Step-by-step instruction

The organization entered into an export contract with a foreign buyer LadystyleKz (Kazakhstan) for the supply of non-raw materials in the amount of 15,000 USD.

On February 15, the products “Kate” women’s sandals (1,000 pairs) worth 15,000 USD were exported to the buyer LadystyleKz.

The organization did not collect a package of documents on time (within 180 days) to confirm the 0% VAT rate for export shipments.

On August 14 - 181 days from the date of shipment of goods for export, the Organization charged VAT at a rate of 18% and submitted to the Federal Tax Service an updated VAT return for the 1st quarter.

Penalties and taxes have been calculated and paid to the budget until the updated declaration is submitted.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Export of non-commodity goods (finished products) not confirmed within 180 days | |||||||

| VAT accrual on export proceeds | |||||||

| August 14 | 68.22 | 68.02 | 167 400 | VAT accrual on export proceeds | Confirmation of zero VAT rate - 0% rate not confirmed | ||

| 91.02 | 68.22 | 167 400 | 167400 | Accounting for accrued VAT on export proceeds as an expense | |||

| — | — | 930 000 | Issuance of SF for shipment (VAT rate 18%) | Invoice issued for sale | |||

| — | — | 167 400 | Reflection of VAT in Additional. sales book sheet for the first quarter | Sales book report - Additional. sheet | |||

| Payment of VAT debt to the budget | |||||||

| August 14 | 68.02 | 51 | 167 400 | Payment of VAT to the budget for the first quarter by payment deadlines of April 25, May 27, June 25 | Debiting from a current account – Tax payment | ||

| Accrual and payment of VAT penalties to the budget | |||||||

| August 14 | 91.02 | 68.02 | 7142,40 | Calculation of penalties for VAT | Manual entry - Operation | ||

| August 14 | 68.02 | 51 | 7 142,40 | Payment of VAT penalties to the budget | Debiting from a current account – Tax payment | ||

| Submission of an updated VAT return for the 1st quarter. to the Federal Tax Service | |||||||

| August 14 | — | — | 167 400 | Reflection of accrued VAT on unconfirmed export sales | Regulated report VAT Declaration - Section 6 page 030 | ||

See the beginning of the example Sales of finished products for export (EAEU)

Flowchart of Export of non-commodity goods (finished products) to the EAEU for goods purchased from 07/01/2016

The diagram shows the procedure for exporters to reflect data in:

- sales book;

- VAT declarations regarding shipment and deduction;

- 1C.

Let's consider the procedure for situations:

- Documents were NOT collected on time (180 days). Export will be confirmed later .

- Documents were NOT collected on time (180 days). Export will NOT be confirmed later .

VAT when exporting goods from Russia

The peculiarities of the value added tax when exporting products are discussed in clause 2 of Art. 151, paragraph 1, art. 164, paragraph 1, art. 165, paragraph 9 of Art. 167 of the Tax Code of Russia. Exported goods and materials are not sold to Russian consumers, so the state returns the tax previously paid by the manufacturer. The terms “no tax paid” and “0% rate” are used synonymously. All primary documents confirming the export of goods that should be submitted to the tax office are specified in the agreement on the Eurasian Economic Union dated May 29, 2014 (Appendix No. 18) and in Article 165 of the Tax Code of the Russian Federation. Taxpayers and agents provide supporting documents in electronic format; the validity of the provisions is enshrined in the order of the Federal Tax Service dated September 30, 2015 No. ММВ-7-15/427.

VAT accrual on export proceeds

Regulatory regulation

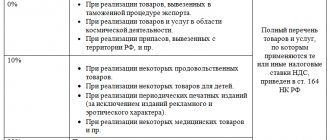

If a package of documents to confirm the export of goods (finished products) that were purchased starting from July 1, 2016 (Article 165 of the Tax Code of the Russian Federation) is not collected and submitted to the Federal Tax Service within 180 days, then export sales are subject to VAT at the rate of 18 (10 )% (clause 5 of the EAEU Protocol). In this case, the taxpayer loses the right to a 0% VAT rate.

In this case, the tax base for additional VAT calculation is determined on the date of shipment (clause 1, article 167 of the Tax Code of the Russian Federation, paragraph 2, clause 5 of the EAEU Protocol). Thus, it is necessary to “go back” to the shipment period and charge additional VAT at the normal rate.

