Production and consumption waste are the remains of raw materials, materials, semi-finished products, other items or products that were generated in the process of production or consumption, as well as goods (products) that have lost their consumer properties.

Waste can be irretrievable or returnable.

Irrecoverable waste or technological losses cannot be used further in production or sold externally.

In this article we will consider the procedure for taxation and accounting of irrecoverable waste.

Technological losses

Technological losses are understood as losses that occur during the production or transportation of goods (work, services) and are caused by the technological features of the production cycle or transportation, as well as the physical and chemical characteristics of the raw materials used.

In particular, technological losses include:

- loss of flour when kneading dough (clause 7.2.2 of the Rules for organizing and maintaining the technological process at bakery enterprises, approved by the Ministry of Agriculture and Food of Russia on July 12, 1999);

- losses during the transfer of thermal energy arising through the heat-insulating structures of heat pipelines in the form of steam, condensate, water (clause 2 of the Procedure for determining standards for technological losses during the transfer of thermal energy, coolant, approved by Order of the Ministry of Energy of Russia dated December 30, 2008 N 325).

Accounting

Irrecoverable waste or technological losses cannot bring economic benefits to the organization, and therefore they are not accepted for accounting as assets and, accordingly, are not assessed (clause 7.2, clause “a”, clause 7.2.1, clause 8.3 Concepts of accounting in the market economy of Russia (approved by the Methodological Council on Accounting under the Ministry of Finance of Russia, the Presidential Council of the Institute of Professional Accountants on December 29, 1997)).

A similar procedure for irrecoverable waste is established by some industry recommendations for accounting for production costs (for example, clause 60 of the Methodological Recommendations for accounting for production costs and calculating the cost of products (works, services) in agricultural organizations, approved by the Order of the Ministry of Agriculture of Russia dated 06.06.2003 N 792, clause 7 of the Methodological recommendations (instructions) for planning, accounting and calculating the cost of products of the timber industry complex, approved by the Ministry of Economy of Russia on July 16, 1999, clause 27 of the Basic Provisions for planning, accounting and calculating the cost of production at industrial enterprises (approved by the State Planning Committee of the USSR , State Committee for Prices of the USSR, Ministry of Finance of the USSR, Central Statistical Office of the USSR 07/20/1970)).

Thus, separate accounting of expenses in the form of technological losses is not carried out.

Accounting press and publications

"Russian Tax Courier", N 12, 2004

TECHNOLOGICAL LOSSES AND NATURAL LOSS:

TAXATION

Losses of inventory items during production processes are inevitable. In some cases this is due to the specifics of the technologies used, in others - to the physical and chemical properties of goods and materials. How to correctly account for losses incurred for profit tax purposes?

What are the differences between technological losses?

and natural decline

For tax purposes, profits are treated as material expenses:

— losses from shortages and (or) damage during storage and transportation of inventory items within the limits of natural loss norms approved in the manner established by the Government of the Russian Federation (clause 2, clause 7, article 254 of the Tax Code of the Russian Federation);

— technological losses during production and transportation (clause 3, clause 7, article 254 of the Tax Code of the Russian Federation).

To avoid confusion, let us differentiate between these two concepts.

Natural loss is a decrease in the mass of inventory items due to natural changes in biological and (or) physicochemical properties while maintaining the quality of the assets within the requirements (standards) established by regulations. This definition of natural loss is contained in the Methodological Recommendations for the development of norms of natural loss, approved by Order of the Ministry of Economic Development of Russia dated March 31, 2003 N 95. Losses from natural loss arise during the storage and transportation of material assets. Natural loss includes shrinkage, attrition, weathering, evaporation, etc.

Please note: natural loss does not include technological losses and losses from defects, losses of inventory during storage and transportation, which are caused by violation of requirements and standards, technical and technological conditions, rules of technical operation of equipment and damage to containers.

Technological losses arise in the process of processing, processing and delivery of valuables due to the characteristics of the technologies used. For example, in metallurgy, part of the metal goes into slag, in woodworking, part of the wood turns into chips, etc.

When transporting goods, both technological losses and natural loss may occur. Therefore, these two types of losses must be distinguished. And for this it is necessary to establish the cause of the losses. For example, during drying, the mass of values changes due to evaporation. That is, losses are associated with changes in physical and chemical properties: moisture turns into steam. During attrition, the mass of valuables changes as a result of dust settling from bulk cargo. In this case, the physicochemical properties also change. What if losses occur for technological reasons? For example, after transportation, a certain amount of oil remains at the bottom of the tanks, and some bulk cargo remains in the cracks of the cars. There are technological losses here. The physical and chemical properties of the transported materials do not change: the same oil remains at the bottom of the tank, and the same bulk cargo remains in the cracks of the car.

Technological losses

Technological losses during production and (or) transportation depend on the operational (technical) characteristics of the equipment used. The amount of losses in a specific technological process for profit tax purposes must be justified and documented in accordance with the requirements of Article 252 of the Tax Code of the Russian Federation. This is the position of the tax authorities.

Let's consider what documents need to be drawn up to confirm the legality of writing off losses.

For clarification, please refer to Letter of the Ministry of Finance of Russia dated September 2, 2003 N 04-02-05/1/85. It states that organizations independently determine the waste generation standard for each specific type of raw material used in production. To do this, organizations can use the services of third-party specialized organizations or attract their own qualified specialists.

When developing standards for technological losses, one should proceed from the characteristics of the technological process. The standards are fixed in the technological map or in another similar internal document. Provided that the standards are established and justified by technologists. After this, authorized persons sign the document. In addition, the norms for technological losses must be approved by order of the head of the organization.

———————————————————————————————— Technological map (technological process estimate) is a document that does not have a unified form and is approved by the enterprise as an internal document. — Approx. ed.

To establish standards for the formation of technological losses, you can use industry regulations, calculations and research results of the enterprise’s technological services, or other limits regulating the progress of the technological process. It is advisable to use various unified reference materials on specific indicators of the formation of the main types of production and consumption waste, published by industry departments.

Example 1. An enterprise produces furniture. The sawdust formation standard for plywood of grade “A” is 100 kg per 1 ton, for plywood of grade “B” - 120 kg per 1 ton. Sawdust from plywood of grade “B” is subsequently used in production in the form of returnable waste (chipboards are made). At the same time, 15 kg per 1 ton of sawdust is irrecoverable waste.

In March 2004, 900 tons of “A” grade plywood and 800 tons of “B” grade plywood were processed.

We will draw up an estimate of the technological process, or a technological map (see table on page 56).

