If the founders of an LLC are individuals, then income in the form of dividends received from the business is subject to income tax (NDFL). The organization itself, performing the functions of a tax agent, is obliged to transfer personal income tax to the budget and report on time. In this article you will find an example of filling out dividends in 6-NDFL 2021.

Before January 1, 2015, the tax rate on dividends was 9%, and in 2021, a rate of 13% is applied to tax residents of the Russian Federation. If the LLC participant has been in Russia for less than 183 calendar days over the past 12 months, then the rate is already 15%.

Recipients of dividends

Russian citizens and foreigners act as payers of personal income tax on dividends when receiving income within Russia. In addition, income can also be received from foreign sources. In such cases, income recipients must independently calculate taxes in relation to each amount of dividend income.

There are some nuances here. Citizens who have received dividends from foreign sources have the right to reduce the personal income tax payable by the amount of the transferred tax at the place of source of income. Thus, a double taxation situation does not arise. But these actions can only be performed in relation to income with which Russia has entered into a special agreement with the source countries. If the tax amounts paid at the source of income are greater than those accrued in accordance with the legislation of the Russian Federation, then it is impossible to return the difference from the budget.

Dividends must be reported to the Federal Tax Service

Situation Who must report What reporting is submitted Deadline for submitting personal income tax reporting on dividends is withheld by the tax agent Tax agent If dividends are paid by a joint-stock company (regardless of the applied tax regime) - income tax return with completed Appendix No. 2 No later than March 28 of the year following the year of payment dividends If dividends are paid by an LLC - Certificate in form 2-NDFL (with sign “1”) No later than April 1 of the year following the year of payment of dividends () Personal income tax on dividends is not withheld by the tax agent Tax agent Certificate in form 2-NDFL () Not later than March 1 of the year following the year of payment of dividends ().

Certificate in form 2-NDFL (with sign “1”) No later than April 1 of the year following the year of payment of dividends (when reporting on all income paid to individuals is submitted) Individual Declaration in form 3-NDFL No later than April 30 of the year following the year upon receipt of dividends, personal income tax on dividends is calculated and paid by the “physician” Individual Also, starting from 2021, all tax agents (JSC and LLC) must reflect the amount of dividends paid in the form.

Tax agents for dividends

The responsibility to withhold income from dividends rests with the tax agent, i.e. the organization that paid the income. In this case, income tax must be calculated separately for each income recipient. Tax is withheld at the time of actual payment of income, including when amounts are credited to the taxpayer’s bank account. If the recipient, for any reason, decides to refuse to receive the profit, personal income tax in any case must be withheld on the day of refusal.

In the event that the tax agent does not withhold in full or within the agreed time frame, the organization may be subject to a fine of 20% of the amount of personal income tax not transferred.

Example 1. Profit to be distributed to Rassvet LLC is 750,000 rubles. The founders of the company are three individuals: two residents of the Russian Federation with shares of 40% and a non-resident with a share of 20%. Based on the accrual results, Russian founders are entitled to 300,000 rubles minus the withholding tax of 13%, equal to 39,000 rubles from each payment. Dividends in favor of a foreign citizen are equal to 150,000 rubles. Withholding tax - 22,500 rubles.

Based on the results of payments and withholding of personal income tax, tax agents are required to submit calculations and certificates of accrued amounts of income and withheld income in the following forms:

- 2-NDFL, compiled annually for each person;

- 6-NDFL has been provided quarterly since 2021 and reflects the total amounts of accrued and withheld tax for an organization (or individual entrepreneur).

What are dividends

This is any income received by a shareholder (participant) from an organization when distributing profits on shares (shares) owned by him in proportion to his share in the authorized capital of this organization.

An important detail: dividends are always paid from profits that remain after taxation.

This is directly stated in paragraph 1 of Article of the Tax Code of the Russian Federation. REFERENCE. What is profit remaining after tax (often called net profit)? The answer depends on the tax regime that the organization applies. Under the general system, profit is less income tax. With UTII - profit minus the single tax on imputed income.

