Who is entitled to compensation for unused vacation?

When an employee leaves the company, most often he has “non-vacation” days of vacation. The accountant calculates the amount of these conditional vacation pay according to special rules, withholds personal income tax and pays it along with the last salary and severance pay.

No compensation is paid to employees who are simply transferred from one department to another without being fired. It is also not issued to external part-time workers who are transferred to their main place of work. And an employee who was hired less than half a month ago and is now being fired will not receive anything.

There are categories of citizens who are not supposed to make a refund (Articles 122, 126 of the Labor Code of the Russian Federation).

The employer must send on a well-deserved rest:

- Pregnant women. Even though they are going or have already gone on maternity leave.

- Parents who have adopted a child less than 3 months old.

- Company employees who are under 18 years of age.

- Specialists who work in an enterprise that is harmful or dangerous to health and life.

In addition, no leave is provided and no monetary compensation is paid to employees who were fired due to theft, damage to property, or other illegal actions against the company/employer.

Before making a calculation, you must write a statement.

Example:

And the employer is obliged to sign the corresponding order.

Example:

How to calculate average daily earnings

Average daily earnings for the 12 months before dismissal are needed to find out the amount of compensation for the remaining days of vacation. If an employee joined the organization less than a year ago, calculate the average salary from the moment he was hired (Government Decree No. 922 of December 24, 2007).

We add up the amounts of earnings for the required period: this includes income in cash and in kind - salary and additional payments, bonuses, allowances. The amount does not include sick leave, vacation pay and other payments, for the calculation of which average earnings have already been used.

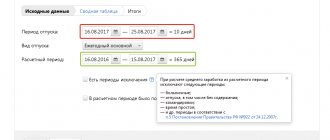

Next, we determine the number of calendar days for the period and consider working months:

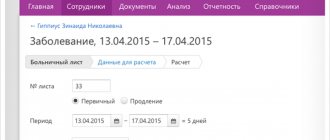

- if the employee worked a full month, we take the average number of calendar days in it - 29.3;

- if there were missed working days in a month (vacation or sick leave), then we find the number of days using the formula: (Number of calendar days of the month - Days of vacation or sick leave) * 29.3 / Number of calendar days of the month .

Now let’s find the average daily earnings using the formula: Amount of payments for the billing period / Calendar days for the billing period .

Duration of vacation

We have already mentioned that usually the duration of annual paid leave is 28 calendar days of paid rest. If an employee has the right to extended or additional leave, then when calculating vacation pay in 2021, all these days must be added up. This will be the total duration of the vacation.

There is no limit on the duration of rest in a calendar year. So, if a person has accumulated unused days, he can, in agreement with the employer, take them all off at once. Let’s say an employee is entitled to annual basic paid leave of 28 calendar days. And over the last two working years he did not have 40 days of vacation. An employee has the right to use all these days within one calendar year.

These rules are established by Articles 115 and 120 of the Labor Code of the Russian Federation.

Be careful: when determining the length of vacation, non-working holidays should be excluded from the calculation. Moreover, both federal (specified in Article 112 of the Labor Code of the Russian Federation) and regional. The latter establish the authorities of the constituent entities of Russia. This procedure follows from the set of norms of Articles 22, 120 of the Labor Code of the Russian Federation, Part 1 of Article 72 of the Constitution of the Russian Federation, Article 4 of the Law of September 26. 1997 No. 125-FZ. The correctness of this approach is confirmed by Rostrud in paragraph 2 of the letter dated 12.09. 2013 No. 697-6-1.

How to calculate compensation for unused vacation

First, understand how many days of the allotted vacation the employee did not take off. We provide a detailed algorithm for calculating this figure here. And in simple cases, when an employee is entitled to 28 vacation days per year, 2.33 vacation days accumulate in a month. If in some months a person worked less than 15 days, we exclude these months from the calculations; if more than 15 days, we round up to a full month. Add the number of months and multiply it by 2.33. From the resulting number, we subtract the days that the employee has already “taken off.”

Calculate the amount of compensation using the formula: Amount of compensation = Average daily earnings * Number of days of unused vacation .

