Any enterprise is profitable only if its activities make a profit.

Profit accounting is one of the most important accounting operations, since it indicates the economic efficiency and positive outcome of the organization.

Even if the organization is not commercial, where profit is a priority, income is still accounted for.

A consistently high figure for this indicator in accounting documents indicates the stability of the enterprise in the waves of market fluctuations, its financial success, and the economic efficiency of business methods.

Let's consider what functions does accounting for profit before tax perform, how to correctly calculate it using formulas, and what financial indicators this calculation depends on.

Concept concept

Profit before tax is a measure of a company's profitability that takes into account profits earned before any taxes are paid. It compares all of a company's expenses with its income, but excludes the payment of income taxes.

Take our proprietary course on choosing stocks on the stock market → training course

The indicator combines the company's entire profit before tax, including operating, non-operating income and expenses. This value exists because tax expenses are constantly changing, and eliminating them helps an investor gain insight into changes in a company's earnings or revenue from year to year. The term is interchangeable with the concept of “income before taxes” or “profit before taxes”.

This indicator is indicated in the company's financial performance report. Profit before taxes characterizes the business indicator that is the result of the company's reporting.

Taxable income is especially important because it is the basis for a company's tax payments, as well as tax expenses under applicable law.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

Summary

How to calculate EBITDA?

You can calculate EBITDA using information from the income statement, cash flow statement, and balance sheet. The formula looks like this:

EBITDA = Net income + Interest + Taxes + Depreciation of fixed assets + Amortization of intangible assets

What EBITDA indicator is considered “good”?

EBITDA is a measure of a company's financial performance and profitability, so a relatively high EBITDA is clearly better than a lower EBITDA. Companies of different sizes in different sectors and industries vary greatly in their financial performance. Therefore, the best way to determine whether EBITDA is EBITDA is to compare its performance to its peers—companies of similar size in the same industry and sector.

What is amortization of intangible assets in EBITDA?

Regarding EBITDA amortization of intangible assets, it is an accounting method used to periodically reduce the carrying amount of intangible assets over a specified period of time. Amortization of intangible assets is reflected in the company's financial statements. Examples of intangible assets include intellectual property such as a company's patents or trademarks, or goodwill acquired through past mergers and acquisitions.

Main points

- EBITDA is a widely used measure of a company's profitability.

- EBITDA can be used to compare companies to each other and to industry averages.

- Additionally, EBITDA is a good indicator of underlying earnings performance because it removes some extraneous factors and allows for more detailed comparisons.

- EBITDA can be used as a shortcut to estimate the cash flow available to pay debt on long-term assets.

And that’s all for today about EBITDA. In future articles I will continue to look at related financial indicators. I hope you found this article useful and interesting. Successful investments to you and see you again on the pages of the Tyulyagin !

The need to calculate the indicator

Most businessmen start their companies out of a desire to make a profit. There are several metrics that business owners can use to determine the performance of their business. One such indicator is profit before tax.

The purpose of calculating this indicator is to determine the total amount of profit of the company, on the basis of which the amount of tax payments can be finally determined.

The profitability of a company can be calculated using the profit before tax indicator. The significance of this indicator in efficiency calculations is very high.

EBITDA and financed buyout

EBITDA first came into active use in the mid-1980s, when investors made financed buyouts after looking at troubled companies that needed financial restructuring. They used EBITDA to quickly calculate whether these companies would be able to pay the interest on these financed deals.

Funded buyouts by investment bankers promoted EBITDA as a tool to determine whether a company could service its debt in the near future, say within a year or two. By looking at a company's EBITDA coverage ratio (at least in theory), investors can get an idea of whether the company will be able to pay the higher interest payments it will face after the restructuring. For example, bankers might bet that a company with $5 million in EBITDA and $2.5 million in interest expense has interest coverage of two—more than enough to pay off its debt.

EBITDA was a popular metric in the 1980s to measure a company's ability to service debt used in a financed buyout (LBO). It is appropriate to use a capped profit margin before the company is fully committed to the LBO. EBITDA was further popularized during the dot-com bubble, when companies had very expensive assets and debt loads that obscured what analysts and managers said were reasonable growth numbers.

Indicator value

Profit before tax is important for:

- management and internal management of the company;

- external users of financial data from the company's operating activities.

By excluding the amount of tax payments, profit before taxes minimizes the impact of an additional variable, which may contain various indicators that affect the way the company's financial data is analyzed

For example, one industry may have significant tax benefits that will positively impact the net income of an organization in that industry. Conversely, a company in another industry will be negatively impacted by unfavorable tax policies.

Eliminating tax expense will allow the two companies' operations to be better compared, regardless of how tax policies determine their bottom line.

These tax differences can also exist between companies within the same industry, as age, use of capital and geographic location will all play a role in how much tax a business has to pay.

