This or that property is classified as depreciable property if the following criteria are met:

- the service life of the property is more than one year;

- the property costs more than 100,000 rubles;

- the property is capable of generating income.

If the property does not meet the listed criteria, then it is included in material expenses. But only if such expenses are provided for in Article 254 of the Tax Code. If the costs of acquiring non-depreciable property are not listed in this article, then they do not apply to material costs. Therefore, it will not be possible to take them into account for tax purposes.

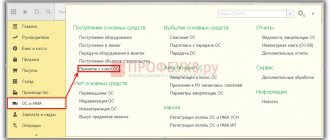

Composition of non-current assets of the enterprise

Non-current assets are assets that repeatedly take part in the production cycle and transfer their value to manufactured products in parts, over several production cycles.

Non-current assets include:

· Intangible assets.

· Long-term financial investments.

· Unfinished capital investments.

· Fixed assets.

Intangible assets are assets that do not have a tangible (physical) form, but are involved in the production of products.

Long-term financial investments represent costs for equity participation in the authorized capital and other enterprises, for the acquisition of shares and bonds on a long-term basis. Also include investments in subsidiaries and affiliates, loans for a period of more than 12 months.

Unfinished capital investments include costs for construction and installation work, purchase of buildings, equipment, vehicles, tools, inventory and other durable objects that are not documented in the acceptance and transfer certificates of fixed assets.

Fixed assets are part of an enterprise’s property that transfers its value to a newly created product in parts, over several production cycles. Fixed assets include assets involved in the production of products or for management needs for a period of more than 12 months. Items used for less than 12 months, regardless of their cost, or costing less than 100 times the minimum wage per unit, regardless of their useful life, are not considered fixed assets.

Useful life refers to the period during which an item generates income or serves the purpose of the enterprise.

The unit of accounting for fixed assets is an inventory item

. An inventory item of fixed assets is recognized as an object with all fixtures and accessories, or a separate structurally isolated object intended to perform certain independent functions, or a separate complex of structurally articulated objects, representing a single whole, intended to perform a specific job. If one object has several parts that have different useful lives, each such part is accounted for as an independent inventory item.

The cost of a land plot under the simplified tax system

When calculating the single tax, it is impossible to take into account the cost of the land plot.

The fact is that, as part of fixed assets, the “simplified” take into account only those objects that are depreciable property in accordance with Chapter 25 of the Tax Code (clause 4 of Article 346.16 of the Tax Code of the Russian Federation). But land and other environmental management facilities are not subject to depreciation (clause 2 of article 256 of the Tax Code of the Russian Federation).

As for the expenses associated with the purchase of a land plot from state property, they can be taken into account in expenses on the basis of subparagraph 29 of paragraph 1 of Article 346.16 of the Tax Code as expenses for paying for the services of specialized organizations for the production of cadastral and technical registration documents for real estate (including title documents) documents for land plots and documents on land surveying) (see letter of the Ministry of Finance of Russia dated April 18, 2006 No. 03-11-04/2/84).

Valuation of fixed assets

Fixed assets have the following types of monetary valuation:

1. Initial

the cost at which they are accepted for accounting.

2. Restorative

the value they have during the reproduction period, taking into account obsolescence and revaluation.

3. Residual

cost, which represents the original or replacement cost of a fixed asset minus depreciation.

The initial cost of fixed assets acquired for a fee is considered to be the sum of the actual costs of the enterprise for their acquisition, construction and production, with the exception of value added tax and other refundable taxes. Actual costs for the acquisition, construction and production of fixed assets may be:

· payment of contracts in accordance with the agreement to the supplier;

· payment for work performed under a construction contract and other contracts;

· payment for information and advisory services related to the acquisition of fixed assets;

· registration fees, state duties and other similar payments made in connection with the acquisition or receipt of rights to an object of fixed assets;

· costs directly related to the acquisition, construction and production of fixed assets.

The initial cost of fixed assets contributed to the authorized capital of an enterprise is considered to be their monetary value, agreed upon with the founders, and in some cases, with a professional appraiser.

The initial value of fixed assets received under a gift agreement and in other cases of gratuitous receipt is recognized as their market value on the date of their receipt by the enterprise.

The cost of fixed assets at which they are accepted for accounting may be subject to change. Changes in the initial value of fixed assets are permitted in cases of completion, additional equipment, reconstruction and partial liquidation of the relevant facilities. The enterprise has the right, no more than once a year, to revaluate fixed assets at replacement cost by indexation or direct recalculation at documented market prices.

