Documenting

When moving a fixed asset internally, fill out the invoice according to form No. OS-2. In particular, the invoice is drawn up:

- when transferring a fixed asset for operation to another division of the organization. When transferring a fixed asset from a warehouse into operation, an invoice in form No. OS-2 must be drawn up if the fixed asset is put into operation after it is registered;

- when transferring a fixed asset for repair, reconstruction, modernization, completion (additional equipment) to a special division of the organization (for example, a repair service);

- when changing materially responsible persons.

When moving a fixed asset, the delivering unit issues an invoice in triplicate. The invoice must be signed by:

- an employee responsible for the safety of fixed assets in the delivering unit;

- employee responsible for the safety of fixed assets in the recipient department.

The first copy of the invoice remains in the delivery department and serves as justification for the absence of a fixed asset. The second copy is transferred to the recipient unit, the third to the accountant to reflect the movement of fixed assets in accounting and in the inventory card in form No. OS-6 (OS-6a) or in the inventory book in form No. OS-6b (intended for small enterprises).

This procedure is provided for in the instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

Situation: how to formalize the transfer of a fixed asset to a separate division of the organization, allocated to a separate balance sheet?

When transferring a fixed asset from one division to another, an invoice is drawn up in form No. OS-2 (instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7). The disadvantage of this form is that it does not contain data on accrued depreciation. Therefore, when transferring fixed assets to a separate division allocated to a separate balance sheet, you can modify No. OS-2 by including the necessary details, or use another document, for example, an advice note.

Enter information about the transfer of fixed assets to a division of the organization allocated to a separate balance sheet in the inventory card in form No. OS-6 (OS-6a) or in the inventory book in form No. OS-6b.

The card in form No. OS-6 is kept in one copy for each fixed asset item. Therefore, the accountant of the head office of the organization must transfer the account card to the accountant of a separate division allocated to a separate balance sheet. This is necessary for the correct calculation of depreciation for the transferred fixed asset, as well as for reflecting in it the operations associated with this object (for example, revaluation, disposal, etc.).

The card in form No. OS-6a is kept in one copy for a group of homogeneous fixed assets. Therefore, if not the entire group of fixed assets is transferred to a separate division, the card in form No. OS-6a must be kept in the head office of the organization. To correctly calculate depreciation, the accountant of a separate division allocated to a separate balance sheet must provide a copy of the card in form No. OS-6a. Based on the copy, the accountant of a separate division can create a separate card for this fixed asset in Form No. OS-6. The above is also true if the organization keeps records of fixed assets in a book according to form No. OS-6b.

Nuances of filling

Rows in the table should not be left empty. If a document is generated electronically, then unfilled sections of the document are simply deleted. If the paper is already printed, they are crossed out. Corrections to the invoice are not recommended. But if a mistake was made, it is corrected by a longitudinal strikethrough and the inscription “Believe the corrected one.” Moreover, next to this inscription there must be signatures of all persons who are also signed at the end of the document: the chief accountant, the handing over and receiving persons.

Is it possible to change graphs?

All this data is necessary for maintaining full-fledged accounting and warehouse records in the organization. Since 2013, this form has ceased to be mandatory. It became only advisory, in accordance with the law “On Accounting” dated 06.12.2011 No. 402-FZ.

At its own discretion, the organization has the right to refuse some columns of the primary document or add new ones. However, all these changes must be documented and have good reasons.

In short, the form is widely used today because it is convenient, illustrates the maximum amount of information and does not confuse regulatory authorities when conducting inspections and audits.

How many copies will be required?

The invoice must be filled out in at least 3 identical copies. This is done so that one invoice remains with the accountant (or the employee performing his duties) for the generation of further reporting. The second paper must be kept by the employee responsible for it for a specific facility. And the third option must be provided to the receiving party as confirmation of the verified fact. Ideally, all 3 invoices have 3 signatures of employees who are financially responsible.

