Features of import operations

Import is the import of goods into the customs territory of the Russian state without obligations for their re-export (Clause 10, Article 2 of Federal Law No. 164-FZ).

Delivery of goods to the customs territory of the Russian state is permissible only at state border checkpoints. In this case, the carrier is obliged to deliver the products imported by him to the checkpoint, present them to the customs authority, and also provide the documentation provided for in Art. 73-76 TC (Customs Code) of the Russian Federation.

A distinctive feature of import transactions is the fact that value added tax is paid not to the tax authority, but at the customs post along with other fees, duties and excise taxes. The exceptions are the following material assets:

- products that are imported free of charge or as humanitarian aid;

- technological equipment that has no analogues and is not produced by countries that are part of the Customs Union:

- medicines and medical equipment (according to the list approved by the Russian Government);

- cultural property that receives funding from the federal budget and property received as a gift from cultural institutions;

- printed products received by libraries or museums as a result of non-commercial transactions (for example, international exchange);

- untreated natural diamonds;

- material assets that are imported for personal use by representatives of foreign diplomatic organizations;

- securities and currency:

- marine industry products caught and processed by Russian organizations:

- objects that are used for the purpose of studying and developing outer space;

- objects that are aimed at the implementation of the 2014 Olympic and Paralympic Winter Games.

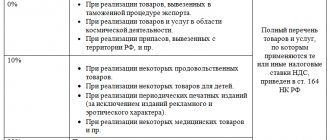

A complete list of goods that have received exemption from paying this tax at customs is given in Art. 150 Tax Code of the Russian Federation. Depending on the type of imported material assets, according to Art. 164 of the Tax Code of the Russian Federation, the tax rate can vary from ten to eighteen percent.

Thus, ten percent VAT is paid on the import of imported food products, medical supplies and equipment (which are not included in the list approved by the Government of the Russian Federation), imported goods for children, printed books and periodicals. If the products that are imported are not included in the above categories, then they are taxed at an eighteen percent rate.

The deadline for paying value added tax on imports in 2014 is considered to be fifteen days from the moment the goods are presented to the customs authority. [goo_mid]

Accounting for joint production in the Russian Federation

Enterprises created to conduct joint activities form an authorized capital from the contributions of each party. The status and procedure for conducting activities of an organization registered on the territory of the Russian Federation is determined by the legislation of the country. A joint venture can be created in any of the existing organizational forms. Founders can be both organizations and individuals.

Accounting for deposits received from foreign founders is kept separately from the shares of Russian participants. Documentation of an enterprise registered in the country is drawn up in Russian or a foreign language, accompanied by translation. Transactions are accounted for separately, and the main provisions are set out in the accounting policy:

- Working chart of accounts and accounting of transactions on separate sub-accounts of analytics.

- The share of participation of each party in the activities of the enterprise.

- Distribution of profits received from activities (in the standard version, determined in the ratio of shares).

- Distribution of expenses incurred in generating income.

- The procedure for generating reporting, including forms for internal accounting for submission to each participant. JVs often use management accounting in their activities with the distribution of expenses by cost location.

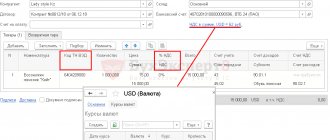

A feature of accounting in a joint venture is the use of foreign currency along with Russian. Receipts from the participant in foreign currency are recalculated at the Bank of Russia exchange rate on the date of acceptance of the asset. Accounting for transactions in foreign currency is carried out taking into account legal requirements.

Taxation of joint ventures is carried out in accordance with the Tax Code of the Russian Federation, taking into account the prevention of double taxation.

Object of taxation and conditions for deducting VAT on imports

According to Art. 160 of the Tax Code of the Russian Federation, the object of VAT taxation when importing goods consists of the cost of these goods, which is indicated in the declaration, the amount of customs duty and the amount of excise tax.

Payment of value added tax, as well as other customs duties, must be made to the account of the Federal Treasury. In order for value added tax paid upon import to be deductible, the following requirements must be met:

- Imported material assets must be registered. If these goods were purchased for further sale, then their acceptance for accounting is carried out by posting their price to accounting account 41. As for the import of fixed assets, they are considered accepted for accounting immediately after their actual acceptance into accounting account 07 ( Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 24, 2004 N 10865/03).

- The taxpayer must have all the necessary primary documentation. Moreover, in this case, the basis for deducting VAT that was paid upon import is not invoices, but a customs declaration;

- products that are imported must be used to carry out operations that are subject to value added tax;

- actual payment of VAT to the customs authority. In the case where payment for imported goods was made using funds borrowed, the tax authority does not have the right to decide to deny the company a deduction.

