Accounting

The founder reflects his contribution to the authorized capital of other organizations in account 58 “Financial investments”. You can use account 76 to reflect settlements with a subsidiary, or you can immediately reflect all settlements on account 58 without using account 76.

Debit 58.1 Credit 76 subaccount “Settlements on contributions to the authorized capital” - reflects the debt on the contribution to the capital of another organization.

The disposal of a fixed asset and its transfer to the management company is reflected as follows:

Debit 01 subaccount “Disposal of fixed assets” Credit 01

– the original (replacement) cost of the fixed asset is written off.

Debit 02 Credit 01 subaccount “Disposal of fixed assets”

– the amount of accrued depreciation is written off.

Debit 76 subaccount “Calculations for contributions to the authorized capital” Credit 01 subaccount “Disposal of fixed assets” or Debit 58.1 Credit 01 subaccount “Disposal of fixed assets” - reflects the transfer of an asset as a contribution to the authorized capital (at residual value).

If the residual value of the fixed assets does not coincide with the assessment of the founders, then the difference is taken into account as part of other income or expenses.

Debit 76 subaccount “Settlements on contributions to the authorized capital” Credit 91.1

or

Debit 58.1 Credit 91.1 - reflects the positive difference between the assessment of the fixed assets agreed upon by the founders and its residual value.

Debit 91.2 Credit 76 subaccount “Settlements for contributions to the authorized capital”

or

Debit 91.2 Credit 58 - reflects the negative difference between the assessment of the fixed assets agreed upon by the founders and its residual value.

Tax accounting

VAT

VAT is not charged on fixed assets transferred to the authorized capital, since this operation is not recognized as a sale.

Input VAT on fixed assets, previously accepted for deduction, must be restored. But not all, but a part proportional to the residual value of the OS.

Debit 19 Credit 68 subaccount “Calculations for VAT” – VAT on fixed assets transferred as a contribution to the management company has been restored;

The transferring party includes the recovered VAT in the initial cost of the financial investment.

Debit 58.1 Credit 19 – restored VAT is reflected as part of financial investments.

The receiving party can accept the restored VAT as a deduction.

Income tax

When transferring property to the authorized capital of organizations, no income or expenses arise.

A loss from the contribution of fixed assets to the authorized capital of another organization does not reduce the taxable profit of the organization. If the residual value differs from the agreed valuation of the founders, then permanent differences arise.

The positive difference between the residual value and the founders’ assessment forms a permanent tax asset:

Debit 68 subaccount “Calculations for income tax” Credit 99 subaccount “Permanent tax assets”.

The negative difference between the residual value and the founders’ assessment forms a permanent tax liability:

Debit 99 subaccount “Fixed tax liabilities” Credit 68 subaccount “Calculations for income tax”.

GLAVBUKH-INFO

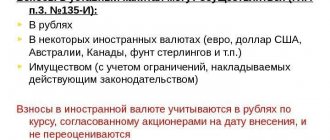

In accordance with the legislation of the Russian Federation, the founders of an organization can make contributions to the authorized (share) capital in cash and/or by contributing material and other assets, including fixed assets. The founders of an organization can be both legal entities and individuals.The primary documents confirming the receipt of an item of fixed assets from the founders and serving as the basis for its acceptance for accounting are:

- the decision of the general meeting of founders and the constituent agreement, which reflect the monetary value of the fixed asset item made by the founders as a contribution to the authorized (share) capital of the organization;

- act of an independent appraiser on the valuation of a fixed asset (if necessary);

- invoice and invoice for the cost of assessing a fixed asset by an independent appraiser;

- documents (invoices and invoices) confirming the costs associated with the receipt of a fixed asset item as a contribution to the authorized (share) capital of the organization, its delivery and bringing it into a condition suitable for use;

- payment and settlement documents confirming payment of these expenses.

The initial cost of fixed assets contributed as a contribution to the authorized (share) capital of an organization is recognized as their monetary value, agreed upon by the founders (participants) of the organization, unless otherwise provided by the legislation of the Russian Federation.