Important! Earnings before taxes eliminate any impact that tax policies may have on a company's financial information.

Thus, the indicator is a performance measurement that highlights the overall operations of a business. Although the metric can be used to compare any company, it is most useful when applied within the same industry.

Ignoring taxes, profit before taxes focuses solely on a company's ability to generate profits from operations and business, ignoring variables such as tax burden. The ratio is a particularly useful indicator because it helps determine a company's ability to generate enough profit to be effective in the marketplace, pay off debt, and finance ongoing operations.

Earnings before taxes are also useful for investors who are comparing multiple companies with different tax situations.

For example, an investor is thinking about buying shares in a company, the pre-tax earnings figure can help determine the company's operating profit before taxes in the analysis. If the company received tax breaks or tax rates were reduced, net income would increase.

Earnings before taxes help analyze companies operating in capital-intensive industries, meaning that they have a significant amount of fixed assets on their balance sheets. Fixed assets are physical assets, plant and equipment that are typically financed through borrowing. For example, companies in the oil and gas industry are capital intensive because they have to finance their drilling equipment and oil rigs. As a result, capital-intensive industries incur high tax costs. Earnings before taxes help investors in such companies analyze operating performance and profit potential while removing tax payments.

Loss before tax

Profit = income – costs. If the result of such a difference is negative, then it is recognized as a loss. Relatively speaking, profit can be positive (with a plus sign) and negative (with a minus sign). This is the same indicator, only with a different meaning and a different interpretation of the result.

Consequently, a negative operating profit value obtained during calculation means that the enterprise’s costs exceed its income (cash inflows). Therefore, the company suffers losses (incurs losses). This indicates a deterioration in its financial situation and requires urgent measures to stabilize the situation.

Indicator analytics

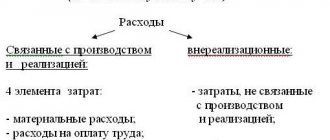

Since the indicator measures the amount of profit before tax payments are calculated, then:

- an increase in value indicates the efficiency of the company;

- a decrease indicates management inefficiency and a crisis in the company.

When analyzing profit before tax, we study:

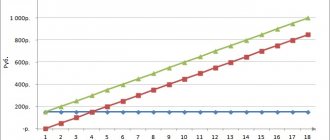

- dynamic trends of the indicator for 2-3 reporting periods in absolute terms, that is, in monetary terms;

- trends in the indicator for 2-3 reporting periods in relative terms, that is, as a percentage;

- Weaknesses are identified through the use of vertical analysis techniques for individual expense categories.

Operating profit accounting functions

This indicator is used to assess the effectiveness of the company's core activities. It allows one to judge its investment attractiveness. The calculated operating profit indicator, which is recorded in the report, is taken into account and applied for the purposes of:

- determination of net profit, mandatory budget payments;

- optimization of future expenses and coverage of losses already incurred, as well as existing ones;

- sharing profits among the founders;

- replenishment of accumulated income and study of non-production income.

Therefore, the enterprise always has 2 key tasks in the first place: correct calculation of the indicator and ensuring its high value.

Calculation example

For an example of calculation, let's take a conditional company with the following initial data presented in the table below.

| Index | 2017, t.r. | 2018, t.r. |

| Revenue | 547800 | 654700 |

| Expenses | 321470 | 455900 |

| Business expenses | 12455 | 17855 |

| Administrative expenses | 9875 | 9777 |

| Income from participation | 5446 | 6511 |

| Interest receivable | 7885 | 8444 |

| Interest payable | 15477 | 19745 |

| Other income | 5423 | 2144 |

| other expenses | 7895 | 6744 |

To calculate the profit from sales, we use the table below.

| Index | 2017, t.r. | 2018, t.r. | Absolute deviation, t.r. | Rate of change, % |

| Revenue | 547800 | 654700 | 106900 | 119,5 |

| Expenses | 321470 | 455900 | 134430 | 141,8 |

| Gross profit | 226330 | 198800 | -27530 | 87,8 |

| Business expenses | 12455 | 17855 | 5400 | 143,4 |

| Administrative expenses | 9875 | 9777 | -98 | 99,0 |

| Profit from sales | 204000 | 171168 | -32832 | 83,9 |

| Income from participation | 5446 | 6511 | 1065 | 119,6 |

| Interest receivable | 7885 | 8444 | 559 | 107,1 |

| Interest payable | 15477 | 19745 | 4268 | 127,6 |

| Other income | 5423 | 2144 | -3279 | 39,5 |

| other expenses | 7895 | 6744 | -1151 | 85,4 |

| Profit before tax | 199382 | 161778 | -37604 | 81,1 |

As can be seen from the table, by 2021 there is a decrease in profit before tax by 37,604 tr. or by 18.9%. This decrease is due to the fact that the growth rate of revenue (19.5%) was lower than the growth rate of expenses (41.8%). Along with the decrease in profit before tax, one can also see a decrease in gross profit by 27,530 tr., profit from sales by 32,832 tr.