If the customs tax was paid by a third party (for example, the importer’s debtor), then, according to Art. 328 of the Labor Code of the Russian Federation, the tax authority does not have the legal right to refuse a deduction.The amount of VAT paid when carrying out import operations is reflected in the declaration, which must be submitted to the tax authority no later than the 20th day of the month following the tax period. Along with the declaration, the following documentation is submitted to the tax authority:

- application for import and payment of indirect taxes;

- bank statement confirming the fact of payment of taxes on import transactions;

- shipping documentation that confirms import;

- an agreement that serves as the basis for operations to import products;

- supplier invoices.

Features of documentary accounting of foreign trade activities

A standard chart of accounts is used to record transaction data. To obtain reliable information, separate sub-accounts are used to separate data on ordinary and foreign economic activities.

Features of conducting business include: (click to expand)

- Availability of payments made in foreign currency. The need to keep records in Russian rubles obliges enterprises to convert currencies, taking into account emerging exchange rate differences.

- The emergence of additional supporting documents.

- Application of a special procedure for VAT taxation.

The main document on which accounting is based is the Federal Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control.” Conducting foreign economic activity obliges enterprises to use additional forms of primary accounting that are not used to reflect domestic transactions. Forms completed in a foreign language must be translated.

Documents often used in accounting:

| Document | Description |

| Transaction passport | Confirms the legality of the transaction and has the information necessary to carry out control |

| Contract | Concluded with foreign partners |

| gas turbine engine | Filled out for each batch when moving goods or placing them under customs control |

| Invoice | Issued by the seller for the buyer and contains data about the product |

| Licenses, certificates, insurance policy | A complete list of required documents is provided by the body exercising control |

Reimbursement of value added tax on imports in 2014

An enterprise has the right to a refund when carrying out import operations if during the reporting period the amount of VAT actually paid through the customs post is greater than the amount of VAT payable, as well as at a rate of zero percent.

An enterprise can claim a VAT refund if a number of conditions are met:

- this enterprise is a VAT payer;

- imported products are not exempt from tax;

- the fact of payment confirmed by a tax return and correctly executed primary documentation.

In 2014, compensation can be made in the following forms:

- offset on the payer’s existing debts and penalties;

- refund of funds to the taxpayer's bank account;

- credit for future tax payments;

- partial refund and credit.

Common mistakes when conducting foreign trade activities

Accounting for foreign trade activities is accompanied by many nuances that arise when using customs legislation, international law and making payments in foreign currency

| Position | Wrong position | Correct position |

| Accounting for currency transactions | Accounting is carried out in foreign currency or taking into account commercial exchange rates | If there are currency transactions, accounting is carried out in rubles, recalculated at the exchange rate of the Central Bank of the Russian Federation on the date of receipt of the proceeds |

| Condition of an international contract on the transfer of rights | The condition is not defined or options are not reflected when changing the terms of payment or the participation of an intermediary | The condition is important for determining when revenue is reflected in accounting |

| VAT adjustment on exports | There is no VAT adjustment if export cannot be confirmed within 180 days | Upon expiration of the period, the company generates a new document - an invoice indicating the VAT rate of 10 or 18%, pays the arrears and submits an updated declaration |

Accounting for import operations in 2014

Tax obligations to the state budget are reflected in accounting account 68, “Calculations for taxes and fees.” The debit of the nineteenth account “Value added tax on acquired assets” records VAT, which is calculated for payment to the state budget. To carry out accounting when importing, you must make the following entries:

- Dt 68 - Kt 51 - payment of tax when importing material assets into the territory of the Russian state.

- Dt 19 - Kt 68 - accounting for the volume of tax on imported products.

- Dt 41 - Kt 60 - registration of imported goods.

- Dt 68 - Kt 19 - the amount of VAT that was paid through customs is accepted for deduction.

If, despite the availability of substantiated documentation, the fiscal authorities make a decision to deny the taxpayer a refund, then he has the right to appeal to the arbitration court.

How to reduce tax payments when purchasing goods in China

Hong Kong is an administrative region of the People's Republic of China. However, due to historical reasons, it has developed its own economic, financial, and tax system, different from China. This duality of systems within one state creates the possibility of using an export scheme, thanks to which each of the participants benefits. And not only economic, but also tax. This scheme allows you to avoid paying taxes in China and Hong Kong and significantly reduce the input VAT paid by companies when importing goods into the Russian Federation.