Table

Technological map of plywood production for March 2004

——————————T——————————————T——————————————————————— T———————————————————————T———————————————————————¬ | Brand | Standard | Recycling rates (t) | Factual data | Deviation (t) | | | education | | processing (t) | | | | waste (%) | | | | | +—————T————————+————————T———————————————+————————T ——————————————+————————T——————————————+ | |total|in that |wasted—| waste |wasted—| waste |wasted—| waste | | | |number |doven +—————T—————————+dove +—————T————————+dove +—————T———— ————+ | | |without— | |total|in that | |total|in that | |total|in that | | | |return—| | |number | | |number | | |number | | | | | |without— | | |without— | | |without— | | | | | | |return— | | |return—| | |return—| | | | | | | new | | | new | | | new | | | | | | |(page 2 x| | | | | | | | | | | | |page 4) | | | | | | | +—————————+—————+————————+————————+—————+————————— +————————+—————+————————+————————+—————+————————+ | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | +—————————+—————+————————+————————+—————+————————— +————————+—————+————————+————————+—————+————————+ | Brand "A"| 10 | 10 | 900 | 90 | 90 | 900 | 90 | 90 | — | — | — | +—————————+—————+————————+————————+—————+————————— +————————+—————+————————+————————+—————+————————+ | Brand "B"| 12 | 1.5 | 800 | 96 | 12 | 800 | 96 | 12 | — | — | — | +—————————+—————+————————+————————+—————+————————— +————————+—————+————————+————————+—————+————————+ | Petrenko | |General Director: ———————— Petrenko A.S. | | Ivanov | |Compiled by: Chief Economist —————— Ivanov P.A. | L————————————————————————————————————————————————— —————————————————————————————————————————————————

Technologists and economists of the enterprise must constantly ensure that the actual losses of raw materials do not exceed the approved standards. The excess of actual technological losses over established standards, as a rule, indicates either a violation of technology, or the use of low-quality raw materials, or incorrect calculations. If the established standards for process losses are regularly exceeded, it is necessary to reconsider.

It is important to distinguish between process losses and returnable waste. Returnable waste refers to the remains of raw materials (materials), semi-finished products, coolants and other types of material resources that were generated during the production of goods (performance of work, provision of services). During processing, these material resources partially lost their consumer qualities (chemical or physical properties), and therefore they are used at increased costs (reduced product yield) or are not used for their intended purpose (clause 6 of Article 254 of the Tax Code of the Russian Federation). For example, returnable waste includes pieces of metal and metal shavings that can be scrapped. Returnable waste does not include the remains of inventory items, which, in accordance with the technological process, are transferred to other departments as full-fledged raw materials, as well as by-products obtained during the production process.

Both technological losses and returnable waste are associated with technological features of production. At the same time, there is one significant difference between these types of losses: returnable waste can be used again (either in production, or sold externally), while technological losses are irreversible - their further use is impossible.

The volume of raw materials and materials written off for production is calculated based on technological standards for their consumption. The amount of irretrievable and returnable waste is also taken into account. In other words, quantitative standards for the consumption of raw materials initially take into account the volume of generation of returnable waste and irreversible losses in the production of products.

Raw materials are released into production on the basis of a limit card (requirements, estimates of consumption of raw materials and materials, other document), drawn up in natural units of measurement of the material resource. Typically, this document contains information about the weight of raw materials or material released into production. In practice, there are often cases when, when issuing, for example, a metal sheet from a warehouse for the preparation of a product, information about the volume of planned production waste is entered into the limit card.

Assessment of technological losses

Technological loss norms apply to quantitative indicators of inventory items. The cost of these values in accounting and tax accounting is different. In tax accounting, the cost of inventory does not include non-operating expenses and expenses that are taken into account in a special manner:

— amount and exchange rate differences that arose before the values were accepted for accounting;

— costs of insuring the delivery of valuables to the place of their use;

— interest on loans raised to purchase valuables, accrued before the valuables were taken into account.

Own-produced products that are used in the manufacture of products are valued as finished products. And, as you know, in accounting and tax accounting, the assessment of finished products is different. In tax accounting, these products are valued at direct costs. The list of such costs is small.

In the accounting and tax accounting of a trading enterprise, the valuation of goods will also be different. In accounting, goods are valued at actual cost, and in tax accounting - at direct costs. The latter includes only the purchase price of goods and the costs of delivering them to the warehouse.

For these reasons, losses of the same amount will differ in value in accounting and tax accounting.

Example 2. An enterprise is engaged in sawing wood for furniture factories. The standard for technological losses in production is 0.5%. In January 2004, the company purchased 100 cubic meters. m of wood at a price of 840 rubles. for 1 cubic m.

The company exported wood at its own expense. The cost of transportation was 5,000 rubles. The company insured the cargo and paid the insurer a premium of 1,200 rubles. In February, all the wood was put into production.

Let's assume that the size of real losses corresponds to the normative one. Then, in tax and accounting, the enterprise can take into account 0.5 cubic meters of technological losses. m of wood (100 cubic meters x 0.5%). In tax accounting, the cost of wood consists of the purchase price and transportation costs. The cost of all wood will be 89,000 rubles. (840 rubles x 100 cubic meters + 5000 rubles). The cost of technological losses is 445 rubles. (RUB 89,000: 100 cubic meters x 0.5 cubic meters). Insurance costs are taken into account in a special manner in accordance with Article 263 of the Tax Code.

In accounting the picture is different. The cost of wood consists of the purchase price, transportation costs and cargo insurance. The cost will be 90,200 rubles. (840 rubles x 100 cubic meters + 5000 rubles + 1200 rubles). The cost of technological losses is 451 rubles. (90,200 rubles: 100 cubic meters x 0.5 cubic meters).

Accounting and tax accounting of technological losses

According to industry instructions for accounting for production costs, irrecoverable waste (losses) are taken into account in accounting accounts along with the raw materials that form them. In large organizations, materials are written off for production according to standards. Subsequently, deviations of the actual flow rate from the standard flow rate are calculated.

Does this mean that in tax registers containing information on the consumption of industrial raw materials, technological losses should also not be assessed as a separate line of calculation? For clarification, please refer to Article 318 of the Tax Code of the Russian Federation. It establishes a recognition mechanism for tax accounting purposes of material expenses, which include technological losses.

Material production costs for tax accounting purposes are divided into direct and indirect. This procedure is established by clause 1 of Article 318 of the Tax Code of the Russian Federation. These types of expenses are recognized differently for income tax purposes. Thus, indirect expenses are written off in full as expenses of the current reporting (tax) period. Direct - recognized in the current period only in part of expenses related to products sold. The remaining part is distributed among the balances of work in progress, finished goods and products shipped but not sold. It is not included in the reduction of the tax base of the reporting period. Direct material costs include acquisition costs:

- raw materials and (or) materials used in the production of goods (when performing work, providing services) and (or) forming their basis or being a necessary component in the production of goods (performing work, providing services) (clause 1, clause 1, art. 254 Tax Code of the Russian Federation);

— components for products undergoing installation, and (or) semi-finished products undergoing additional processing by the taxpayer (clause 4, clause 1, article 254 of the Tax Code of the Russian Federation).

All other material costs are classified as indirect.

Technological losses are included in material costs on the basis of clause 3, clause 7, article 254 of the Tax Code of the Russian Federation and, it would seem, relate to indirect costs.

However, as practice shows, it is quite difficult to isolate technological losses from the composition of materials before the raw materials are put into production. According to the tax authorities, technological losses should be taken into account as part of raw materials. Like raw materials, process losses are direct costs. Therefore, in tax accounting they should not be assessed as a separate line of calculation.

According to paragraph 3 of paragraph 7 of Article 254 of the Tax Code of the Russian Federation, for profit tax purposes, technological losses during production or transportation are written off as expenses. However, as already noted, as a general rule, expenses in tax accounting are recognized as justified and documented expenses (clause 1 of Article 252 of the Tax Code of the Russian Federation). The organization will be able to accept amounts of technological losses as a reduction in taxable profit only within the limits of justified and documented standards.

