A GPC agreement concluded between an organization and an individual provides for compensation to the contractor for expenses arising in connection with the provision of services under the agreement.

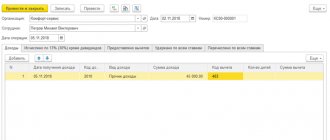

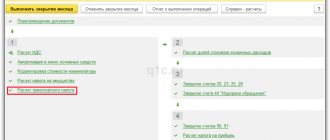

The amount of reimbursed expenses is not subject to personal income tax and insurance premiums, but must be taken into account in the calculation of insurance premiums in the total amount of income of an individual, as well as as part of non-taxable payments. Indicating the amount of expenses in the details Amount of deduction of the document Contract (work, services) (Salary – Contracts (including copyright) – Contract (work, services)) is not suitable in this case, because with this option of reflection the payment will be subject to insurance contributions.Information about the reflection of compensation of expenses in accounting is supposed to be generated on the ZUP 3 side, therefore the document Contributions Accounting Operation (Taxes and Contributions - Contributions Accounting Operations) is also not a solution in this situation.

Let's consider what documents can be used to reflect the reimbursement of expenses to the contractor under a civil process agreement in the program.

This problem can be solved in different ways depending on additional conditions. Possible solutions include:

- Document One-time charge (Salary – One-time charges). It is convenient to use this document if:

- in accounting, compensation for expenses is reflected in accounts 70 or 73;

- you need to see the amount of compensation in the analytical Salary Reports (Salary – Salary Reports);

- It is necessary in ZUP 3 to reflect the payment of compensation for expenses using the document Statement...

- Document Accrual of other income (Payments – Other income – Accrual of other income). This option is convenient:

- if in accounting, settlements with the contractual partner are reflected in account 76;

- when there is no need to reflect the payment in the salary program.

Let's look at both solutions using examples.

What can still be compensated?

Under civil contracts for the performance of work or provision of services, the contractor can count (Clause 2 of Article 709, Article 783 of the Civil Code of the Russian Federation): - remuneration for his services or work. This will actually be its economic benefit; - to compensate for their costs.

We warn the manager If you decide to compensate the contractor for his costs, then it is better to indicate in the contract separately the amount of remuneration and separately a clear list of compensated costs and the procedure for their compensation (Clause 4 of Article 709 of the Civil Code of the Russian Federation). You can also specify the limits (“standard”) of reimbursable costs. This is necessary to avoid conflicts with both the contractor and the tax authorities.

Now let’s outline this very list of compensable costs in relation to a citizen contractor. These can only be costs directly related to the execution of the contract. At the same time, goods, works and services, the cost of which your company is ready to compensate to the contractor, must be used to perform the work you need (provide services). You, of course, can compensate the contractor for the purchase of expensive equipment. But regulatory authorities (tax inspectorate and extra-budgetary funds) may reasonably consider that this is no longer compensation for costs, but a way of paying part of the remuneration or even a gift to the contractor. This means that there will be additional personal income tax and insurance premiums. After all, he can use this equipment to fulfill orders from other companies. With the same success, you can compensate the contractor for the purchase of a machine, which he also partially uses for the benefit of the customer. So, for tax purposes, it is safer to limit ourselves to compensation of expenses: - for materials, work and services necessary to complete your order. For example, a contractor purchases wood and processes it according to your needs; — for travel to the place where the work is actually performed and accommodation there . This is typical for situations when you hire a nonresident citizen and he has to get to your city and rent housing there. Or, conversely, you send a local contractor to provide services to another city.

What about compote?