Accounting: the division is not allocated to a separate balance sheet

If the recipient division is not allocated to a separate balance sheet, then the movement of fixed assets is reflected in internal records in accounts 01 “Fixed Assets” (03 “Income Investments in Material Assets”) and 02 “Depreciation of Fixed Assets.” For example, if a fixed asset is transferred from workshop No. 2 to workshop No. 1, then the following entries are made:

Debit 01 (03) subaccount “Fixed assets in workshop No. 1” Credit 01 (03) subaccount “Fixed assets in workshop No. 2” - reflects the movement of fixed assets from workshop No. 2 to workshop No. 1 in the amount of the original (replacement) cost;

Debit 02 subaccount “Fixed assets in workshop No. 2” Credit 02 subaccount “Fixed assets in workshop No. 1” - reflects the movement of fixed assets from workshop No. 2 to workshop No. 1 for the amount of accrued depreciation.

Example of reflection in accounting and taxation of internal movement of fixed assets

OJSC "Proizvodstvennaya" is engaged in construction activities. The head office of the organization is located in Moscow. "Master" uses the accrual method. The organization does not perform operations that are not subject to VAT.

To carry out his activities, “Master” transferred the bulldozer to a unit located in Kursk. The division is not allocated to a separate balance sheet. The bulldozer was transported by a third-party organization, the cost of which was 11,800 rubles, including VAT - 1,800 rubles. The initial cost of the fixed asset is RUB 1,500,000. Accumulated depreciation – RUB 500,000. Accounting and tax accounting data are the same.

The Master's accountant made the following entries in the accounting:

Debit 01 sub-account “Kursk branch” Credit 01 sub-account “Moscow branch” – 1,500,000 rubles. – the movement of the bulldozer is reflected in the amount of the original cost;

Debit 02 subaccount “Moscow branch” Credit 02 subaccount “Kursk branch” – 500,000 rubles. – the movement of the bulldozer is reflected in the amount of accrued depreciation;

Debit 20 Credit 60 – 10,000 rub. (118,000 rubles – 18,000 rubles) – the cost of services for transporting the bulldozer is taken into account;

Debit 19 Credit 60 – 1800 rub. – VAT is taken into account on the cost of services for transporting the bulldozer;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 1800 rub. – accepted for VAT deduction;

Debit 60 Credit 51 – 11,800 rub. – services for transporting the bulldozer were paid for.

The accountant reduced the tax base for income tax by the cost of services for transporting the bulldozer in the month in which it was delivered to the Kursk branch of the organization.

Sample invoice for internal movement, transfer of goods, containers in the TORG-13 form

At the beginning of the document it is written:

- the name of the organization, as well as its OKPO code, activities according to OKPD and type of operation;

- number and date of invoice;

- the sender of the product (package) and the type of activity of this division;

- similar information about the recipient;

- accounts through which the movement of inventory items is carried out.

Below is a table where they fit:

- name of the product (package);

- its code, grade, unit of measurement (name and according to OKEI);

- quantity and price supplied (quantity, weight).

The table summarizes the results and places the signatures of the financially responsible persons.

Accounting: the division is allocated to a separate balance sheet

If the recipient division is allocated to a separate balance sheet, then when moving the fixed asset is written off from the balance sheet of the organization's head office. For settlements with a separate division, use account 79-1 “Settlements for allocated property” (Instructions for the chart of accounts).

In the accounting of the head office of the organization, you need to make the following entries:

Debit 79-1 Credit 01 (03) – reflects the transfer of fixed assets to a unit allocated to a separate balance sheet in the amount of the original (replacement) cost;

Debit 02 Credit 79-1 - reflects the transfer of fixed assets to a division allocated to a separate balance sheet for the amount of accrued depreciation.

In the accounting of a division allocated to a separate balance sheet, the receipt of fixed assets from the head office of the organization is reflected by the following entries:

Debit 01 (03) Credit 79-1 – the initial (replacement) cost of the fixed asset transferred from the head office of the organization is taken into account;

Debit 79-1 Credit 02 – the amount of accrued depreciation on fixed assets transferred from the head office of the organization is taken into account.