The amount of material production costs is reduced by the cost of returnable waste. Returnable waste, which can be used as a raw material for main or auxiliary production, but with increased costs (with a reduced yield of finished products), is valued at a reduced price of the original material resource (at the price of possible use). Returnable waste sold externally is valued at the selling price. This procedure is described in paragraph 6 of Article 254 of the Tax Code of the Russian Federation.

Example 3. Salut LLC produces mayonnaise. Vegetable oil is used in the production of products. Technological losses associated with pumping (transporting) oil, in accordance with the technological map, amount to 1.5% of the volume of oil released into production.

In January 2004, 10 tons of vegetable oil were transferred to production at a price of 18,000 rubles. per ton. Returnable waste in the form of sludge amounted to 120 kg. They were capitalized at the price of possible use - 7 rubles. for 1 kg. After processing the vegetable oil, the weight of the finished semi-finished product was 9.75 tons.

The following entries were made in accounting:

Debit 20 Credit 10

— 180,000 rub. (RUB 18,000 x 10 t) - vegetable oil transferred to production;

Debit 10 Credit 20

— 840 rub. (7 rubles x 120 kg) - returnable waste is capitalized.

Irreversible technological losses of vegetable oil amounted to 130 kg (10,000 kg - 9,750 kg - 120 kg), or 1.3% (130 kg: 10,000 kg x 100%).

As we can see, the amount of technological losses (1.3%) does not exceed the established norm (1.5%). Consequently, such losses can be taken into account for profit tax purposes in full, that is, in the amount of 2,340 rubles. (RUB 18,000 x 0.13 t).

As already noted, when calculating income tax, technological losses are included in direct material costs for taxpayers whose activities are related to the processing of raw materials. Such losses are classified as direct material costs.

The amount of material costs is reduced by the cost of returnable waste. Therefore, direct material costs of Salut LLC will amount to 179,160 rubles. (180,000 rubles - 840 rubles).

Sometimes it happens that deviations of technological losses from established standards are too large. The reason is low-quality raw materials, breakdown of production equipment or incorrect standards. In this case, one technological map is not enough to confirm the actual consumption of raw materials. There must also be a document explaining the reasons for what is happening. For example, the conclusion of competent specialists (commission). If there is documentary evidence, excess technological losses can be accepted in tax accounting.

Continued use of low-quality raw materials in production or the use of outdated equipment will require the development of a new technological map taking into account the technological features of the process.

Losses in the form of natural loss

The reasons for the occurrence of natural loss lie in the peculiarities of the physical and chemical properties of materials. As already mentioned, natural loss can occur due to shrinkage, weathering or evaporation, for example during storage.

To identify such losses, it is necessary to use the norms of natural loss. The norms of natural loss should be understood as the maximum permissible value of irretrievable losses of materials. Such losses occur during transportation and storage of inventory items due to changes in the physicochemical and biological properties of materials.

The Decree of the Government of the Russian Federation of November 12, 2002 N 814 “On the procedure for approving norms of natural loss during the storage and transportation of inventory items” says the following. Norms for natural loss are developed by the relevant ministries and departments, taking into account the technical conditions for storing and transporting inventory, climatic and seasonal factors affecting their natural loss. The standards are subject to revision as necessary, but at least once every five years.

To date, these standards have not been developed for most sectors of the economy. To date the following have been approved:

— norms of natural loss of grain, products of its processing and oilseeds during storage (Order of the Ministry of Agriculture of Russia dated January 23, 2004 N 55, registered with the Ministry of Justice of Russia on March 3, 2004 N 5603);

— norms of natural loss during storage of chemical products (Order of the Ministry of Industry and Science of Russia dated January 31, 2004 N 22, registered with the Ministry of Justice of Russia dated March 3, 2004 N 5599);

— norms of natural loss in the metallurgical industry during transportation by rail (Order of the Ministry of Industry and Science of Russia dated February 25, 2004 N 55, registered with the Ministry of Justice of Russia on March 9, 2004 N 5651).

Calculation of the amount of natural loss

Losses are calculated strictly according to the norms of natural loss, approved in the prescribed manner - as a percentage for each product separately. Natural loss is written off based on the results of the inventory. The amount of natural loss is determined by the formula:

E = T x N: 100,

where E is the amount of natural loss;

T - the number of goods transported (transferred to the warehouse) during the inter-inventory period;

N is the established rate of natural loss.

In batch accounting, the loss of goods is calculated based on the actual period of their storage in warehouses.

If the organization does not maintain batch records, the average shelf life of goods in the warehouse should be established. This period is calculated by dividing the average daily balance of goods for the inventory period by their daily turnover. The average shelf life is calculated in complete days of circulation.

To determine the average daily balance of goods, it is necessary to sum up the balance of goods for each day of storage in the inventory period and divide the resulting amount by the number of days in the inventory period.

One-day turnover is determined by dividing the number of goods sold during the inventory period by the number of days in this period.

Tax and accounting of natural loss

Losses as a result of natural loss are written off as a reduction in taxable profit only within the limits of standards approved by the relevant ministries and departments. This is provided for in paragraph 2, paragraph 7, article 254 of the Tax Code of the Russian Federation. In those sectors of the economy for which norms of natural loss have not been approved, this provision of the Code cannot be applied. The “old” norms of natural decline, which were in force before Chapter 25 of the Tax Code of the Russian Federation came into force, cannot be applied. This is the position of the tax authorities.

To date, for most inventory items, norms for natural loss during storage and transportation have not been approved. Therefore, corresponding losses are not taken into account for tax purposes.

What to do if organizations have losses in excess of the norms of natural loss? First of all, the amount of excess losses must be recorded. Damage is compensated either at the expense of financially responsible persons or at the expense of the guilty persons. If there are no guilty persons, and also if the losses occurred as a result of theft, the perpetrators of which have not been identified, excess losses in tax accounting are accepted only if there is a corresponding document from the authorized government bodies. This is stated in paragraph 5 of paragraph 2 of Article 265 of the Tax Code of the Russian Federation.

When writing off expenses in the form of technological losses or natural loss, the question arises: is it necessary to restore the value added tax attributable to such expenses? No no need. There is no such requirement in the Tax Code. What about VAT on excess losses? In order not to restore the tax, the organization must prove that the raw materials included in the losses were used to carry out operations subject to VAT. And this is quite difficult to do. An organization may try to prove that the losses occurred as a result of the use of materials to produce products subject to VAT. Perhaps these arguments will convince the tax inspector. Otherwise, the organization will have to restore VAT.

For accounting purposes, losses within the limits of natural loss norms are included in operating expenses on the basis of clause 11 of PBU 10/99 “Organizational expenses”.

The amounts of identified shortages are initially taken into account on account 94 “Shortages and losses from damage to valuables.” Within the limits of natural loss, these shortages are written off at actual cost to the debit of production cost accounts (selling expenses). Accounting for excess expenses depends on whether the culprits are found or not. If there are none, losses are also included in operating expenses.

Example 4. A batch of millet weighing 3500 tons and costing 1000 rubles. for 1 ton arrived at the warehouse on January 7, 2004. It is stored in bulk at the organization’s warehouse. As of March 31, 2004, the balance of the grain consignment was 2970 tons. During the inter-inventory period, 500 tons were sold. The shortage of millet as of March 31 was 30 tons (3000 tons - 500 tons - 2970 tons).