That's probably all the usually reimbursable expenses. But some companies also pay private contractors a “per diem” allowance, usually in the same amount as their full-time seconded employees. Let us immediately note that daily allowances are provided only to “regular employees” sent on business trips (Articles 166, 168 of the Labor Code of the Russian Federation). And you will have a dispute with inspectors from both the Federal Tax Service (regarding the withholding of personal income tax) and extra-budgetary funds (regarding the calculation of insurance premiums). In addition, tax authorities will not allow such “daily allowances” to be taken into account when taxing profits. So it is better not to call these payments exactly per diem, but to compensate the contractor for the inconvenience of staying in another city: ( or ) under the guise of compensation for the costs of an individual contractor for food, if, of course, they are documented by the contractor. Although you are not obliged under the Civil Code of the Russian Federation to provide food for the contractor, in particular, when performing work in another locality, you have the right to assign such an obligation to yourself by contract. True, even in this case, a dispute with the tax authorities is likely, who are unlikely to consider such expenses of contractors directly related to the implementation of your contract; ( or ) increased remuneration. That is, you simply increase it by the approximate amount of the contractor’s “overhead” costs. Then you can easily include the payment under the contract in your expenses. But, of course, you will have to pay insurance premiums and withhold personal income tax on the remuneration amount. For a similar reason, you should not compensate the contractor for “representation expenses”. Even if the subject of the contract is activities related to meetings. After all, entertainment expenses require participation of your employees in meetings, but in this case this is not the case. So such compensation cannot be taken into account when taxing profits, and personal income tax and insurance premiums will have to be charged on their amount (Clause 2 of Article 264, paragraph 6 of paragraph 1 of Article 208 of the Tax Code of the Russian Federation; part 1 of Article 7 of the Federal Law of July 24 .2009 N 212-FZ). As in the case of “per diems”, it is better not to call such payments compensation for entertainment expenses, but to formalize them as compensation for specific expenses of the contractor in fulfilling your contract (for example, for renting a hall for negotiations with potential contractors) or simply increase his remuneration.

Disadvantages of registration under a contract (explain)

First, you need to carefully read the contract. The agreement is drawn up in 2 copies. One of yours needs to be stored in order to be provided in the future for calculating your pension. Contributions to the pension are made and this can be verified. Your organization annually provides data for each employee to the pension fund.

I'm looking for a job. There is an offer that suits me practically with everything: location, schedule and salary. But they don’t apply based on a work book. They said that they do not pay sick leave (I have a small child and will have to take it sometimes), there is no vacation and vacation pay, i.e. the schedule will indicate that I worked these days.

Income tax and tax under the simplified tax system

You can equally reasonably take into account compensation for material expenses of contractors as (Clause 4 of Article 252 of the Tax Code of the Russian Federation): ( or ) other expenses (Subclause 49 of Clause 1 of Article 264 of the Tax Code of the Russian Federation); ( or ) expenses of the same type to which the contractor’s remuneration is attributed (for example, expenses for repairing your OS (Article 260 of the Tax Code of the Russian Federation)). After all, we remember that such compensation is part of the price of the contract. This method, by the way, is most suitable for simplifications with the “income minus expenses” object. After all, they have no right to take into account other expenses (not mentioned in the closed list), but repair expenses are welcome (Subclause 3, clause 1, Article 346.16 of the Tax Code of the Russian Federation); ( or ) material expense. For example, it is quite acceptable to consider compensation for the cost of spare parts for repairs as expenses for the purchase of materials used for the maintenance and operation of fixed assets (Subclause 3, clause 1, Article 254, subclause 5, clause 1, Article 346.16 of the Tax Code of the Russian Federation). And in any case, we remember that it is necessary to obtain from the contractor documents confirming his expenses (purchase contracts, cash and sales receipts, invoices, etc.).

Attention! It is necessary to obtain from the contractor documents confirming his expenses. Otherwise, payments to him cannot be regarded as compensation for expenses.

Compensation for travel and accommodation expenses of a citizen contractor can also be taken into account: ( or ) on the same basis as the contractor’s remuneration. This is exactly the position (though in disputes over compensation to organizations, not “physicists”) that the courts take (Resolutions of the FAS UO dated 04/30/2009 N F09-2594/09-S3; FAS PO dated 03/05/2009 in case N A57-12814/ 2006); ( or ) as other reasonable expenses associated with production or sales. True, those who simplify things with the object “income minus expenses” will not be able to take into account expenses on this basis.