Using account 79-1 does not change the balance sheet currency for the organization as a whole. The fact is that separate divisions are not legal entities and do not generate separate financial statements (Clause 3 of Article 55 of the Civil Code of the Russian Federation, Article 2 of Law No. 402-FZ of December 6, 2011). The balance sheet and other forms of reporting are prepared by the head office of the organization, taking into account indicators for all divisions, including those allocated to a separate balance sheet (clause 8 of PBU 4/99). Account 79-1 is an account for intra-company settlements and, in general, according to the organization, the balance on this account should always be zero (Instructions for the chart of accounts).

An example of reflecting in accounting the receipt of property by a separate division of an organization allocated to a separate balance sheet

OJSC "Proizvodstvennaya" is engaged in the production of artificial leather. “Master” has a separate division allocated to a separate balance sheet. To carry out its activities, this division received from the “Master” a machine that the “Master” had previously used in production.

The initial cost of the fixed asset is RUB 2,500,000. Accumulated depreciation – RUB 500,000. The accountant of the separate division continued to calculate depreciation at the rate calculated in the head office - 25,000 rubles.

In the accounting of the head office, the accountant reflected the transfer of property as follows:

Debit 79-1 Credit 01 – 2,500,000 rub. – the transfer of fixed assets to a unit allocated to a separate balance sheet is reflected in the amount of the original cost;

Debit 02 Credit 79-1 – 500,000 rub. – the transfer of fixed assets to a unit allocated to a separate balance sheet is reflected in the amount of accrued depreciation.

When receiving property from the head office, the following entries were made in the accounting of the separate division:

Debit 01 Credit 79-1 – RUB 2,500,000. – the initial (replacement) cost of the machine transferred from the head office of the organization is taken into account;

Debit 79-1 Credit 02 – 500,000 rub. – the amount of accrued depreciation on fixed assets transferred from the head office of the organization is taken into account.

The result was a 79-1 finish for the organization as a whole.

The accountant of a separate division calculates depreciation on a monthly basis until the cost of the fixed asset is completely written off:

Debit 20 Credit 02 – 25,000 rub. – depreciation has been calculated on the received machine.

Request-invoice form 0504204: sample filling

Step 1. The storekeeper of warehouse No. 3 fills out the details of the institution, including its OKPO code, indicates the name of the structural units that are involved in the transfer, and then the number of the demand invoice and the date of the operation. Next, fill in the details “Requested” and “Allowed”, indicating the positions and full names of the responsible persons:

Step 2. Then, in the tabular section, it reflects the name of the transferred goods and materials, item number, passport number (or serial number) of each unit (if any), the number of transferred goods and materials, their price and amount.

The “Total” line displays summarized data for all records specified in the document. The storekeeper, as a financially responsible person, should not fill out columns 10 and 11 here - this information is indicated by the responsible services (including accounting).

Step 3. Finally, the parties enter the details of the employees who are responsible for the transfer of the electric drill, and the date of the event is indicated.

Step 4. Within the established period, the demand invoice is transferred by the storekeeper to the appropriate service of the institution, which processes the received data: indicates the corresponding accounts and makes appropriate entries in the transaction log. After this, fill in the details of the “accounting” part of the document:

Accounting: expenses for internal movement during reconstruction

When internally moving fixed assets, an organization may incur expenses. For example, transportation costs, costs for dismantling and installing equipment, etc. The procedure for accounting for these costs depends on whether the movement of a fixed asset is associated with its reconstruction (modernization, additional equipment).

If a fixed asset is transferred from one division of the organization to another as part of reconstruction (modernization, additional equipment), then the costs of the transfer are taken into account in account 08 “Investments in non-current assets”:

Debit 08 Credit 60 (10, 70, 68, 69...) – expenses associated with the internal movement of fixed assets for reconstruction (modernization, additional equipment) are taken into account.