When selling prices for means of production, estimated prices and tariffs in construction change due to changes in the cost of reproduction of fixed assets, incomparability arises in the prices of existing and newly introduced fixed assets. This makes it difficult to determine the efficiency of their use, as well as the volume and structure of capital investments. To eliminate these shortcomings, fixed assets are periodically revalued.

The concept of the initial cost of an object

Initially, you should define the concept of fixed assets, which are tools of labor, production property, or intended for the provision of services with a cost of over 40,000 rubles. Such assets are not intended for sale, but are used for a long time to obtain economic benefit.

The initial cost is all those costs that actually occurred at the time of purchasing the OS before the start of its use. To highlight the initial cost, it is necessary to summarize all these costs up to the moment the property is brought into operational condition.

Important! Assets for which the initial cost is determined to be 40 thousand rubles or less can be received as inventory, and then immediately written off without depreciation.

Expenses for companies associated with the acquisition of operating systems can be taken into account as expenses only if there is documentation. Without documents, accounting entries are not made, and tax expenses are not accepted as a reduction in the tax base.

When fixed assets are received, the composition of costs differs somewhat depending on the option of their receipt.

Methods of depreciation of fixed assets

The mechanism for the reproduction of fixed assets is depreciation deductions made from proceeds from sales of products.

Depreciation charges are accrued on an object of fixed assets from the 1st day of the month following the month in which this object was accepted for accounting, and is made until the cost of the object is fully repaid or the object is written off.

If the useful life is not in the technical specifications or is not established centrally, it is determined based on the planned period of use of the object in accordance with the expected productivity and power and physical wear and tear, which may depend on the operating mode, natural conditions and the influence of an aggressive environment, the system of all types of scheduled preventive maintenance.

Depreciation is calculated monthly, regardless of the results of the enterprise's activities. The exception is the periods when equipment is put into storage, i.e. withdrawal from production for a period of at least 3 months and documented by special acts, and a period of restoration of the facility, the duration of which exceeds 12 months.

Features of depreciation calculation:

1. The cost of special tools, special devices and replacement equipment is repaid only by writing off the cost in proportion to the volume of products (works, services).

2. The cost of items intended for rental under a rental agreement is repaid only in a straight-line manner.

3. Objects of fixed assets whose consumer properties do not change over time (land plots, environmental management facilities) are not subject to depreciation.

4. If an object of fixed assets was acquired using budgetary allocations, then depreciation should be calculated only based on the amounts of own funds used (the cost of the object minus the amount of amounts received).

In addition, depreciation is not charged for:

· objects of fixed assets received under a gift agreement and free of charge during the privatization process;

· housing stock;

· external improvement facilities and similar forestry, road facilities, specialized navigation facilities and other facilities;

· purchased publications (books, brochures, etc.).

In accounting, one of the following methods is used to calculate depreciation:

· linear;

· reducing balance method;

· method of writing off value by the sum of the numbers of years of useful life;

· method of writing off cost in proportion to the volume of products (works).

Using the linear

method

assumes an even write-off of the cost of the object over the entire period of operation. In this case, the initial cost of the fixed asset item is taken as the calculation base.

For groups of high-tech equipment, obsolescence occurs much earlier than physical wear and tear. To generate the necessary resources, the reducing balance method

(accelerated method), which involves the use of acceleration factors. The coefficient can be equal to 2 or 3. For this method, the residual value of the object at the beginning of each period is taken as the calculation base.

When applying the method of writing off value by the sum of the numbers of years of useful life

the annual amount of depreciation charges is determined based on the initial cost of the fixed assets object and the ratio of the number of years remaining until the end of the asset’s service life and the sum of the numbers of years of the asset’s service life. From the point of view of financial planning, this method is preferable because it allows you to write off most of the cost of fixed assets at the beginning of operation. Further, the rate of write-off slows down, which ensures a reduction in production costs.

With the method of writing off the cost in proportion to the volume of products (works)

depreciation charges are calculated based on the natural indicator of the volume of production (work) in the reporting period and the ratio of the initial cost of the fixed asset object and the estimated volume of production (work) for the entire useful life of the fixed asset object. The use of this method allows enterprises to take into account the physical wear and tear and mode of use of the object.

In tax accounting

depreciation is calculated using one of the following methods:

1. linear method;

2. nonlinear method.

The amount of depreciation for tax purposes is determined by taxpayers on a monthly basis. Depreciation is calculated separately for each item of depreciable property.

The taxpayer applies the straight-line method

depreciation charges for buildings, structures, transmission devices included in the eighth - tenth depreciation groups, regardless of the timing of commissioning of these objects.

For other fixed assets, the taxpayer has the right to apply any of the methods provided for by the Tax Code of the Russian Federation.

