From 2021, the payment of insurance premiums comes under the control of the Federal Tax Service. Changes in administration are due to the fact that the Pension Fund is poorly coping with the complete collection of these payments. Otherwise, little will change for employers, except that the maximum base for calculating insurance premiums in 2017 has once again been increased.

Up-to-date information on the maximum base for calculating insurance premiums in 2021 and 2021 is in our new article. Data for 2021 can be found here.

What is a marginal base

The maximum size of the base for calculating insurance premiums, established by the state, is the amount of payments in favor of the employee, above which payments are calculated at a reduced rate. In general, insurance payments that the employer pays at his own expense are:

- for pension insurance – 22%;

- for health insurance – 5.1%;

- for social insurance – 2.9%.

Additionally, a contribution is paid to the Social Insurance Fund for compulsory insurance against accidents at work and occupational diseases (from 0.2% to 8.5%).

If the annual payment amount exceeds a certain limit, then the employee contribution rate is reduced, which means the employer must pay less. The maximum base for calculating insurance premiums in 2021 by employers is established by Decree of the Government of the Russian Federation dated November 29, 2016 No. 1255, which comes into force on January 1 of the new year. With regard to individual entrepreneurs’ contributions for themselves in 2021, the concept of “limit base” is not used, but for them a maximum amount of payments to the Pension Fund is established, regardless of the income that the entrepreneur receives from the business.

Please note: payment of insurance premiums in 2021 to the Pension Fund, and to the Federal Social Insurance Fund of the Russian Federation and the Compulsory Medical Insurance Fund (only for disability and maternity benefits) will be made using the details of the tax authorities, so the KBK payment system will change. We recommend using current accounts to pay insurance premiums. Many banks offer favorable conditions for opening and maintaining a current account. You can view the offers on our website.

Deadlines and procedure for submitting reports to the Federal Tax Service

For the first time, calculations of insurance premiums will need to be submitted to the Federal Tax Service for the first quarter of 2021. It will be submitted to the tax office at the location of the organization and its separate divisions, which accrue payments and other remuneration in favor of individuals, as well as at the place of residence of the individual who pays remuneration to individuals (clause 7 of Article 431 of the Tax Code of the Russian Federation as amended by 243-FZ ).

Insurance premium payments will need to be submitted no later than the 30th day of the month following the billing (reporting) period - quarter. Thus, it will need to be submitted to the Federal Tax Service:

- for the first quarter of 2021 - from April 1 to April 30;

- for the half-year - from July 1 to July 30;

- for 9 months - from October 1 to October 30;

- for 2021 - from January 1 to January 30, 2021, etc.

Organizations with more than 25 employees are required to submit calculations via telecommunication channels (TCC) in electronic form with an enhanced qualified electronic signature. Failure to comply with this requirement will result in a fine of 200 rubles. Payers with less than 25 people have the right to submit calculations to the tax authority either in person or in the form of a postal item with a list of attachments, or via TKS in electronic form.

Administration of insurance premiums passes to the Federal Tax Service, and you can go to Kontur.Extern and receive a 50% discount

To learn more

Limit base for contributions in 2021

The maximum base for calculating insurance premiums in 2021 has increased; the table below contains the new established contribution rates for different types of employee insurance.

Limits are set only for two types of insurance:

- for pension insurance - 876,000 rubles (in 2021 - 796,000);

- for compulsory social insurance - 755,000 rubles (in 2016 - 718,000).

With regard to amounts for compulsory health insurance and contributions to the Social Insurance Fund for injuries, the law does not provide for a maximum base size, therefore this category of contributions is calculated at a single rate, regardless of how much is paid to the employee.

| Amount of payments to the employee | to the Pension Fund of Russia | in FFOMS | in the FSS |

| Contribution rate until the limit is reached | 22% | 5,1% | 2,9% |

| Contribution rate after reaching the limit | 10% | 5,1% | 0% |

Let us show with an example how to calculate the amount of contributions payable, taking into account the maximum base for accrual for pension and health insurance in 2021.

Calculation example: a senior lawyer was paid a total of RUB 913,000 during 2021. How to calculate the amount payable for insurance for this employee?

- contributions to the Pension Fund within the limit: 876,000 * 22% = 192,720 rubles;

- contributions to the Pension Fund over the limit: (913,000 - 876,000) * 10% = 3,700 rubles;

- contributions to the FFOMS (there is no limit, therefore the entire amount is taxed at one rate): 913,000 * 5.1% = 46,563 rubles;

- contributions to the Social Insurance Fund within the limit: 755,000 * 2.9% = 21,895 rubles;

- contributions to the Social Insurance Fund in excess of the limit are not accrued.