Note But it’s absolutely not worth taking such compensation into account as actual travel expenses! After all, only full-time employees need to be reimbursed for travel expenses (Articles 166, 168 of the Labor Code of the Russian Federation). So the tax authorities will definitely “remove” such expenses when checking your company (Letter of the Ministry of Finance of Russia dated December 19, 2006 N 03-03-04/1/844), and in addition, you will have problems with personal income tax. After all, even some courts believe that “travel payments” to non-employees should be subject to personal income tax (Resolution of the Federal Antimonopoly Service dated June 1, 2009 in case No. A12-15743/2008).

What fees are subject to a civil contract?

Individuals with whom GPC agreements have been concluded are not reflected in the working time sheet.

Such persons do not obey the internal labor regulations of the organization, and labor law norms do not apply to them (Part 8 of Article 11 of the Labor Code of the Russian Federation). The calculation of remuneration amounts for “contractors” is carried out separately from regular employees without using a payroll or payroll sheet.

From remuneration under contract agreements, only pension and medical contributions are paid to the Federal Tax Service (subclause 2, clause 3, article 422 of the Tax Code). Social insurance tax contributions that give the right to receive social benefits (sick leave, maternity leave, children's benefits) are not assessed and, accordingly, are not paid. This is one of the formal differences between an employment contract and a GPC agreement.

Contributions to the Social Insurance Fund for injuries (from accidents and occupational diseases) are also not paid as a general rule. But here the parties can agree and include a provision on social insurance insurance in the text of the agreement (paragraph 4, paragraph 1, article 5 of Law No. 125-FZ of July 24, 1998). In case something happens to the employee. This contractual provision is relevant for insecure employment. For example, in construction, hazardous production, etc.

Attention! Rostrud taught workers to distinguish GPC contracts from labor contracts. If an employee complains about the substitution of one contract for another, the company will be fined, and the accountant will have to recalculate insurance premiums. The editors of the magazine “Salary” have prepared a table that will show all the differences between GAP and employment contracts. The table can be downloaded as a memo.Download

Please note that transactions with ordinary individuals are subject to taxation. If the counterparty is an individual as an individual entrepreneur, then insurance deductions do not arise. Such payments are made by the businessman himself.

The company is also free from contributions when the GPA is concluded not for the performance of work (provision of services), but for the transfer of ownership or other rights to property (clause 4 of Article 420 of the Tax Code). For example, this could be a loan, lease or sale.

If you charge too much, then, of course, there will be no mistake before the state. But the company's money will be spent. It will also not be possible to include such transfers to the budget in expenses.

Personal income tax deductions for contractors (performers)

A resident of the Russian Federation engaged in work under a civil contract can be provided with the following deductions for personal income tax.

Standard deductions. For example, for children (for the first child in 2018 - in the amount of 1,400 rubles). Only deductions are possible only for those months during which the contract is valid. And you need to take into account all the income received by the physicist since the beginning of the year.

If the agreement is valid for several months, and the remuneration is not paid monthly (for example, in a lump sum upon expiration of the contract), then the procedure is as follows. Provide standard tax deductions for each month of the contract, including those months in which remuneration was not paid.

To apply for a deduction, you need to:

- obtain all the necessary documents - focus on the usual package, which is also needed in the case of staff members (clause 3 of Article 218 of the Tax Code of the Russian Federation);

- determine the amount of the deduction (Clause 1 of Article 218 of the Tax Code of the Russian Federation) - for example, if the number of children in a family is different, the children’s deduction will be different for different people.

Professional deduction. An employee can receive one upon application (clauses 2 and 3 of Article 221 of the Tax Code of the Russian Federation). The deduction is provided (one of the two options is selected):

- in the amount of expenses actually incurred to execute the contract;

- in the amount of the standard given in the table in Article 221 of the Tax Code of the Russian Federation.

- In an employment contract, the parties, their rights and obligations are determined in accordance with the current Labor Code. In accordance with it, various payments and accruals are made.

- When concluding a civil law contract, the parties become the employee and the contractor, therefore the construction of legal relations is based on the Civil Code.

- The subject of contractual relations when working under a work book is long-term performance of work within the framework of the staffing schedule. In the case of a GPC agreement, temporary work or the provision of one service.