In our country, actions aimed solely at obtaining tax benefits are considered illegal. Paragraph 2 of paragraph 9 and paragraph 11 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 No. 53 states that a tax benefit cannot be considered as an independent business goal. The court's recognition of a tax benefit as unjustified entails a refusal to satisfy the taxpayers' claims related to its receipt.

However, the use of the Sino-Hong Kong link does not fall within this definition. Because businessmen act according to the laws of the jurisdiction where the business is registered. But the legislation of China and Hong Kong does not contain such restrictions.

The gray economy is artificially created at the state level

When doing business in China, it is impossible to stay away from gray schemes, because all Chinese businesses use them. It is precisely this kind of import-export activity that makes the entire Chinese economy gray. Moreover, such a policy finds support at the state level. One could even say that conditions have been created that encourage gray schemes.

The reason for this is the obvious benefit that China receives. The modernization of its economy since 1976 has led to China becoming the world's factory within 20 years. In China, conditions have been created for foreign investors to make profitable investments in the economy. Partly thanks to cheap labor – there are few places in the world where workers receive such low wages. According to statistics for 2012, the average salary of a Chinese worker is $80 per month.

But it is obvious that at this level of income people cannot buy the bulk of industrial goods. Domestic consumption of goods produced by China is impossible. Therefore, the economy is export-oriented.

At the same time, people who profit from this state of affairs try to protect their capital. Hong Kong, which is essentially a pocket offshore of the Chinese elite, can help with this. Such an island on which you can place capital completely legally and without taxes. Naturally, Chinese laws do not apply there.

Hong Kong is a former English colony, English law applies there, and trust relations apply. Accordingly, there is a possibility of concealing the beneficial owners of a business.

The PRC turns a blind eye to these manipulations. They ultimately make it possible to solve internal problems: they provide employment to the population, reducing social tension.

So if a Russian company wants to buy goods from a manufacturer from China, then most likely, a scheme involving a Hong Kong intermediary will initially be proposed by the counterparty itself. The only question is how fully the Russian entrepreneur will be involved in the process of obtaining tax benefits.

For the purposes of applying the scheme in Russia, the benefit is that when importing, customs duties and VAT are assessed at customs based on the customs value of the goods. The lower the price, the less the company will pay. Therefore, they are trying to import the goods at the lowest possible price. And then, through a chain of resellers, including those using special modes, the selling price rises to the level required by the business owner. The diagram presented in the article (see diagram) considers an option beneficial for the Russian side.

Import from China with the participation of a Hong Kong intermediary

Inclusion of a Hong Kong company in the chain reduces risks

Let us consider in detail what the “foreign” chain of counterparties consists of. The initial stage is a company producing goods in China. From now on we will call this company the manufacturer. A contract for the supply of products is concluded with a Chinese manufacturer. Let's assume that the contract price is 100 units per product.

In China, all companies have limited legal capacity. A manufacturing company cannot carry out import-export activities. Companies engaged in export-import operations do not have the right to produce and process products. But one person can be the owner of both a manufacturing and an export-import company. And in this case, based on the requirement to limit legal capacity, transactions can be concluded between related companies. This means that business fragmentation is justified at the state level.

In this case, it is noteworthy that in order to export goods, the manufacturer needs another company. In this chain, the export-import company does not become the owner of the goods; the manufacturer enters into an agency agreement with it. And under this agreement the agent receives remuneration. Note that it can be very, very modest - fractions of a percent of the transaction, perhaps even hundredths.

The benefit of the agent is that, according to Chinese law, he is considered the exporter. At the same time, unlike Russian ones, Chinese exporters pay VAT not at zero, but at the regular tax rate, which, depending on the type of product, can reach 17 percent. In agency relationships, this tax is paid by the principal, but the agent has the right to a refund from the budget.

At the same time, in China there is a widespread practice of inflating the sales price in order to obtain more VAT from the budget. In order to stimulate exports, it is officially permitted. For example, a Chinese manufacturer instructed an agent to sell a product at a price of 100 units. However, the document agent inflates the sale price of the goods, usually in a ratio of 5:8.

In our example, he will add another 60 to 100 units. Thus, the agent will be refunded VAT in an amount greater than what was paid to the budget, and not by the exporter himself, but by the manufacturer. Everything that the state returns to the export-import company is the profit of this company. If the owner of the agent is not the manufacturer himself, then he is usually paid a part of this profit, about 40 percent.

But since the buyer must deliver the goods at the agreed price, a Hong Kong intermediary appears in the scheme. It is with this company that the exporter enters into a contract. And the intermediary sells the goods to the Russian company. It turns out that it is sold at a price lower than the purchase price, and the Hong Kong intermediary incurs a loss.

