Home — Articles

In the conditions of development of market relations, contractual relations between enterprises have become widespread. This is due to the fact that not all organizations can afford the appropriate equipment or the required workforce. Therefore, we have to resort to the help of other companies that perform various types of work or services on a contractual basis, for example, processing of materials, installation of equipment, construction of facilities, their major and current repairs, and much more. This work scheme is beneficial for both partners. The first to receive completed work or services. The latter receive both monetary compensation and production capacity utilization. However, there are some peculiarities in terms of accounting and documentation for one and the other party.

Civil relations

The transfer of goods as raw materials for processing on a toll basis is a type of contract.

Under a contract, the contractor undertakes to perform certain work according to the customer’s instructions and deliver it to the customer. The customer undertakes to accept and pay for the result of the work. When transferring raw materials for processing to a contractor, the organization retains ownership of it. In this case, the contractor, after completing the work, provides the customer with a report on the raw materials consumed and transfers the rights to the manufactured products to the customer. This follows from the provisions of paragraph 1 of Article 713, paragraph 1 of Article 220, paragraph 2 of Article 703 of the Civil Code of the Russian Federation.

Documenting

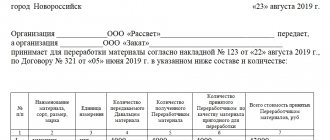

In order to reflect in accounting the performance of work under a contract for the manufacture of products using customer-supplied materials, it is necessary to correctly draw up the primary documents.

When transferring customer-supplied materials, it is not necessary to issue invoices, since there is no fact of sale of materials. In this case you can:

- draw up a transfer and acceptance certificate in any form;

- or issue an invoice for the release of materials to the third party using Form No. M-15, if the use of unified forms of primary documents is enshrined in the accounting policy.

The document is drawn up in two copies (one each for the customer and the contractor).

The cost of customer-supplied materials is written off in accounting based on the contractor’s (processor’s) report on their use.

Transfer of equipment

Equipment that does not require installation includes equipment that does not require preliminary assembly or installation on supports or foundations to put it into operation. These can be construction and road machines, cars, engines, instruments, etc. If equipment that does not require installation is purchased by the customer, then accounting for its acquisition, installation and commissioning is carried out only by the customer. For accounting purposes, machines and equipment that do not require installation, as well as machines and equipment that require installation , but are intended for stock (reserve), are accepted as fixed assets on the basis of a certificate of acceptance and transfer of fixed assets approved by the manager (clause 39 of the Guidelines for accounting of fixed assets approved by Order of the Ministry of Finance of Russia dated October 13, 2003 N 91n). Since this object remains the property of the customer, when transferring it to the contractor, an entry is made in analytical accounting under account 01 “Fixed Assets” (Instructions for the use of the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n ). Expenses for the formation of the cost of equipment that does not require installation are formed directly on account 08 “Investments in non-current assets”, a subaccount 08-4 “Purchase of fixed assets” is opened to it. The transfer of equipment to the contracting organization is formalized by a transfer and acceptance certificate drawn up in free form. It is recommended to approve the forms of documents independently developed by the organization in the accounting policy of the organization (clause 4 of PBU 1/2008 “Accounting Policy of the Organization”). Also, as such a document, you can use form N OS-15 “Act on acceptance and transfer of equipment for installation”, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 N 7. Installation of equipment is recorded by the presence of expenses in the certificate of the volume of work performed on the installation of this equipment ( or in the act of their inventory), drawn up in the prescribed manner (clause 3.1.3 of the Regulations on the accounting of long-term investments, approved by Letter of the Ministry of Finance of Russia dated December 30, 1993 N 160, hereinafter referred to as the Regulations on the accounting of long-term investments). The contractor is responsible for the failure to preserve materials, equipment provided by the customer, items or other property transferred for processing (processing) (Article 714 of the Civil Code of the Russian Federation). Equipment, the acceptance for operation of which is formalized in the prescribed manner, is included in fixed assets (clause 3.2.2 of the Regulations on Accounting for Long-Term Investments, clause 4 of PBU 6/01 “Accounting for Fixed Assets”).

Tax accounting

VAT

The amount of “input” VAT on purchased materials, which will subsequently be transferred to the contractor on a toll-to-pay basis, can be deducted by the customer in the usual manner.