The depreciation calculation method chosen by the taxpayer cannot be changed during the entire period of depreciation calculation for the depreciable property.

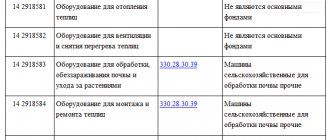

For tax purposes, fixed assets subject to depreciation (depreciable property) are distributed into depreciation groups in accordance with their useful lives.

Depreciable property is combined into the following depreciation groups:

· first group

– all short-lived property with a useful life from 1 year to 2 years inclusive;

· second group

– property with a useful life of more than 2 years up to 3 years inclusive;

· third group

– property with a useful life of more than 3 years up to 5 years inclusive;

· fourth group

– property with a useful life of more than 5 years up to 7 years inclusive;

· fifth group

– property with a useful life of over 7 years up to 10 years inclusive;

· sixth group

– property with a useful life of over 10 years up to 15 years inclusive;

· seventh group

– property with a useful life of over 15 years up to 20 years inclusive;

· eighth group

– property with a useful life of over 20 years up to 25 years inclusive;

· ninth group

– property with a useful life of over 25 years up to 30 years inclusive;

· tenth group

– property with a useful life of over 30 years.

The classification of fixed assets included in depreciation groups is approved by the Government of the Russian Federation.

GLAVBUKH-INFO

| All pages |

Page 1 of 2

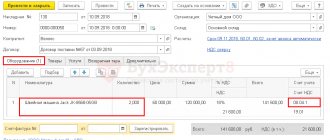

For fixed assets received under sales and purchase agreements and other similar agreements, the purchasing organization must receive settlement and shipping documents from the supplier (shipper).

Primary documents confirming the acquisition of fixed assets for a fee are:

- supplier invoice and invoice for fixed assets;

- invoices and invoices confirming expenses associated with the acquisition, delivery of fixed assets and bringing them into a condition suitable for use;

- payment and settlement documents indicating payment for the fixed asset item and all expenses associated with its acquisition, delivery, etc.

Accounting for the presence and movement of fixed assets of the organization is carried out on active account 01 “Fixed Assets”.

Any receipt of fixed assets into the organization is initially reflected in account 08 “Investments in non-current assets”.

Account 08 “Investments in non-current assets” is a calculation account designed to accumulate and summarize the actual costs of incoming fixed assets.

Actual costs associated with the acquisition of fixed assets for a fee are initially collected from the debit of account 08 “Investments in non-current assets” (subaccount 08–4 “Purchase of fixed assets”) in correspondence with settlement accounts (account 60 “Settlements with suppliers and contractors” "and account 76 "Settlements with various debtors and creditors").

Subaccount 08–4 “Purchase of fixed assets” takes into account the actual costs of purchasing equipment, machinery, tools, inventory and other fixed assets that do not require installation.

Actual costs associated with the construction and production of fixed assets are also initially collected from the debit of account 08 “Investments in non-current assets” (subaccount 08–3 “Construction of fixed assets”) in correspondence with the settlement accounts.

Subaccount 08–3 “Construction of fixed assets” takes into account the costs of constructing buildings and structures, installing equipment, the cost of equipment transferred for installation and other expenses provided for in estimates, financial estimates and title lists for capital construction (regardless of whether it is carried out This is construction by contract or economic method).

When accepting fixed assets for accounting, the actual costs recorded on account 08 “Investments in non-current assets” (according to the corresponding sub-accounts) are debited to account 01 “Fixed Assets”.

Analytical accounting for account 01 “Fixed Assets” is carried out for individual inventory items of fixed assets. At the same time, the construction of analytical accounting should provide the ability to obtain data on the availability and movement of fixed assets necessary for the preparation of financial statements (by type, location, etc.).

Costs for the acquisition of equipment that does not require installation are reflected in accounting in the same manner as for accounting for transactions for the acquisition of fixed assets, and are recorded directly in account 08 “Investments in non-current assets”.

The initial cost of fixed assets (including used ones) acquired for a fee is recognized as the amount of the organization's actual costs for acquisition, construction and production, with the exception of value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation).

The list of actual costs taken into account when forming the initial cost of fixed assets is given in paragraph 4 of this chapter.

Tax aspects. From January 1, 2006, a new procedure for tax accounting of expenses associated with the acquisition of fixed assets for a fee was established.

In accordance with the general norm of Art. 270 of the Tax Code of the Russian Federation, expenses for the acquisition of depreciable property (including fixed assets) are classified as expenses not taken into account for profit tax purposes.

In accordance with this norm, these expenses must form the initial cost of fixed assets.

