signing the act.

In an organization, the act of writing off materials is usually signed by members of the formed commission, and approved by the manager.

We suggest you read: Is it possible to discharge a non-resident person from social housing?

FULL NAME. and the position of the manager are automatically inserted into the act from the organization’s card. And the data of the commission members must be manually entered in the Composition of the commission form. This procedure was implemented due to the fact that changes in the composition of the commission are possible.

For example, in the event of vacation of the chairman or one of the members of the commission, an order for replacement can be issued. Otherwise, the actual absence of one of the commission members may serve as grounds for invalidating the results of the write-off of materials. The composition of the commission is remembered and filled out automatically from the last Request-invoice document.

If the Composition of the Commission menu from the Request-Invoice document is not selected by the user, this detail in the generated Act will be empty. In a printed document, you can fill it out manually.

Equipment malfunctions for write-off

But equipment can fail or not meet the requirements of production processes without any theft, war or natural disaster. In this regard, the following breakdowns of equipment for write-off are noted:

- Failure of the main components of the system unit, its physical deformation, which caused internal elements to break, electrolyte getting onto the boards due to depressurization of the BIOS battery;

- Fatal breakdowns of auxiliary equipment that make replacement impossible and impractical;

- Obsolescence – modern software required in the production process is not installed or does not work efficiently.

In the latter case, the equipment works slowly and often freezes. Its use leads to data loss and ineffective staff work.

A special case is a breakdown of the voltage stabilizer. It is easy to replace and repairs are inexpensive. But due to this malfunction, microcircuits and other components may burn out.

All these defects in equipment for write-off must be displayed in the equipment technical condition report after inspection by a specialist. The easiest way to obtain documentation of the misuse and disposal of your computer is to contact the company involved in this type of activity. They have a complete set of documents for such work. The list of their activities includes working with precious, ferrous and non-ferrous metals, substances containing toxins.

Below is a list of the best companies in major cities:

In 80% of cases, computer equipment contains precious metals. In addition, its components contain substances hazardous to the environment.

Therefore, disposal must be carried out by specialized organizations that have the appropriate license. Documents remain at the enterprise confirming the malfunction of the equipment, its write-off and transfer for disposal within the framework of the procedures provided for by law.

If the product is damaged or expired

Products that have expired, are stale, damaged during transportation or storage, require disposal in accordance with the law. State regulations have been established for this procedure. Product examination is carried out.

If low-quality goods that pose a threat to health or unsuitable products are identified, acts are drawn up that reflect this and signed by members of the commission. There is no established procedure for writing off expired goods due to their expiration date. If this is identified during the inventory process, a record is compiled according to the general scheme for reflecting the results. As a result of the inventory, a shortage may also be identified, then in accounting and tax accounting the amount of this product is attributed to:

- costs associated with circulation or production within the limits of natural loss;

- the number of persons guilty of this is in excess of the norms of natural loss;

- other expenses of the organization - without identifying the perpetrators.

The actual presence of inventory items is entered into the inventory list (INV-3 form). To reflect the identified deviations between accounting data and actual availability, the INV-19 matching statement is intended. The final data is transferred to the INV-26 statement.