The rate of natural loss according to Order of the Ministry of Agriculture of Russia dated January 23, 2004 N 55 for three months will be 0.11% of the total stock. Consequently, due to natural loss during storage of millet, only 3.85 tons (3500 tons x 0.11%) can be written off. Thus, for accounting and tax accounting purposes, the organization will be able to attribute only 3,850 rubles to expenses. (1000 rub. x 3.85 t).

The following entries will be made in accounting:

Debit 94 Credit 43

— 30,000 rub. (1000 rubles x 30 tons) - the shortage of millet in the warehouse is reflected as losses from a shortage of valuables;

Debit 91 Credit 94

— 3850 rub. — the shortage of millet within the limits of natural loss was written off as expenses.

If the persons responsible for the shortage are not identified, the following posting is made:

Debit 91 Credit 94

— 26,150 rub. (1000 rub. x 30 t - 3850 rub.) - the shortage of millet was written off, for which the perpetrators were not identified.

If the perpetrators are identified, the costs are reimbursed at their expense:

Debit 73 Credit 94

— 26,150 rub. - the shortage of millet was attributed to the perpetrators.

Excessive costs in the amount of RUB 26,150. (1000 rub. x 30 t -3850 rub.) cannot be recognized in tax accounting. Unless the organization receives a document from authorized government bodies confirming the absence of persons who are responsible for the shortage.

O.A.Lositsky

Head of General Audit Department

groups

Signed for seal

08.06.2004

—————————————————————————————————————————————————————————————————— ———————————————————— ——

Tax accounting

For tax accounting purposes, technological losses are understood as such losses of raw materials and supplies that arise during production or transportation and are associated with the technological features of the production cycle or transportation process, as well as the physical and chemical characteristics of the MPZs themselves.

Essentially, this is irrevocable waste that arises due to technological features. They are part of material expenses (Subclause 3 of clause 7 of Article 254 of the Tax Code of the Russian Federation).

Technological losses as expenses for profit tax purposes are taken into account as part of material expenses. Moreover, separately from the costs of purchasing raw materials and materials.

Technological losses are written off as expenses based on paragraphs. 3 paragraph 7 art. 254 of the Tax Code of the Russian Federation, and raw materials and materials used in production are reflected in paragraphs. 1 clause 1 art. 254 Tax Code of the Russian Federation.

Justification of technological losses as expenses for taxation

The Russian Ministry of Finance answered the question about documentary evidence of expenses in the form of technological losses.

Corporate income tax

Technological losses are irrecoverable waste during the production or transportation of goods, performance of work, provision of services, caused by the technological features of the production cycle or transportation process, as well as the physical and chemical characteristics of the raw materials used.

In tax accounting, technological losses are included in material costs (subclause 3, clause 7, article 254 of the Tax Code of the Russian Federation). This provision of the Tax Code of the Russian Federation does not contain any restrictions on the amount of expenses. Technological losses of a specific production process are determined:

- conditions of economic activity;

- based on the principle of economic feasibility and industry specifics.

As the Ministry of Finance of Russia indicated in letter No. 03-03-06/1/8847 dated February 16, 2017, taking into account the technological features of their own production cycle and transportation process, organizations can determine standards for the generation of irrevocable waste for each specific type of raw material used in production. Standards can be set:

- technological maps;

- process estimates;

- other similar internal documents that are developed by the organization’s specialists who control the technological process (for example, technologists) and approved by authorized persons of the organization.

Such expenses should be recognized in the period when documents for writing off losses are drawn up (clause 1 of Article 252, clause 1 of Article 272 of the Tax Code of the Russian Federation). To do this, it is necessary to draw up an accounting certificate based on technological maps, estimates or other similar documents approved by authorized persons of the organization (clause 1 of article 252 of the Tax Code of the Russian Federation, clause 8 of article 3 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting accounting”, Article 313 of the Tax Code of the Russian Federation).

Also, supporting documents can be a bill of lading, a certificate of established discrepancies in quantity and quality when accepting inventory items.

Value added tax

The disposal of property in the process of production and transportation is not an operation taken into account when forming the object of taxation for VAT. However, it is necessary to document the fact of disposal of property and the fact that it was disposed of precisely due to the technological features of production (clause 10 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33).

There is no need to restore “input” VAT when writing off property due to its losses during production or transportation, since such a case of VAT restoration is not provided for in paragraph 3 of Article 170 of the Tax Code of the Russian Federation.

Accounting

Technological losses are inevitable in production activities and during transportation, therefore they are included in expenses for ordinary activities (clauses 5, 7 of PBU 10/99 “Organization expenses”, approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n). At the same time, technological losses do not relate to natural loss.

As already mentioned, the organization sets its own standards for technological losses.

Technological losses are written off in a manner similar to the procedure for writing off losses within the limits of natural loss norms. This procedure is established by paragraphs 29, 30 of the Methodological guidelines for accounting of inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Example

. Accounting for technological losses

The technological process estimate developed by the organization allows technological losses of raw materials in the amount of 1 percent of its total mass during the processing process. 100 tons of raw materials were processed, losses amounted to 0.5 tons. The actual cost of 1 ton of raw materials is 6,000 rubles. Raw materials are used in the main production.

Allowable technological losses when processing 100 tons of raw materials will be 1 ton (100 tons x 1%). The actual losses incurred (0.5 tons) do not exceed this limit.

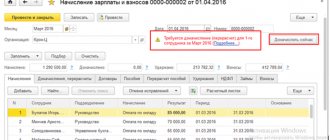

The accountant will make the following entries:

DEBIT 94 CREDIT 10

— 3000 rub. (0.5 x 6000) – actual losses of raw materials are reflected;

DEBIT 20 CREDIT 94

– 3000 rub. – technological losses are included in expenses for ordinary activities.

Date of recognition of material expenses in the form of technological losses

Date of recognition of material expenses in the form of technological losses art.

272 of the Tax Code of the Russian Federation has not been established. In our opinion, material costs in the form of technological losses can be taken into account as a separate type of material costs on the date of actual identification of these losses.

At the same time, material costs in the form of the cost of materials used in production, recognized on the date of transfer of materials into production, must be reduced by the amount of identified technological losses. This follows from paragraph 5 of Art. 254 Tax Code of the Russian Federation.

Documentation of technological losses

In accordance with paragraph 1 of Art.

252 of the Tax Code of the Russian Federation, for the purpose of calculating income tax, the payer reduces the income received by the amount of expenses incurred (except for the expenses specified in Article 270 of the Tax Code of the Russian Federation). Based on para. 2 p. 1 art. 252 of the Tax Code of the Russian Federation, expenses are recognized as justified and documented expenses (and in cases provided for in Article 265 of the Tax Code of the Russian Federation, losses) incurred (incurred) by the taxpayer.

By virtue of para. 3 p. 1 art. 252 of the Tax Code of the Russian Federation, justified expenses are understood as economically justified expenses, the assessment of which is expressed in monetary form.

According to para. 4 paragraphs 1 art. 252 of the Tax Code of the Russian Federation, documented expenses are understood as expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation, or documents drawn up in accordance with business customs applied in the foreign state in whose territory the corresponding expenses were made, and (or) documents , indirectly confirming the expenses incurred (including a customs declaration, business trip order, travel documents, report on work performed in accordance with the contract).

Any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

Taking into account the requirements of Ch. 25 of the Tax Code of the Russian Federation, an organization, in order to confirm the costs incurred due to technological losses, must have developed technological maps (sheets, etc.) justifying these losses. This is necessary to comply with the requirements of Art. 252 of the Tax Code of the Russian Federation.

