Accounting according to Russian rules

The regulation on accounting for fixed assets (PBU 6/01 “Accounting for fixed assets”, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n) stipulates that the restoration of an object can be carried out through repair, modernization (completion, additional equipment) and reconstruction.

In this case, restoration costs are reflected in the accounting records of the reporting period to which they relate.

The creation of reserves according to accounting rules is not allowed.

However, enterprises retain this right in relation to tax accounting (Article 324 of the Tax Code of the Russian Federation). In order not to record repair costs in accounting and tax accounting differently, companies have the right to establish a uniform approach in their accounting policies, that is, refuse to create a reserve for OS repairs at all.

If, as a result of modernization and reconstruction, the useful life, power, quality of use, etc., originally accepted for the object, are improved, then the costs of modernization and reconstruction of this object after their completion increase its initial cost.

A similar rule applies to tax legislation. The initial cost of fixed assets changes in the following cases (clause 2 of Article 257 of the Tax Code of the Russian Federation):

- completion, retrofitting, modernization;

- reconstruction;

- technical re-equipment.

Thus, only if the characteristics of the object are improved, amounts aimed at its modernization or reconstruction and other improvement can be included in the cost of the fixed asset. Otherwise, the costs must be taken into account as operating expenses.

The costs of maintaining facilities in both accounting and tax accounting are included in current expenses.

"Modernization" cheat sheet

The main and fundamental difference between modernization, addition, reconstruction and repair is that it changes the operational performance of the building. For example, the capacity of engineering communications increases, corridors are expanded, and the like. That is, the building receives new properties, and its characteristics are qualitatively improved.

But it must be taken into account that the operational performance of a building may change during major (and even sometimes during current!) repairs. Therefore, it is important to take into account two more indicators: the scale of change and the goal. Thus, during repairs, improved performance is always a side effect associated with the use of modern materials and (or) technologies. This effect is not the purpose of the work being carried out and is optional. And in scale, such improvements are not comparable with the scale of all the work being carried out; in the estimate and schedule they do not occupy a leading role.

During reconstruction and modernization, on the contrary, improving performance is the main goal of the work carried out. They determine not only the choice of materials and technologies for carrying out work, but also the very need for this work. Accordingly, if the estimate and schedule for reconstruction and modernization contain some work related to repairs, then they are only secondary, caused by the need and type of modernization.

Thus, modernization (reconstruction, addition) can be distinguished from repair by the documents that are drawn up in connection with the work: technical specifications, justification, estimates, schedules, contracts. During modernization, the red thread in all these documents will be quality indicators. And during repairs - quantitative.

Accounting

The legislation provides for the following methods of accounting for the costs of repairing fixed assets:

- based on actual costs incurred;

- using deferred expense accounts.

In accordance with accounting standards, costs for the restoration of fixed assets are reflected in the accounting records of the reporting period to which they relate.

When repairs of fixed assets are carried out unevenly throughout the year, for the purpose of preliminary accounting of repair work, account 97 “Future expenses” is used. The costs of repair work accumulated on this account are written off as production (handling) costs in the manner established by the organization. This may be a uniform write-off of costs over the period to which they relate, a write-off in proportion to the volume of production, and other options.

Attention

The costs of maintaining facilities in both accounting and tax accounting are included in current expenses.

Let us dwell a little on the issue of using account 97. By Order of the Ministry of Finance of Russia dated December 24, 2010 No. 186n, changes were made to the Regulations on accounting and reporting in the Russian Federation. The amendments also affected the wording of paragraph 65 of the Regulations, according to which costs incurred by the organization in the reporting period, but relating to subsequent reporting periods, are reflected in the balance sheet in accordance with the conditions for recognition of assets established by regulatory legal acts on accounting, and are subject to write-off in the procedure established for writing off the value of assets of this type. Previously, we talked about the direct application of the article on deferred expenses. However, if a resource arises that will bring future economic benefits to the organization, the expense should not be recognized immediately in full. And it makes sense to use account 97. At an enterprise, the use of account 97 should be enshrined in the accounting policy.