For accounting purposes, the initial cost of fixed assets received by the organization as a contribution to the authorized (share) capital may include the actual costs of the organization for the delivery of these objects and bringing them into a condition suitable for use.

The monetary value of contributions to the authorized (share) capital of the company in the form of property contributed by the company's participants and accepted into the company by third parties is approved by a decision of the general meeting of the company's participants, adopted by all company participants unanimously.

For accounting purposes, the receipt of fixed assets as a contribution to the authorized (share) capital is reflected at the cost agreed upon by the founders (participants) of the organization, regardless of the residual (book) value of fixed assets of the transferring organization.

At the same time, it should be borne in mind that the legislation of the Russian Federation, to one degree or another, stipulates the need to compare the valuation of the contributed property with the level of market prices for similar products.

For example, it has been established that if the agreed value of property contributed to the company exceeds 200 times the minimum wage, it is necessary to involve an independent appraiser.

If non-cash contributions are made to the authorized capital of the company, the company's participants and the independent appraiser, within three years from the date of state registration of the company or corresponding changes in the company's charter, jointly and severally bear, if the company's property is insufficient, subsidiary liability for its obligations in the amount of the overvaluation of non-cash contributions,

In accordance with clause 2 of PBU 9/99, contributions to the authorized (share) capital received from the founders (participants) of the organization are not recognized as income of the organization.

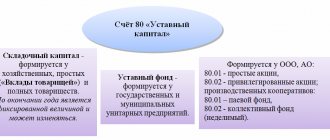

The size of the authorized (share) capital and the actual debt of the founders on contributions to the authorized (share) capital are reflected in the accounting records as a debit to account 75 “Settlements with founders” (subaccount 75–1 “Settlements on contributions to the authorized (share) capital”) and a credit account 80 “Authorized capital”.

When an item of fixed assets is received as a contribution to the authorized (share) capital of the organization, its value is preliminarily reflected in the debit of account 08 “Investments in non-current assets” (subaccount 08–4 “Acquisition of fixed assets”) in correspondence with account 75 “Settlements with founders” "(subaccount 75–1 "Calculations for contributions to the authorized (share) capital").

If the receiving organization has actual costs for the delivery of fixed assets and bringing them into a condition suitable for use, they are also preliminarily taken into account in account 08 “Investments in non-current assets” (subaccount 08-4).

When accepting an object of fixed assets for accounting, the initial cost of the object formed on account 08 “Investments in non-current assets” (subaccount 08-4) is written off to the debit of account 01 “Fixed assets”.

Tax aspects.

Tax legislation establishes that the value of property (including fixed assets) received from the founders as a contribution to the authorized (share) capital of an organization is not recognized as income of the organization and is not subject to income tax and value added tax.

For tax accounting purposes, fixed asset objects contributed as a contribution to the authorized (share) capital of an organization must be taken into account at the residual value of the received objects.

The residual value of the received fixed assets is determined according to the tax accounting data of the transferring organization on the date of transfer of ownership of the specified objects.

In cases where an organization receives a new fixed asset item, that is, one that has not been in use, its value for tax accounting purposes is taken to be equal to the original cost of the item, confirmed by documents of the transferring party.

In such cases, as a rule, the fixed asset item was not used in production, depreciation was not accrued on it, the amount of VAT paid to the supplier of the fixed asset item was not deducted and was taken into account in the initial cost of the transferred fixed asset item

In such cases, and provided that the monetary value of the fixed asset object, agreed upon by the founders, is equal to the initial cost of the contributed fixed asset object, and also in the absence of any costs associated with the delivery of the object to the organization, etc., receipt transactions object of fixed assets as a contribution to the authorized capital of the organization can I? be reflected in accounting by the following entries:

No.

| Contents of business transactions | Corresponding accounts | ||

| Debit | Credit | ||

| 1 | The authorized capital of the organization, recorded in the constituent documents, has been announced | 75-1 | 80 |

| 2 | The cost of the fixed assets item received as a contribution to the authorized capital is reflected (in monetary value agreed upon by the founders of the organization) | 08-4 | 75-1 |

| 3 | The received asset was accepted for accounting at its original cost. | 01 | 08-4 |

If the receiving organization has actual costs for delivering the received fixed assets and bringing them into a condition suitable for use, the amounts of VAT paid on these costs are subject to deduction in the generally established manner after accepting the received fixed assets for accounting.

