The founders, along with the formation of the authorized capital (AC), can provide their own organization with financial assistance. The contribution is made to increase the enterprise's funds, to create reserve and additional capital, or to cover losses incurred in the course of business. Documentation of the operation is a prerequisite. In the article we will tell you how repayable financial assistance from the founder is carried out, and we will give examples of postings.

The actions of the founder must be based on the decision of the general meeting of founders. Compliance with a quorum is determined by the provisions of the Charter. The founder's intention to make a contribution must be approved by the majority of participants and reflected in the minutes of the general meeting. The sole participant must indicate the intention in the decision.

Types of founder contributions

There are several reasons why the owner of an enterprise can provide financial assistance as a founder or individual. To improve the economic condition of the enterprise or perform a one-time transaction, the founder makes several types of targeted contributions.

| Purpose of the contribution | Operation description |

| Contribution to increase the capital | Made on the basis of the decision of the founders with registration of changes in the Federal Tax Service |

| Contribution to increase net assets | Receipt does not increase the amount of the authorized capital |

| Transfer of funds to replenish reserve capital | Cash becomes the property of the enterprise, the founder has the right to receive dividends |

| Contribution in kind | Proceeds from the founder in the form of property are used to replenish additional capital |

| Providing a repayable loan | The contribution is formalized by an agreement with a repayment condition - indicating a limited period for using funds |

Funds transferred to the organization from the founder, provided they are properly executed, are not income of the enterprise. The transfer of funds to the enterprise is documented. In the absence of an agreement between the founder and the organization, income arises for a legal entity upon receipt of funds, and for an individual - upon return of funds or the equivalent of contributed property.

Difference No. 1. Refund/non-refundability of funds

The law does not limit the ability of founders to help their company financially. This assistance can be provided:

- in the form of a loan (interest-bearing or interest-free) ─ in this case, funds or other property are transferred to the company on the terms of repayment;

- in the form of making a contribution to the company’s property (without increasing the authorized capital) ─ this form of financial assistance does not provide for the return by the company to the founder of the funds received from him.

According to Art. 415 of the Civil Code of the Russian Federation, the founder has the right to forgive the debt under the loan agreement of his company (if the rights of other persons in relation to the creditor’s property are not violated).

Contributions of the founder to the current account

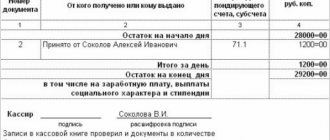

The founder of the enterprise can replenish the current account with cash or by wire transfer. Replenishment of the current account with cash is carried out through the cash desk of the enterprise. The founder does not have the right to directly deposit cash into current accounts, except in cases stipulated by law. The cashier must:

- Accept funds on the basis of the PKO, indicating the details of the person, amount, and basis for the contribution.

- Attach a copy of the basis document to the cash order.

- Transfer funds to your current account. When depositing cash, the purpose of the payment is important. It is necessary to exclude the definition of a contribution as revenue.

Transfer of funds from the personal account of the founder is allowed. When making a non-cash transfer, the purpose of payment of the payment order must indicate the basis for the transfer, otherwise the receipt of funds can be treated as an advance on a taxable transaction.

Is it possible to return gratuitous assistance from the founder?

Such clarifications are given in the letter of the Federal Tax Service of Russia dated May 2, 2012 No. ED-3-3/1581. An example of reflection in accounting and taxation of fixed assets received free of charge from the founders to increase net assets.

The organization applies a general taxation system. Based on the results of 2014, Torgovaya LLC revealed that the size of net assets is less than the authorized capital. In March 2015, one of the participants, A.S. Glebova - decided to make a property contribution to the society in order to increase net assets - a Sony VAIO VPC-L22Z1R/B computer worth 78,000 rubles.

In the same month, at the general meeting of participants, this decision was approved and enshrined in the minutes. The computer was handed over to Glebova to the company and put into operation the same month. In March, the following entries were made in Hermes’s accounting: Debit 08 Credit 83 subaccount “Glebova’s contribution to increasing net assets” - 78,000 rubles.