After completion of reconstruction work (modernization, additional equipment), expenses associated with internal movement are included in the initial cost of the fixed asset:

Debit 01 (03) Credit 08 – the initial cost of a fixed asset has been increased by the amount of costs associated with its movement for reconstruction (modernization, additional equipment).

This procedure for reflecting expenses for the internal movement of a fixed asset in connection with its reconstruction, modernization or additional equipment follows from paragraph 42 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

How to fill out a demand invoice

To keep track of the movement of inventory items (hereinafter referred to as goods and materials) between structural divisions of an organization (for example, warehouses) or between financially responsible persons (for example, when transferring inventory into operation), a special document is used - a demand invoice.

This is interesting: Decision to withdraw from the founders of LLC sample 2021

Based on it, one party (sender) transfers to the other party (recipient) a certain amount of goods and materials at the appropriate nomenclature and cost. A demand invoice can act as both a receipt and an expenditure document, depending on the situation.

Accounting: expenses for internal relocation

If the transfer of a fixed asset is not related to its reconstruction (modernization, additional equipment), then the costs of moving are included in the current expenses of the organization. In this case, take into account the costs arising from the internal movement of fixed assets in the following order.

If the movement of a fixed asset is carried out by a special division of the organization (for example, a transport service), then reflect the costs of this work by posting:

Debit 23 Credit 70 (10, 68, 69...) – expenses for internal movement of fixed assets are reflected.

After completing the work on moving the fixed asset, write off the expenses recorded on account 23:

Debit 25 (26, 44...) Credit 23 – expenses for internal movement of fixed assets are written off.

If there is no such division in the organization, then do not take into account the costs of internal movement of fixed assets in account 23. As they arise, do the wiring immediately:

Debit 25 (26, 44...) Credit 70 (10, 68, 69...) - expenses for internal movement of fixed assets are taken into account.

If the movement of a fixed asset is carried out with the involvement of a third-party organization (for example, a transport company), then reflect the costs of paying it remuneration by posting:

Debit 25 (26, 44...) Credit 60 – expenses for internal movement of fixed assets carried out with the involvement of a third party are taken into account.

This procedure follows from paragraph 74 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, and the Instructions for the chart of accounts (account 23).

Filling algorithm

The invoice is filled out on both sides. It consists of a header on the title side, a table of seven columns that continues on the reverse side, as well as a place for a brief description of the transferred object and signatures of the responsible persons.

In the upper right corner of the title part of the document there is a link to the Decree of the State Statistics Committee of 2003, which approved this form as mandatory. After 10 years, it became a recommendation, but its use continues.

At the top of the invoice, the OKUD and OKPO forms and the name of the company within which the movement takes place are indicated. The unit from which the object is being withdrawn is indicated first (it is called the “delivery”). The recipient department is indicated below.

Attention! The invoice must be filled out by the delivery department.

After the names of the departments, the name of the document, the date of preparation of the paper and the assigned number are written.

Below is a table with:

- number;

- a description that includes the date of manufacture (or construction), full name, inventory number;

- number of transferred objects in pieces;

- cost;

- results.

After the table, space is left to describe the object, its technical and other characteristics. When filling out, these lines cannot be left blank.

You can mention the condition (good, excellent, satisfactory), existing defects (scuffs, chips, etc.), and describe the packaging. If warranty cards or instructions are included, these are also included.

At the end there should be signatures (deciphered) of the persons who made the delivery and acceptance. The fact that information about the movement was entered into the accounting book is confirmed by the chief accountant (or simply the accountant who carried out the data transfer).

Important! When putting signatures, mentioning the positions of persons is mandatory.

BASIC: income tax

Reflection in tax accounting of expenses for moving a fixed asset within an organization depends on whether this is related to its reconstruction (modernization, additional equipment).

