In this lesson we will look at the use of transactions with clients.

This functionality allows you to reflect multi-stage sales in the program (for example, participation in a tender), create a sales funnel, and also register additional. costs for specific sales transactions (not included in the cost of goods sold).

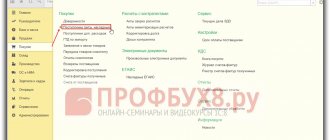

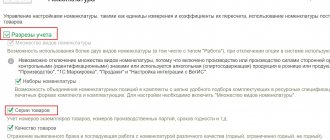

I'll show you where this functionality is enabled:

How to fill out Form 11 (transaction)

The form contains: a title page and two information sections.

The name, address and OKPO of the company should be written on the title page.

Section 1 provides information on fixed assets, the place of purchase and sale of which is the secondary market.

A limited number of transactions are recorded in the form:

- medium business - no more than 15 transactions;

- non-profit organizations - no more than 8 transactions;

- other companies - no more than 25 transactions during the reporting year.

In addition, each category of tangible fixed assets also has its own limitation. For example, medium-sized businesses show no more than three transport transactions. All restrictions can be studied in Rosstat Order No. 382 dated July 4, 2019.

If the number of transactions is higher than the specified values, a selection of the most significant transactions is made.

Section 1 does not take into account:

- purchase and sale of new objects that have not yet been used as fixed assets;

- gratuitous transfer and acquisition of fixed assets;

- transactions with fixed assets where their price differs from the market price;

- transfer or sale of objects for processing.

Column 1 contains the name of the object. Columns 3 and 4 contain OKOF (at least nine characters) and the depreciation group number, respectively.

Column 5 records the time of initial commissioning. The year must be indicated without abbreviations (four characters). Information for this column can be taken from the inventory card.

In the sixth column, the full accounting value is recorded, and in the seventh column, the residual value of the object.

The full accounting value (FV) is understood as the initial cost, adjusted as a result of revaluation, modernization, other improvements and interventions in the fixed asset. The RUS of revalued funds is the replacement cost at the time of the last revaluation.

Column 8 records the year at the prices of which the fixed assets item was registered with the seller under the purchase and sale agreement in the reporting year. Thus, the year of receipt or the year of revaluation of the object is recorded in the column.

Column 9 indicates the actual cost of the sale or purchase of fixed assets, where the parties to the transaction are organizations and individuals. The cost at which the new owner registered the object is recorded.

In column 10, code 5 is indicated for purchased objects, and code 6 for sold objects.

Column 11 records the area of buildings in square meters. For other types of fixed assets, the column is not filled in.

In Section 2, you need to provide information on rented and leased properties. Data shown as of 12/31/2019. At the same time, both fixed assets leased in 2021 and earlier are taken into account.

Section 2 discloses information on fixed assets that meet one of the conditions:

— the object was leased this year and is accounted for by the tenant in account 01;

— the object was rented out this year and presented for temporary paid use under a rental or leasing agreement. In this case, the object is accounted for by the tenant in accounts 01 and 03. Limitations on the number of reflected objects: for organizations (except for medium and small businesses) - no more than ten objects; for entrepreneurs in the medium-sized business sector - no more than seven; for non-profit organizations - no more than five objects.

All columns, except 4, 10 and 11, are filled out according to the principles described above for section 1. Data in columns 7, 8 and 9 are recorded as of the end of the reporting year.

In some cases, a section records a collection (complex) of objects. This is done when it is impossible to reliably distribute the rent to each property. OKOF, depreciation group and other indicators are taken for the most expensive object from the totality.

In column 4, for leased assets indicate code 3, for leased assets - code 4.

Columns 7 and 8 record the cost of a separate part of the object if the building is taken or leased in part (the calculation is made based on the share of the area leased or leased).

Tenants and landlords reflect the annual rent in column 10. If we are talking about renting a complex of objects, the rent is distributed among the objects in proportion to their residual value. If the object is 100% depreciated, then the distribution is proportional to the PUS.

If the property has been leased for less than a full year, then the rent is given in annual equivalent. Let’s say the office building was rented from 07/01/2019 to 12/31/2019 (six months). For six months, the rent amounted to 720,000 rubles. Thus, in column 10 you need to reflect not 720,000 rubles, but 1,440,000 rubles (720,000 / 6 x 12).

Column 11 records the rental duration in full months.

An object is not subject to inclusion in the section if no rent was accrued for it.

Reflection of additional transaction costs

Now let's reflect the additional transaction costs. As such, let’s take consultations from a third-party provider:

To reflect expenses, be sure to fill out the recipient department and select the expense item (we are not focusing on the nuances now; we will talk in detail about the distribution of expenses later):

Let's create a new expense item:

Let's fill in the main points:

As an expense analytics in the invoice, we select our won deal:

Features of filling out the form by organizations that have separate divisions

An organization that has separate divisions submits Form 11 (transaction) taking into account the data on these divisions. That is, the form reflects the objects of both the parent organization and its separate divisions.

Russian representative offices and branches of foreign companies report on Form 11 (transaction) independently.

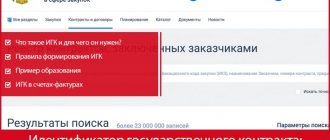

You no longer need to waste time searching for the required up-to-date form. Fill out the necessary reports to Rosstat in the Kontur.Extern system. Using the search, select statistics form 11 (transaction), enter the necessary information and save. Before submitting the completed form, the system will check it for errors. If there are any inconsistencies, you will see a warning. Once the issues are resolved, you can send a report. If the outcome is positive, an acceptance notification will appear in the system. If the report is not accepted, you will learn about this from the notification. You can also upload a ready-made document to Extern and send it to Rosstat. When submitting reports via Extern, you save time.