Therefore, paying taxes and contributions is somewhat different.

Remuneration under a civil law agreement is the income of an individual that he receives from the company. In accordance with subparagraph 6 of paragraph 1 of Article 208 of the Tax Code of the Russian Federation, this type of income is subject to personal income tax.

If the employee is not an individual entrepreneur, then the tax must be calculated and paid by the organization that pays remuneration for work performed. If such obligation is not fulfilled, the company is liable in accordance with the current Tax Code.

If a person is an individual entrepreneur, then the company does not have to withhold personal income tax.

In this case, the company does not act as a tax agent. Under the general taxation system, an individual entrepreneur undertakes to pay the tax independently on the basis of Article 227 of the Tax Code.

The contract for the provision of services indicates that the work will be carried out by an individual entrepreneur. It is also worth indicating the details of the legal entity, then the tax authority will not have any questions regarding payment of the contribution.

Deductions

All taxpayers are entitled to receive a deduction when making proper payments to the government treasury. Employees who are registered under an NPH agreement and who receive payment for the provision of services have the right to receive a professional deduction, as provided for in Article 221 of the Tax Code. The amount will depend on the documented expense.

In other words, the individual must confirm the expenses incurred under the contract. For example, this is often used by citizens who go on a business trip. After all, it is impossible to stipulate in the GPC agreement a direction on a business trip with payment for travel.

A company providing work under a GPC agreement can issue standard tax deductions to the employee, which are prescribed in Article 218 of the Tax Code. Condition – income must be taxed at a rate of 13%.

The taxpayer independently submits an application to one of the tax agents. Most often this is the employer.

The employer also has the right to provide its employee with a property tax deduction. It is provided in connection with the purchase of real estate at the end of the tax period or during it. If an employee provides services under a GPC agreement, the employer does not have the right to provide him with such deductions.

Insurance premiums

All payments accrued under GPC agreements are considered subject to insurance premiums. In this case, there are several differences from the employment contract. For example, contributions to the Social Insurance Fund will not be charged.

Injuries

The employer undertakes to pay the amount for injuries only if this is specified in the contract.

Income tax

Accounting for income taxes depends on the norms and type of expense, as well as on the status of the individual. Such rules are provided for in Chapter 25 of the Tax Code.

Performer or contractor is an individual who is not an individual entrepreneur and is not part of the main staff of the company. In this case, the expense is included in Article 255 of the Tax Code of the Russian Federation. This expense transaction qualifies as labor costs.

Other

- The contractor is an individual entrepreneur who is not part of the main staff of the company. The expense is reflected in other expenses related to sales.

- The performer is a full-time employee. Expenses are accounted for as other production-related expenses.

Often, a contract is concluded between an individual and a legal entity (Chapter 37 of the Civil Code of the Russian Federation). Under this agreement, the contractor (individual) undertakes to perform, on the instructions of the other party - the customer (legal entity), some specific work and deliver its result to the customer. In turn, according to paragraph 1 of Art. 702 of the Civil Code of the Russian Federation, the customer (legal entity) undertakes to accept the results of the work and pay for them.

If a travel company does not apply a general taxation system (discussed above), but is on a simplified taxation system, then the situation changes somewhat. But the point is that in Art. 346.16 of the Tax Code of the Russian Federation does not directly indicate this type of expense, such as payment under civil contracts. In accordance with paragraphs. 6 clause 1 art. 346.

16 of the Tax Code of the Russian Federation, expenses for the purposes of the simplified tax system include expenses for remuneration of labor in the manner prescribed for calculating corporate income tax, Art. 255 of the Tax Code of the Russian Federation (clause 2 of Article 346.16 of the Tax Code of the Russian Federation). Based on clause 21 of Art. 255 of the Tax Code of the Russian Federation, expenses for payment for services (work) performed in favor of the organization by individual entrepreneurs, as well as full-time employees of the organization on the basis of civil contracts, are not included in labor costs.