In total, in 2021 the employer pays 264,878 rubles in contributions, which is 29% of payments to this employee. The savings are insignificant (versus 30%), but they still exist.

Responsibility for non-payment of insurance premiums

Previously, with regard to the payment and calculation of insurance premiums, the payer was not subject to the provisions of the Tax Code - in particular, there was no separate liability for violation of accounting rules. However, now, since the administration of insurance premiums will be transferred to the tax authorities, liability will be extended for gross violation of accounting rules, which resulted in an understatement of the base for insurance premiums (clause 3 of Article 120 of the Tax Code of the Russian Federation). In addition, liability for failure to submit documents during tax control will be extended - in the amount of 200 rubles for each document not submitted. Responsibility for personalized accounting is also established. Thus, for non-compliance by the policyholder in the prescribed cases with the procedure for submitting personalized accounting information in the form of an electronic document, a fine of 1000 rubles is provided (Article 17 of the Federal Law of April 1, 1996 No. 27-FZ).

Additional sanctions certainly have a negative effect on contribution payers. At the same time, there is also a positive aspect: a three-year statute of limitations has been introduced for bringing to justice for committing an offense in the field of personalized accounting. This means that beyond the three-year period the company cannot be held liable. All other reporting, except for the above, must be sent to the Federal Tax Service. Instead of the familiar calculations of RSV-1 and 4 - FSS, tax authorities have already approved a new unified form for quarterly calculation of contributions. It replaces several familiar forms at once: RSV-1, RSV-2, RV-3 and 4 - FSS.

Evgeniy Simonov, head of the personnel service, St. Petersburg, says: “I would like the Ministry of Finance to try to control itself and not issue new rules and report formats every month. When accepting subsequent amendments, officials must be sure that new adjustments will not be required. Why is there a constant need to redo regulations and the Tax Code? Sometimes it seems that this is being done deliberately in order to completely confuse accountants and personnel officers.”

Read also “Responsibility for violations of payment of insurance premiums 2017”

Results

The accounting system for insurance contributions in 2021 has not changed dramatically, but the transfer of provisions on social contributions to the Tax Code has made payments in the field of social insurance equal to other taxes, including in terms of the consequences for business in case of errors or arrears.

This means that the accountant now needs to calculate, transfer and report insurance premiums with extreme care. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The tax authority must be notified of the creation of separate divisions

Starting next year, organizations are required to notify tax inspectorates at their location about all cases of the creation of separate divisions in Russia that make payments to individuals. This must be done within one month from the moment of creation of the unit (subclause “b”, paragraph 17, article 1 of Law No. 243-FZ). This requirement applies to those units that will be formed after 01/01/2017 (Part 2 of Article 5 of Law No. 243-FZ).

Please note that organizations currently do not submit such information to foundation authorities. The obligation to report the creation and closure of separate divisions has been canceled since 01/01/2015 (clause “c”, paragraph 17, article 5 of the Federal Law of June 28, 2014 No. 188-FZ). Amendments to the Tax Code of the Russian Federation partially restored this obligation.

The Federal Tax Service and the Social Insurance Fund will interact during inspections

The interaction of regulatory authorities is as follows:

- tax authorities check the correctness and timeliness of payment of social insurance contributions (in case of disability and in connection with maternity);

- Fund authorities verify the correctness of expenses for social security payments (in particular, benefits).

The amount of assessed contributions for compulsory social insurance may still be reduced by the amount of benefits paid. This information is reflected in the calculation of contributions, which will be checked by the tax authorities.

Tax authorities, as part of an interdepartmental exchange, will transfer information about the expenses indicated in the reports to the authorities of the Federal Tax Service of the Russian Federation. Based on the data received, funds have the right to conduct desk and on-site inspections of payers (Clause 8, Article 9 of Federal Law No. 250-FZ dated July 3, 2016, hereinafter referred to as Law No. 250-FZ).

In addition, tax authorities and the Federal Tax Service of the Russian Federation will be able to conduct joint inspections.

Please note: if the costs of paying benefits exceed the amount of contributions, then the resulting difference is subject to (clause 9 of Article 431 of the Tax Code of the Russian Federation, clause 8 of Article 9 of Law No. 250-FZ):

- offset against future contribution payments. The decision on this will be made by the tax authority after it receives confirmation of such expenses from the fund authority;

- reimbursement by the fund body.