Note that in the customs declaration on the Chinese side - since the law establishes a limitation of legal capacity - there are two columns for indicating the supplier. One is for the manufacturer, the other is for the exporting agent. In this case, Russian customs authorities may require the manufacturer's price list to compare the selling price with the contract price.

However, when concluding a contract with a Hong Kong company, this risk is reduced to zero. In this case, the manufacturer remains outside the deal.

If the Hong Kong intermediary is “foreign”, then you can agree on an “official” price reduction. In this case, the contract indicates the price that interests the Russian buyer. Then part of the cost under this contract will be paid in advance.

This option will suit the Chinese manufacturer quite well - he will not have to show full revenue and convert it into yuan at a rather unfavorable government exchange rate. Income tax in China is 25 percent, and VAT is also paid. Therefore, they will only be happy to reduce the cost of the contract. The money will go directly to some Hong Kong subsidiary of the manufacturer, and they are sometimes used as electronic wallets.

Having your own company in Hong Kong increases your tax benefits

In such transactions, it is more profitable for a Russian business owner to also act as the owner of a Chinese exporting agent and a Hong Kong intermediary. If you want to invest in production in China, you can include the manufacturing company in your chain. But the presence of a Hong Kong intermediary affiliated with the Russian side makes it possible at this stage to set any transaction price. It can be reduced as much as possible in order to save customs duties and VAT. In our scheme, the selling price was set to 30 units.

But you still need to start building your own Chinese-Hong Kong business with a Hong Kong company. In Hong Kong, companies have no restrictions on legal capacity, but do not forget about the territorial basis of taxation in this jurisdiction - income received outside of Hong Kong is not subject to taxes in this country.

To do this, it is desirable that the company does not have an office, much less production units, in Hong Kong. Of course, the address is indicated when opening a company, but the office itself is not there. The company has only a secretary on staff who receives and forwards correspondence. He performs only such nominal work and cannot be involved in the business activities of the firm. Thus, Hong Kong welcomes what Russia is fighting against – a fictitious legal address.

The goods should not arrive in Hong Kong - clear customs and be sold there. For contracts, the requirement to earn income outside of Hong Kong is determined by the place where the contract was concluded – it does not have to be Hong Kong.

Accordingly, the lack of internal income must be proven. For these purposes, the company undergoes an external audit annually.

Auditors need to prove that the address is fictitious and the transactions are not related to Hong Kong. To confirm this, the auditee fills out the “Operations Test” table. It consists of items that are and are not related to business. In particular, the test may contain the following questions: when was the last time you saw your wife/husband, what restaurant did you have dinner at, when was the last time you fed the dog? These questions reveal how much of a person's time was spent in Hong Kong rather than at home.

Before the audit, you can undergo a paid consultation. It shows the auditor all transactions, and he then makes recommendations on how to avoid paying taxes where possible. This consultation is absolutely legal, but quite expensive. An alternative and often more economical option is business support services. They are provided by specialized companies.

Proof that the deal went past Hong Kong is provided by primary documentation. In Hong Kong it is recognized only electronically. The contracts that pass through the bank, their invoices, bills of lading and export declarations are saved. When conducting bank transactions, they offer to print out their confirmation. In this case, you should select the print to file option. It is this electronic statement that will be proof of the completed money transfer. And if a company wants to save on accountant services, then it is better to immediately save the statements, systematizing them monthly.

Reporting is also provided only in electronic form. There are no paperwork requirements in Hong Kong.

Note that for a company that plans to operate in Hong Kong for a long time, it sometimes makes sense to show part of its income in Hong Kong. The income tax is relatively small - 16.5 percent. There are no indirect taxes.

Income of individuals in the form of wages is taxed at a floating progressive rate. However, the income of employees who are not tax residents of Hong Kong is not subject to taxation.

Hong Kong also has a property tax. It is high, which is explained by the high cost of the cadastral value of land. Accordingly, this affects the rental price.

Hong Kong positions itself as a liberal and non-offshore economy. Therefore, it does not have acts that discriminate against residents of other states. There are no currency controls, as in Russia, and there are no “black” lists of jurisdictions.

However, the government is paying attention to how Hong Kong is treated in other countries. Since in Russia Hong Kong is on the “black” list of the Ministry of Finance, Hong Kong banks are directed to create maximum obstacles to the opening of accounts and the movement of money through them for Russian clients. This has become especially noticeable in the last one and a half to two years. Therefore, a situation may arise when a company is registered, but problems arise at the stage of opening an account - after passing an interview at the bank, the company will be refused to open an account for administrative reasons.

Of course, you can open a bank account in any other jurisdiction. But from the point of view of Russian currency and tax controls, such transactions will attract attention.