Founder's contribution to open an account

A current account is opened after registration of the organization. At the time of opening the account, the company does not have funds received in the form of income. Payment of the bank commission is carried out at the expense of the founder. The best option to confirm the basis for the receipt of funds from the founder is a loan agreement. Funds are deposited through the company's cash desk.

The founder registered Yunost LLC. After opening, the company needed to open a bank account. The commission for opening an account was 500 rubles. Due to the lack of funds for current needs, a loan agreement was drawn up with the founder for the amount of the commission.

The following entries are made in accounting:

- The receipt of funds to the cash desk is taken into account: Dt 50 Kt 66 in the amount of 500 rubles;

- The deposit of the amount to the bank is reflected: Dt 51 Kt 50 in the amount of 500 rubles;

- The amount of the commission is taken into account as part of other expenses: Dt 91 Kt 51 in the amount of 500 rubles.

The loan is repaid from the cash desk or by bank transfer to the founder’s account.

What tax obligations arise from temporary financial assistance from the founder?

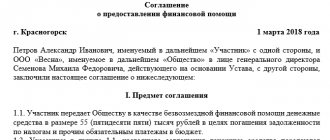

Temporary financing is formalized by an agreement, which is essentially a loan agreement.

According to Article 716 of the Civil Code of the Republic of Kazakhstan (hereinafter referred to as the Civil Code), the loan agreement must be concluded in a form that complies with the rules of Articles 151–152 of the Civil Code (written form of the transaction).

Based on paragraph 1 of Article 715 of the Civil Code, under a loan agreement, one party (the lender) transfers, and in cases provided for by the Civil Code or the agreement, undertakes to transfer into ownership (economic management, operational management) to the other party (borrower) money or things determined by patrimonial property signs, and the borrower undertakes to promptly return to the lender the same amount of money or an equal number of things of the same kind and quality.

It should be noted that, according to paragraph 3 of Article 715 of the Civil Code, legal entities and citizens are prohibited from raising money in the form of a loan from citizens as a business activity and such agreements are declared invalid from the moment of their conclusion. Moreover, the restriction of Article 715 of the Civil Code applies only to loans received from citizens (not legal entities).

According to the Law of the Republic of Kazakhstan dated December 23, 2005 No. 107-III “On introducing amendments and additions to certain legislative acts of the Republic of Kazakhstan on licensing and consolidated supervision”, lending on terms of urgency, payment and repayment is not a licensed type of activity, with the exception of lending banks, mortgage organizations, brokers and (or) dealers with the right to maintain client accounts as a nominee holder and legal entities whose sole shareholder (participant) is the state.

The remuneration is established by the loan agreement, that is, according to the agreement, the loan can be interest-free.

An interest-free loan is a financial instrument. In accordance with the provisions of IFRS 9 “Financial Instruments”, IAS 39 “Financial Instruments: Recognition and Measurement”, an interest-free loan is initially accounted for at fair value, which is the estimated future receipts of the asset, discounted at the market rate prevailing on the date of origin of the asset.

Subsequently, the loan is accounted for at amortized cost at the market rate.

Discounting is performed according to the formula:

PV = FV × 1 / (1 + i) × n,

where PV is the discounted (present) value;

FV – future value;

I – interest rate;

N – period.

For example, the amount of the loan issued is 11,000,000 tenge, the loan term is 1 year, the market rate prevailing on the date the obligation arose is 10% (conditionally). Let's estimate the discounted value at the prevailing market interest rate:

PV = 11,000,000 × 1 / (1 + 0.1) = 10,000,000 tenge.

The interest on the loan will be 1,000,000 tenge (10,000,000 × 10%).

Outgoing balance – 11,000,000 (10,000,000 + 1,000,000).

Recommended account correspondence is shown in the table.

Thus, in relation to the loan, according to accounting data, both income and expense arise.

According to paragraph 15 of Article 100 of the Tax Code, unless otherwise provided by the Tax Code, an expense arising in accounting in connection with a change in the value of assets and (or) liabilities when applying International Financial Reporting Standards and the legislation of the Republic of Kazakhstan is not considered an expense for tax purposes. on accounting and financial reporting, except for the subject to payment (paid).

In accordance with subparagraph 5 of paragraph 2 of Article 84 of the Tax Code, unless otherwise provided by the Tax Code, for tax purposes, income arising in connection with a change in the value of assets and (or) liabilities, recognized as income in accounting in accordance with International financial reporting standards and the requirements of the legislation of the Republic of Kazakhstan on accounting and financial reporting, except for those to be received (received) from another person.

For an interest-free loan, the cash outflow (upon issuance) is equal to the cash inflow (upon repayment); the organization does not receive any interest income. Income arises in accounting to adjust the value of an asset (loan issued), the recognition of which is carried out to amortize the discount on the loan, which was recognized as an expense initially when the loan was issued.

Thus, the amount of income recognized in accounting for an interest-free loan issued is not considered for the purposes of calculating corporate income tax (hereinafter referred to as CIT).

Tax obligations for CIT and VAT will arise if the loan is with interest rather than interest-free. Then the loan remuneration is subject to inclusion in the total annual income (hereinafter referred to as the SRS) for the purposes of CIT (clause 2 of Article 86 of the Tax Code), and forms a taxable turnover for VAT purposes (clause 3-1 of Article 238 of the Tax Code).

According to paragraph 7 of Article 8 of the Law of the Republic of Kazakhstan dated June 13, 2005 No. 57-III “On Currency Regulation and Currency Control” (hereinafter referred to as the Law on Currency Regulation), the regulatory legal act of the National Bank of the Republic of Kazakhstan establishes a threshold value in relation to the transaction amount, with exceeding which the currency agreement is subject to registration, as well as exceptions from the registration regime, in respect of which the National Bank of the Republic of Kazakhstan has the right to establish a notification regime.

In accordance with paragraph 46 of the Rules for carrying out foreign exchange transactions in the Republic of Kazakhstan, approved by the resolution of the board of the National Bank of the Republic of Kazakhstan dated April 28, 2012 No. 154, in the cases provided for by part two of paragraph 3 of Article 20 and paragraph 2 of Article 23 of the Law on Currency Regulation, registration is carried out , if the amount of debt of a resident for all deliveries (payments) of a non-resident under a foreign exchange agreement exceeds 500,000 US dollars in equivalent, or the amount of debt of a non-resident for all supplies (payments) of a resident under a foreign exchange agreement exceeds 100,000 US dollars in equivalent.

That is, according to the above norms of legislative acts, registration is subject to:

– a loan from a non-resident to a resident in the amount of more than $500,000 (or an equivalent amount) with a loan term of more than 180 days;

– a loan from a resident to a non-resident in the amount of more than $100,000 (or an equivalent amount) with a loan term of more than 180 days.

If the loan term is less than 170 days, registration is not required; when extending the loan period by concluding an additional agreement (or deferring payments) for a period of more than 180 days, registration is required.

Thus, the provision of temporary financial assistance by a non-resident founder is not prohibited by the current legislation of the Republic of Kazakhstan. If the loan is provided on the basis of repayment, the loan amount will not be recognized as income of the person who received it (since it must be repaid), and, accordingly, the issuance (receipt) of the loan amount does not incur tax obligations.

It should be taken into account that the tax authorities can recognize income from savings on remuneration as income in accordance with the provisions of Article 96 of the Tax Code: the cost of any property, including work and services received by the taxpayer free of charge, is his income.

The cost of gratuitously received property, including works and services, is determined based on accounting data in accordance with International Financial Reporting Standards and the requirements of the legislation of the Republic of Kazakhstan on accounting and financial reporting.

Income in the form of property received free of charge, including work and services, is recognized in the tax period in which such property is received, work is performed, and services are provided.

Thus, when providing an interest-free loan to a legal entity (LLP), the enterprise generates income from savings on remuneration, the amount of which is determined in accordance with the rules adopted in its accounting policies.

Income from the gratuitous use of a loan is subject to inclusion in the SRS of a legal entity when calculating its taxable income.

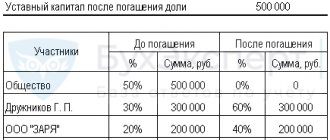

Contribution of the founder to increase the enterprise's NAV

Maintaining the level of net assets of the enterprise is a mandatory condition for conducting the company's activities. When the value of the net asset value decreases below the value of the capital company, risks arise that the Federal Tax Service will initiate the closure of the organization . The NAV value is an important indicator for assessing the balance sheet structure when receiving investments. The amount is increased from various sources, one of which is the founder’s contribution to increase the authorized capital or issued in the form of a repayable loan.

When concluding a loan, an agreement is drawn up between the company and the person. The transfer of the founder's funds for temporary use is carried out free of charge or with an indication of the interest received by the person as a result of the loan. If there is no information about the frequency of interest payments, payment will be transferred monthly.

| Increase in capital | Recording a transaction in accounting registers | Founder's contribution to increase the NAV | Transaction Record |

| The increase in the size of the authorized capital is reflected | Dt 75 Kt 80 | Cash inflow | Dt 50 (51) Kt 83 |

| Founder's contribution reflected | Dt 51 (50) Kt 75 | Receipt of contribution by property | Dt 10, 41, 08 Kt 83 |

Financial assistance from the founder

The wiring will look like this:

- on the date of registration of the minutes of the meeting of participants (or the decision of the sole founder), it is necessary to enter debit 75, subaccount “Funds of the founders aimed at covering the loss”, credit 84 - a decision was made to pay off the loss at the expense of the shareholder (founder);

- on the date of receipt of funds to the account, debit 50 (51), credit 75, subaccount “Funds of the founders aimed at covering losses” is entered - finances were received from the founder to cover losses at the end of the reporting year.

EXAMPLE. CJSC Stalprokat applies a general taxation system. According to the financial results of 2021, it shows a loss in the amount of 600,000 rubles. The founders of CJSC Stalprokat are R. I. Proskurov (share in the authorized capital 51%), N. S. Probirchenko (share in the authorized capital 28%) and L. D. Samoilova (share 21%). In addition, the period for which money can be issued on account is also not established by law. Another thing is that companies, as a rule, themselves set both the upper limit for the amounts issued for reporting and the period for which they are issued.

Otherwise, it is difficult to control the timely return of money by employees. And in this case, you can already set a specific date for the return of money.

The fact is that the period during which the employee must account for the amounts received is precisely stipulated. It is stated in paragraph 11 of the Procedure for Conducting Cash Transactions (approved by decision of the Board of Directors of the Bank of Russia dated September 22, 1993 No. 40) and is three working days from the moment the employee was supposed to return the money.

Read more: How to get a quote for a hip replacement

However, even if this deadline is missed, nothing bad will happen. The fact is that no liability is provided for such a violation.

Contributions of the founder to create a reserve fund

The creation of a reserve fund is carried out at the expense of retained earnings of organizations. Accounting for the funds of the fund is carried out in account 82. For joint-stock companies, the formation of a fund is a mandatory condition for conducting business. LLC creates reserve capital on a voluntary basis.

To replenish the reserve fund, financial assistance from the founder is sent to the other income account. Further, the net profit received at the end of the year will be used to form a reserve fund.

| the name of the operation | Recording a transaction in accounting registers |

| Reflection of receipt of assistance from the founder | Dt 50 (51) Kt 91/1 |

| Year end reflected | Dt 91/1 Kt 99 |

| Net profit reflected | Dt 99 Kt 84 |

| The formation of a reserve fund is reflected | Dt 84 Kt 82 |

The reserve fund funds are spent for the purposes specified in the Charter, including the payment of dividends to the founders in the absence of profit.

Difference No. 2. Difference in accounting accounts

Receipt of financial assistance from the founder is reflected according to the following scheme:

| Account correspondence | Contents of operation | |

| Debit | Credit | |

| 75 | 83 | The amount of debt of participants on contributions to the company’s property is reflected (based on the decision of the general meeting of participants) |

| (50) | 75 | Cash received as a contribution to the company's property |

Receipt of a loan from the founder is reflected according to the following scheme:

| Account correspondence | Contents of operation | |

| Debit | Credit | |

| Providing a loan | ||

| (50) | 66 (67) | Received a loan from the founder |

| 91.02 | 66 (67) | Interest accrued under the loan agreement |

Founder's contribution in kind

The founder has the right to contribute property to the ownership of the enterprise, provided that the possibility of contributing property is documented. State registration is not required for the operation of a contribution to property. The contribution is made subject to the following conditions:

- The ability to contribute property must be provided for by the main constituent document - the Charter.

- The decision to contribute an asset is made by the general meeting of founders with the consent of at least 2/3 of the votes.

- Approval of the transaction must be reflected in the minutes of the general meeting.

- The contribution of property does not affect the amount of the founder’s contribution to the management company.

The receipt of property is carried out at market value. To confirm the value of the property, you must order an independent appraisal. The transfer is made by deed. When conducting transactions with property, an important condition is the authenticity of documents and execution of the transfer. The asset is accounted for in account 83 as part of additional capital.

Difference No. 4. Restrictions and prohibitions

The fourth difference is the presence of various restrictions and prohibitions on operations. So, according to paragraph 1 of Art. 27 of the Federal Law “On Limited Liability Companies” dated 02/08/98 N 14-FZ, the founder can provide financial assistance in the form of contributions to property if such an obligation is provided for by the charter. Contributions are made by all participants of the company in proportion to their shares, unless otherwise provided by the Charter (Clause 2, Article 27 of Federal Law No. 14-FZ). If the articles of association do not contain an obligation to make a contribution, appropriate amendments to the articles of association must first be made.

When receiving a loan from the founder, there is no such restriction, but it is necessary to take into account that in the situation of debt forgiveness under a loan agreement, forgiveness can only be formalized through a gift agreement if the founder is an individual. This is due to the fact that donation between legal entities is prohibited (Article 575 of the Civil Code of the Russian Federation). If the founding company has forgiven you a debt under a loan agreement, then it is better to formalize this operation with a debt forgiveness agreement rather than a gift agreement.

Providing free assistance to the founder with a share of less than 50% of the authorized capital

Along with paid assistance, founders can make gratuitous contributions. The transfer of property by the founder when he owns more than 50% shares in the management company is not taxed in accordance with the provisions of clause 11 of Art. 251 Tax Code of the Russian Federation. The status of the founder (legal or individual) does not matter.

Free assistance from the founder if he owns a 50% or smaller share in the management company is subject to income tax in accordance with clause 8 of Art. 250 Tax Code of the Russian Federation. The tax base is the market valuation of the transferred property.

Difference #6: Additional Responsibilities

The sixth difference is that the company has additional information obligations when receiving an interest-free loan from the founder. According to the Federal Law “On Combating the Legalization (Laundering) of Proceeds from Crime and the Financing of Terrorism” dated 08/07/2001 N 115-FZ, the provision of interest-free loans by legal entities that are not credit institutions to other legal entities, as well as the receipt of such a loan are classified as transactions with funds or other property subject to mandatory control. Control is required if the amount of such transactions is equal to or exceeds 600,000 rubles. either equal to or exceeds an amount in foreign currency equivalent to 600,000 rubles (clause 4, clause 1, article 6 of Federal Law No. 115-FZ).

Thus, transactions to provide interest-free loans between related parties may be considered controlled, and in some cases they are so under Russian law. The taxpayer is required to notify the tax authorities about such transactions.

Whatever form of receiving financial assistance from the founder you choose, an in-depth study of all the nuances, consequences, legal restrictions and prohibitions is required: depending on what form of financial assistance is chosen, who the founder is (a legal entity or an individual), etc.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Providing founder assistance for different tax systems

Help from the founder, as a result of which no taxable object arises, does not entail payment of tax, regardless of the chosen system. The provision of assistance with property does not become a taxable object if the objects are used to conduct business for more than a year (Article 251 of the Tax Code of the Russian Federation). When transferring property to a third party during a year of operation, the enterprise becomes subject to taxation under the income tax or single tax under the simplified tax system.

If the obligation to pay tax arises, the enterprise pays:

- Under OSNO – income tax.

- Under the simplified tax system and unified agricultural tax there is a single tax.

- For UTII - income tax or single tax, if the enterprise has declared the simplified tax system along with imputed income.

Contributions of funds in the form of a loan, additional capital, creation of a reserve fund, or property are not subject to VAT taxation. Contributions from the founders are not payments related to the sale and relate to investment activities.

Accounting entries

From an accounting point of view, the founder’s money transferred to the organization free of charge is considered “other income” (in accordance with paragraph 10, clause 7 of PBU 9/99). They must be recognized on the date they are received into the account; this determines how they are reflected in accounting.

- Money for any purpose can be credited throughout the entire reporting period. The posting should be formulated as follows: debit 51(51), credit 91-1, “Free receipt of funds from an LLC participant (shareholder, founder).”

NOTE! Account 98-2 “Gratuitous receipts of funds” is not suitable here; it is intended to register the transfer of tangible assets, not cash.

EXAMPLE. The founder of Cantata LLC, L.V. Kontrabasov, owns 50% of the company’s authorized capital. In February 2017, he transferred financial assistance to the company to replenish working capital, which amounted to 300,000 rubles. The Cantata account was replenished on February 16, 2021. The accounting records as of this date should contain the following entry: “Debit 50(51), credit 91-1 – 300,000 rubles. – financial assistance was received from the founder L. Kontrabasov.” However, this assistance will not be subject to income tax.

- Funds intended to cover the loss must be deposited exclusively at the end of the accounting year (meaning the loss shown on account 84 “Retained earnings, uncovered loss”), but even before the annual accounting report is generated. 91 debit is not suitable for this. You should use account 75 “Settlements with shareholders”; it is possible to open a sub-account “Funds intended to repay losses”. The wiring will look like this:

- on the date of registration of the minutes of the meeting of participants (or the decision of the sole founder), it is necessary to enter debit 75, subaccount “Funds of the founders aimed at covering the loss”, credit 84 - a decision was made to pay off the loss at the expense of the shareholder (founder);

- on the date of receipt of funds to the account, debit 50 (51), credit 75, subaccount “Funds of the founders aimed at covering losses” is entered - finances were received from the founder to cover losses at the end of the reporting year.

- debit 75, subaccount “R. Proskurov’s funds aimed at covering the loss”, credit 84 – 300,000 rubles. – a decision was made to cover part of the loss by R. Proskurov;

- debit 75, subaccount “N. Probirchenko’s funds aimed at covering the loss”, credit 84 - 300,000 rubles. – a decision was made to cover part of N. Probirchenko’s loss;

- debit 75, subaccount “L. Samoilova’s funds aimed at covering the loss”, credit 84 - 300,000 rubles. – a decision was made to cover part of L. Samoilova’s loss.

