Entrepreneurs and organizations that use the “simplified” tax system make payments under the simplified tax system several times throughout the year. In accordance with accepted reporting periods (quarter, half-year and 9 months), upon completion of each quarter, advance payments are made within 25 days:

- until April 25 - for the first quarter;

- no later than July 25 - for half a year;

- October 25 is the payment date for 9 months of the current year.

There is no advance payment for the last quarter, since the tax period ends at the same time. In this regard, the taxpayer has the obligation to report and pay tax based on the results of work for the entire year. The deadlines established for the transfer of tax to the simplified tax system by legal entities and individual entrepreneurs are: until March 31 and April 30, respectively.

The procedure for calculating the simplified tax system

For the simplified tax, as for other payments, a tax period is established. It is equal to a year and is divided into reporting periods, determined quarterly by adding the duration of the next quarter to the previous period (Clause 2 of Article 346.19 of the Tax Code of the Russian Federation).

At the end of the year, simplified taxation reporting (declaration) is submitted and the final tax payment is made. Interim reporting is not provided. But based on the results of each reporting period, the amount of the advance payment to be paid is necessarily calculated (clause 3 of Article 346.21 of the Tax Code of the Russian Federation).

The calculation of advances and taxes for the year is done according to the same algorithm (the base, calculated on an accrual basis, is multiplied by the rate). Then, to determine the amount of payment actually payable for the last quarter of the period, the amount of advances accrued for the previous period is subtracted from the resulting amount. The last provision does not apply when calculating the advance payment under the simplified tax system for the 1st quarter.

Note! From 01/01/2021, the Treasury details for making tax payments have changed. The period from 01/01/2021 to 04/30/2021 is a transition period, and payments with old details will be processed correctly. From 05/01/2021, taxes transferred to old details will be included in outstanding payments.

The presence of two different objects of taxation (“income” with a rate of 1% to 6% and “income minus expenses” with a rate of 5% to 15%) causes differences in the determination procedure:

- the base to which the relevant rate applies;

- the final amount of tax due for payment (the “income” object allows for its direct reduction by a number of paid expenses, and for the “income minus expenses” object a limit has been established below which tax payable cannot be accrued).

Advance payments for the “Revenue” object

The tax base in this case will be all income of an enterprise or individual entrepreneur for the period, determined “by payment” (Article 346.18 of the Tax Code of the Russian Federation).

First you need to multiply the indicated amount of income for the six months by the established tax rate. In the general case, it is equal to 6%, but can be reduced to 1% by decisions of the constituent entities of the Russian Federation (Article 346.20 of the Tax Code of the Russian Federation). For entrepreneurs, a zero rate may be set as part of the “tax holiday”.

After calculating the original tax amount, it can be reduced by the following deductions (Article 346.21 of the Tax Code of the Russian Federation):

- Insurance contributions from the payroll fund (compulsory pension, health and social insurance). Contributions paid “for oneself” by an individual entrepreneur are also included in this deduction

- Payment of sick leave at the expense of the employer.

- Contributions for voluntary personal insurance of employees in case of illness.

- Trade fee amounts.

The use of these deductions is subject to a number of conditions:

- We are talking only about the amounts actually transferred for the period (but within the limits of accruals).

- Using the deductions specified in paragraphs 1-3, you can reduce the tax amount by no more than 50%. The exception is entrepreneurs who do not have employees and pay insurance premiums “for themselves” in accordance with paragraph 1 of Art. 430 Tax Code of the Russian Federation. They can use these contributions to deduct the full amount.

- The trade tax deduction is relevant only for Muscovites, because... Today, this payment is valid only in the capital (although it could potentially be introduced in St. Petersburg and Sevastopol).

After applying all deductions, advances paid for previous billing periods must be subtracted from the remaining amount.

As a result, the formula for calculating the advance payment under the simplified tax system for the 2nd quarter of 2021 is: for the “Revenue” object will look like this:

A2 = D x C – B – A1, where:

- D – income for the six months “on payment”;

- C – tax rate;

- B – deductions for half a year;

- A1 – previously transferred advance payment for the 1st quarter.

Example 1

Alpha LLC received for the 1st half of 2021. income in the amount of 1,200,000 rubles. The tax rate under the simplified tax system for the “Income” object in the region where the company is registered is set at 6%. The amount of insurance premiums and sick leave paid during the period totaled 80,000 rubles. For the 1st quarter, advance payments in the amount of 25,000 rubles were paid.

The estimated tax amount for the six months will be 1,200,000 x 6% = 72,000 rubles. The amount of deductions (80,000 rubles) exceeds the amount of the tax itself, so they are applied in the amount of 50% of it (36,000 rubles). As a result, we get the amount of the advance payment according to the simplified tax system for the 2nd quarter of 2021:

A2 = 1,200,000 x 6% – 36,000 – 25,000 = 11,000 rub.

