Home / Labor Law / Payment and benefits / Wages

Back

Published: 03/03/2016

Reading time: 8 min

2

12663

Forced collection of part of an employee’s wages is regulated by Articles 137-138 of the Labor Code of the Russian Federation.

One of the grounds allowing such deductions is an executive document received by the accounting service of the enterprise.

The legislation regulates the procedure for working with such documentation by Federal Law No. 229-FZ of October 2, 2007 “On Enforcement Proceedings”.

- Types of executive documents

- When should it not be used?

- Amount of deductions from wages

- Deduction order

- Several writs of execution: how the debt is retained Writs of execution of one turn

- Writs of execution of different priority (alimony and credit)

Types of executive documents

The executive documentation that is mandatory for implementation in relation to an employee includes:

- writs of execution issued on the basis of decisions of courts of general jurisdiction;

- court orders issued at the request of creditors;

- voluntary agreements on the payment of alimony for the maintenance of children or disabled relatives, notarized;

- protocols and acts of administrative bodies, penalties for which are provided for by federal legislation;

- orders of a notary or bailiff;

- certificates and acts issued by the Pension Fund authorities in relation to an employee who has the status of an individual entrepreneur.

According to the category of requirements, writs of execution are divided into:

- requiring compensation for harm to health or compensation for material damage caused as a result of an offense committed;

- prescribing the payment of an administrative fine;

- obliging to pay alimony for the maintenance of minor children;

- claims for repayment of debts in favor of financial institutions or utility companies.

Ways to reduce penalties from an employee’s salary

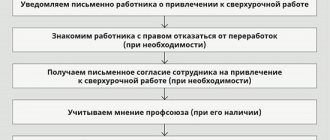

When an employee does not agree with what he has been ordered to pay, he has the right to appeal to the appellate court with objections. A citizen will be able to submit an application within 10 days. The result can be either a positive decision in favor of the plaintiff or a negative one.

This is important to know: How to get a duplicate of a writ of execution in court if it is lost

If the writ of execution has already been issued and is in the bailiff service, then there are also two options for action that the employee can take:

- Make an appointment with the senior bailiff of the unit where the enforcement proceedings in the specified case are being carried out;

- File an appeal to the court where the decision was made. Here you can send requests to change the collection procedure and also need to be changed.

In some cases, the court completely or partially cancels payments. What may influence the court's decision:

- Health problems. Moreover, it is not necessarily the health of the debtor; problems with family members can also influence the decision;

- Living with the defendant's dependents.

Also, the presence or absence of an official place of work may have a significant impact on the court’s decision.

When should it not be used?

The Law “On Enforcement Proceedings” contains a list of cases when deductions from wages under enforcement documents are impossible:

- social payments made at the expense of the Social Insurance Fund (pregnancy benefits, child care benefits up to one and a half years old) or at the expense of the employer (in connection with the death of close relatives, marriage registration and the birth of a child). At the same time, temporary disability benefits (sick leave payments) are not included in this list, i.e. they may be subject to deduction in the usual manner;

- all types of compensation payments - when sending an employee on a business trip, when compensating for harm to health or when losing a breadwinner;

- amounts sent by the employer for full or partial payment of vouchers for sanitary and resort treatment of employees.

What income cannot be foreclosed on?

Collection cannot be applied, in particular, to income paid:

- for compensation for harm caused to health;

- in compensation for damage in connection with the death of the breadwinner;

- persons who received injuries (wounds, injuries, concussions) during the performance of their official duties, and members of their families in the event of death of these persons;

- in connection with a business trip (daily allowance, compensation for housing and travel), with transfer, reception or assignment to work in another area.

- in connection with the birth of children from the Social Insurance Fund.

Amount of deductions from wages

The amount of monthly deduction from wages is prescribed in the text of the writ of execution by the bailiff. This can be a fixed amount of money or a certain percentage of earnings.

When the amount of deduction is indicated in the writ of execution, this amount is deducted from the accrued wages and transferred to the address of the claimant. If there is a debt for the employee’s unpaid obligations, then the deduction is made in the maximum amount, up to the repayment of the debt.

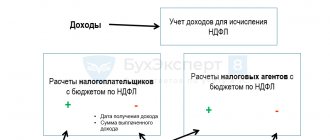

As a general rule, upon receipt of a writ of execution, no more than half of the amount remaining after deducting personal income tax can be withheld from the employee’s earnings.

The limit on the amount of deductions of 50% applies even in cases where several writs of execution have been received for one employee.

The following situations are exceptions to this rule:

- when collection is made for the maintenance of minor children (alimony);

- when the writ of execution contains a claim for compensation for harm to health, death of the breadwinner or damage caused as a result of the commission of a crime.

In such cases, the maximum percentage of salary deductions increases to 70%.

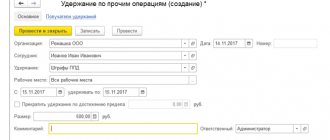

Algorithm for how to properly carry out holds:

- Payroll is being processed. Additionally, compensation payments and additional payments are calculated.

- On the wages received, personal income tax is first calculated and then withheld. You need to be especially careful at this point, since you should always remember about the tax deduction that is provided to everyone who is officially employed.

- Next, taxes are calculated from wages.

- The next step will be to withhold the amount of the writ of execution.

- The received funds are transferred to the recipient's details no later than 3 days from the moment the income was paid in person or transferred to the card.

If the amount of debt exceeds the employee’s salary or regular payments need to be made, then deductions will be made until the debt is fully repaid.