Payment of VAT on this sale is overdue. Therefore, it is necessary to calculate and pay VAT penalties, as well as pay additional tax to the budget (Article 75 of the Tax Code of the Russian Federation). Only after this do you submit an updated VAT return, then you can avoid a fine for incomplete payment of tax (Article 122 of the Tax Code of the Russian Federation).

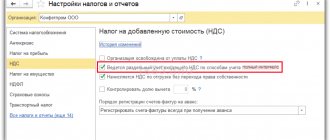

Accounting in 1C

If export sales are not confirmed within 180 days, you must register this event with the Confirmation of zero VAT rate document in the Operations section – Period closure – VAT routine transactions – Create button.

Let's look at the features of filling out the document Confirmation of the zero VAT rate using an example.

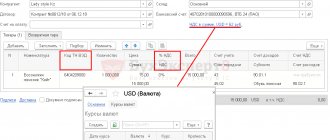

Document header

- from — the date on which the confirmation period for the zero VAT rate expires;

- Item of other expenses - Write-off of VAT on other expenses .

The expense item on which accrued VAT is taken into account is selected from the Other income and expenses directory. Type of article in NU - Taxes and fees (clause 1, clause 1, article 264 of the Tax Code of the Russian Federation). The type of article in NU should be changed for a predefined article manually or a new article with this type in NU should be created.

Tabular part of the document

The tabular part can be filled automatically with export implementations by clicking the Fill .

- Event - 0% rate not confirmed .

Please note that the document is filled by default with all export sales for which the 0% VAT rate has not yet been confirmed. Therefore, unnecessary data must be deleted and only those for which the package of supporting documents has not been collected on time as of the date of the document must be left.

If export is not confirmed within 180 days, you must:

- additionally charge VAT at the rate of 18 (10)%;

- issue a new invoice with VAT in one copy (clause 22.1 of the Rules for maintaining the sales book, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137). Such SF is not transferred to the buyer.

When posting the document Confirmation of the zero VAT rate with the Event 0% rate not confirmed, Invoice document is automatically created with the transaction code “” and with the amount of additional VAT charged.

Postings according to the document

The procedure for calculating VAT on unconfirmed export transactions is not regulated. In 1C, the position of the Ministry of Finance of the Russian Federation is implemented (Letter dated May 27, 2003 N 16-00-14/177):

- VAT is charged on unconfirmed export sales by posting Dt 68.22 “VAT on exports for reimbursement” Kt 68.02 “Value added tax”;

- accrued VAT is charged to other expenses - Dt 91.02 “Other expenses” Kt 68.22 “VAT on exports for reimbursement”.

If the export is not confirmed within 180 days, two situations are possible in the future:

- previously unconfirmed exports will not be confirmed later than 180 days;

- previously unconfirmed exports will be confirmed later than 180 days.

Let's consider each case in more detail.

Option No. 1. Export will not be confirmed later than 180 days

The document generates transactions:

- Dt 68.22 Kt 68.02 - VAT is charged on export proceeds;

- Dt 91.02 Kt 68.22 - VAT accrued on export proceeds is included in expenses.

Posting data is generated automatically when posting a document.

Reporting

If the zero VAT rate is not confirmed within 180 days and is not confirmed later, then VAT accrued on unconfirmed export sales is reflected in the income tax return as indirect expenses: PDF

Sheet 02 Appendix No. 2:

- p. 040 “Indirect expenses - total”: p. 041 including “amounts of taxes and fees...”.

Study in more detail What taxes should be reflected on page 041 of Appendix No. 2 to Sheet 02 in the income tax return

Option No. 2. Export will be confirmed later than 180 days

If the taxpayer is confident that supporting documents will be collected later, then posting Dt 91.02 Kt 68.22 must be removed from the document movements by checking the Manual adjustment . It is also necessary to remove movements from the VAT register for the sale of 0% .

This is done so that later, when confirming the VAT rate of 0% later than 180 days, the document Confirmation of the zero VAT rate .

To edit you should:

- DtKt button to go to the movements of the document Confirmation of the zero VAT rate ;

- enable Manual adjustment ;

- on the Accounting and Tax Accounting , delete the posting Dt 91.02 Kt 68.02.

After that, go to the VAT tab on sales of 0% and delete the movement in the register.