Based on this, we can come to the conclusion that such expenses cannot be taken into account by a taxpayer who is on the simplified tax system, according to paragraphs. 6 clause 1 art. 346.16 of the Tax Code of the Russian Federation as labor costs. Labor costs include only payments to employees who are not on the staff of the organization for performing work under civil contracts (including work contracts), with the exception of wages under such contracts concluded with individual entrepreneurs (clause 21 of article 255 Tax Code of the Russian Federation).

Thus, work (services) performed (rendered) for an organization on the simplified tax system by individuals under civil contracts (with the exception of contracts with “staff employees” and individual entrepreneurs) reduce the tax base under the simplified tax system as labor costs under paragraphs. 6 clause 1 art. 346.16 of the Tax Code of the Russian Federation (Letter from the Federal Tax Service of Russia for Moscow dated September 14.

2006 N 18-12/3/). However, in addition to paragraphs. 6 clause 1 art. 346.16 of the Tax Code of the Russian Federation in the Code you can find other norms according to which the costs of paying for services (performing work) provided to a “simplified” taxpayer by individual entrepreneurs can still be taken into account. So, in accordance with paragraphs. 5 p. 1 art. 346.

16 of the Tax Code of the Russian Federation, when determining the object of taxation, a taxpayer applying a simplified taxation system with the object of taxation in the form of income reduced by the amount of expenses, reduces the income received by the amount of material expenses. According to paragraph 2 of Art. 346.16 of the Tax Code of the Russian Federation, the expenses specified in paragraphs. 5 p.

1 of the specified article of the Tax Code of the Russian Federation, are adopted in the manner prescribed for calculating corporate income tax, Art. 254 Tax Code of the Russian Federation. Subclause 6 of clause 1 of Art. 254 of the Tax Code of the Russian Federation establishes that material expenses, in particular, include the taxpayer’s costs for the acquisition of works and services of a production nature, performed by third-party organizations or individual entrepreneurs, as well as for the performance of these works (provision of services) by the structural divisions of the taxpayer.

Thus, the costs of paying for services under a civil contract concluded with an individual entrepreneur are taken into account when calculating the tax base for the tax paid when applying the simplified tax system, as part of material costs (Letter of the Ministry of Finance of Russia dated January 18, 2010 N 03-11-11/03 ). In addition, it is possible to take into account the costs of paying for services (performing work) provided to the “simplified” taxpayer by an individual entrepreneur or by full-time employees of an organization on the basis of civil law contracts on other grounds.

Procedure for paying taxes under a GPC agreement

- the text must clearly indicate the period during which the work must be completed;

- the amount of remuneration must be reflected for the entire scope of work and not divided by time periods;

- the contract should not contain references to job descriptions or the operating mode of the enterprise;

- the fact that the full scope of work has been completed must be confirmed by an acceptance certificate for completed work, signed by both parties;

- the work must be one-time in nature, and after the entire scope has been completed, the relationship between the parties must cease.

- Enterprises that have the status of participants in the Skolkovo scientific and technical project pay only insurance contributions to the Pension Fund of the Russian Federation in the amount of 14%.

- Organizations operating in a free economic zone - on the territory of the Republic of Crimea and the city of Sevastopol - make contributions to compulsory health insurance in the amount of 6%, to compulsory medical insurance - 0.1%.

Personal income tax

There is no need to withhold personal income tax from the compensation paid to the contractor for his expenses for the following reasons. If we are talking about compensation for materials, then they are purchased in the interests of your company and their cost is compensated to the contractor without any extra charge. So we can talk about the absence of economic benefit, and therefore no income (Article 41 of the Tax Code of the Russian Federation). The same conclusions apply to compensation for travel and accommodation expenses - after all, the contractor travels to another city and lives there on the initiative and in the interests primarily of the customer. And finally, the main argument is that tax authorities now also believe that compensation for the contractor’s expenses incurred in the interests of the customer is not taxable income, since it is not his income in principle (Letter of the Federal Tax Service of Russia dated March 25, 2011 N KE-3-3 /926).