Deduction order

When receiving two or more writs of execution, where the debtor is one individual, the employee responsible for making deductions must comply with the order of transfers of money to the recoverer. If the collected amount is not enough to pay off all obligations, deduction is made in the following order:

- alimony and compensation for harm (including moral);

- claims from individuals who were in contractual relations with the debtor;

- obligatory payments to the budget, the Pension Fund and other extra-budgetary funds; other collectors (loans, fines, etc.).

In the writ of execution, in addition to the principal debt, the amounts of fees required to be withheld are indicated. When distributing the collected amounts, the following procedure is observed:

- satisfaction of the claimant's requirements in full;

- reimbursement of expenses for enforcement proceedings;

- performance fee of 7%;

- fines imposed by the bailiff service.

It’s better not to make mistakes with alimony

When making deductions based on writs of execution, it is better not to make mistakes. Administrative liability is provided for incorrect withholding. In addition, if during the inspection the bailiff discovers that the incorrect withholding of alimony was carried out intentionally, he will contact the prosecutor's office so that the officials of the organization are brought to criminal liability (for more information, see “Responsibility is provided for the incorrect withholding of alimony”).

This is important to know: Compulsory enforcement authorities in enforcement proceedings

If you find an error, please select a piece of text and press Ctrl+Enter.

Several writs of execution: how the debt is held

When one employee receives several enforcement documents, the accounting official must strictly follow the rule of order of deductions. For each subsequent phase, deductions can be made only after the debt for the previous one has been fully repaid. In this case, the maximum amount of deductions should not be exceeded.

Writs of execution of one stage

The employee received two writs of execution for the collection of alimony - one in the amount of 33% of earnings and the second, for the maintenance of his wife, who is on maternity leave, in a fixed sum of 6,000 rubles. When calculating wages, the accountant, first of all, withholds income tax in the amount of 13%, and, after that, must withhold alimony under writs of execution.

Example

The employee was credited 35,000 rubles. Personal income tax on this amount will be 4,550 rubles. Collection under two writs of execution cannot exceed 70% of income, i.e. 21315 rubles.

The deduction for the first writ of execution (33%) should be:

(35000 – 4550) x 33% = 10048.50 rubles.

According to the second writ of execution, the collection of a fixed amount is determined - 6,000 rubles. The total amount of deductions is:

10048.50 + 6000 = 16048.50 rubles.

Since the calculated amount of alimony under two writs of execution “fits” into the maximum limit of deductions, it can be recovered in full.

If the maximum amount of possible deductions is not enough to satisfy all demands, then collection is made in proportion to the amounts specified in the writs of execution.

The employee given in the above example received another writ of execution - for compensation for harm to health. The monthly withholding amount under this document is 9,000 rubles.

Deductions for the first two writs of execution amount to a total of 16,048.50 rubles. According to the third document, 9,000 rubles are withheld. A total of 25,048.50 rubles is subject to recovery. Considering that the maximum deduction amount for this line cannot exceed 21,315 rubles (70% of earnings), it is impossible to withhold all the required amounts.

The accounting department will make the following calculation:

- The total amount of deductions is 25,048.50 rubles, the limit is 21,315 rubles;

- 1st writ of execution: 30450 x 33%: 25048.50 x 21315 = 8550.76 rubles;

- 2nd writ of execution: 6000: 25048.50 x 21315 = 5105.69 rubles;

- 3rd writ of execution: 9000: 25048.5 x 21315 = 7658.54 rubles.

The balance of debt on all writs of execution in the amount of 3,733.50 rubles will be transferred to the next month.

Writs of execution of different priority (alimony and credit)

If the accounting department receives enforcement documents of varying priority, then when calculating deductions the principle of proportionality and compliance with the maximum amount of deductions must also be observed.

Employee A received a writ of execution for alimony in the amount of ¼ of his salary. In the same month, enforcement proceedings were initiated on the outstanding loan and the accounting department received a second document for the recovery of 10,000 rubles. Employee A's salary was 50,000 rubles.

The amount that can be deducted is:

50,000 – 6,500(13%) = 43,500 rubles.

First of all, it is necessary to withhold alimony:

43500 x 25% = 10875 rubles.

When paying a credit debt under a writ of execution, there is a limit - deductions should not exceed 50% of the basic income (21,750 rubles). Since part of this limit is already used to calculate alimony, to repay the loan the following calculation is performed:

21750 – 10875 =10875 rubles – the remainder of the possible deduction.

Since, with simultaneous collection under both writs of execution of different priority, the principle of the maximum amount of deductions is not violated, the requirements for obligations can be satisfied in full.

If there is a writ of execution for alimony, which prescribes a deduction of 50% (if there is an existing debt, for example), collection under other writs of execution, which provide for a different priority, is not possible.

How to get maternity leave - we have all the information you need! You can find out how to get paid sick leave after dismissal in this article!

Salary deductions are a very unpleasant thing! But you can figure it out if you read our material.

Employee's application for deduction

There are situations when the employee himself knows that he has a debt. The reasons for the occurrence of debt are different, but the executive service will not send relevant decisions to the employer. Then, for the accounting department, the basis for deduction becomes the statement of the employee himself.

But here you need to take into account some features:

- The employer may not accept the application and refuse to make deductions;

- The employee himself determines what income will become the source for calculation and subsequent transfer to the account of the claimant;

- The law nowhere specifies limits on the amount withheld voluntarily.