Additional sheet in the sales book

Unconfirmed export sales are reflected in an additional sheet of the Sales Book during the export shipment period. In our example - in the 1st quarter.

Sales Book report can be generated from the Reports – VAT – Sales Book section. PDF

To display data from an additional sheet of the sales book, you need to configure the report using the Show settings . Let's consider the formation of an additional sheet of the sales book from the adjustment period.

In our example, export sales were in the 1st quarter, the confirmation period of 180 days expired in the 3rd quarter. We create an additional sheet of the sales book from the adjustment period, i.e. from the 3rd quarter.

- Period - 3rd quarter: the period in which the adjustment was made.

- Settings : checkbox Generate additional sheets and select analytics for the adjusted period from the drop-down list;

- For convenience, you can also check the box Display only additional sheets .

For non-commodity goods (finished products) purchased and sold starting from 07/01/2016, it is not required to restore the deduction of input VAT if export sales are not confirmed (clause 3 of Article 172 of the Tax Code of the Russian Federation).

Documenting

If the export is not confirmed within 180 days, then the invoice with the calculated VAT amount is issued in one copy. There is no need to hand over the document to the buyer.

The Invoice form was approved by Decree of the Government of the Russian Federation dated December 26, 2011 N 1137. It can be printed by clicking the Invoices from the document Confirmation of the zero VAT rate . PDF

Rules for filling out sections 4–6 of the declaration

How to fill out section 4 of the VAT return . Despite the changes made to the form of the declaration itself (first from 2015, and then from 2017), no fundamental adjustments were made to sections 4–6. Therefore, filling out section 4 of the VAT return is carried out according to previously existing rules. Updates in these sections affected only the data display structure.

Thus, in the 4th section of the declaration in both of its latest editions, codes of business operations must be indicated line by line, and for each code - tax bases, confirmed deductions for transactions with a zero tax rate, the estimated amount of previously unconfirmed VAT, previously accepted tax deductible and subject to recovery. Moreover, this block of these five lines is repeated exactly as many times as required - according to the number of operations.

This section also contains blocks of information on:

- return of goods (lines 060–080) with the following order of information submission - transaction code, tax base and tax amount for recovery;

- adjustment of the tax amount due to a change in the sales price (lines 090–110), in which the transaction code is entered, adjustment of the tax base when the price increases/decreases.

The total lines 120 and 130 reflect the amount of VAT to be reimbursed/paid based on the results of the 4th section.

In the 5th section, lines 030–070 indicate for each transaction code (030) with a VAT rate of 0% the tax base and deductions (040 and 050), for which supporting documentation was provided in the previous period, or the base and deductions (060 and 070), not supported by documents. There are also 2 total lines (080 and 090), “counting” the total amounts of tax deductions for transactions, confirmed and unconfirmed by documents.

In the 6th section, concerning the calculation of VAT on transactions with an unconfirmed zero rate, blocks of information on transaction codes are structured in lines 010–040 in the following sequence: codes, tax base, VAT amount and deductions. In the final lines 050–060, the amounts of calculated tax and deductions are “totalled.” Lines 070–100 display information on product return transactions. And in lines 110–150 - adjustment of the tax base due to changes in the price of goods. The total lines for the section - 160 and 170 - determine the amount of VAT payable or refundable, respectively.

To learn how to organize VAT accounting when exporting, read the article “How is separate VAT accounting carried out when exporting?”

To reflect transactions taxed at a 0% VAT rate, sections 4–6 must be completed in the declaration. The main volume of data (on confirmed exports) falls into section 4. Section 6 contains transactions for which the taxpayer has not collected documents justifying his right to apply a preferential rate, and section 5 contains transactions that have already been documented previously , but the right to apply deductions for them arose only in the reporting period.

Sales of goods for export are subject to VAT at a rate of 0%. But the right to apply such a rate must be confirmed by documents (Subparagraph 1, paragraph 1, Article 164, Article 165 of the Tax Code of the Russian Federation). 180 days are given for collecting documents from the date of placing the goods under customs export procedures (this date is determined by the mark on the customs declaration “Release permitted”) (Clause 9 of Article 165 of the Tax Code of the Russian Federation; Article 204 of the Customs Code of the Customs Union). The procedure for calculating tax depends on the period in which you collected the documents - before the expiration of 180 calendar days or after. And, as a result, the procedure for filling out a VAT return . For exporters, special sections have been allocated in the declaration - section. 4, 5 and 6 . We will talk about in what case it is necessary to fill out this or that section.