Note The Ministry of Finance, by the way, takes a completely different position (Letter of the Ministry of Finance of Russia dated 03/05/2011 N 03-04-05/8-121). He believes that compensation to individual contractors should be included in their taxable income, since they are not specified in Art. 217 Tax Code of the Russian Federation. But you can immediately provide a tax deduction for the amount of compensated expenses (Clause 1, 3 of Article 210, paragraph 2 of Article 221 of the Tax Code of the Russian Federation). Thus, there will be no additional tax payable.

The courts do not have a common position here. Some, like now tax authorities, believe that compensation for costs, in principle, is not a citizen’s income (Resolution of the Federal Antimonopoly Service of the Far East of Russia dated December 16, 2008 N F03-5362/2008). Other courts still offer preferential treatment for such compensation under paragraph 3 of Art. 217 of the Tax Code of the Russian Federation as reimbursement of expenses in connection with the performance of labor duties (Resolution of the Federal Antimonopoly Service of the Eastern Military District dated May 14, 2007 in case No. A43-7991/2006-30-215). But since the tax authorities themselves are ready to recognize such payments as non-taxable and not “clog up” the 2-NDFL form, then what else do we need?!

GPC agreement: taxes and fees

According to the provisions of Article 226 of the Tax Code of the Russian Federation, an organization or individual entrepreneur that makes payments in favor of individuals becomes their tax agent. This means that they must withhold personal income tax from the income paid and pay it to the budget. Therefore, if an organization has entered into a civil agreement on the performance of work (provision of services) with an ordinary citizen (not an individual entrepreneur), then it will have to withhold and pay personal income tax from the amount of remuneration paid to him. Moreover, even if the terms of the contract stipulate that the contractor must independently pay personal income tax, this does not cancel the tax agent’s obligation to withhold tax. After all, the norms of the Tax Code of the Russian Federation, as the Ministry of Finance of Russia recalled in Letter No. 03-04-05/12891 dated 03/09/2016, in this case have greater legal force than the agreement between the parties.

The personal income tax rate in this case is standard - 13%. In some specific situations, higher rates may need to be applied. Employees within the framework of the GPC must also be included in all reports: form 6-NDFL and certificates 2-NDFL.

In addition, the customer who has entered into a civil contract has an obligation to pay insurance premiums for the contractor. True, the GPC agreement obliges you to pay contributions not the same as for wages, but in a reduced version. How does this happen?

Insurance premiums

Everything is simple here. Compensation payments established by law related to the expenses of an individual in connection with the performance of work or provision of services under civil contracts are expressly designated as not subject to insurance contributions (Subclause “g”, clause 2, part 1, article 9 of the Federal Law dated 07/24/2009 N 212-FZ). The explanations of the Ministry of Health and Social Development on this matter are also (!) unambiguous - such compensations “are not subject to insurance premiums” if supporting documents are available (Clause 6 of the Letter of the Ministry of Health and Social Development of Russia dated 06.08.2010 N 2538-19).

Table of differences

What is the right thing to do in this situation?

A civil contract for the performance of work has been concluded with an individual. The contract price is 850,000 rubles. An advance payment of 40% of the contract value is provided. The final payment will be made in 2015. How and when to make and transfer insurance contributions correctly. Payments and rewards under civil law contracts are included in the calculation base for mandatory insurance contributions on the date of their accrual (clause 1 of Article 11 of the Law of July 24, 2009 No. 212-FZ). In this case, the base for calculating contributions is determined monthly for each individual in whose favor payments were made (Part 3 of Article 8 of Law No. 212-FZ of July 24, 2009).

Labor relations with employees employed on the basis of an employment contract are regulated by the Labor Code, and relations under a GPC agreement are regulated by the Civil Code. In the matter of paying insurance premiums under a GPC agreement, it is important that when signing such a contract, any hints of its similarity with a standard employment contract are excluded, since in judicial practice there have been cases when a GPC agreement was recognized as an employment contract, and subsequently the company was forced to pay additional insurance premiums and pay penalty for late payment.

- The subject of the contract must include work, services or the transfer of rights to property, but not the performance of official functions. The expected result of the work should be a completed project, equipment in a state of high-quality assembly, rental of premises, etc. As the basis for payment, indicate an order, act, statement (not a time sheet).