We calculate the simplified taxation system advance for the 1st quarter of 2021

Let's look at the calculation of the simplified tax system advance using examples.

Example 1

An individual entrepreneur working on the simplified tax system, who chose the “income” object and has no employees, received an income of 835,000 rubles during the 1st quarter of 2021. In the region of its activity, the simplified tax system is subject to a 6% rate. In March, he paid insurance premiums totaling RUB 35,000.

The amount of tax payable for individual entrepreneurs will be:

835,000 × 6% - 35,000 = 15,100 rubles.

Example 2

Stimul LLC, when applying the simplified tax system with the object “income minus expenses,” received an income of 1,314,000 rubles for the 1st quarter of 2021. Accepted expenses for this period amounted to RUB 917,000. The simplified tax rate applied in the region is 15%.

The amount of tax payable will be equal to:

(1,314,000 - 917,000) × 15% = 59,550 rub.

Advance payments for the object “Income minus expenses”

In this case, the tax base is the difference between the income and expenses of a businessman. It can be considered to some extent “analogous” to taxable income, which is calculated using the general tax system. The difference lies, firstly, in the recognition of income and expenses for payment, and secondly, in the list of expenses themselves (Article 346.16 of the Tax Code of the Russian Federation).

In this case, the base rate of 15% is applied, which can be reduced by regional authorities to 5%, and in Crimea and Sevastopol - to 3% (clause 2.3 of Article 346.20 of the Tax Code of the Russian Federation).

There are no deductions from the amount of “simplified” tax when using this taxation object, because all expenses are already taken into account as part of the calculation of the tax base.

Previously paid advances must be taken into account similarly to the option with the “Income” object.

You need to calculate the advance payment under the simplified tax system for the 2nd quarter of 2021 for the object “Income minus expenses” using the following formula:

A2 = (D – P) x C – A1, where:

- D – income for the half year;

- P – expenses for half a year;

- C – tax rate;

- A1 – advance payment paid for the 1st quarter.

If expenses for the reporting period turned out to be equal to or exceed income, then the advance payment does not need to be transferred. The provision on the payment of the minimum tax (clause 6 of Article 346.18 of the Tax Code of the Russian Federation) applies only based on the results of the tax period as a whole and does not apply to advances.

Example 2

Alpha LLC received for the 1st half of 2021. income in the amount of 1,200,000 rubles. Expenses recognized in accordance with Art. 346.16 of the Tax Code of the Russian Federation amounted to 900,000 rubles. The tax rate under the simplified tax system for the object “Income minus expenses” in the region where the company is registered is set at 15%. For the 1st quarter, advance payments in the amount of 20,000 rubles were paid. Amount of advance payment under the simplified tax system payable for the second quarter of 2021. will be:

A2 = (1,200,000 – 900,000) x 15% – 20,000 = 25,000 rub.

What is important when paying a simplified taxation system in advance?

In contrast to the deadlines for transferring the simplified tax system for the year, linked to the deadline for filing a declaration on it (they differ for legal entities and individual entrepreneurs), advances under the simplified tax system, regardless of which category the payer belongs to, are paid within the same period. This happens in the month following the end of the next reporting period (quarter), no later than the 25th (clause 7 of Article 346.21 of the Tax Code of the Russian Federation). When the 25th day turns out to be a weekend, the end date is shifted forward to the nearest weekday (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Taking into account these rules, the deadline for paying the simplified tax system advance for the 1st quarter of 2021 is 04/26/2021 (postponement from Sunday, April 25).

Details for paying the simplified tax system “Income” in 2021

| Payment details | Code (decoding) | Note | |

| Field no. | Name | ||

| 101 | Payer status | 01 – legal entity 09 – IP | They are indicated only when transferring funds to the budget (in our case, tax under the simplified tax system). |

| 18 | Type of operation | 01 | The payment order is assigned code 01. |

| 21 | Payment order | 5 | Self-payment of taxes has the fifth priority. |

| 22 | Code | 0 | The transfer of current taxes is encrypted with code 0. If a request is made by the Federal Tax Service, then the request code (UIN) is indicated. |

| 24 | Purpose of payment | Advance tax payment/Tax transferred in connection with the application of the simplified taxation system (income), for _____ 2021/for 2021 | |

| 104 | KBK | 182 1 0500 110 | |

| 105 | OKTMO | OKTMO code at the location of the individual entrepreneur or enterprise. It must match the OKTMO code specified in the declaration under the simplified tax system. You can determine it by calling the supervising Federal Tax Service Inspectorate or by checking ]]>on the Federal Tax Service website]]>. | |

| 106 | Basis of payment | TP TR ZD | TP – current payment TR - at the request of the inspection ZD – transfer of debt |

| 107 | Taxable period | KV.01.2018 (quarterly) GD.00.2018 (for 2021) | KV – the second two digits indicate the number of the quarter for which the payment is made; GD – the second digit is set to 00 |

| 108 | Document Number | 0, or the Federal Tax Service requirement number | 0 - upon voluntary payment of tax/advance payment; No. of the Federal Tax Service's requirement - when paying on its basis. |

| 109 | Document date | 0, or the date of signing the declaration, or the date of the request of the Federal Tax Service | When paying advances - 0, tax for the year - the date of signing the declaration, if the payment is required by the Federal Tax Service - its date. |