According to Part 3 of Article 5 of Law No. 243-FZ, the provision that social insurance contributions are reduced by expenses for the payment of insurance coverage is valid until December 31, 2018 (inclusive).

It follows from this that starting from 2021, contributions must be transferred in the same amount in which they were accrued.

We can assume that from this date benefits will be paid directly to insured individuals by the Federal Social Insurance Fund of the Russian Federation, and not by employers (this has now been implemented in some regions participating in the Fund’s pilot project).

Currently, the participants in the FSS pilot project include:

- Karachay-Cherkess Republic and Nizhny Novgorod region - from 01/01/2012;

- Astrakhan, Kurgan, Novgorod, Novosibirsk, Tambov regions and Khabarovsk Territory - from 07/01/2012;

- Republic of Crimea, Sevastopol - from 01/01/2015;

- Republic of Tatarstan, Belgorod, Rostov and Samara regions - from 07/01/2015;

- Republic of Mordovia, Bryansk, Kaliningrad, Kaluga, Lipetsk and Ulyanovsk regions - from 07/01/2016.

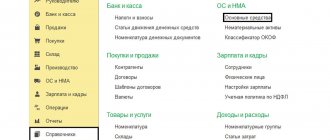

The 1C: Salaries and Personnel Management 8 program implements all the necessary documents for pilot regions*.

Note:

* For information on how to set up “1C: Salary and HR Management 8”, if your region is participating in the FSS pilot project, read the article “1C: Salary and HR Management 8: How to connect to the FSS pilot project to pay benefits directly.”

Registration as insurers under mandatory...

… pension insurance

The Pension Fund of the Russian Federation will register policyholders in the field of compulsory pension insurance (OPI) only for the purpose of submitting personalized reporting, and all information about the registration of organizations, their separate divisions, individual entrepreneurs, as well as other payers (including lawyers, notaries ) will be transferred to the PFR authorities by the tax inspectorates (clause 4 of Article 6 of the Federal Law of July 3, 2016 No. 250-FZ, hereinafter referred to as Law No. 250-FZ).

Currently, tax authorities also transfer information about the registration of organizations to the fund, but registration of entrepreneurs and organizations at the location of separate divisions is carried out in an application form (such payers independently apply to the fund authorities for registration) (clauses 12, 21 of the Procedure, approved by Resolution of the Board of the Pension Fund of October 13, 2008 No. 296p).

…health insurance

The registration procedure does not change: entrepreneurs and organizations are recognized as insurers of compulsory health insurance (CHI) from the moment of registration with the tax authority. The inspectorates will independently transmit all the necessary information to the territorial bodies of the fund (Clause 1, Article 12 of Law No. 250-FZ).

...social insurance

The procedure for registering policyholders in the field of compulsory social insurance (OSI) also remains the same.

Data about the organization upon its creation is transferred to the fund body by the tax inspectorate (clause 1, part 1, article 2.3 of the Federal Law of December 29, 2006 No. 255-FZ, subclause 1, clause 1, article 6 of Law No. 125-FZ).

By submitting an application, organizations at the location of a separate unit, as well as individual entrepreneurs (who have entered into an employment contract or a civil contract with an individual with the condition of paying contributions “for injuries”) are registered (clause 2 of article 9 of Law No. 250-FZ ).

Another change is that from next year, an organization is required to register with the Pension Fund of the Russian Federation and the Federal Social Insurance Fund of the Russian Federation at the place where separate divisions are created if such a division:

- has its own current account;

- makes payments to individuals.

Thus, the current requirement to allocate a division to a separate balance sheet has been canceled (clause 1 of Article 3, clause 4 of Article 6, clause 2 of Article 9 of Law No. 250-FZ). The listed provisions are intended for payers whose obligation to register with the funds will arise from 01/01/2017.

Payers who are already registered with extra-budgetary funds do not need to register again.

Daily allowances for business trips are not subject to contributions within the norms

The Tax Code enshrines the provision that when paying for travel expenses, daily allowances are not subject to contributions according to the standards established for personal income tax purposes (clause 2 of Article 422 of the Tax Code of the Russian Federation).

Let us remind you that personal income tax is not withheld from daily allowance in the amount of no more than (clause 3 of article 217 of the Tax Code of the Russian Federation):

- 700 rub. — on business trips around Russia;

- 2,500 rub. - on business trips abroad.

Starting next year, similar rules will apply to insurance premiums.

Such unification is not in favor of contribution payers, because currently daily allowances are exempt from contributions in the full amount in which they are provided for posted workers by a local act of the organization (see Part 2 of Article 9 of Law No. 212-FZ).