Since the subsequent transfer of customer-supplied materials to the contractor is not recognized as a sale, this operation is not subject to VAT. Therefore, when transferring materials, the customer does not charge VAT and does not issue an invoice.

If the remaining unused materials are not returned by the contractor, the customer needs to reflect the sale of materials. And also charge VAT payable to the budget and issue an invoice to the contractor within 5 calendar days from the date of signing the report on the use of materials.

Income tax

The customer's costs for the purchase of materials are considered material costs. When calculating income tax, they are taken into account on the date of transfer to production.

At the time the customer transfers customer-supplied materials to the contractor, their actual transfer to production has not yet been confirmed; at this stage, no expense arises for profit tax purposes.

It can only be recognized on the date the customer approves the contractor's report on the use of materials.

If the contractor does not return the remainder of the supplied materials and counts them against payment for work performed, the customer must include them in income. For the purposes of calculating income tax, revenue from their sales is reflected as of the date of approval of the report on the use of materials.

simplified tax system

A customer who uses the simplified tax system with the object “income minus expenses” includes the cost of purchased materials as expenses at the time of payment to the supplier.

When selling the remaining customer-supplied materials to the contractor, the customer must reflect the simplified tax system income on the date of repayment of the debt for materials in accordance with the terms of the contract.

Read on the website

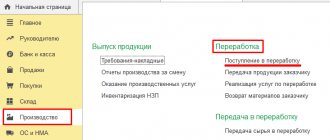

We recycle goods

Accounting press and publications

“Construction: taxation, accounting”, N 4, 2004

TRANSFER OF CONSTRUCTION MATERIALS TO THE SUBCONTRACTOR

To perform construction and specialized work, for example, to install elevators or plumbing equipment, the contractor has the right to involve other persons (subcontractors) in fulfilling its obligations. In this case, the contractor acts as the general contractor (or simply the main contractor if he does not receive compensation from subcontractors).

According to clause 3 of Article 709 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), the general contractor is responsible to the customer for the consequences of non-fulfillment or improper fulfillment of obligations by the subcontractor, and to the subcontractor is responsible for the non-fulfillment or improper fulfillment by the customer of obligations under the contract.

In relation to the subcontractor, the general contractor performs the functions of the customer. The construction contract may stipulate that the construction in whole or in a certain part is provided by the customer.

Article 713 of the Civil Code of the Russian Federation determines that the contractor is obliged to use the material provided by the customer economically and prudently, after completing the work, provide the customer with a report on the consumption of the material, and also return the remainder or, with the consent of the customer, reduce the price of the work taking into account the cost of the unused material remaining with the contractor.

The ownership of the materials transferred for processing remains with the customer (Article 220 of the Civil Code of the Russian Federation). In this case, the materials must be accounted for as customer-supplied raw materials.

The methodological instructions for accounting for inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 N 119n (hereinafter referred to as the Methodological Instructions), define that customer-supplied materials are materials accepted by the organization from the customer for processing (processing), performing other work or manufacturing products without payment for the cost of accepted materials and with the obligation to fully return processed (processed) materials, delivery of completed work and manufactured products. Wherein:

— materials are transferred by the customer to the contractor without transfer of ownership;

— the contractor processes the customer’s construction materials, resulting in the formation of a finished building or part of it;

— ownership of construction work passes from the contractor to the customer, with the exception of ownership of materials transferred by the customer to the contractor.

The transfer of building materials must be documented with appropriate invoices with reference to the transfer for customer-owned processing. The subcontractor prepares a report on the materials used. The subcontractor either returns the rest of the unused materials to the general contractor or reduces the amount of payment for the work performed by their value, since it receives ownership of these materials.

Since there is no transaction for the sale of construction materials, the customer does not have any additional VAT taxable items.

Let's consider the reflection in the accounting of the general contractor and subcontractor of the transfer of customer-supplied materials to the subcontractor and calculations of value added tax on these materials.

Analytical accounting of customer-supplied materials from the subcontractor is carried out by customer, name, quantity and cost, as well as by storage and processing locations (work performance, product manufacturing).

In accordance with paragraph 157 of the Methodological Instructions, an organization that has transferred its materials to another organization for processing (processing, performing work, manufacturing products) as toll, does not write off the cost of such materials from the balance sheet, but continues to account for them in the account for the corresponding materials (in a separate sub-account ).