At the same time, the issue of regulation and approval of standards is related to the industry affiliation of the organization.

Therefore, in addition to developing local documents, the organization should also take into account the industry specifics of a particular production.

It is based on the technological features of the organization’s own production cycle and transportation process that, for example, the standard for the formation of irrevocable waste for each specific type of raw materials used in production can be determined.

This standard must be confirmed by the relevant internal documents of the organization, developed by specialists who have certain powers and control the technological process (for example, production technologists, chief engineers), and approved by the head of the organization.

In the absence of the documents under consideration, to calculate losses taken into account when calculating taxable profit, industry regulations, calculations or other limits regulating the course of the technological process can be used.

In Letter dated 08/29/2007 N 03-03-06/1/606, the Russian Ministry of Finance noted that, based on the technological features of their own production cycle and the transportation process, taxpayers can determine the standards for the generation of irrevocable waste for each specific type of raw material used in production. These standards can be established, in particular, by technological maps, process estimates or other similar documents, which are internal documents that do not have a unified form, which are developed by enterprise specialists who control the technological process (for example, technologists) and approved by persons authorized by the enterprise management ( for example, chief technologist or chief engineer).

In Letters dated 01.10.2009 N 03-03-06/1/634, dated 05.07.2013 N 03-03-05/26008, dated 31.01.2011 N 03-03-06/1/39, the Ministry of Finance of Russia confirmed the immutability of its position .

Judges adhere to a similar position (Resolution of the Federal Antimonopoly Service NWO dated 07/02/2008 N A05-6193/2007).

7.5. Control of technological losses and costs

The magnitude of each loss and costs are controlled by weight (the cost of fermentation is usually determined chemically, since it is not always possible to weigh production containers with fermenting semi-finished products). The most frequently monitored items are baking (2…3 times a week) and losses due to inaccuracy in the mass of piece goods (every shift). Shrinkage is checked 1...2 times a quarter, other losses and costs are determined 1...2 times a year, since their value is relatively constant under established technological conditions.

Control of bread yield and control of technological losses and costs is of important technological and economic importance. Having determined the size of the quantitative indicators of the technological process, they analyze the reasons causing this amount of losses and take measures to reduce the amount of losses and costs.

Losses of flour before mixing semi-finished products (PM) consist of losses in the form of spray when receiving flour, its storage and passage through flour lines, from waste from sifting devices and from the removal of bags (during container storage). Flour loss is monitored during the shift; Before the start of observation, the warehouse and flour sifting department are thoroughly cleaned, and at the end of the shift, accumulated flour dust and waste are collected and weighed. The mass of waste (in kg per dough from 100 kg of flour) is calculated using the formula

where gm is the total mass of waste and flour dust per 100 kg of flour, kg; Wм— flour moisture content, %; Wt—dough moisture content, %.

They also check the loss of flour per bag in the form of waste (usually 15...35 kg).

Losses of flour and dough during the period from mixing semi-finished products to their baking (Pt) are determined by weighing dough and flour waste collected per shift in the dough preparation and dough cutting departments, previously thoroughly cleaned, in two stages.

Stage I includes all mechanical losses that, due to sanitary conditions, cannot be used for preparing bread in the dough mixing department (waste in the form of flour dust, flour and pieces of dough).

When determining losses in the dough mixing shop, they are collected and weighed after work for the test period (per shift).

The results of observations are entered into the journal according to form P.2.3.

The amount of loss (in kg per dough from 100 kg of flour) is found using the formula

where gt is the total mass of collected waste from the beginning of kneading until the dough is placed in the oven (in kg per 100 kg of flour); Wav—average moisture content of waste, determined by drying the mass of waste after mixing it to a uniform consistency, %.

If there is a significant amount of flour waste, it is weighed separately from the dough and Wwaste is determined as a weighted average value based on the moisture content of the processed flour and the moisture content of the test waste according to the formula:

where tp5 is the spray of flour in the presence of adding dough pieces, kg; tp5 - dough waste obtained due to leakage of dividers, dough waste during forming and proofing, kg.

In the case of a small amount of waste in the form of flour (mt3 and tr6), it is thoroughly mixed with test waste (tm4 and tr6), weighed and the moisture content of this mass, Wav, is determined.

Stage II includes the loss of flour and dough during the period from kneading to placing the dough pieces in the oven (in the dough yield dimension (kg). Pot is determined as the sum of losses of flour and dough in the dough mixing and dough cutting departments (Ptot + Pr from).

When using crumb crumbs to top a scarf or plywood sheets while laying dough pieces, its loss is measured separately and qрк (in%) is calculated using the formula:

where mр7 is the loss of cracker crumbs during cutting, kg; Msh is the mass of processed flour during the observation period, kg.

When working in tunnel ovens, crumbs are collected that are formed when planting dough pieces; when working on dead-end ovens, this estimate form includes crumbs sprinkled on the floor when planting and removing bread.

Additional losses in the form of crumbs (kg) in the cutting department are calculated using the formula:

de qrk—crumb loss, %; Wк — moisture content of breadcrumbs, %; K is the conversion factor of cracker crumbs to flour, which is equal to 100/Qt.

where P1ot is the total loss in the form of waste flour and dough, kg Then

To reduce losses, trays are installed near dough mixing and cutting machines, under conveyors and in proofing cabinets, and blowing of dough pieces is used, and conveyor belts are treated with polymer coatings.

The consumption of dry matter during fermentation (З6р) in wheat dough is determined by the alcohol content in it before planting in the oven. Based on the alcohol content, it is easy to calculate the amount of carbon dioxide formed during the fermentation of the dough. The volatilization of carbon dioxide is the main reason for the consumption of flour dry matter for dough fermentation.

The consumption of dry matter for fermentation (Dry, %) is calculated using the formulas for wheat dough:

for rye dough:

where St p is the alcohol content, %; Wt is the moisture content of the dough after kneading it, %; Lk is the content of volatile acids, % acetic acid; 1.96 is the conversion factor for the amount of alcohol to sugar spent on fermentation during the formation of a given amount of alcohol; 0.77 is the conversion factor for the amount of acetic acid per equivalent amount of alcohol.

The alcohol content in the dough is determined by the oxidimetric method, passing the distillation of alcohol from 10 ... 12 g of dough through a solution of potassium dichromate, which oxidizes the alcohol to acetic acid and water. Based on the amount of potassium dichromate solution consumed for oxidation, the alcohol content in a sample of dough is found, and then the alcohol content is calculated as a percentage of the dough mass. By multiplying the percentage of alcohol in the dough by a factor of 0.95, the consumption of dry matter for fermentation is found as a percentage of the dough. (During alcoholic fermentation, one part of alcohol produces 0.95 parts of CO2.)

During the fermentation of rye dough, volatile acids are also lost along with carbon dioxide, therefore, by controlling the consumption of dry matter for the fermentation of rye dough, in addition to the alcohol content, the content of volatile acids is determined.

When determining the content of volatile acids, an aqueous extract is prepared from a sample of rye dough. One portion of the extract, corresponding to 1.0 g of dough, is titrated with a solution of caustic alkali immediately after its preparation, and the second after evaporation in a water bath to remove volatile acids. The content of volatile acids per 100 g of dough in grams of acetic acid (Lc) is found from the expression:

where V1 is the amount of 0.1 n. alkali used to titrate the extract from 10 g of dough before evaporation, cm5; V2 - amount 0.1 n. alkali used to titrate the extract from 10 g of dough, after evaporation, cm5; 0.06 is the amount of acetic acid corresponding to 1 degree, g.