With UTII - profit minus the single tax on imputed income. Under the Unified Agricultural Tax - profit minus the unified agricultural tax.

Payment of dividends to the founder of an LLC using the simplified tax system is made from the profit remaining after paying a single “simplified” tax.

Reflection of dividends in the calculation of 6-NDFL

The calculation of 6-NDFL involves not only reflecting the amounts of wages, sick leave and other income received. Paid and transferred dividends also need to be shown in the reporting; below we will look at how to reflect dividends in the mandatory calculation in Form 6-NDFL.

If among the founders of the enterprise there are not only Russian citizens, but also foreigners (as in our example), then personal income tax must be calculated at different rates. For residents of the Russian Federation - 13%, for non-residents the rate is 15%. In such cases, when drawing up a document, it is necessary to draw up a separate block of lines 010 - 050 for each rate.

Reflection of dividends when they are paid is required when filling out 6-NDFL. We included the dividends paid to the founders of Rassvet LLC in the sample form. You can use this example to enter data into your calculation.

Completing section 1

- line 010 - the rate at which the calculation is made;

- line 025 - the total amount of dividends paid before personal income tax is withheld, all amounts transferred during the year are taken into account;

- line 020 - the amount of all income (including tax) taking into account the data in line 025;

- line 030 - the full amount of deductions, including those related to line 025;

- line 040 - the amount of calculated tax based on the amount on line 020;

- line 045 - personal income tax withheld from dividends.

Next comes the formation of general information on the calculated tax:

- line 060 - you need to indicate the number of persons receiving income;

- line 070 - withheld tax, including transfers and from dividend payments;

- line 080 - calculated tax, but not transferred.

Completing section 2

In section 2, you must indicate the amount for transactions that occurred not from the beginning of the year, but based on the results of the last 3 months (quarter). The following operations are reflected by row:

- On line 100 - the date of payment of dividend amounts, and transfers are taken into account, including in kind;

- Line 110 data is the tax withholding date. Personal income tax is required to be withheld at the time of actual payment of income.

- Line 120 reflects the date of transfer of tax on dividends paid. As a rule, this should happen no later than the day following the payment. Joint-stock companies are given the right to transfer personal income tax no later than one month from the date of payment of funds.

- Line 130 – the amount of income received in monetary terms.

- Line 140 – amount of tax withheld.

If the payment of dividends does not occur in each quarter of the reporting period, their amounts and the amount of withheld tax should be reflected in Section 2 only during the period of their actual payment. That is, when transferring dividends in the 1st quarter, it is not necessary to reflect transactions under the 2nd section of subsequent calculations of 6-NDFL.

You can prepare 6 personal income tax reports using online accounting from Tinkoff. Open a current account with Tinkoff Bank and get online accounting for free, as well as:

- issue of KEP as a gift

- 2 months of account maintenance free of charge

- reminders about due dates and payments

- automatic filling of the declaration

[News issue No. 04] Help 2-NDFL, reflection of dividends, Changes in 1C 8.3 from release 3.0.43.88

Register and receive free more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8, 1C: UT 8

We guarantee the security of your data and under no circumstances will we transfer it to third parties

Dear Colleague, good afternoon!

We continue to inform you about the latest legislative changes and interesting features in the 1C:8 program.

At the very beginning of the issue, we remind you that on March 1st there will be live broadcasts of online seminars - “Complex issues of accounting statements for 2015” and “Simplified accounting and financial reporting” .

Lecturer: Klimova M.A., live broadcast + recording

Detailed programs of online seminars and conditions of participation here >>

News release No. 4 dated February 25, 2021

Certificate 2-NDFL, reflection of dividends

If an organization (LLC) using the simplified tax system pays dividends to the founders - individuals, then when paying such income it is necessary to withhold personal income tax and report in form 2-NDFL (Letter of the Ministry of Finance of Russia dated October 19, 2015 No. 03-03-06/ 1/59890).