- An employee cannot be required to follow the company’s labor discipline, internal regulations, or subordination, which are accepted for full-time employees. The same calculation standards that apply to employees cannot be applied to wage conditions.

- How and in what amount an employee’s work will be paid under a civil process agreement is not regulated by Labor legislation, but is approved by agreement of the parties. Money is paid upon completion of the work, unless the agreement requires an advance payment.

- The GPC agreement is one-time in nature and limited in time, so write down how long the work must be completed.

- Make sure in advance that the GPC agreement does not imply the regular provision of services to the organization for the same fee, otherwise regulatory authorities may recognize the agreement as a disguised employment contract.

Example. Versailles LLC entered into an agreement with R.P. Chernyshev (b. 1961) author's order agreement. The subject of the agreement is writing an article for publication in a magazine. Chernyshev is not an employee of the organization. The author's remuneration is 8,000 rubles. In March 2011, Chernyshev handed over the article to the organization (an acceptance certificate was signed).

In the same month, the accountant accrued remuneration to Chernyshev in the amount indicated above. Chernyshev did not document the costs of writing the article, therefore, when calculating insurance premiums, the amount of remuneration was reduced by 20%. The base for calculating insurance premiums under the author's contract was 6,400 rubles. (8000 rub. - 8000 rub. x 20%).

Thus, for payments under the author's agreement in March 2011, the accountant of Versailles LLC accrued insurance contributions in the amount of 1990 rubles, including: - to the Pension Fund of the Russian Federation to finance the insurance part of the labor pension - 1664 rubles. (RUB 6,400 x 26%); - in FFOMS - 198 rubles. (RUB 6,400 x 3.1%); - in TFOMS - 128 rubles. (RUB 6,400 x 2%). The accountant did not accrue contributions for compulsory social insurance to the Federal Social Insurance Fund of the Russian Federation from payments under the agreement on the transfer of copyrights.

Example. In January 2011, R.V. Fateev (b. 1974) performed equipment installation at Tantal LLC under a contract. The cost of the work was 150,000 rubles. Fateev is not an employee of the organization and is not registered as an entrepreneur. The accrual of contributions for insurance against accidents and occupational diseases is not provided for in the agreement concluded with him.

Thus, the base for calculating insurance premiums for January 2011 is less than 415,000 rubles. (150,000 {amp}lt; 415,000). Therefore, the accountant assessed the following insurance contributions on them: - to the Pension Fund of the Russian Federation to finance the insurance part of the labor pension - 30,000 rubles. (RUB 150,000 x 20%); — to the Pension Fund of the Russian Federation to finance the funded part of the labor pension — 9,000 rubles. (RUB 150,000 x 6%);

We invite you to familiarize yourself with: Employment contract between the manager and the housing cooperative

- in FFOMS - 4650 rubles. (RUB 150,000 x 3.1%); - in TFOMS - 3000 rubles. (RUB 150,000 x 2%). The accountant did not accrue insurance contributions to the Social Insurance Fund of the Russian Federation. In March 2011, under a new contract, R.V. Fateev carried out renovation of office premises for Tantal LLC. The cost of the work was 300,000 rubles. The total amount of payments in favor of Fateev since the beginning of the year exceeded 415,000 rubles. (415,000 {amp}lt;

(150,000 300,000)). The excess amount was 35,000 rubles. (150,000 300,000 - 415,000). Therefore, when paying remuneration under the second contract, the organization’s accountant calculated insurance premiums only from the amount of 265,000 rubles.0). In this case, insurance premiums are calculated at the same rates as when paying remuneration under the first contract.

The subject of the contract is also different: for a labor contract, this is personal, long-term performance of work in accordance with the staffing table, profession and position (Article 15; 57 of the Labor Code of the Russian Federation), for which the employee is regularly paid wages. For a GPC agreement, the subject is the completion of work or services by a specific deadline, that is, some result in favor of the customer (Article 702 of the Civil Code of the Russian Federation), which he accepts under the act and pays remuneration for the entire scope of work.