For tax accounting purposes in accordance with paragraph 1 of Art. 257 of the Tax Code of the Russian Federation, the initial cost of an item of fixed assets is defined as the amount of expenses for its acquisition and bringing it to a state in which it is suitable for use, with the exception of amounts of value added tax and excise taxes, except for the cases provided for by the Tax Code of the Russian Federation.

For tax accounting purposes, the initial cost of a depreciable fixed asset item must be repaid by calculating depreciation.

Thus, in the general case, the cost of a fixed asset item is included in expenses taken into account for profit tax purposes in the form of depreciation amounts accrued on the fixed asset item during its useful life.

An exception to this general rule is provided for in paragraph 1.1 of Art. 259 of the Tax Code of the Russian Federation. According to this paragraph, an organization, when accepting fixed assets for accounting, has the right to include in the expenses of the reporting (tax) period the costs of capital investments in the amount of no more than 10 percent of the initial cost of fixed assets (with the exception of fixed assets received free of charge).

When using such a right, the organization must subsequently charge depreciation on the remaining 90 percent of the original cost of the fixed asset.

In the latter case, the value of the initial cost of fixed assets formed in accounting will differ from the value of the initial cost of fixed assets reflected in tax accounting, since the above exception is not provided for in accounting.

These kinds of differences between accounting and tax accounting of fixed assets may also arise due to different approaches to the recognition for profit tax purposes of certain types of expenses associated with the acquisition and/or creation of fixed assets.

For example, unlike accounting, for tax accounting purposes interest on borrowed funds accrued before the fixed asset was accepted for accounting is not included in the initial cost of fixed assets. In tax accounting, the specified interest is included in non-operating income or expenses, regardless of the nature of the loan or credit.

Obviously, in the presence of such expenses, the value of the initial cost of fixed assets in accounting and tax accounting will differ, which will ultimately lead to discrepancies between the profit generated according to accounting data and the profit generated according to tax accounting data.

To establish the relationship between accounting and tax accounting data, organizations must be guided by the rules of the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02, which are not discussed in this chapter, as they are set out in detail in paragraph 2.3 of Chapter. 14.

In accordance with paragraph 1 of Art. 170 of the Tax Code of the Russian Federation, VAT amounts presented to the organization (VAT payer) when purchasing fixed assets in the territory of the Russian Federation or actually paid by the organization when importing fixed assets into the customs territory of the Russian Federation are not included in the organization’s expenses taken into account when calculating income tax.

When purchasing fixed assets, the organization takes into account the above VAT amounts in the debit of account 19 “Value added tax on acquired assets” (subaccount 19–1 “Value added tax on the acquisition of fixed assets”) in correspondence with the credit of account 60 “Settlements with suppliers and contractors."

The above VAT amounts must be highlighted as a separate line in primary accounting and settlement documents, as well as in invoices received from suppliers.

In particular, according to paragraph 4 of Art. 168 of the Tax Code of the Russian Federation in payment documents, including in registers of checks and registers for receiving funds from a letter of credit, in primary accounting documents and invoices, the VAT amount must be highlighted on a separate line.

In this case, invoices received from suppliers of fixed assets are subject to registration in the purchase book. When purchasing fixed assets, the invoice is registered in the purchase book in full after the fixed assets are registered.

Subject to the conditions established by Ch. 21 of the Tax Code of the Russian Federation, the purchasing organization may subsequently present the above amounts of VAT for deduction.

Amounts of VAT subject to tax deduction are written off from the credit of account 19 “Value added tax on acquired assets” (subaccount 19–1 “Value added tax on the acquisition of fixed assets”), to the debit of account 68 “Calculations for taxes and fees” ( subaccount 68–1 “Calculations for value added tax”).

It has been established that deductions of VAT amounts presented to an organization upon acquisition or paid upon import into the customs territory of the Russian Federation of fixed assets, including equipment for installation, are made in full after they are registered.

In addition, VAT amounts can be deducted if there are correctly executed primary documents (including invoices) and provided that the acquired fixed assets are intended for production activities or other operations recognized as objects of taxation.

It has been established that if the above conditions are not met, the amounts of VAT presented to the organization when purchasing fixed assets or actually paid by the organization when importing fixed assets into the customs territory of the Russian Federation are not subject to deduction and are reflected in accounting in a different way.

In cases where the primary accounting documents (bills, invoices, invoices, cash receipt orders, certificates of completion of work, etc.) confirming the cost of purchased goods do not indicate the amount of VAT, then the settlement documents (orders, demands-orders) , registers of checks and registers for receiving funds from a letter of credit) its calculation is not carried out by calculation.