If all the above conditions are maintained, transactions for the receipt of such an object of fixed assets (for example, a machine) as a contribution to the authorized capital of the organization, if the receiving organization has expenses associated with the delivery of the object, etc., can be reflected in accounting as follows wiring;

| No. | Contents of business transactions | Corresponding accounts | |

| Debit | Credit | ||

| 1 | The authorized capital of the organization, recorded in the constituent documents, has been announced | 75-1 | 80 |

| 2 | The cost of the fixed asset (machine) received as a contribution to the authorized capital is reflected (in monetary value agreed upon by the founders of the organization) | 08-4 | 75-1 |

| 3 | The cost of services of a transport organization for delivery of the machine to the organization is reflected (excluding VAT) | 08-4 | 60 |

| 4 | The amount of VAT presented by the service provider for the delivery of the machine is reflected | 19-1 | 60 |

| 5 | Payment for services for the delivery of the machine has been made (including VAT) | 60 | 51 |

| 6 | The cost of work carried out by a third party to set up the machine is reflected (excluding VAT) | 08-4 | 60 |

| 7 | The amount of VAT presented by the supplier of work on setting up the machine is reflected | 19-1 | 60 |

| 8 | Payment for work on setting up the machine has been made (including VAT) | 60 | 51 |

| 9 | An asset (machine) that was received as a contribution to the authorized capital was accepted for accounting at its original cost. | 01 | 08-4 |

| 10 | The amounts of VAT paid on expenses incurred upon receipt of an asset as a contribution to the authorized capital are presented for deduction | 68-1 | 19-1 |

In cases where an organization receives an item of fixed assets that has been in operation, its value for tax accounting purposes is taken to be equal to the residual value of the item, confirmed by the documents of the transferring party.

For profit tax purposes, if the receiving organization cannot document the value of the contributed property or any part of it, then the value of this property or part of it is recognized as zero.

To determine the useful life of an object of fixed assets that was in operation and received as a contribution to the charter (stock) captain from the founder, it is necessary that he transfer all technical documentation for this object, including confirming the period of its actual operation from the time of acquisition ( construction, manufacturing).

In these cases, as a rule, until the moment of transfer, the fixed asset item was used by the transferring organization in the production of products, depreciation was calculated on it and the amount of VAT paid to the supplier was presented for deduction after the fixed asset item was accepted for accounting, and was not taken into account in the initial cost of the transferred property. object.

In accordance with paragraph 3 of Art. 170 of the Tax Code of the Russian Federation, in the case of transfer of such an object of fixed assets as a contribution to the authorized (share) capital of another organization, the transferring organization must restore the amount of VAT previously claimed for deduction on this object of fixed assets.

In relation to fixed assets of the transferring organization, the amount of VAT is subject to recovery in an amount proportional to the residual (book) value of the transferred fixed assets without taking into account revaluation.

Restoration of VAT amounts is carried out by the transferring organization in the tax period in which fixed assets were transferred to another organization as a contribution to the authorized (share) capital.

VAT amounts subject to recovery in such cases should not be included in the cost of the transferred fixed assets and are subject to tax deduction from the receiving organization.

For this purpose, the amount of VAT recovered by the transferring organization must be indicated in the documents that formalize the transfer of the specified fixed assets.

Amounts of VAT that were recovered by the transferring organization are subject to deduction from the organization that received fixed assets as a contribution to the authorized capital, provided that the received fixed assets are used to carry out operations recognized as objects of taxation by value added tax.