About the calculator for calculating the number of vacation days

The vacation days calculator will easily allow you to find out how many days of vacation the employee has accumulated at one time or another.

Legislative basis for calculating vacation days

The calculation of vacation time is made in accordance with Art. 121 of the Labor Code of the Russian Federation.

Why know your vacation record?

The time spent working for one employer, which gives the right to take annual leave, which will be paid, may be needed not only to directly calculate this period, but also to know how many days are subject to compensation upon dismissal.

What is included in the vacation experience?

An employee who works continuously for the same employer will be entitled to annual leave, taking into account the following periods:

- the time when he actually performed his duties;

- periods when the employee was absent from work, but his place was retained (vacation, sick leave, maternity leave, military service, etc.);

- weekends and other non-working days;

- forced absence from work due to illegal dismissal;

- suspension due to untimely completion of a medical examination (if this is not the employee’s fault);

- additional administrative leaves (no more than two weeks per calendar year).

IMPORTANT! Changes were made to the legislation regarding the accrual of length of service during administrative leave:

- from 12/30/2001 to 10/05. 2006, no more than 7 days of vacation at your own expense per year were taken into account;

- from 10/06/2006 this limit increased to 14 days.

What is not included in the vacation experience

Some periods of time will not be taken into account when calculating the length of service required for leave, namely:

- employee absenteeism;

- suspension due to alcohol, drug or toxic intoxication;

- denial of permission to work due to ignorance or failure to pass safety regulations;

- the employee did not undergo a mandatory medical examination due to his own fault;

- inability to perform work according to a medical report;

- termination of a license required for work (for example, a driver’s license, a weapons permit, etc.);

- child care leave up to 1.5 and up to 3 years.

Indexation of average earnings with salary increases

If before or during an employee’s vacation the organization increased salaries (tariff rates), then it is necessary to index the average earnings to calculate vacation pay. This is where the increase factor (KPI) comes in handy: KPV = OH / OS, where OH is the new salary, OS is the old salary. There are three indexing options:

- The salary increased during the pay period. Then all payments taken into account when calculating vacation pay from the beginning of the billing period to the month of salary change are multiplied by the KVP.

- The salary increased after the pay period before the start of the vacation. The entire calculated average earnings are multiplied by the increase factor.

- Salary increased during vacation. Only part of the vacation pay increases, starting from the effective date of the new salaries.

When vacation is postponed or extended

Annual leave can be postponed or extended. This can be done both during the current year of work (working year) and the next year.

Annual paid leave is extended or transferred to another period in the event of temporary disability of the employee. Another reason for transfer or extension is that a person performs state duties during his annual paid leave, if labor legislation provides for this to be exempt from work. The employer determines the specific dates to which the vacation is transferred, taking into account the wishes of the employee.

Also reschedule the vacation if vacation pay was not paid at least three days before the start of the vacation or if the employee was not notified two weeks in advance about the start date of the vacation. In these two cases, the employee writes a free-form transfer application, in which he indicates the desired dates for transferring the vacation.

Let us add that annual leave, with the consent of the employee, can be transferred to the next working year if the employee’s absence from work adversely affects the employer’s activities. The employee must use the leave no later than 12 months after the end of the working year for which the leave is granted. In other words, you can only transfer your vacation to the next working year.

Such rules are established by Article 124 of the Labor Code of the Russian Federation.

Vacation pay

Vacation pay must be paid at least 3 days before the start of the vacation (Article 136 of the Labor Code of the Russian Federation). We take the number of vacation days from the management’s order to provide legal vacation. We pay for all calendar days of vacation except non-working holidays (according to Article 120 of the Labor Code of the Russian Federation).

The situation usually raises questions when vacation starts at the beginning of the month. For example, an employee goes on vacation on July 1, 2018, and vacation pay must be paid on June 27. In this case, the calculation requires the salary for June, which has not yet been accrued.

In this case, the salary calculation for June is first performed: either assuming that the employee will work the last days of the month, or based on the days already worked. Vacation pay is then calculated. If the salary for June changes after calculating vacation pay, you will need to recalculate and pay extra or withhold the difference.