If a fixed asset is transferred from one division of the organization to another as part of reconstruction (modernization, retrofitting), then do not take into account the costs of movement in the current expenses of the organization. In this case, the costs of moving a fixed asset are considered expenses associated with reconstruction (modernization, additional equipment) (Clause 2 of Article 257 of the Tax Code of the Russian Federation). Therefore, take them into account in the same order as all other expenses that arise for an organization during the reconstruction (modernization, retrofitting) of a fixed asset. For more information, see

- How to reflect in accounting the reconstruction of fixed assets,

- How to reflect in accounting the modernization of fixed assets,

- How to reflect the completion (retrofitting) of fixed assets in accounting.

If the transfer of a fixed asset is not related to reconstruction (modernization, additional equipment), then take into account the costs of moving in the following order.

If the transfer of a fixed asset is not related to the production activities of the organization, then the costs of moving do not reduce the tax base. This is explained by the fact that all expenses that reduce the tax base must be economically justified (clause 1 of Article 252 of the Tax Code of the Russian Federation). For example, when calculating income tax, moving expenses are not taken into account due to the need to use fixed assets in departments of the socio-cultural sphere (for example, in boarding houses, gyms, etc.) that are not service industries and farms.

If the transfer of a fixed asset is related to the production activities of the organization, then take into account the costs of its movement when calculating income tax in the following order. When using the accrual method, reduce the tax base according to the rules established for certain types of costs incurred when moving a fixed asset (Article 272 of the Tax Code of the Russian Federation). For example:

- the salary of employees who dismantle and install equipment is taken into account monthly (clause 4 of article 272 of the Tax Code of the Russian Federation);

- transport services are taken into account on the date of provision (subclause 6, clause 1, article 254, clause 2, article 272 of the Tax Code of the Russian Federation).

With the cash method, reflect the costs of performing work to move fixed assets as they are completed and paid for (clause 3 of Article 273 of the Tax Code of the Russian Federation).

Consider moving expenses due to the need to use fixed assets in service industries and farms separately.

Transfer of fixed assets between accounts in 1C: Accounting of a government institution 8

Published 08/17/2017 23:44 Sometimes a situation arises when a fixed asset needs to be transferred from one accounting account to another. For example, after conducting a commission at your institution, it turned out that the fixed asset is not particularly valuable, and it needs to be transferred to an account for accounting for other movable property. How to reflect such an operation in the 1C: Public Institution Accounting program 8 edition 1.0 will be discussed in the article.

So, first, let’s create a balance sheet and see in which account the fixed asset is currently located.

To transfer fixed assets between accounts, use the “Internal Transfer” document. The transfer is carried out on the date of discovery of the error or the date of the situation when the need for this operation arose.

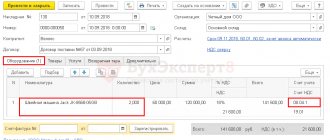

In the document, select the operation “Move fixed assets between accounts.”

On the “General” tab we indicate the MRP (materially responsible persons) and the transfer account. The rollover is done through a 401.10 account.

On the “Fixed Assets” tab, fill out the tabular part by selecting the balances.

In the window for selecting NFA for documents, select the required fixed asset and indicate the quantity. After clicking the OK button, the main tool appears in the tabular section.

In the tabular section, select the account to which you want to transfer the fixed asset.

After this, we carry out the document and look at the generated transactions.

Then it is necessary to analyze the balance sheets for accounts 101.24 and 101.34.

The reports show that the fixed asset was transferred from one account to another. If you have any questions, you can ask them in the comments. And if you need more information about working in 1C: BGU 8, then you can get our collection of articles for free using the link.

Author of the article: Natalya Stakhneva

Consultant on 1C programs for government agencies

Company channel on YouTube

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 #22 Olga 08.10.2020 14:23 Good afternoon When changing the fixed assets account from account 101.36 to account 101.26 as in 1C8.2 (which document) change the depreciation account from account 104.36 to account 104.24 And what date in the month should this be done 01st or last day of the month

Quote

+4 #21 Natalya 07/16/2020 09:45 Good afternoon, is it possible to transfer in this way from 101 accounts to 21 accounts?