Results

Advance payment is a mandatory attribute of the simplified tax system, the final calculation of which is made at the end of the year. STS advances are calculated quarterly, determining the basis for calculation on an accrual basis. Whenever calculating the amount payable for the next period (except for determining such an amount for the 1st quarter), advance payments made in previous reporting periods are taken into account.

The determination of the tax base and the calculation of the tax itself, depending on which of the objects (“income” or “income minus expenses”) the simplified tax system is applied to, have their own characteristics.

Payment of simplified taxation system advances, regardless of whether the taxpayer is a legal entity or individual entrepreneur, must be made no later than the 25th day of the month following the next quarter. For payment for the 1st quarter of 2021, this deadline (taking into account the postponement from the weekend) corresponds to 04/26/2021.

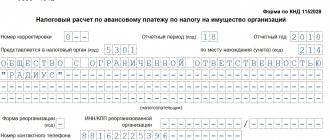

Payment order of the simplified tax system “Income” - 2021: mandatory attributes

Each payment document detail requires careful attention and is filled out in accordance with the inscriptions on the form. For example, in the columns reserved for information about the payer, comprehensive information about him is entered, such as: the name of the company or full name of the businessman, INN, KPP (for companies), the name and BIC of the institution of the payer’s bank and the current account number from which the money is transferred to the budget payment, as well as the amount of payment. An important aspect is the detailed description of the purpose of payment, for example, advance payment for the 1st quarter.

The block of fields reserved for information about the payee is also thoroughly filled out. When creating a payment order, they indicate:

- Name, number of the Federal Tax Service;

- TIN/KPP inspection;

- Name of the local treasury office accepting payment for the Federal Tax Service;

- BIC of the bank, account number of the Federal Tax Service.

The details of the Federal Tax Service for correctly filling out the order can be found by calling the inspectorate at the place of registration, or on the Federal Tax Service website in the service “]]>Addresses and details of your inspection]]>”, for which you only need to select the payer category (legal entity or individual), Enter the Federal Tax Service code and select OKTMO.

Registration of penalties and debts according to the simplified tax system

A penalty on the tax paid is a necessary condition, not a penalty. It facilitates timely payment of taxes and has almost no difference with the original example of the simplified tax system for profit and is filled out in the same way. There are several distinctive nuances, one of which requires a description of the KBK code. Before providing the penalty form, you must enter the appropriate code, and when paying the income-expense penalty, enter the code 18210501021012100110.

There is one more nuance regarding the “Basis of payment” field. If the entrepreneur decides to recalculate the penalty himself with an arbitrary payment, then when paying, he must indicate - ZD. If the payer has received a written notification of payment, the TP code is written in this column. If the recalculation of penalties is made on the basis of an act after the corresponding tax audit, then the AP is indicated in the column. These conditions are met when paying the minimum tax.

The field that prescribes the terms of repayment, in a payment order according to the usn, is sometimes set to 0. This happens when the penalty is paid in an arbitrary manner, or in the presence of a drawn up act, and therefore does not require a specific date. In other cases, the column indicates the numbers corresponding to the appointed date. And if the calculation is carried out upon request, then the number indicated in the resolution is written in the column.

In addition to the above aspects, in case of arbitrary payment of penalties, without the presence of various regulations, it is recommended to indicate 0 in the order number and date. After the control audit, the numbers specified in the requirement are indicated in this line.

Checking tax calculations with the budget under the simplified tax system

To check calculations with the budget for tax under the simplified tax system (Income), you can create a report Account analysis 68.12 “Tax under the simplified taxation system”, section Reports - Standard reports - Account analysis.

See also:

- Paying tax under the simplified tax system (Income-expenses)

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Paying tax under the simplified tax system: object Income - expenses In this article we will talk about how to fill out a payment form...

- Intangible assets when switching from the simplified tax system for income to the simplified tax system for income and expenses Good afternoon! The LLC has 08 intangible assets on its account. In the current...

- Individual entrepreneurs without employees, insurance premiums for income over 300 thousand when switching from the simplified tax system, income-expenses to the simplified tax system, income of individual entrepreneurs without employees from 01/01/2021. switches from the simplified tax system (D-R) to...

- Transition from the simplified tax system (Income) to the simplified tax system (income - expenses) You do not have access to view. To gain access: Complete...