A nominal service helps to get around this problem in practice. In Hong Kong, a common type of income is renting out passports. During the rental period of the passport, its owner can be made a nominee director of the company. A bank account is opened on behalf of this person, but he is not the account manager.

After a Hong Kong company has fulfilled its purpose, it is better to close it officially. All you need to do is submit a liquidation balance sheet. It's a small price to pay for peace of mind.

If you leave a company, the consequences can be unpredictable. When a company does not pass an audit, information about this is posted on a special resource. Chinese scammers are constantly viewing it in order to use it for their own purposes. To do this, it is enough just to forge the seal of the abandoned company and the signatures of its management, and copy documents. And while commercial structures do not think of looking at the same resource, a loan can be issued to the company, something can be registered.

One more link will add respectability and tax savings to the scheme

In the last year, the scheme we considered also began to include a company in some respectable jurisdiction. For example, British. As a result, goods come to Russia from the United Kingdom. Even if it actually comes straight from China, the transaction passport is still issued under a British contract. This implies greater credibility in the transaction.

In addition, with the help of an intermediary from the UK, legal withdrawal of funds is possible. To do this, a trademark is registered in the United Kingdom. When ordering goods from a Chinese manufacturer, a condition is imposed that this trademark be indicated on the goods. They will also have a UK barcode. The country of origin will remain China (this is a requirement of Chinese law), but the label and brand will be from the UK. This will significantly increase the value of the product in the eyes of the end consumer.

But for a Russian company, the use of a trademark under a licensing agreement is also valuable. This allows the English copyright holder to reduce its income tax liability through royalties.

There is no double taxation agreement between Russia and Hong Kong. Moreover, the Ministry of Finance has Hong Kong on the “black” list of offshore companies. But Russia has such an agreement with Great Britain. It establishes that royalties are taxable only in the United Kingdom. And from there, through various expenses or loans, the money is transferred to Hong Kong, to the account of the Hong Kong company to cover the loss of the scheme and finance subsequent deliveries.

Since Hong Kong is a former British colony, they have a very favorable double taxation agreement with the United Kingdom. The withholding tax rate for royalty payments in the UK is capped at 3 percent; dividends are not taxed at all if the recipient owns at least 10 percent of the shares in the source company. Also, interest rates on borrowed funds are not taxed unless they are paid to banking institutions.

Things to remember when working under the China-Hong Kong scheme

There are not many risks in using the scheme. And they can be divided into two groups, according to the territory of origin: Russian and Chinese.

Do not forget that when determining the customs value of goods, the key point is the price of risk. This is the average cost of a product at which it can be imported into the Russian Federation. If the contract price is too low, another document will be added to the cargo customs declaration - CTS (adjustment of customs value). Customs duties and VAT will be calculated for the value indicated therein. The importer will have to pay them first, and then sue customs to return the overcharged amounts. This is possible, but long and unpleasant.

Therefore, it is advisable to either set the contract price close to the risk price, or have arguments on hand that will justify the low level. For example, an entrepreneur imported goods at a low price because they were sold to him as defective. Already on the territory of Russia, the products were finalized, after which they were released for sale. This helped justify the contract price as a customs value.

The risk is also the participation of chains of resellers in Russia. They are used in practice to raise the price to the desired level. Currently, transactions involving intermediaries and resellers are under special control by tax authorities. If the persons in the chain are recognized as interdependent, then the importing company may be subject to additional taxes according to the rules of transfer pricing (Article 105.3 of the Tax Code of the Russian Federation).

As for the risks that are possible on Chinese territory, they are explained by the mentality of the country. According to Chinese business customs, all laws adopted in the world, including international acts, are applied to the extent that they correspond to the interests of China. Domestic legislation of China takes precedence over international legislation when resolving disputes.

An example is trademark law. Wherever a trademark is registered, it is recognized as protected in the PRC only under one condition. This trademark must be registered under the domestic laws of China or known to a sufficiently wide range of the Chinese public.

In essence, this clause cancels everything that was written before. Therefore, when working in China with your own trademark, it is necessary to register it in accordance with the laws of this country. Or take steps to familiarize the Chinese population with it.

How is it beneficial for a Russian importer to participate in a scheme for the supply of goods from China from a friendly Hong Kong intermediary? the opportunity to reduce the import customs value of goods and reduce duties. the opportunity to recover more VAT from the budget; In order to reduce customs duties, it is more profitable for a Russian importer to import goods into Russia at the lowest price. To do this, a friendly Hong Kong intermediary can resell the goods to a Russian importer at a loss.