You can calculate your vacation pay in a few minutes using our calculator.

Taxes and fees

Vacation pay is subject to personal income tax and insurance contributions. Also, these amounts can be taken into account in expenses when calculating income tax and on a simplified basis.

The easiest way with insurance contributions is to accrue vacation pay and no later than the 15th day of the next month we transfer all contributions in four installments (pension, medical, social, injury). Moreover, they transfer contributions in bulk along with contributions from other payments to employees - salaries, bonuses, etc. By the way, they accrue vacation pay along with contributions before the start of the vacation.

There is one trick about personal income tax. Typically, taxes are transferred the next business day after income is paid. But starting from 2021, personal income tax on vacation pay must be transferred to the budget no later than the last day of the month in which such payments were made. That is, you will have to issue a separate payment for tax on vacation pay (Clause 6, Article 226 of the Tax Code of the Russian Federation).

note

Personal income tax must be withheld from the payment of additional vacation days for employees engaged in harmful and dangerous work. This is due to the fact that these payments are not included in the list of income not subject to personal income tax (letter of the Ministry of Finance of Russia dated May 6, 2013 No. 03-04-06/15555.

There are difficulties with income tax if the vacation falls on two reporting periods. For example, a vacation begins in February and ends in March. According to the Russian Ministry of Finance, in this case, vacation pay should be broken down by month. They say that labor costs, including vacation pay, are recognized monthly. And if you take into account lump sum payments, the principle of the accrual method will be violated. Although judges have long agreed that there is no need to split vacation pay, officials are adamant (letters from the Ministry of Finance of Russia dated 06/09/2014 No. 03-03-RZ/27643, dated 04/07/2021 No. 03-03-06/2/19828, dated 10.25.16 No. 03-03-06/2/62147).

It is noteworthy that the Federal Tax Service of Russia at one time issued a letter with the opposite position: the costs of wages retained by employees during a vacation of several months are taken into account at a time in the reporting period in which they were generated and paid (letter dated March 6, 2015 No. 7 -3-04/ [email protected] ). Tax officials argue their position by the fact that vacation pay is paid to the employee no later than three days before the start of his vacation (Part 9 of Article 136 of the Labor Code of the Russian Federation) regardless of the periods during which the vacation falls. In addition, the Tax Code does not indicate that vacation pay is taken into account in proportion to vacation days falling in different reporting periods.

For insurance premiums and personal income tax, it does not matter whether the vacation covers different months or not. Everything is standard, as we described above.

There are no tricks with simplified taxation and UTII either. With the object “income” and “imputed”, vacation pay does not affect the amount of the single tax. If the object is “income minus expenses”, vacation pay is taken into account on the date of payment.

When leave is granted in working days

For some categories of employees, vacation is set not in calendar days, but in working days. In particular, two working days of vacation for each month of work are due to seasonal employees and people with whom the employment contract is concluded for a period of no more than two months (Articles 291, 295 of the Labor Code of the Russian Federation).

For all other employees whose vacation is set in working days in accordance with the law (for example, judges, scientific employees with an academic degree, etc.), convert its duration to calendar days. To do this, calculate the duration of vacation according to a six-day workweek schedule when calculating vacation pay in 2021.

That is, from the start date of the vacation, count the number of working days of vacation according to the calendar of a six-day working week. This will determine the last day of your vacation. After this, recalculate the total vacation period into calendar days (Article 120, Part 5, Article 139 of the Labor Code of the Russian Federation).

Cash compensation upon dismissal of an employee

At the request of the employee, unused vacations may be provided to him before dismissal.

Article 127 of the Labor Code of the Russian Federation stipulates that upon dismissal, an employee is paid monetary compensation for all unused vacations. In this case, the day of dismissal is considered the last day of vacation. The employee must reflect this in his resignation letter. The exception is dismissal for wrongdoing. Payment of compensation for unused vacation upon dismissal of an employee is the responsibility of the employer and does not depend on the reason for the dismissal of the employee. The basis for its payment is the dismissal order and must be made on the day the employee is dismissed.