Payment of VAT debt to the budget

Additional payment of VAT to the budget is reflected in the document Write-off from the current account transaction type Tax payment in the Bank and cash desk section - Bank - Bank statements - Write-off button.

Learn more Payment of VAT (general procedure)

Postings according to the document

The document generates the posting:

- Dt 68.02 Kt - payment of VAT debt.

Refuse the zero VAT rate

Sometimes it is more profitable to pay 20% VAT than to collect documents for the tax office. As mentioned above, the tax office carefully examines the documents and can refuse for any inaccuracy. From experience, sometimes tax inspectors refuse wrongfully; this is clarified in court.

Therefore, small companies that do not export constantly prefer to pay tax rather than bother with the tax office. You can refuse the zero rate when exporting to any country except the countries of the Customs Union. When exporting to these countries, a 0% rate is required.

To refuse the zero rate, a free-form application is submitted to the tax office.

You can write the application however you like, the main thing is to indicate from whom, to whom and what you want

You must submit your application no later than the first day of the quarter in which you want to waive the zero rate. If you want to export goods in May, you must submit an application before April 1.

The application is valid for a year. If you decide to abandon the zero rate, you will have to pay 20% VAT for a year, and only then can you return to the zero rate.

Accrual and payment of VAT penalties to the budget

The organization independently establishes in its accounting policies the procedure for recording the amounts of accrued penalties. In our example, we will adhere to the position of the Ministry of Finance of the Russian Federation and attribute accrued penalties to other expenses by posting Dt 91.02 Kt 68.02 (Letter of the Ministry of Finance of the Russian Federation dated December 28, 2016 N 07-04-09/78875).

Penalties are calculated taking into account the period of delay:

Up to 30 days:

Starting from day 31:

The current refinancing rate can be viewed on the website of the Central Bank of the Russian Federation.

Learn more about the procedure for calculating penalties

The deadline for paying VAT is no later than the 25th day of each of the three months following the expired tax period (clause 1 of Article 174 of the Tax Code of the Russian Federation). Therefore, VAT penalties are calculated on every 25th day of the payment deadline. In our example, we must calculate penalties for the 1st quarter of 2021, tax payment deadlines are April 25, May 27, June 25.

The taxpayer independently decides from what day to accrue penalties for late payment of VAT on unconfirmed export sales. There are two positions - penalties are charged:

- from the 26th day of the month following the quarter in which there was an unconfirmed export sale - the position of the Federal Tax Service (Letter of the Ministry of Finance of the Russian Federation dated July 28, 2006 N 03-04-15/140);

- from 181 days from the date of implementation - judicial practice (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 16, 2006 N 15326/05, Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated October 7, 2010 N A43-40137/2009).

Let's calculate penalties using our example:

If the export is confirmed later than 180 days, then the paid penalties are not refundable. Only the amount of VAT paid on unconfirmed exports can be returned or offset against future payments (paragraph 2, paragraph 9, article 165 of the Tax Code of the Russian Federation, paragraph 2, article 173 of the Tax Code of the Russian Federation).

The accrual of penalties is documented in the document Transaction entered manually, type of operation Transaction in the section Operations – Accounting – Transactions entered manually.

The payment of VAT penalties to the budget is reflected in the document Write-off from the current account transaction type Payment of tax in the Bank and cash desk section - Bank - Bank statements - Write-off button.

Let's look at the features of filling out the document Write-off from a current account using an example.

Learn more Calculation and payment of VAT penalties

Postings according to the document

The document generates the posting:

- Dt 68.02 Kt - payment of penalties to the budget for VAT.

Is the deduction still valid for the loss of exported goods?

When carrying out export operations, cases of loss of goods occur. Disposal of goods in such a situation does not apply to transactions subject to VAT (clause 1 of Article 146 of the Tax Code of the Russian Federation). In addition, if the perpetrators compensated for the corresponding losses, then there is no reason to include the lost goods in the tax base.