The amount of dividends paid must be reflected in section. 3 certificates 2-NDFL indicating the tax rate - 13%. The amount of dividends is indicated in full, without reduction by the amount of withheld tax. The income code for dividends is “1010”.

When paying dividends to individuals, joint stock companies reflect information about withheld personal income tax in Appendix No. 2 in the income tax return, which is issued in the form of certificates and only for the tax period (year). (Clause 2, 4, Article 230 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated 02.02.2015 N BS-4-11/ [email protected] ).

Provision for doubtful debts in tax accounting

The court decision related to the registration of reserves for doubtful debts was made in favor of taxpayers (Resolution dated September 25, 2015 No. A 53-23595/2014).

Creating a reserve for doubtful debts in tax accounting is the right of the taxpayer (Articles 266 and 313 of the Tax Code of the Russian Federation). The reserve can be formed not only at the end of the year, but also at the end of the reporting period.

The reserve should be formed based on the results of the inventory. The inventory can be carried out throughout the year, therefore, the company can create a reserve throughout the year, and not just at the end of the tax period. This situation is not prevented by the absence of appropriate provisions on inventory in the accounting policy.

Penalty for failure to publish an audit report

Joint-stock companies that do not publish an audit report on the Internet in the event of a mandatory audit or publish it late, face a fine of up to 1 million rubles. The publication period is three days from the date of drawing up the audit report (clause 71.4 of the Regulations, approved by the Bank of Russia dated December 30, 2014 No. 454-P). For this violation, the manager can also be fined up to 50,000 rubles (Part 2 of Article 15.19 of the Code of Administrative Offenses of the Russian Federation).

News 1C Accounting 8.3 ed. 3.0

Changes in the program!

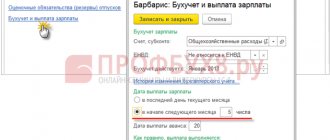

Since 2021, changes have been made to the Tax Code of the Russian Federation, which were reflected in the program, starting with release 3.0.43.88

Simplified taxation system

If a “simplified” person has issued an invoice with allocated VAT, then he is obliged to pay VAT to the budget and submit a VAT return.

In this case, this amount of VAT will be excluded from his income at the time of payment of funds by buyers of goods, works and services (clause 1 of Article 346.15, Letter of the Ministry of Finance of Russia dated 08/21/15 No. 03-11-11/48495).

In order for the amount excluding VAT to be automatically recorded in the Income and Expense Book, it is necessary, starting from 2021:

Step 1. Draw up the document “Sales (act, invoice)” with allocated VAT (Fig. 1) and issue an invoice based on it (document “Invoice issued”).

Rice. 1

Step 2. Upon receiving payment from the buyer, issue a document “Receipt to the current account” based on the sales document with allocated VAT (Fig. 2)

Rice. 2

When posting the document, entries will be made in accounting and movements in the accumulation registers of the simplified tax system. Column 4 “Income” of the Income and Expense Book will automatically include the amount of income excluding VAT (Fig. 3).

Rice. 3

It should be noted that when receiving an invoice with allocated VAT from a “simplified” person, even if he paid it to the budget and submitted a VAT return, the regulatory authorities are against accepting VAT for deduction on such invoices (Letter of the Ministry of Finance of the Russian Federation dated 05.10. 2015 No. 03-07-11/56700).

Analysis of current issues from Profbukh8 subscribers:

Question:

If furniture was purchased in January 2015 and, according to the furniture passport, its warranty period is 18 months, can it be classified as depreciation group 2? Cost more than 400 thousand rubles.

Answer:

We believe that to determine the depreciation group of a fixed asset, it is necessary to use the Decree of the Government of the Russian Federation dated January 1, 2002 No. 1 (as amended on December 10, 2010 No. 1011) “On the classification of fixed assets included in depreciation groups” (hereinafter referred to as the Classifier). Moreover, the warranty period is not an indicator of the useful life (hereinafter, SPI), but the period of service.