The subcontractor's materials are accounted for in off-balance sheet account 003 “Materials accepted for processing.”

The customer, who transfers materials for processing, takes them into account during the entire construction period in account 10 “Materials”, subaccount 7 “Materials transferred for processing to third parties”. Upon completion of construction, processing costs and the cost of materials are charged to an increase in the initial cost of the construction project from the customer or to the cost of construction work by the general contractor.

In this case, the following entries are made in the accounting records of the general contractor:

Debit 10 Credit 60 “Settlements with suppliers and contractors” - reflects the purchase of materials that are planned to be transferred to the contractor on a toll basis;

Debit 19 “Value added tax on purchased values” Credit 60 - VAT was charged on the cost of purchased materials;

Debit 60 Credit 51 “Current accounts” - the debt to the supplier of materials has been paid;

Debit 68 “Calculations for taxes and fees”, subaccount “Calculations for VAT” Credit 19 - submitted for deduction of VAT on materials purchased, registered and paid for;

Debit 10, subaccount 7 “Materials transferred for processing to third parties” Credit 10, subaccount 1 “Raw materials and materials” - the accounting value of raw materials and materials transferred for processing is written off;

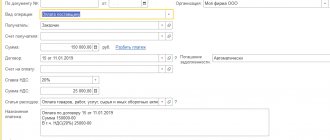

Debit 20 “Main production” Credit 60 - reflects the cost of subcontracted construction work (excluding VAT) accepted for payment (i.e., minus the cost of customer-supplied materials);

Debit 19 Credit 60 - VAT is reflected on the cost of construction work on processing materials that do not become the property of the subcontractor;

Debit 20 Credit 10, subaccount 7 “Materials transferred for processing to third parties” - the accounting value of raw materials and materials transferred for processing (not becoming the property of the subcontractor) is written off upon acceptance of the finished construction project;

Debit 10, subaccount 6 “Other materials” Credit 10, subaccount 7 “Materials transferred for external processing” - reflects the cost of returned materials received from the contractor;

Debit 10, subaccount 1 “Raw materials” Credit 10, subaccount 6 “Other materials” - reflects the cost of returned materials received from the contractor, which can be used in the following construction work.

Thus, the transfer of materials for processing is not considered as their sale.

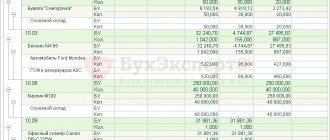

Example 1. The general contractor hired a subcontractor to perform the work. Construction materials according to the terms of the contract are provided by the general contractor.

The cost of building materials is 118,000 rubles, including VAT 18% -18,000 rubles.

These business transactions are reflected in the general contractor’s accounting as follows:

Debit 10, subaccount 1 “Raw materials and supplies” Credit 60 - 100,000 rub. — materials were purchased for transfer to the contractor on a toll basis (excluding VAT);

Debit 19 Credit 60 - 18,000 rub. — VAT is charged on the cost of purchased raw materials and supplies;

Debit 60 Credit 51 - 118,000 rub. — the debt to the supplier of materials has been repaid;

Debit 68 Credit 19 - 18,000 rub. — the amount of VAT on paid and received materials is credited;

Debit 10, subaccount 7 “Materials transferred for processing to third parties” Credit 10, subaccount 1 “Raw materials and supplies” - 100,000 rubles. — reflects the cost of raw materials and materials transferred for processing.

The conditions for applying VAT deductions are established by clause 2 of Article 171 and clause 1 of Article 172 of the Tax Code of the Russian Federation:

— materials must be accepted for accounting and used in taxable activities;

- the tax amounts presented must be paid;

— there is an invoice with a allocated VAT amount.

Tax authorities believe that tax deductions cannot be applied until VAT amounts are calculated for payment to the budget, i.e. until the relevant objects of completed capital construction are registered or the objects of unfinished capital construction are sold. Thus, according to the tax authorities, construction organizations, when purchasing materials, goods and services for construction, do not have the right to apply tax deductions until its completion. At the same time, defending this point of view, they invariably lose in court. This follows from the determination of the amount of tax payable to the budget established by clause 1 of Article 173 of the Tax Code of the Russian Federation.