The amount of volatile acids is converted to an equivalent amount of carbon dioxide. The conversion factor in this case is 0.73 (gram molecule of acetic acid is 60 g, and carbon dioxide is 44 g). One part of acetic acid corresponds to 44/60, that is, 0.73 parts of carbon dioxide.

The cost of fermentation of rye dough (in kg per dough from 100 kg of flour) is calculated from the expression

where Cn is the alcohol content per 100 g of dough, g; Lk—content of volatile acids per 100 g of dough, g; Wc—weighted average moisture content of raw materials, gsection—amount of flour for cutting to total flour consumption, %; Gc—total mass of raw materials required to prepare dough from 100 kg of flour, kg.

Cutting costs (Zrazd) are determined by the difference between the amount of flour taken for this purpose at the beginning of the shift and its remainder. Before determining the flour consumption for cutting dough (before the start of a shift), tables and equipment intended for this operation are cleared of flour. At the end of the shift, tables, equipment and inventory are cleaned, unused flour is collected and weighed.

The cost of cutting (in kg per dough from 100 kg of flour) is found using the formula

where gsection is the consumption of flour for cutting in terms of 100 kg of processed flour, kg.

If the cutting is carried out using crumb crumbs, then calculate

where Mrk is the mass of rusk crumbs used for cutting the dough, kg; Wк—humidity of breadcrumbs, %.

In the case of cutting the dough without adding flour (on water, oil and specially treated lines), form P.2.7 is not filled out, and the explanatory note attached to all the material indicates the measures that eliminate the consumption of flour and crumbs for adding.

Baking costs (baking amount Zup) are controlled by the range of products on a specific oven. During the observation process, be sure to record the duration of baking, the temperature in the baking chamber and, if possible, the center of the crumb at the end of baking the bread.

When checking the baking, the dough pieces are weighed before baking, and after baking the finished products, located on one oven cradle or arranged in stages on two or three cradles. In ovens with a belt hearth, pieces of dough and finished products placed in one row along the width of the hearth are weighed. Packing (in % of dough weight) is determined from the expression

where Gt and Gg are the mass of dough pieces and the mass of hot products, respectively, kg. The cost of baking (in kg for dough from 100 kg of flour) is found using the formula

When checking the baking, they also control the baking time of the products, the temperature in the baking chamber and in the center of the bread crumb. It is also necessary to determine the loss in the mass of bread from leaving the oven to placing it on the trolley.

In the case of production of products with surface finishing, the unit size is determined as follows:

- the formed dough pieces are placed on a pre-weighed sheet, which is weighed together with the dough pieces until proofing;

- At the end of proofing, the dough pieces are greased and sprinkled with nuts, poppy seeds and other products, depending on the type of product.

Products prepared for baking are weighed along with the sheet. Immediately after removal from the oven, weigh the sheet along with the products, then remove the products from the sheet and weigh it uncleaned and after cleaning it from any remaining coating and lubricant.

Finishing losses are determined by the difference in the mass of the sheet, unpeeled and cleared of residues of crumbs and grease, according to the formula:

de Ml is the mass of the unpeeled sheet, kg; Ml1—mass of stripped sheet, kg.

The total losses during baking, finishing and unloading (in%) are calculated using the formula:

When calculating the yield of finished products and establishing the mass of a piece of dough, the total loss should be taken.

In the formula for determining Zup, the value g is replaced by qsum.

Bread storage costs (Zus) include:

- reduction in the mass of hot bread during its transportation from the oven to the circulation table (Ztr);

- reduction in the mass of hot bread during the period of laying it from the circulation table until the trolley is fully loaded (Zukl);

- reduction in the mass of hot bread during storage during the expedition before sending it to the distribution network (3us).

The value of each of these costs is determined separately, and the formula for further calculations includes the sum of these values Zus.sum

The costs of cooling and storing bread (3us) are determined by observing the drying of bread on two trolleys for 8 hours. Experimental trolleys are weighed immediately after loading them at the ovens and then after every hour of storage. Shrinkage (in %) to the mass of hot bread:

where Gg and Gx are the mass of hot and cold bread, respectively, kg.

While controlling the shrinkage, the temperature of the center of the bread crumb and the air parameters in the bread storage facility are simultaneously measured.

Shrinkage in terms of dough obtained from 100 kg of flour is expressed by the formula

When calculating the cost of drying, take the size of shrinkage gvc (in %) to the mass of hot bread, corresponding to the average duration of storage of bread at the enterprise.

Losses of bread in the form of crumbs and scrap (Pkr) are determined by weighing the bread waste generated during the shift when knocking bread out of molds, transporting it to the expedition and laying it on trolleys. Losses in terms of dough made from 100 kg of flour

where gкp is the mass of crumbs and scrap per 100 kg of cooled bread, kg.

When producing piece bread, inaccuracy in the mass of individual products can affect the yield of the finished product. Losses due to inaccuracy in the mass of products (Psht) are checked by weighing 1 ... 2 trolleys with bread before sending to the distribution network, at the same time counting the number of pieces of products on the trolley or weighing about 100 pieces. products and calculate the average weight of 1 piece. Losses due to inaccuracy of mass in terms of dough prepared from 100 kg of flour:

where gpc is the average deviation from the standard mass of the product, %.

Losses from waste processing in terms of dough obtained from 100 kg of flour:

Determination of volumetric yield of bread. The volumetric yield of bread is the volume of bread in cm3 per 100 kg of flour with a moisture content of 14.5%. Flour with normal strength and good gas-forming ability produces bread with a high volumetric yield. The volume of tin loaves is determined using a special device, measuring the volume of small grains displaced by the loaf from the volume meter box (Fig. 7.2).

Grain is always poured into the small upper drawer of device 3 from the same height - 10 cm from the top edge of the box. The surface of the grain is compared with a ruler, excess grain is removed through the lower drawer 2 and the damper 1. Then the upper drawer is overturned and the grain is poured into the ladle. The volume of grain in the bucket is equal to the volume of the box. Part of the grain from the ladle is poured back into box 3, one of the tin loaves is placed there and the excess grain from the ladle is poured into the box. The surface of the grain is again compared with a ruler, pouring excess grain into the bottom box and the remainder of the grain in the ladle. Then place a measuring cylinder with a capacity of at least 1000 cm3 under the bottom box, open the valve and determine the volume of grain displaced by the bread from the small box, that is, the volume of bread.

The volume of each loaf is measured twice. The discrepancy between results between parallel determinations should not exceed 5%. The volumetric yield of bread is calculated using the formula

Table 7.9

Approximate standards for the volumetric yield of bread and its spread

| Indicators | Norms of volumetric yield and h / d for bread made from flour | |||

| premium | first class | second class | wallpaper | |

| Volumetric yield of bread, cm, not less | 400…500 | 350…400 | 300…350 | 260 |

| Ratio h/d, not less | 0,40… 0,50 | 0,35… 0,45 | 0,30… 0,40 | 0,25 |

where V is the volume of the best loaf according to the combination of characteristics, cm3; 374 - mass of flour (moisture content 14.5%) used for baking one loaf of bread, g.