Quote

+1 #20 Natalia 06.06.2020 09:59 Good afternoon. They mistakenly put the building on account 111.44, but it should have been on account 111.42 What kind of wiring and what document can it be corrected?

Quote

0 #19 Ekaterina 11.21.2019 15:29 Good afternoon, tell me what the problem might be when transferring from account to account, I don’t see the fixed asset on the balances, which was transferred supposedly by internal transfer

Quote

0 #18 Svetlana 11/12/2019 6:56 pm Hello! Please tell me why my depreciation transfer postings are not automatically generated? What needs to be done for this?

Quote

+2 #17 Yulia 01/18/2019 12:38 Hello! Please tell me why postings for transferring depreciation are not automatically generated for me. Is there something wrong with the settings or a flaw in my version?

Quote

-2 #16 Konstantin 10.31.2018 13:40 Transfer from 101 to 21 You did not explain.

Quote

+5 #15 Inna 08/14/2018 17:59 Good afternoon. Please tell me how to transfer fixed assets from account 07 (off-balance) to account 21 (off-balance). What kind of wiring should there be? Thank you

Quote

-1 #14 Oksana 08/13/2018 16:19 Good afternoon. Tell me how to transfer OS from 101.28 to account 01. (purchase of museum objects and their further inclusion in the museum collection of the Russian Federation)

Quote

+11 #13 Olga Strakhova 07/18/2018 01:45 Good evening. I need to transfer OS accounts from 101 to 21. Is it even possible? What documents?

Quote

+1 #12 Natalya_Stakhneva 07/16/2018 20:04 Hello! Write off from account 21 with the document “Write-off of assets in operational accounting” and register them as a gratuitous receipt of assets

Quote

+3 #11 Vilena 06/29/2018 17:47 Hello! I can’t find anywhere how to transfer from account 21 to balance sheet 101. It’s really necessary, an order has been issued! Tell me how to get out, the OS is full

Quote

-1 #10 Natalya_Stakhneva 06.28.2018 06:30 Hello! In the document “Write-off of an inventory item” at the bottom there is a checkbox “transfer to account 02”. You can use this document. Also in the latest editions you can use the document “Transition to the application of order 64n (NFA)” in this document you can transfer several OS at once to account 02

Quote

+3 Tatyana Vladimirovna Adamanskaya 06.27.2018 14:33 Good afternoon, tell me how to transfer OS from account 101 to account 02 in a budget organization, in accordance with the new standards on the use of account 02. Thank you.

Quote

+2 Natalya_Stakhneva 06/14/2018 23:41 Hello! you need to make a debit from account 101 and a free transfer to account 105. it will be more correct. Direct transfer is incorrect

Quote

0 Lyubov Shokirova 06/13/2018 17:19 Hello! Tell me, is it possible to transfer from account 101 to 105? The car engine was mistakenly entered into account 101, it was installed and now we can’t assign it to the car!

Quote

+3 SvetlanaN 02.25.2018 18:12 Hello. Please tell me the postings if I mistakenly entered the account to 21.38, it should be 101.38. Transfer from the score 21.38 to the score 101.37. Thank you very much

Quote

+1 Natalya_Stakhneva 12/18/2017 23:31 I quote Tatyana vet:

Hello! Please tell me whether it is necessary to change the code and inventory number of the operating system when moving from account 101.13 to account 101.34? Thank you!

Hello!

OKOF and inventory number do not need to be changed Quote +1 Natalya_Stakhneva 12/18/2017 23:29 Hello! This is a moving operation and the cash value is 310; when written off, the cash value will be 410

Quote

-1 Natalya159 12/18/2017 19:54 Hello! Isn’t it a mistake to indicate KEK 310 in the first posting of example Dt401.10 (172) Kt 101.24 (310)?

Quote

+2 Tatyana vet 10.19.2017 18:05 Hello! Can you please tell me whether it is necessary to change the code and inventory number of the OS when moving from account 101.13 to account 101.34? Thank you!