Tax accounting

According to the rules of the Tax Code, funds for the restoration of fixed assets can be either current expenses of the enterprise (repair and maintenance) or capital investments in fixed assets (completion, retrofitting, modernization, reconstruction, technical re-equipment).

Expenses for the repair of fixed assets made by the enterprise are considered as other expenses (other expenses associated with production and sales) and are recognized for tax purposes in the reporting (tax) period in which they were incurred in the amount of actual expenses (Article 260 Tax Code of the Russian Federation) similar to accounting.

Capital investments are reflected in accounting in the accounts of investments in non-current assets with a further increase in the value of fixed assets. For the purpose of calculating corporate income tax, these costs increase the initial cost of the corresponding fixed assets.

To ensure equal inclusion of repair costs over two or more tax periods, enterprises are allowed to create reserves for upcoming repairs of fixed assets in accordance with the procedure established by Article 324 of the Tax Code. Let us remind you that in accounting, reserves are not created for upcoming repairs.

Costs for completion, additional equipment, reconstruction, modernization of fixed assets are recorded in the account for investments in non-current assets. And upon completion of the work they are debited from this account.

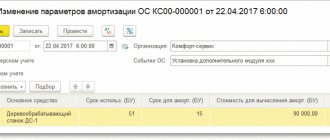

As a result of completion, additional equipment, reconstruction, modernization or technical re-equipment, the useful life of a fixed asset item may increase. Based on the new useful life of the object, it is necessary to recalculate the depreciation rate to be applied.

A distinctive feature of tax accounting is the right of enterprises to the so-called “depreciation bonus” in relation to capital investments. Capital investment costs in the amount of 10 (30) percent of the initial cost of fixed assets are taken into account for profit tax purposes at a time.

Convergence with IFRS

Let us turn to the draft regulation “Accounting for fixed assets”, which was proposed by legislators and is at the discussion stage as a federal accounting standard for accounting for fixed assets in organizations (with the exception of credit organizations and budgetary institutions). This standard is intended to replace PBU 6/01. They may introduce a new rule regarding accounting for the costs of restoring an asset for cases where the amount of restoration costs is taken into account as a component of the object.

When performing a regular audit of the technical condition and major repairs recognized as components of an asset, the organization will be able to recognize the associated costs in the actual cost of the asset component at the time of their occurrence. At the same time, any unamortized amount of costs for the previous regular inspection or repair will be subject to derecognition, that is, it will have to be written off.

The initial cost of the inventory item after overhaul/revision (Cp) in this case will be equal to:

Wed = Sp + Sk2 – Sk1

, Where

Sp

– the initial cost of the object – the main part;

Sk1

– cost of the component – previous major overhaul;

Sk2

– cost of the component – subsequent major repairs.

Example

An organization carried out a major overhaul of a hot-dip galvanizing line in the amount of RUB 5,133,000. The previous similar overhaul was taken into account as a component of the facility.

The cost of the previous overhaul was 3,781,500 rubles, accrued depreciation until the date of the current overhaul is 3,002,000 rubles. The following entries will be made in accounting: DEBIT 08 CREDIT 60

- 5,133,000 rubles.

– expenses for major repairs of the line are reflected; DEBIT 01, subaccount “Disposal” CREDIT 01

– RUB 3,781,500.

– the original cost of the component is written off in the form of costs for the previous overhaul; DEBIT 02 CREDIT 01, subaccount “Disposal”

– RUB 3,002,000.

– the accrued depreciation of the previous overhaul is written off; DEBIT 01 CREDIT 08

– 5,133,000 rub. – a component of the fixed asset is reflected in the form of costs for major repairs of the line.

This is just a single example that demonstrates the actual convergence of domestic accounting standards and the rules established for the preparation of financial statements according to international standards (IFRS). In accordance with IAS 16 “Fixed Assets” (put into effect on the territory of the Russian Federation by order of the Ministry of Finance of Russia dated November 25, 2011 No. 160n), if elements of fixed assets are subject to regular replacement, then the carrying amount of the replaced parts is subject to derecognition in accordance with provisions for write-off from the balance sheet (clause 13 of IFRS 16).