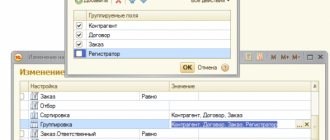

Reflection of transactions in the program

In order to start creating transactions, you first need to fill out the transaction types

:

Let's create a new type of deal:

The main attribute of the transaction type is type; three options can be selected:

We are not interested in other non-process transactions (since there are no stages there). A typical sale is a type of transaction with a fixed number of stages (they cannot be changed, the transition between stages is automatic). We will focus on the option with manual transition between stages:

Set up a list of transaction stages (optional):

We indicate the use of this type; to simplify the task, we do not set the need for recording primary demand (storing information about those goods that the client wanted to purchase in comparison with those goods that the client purchased) and separate accounting of goods for the transaction (separate accounting of cost and profit for each transaction of this type):

Those. for transactions of this type, you will first need to record the initial contact (interaction with the partner), then put forward a commercial offer, then, if necessary, adjust it, then agree on payment terms, shipment, terms, etc., and then fulfill obligations (we - ship, client - pay).

Now we can create the transactions themselves:

Please note that a transaction is not a document, but a reference book; it does not record any business transactions, but is a kind of end-to-end analytics.

The first tab contains basic information about the transaction - name, client, agreements, status, type. In the Primary Interest

we need to select the advertising channel (i.e. where we learned about the deal):

In order to fill out these fields, you must first fill out the corresponding reference book:

Let's create one channel for example:

We fill in the primary interest in the transaction (later it will be possible to see in the reports, for example, the gross profit of transactions in the context of advertising channels in order to assess the effectiveness of the advertising campaign in different media):

On the second tab, you can specify information about other counterparties directly or indirectly involved in the transaction (for example, competitors):

We record the deal, information about the current stage appears:

To move between stages, use the Process Plan

:

To go to the selected stage, use the button of the same name:

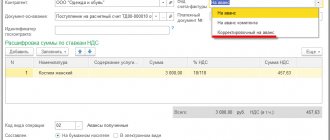

We formulate a commercial offer directly on the basis of the transaction:

The document header is filled in automatically:

But there is no data about the goods in the transaction, so we enter it ourselves:

We process the document and send it to the counterparty. Let's say he rejected it. We are introducing a new compr, we will make a discount in it:

Let’s say the counterparty likes the new commissioner, let’s move on to the stage of fulfilling obligations:

We create a customer order based on a commercial proposal:

Based on the order, we create an implementation document:

We fix the status of the transaction:

Also, don’t forget to close it:

There is a navigation bar at the top of the deal card. On the second tab we can create/view interactions with a partner for this transaction:

The following tab displays all documents entered into the transaction:

On the next page we see the complete environment of the transaction - a list of partners and contact persons who are directly or indirectly involved (according to the Participants

):

Now, to build a beautiful funnel, we’ll make a couple of new deals, but we’ll record a loss on them. First you need to fill out the guide Reasons for Losing Trades

:

We create a new deal and at one stage set the status to Lost

:

Select a reason and close the deal:

Exchange with treasury systems and bank institutions

Updated formats:

- exporting data to OFK/UFK of the document “Accepted monetary obligation” into an XML file (EB.xml file).

- uploading a payment order to the Electronic Budget (file GIISEBNUBP.xml)

Attention! When updating the configuration, the formats are not updated. Files of supplied formats should be uploaded to the “Types of exchange formats” directory (the “Load formats” button on the “Exchange formats” tab of the “Exchange with treasury and banking systems” form). In the “Format Download and Update Assistant” window that opens, specify the download source – “Folder on this computer or a computer on the local network” and then follow the program’s instructions.

Standard "Intangible assets"

Document “Free receipt of fixed assets and intangible assets”

Operations added to the document:

- Free receipt of rights to use intangible assets (106.60 - 401.10.195-199);

- Centralized supply of rights to use intangible assets (106.60 - 304.04.350);

- Centralized supply of rights to use intangible assets (111.60 - 304.04.350);

- Intradepartmental transfer of rights to use intangible assets (106.60 - 304.04.350);

- Intradepartmental transfer of rights to use intangible assets (111.60 - 304.04.350);

- Acceptance of the rights to use intangible assets into account during reorganization (111.60 - 304.06).

Document “Transfer of Capital Investments”

Operations added to the document:

- Disposal of rights to use intangible assets for centralized supply (304.04 - 106.60);

- Disposal of rights to use intangible assets for intradepartmental transfer (304.04 - 106.60);

- Disposal of rights to use intangible assets by gratuitous transfer (401.20 - 106.60).

Document “Write-off of inventory item”

The operation “Termination of rights to use intangible assets (401.10.172, 401.20.226)” has been added to the document.

Document “Free transfer of inventory item”

Operations added to the document:

- Rights to use intangible assets: gratuitous interbudgetary transfer (401.20.250 - 111.60);

- Rights to use intangible assets: intradepartmental movement by subordinates (304.04.350 - 111.60);

- Rights to use intangible assets: centralized supply (304.04.350 - 111.60);

- Rights to use intangible assets: gratuitous transfer to organizations (401.20.280 - 111.60);

- Rights to use intangible assets: disposal during reorganization (304.06.830 - 111.60).

Document “Changes in value, depreciation, impairment of fixed assets and intangible assets”

The operation “Reclassification of rights to use intangible assets when determining private property assets” has been added to the document.

Document “Inventory of OS, intangible assets, legal acts”

The document has added the ability to select 111.60 accounts.

Document “Internal movement of fixed assets and intangible assets”

The operation “Internal movement of capital investments” has been added to the document.

Document “Acceptance for accounting of fixed assets and intangible assets”

The operation “Acceptance for accounting of freely received rights to use intangible assets (111.60 - 106.60)” has been added to the document.