Volumetric yield is expressed to the nearest 1 cm3. The ratio of the greatest height of the bread to its average diameter h/d characterizes the bread's breadiness, which depends on the strength of the flour: the stronger the flour, the greater the h/d ratio. The average diameter of bread is found by measuring its diameter along the bottom crust in two opposite directions. The average value is taken from the two measurements. The height and diameter of the bread are expressed in millimeters.

Approximate standards for the volumetric yield of bread and its spread h/d for different types of flour of satisfactory quality are given in Table. 7.9.

Determination of baking properties of rye flour using express baking. An express way to determine the baking properties of rye flour is kolobok baking. The bun is prepared by kneading the dough from 50 g of flour and 41 cm3 of water at room temperature until smooth. The dough is immediately formed into a ball and baked for 20 minutes at a baking chamber temperature of 230°C. After baking, the bun is organoleptically examined, determining its appearance, the color of the crust and the condition of the crumb. The shape of the kolobok, obtained from flour with normal baking properties, is correct, with minor distortions. The crumb of such a bun is quite dry, the crust is gray. A kolobok made from flour with increased autolytic activity is characterized by a dark crust, sticky and dark crumb, and significant tears are observed at the bottom crust. The method of determining the baking properties of rye wallpaper flour using the express baking method has found wide application at our enterprises, despite its subjectivity.

Determination of autolytic activity of rye flour using an autolytic test (standard method). The mash, obtained from rye flour and water, is heated at a temperature close to the temperature of the crumb of the baked bread. In this case, autolysis of complex flour substances, mainly starch, occurs. After autolysis, the mash is filtered, the content of water-soluble substances in the filtrate is determined, recalculating it for absolutely dry flour. Rye wallpaper flour with normal autolytic activity forms up to 55% of water-soluble substances under experimental conditions, counting on absolutely dry flour, and peeled rye flour - up to 45...50%. The content of water-soluble substances in the filtrate is determined using precision (RPL) or laboratory (RL) refractometers. Refractometers are also used for other analyzes performed by bakery laboratories, so below is basic information about their design and operation.

The operating principle of refractometers and their design. Refractometers of any system are used to determine the refractive index of a solution or liquid substance. A light beam, moving from one medium to another, deviates from its original direction (Fig. 7.3) if the optical density of these media is not the same. This phenomenon is called refraction, or refraction, of light.

The index, or coefficient, of refraction (refraction) is the ratio of the sine of the angle of incidence of a light beam to the sine of the angle of its refraction

The refractive indices of various substances range from 1.30 to 1.80. The refractive index of a solution depends on its temperature, the chemical nature of the solute and its concentration. At the same temperature, the refractive index of a solution of a certain substance depends only on its concentration. The use of refractometers to determine the concentration of solutions is based on this dependence. In refractometers, the refractive index of a substance is determined by the maximum refractive angle at which light undergoes total internal reflection.

A precision refractometer is used to determine the concentration of sugar solutions ranging from 0 to 30%. Reading accuracy 0.02…0.04%. The scale of this refractometer is divided into 102 identical conventional divisions, corresponding to the refractive index from 1.3330 to 1.3810 or from 0 to 30 for sucrose. The precision refractometer RPL-1 is described below (Fig. 7.4). Currently, the second model of the precision laboratory refractometer RPL-2 with a vertically positioned telescope is also widely used.

The light source when working with a refractometer is daylight or an electric lamp with a power of 75...100 W, placed at a distance of 0.5...0.7 m from the device.

Before starting work, the device is set to zero. To do this, apply 1...2 drops of distilled water to the middle of the lower prism with a fused glass rod. Close the camera shutters, open the shutter of the illuminating prism 2 and, setting the counting drum to zero, observe the field of view. By rotating the compensator ring 4, the rainbow coloring is destroyed. A clear dividing line between the dark and light parts of the field of view should pass through the zero scale division. If this is not observed, then the dividing line is aligned with the zero division as follows: turn the screw of the counting drum 5 one turn, and holding the counting drum in the desired position with your left hand, rotate the washer until the dividing line is aligned with the zero division of the scale. After this, holding the counting drum and washer, screw in the screw. The device is designed for a temperature of 20°C.

Before installing the device, a flow of water at a temperature of 20°C is passed through the clips of prisms 1, 2, making sure that the temperature of the prism does not change during the experiments. If the device was set to zero at a temperature of 20 ° C, and the test was carried out at a different temperature, then a correction is introduced into the device reading using a special table.

You can work without correction if, when installing the device, the temperature of the distilled water was the same as the temperature of the room and solution, which is much more convenient for calculating the results.

Testing the solution on a precision refractometer. Set the counting drum to zero, place 1...2 drops of the test solution on a dry and clean measuring prism of the refractometer and observe the position of the dividing line on the scale. If the dividing line is between any two divisions, then by rotating the counting drum, bring the dividing line to the nearest lower scale division. The reading obtained on the scale is recorded as whole units, and the number of divisions located on the counting drum opposite the indicated line is added to it as tenths. The percentage of dry substances is determined according to the table. 7.10

Table 7.10

Determination of dry matter percentage

| Scale divisions | % dry matter | Scale divisions | % dry matter | Scale divisions | % dry matter |