It is allowed to independently establish SPI for fixed assets that are not listed in the “Classifier” and in the OKOF on the basis of clause 1 of Article 258 of the Tax Code of the Russian Federation: “The useful life is determined by the taxpayer independently on the date of commissioning of this depreciable property in accordance with the provisions of this article and taking into account the classification of fixed assets approved by the Government of the Russian Federation ."

And furniture in this Classifier belongs to the fourth depreciation group with codes 16 2929000, 16 3222000, 16 3311000, 16 3612000. Accordingly, the useful life of furniture can be set in the range from 5 years and 1 month to 7 years.

Thus, by classifying furniture into the second depreciation group, you risk attracting close attention from the tax authorities to both income tax and property tax.

Dear Colleague, we hope that this issue was interesting and useful for you!

You can discuss this issue in the comments: Ask a Question >>

Previous issues of 2015-2016: Here >>

Join the online seminar on March 01 >>

—

Please rate this article:

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

You might be interested

Publication date: Feb 25, 2016

Please rate this article:

What is the general procedure for reflecting dividends to individuals in the new 2-NDFL certificate?

Dividends in the new 2-NDFL should be reflected along with other income taxed at the same rate. In a typical case, when the individual recipient is a tax resident of the Russian Federation, this will be 13%.

For dividends, an income code is provided in 2-NDFL 1010. The amount according to the code should be shown in full (along with tax).

Sections 1-3 of the new certificate and the Appendix separately for dividends do not need to be filled out.

Sign 1 is added to the new certificate if the dividends were paid in cash and personal income tax was withheld at the source (Article 226 of the Tax Code of the Russian Federation).

2-NDFL with sign 1 must be submitted no later than April 1 of the year following the year of payment.

Sign 2 (tax not withheld) must be included in the certificate if dividends were paid in non-monetary form (for example, in kind). In this case, the payer of dividends does not withhold tax at source and the obligation to calculate and pay personal income tax to the budget falls on the recipient of dividends (Article 228 of the Tax Code of the Russian Federation).

2-NDFL with sign 2 must be submitted no later than March 1 of the year following the year of payment.

How to reflect dividends in 2-NDFL

To clarify the tax rate, in the second section you must indicate the payer’s status: resident (1) or non-resident (from 2 to 5).

Dividends are displayed in the 3rd section of the certificate in income with a tax rate of 13% for our residents. If the rate has undergone changes during the year, then in sections 3, 4 and 5 of the certificate there should be a separate entry for each case. This section provides information: About actual income in cash or other kind with deductions listed for all months.

In addition, section 5 reflects the total share of accrued and withheld income at the corresponding rates.

The tax base for withholding tax on dividends may be reduced in cases stipulated by law. Deduction code – 601.

Example of filling out 2-NDFL when paying dividends:

- The header of the document indicates the year, document number and date of completion.

- Below is sign (1), the number of the adjustment (00 – the first and further – adjustments). In the same line is the code of the Federal Tax Service Branch.

- Section 1. Tax agent information: OKTMO, telephone, INN, KPP, company name.

- Section 2. Data about the individual. Next line by line.

- TIN in Russia or country of citizenship.

- Last name and full initials.

- Status (1 – resident), date of birth, country code.

- ID or passport details (code, number).

- Section 3. Income at the rate, in our case – 13%.

- This is a table in which you need to indicate: month of receipt, income code, its amount, deduction code, its amount.

- Section 4. Skip.

- Section 5. It records: income, tax base including deductions, tax (calculated, withheld, transferred).

- Signature.

The certificate form can be downloaded here.