If a construction organization receives an advance (prepayment for contract work), in accordance with Article 162 of the Tax Code of the Russian Federation, it already has an obligation to pay VAT. Then, during the period of receiving the advance, she can immediately apply a tax deduction for purchased and paid for goods, work, and services.

To apply tax deductions, it does not matter on what object the obligation to pay VAT arises. For example, an organization is constructing several facilities and one of them is registered for its own consumption. The organization has an obligation to charge VAT on the cost of work performed and pay it to the budget. In the same period, it is legal to apply a tax deduction on expenses for any object for which this organization is a contractor.

The following entries are made in the accounting records of a construction subcontractor that accepts materials for processing:

Debit 003 - reflects the cost of materials accepted for processing;

Debit 20 Credit 10, 23 “Auxiliary production”, 25 “General production expenses”, 26 “General business expenses”, 69 “Calculations for social insurance and security”, 70 “Settlements with personnel for wages”, etc. - processing costs are reflected raw materials and supplies;

Debit 90 “Sales”, subaccount 2 “Cost of sales” Credit 20 - costs of transferring finished products to the customer are written off;

Debit 62 “Settlements with buyers and customers” Credit 90, subaccount 1 “Revenue” - revenue from processing work is reflected (without taking into account the cost of materials received on toll terms);

Debit 90, subaccount 3 “Value added tax” Credit 68, subaccount “Calculations for VAT” - VAT is charged on revenue;

Debit 90, subaccount 9 “Profit/loss from sales” Credit 99 “Profits and losses” - the financial result is determined;

Debit 99 Credit 68, subaccount “Calculations for income tax” - income tax accrued;

Debit 51 Credit 62 - reflects the repayment of accounts receivable for services related to material processing.

Credit 003 - the cost of raw materials and materials accepted for processing is written off.

Example 2. A construction organization - a subcontractor received from the general contractor (customer) construction materials in the amount of 118,000 rubles. (including VAT 18% - 18,000 rubles). The cost of work agreed upon by the parties is 35,400 rubles. (including VAT 18% - 5400 rubles). Reception of materials is formalized by a receipt order (Form N M-4) with a note that the materials were received by the organization on tolling terms.

The following entries are made in the accounting records of the subcontractor organization:

Debit 003 - 100,000 rubles. — reflects the cost of materials accepted from the customer;

Debit 20 Credit 69, 70, etc. — 20,000 rub. — the costs of constructing the facility are reflected;

Debit 62 Credit 90, subaccount 1 “Revenue” - 35,400 rubles. — reflects the cost of services for the construction of the facility agreed upon by the parties (including VAT);

Debit 90, subaccount 2 “Cost of sales” Credit 68, subaccount “VAT calculations” - 5400 rubles. — VAT is charged on the cost of services provided;

Debit 90, subaccount 2 “Cost of sales” Credit 20 - 20,000 rubles. — actual costs associated with the provision of services to the customer are written off for sales;

Debit 51 Credit 62 - 35,400 rub. — actual payment by the customer for the cost of services provided is reflected;

Loan 003 - 100,000 rub. — the cost of customer-supplied materials was written off upon transfer of the finished object to the customer.

Thus, the contractor records operations related to the processing of customer-supplied materials in off-balance sheet account 003 without using double entry until the customer accepts the construction work (transfer of finished products).

Analytical accounting of raw materials and supplies on this account is carried out by customer, by type of value and in the assessment provided for in contracts (clause 156 of the Methodological Instructions).

The transfer of materials is reflected in the general contractor’s accounting in a slightly different manner if he sells construction materials to a subcontractor under a separate agreement (transfers ownership of the material):

Debit 62, subaccount “Settlements for Other Income and Expenses”, subaccount 1 “Other Income” - reflects the supply of materials at negotiated prices;

Debit 91, subaccount 2 “Other expenses” Credit 10 - the purchase price of building materials is written off (excluding VAT);

Debit 91, subaccount 2 “Other expenses” Credit 68, subaccount “Calculations for VAT” - reflects VAT on materials sold;

Debit 91, subaccount 9 “Balance of other income and expenses” Credit 99 - profit from the sale of materials is taken into account;

Debit 60, subaccount “Settlements with subcontractor” Credit 62, subaccount “Settlements for BKR-Intercom-Audit”

Signed for seal

26.11.2004

—————————————————————————————————————————————————————————————————— ———————————————————— ——