Tax accounting, procedure for writing off received losses

An enterprise has the right to write off the resulting loss when calculating income tax. This norm, as well as the procedure and features of write-off, are explained by the Ministry of Finance of the Russian Federation in letter No. 03-03-06/2/3 dated 01/16/2013. In particular, the following is explained to taxpayers.

According to paragraph 1 of Art. 283 of the Tax Code of the Russian Federation, due to the loss received in the previous tax period, it is possible to reduce the income tax base calculated in the current (tax, reporting) period. Moreover, both for part of this untransferred loss and for its entire amount. And when a loss is written off in parts, this loss must be carried forward to the future.

FAQ

Question No. 1. What are the limitations when calculating the indicator?

Answer. Depreciation is included in the calculation of earnings before taxes and can lead to different results when comparing companies in different industries. If an investor compares a company with a significant amount of fixed assets to a company that has few fixed assets, depreciation expense can hurt a company with fixed assets because the expense reduces profits.

Additionally, companies with a large amount of debt are likely to have high interest costs. Earnings before taxes reduce a company's earnings potential, especially if the company had a lot of debt. If debt is not included in the analysis, the problem may be that the firm will increase its debt due to lack of cash flow or poor sales performance. It is also important to consider that in a rising rate environment, interest costs will rise for companies that have debt on their balance sheet, and this must be taken into account when analyzing a company's financial performance.

Question No. 2. What is the indicator used for?

Answer. Profit before taxes takes into account all the profits a company generates, whether from core activities or non-core activities. The indicator calculation was invented to account for the constantly changing tax expenses of a company. It gives company owners and investors a good idea of how much profit a company makes without taking into account payments to the budget.

Question No. 3. Where is the value reflected?

Answer. Profit before tax is indicated exclusively in the income statement on line 2300.

Real world example

As an example, below is Procter & Gamble Co's income statement for the year ended June 30, 2021 (all figures in millions of US dollars):

To calculate EBIT, we subtract cost of goods sold and SG&A expenses from net sales. However, P&G had other types of income that could be included in the EBIT calculation. P&G had non-operating income and interest income, in which case we calculate EBIT as follows:

For the fiscal year ended 2015, P&G had a fee from Venezuela. Whether to include the Venezuela charge is questionable. As mentioned above, the company can exclude one-time expenses. In this case, a note to the 2015 income statement explains that the company continued to operate in the country through subsidiaries. Due to capital controls in place at the time, P&G took one-time action to remove Venezuelan assets and liabilities from its balance sheet.

Likewise, we can make an argument for excluding interest income and other non-operating income from the equation. These considerations are somewhat subjective, but we must apply consistent criteria to all companies being compared. For some companies, the amount of interest income they report may be small and may not be reported. However, other companies, such as banks, earn significant interest income from the investments they hold in bonds or debt instruments.

Another way to calculate P&G's EBIT for fiscal year 2015 is to work from the bottom up, starting with net income. We ignore noncontrolling interests because we are concerned only with the company's operations and subtract net income from discontinued operations for the same reason. We then add back income taxes and interest expense to get the same EBIT as the top-down method:

EBIT = NE – NEDO + IETchereore, EBIT = $10,604 – $577 + $3,342+ $579 = $13,948jere:NE = Net earningsNEDO = Net earnings from discontinued operationsYat = Jansome theyIE = Interest expense\ begin {aligned } & \ text {EBIT} \ = \ \ text {NE} \ – \ \ text {NEDO} \ + \ \ text {IT} \ + \ \ text {IE} \\ & \ begin { leveled } \ text { Therefore, EBIT} \ & = \ \ 10.604 \ – \ $577 \ + \ \ $3.342 \\ & \ quad + \ \ $579 \ = \ \ $13.948 \ end {leveled} \\ & \ textbf {where: } \\ & \ text {NE} \ = \ \ text {Net Income} \\ & \ text {NEDO} \ = \ \ text {Net Income from Discontinued Operations} \\ & \ text {IT} \ = \ \ text {Income Tax} \\ & \ text {IE} \ = \ \ text {Interest Expense} \end {equalized}Interaction with Other PeopleEBIT = NE – NEDO + THIS + IETherefore, EBIT Interaction with Other People = $10,604 – $577 US + 3dollars, 342+ 579dollars = $13,948 Interactions with other peoplewhere:NE = Net RevenueNEDO = Net Income from Discontinued OperationsIT = Income TaxesIE = Expenses Percent Interactions with Other People