The cost of goods purchased in such cases (including fixed assets), including the estimated VAT on them, is taken into account as a whole in their accounting accounts, i.e. the amount of VAT is taken into account in their cost.

In addition, according to paragraph 2 of Art. 170 of the Tax Code of the Russian Federation, VAT amounts presented to the buyer when purchasing fixed assets on the territory of the Russian Federation or actually paid when importing fixed assets into the territory of the Russian Federation are taken into account in their cost in the following cases:

- acquisition (import) of fixed assets used for operations for the production and/or sale (as well as transfer, execution, provision for one’s own needs) of goods (work, services) that are not subject to taxation (exempt from taxation);

- acquisitions (import) of fixed assets used for production operations and/or sales of goods (works, services), the place of sale of which is not recognized as the territory of the Russian Federation;

- acquisition (import) of fixed assets by persons who are not VAT payers or are exempt from fulfilling taxpayer obligations for the calculation and payment of VAT;

- acquisition (import) of fixed assets for the production and/or sale (transfer) of goods (work, services), operations for the sale (transfer) of which are not recognized as the sale of goods (work, services) in accordance with clause 2 of Art. 146 of the Tax Code of the Russian Federation.

Previous — Next >>

| < Previous | Next > |

Indicators of use of fixed assets

When analyzing the financial and economic activities of an enterprise, indicators of the condition and efficiency of use of fixed assets are examined.

Indicators of the condition of fixed assets include:

· wear rate,

· suitability factor,

· renewal coefficient,

· retirement rate.

The degree of use of fixed assets in monetary terms is determined by the following indicators:

· capital productivity,

· capital intensity,

· capital-labor ratio.

Depreciation rate of fixed assets

– an indicator characterizing the average wear and tear of labor tools. It is defined as the ratio of the amount of depreciation of fixed assets to their original cost.

Fixed asset serviceability ratio

– an indicator characterizing their condition on a certain date. It is calculated by the ratio of the residual value of fixed assets to their original cost and is a value inversely proportional to the depreciation rate of fixed assets.

Fixed asset renewal ratio

– an indicator characterizing the share of new fixed assets put into operation in a given period in their total cost. At the end of the period, it is determined by the ratio of the value of newly introduced fixed assets for the period under review to the value of all fixed assets at the end of the period, assuming that during the period under review all newly received fixed assets were preserved.

Retirement rate of fixed assets

is calculated as the ratio of the value of fixed assets disposed of during the year to the value of fixed assets at the end of the year.

Capital intensity indicator

equipment is calculated as the ratio of the average annual cost of fixed assets to the volume of production.

A general indicator of the efficiency of use of fixed assets is capital productivity

: the ratio of the volume of production (work, services) to the average annual book value of fixed production assets.

Capital-labor ratio

is the cost of fixed assets per worker. This indicator is calculated by the ratio of the average annual cost of existing production fixed assets to the average number of workers in the largest shift.

Reproduction of fixed assets

The use of depreciation charges is aimed at the reproduction of fixed assets. In real conditions, especially with inflation, these funds are usually not enough not only for expanded, but also for simple reproduction. Therefore, other sources are necessary for effective reproduction.

Financing of the process of formation of fixed assets can be carried out from the following main sources:

· funds of the founders transferred at the time of creation of the enterprise or already in the process of its functioning;

· the enterprise’s own resources created in the process of its statutory activities;

· funds received by the enterprise on a borrowed basis in the form of targeted bank loans;

· allocations from budgets of various levels and extra-budgetary funds;

· rent, and its variety – leasing.

There are simple and expanded reproduction of fixed assets.

Simple reproduction

involves restoring the original properties of an object of fixed assets or replacing it with a similar object in terms of technical and technological properties.

The main forms of simple reproduction include:

· current repairs – the process of partial restoration of the functional properties and value of fixed assets in the process of their renewal (replacement of parts, assemblies);

· major repairs – the process of partial or complete replacement of individual elements of fixed assets, including basic ones, as well as complete restoration of fixed assets.

· acquisition of new types of fixed assets.

With expanded reproduction

it is planned to reconstruct or modernize a fixed asset object, to replace the object with a more modern, improved analogue.

Reconstruction

represents a complete or partial re-equipment and reconstruction of an enterprise with the replacement of obsolete and physically worn-out equipment, mechanization and automation of production, elimination of imbalances in technological units and support services.

Technical re-equipment

includes a set of measures to improve the technical level of individual production areas, units, installations to modern requirements by introducing new equipment and technology, mechanization and automation of production processes, modernization and replacement of outdated and physically worn equipment with new, more productive ones; eliminating bottlenecks, improving the organization and structure of production.