Input tax on lost goods is also not deductible. Such amounts relate to transactions that are not subject to VAT, which means: the condition for deduction established in paragraph 2 of Art. 171 of the Tax Code of the Russian Federation, not fulfilled. This approach of the regulatory authorities can be seen in the letters of the Ministry of Finance of Russia dated April 16, 2014 No. 03-07-08/17292, dated January 21, 2016 No. 03-03-06/1/1997.

But loss of goods can also occur for natural reasons. The Russian Ministry of Finance, in letter No. 03-07-08/244 dated 08/09/2012, explained that in this case, input VAT can be deducted, but only within the limits provided for natural loss. Arguing their statement, the ministry’s specialists refer to the norms of subsection. 2 clause 7 art. 254 Tax Code of the Russian Federation.

Submission of an updated VAT return for the 1st quarter. to the Federal Tax Service

VAT accrued on unconfirmed export sales is reflected in the updated declaration for the shipment period. In our example, in the 1st quarter.

The VAT return must be submitted to the Federal Tax Service no later than the 25th day of the month following the quarter in which the deadline for collecting supporting documents expired.

Reporting

If the zero rate is not confirmed, you must provide an updated VAT return for the shipment period.

In Section 6 “Calculation of the tax amount...the justification for applying a tax rate of 0 percent for which is not documented”: PDF

- page 010 - transaction code 1010421 “Sale of goods (not specified in clause 2 of Article 164 of the Tax Code of the Russian Federation) to the territory of the EAEU member states.” This code must be selected manually from the drop-down list. By default, a different code is filled in the declaration.

- line 020 - tax base for VAT.

- line 030 - amount of accrued VAT.

In Section 9 Appendix No. 1 “Information from additional. sales book sheets":

- registration of an invoice issued when calculating VAT on unconfirmed export sales, transaction type code “”.

See also:

- Sales of finished products for export

- Export of non-commodity goods (finished products) confirmed within 180 days

- Export of non-commodity goods (finished products) confirmed later than 180 days

- Purchase of materials for production of products

- Release of products with write-off of materials according to specifications (without subconto Products)

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Export of non-commodity goods (products) to the EAEU is confirmed within 180 days Package of documents to confirm the 0% VAT rate for export of non-commodity goods...

- Export of non-commodity goods (products) to the EAEU is confirmed later than 180 days Documents to confirm the 0% VAT rate for the export of non-commodity goods...

- Export of non-commodity goods to non-commodity countries has not been confirmed within 180 days Package of documents to confirm the 0% VAT rate for export of non-commodity goods...

- Export of non-commodity goods to non-commodity countries confirmed within 180 days Package of documents to confirm the 0% VAT rate for export of non-commodity goods...

Results

Currently, there are three possible points for deducting input VAT.

For exported non-commodity goods, the deduction is made in the general manner, and for raw materials, the moment of deduction depends on timely confirmation of the fact of export. If the right to a deduction arises after confirmation of the zero rate on raw materials, then it can be declared in the period of its occurrence in section 5 of the VAT return. For non-commodity goods, a “late” deduction is reflected in the general manner in section 3 of the VAT return. In the event of loss of exported goods, input VAT, according to officials, can be deducted only within the limits of natural loss norms. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Refund, refund or deduction of VAT on export

All three terms meaning reduction or exemption from tax payments are often found on the Internet, and they are easy to confuse:

- the deduction refers to the calculation of the amount of tax (Article 171), determined by the enterprise itself when filing a declaration;

- refund or return of VAT when exporting from Russia is a general concept for offset and return (Article 176), the issue is decided by the Federal Tax Service on the basis of submitted documents: declarations and applications.

Paying taxes often leads to a situation where, due to deductions, the tax amount becomes negative. Further steps for tax refund:

- The company submits a declaration and an application for credit or refund of VAT. Offset on the declaration - the amount goes towards fines, arrears or future payments; If the documents indicate a return, the amount is transferred to a bank account.

- The tax office checks information in reporting declarations within three months, as provided for in Article 88 of the Tax Code of the Russian Federation on a 0 percent VAT rate for exports. Tax authorities are authorized to request additional documents, such as copies of invoices, sales ledgers or clarifying declarations.

- She then makes a decision within seven days about full, partial, or refusal of reimbursement. The form of compensation - offset or refund - is determined either by the Federal Tax Service to cover arrears to the budget, or according to the application.

- The Federal Inspectorate sends payment documents to the Treasury the next day after the decision on the return is made. The money is transferred by the Treasury within five days.