Deductions of the specified amounts of VAT are made by the receiving organization after registration of fixed assets received as a contribution to the authorized (share) capital of the organization.

From January 1, 2008, in accordance with subparagraph. 3.1 Art. 251 of the Tax Code of the Russian Federation, income in the form of VAT amounts subject to tax deduction from the receiving organization when receiving fixed assets as a contribution to the authorized (joint) capital is not taken into account when determining the tax base for income tax.

In accordance with the letter of the Ministry of Finance of Russia dated October 30, 2006 No. 07-05-06/262, the amount of VAT on fixed assets accepted as a contribution to the authorized (share) capital, subject to tax deduction from the receiving organization, is subject to reflection in the accounting records of the receiving organization according to the debit of account 19 “Value added tax on acquired assets” in correspondence with the credit of account 83 “Additional capital”.

Transactions involving the receipt of such fixed assets as a contribution to the authorized capital of the organization can be reflected in accounting using the following entries:

| No. | Contents of business transactions | Corresponding accounts | |

| Debit | Credit | ||

| 1 | The authorized capital of the organization, recorded in the constituent documents, has been announced | 75-1 | 80 |

| 2 | The cost of the fixed assets item received as a contribution to the authorized capital is reflected (in monetary value agreed upon by the founders of the organization) | 08-4 | 75-1 |

| 3 | Reflects the amount of VAT recovered by the transferring organization and indicated in the documents on the transfer of the fixed asset | 19-1 | 83 |

| 4 | An asset received as a deposit by contributing the authorized capital of the organization was accepted for accounting at its original cost. | 01 | 08-4 |

| 5 | The recovered amount of VAT on the received fixed asset was presented for deduction | 68-1 | 19-1 |

| < Previous | Next > |

Case Study

Medea LLC contributed a laptop to the authorized capital of Les LLC. The agreed monetary value of the founders is 40,000 rubles.

The initial cost of the laptop is 76,700 rubles. (including VAT - 11,700 rubles). The amount of accrued depreciation is RUB 32,500.

Solution:

- Debit 01 subaccount “Disposal of fixed assets” Credit 01 - 65,000 rub. (76,700 - 11,700) - the initial cost of the laptop has been written off.

- Debit 02 Credit 01 subaccount “Disposal of fixed assets” - 32,500 rubles. — accrued depreciation is written off.

- Debit 58.1 Credit 01 subaccount “Disposal of fixed assets” - 32,500 rubles. (65,000 - 32,500) - the residual value of the laptop has been written off.

- Debit 19 Credit 68 - 5,850 rub. ((32,500: 65,000) x 11,700) — VAT has been restored.

- Debit 58.1 Credit 19 - 5,850 rub. the restored VAT is taken into account as part of financial investments.

- Debit 58.1 Credit 91.1 - 7,500 rub. (40,000 - 32,500) - reflects the positive difference between the founders’ assessment and the residual value of the laptop.

- Debit 68 Credit 99 - 1,500 rub. (7,500 x 20%) - a permanent tax asset is reflected.

Increase the authorized capital

The amount of the authorized capital may be increased by the decision of the participants if certain conditions are met:

- Registration of an additional issue, conversion of shares with the Federal Tax Service or SBRFR (for joint-stock companies and PJSC).

- Payment in full not only of the initial deposits, but also of the increase.

The main sources of increasing the authorized capital are considered to be the organization's retained earnings, including additional capital or financial resources of the founders. If a new participant is accepted in addition to the others, then only his funds are taken into account. Also, a specific founder or several owners can increase their share at the same time. If all participants are involved in increasing the authorized capital, then such an increase is carried out through a proportional increase in all shares and shares.

Accounting entries reflecting the increase in the authorized capital (postings) are similar to the operations for the formation of the management company and are made on the immediate date of transfer of money or transfer of property objects. All decisions regarding transactions on such deposits are also reflected in the founding agreement.