| 0,0 | 0,00 | 8 | 2,00 | 6 | 97 |

| 1 | 04 | 9 | 03 | 7 | 4,01 |

| 2 | 07 | 6,0 | 07 | 8 | 04 |

| 3 | 11 | 1 | 10 | 9 | 08 |

| 4 | 14 | 2 | 14 | 12,0 | AND |

| 5 | 18 | 3 | 17 | 1 | 14 |

| 6 | 21 | 4 | 21 | 2 | 18 |

| 7 | 25 | 5 | 24 | 3 | 21 |

| 8 | 28 | 6 | 27 | 4 | 24 |

| 9 | 32 | 7 | 31 | 5 | 27 |

| 1,0 | 35 | 8 | 34 | 6 | 31 |

| 1 | 39 | 9 | 38 | 7 | 34 |

| 2 | 42 | 7,0 | 41 | 8 | 37 |

| 3 | 46 | 1 | 44 | 9 | 41 |

| 4 | 49 | 2 | 48 | 13,0 | 44 |

| 5 | 53 | 3 | 51 | 1 | 46 |

| 6 | 56 | 4 | 55 | 2 | 51 |

| 7 | 60 | 5 | 58 | 3 | 54 |

| 8 | 63 | 6 | 61 | 4 | 57 |

| 9 | 66 | 7 | 65 | 5 | 61 |

| 2,0 | 70 | 8 | 68 | 6 | 64 |

| 1 | 73 | 9 | 72 | 7 | 67 |

| 2 | 77 | 8,0 | 75 | 8 | 70 |

| 3 | 80 | 1 | 78 | 9 | 74 |

| 4 | 84 | 2 | 82 | 14,0 | 77 |

| 5 | 87 | 3 | 85 | 1 | 80 |

| 6 | 90 | 4 | 89 | 2 | 84 |

| 7 | 94 | 5 | 92 | 3 | 87 |

| 8 | 97 | 6 | 95 | 4 | 91 |

| 9 | 1,00 | 7 | 99 | 5 | 94 |

| 3,0 | 04 | 8 | 3,02 | 6 | 97 |

| 1 | 07 | 9 | 06 | 7 | 5,01 |

| 2 | 11 | 9,0 | 09 | 8 | 04 |

| 3 | 14 | 1 | 12 | 9 | 08 |

| 4 | 18 | 2 | 16 | 15,0 | 5,11 |

| 5 | 21 | 3 | 19 | 1 | 14 |

| 6 | 24 | 4 | 23 | 2 | 18 |

| 7 | 28 | 5 | 26 | 3 | 21 |

| 8 | 31 | 6 | 29 | 4 | 24 |

| 9 | 35 | 7 | 33 | 5 ‘ | 28 |

| 4,0 | 38 | 8 | 36 | 6 | 31 |

| 1 | 42 | 9 | 40 | 7 | 34 |

| 2 | 45 | 10,0 | 3,43 | 8 | 37 |

| 3 | 49 | 1 | 46 | 9 | 41 |

| 4 | 52 | 2 | 50 | 16,0 | 44 |

| 5 | 56 | 3 | 53 | 1 | 47 |

| 6 | 59 | 4 | 57 | 2 | 51 |

| 7 | 63 | 5 | 60 | 3 | 54 |

| 8 | 66 | 6 | 63 | 4 | 57 |

| 9 | 70 | 7 | 67 | 5 | 61 |

| 5,0 | 1,73 | 8 | 70 | 6 | 64 |

| 1 | 76 | 9 | 74 | 7 | 67 |

| 2 | 80 | 11,0 | 77 | 8 | 70 |

| 3 | 83 | 1 | 80 | 9 | 73 |

| 4 | 87 | 2 | 84 | 17,0 | 77 |

| 5 | 90 | 3 | 87 | 1 | 80 |

| 6 | 93 | 4 | 91 | 2 | 83 |

| 7 | 97 | 5 | 94 | 3 | 87 |

(continuation)

| Scale divisions | % dry matter | Scale divisions | % dry matter | Scale divisions | % dry matter |

| 4 | 90 | 20,0 | 6,74 | 6 | 60 |

| 5 | 93 | 1 | 77 | 7 | 63 |

| 6 | 96 | 2 | 81 | 8 | 66 |

| 7 | 99 | 3 | 84 | 9 | 70 |

| 8 | 6,03 | 4 | 87 | 23,0 | 73 |

| 9 | 06 | 5 | 91 | 1 | 76 |

| 18,0 | 09 | 6 | 94 | 2 | 79 |

| 1 | 12 | 7 | 97 | 3 | 83 |

| 2 | 16 | 8 | 7,00 | 4 | 86 |

| 3 | 19 | 9 | 04 | 5 | 89 |

| 4 | 22 | 21,0 | 07 | 6 | 92 |

| 5 | 26 | 1 | 10 | 7 | 95 |

| 6 | 29 | 2 | 14 | 8 | 99 |

| 7 | 32 | 3 | 17 | 9 | 8,02 |

| 8 | 35 | 4 | 20 | 24,0 | 05 |

| 9 | 39 | 5 | 24 | 1 | 08 |

| 19,0 | 42 | 6 | 27 | 2 | 11 |

| 1 | 45 | 7 | 30 | 3 | 15 |

| 2 | 48 | 8 | 33 | 4 | 18 |

| 3 | 52 | 9 | 37 | 5 | 21 |

| 4 | 55 | 22,0 | 40 | 6 | 24 |

| 5 | 58 | 1 | 43 | 7 | 27 |

| 6 | 61 | 2 | 47 | 8 | 31 |

| 7 | 64 | 3 | 50 | 9 | 34 |

| 8 | 68 | 4 | 53 | ||

| 9 | 71 | 5 | 56 |

Testing the solution using a laboratory refractometer. A laboratory refractometer (Fig. 7.5) is usually used to determine the dry matter content in concentrated sugar solutions, but it can also be used to determine the autolytic activity of flour. A laboratory refractometer is less accurate than a precision one, its reading accuracy is up to 0.1...0.2%, but it is more convenient, since the content of dry substances is indicated directly on scale 4 of the device.

Before starting work, the refractometer is checked by placing a drop of distilled water on the lower prism. In eyepiece 6, when the head is rotated, a horizontal dotted line is visible, which in this case should coincide with the zero division, otherwise the refractometer is adjusted with a special key.

To determine dry substances, 1...2 drops of the test solution are applied to the lower prism 3, after which the upper prism 2 is closed. By moving the eyepiece 6, they find a sharp boundary between the dark and light parts of the field, combine it with the dotted line and measure the percentage of dry substances on scale 4 of the device.

The procedure for determining the autolytic activity of flour. On a technical scale, a porcelain glass with a capacity of about 50 cm3 is weighed together with a glass rod (glass height is about 7 cm, diameter is about 3.5 cm). Exactly 1 g of flour to be tested is weighed into a glass and 10 cm3 of distilled water is added with a pipette, thoroughly mixing the mixture with a stick. Simultaneously, three samples of flour are analyzed with parallel determinations, preparing 6 cups; cups containing 10 cm3 of water are inserted into the bath nests. The liquid level in the cups should be 0.75 cm below the water level in the bath. Heating continues for 15 minutes, the first 2...3 minutes the contents of the glass are stirred with a stick to uniformly gelatinize the starch. After gelatinization is complete, the cups are covered with a funnel to retard the evaporation of water. 15 minutes after the start of heating, the glasses are simultaneously removed from the bath, and 20 cm3 of distilled water is added to each of them with a pipette. The contents of the glass are vigorously stirred and cooled to room temperature. Then place each glass on a technical scale and, adding distilled water drop by drop, bring the mass of the contents in the glass to 30 g. After this, the contents of the glass are stirred until foam appears and filtered through a porous paper filter, pouring the liquid above the sediment onto the filter. The sediment is not transferred to the filter. The first two drops of the filtrate are discarded, the subsequent drops are immediately applied to the prism of a precision refractometer and counted.

Using a refractometric table, find the percentage of water-soluble substances in the filtrate and, multiplying it by 30, determine the percentage of water-soluble substances in air-dried flour (the mass of the flour mash, according to the experimental conditions, is 30 times greater than the mass of the flour taken).

The content of water-soluble substances in flour (in terms of absolutely dry flour) is determined by the formula

where a is the content of water-soluble substances in air-dried flour, %; W— flour moisture content,%.

The result is expressed with an accuracy of 1%. The discrepancy between parallel determinations should be no more than 2%.

Other methods for determining the baking properties of rye flour. To evaluate the baking properties of rye flour, an amylograph device is used, which is a viscometer that records the viscosity of a water-flour suspension during its heating from 25 to 92°C. At the beginning of heating, the viscosity of the suspension decreases slightly; starting at a temperature of 50°C, the viscosity increases due to starch gelatinization, and then falls again as a result of amylolysis. The viscosity of a water-flour mixture prepared from flour with high autolytic activity decreases very quickly, which is reflected in the height of the amylogram drawn by the device recorder. A high amylogram indicates good baking properties of flour.

You can test the baking properties of rye flour in a faster way. The water-flour mixture is heated by electric contact to a temperature of 75°C and then tested on an automated penetrometer. The value of the device reading is inversely proportional to the value of the autolytic activity of flour.

It is also proposed to determine the baking properties of rye flour using the “cold” method, testing rye dough on a penetrometer after 35...60 minutes of autolysis at a temperature of 30°C. This method is recommended for testing rye flour with increased autolytic activity, for example, flour from sprouted grains, since the “hot” methods described above are too sensitive to rye germination.