The same applies to regular large-scale technical inspections of fixed assets. Any amount of previous technical inspection costs remaining in the carrying amount (as opposed to spare parts) is subject to derecognition. It does not matter whether or not the costs associated with the previous technical inspection were reflected in the initial cost of this object. The standard indicates that the cost of a previous technical inspection, in the absence of one, must be determined by calculation. The amount of costs for a technical inspection included in the book value of the object at the time of acquisition and construction can be the amount of a preliminary estimate of the costs for an upcoming similar inspection.

Cheat sheet by type of work

| Maintenance* | Major renovation** |

| sealing and filling joints, seams, cracks | resumption of plastering of all premises |

| restoration in some places of the lining of the foundation walls from the basements and plinths | replacement of existing and installation of new technological equipment in buildings |

| re-laying of individual sections of brick walls up to 2 sq.m. | renovation of built-in premises in buildings |

| elimination of local deformations by re-lining and strengthening walls | insulation and noise protection of buildings |

| insulation of freezing sections of walls in individual rooms | repair of plaster in the amount of more than 10% of the total plastered surface |

| restoration of individual walls, lintels, cornices | production of design and estimate documentation |

| partial replacement or strengthening of individual elements of wooden floors | changing the roof structure |

| strengthening the elements of the wooden rafter system, including changing individual rafter legs, racks, struts, sections of purlins, sheathing. | equipment of attic spaces for use |

| elimination of dampness, airflow | transfer of the existing power supply network to increased voltage |

| cleaning ventilation ducts and exhaust devices | installation of automatic fire protection and smoke removal systems |

| repair of ventilation ducts and exhaust devices | partial re-laying (up to 10%), as well as strengthening of stone foundations and basement walls, not associated with the superstructure of the building or additional loads from newly installed equipment |

| antiseptic protection of wooden structures | repair of existing drains around the building |

| fire protection of wooden structures | sealing cracks in brick or stone walls, clearing furrows, and bandaging seams with old masonry |

| strengthening and replacing drainpipes | repair, replacement and replacement of worn partitions with more advanced designs of all types of partitions |

| strengthening and replacement of small coverings of architectural elements along the facade | partial or complete replacement of rafters |

| cleaning the roof from snow and ice | partial (over 10% of the total roof area) or complete replacement or replacement of all types of roofing |

| replacement, restoration of individual elements, partial replacement of window, door stained glass or showcase fillings (wooden, metal, etc.) | partial (more than 10% of the total floor area in the building) or complete replacement of all types of floors and their bases |

| replacement of individual sections of pipelines, shut-off and control valves | repair or replacement of interfloor ceilings |

| changing sections of heating devices, shut-off and control valves | replacement and strengthening of all types of stairs and their individual elements |

| replacement of individual sections of flooring. | continuous anti-corrosion painting of metal structures |

| restoration of destroyed sections of sidewalks, driveways, paths and platforms | repair and renewal of cladding with an area of more than 10% of the cladding surface |

| punching (sealing) holes, sockets, grooves. | continuous painting with stable compounds. |

| replacement of individual sections of blind areas around the perimeter of buildings | partial or complete replacement of air ducts |

| restoration of the building layout. | change of fans, heaters, filters |

| replacement of individual appliances (cisterns, toilets, washbasins, sinks, urinals, drinking fountains, water taps) | partial or complete replacement of ventilation ducts |

| change of individual sections of electrical wiring (up to 10%). | replacement of worn-out sections of the electrical network (more than 10%) |

| all types of plastering and painting works in all premises | changing safety shields |

* The most common types of work are given. For a complete list of works, see Appendix 7 of VSN No. 58-88(r) and Appendix 3 to Regulation No. 279 (approved by Resolution of the USSR State Construction Committee dated December 29, 1973 No. 279). ** The most common types of work are given. For a complete list of works, see Appendix 9 of the VSN No. 58-88(r), as well as Appendix 8 to Regulation No. 279 (approved by Resolution of the USSR State Construction Committee dated December 29, 1973 No. 279).