Quote

0 Natalia I 09/04/2017 23:25 Hello! Please tell me where I can see the movement of cash balances for children’s nutrition from one year to another. For example: a child was studying in 1st grade and there was an overpayment of 100 rubles, now we need to transfer the overpayment to his account, but the child is already in 2nd grade. Thank you!

Quote

Update list of comments

JComments

BASIS: VAT

When moving a fixed asset on your own (i.e., without involving a third party), there is no obligation to charge VAT. This is explained by the fact that VAT is charged when performing operations (providing services) to divisions of the organization (subclause 2, clause 1, article 146 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated June 16, 2005 No. 03-04-11/132 and the Ministry of Taxes of Russia dated January 21, 2003 No. 03-1-08/204/26-B088). The movement of fixed assets does not apply to such work (services).

Input VAT on materials (work, services) used in the internal movement of fixed assets should be deducted in the usual manner (paragraph 1, clause 5, article 172 of the Tax Code of the Russian Federation). That is, after registration of the specified materials (works, services) and in the presence of an invoice (clause 1 of Article 172 of the Tax Code of the Russian Federation). The exception to this rule is when:

- the organization enjoys VAT exemption;

- the organization uses the fixed asset after the transfer only to perform VAT-free transactions.

In these cases, input VAT is included in the cost of materials (work, services) used when moving the fixed asset. This procedure follows from paragraph 2 of Article 170 of the Tax Code of the Russian Federation. In addition, in the latter case, input VAT on the residual value of the fixed asset must be restored (clause 3 of Article 170 of the Tax Code of the Russian Federation).

If an organization uses a fixed asset to perform both taxable and non-VAT-taxable operations, distribute the input tax on the cost of materials (work, services) used in its movement (clauses 4 and 4.1 of Article 170 of the Tax Code of the Russian Federation).

simplified tax system

The tax base of simplified organizations that pay a single tax on the difference between income and expenses, the costs of moving are reduced, provided that they are listed in Article 346.16 of the Tax Code of the Russian Federation. For example, when calculating a single tax, you can take into account:

- materials (for example, gasoline) used when moving fixed assets (subclause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation);

- salaries of employees involved in the movement of fixed assets (subclause 6, clause 1, article 346.16 of the Tax Code of the Russian Federation);

- transport services of third-party organizations for the movement of fixed assets (subclause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Reduce the tax base as expenses for moving fixed assets arise and are paid (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

The tax base of simplified organizations that pay a single tax on income is not reduced by expenses for moving fixed assets (clause 1 of Article 346.14 of the Tax Code of the Russian Federation).

OSNO and UTII

If a fixed asset is used in the activities of an organization subject to UTII and in activities for which the organization pays taxes under the general taxation system, then the costs of internal movement of the fixed asset must be distributed (clause 9 of Article 274 of the Tax Code of the Russian Federation).

VAT allocated in the invoice for the purchase of materials (works, services) for the internal movement of fixed assets also needs to be distributed. Distribute VAT according to the methodology established in paragraphs 4 and 4.1 of Article 170 of the Tax Code of the Russian Federation.

For more information about this, see How to deduct input VAT when separately accounting for taxable and non-taxable transactions.

The amount of VAT that cannot be deducted should be added to the share of expenses for the organization’s activities subject to UTII (subclause 3, clause 2, article 170 of the Tax Code of the Russian Federation).

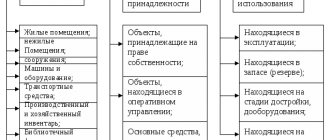

How to capitalize a fixed asset

Receipt can be in the organization (purchase of fixed assets) and in leasing. In this article, we will consider accounting for acquired fixed assets.

So, let's create a document for capitalization of the OS. I will not dwell in detail on the creation of an admission document, since there is a separate article on this topic. I will give just an example of a completed document to make it easier to move on: