The minimum wage in Russia is set at the federal level and guarantees respect for workers' rights to a decent standard of living. Regions, in accordance with the Labor Code, are also vested with the authority to establish minimum wages at the local level. As prices for consumer goods and the cost of living change, the indicator is revised based on an agreement between the authorities, employers and trade unions.

We will tell you what the minimum wage (SMW) is set in Moscow in 2019-2020 under a tripartite agreement, how it changed and whether we should expect an increase from January 1, 2021.

Legal assistance:

Free in Russia: 8

Dear readers!

The free legal assistance hotline is available for you 24 hours a day!

What will the new minimum wage affect?

The federal minimum wage conditionally affects the minimum wage in each region. The latter is established by the constituent entities of the Russian Federation. However, the minimum level of earnings in the region should not be less than the federal indicator (Article 133.1 of the Labor Code). In some cases, on the contrary, it is much greater than the federal value - for example, in the far north.

The regional minimum is increased depending on the economic situation of the subject and territorial conditions. To do this, the federal minimum wage is multiplied by the coefficients established in the constituent entities. Such decisions are recorded in the regulatory acts of the subjects.

The federal law on increasing the minimum wage from May 1, 2021 in Russia will affect many payments:

- temporary unemployment benefits;

- for pregnancy and childbirth - for the period when the woman is unable to work;

- for child care.

How to increase your salary to the minimum wage

There are two options to raise your salary to the minimum wage. The first option is to increase your salary. The second is to introduce bonuses.

In the first case, issue an order to amend the staffing table and enter into additional agreements to the employees’ employment contracts, in which you indicate the new amount of their salaries.

There is no standard form for an order to increase the salary of an employee whose salary does not reach the minimum wage level. Therefore, you can compose it in any form. The main thing is to provide the following information in the order:

- name of the document and its details;

- the basis for the additional payment is the discrepancy between the salary level and the established minimum wage with reference to a federal or regional regulatory act;

- information about the employee in respect of whom the order is issued: full name, position, name of the structural unit in which he works;

- amount of surcharge;

- date of payment;

- indication of persons responsible for executing the order;

- signature of the employer's authorized representative;

- signatures of the persons responsible for the execution of the order and the date of review.

In the second case, an order establishing a premium and additional agreements to employment contracts is sufficient. It is not necessary to make changes to the staffing table.

Minimum wage and benefits

The regional minimum wage does not affect all benefits or for every employee. For example, to calculate sick pay and allowance for caring for a child up to 1.5 years old, the average daily earnings are taken into account. However, in some cases, the calculation is carried out taking into account the minimum wage:

- the employee does not have a salary in the billing period, or his earnings are below the minimum wage;

- less than six months of experience;

- the employee did not follow the prescribed treatment regimen, and the doctor made a corresponding note on the sick leave;

- The cause of illness or injury is alcohol intoxication.

Incentive payments - the amount of incentive and compensation payments

To encourage workers to provide higher-quality services in the public sector, changes were made to the Labor Code of the Russian Federation regarding remuneration. The use of the UTS did not justify itself, and its first category implied a salary below the subsistence level. The quality of services has decreased significantly.

This salary distribution system was not focused on the specifics of the profession. Therefore, the realities of the modern world have required a transition to a fundamentally new wage system, which is maximally adapted to modern business conditions.

These include incentive and compensation payments, the amount of which depends on the assessment of the employee’s performance and is introduced on an individual basis.

What are incentive payments?

Types of additional payments for professional qualifications:

- bonus. Its accrual may be a certain percentage of the salary, or it may be paid to the employee once;

- various rewards;

- additional payments specified in the collective agreement or internal regulations.

Such bonuses are paid from the salary fund and are assigned:

- for quality work performed;

- for good performance and intensity;

- for the period worked;

- for experience

Allowances are set by the management of the institution, the amounts are prescribed in the collective and individual agreement. A provision on incentive payments with criteria for the effectiveness of services provided should be developed.

Additional information: Occupational safety and health at school.

Compensation payments and incentive payments from the public sector

The advantage of modern remuneration is that the manager is given more independence in the distribution of funds for material incentives for employees.

An employee’s salary can be influenced by factors such as the volume and quality of work performed, the education and qualifications of the employee, the scope of professional qualities and job responsibilities. In the qualification group, a basic salary is introduced. Allowances regulate increasing coefficients.

The salary of a public sector employee does not become less if the employee performs the same amount of work. Funds from paid activities also go towards incentive payments.

Incentive criteria and payments to teachers and educators in 2021

The criteria for bonus payments are established by each general education institution separately, focusing on legislation when drawing up a document. The following criteria have been developed for secondary school teachers:

- participation in classroom and extracurricular activities: excursions, social and educational projects;

- monitoring student progress;

- implementation of intermediate knowledge tests;

- holding events with parents;

- the effectiveness of children’s participation in various Olympiads and competitions;

- organization of sports leisure;

- carrying out work with families at risk;

- working with children with disabilities and gifted children;

- work to improve academic performance;

- advanced training, teacher certification and various forms of training.

For educators and teaching staff of the State Budgetary Educational Institution, additional allowances are calculated in the amount of sixty percent of the institution’s bonus fund. The remaining forty percent is provided for other employees.

Incentive payments to healthcare workers in 2021

In 2021, bonuses for employees of medical institutions are calculated on a point system, their amounts depend on the results achieved, and are paid only to those who have a certificate to perform a particular activity. The size depends on the following factors:

- number of diseases detected in time;

- number of incorrect diagnoses;

- cases of untimely hospitalization;

- complications after operations;

- complaints from patients;

- improper documentation.

Minutes of the meeting of the commission on the distribution of incentive payments

Bonuses are accrued based on the employee’s performance, for example, for a year. A portion of the salary fund goes to motivating employees.

Each organization adopts a regulation on the distribution of allowances. Then a commission is elected to distribute these bonuses, which includes several members of the team. The commission draws up a protocol on the decision made. Based on this protocol, the manager issues an order on additional payments. The order is sent to the accounting department.

protocol and order

Score sheet for preschool teacher for incentive payments 2021 - sample

Criteria have been developed for calculating additional payments to teachers; they are used to judge their professional competence. These criteria are stated in the evaluation sheet, which helps to evaluate the work of the teacher in order to calculate subsequent additional payments to the salary.

Additional payment up to the minimum wage: is it a compensation payment or an incentive?

The additional payment to the minimum wage is neither compensatory nor stimulating in nature. Compensations are related to reimbursement of expenses for the performance of labor duties. Additional payments of the incentive plan are associated with an increase in the employee’s material interest in the quality result of the work. The minimum wage is a state guarantee.

If you have questions, consult a lawyer. You can ask your question in the form below, in the online consultant window at the bottom right of the screen, or call the numbers (24 hours a day, 7 days a week): ( 5 3.20 out of 5) Loading…

Source: https://classomsk.com/zashhita-prav-rabotnika-i-rabotodatelya/stimuliruyushhie-vyplaty-razmer-stimuliruyushhix-i-kompensacionnyx-vyplat.html

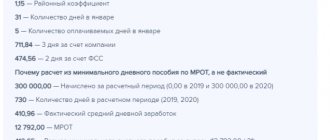

Calculation of sick leave according to the minimum wage

In the cases mentioned above, sick leave payments are determined by the level of the minimum wage. To calculate sickness compensation in 2021, you can take the following example:

- A new employee got a job at the company. There was a difficult economic situation in his region, so from 2016 to 2021 he did not work. After a month of staying in the organization, he went on sick leave, and a week later he presented sick leave to the HR department for 5 days.

- Since the employee did not receive a salary during the estimated time, accounting relies on minimum wage indicators. First, the average salary is determined as 11,163*24 months/730 days. = 367 rubles.

- If the employee’s work experience is 4 years 2 months, the benefit will be equal to 60% (less than 5 years). Payments are calculated in this way - 367 * 5 * 60% = 1101 rubles.

Similar situations arise for employees who have returned from maternity leave.

The percentages used for calculation depend on the length of service of the employee:

- less than 8 years - daily earnings are multiplied by 100%;

- 5-8 years – guarantee of payment of 80% of daily earnings;

- For working experience of no more than 5 years, the bonus is 60%;

- If you have less than six months of experience, the amount is calculated from the minimum wage.

To apply for sick leave benefits, the employee must submit an application for compensation within a month. Otherwise, the funds due to him will not be paid.

History in the world and in the USSR

In the world, minimum wage mechanisms began to be established at the legislative level at the turn of the 19th-20th centuries to resolve conflicts with trade unions. The first such act was passed by the New Zealand Parliament in 1894. In most countries, the minimum wage is set not in monthly, but in hourly terms. For example, in the USA, since 2015, the minimum wage is $7.25 per hour, which, with an eight-hour working day and a five-day working week, corresponds to an average of $1.3 thousand per month (about 75 thousand rubles at the current exchange rate).

In the RSFSR, the concept of “obligatory minimum wage” for labor was first introduced by the Labor Code of 1922. By the Decree of the Central Committee of the CPSU, the Council of Ministers of the USSR and the All-Union Central Council of Trade Unions dated December 12, 1972, the minimum wage for workers and employees was set at 70 rubles. per month and did not change until 1991.

Forecasts

According to the latest news, the Ministry of Labor plans to increase the minimum wage by more than 50% by 2021. At the same time, consumer price growth is projected for the specified period by 12.5%. This forecast for 2019-2020 is based on a new policy of economic strengthening of the state.

From 2021, the minimum level of earnings will be revised annually so that it is equal to the cost of living for the previous year (2nd quarter). According to officials, increasing the minimum wage will have a positive impact on the solvency of the population.

From May 1, 2021, the minimum wage has increased, reaching the subsistence level. It differs for different regions, but cannot be lower than the figure at the federal level.

Based on materials from investpad.ru

Results

In accordance with the current rules for establishing the federal minimum wage, its value is determined annually as of the beginning of the coming year, with a guide to the cost of living for the population capable of working for the 2nd quarter of the ending year. An increase in the cost of living leads to an increase in the minimum wage, but a decrease does not serve as a basis for reducing the minimum wage.

From 2021, the minimum wage in Russia will increase to 12,130 rubles.

This will lead to an increase in wages that do not reach this value, social payments, the minimum amount of which depends on the minimum wage, and the minimum wage in force at the regional level, if it is lower than the federal minimum wage. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Table of minimum wages by region from January 1, 2021, taking into account the regional coefficient

The table was formed taking into account the regional coefficient and special conditions of the regions.

Special conditions include tripartite agreements between employees, trade unions and management and resolutions of territorial government executive bodies.

| Region | Regional coefficient | Special conditions | Total amount of minimum wage, rub. |

| Altai region | 1,15 | — | 13 000 |

| Amur region | 1,2 | — | 14 556 |

| Arhangelsk region | 1,4 | — | 16 982 |

| Astrakhan region | — | — | 12 130 |

| Belgorod region | — | — | 12 130 |

| Bryansk region | — | — | 12 130 |

| Vladimir region | — | — | 12 130 |

| Volgograd region | — | — | 12 130 |

| Vologda Region | — | 1.2 from the subsistence level | minimum 12 130 |

| Voronezh region | — | — | 12 130 |

| Jewish Autonomous Region | — | Minimum wage, including regional coefficient 12,000.00 for all employees | 12 130 |

| Transbaikal region | 1,2 | — | 14 556 |

| Koralsky district of Zabaykalsky Krai | 1,2 | — | 14 556 |

| Ivanovo region | — | — | 12 130 |

| Irkutsk region | 1,3 | — | 15 769 |

| Kabardino-Balkarian Republic | — | — | 12 130 |

| Kaliningrad region | — | — | 12 130 |

| Kaluga region | — | — | 12 130 |

| Kamchatka Krai | 1,8 1,6 | — | 21 834 19 408 |

| Captain's Islands | 2 | — | 24 260 |

| Aleutian Islands | 1,8 | The minimum wage, including the regional coefficient, is 21,834 rubles. for all employees | 21 834 |

| Koryak district | 1,8 | Minimum wage, including regional coefficient 19177.00 for all employees | 21 834 |