EXAMPLE. CJSC Stalprokat applies a general taxation system. According to the financial results of 2021, it shows a loss in the amount of 600,000 rubles. The founders of CJSC Stalprokat are R. I. Proskurov (share in the authorized capital 51%), N. S. Probirchenko (share in the authorized capital 28%) and L. D. Samoilova (share 21%). In February 2021, on the 21st, before the annual reporting for 2021 was generated, the founders decided to cover the loss by donating funds. On February 25, 2021, funds from the founders were deposited into the account of CJSC Stalprokat in the following proportions: R. I. Proskurov contributed 300,000 rubles, and N. S. Probirchenko and L. D. Samoilova - 150,000 rubles each. For February 21, the accounting records:

Read more: Job responsibilities of a vehicle dispatcher

Entries for February 25:

- debit 51, credit 75 subaccount “Funds of R. Proskurov aimed at repaying the loss” - 300,000 rubles. – funds were received from R. Proskurov to cover the loss;

- debit 51, credit 75 subaccount “N. Probirchenko’s funds aimed at repaying the loss” - 300,000 rubles. – funds were received from N. Probirchenko to cover the loss;

- debit 51, credit 75 subaccount “Funds from L. Samoilova aimed at repaying the loss” - 300,000 rubles. – funds were received from L. Samoilova to cover the loss.

The CJSC did not receive any income from the funds used to repay the loss. The income subject to taxation will include funds received from N. Probirchenko and L. Samoilova, since their share is less than half of the authorized capital. The result was the emergence of a permanent tax liability, which is reflected in accounting as follows: debit 99, subaccount “Permanent tax liabilities”, credit 68, subaccount “Income tax liabilities”. This entry reflects a permanent tax liability on the amount paid to N. Probirchenko and L. Samoilova.

When calculating income tax in February, the Hermes accountant did not include funds received from the founder as income. When calculating income tax in March, the cost of materials written off for production was taken into account as expenses. When and how financial assistance should be included in income when calculating income tax When none of the conditions for exemption from taxation of financial assistance received is met, take it into account as part of non-operating income (clause 8 of Article 250 of the Tax Code of the Russian Federation). Recognize income:

- on the day the money is received in the current account or at the cash desk;

- on the date of receipt of the property (for example, execution of the transfer and acceptance certificate).

These rules apply both to the accrual method and to the cash method (subclauses 1 and 2, clause 4, article 271, clause 2, article 273 of the Tax Code of the Russian Federation).

Making a choice

To choose the most suitable option, you need to take into account, in particular, the share of the founder in the authorized capital of the company. If the founder owns only half of the authorized capital (or less than half), then in this case it is better to resort to an interest-free loan or assistance through a contribution to property. A donation of a sum of money by such a founder will result in the organization having to pay income tax on it.

When the sponsor is the only founder, he can choose any of the methods discussed. In our opinion, the simplest options are a donation or an interest-free loan.

Accounting with the creditor

| date | Contents of transactions | Account correspondence | Sum | |

| Dt | CT | |||

| 01.01.2014 | Funds transferred to the creditor's account | 183 “Other receivables” | 311 “Current accounts in national currency” | 1 000 000,00 |

| 01.01.2014 | Financial costs for loan discounting are recognized (1,000,000 - 482,253.09) | 952 “Other financial costs” | 183 “Other receivables” | 517 746,91 |

| 31.03.2014 | Amortization of discount for the first quarter of 2014 (96450.62 / 4) | 183 “Other receivables” | 733 “Other income from financial transactions” | 24 112,66 |

| 30.06.2014 | Amortization of discount for the second quarter of 2014 (96450.62 / 4) | 183 “Other receivables” | 733 “Other income from financial transactions” | 24 112,65 |

| 30.09.2014 | Amortization of discount for the third quarter of 2014 (96450.62 / 4) | 183 “Other receivables” | 733 “Other income from financial transactions” | 24 112,66 |

| 31.12.2014 | Amortization of discount for the fourth quarter of 2014 (96450.62 / 4) | 183 “Other receivables” | 733 “Other income from financial transactions” | 24 112,65 |

| 31.03.2015 | Amortization of discount for the first quarter of 2015 (115,740.74 / 4) | 183 “Other receivables” | 733 “Other income from financial transactions” | 28 935,19 |

| etc. | ||||