- under an employment contract, the relations of the parties (employee and employer) will be regulated by the provisions of the Labor Code,

- under a GPC agreement, the parties to which are the customer and the contractor, relations can be built only on the basis of the provisions of civil law.

The judges indicated that if an individual works in an organization under a civil contract, the relationship between such person and organization is regulated by the norms of the Civil Code of the Russian Federation, and therefore the guarantees and compensation provided for in Art. 164, 168.1, 313 of the Labor Code of the Russian Federation, including those related to the traveling nature of work, do not apply to these persons.

- contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund are calculated according to general rules and at the same rates as for employment contracts;

- contributions to the Social Insurance Fund are not accrued on any remuneration paid to individuals under the GPA (Clause 2, Part 3, Article 9 of Federal Law No. 212-FZ);

- All types of compensation payments related to the expenses of an individual in connection with the performance of work, provision of clause 2, part 1, art. 9 of this law);

- insurance premiums are accrued on the date of accrual of remuneration for work performed and services rendered (Clause 1, Article 11 of Federal Law No. 212-FZ), and in the case of payment of an advance payment stipulated by the contract, on the date of payment of the advance payment.

An employer who enters into a contract with an employee instead of an employment contract must keep in mind that labor legislation protects the interests of the employee. If the court determines that the GPC agreement actually regulates the labor relations between the employee and the employer, the provisions of labor legislation and other acts that contain labor law norms will be applied to these relations. This is stated in Article 11 of the Labor Code of the Russian Federation.

Consequently, the name of the contract itself cannot serve as a sufficient basis for classifying it as an employment or civil law contract. The content of the contract is of primary importance.

If a court decision confirms the existence of an employment relationship, the employer is obliged to draw up an employment contract with the employee (clause 8 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated March 17, 2004 No. 2). The date of commencement of the employment relationship between the employee and the employer will be considered the day the civil contract comes into force. The procedure for requalifying a GPC agreement into an employment contract is regulated by Article 19.1 of the Labor Code of the Russian Federation. The contract may be re-qualified:

- by the customer on the basis of a written application from the contractor;

- by the customer on the basis of an unappealed order from a labor inspector;

- court at the request of the performer;

- court based on materials from the state labor inspectorate and other authorized bodies.

Consequently, the employer will have to pay the employee for periods of temporary disability, provide annual paid leave and pay additional insurance premiums.

Who can apply to the court to reclassify a work contract into an employment contract?

A GPC agreement is a civil law agreement, i.e. a civil law agreement (CLA). A party to this agreement may be one or more individuals and/or legal entities. GPA is any agreement concluded in accordance with the Civil Code of the Russian Federation and does not contradict the current civil legislation.

Civil contracts are conventionally divided:

- related to the transfer of property (donation, exchange, purchase and sale, etc.);

- contracts for the performance of work (contract, R&D, etc.) in accordance with Ch. 37 Civil Code of the Russian Federation;

- contracts for the provision of services (transportation, storage, commission, etc.) in accordance with Ch. 39, 51 Civil Code of the Russian Federation.

We invite you to read: Warranty period under a construction contract

The difference between an employment contract and a GPC is primarily that an employment contract is regulated by the norms of the Labor Code of the Russian Federation, and the GPC is governed by civil law. The GPA cannot use terms and wording of labor legislation.

Many questions arise in a situation when a service invention (sample or model) is created. If, according to the labor functions enshrined in the employment contract or job description, the creation of this invention is prescribed, then this case is considered in the area of labor legislation.

It should be taken into account that Part 2 of Art. 15 of the Labor Code of the Russian Federation directly prohibits the conclusion of civil contracts, which in their meaning regulate labor relations.

The Supreme Court of the Russian Federation came to the conclusion that in a number of cases, GPAs concluded with individual entrepreneurs, which provide for monthly remuneration, compliance with labor regulations, etc., should be reclassified as employment contracts, since they are illegal and infringe on the rights of employees (definition Sun dated 02.27.17 No. 302-KG17-382). This means that companies take a very big risk when they enter into GPAs, which are very similar to employment contracts.