| Karachay-Cherkess Republic | — | — | 12 130 |

| Kemerovo region | 1,3 | — | 15 769 |

| Kirov region | — | — | 12 130 |

| Kostroma region | — | — | 12 130 |

| Krasnodar region | — | — | 12 130 |

| Krasnoyarsk region | 1,3 | — | 15 769 |

| Norilsk | 1,8 | — | 21 834 |

| Kurgan region | 1,15 | — | 13949,5 |

| Kursk region | — | — | 12 130 |

| Leningrad region | — | 12 130 | |

| Lipetsk region | — | — | 12 130 |

| Magadan Region | 1,7 | — | 20 621 |

| Moscow | — | — | 20 195 |

| Moscow region | — | — | 15 000 |

| Murmansk region | 1,5 | Allowances: Murmansk-140 - 1.8 urban areas. Foggy - 1.7 Rest of the region. — 1.4 | 32751 30931,5 25473 |

| Nenets Autonomous Okrug | 1,8 | Surcharges: north of the Arctic Circle - 1.8; to the south - coefficient 1.7. | 39 301,2 37 117,8 |

| Nizhny Novgorod Region | — | — | 12 130 |

| Novgorod region | — | — | 12 130 |

| Novosibirsk region | 1,25 | — | 15162,5 |

| Omsk region | 1,15 | — | 13949,5 |

| Orenburg region | 1,15 | — | 13949,5 |

| Oryol Region | — | — | 12 130 |

| Penza region | — | — | 12 130 |

| Perm region | 1,15 | — | 13949,5 |

| Primorsky Krai | 1,3 | — | 15 769 |

| Pskov region | — | — | 12 130 |

| Republic of Adygea | — | — | 12 130 |

| Altai Republic | 1,25 | — | 15162,5 |

| Republic of Bashkortostan | 1,15 | — | 13949,5 |

| The Republic of Buryatia | — | — | 12 130 |

| The Republic of Dagestan | — | — | 12 130 |

| The Republic of Ingushetia | — | — | 12 130 |

| Republic of Kalmykia | 1,3 | — | 15 769 |

| Republic of Karelia | 1,15 | — | 13949,5 |

| Komi Republic | 1,2 | — | 13 359,60 |

| Republic of Crimea | — | — | 12 130 |

| Mari El Republic | — | — | 12 130 |

| The Republic of Mordovia | — | — | 12 130 |

| The Republic of Sakha (Yakutia) | depending on the territory 1.4 - 2.0 | According to the law of Yakutia dated May 18, 2005 No. 475-III + from 10-80% salary increase depending on length of service. | 18680,2 — 43668 |

| Republic of North Ossetia–Alania | — | — | 12 130 |

| Republic of Tatarstan | — | — | 12 130 |

| Tyva Republic | 1,4 | — | 16 982 |

| The Republic of Khakassia | 1,3 | — | 15 769 |

| Rostov region | — | — | 12 130 |

| Ryazan Oblast | — | — | 12 130 |

| Samara Region | — | — | 12 130 |

| Saint Petersburg | — | The minimum wage is 17,000 rubles. | 17 000,00 |

| Saratov region | — | — | 12 130 |

| Sakhalin region | 1,6-2,0 | Depending on the region, the maximum premium is 0.5-2.6 | 25473 — 55798 |

| Sverdlovsk region | — | — | 12 130 |

| Sevastopol | — | — | 12 130 |

| Smolensk region | — | — | 12 130 |

| Stavropol region | — | — | 12 130 |

| Tambov Region | — | — | 12 130 |

| Tver region | — | — | 12 130 |

| Tomsk region | 1,3 | — | 15 769 |

| Tula region | — | — | 12 130 |

| Tyumen region | 1,15 | — | 13949,5 |

| Udmurt republic | 1,15 | — | 13949,5 |

| Ulyanovsk region | — | — | 12 130 |

| Khabarovsk region | 1,3 | Minimum wage, including regional coefficient 12,480.00 for all employees | 15 769 |

| Khanty-Mansiysk Autonomous Okrug – Ugra | 1,7 | — | 18 977,10 |

| Chelyabinsk region | 1,15 | — | 13949,5 |

| Chechen Republic | — | — | 12 130 |

| Chuvash Republic | — | — | 12 130 |

| Chukotka Autonomous Okrug | 2 | — | 24260 |

| Yamalo-Nenets Autonomous Okrug | 1,5-1,8 | Supplement from 10-60% depending on residence and length of service | 20014,5 — 34934,4 |

| Yaroslavl region | — | — | 12 130 |