Sample of filling out 2-NDFL from dividends

This certificate can be created in the 1c program. And not one, but two different types:

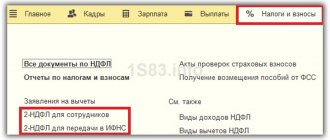

To obtain a certificate for an employee you need to:

For the Federal Tax Service this is done a little differently:

- In the 1c menu taxes and contributions, another new document is created.

- The type of certificate in this case is annual reporting. The header indicates the year, organization with OKTMO and KPP codes. In addition, it is necessary to mention the code of the Federal Tax Service and its checkpoint and record the type of certificate (initial, canceling or correcting).

- Employee data in the tabular section is filled in automatically (the “Fill” button) or manually.

- After checking the 2-NDFL, it can either be uploaded with further printing, or sent to the Federal Tax Service.

The reflection of dividends in 2-NDFL very often raises questions. Let us dwell on the most pressing issues of filling out the new 2-NDFL regarding dividends and show how to draw up a certificate using an example.

How are paid dividends accounted for?

Information on accrued and paid dividend amounts is formed on account 75/2 “Settlements with founders”, and since they are financed from profits, account 75/2 corresponds with account 84 “Retained earnings” (D84 - K75/2). If a company employee receives dividends, then his payments are reflected in the personnel payroll account - 70 (D84 - K70).

Depending on the frequency with which dividends were paid, their reflection in the reporting forms changes. The accrual of interim dividends is reflected in debit turnover in the account. 84 of the profit amounts for the quarter, half year, 9 months. In the balance sheet, accrued amounts reduce the amount of retained earnings in line 1370 of the third section “Capital and Reserves”. For the amounts of dividends paid during the year, new lines are usually opened in the interim balance sheet in the 3rd section of the balance sheet - 1371, 1372, etc., reducing the amount of retained earnings, and in the balance sheet asset the amount of cash will decrease by the amount of payments made in line 1250 (Letter of the Ministry of Finance of the Russian Federation dated December 19, 2006 No. 07-05-06/302).

The issuance of dividends made at a time at the end of the year will not be reflected in the balance sheet, since it is carried out already in the new reporting year.

What is a deduction for dividends in 2-NDFL?

In business practice, not only an individual can own a share in a company, but the company itself can be the owner of shares or shares of other legal entities. Dividends received from such legal entities, firstly, are included in the company’s profit (that is, they form the dividends of the company itself), and secondly, dividends received by the company are also subject to dividend tax.

That is, in the case when the profit distributed by the company includes dividends received and already taxed, double taxation of the same amount results.

Therefore, the legislation provides for the withdrawal of the amounts of such dividends from the second taxation by providing a deduction. The deduction is encoded 601 in deduction codes for 2-NDFL.

The deduction amount is determined by the formula:

Example

Company B received dividends from Company A on February 15, 2019 in the amount of RUB 3,000,000. Dividend tax of 13% was withheld at source and transferred to the budget.

On February 20, 2019, company B distributed its own profit in the amount of RUB 8,000,000. for dividends in proportion to shares in the management company.

The founder Sidorov owns 25% of the management company. Let's determine the amount of his income and deduction.

Dividend income for Sidorov (code 1010):

8,000,000 * 25% = 2,000,000 rub.

The dividend deduction for Sidorov (code 601) will be:

3,000,000 * 25% = 750,000 rub.

Under certain conditions, the tax rate on dividends received by a Russian legal entity may be equal to 0. For dividends with a rate of 0%, the personal income tax deduction is not calculated!

Should dividends be reported?

When paying dividends, the paying company acts as a tax agent for the individual. In other words, it is responsible for the withholding and payment of tax on individuals. Whether this should be reflected in the 2-NDFL form or not depends on the form of ownership of the company:

- LLCs are required to file 2-NDFL when paying dividends to their founders.

- AO - no. Instead, they include this information in the income tax return. Namely in Appendix 2.

This is indicated in the letters:

- Ministry of Finance 03-04-07/3263 dated January 29, 15.

- Federal Tax Service BS-4-22/1443 dated February 2 of the same year.