| The organization sold goods for export. How to reflect export transactions in accounting if the validity of applying a zero VAT rate is documented: a) before the expiration of 180 days, b) after the expiration of 180 days? What entries need to be made in the accounting records of the exporter if, within three years, the organization is unable to collect the necessary documents confirming the validity of applying the zero VAT rate? | Articles on the topic: -VAT on the sale of exported products -The procedure for restoring “customs” VAT -VAT and the Customs Union |

The article uses specific examples to show how, in such cases, export transactions are reflected in the accounting records of the exporter.

Transactions on the export of goods: legislative framework

Economic activity with foreign partners takes place with the participation of the customs service and is based on laws, the content of which we have reflected in the tables:

| Federal Law “On Currency Regulation and Currency Control” No. 173-FZ dated December 10 defines: |

| rights and obligations of participants in foreign economic transactions |

| currency regulation authorities and currency control authorities |

| rights and obligations of currency control authorities and agents |

| Federal Law “On the Fundamentals of State Regulation of Foreign Trade Activities” N 164-FZ dated December 8, 2003 defines goods as subject to export if the following conditions are met: |

| for transactions that are not subject to statutory benefits, all export customs duties are paid |

| all restrictions and prohibitions are observed |

| for goods included in the consolidated list, a certificate of origin is presented |

When does the zero rate apply? List of documents confirming export

A zero tax rate for the export of goods is applied when carrying out the following operations:

- Sales of products that were exported under the customs export regime.

- Sales of goods in the field of space activities.

- Sales of supplies (meaning fuels and lubricants necessary for the normal functioning of aircraft and ships) that were exported from the territory of the Russian state in the mode of movement of supplies.

- Sales of products for the use of foreign diplomatic (or equivalent) missions, or for the personal use of personnel of such missions and members of their families living together.

However, in order to apply a 0% rate for exports in 2014, a mandatory condition must be met: documentation confirming the export and provided for in Art. 165 Tax Code of the Russian Federation:

- a contract with a foreign physical or legal partner for the export of goods beyond the state borders of Russia;

- bank statements confirming payment for products by the buyer;

- cargo customs declaration (original or copy), which contains a customs mark;

- shipping and transport documentation (copy) with customs authority marks confirming export.

- In cases where the export of goods is carried out through an intermediary (agent, commission agent or attorney), the tax authority must provide:

- agreement between the taxpayer and the intermediary on the export of products;

- a contract (or a copy thereof) of a person who exports on behalf of a value added tax payer, which was concluded with a foreign buyer for the supply of products outside the borders of the Russian Federation;

- original or copy of the cargo customs declaration;

- copies of shipping and transport documents with the customs mark required for export.

This list of documentation is quite comprehensive, so the taxpayer is not required to submit other documentation to confirm the fact of export in 2014 to the tax authority.

All of the above documents must be submitted to the tax authority no later than 180 days from the moment the goods were moved under the export customs regime (paragraph 1, clause 9, article 165 of the Tax Code of the Russian Federation). You also need to know that in 2014, all documentation confirming export must be submitted together with the declaration.

In the event that the necessary documents were not provided on time, the tax office has legal grounds to charge additional value added tax at a rate of 10 or 18 percent. In addition, penalties are charged (one three hundredth of the Bank of Russia refinancing rate that was in effect during the period of delay).

What is necessary to conduct transactions with foreign counterparties?

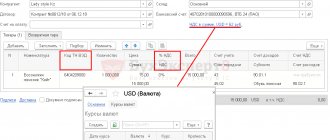

All financial export transactions are carried out in two currencies - Russian and foreign. To implement them you need:

- open a foreign currency account, or several accounts if transactions are carried out in different currencies;

- to buy and sell currency, use accounts 57 and 91;

- use account 52 for settlements with the counterparty, making entries: DT 52 CT 62;

- reflect the results of counterparties' debt on accounts 91: Dt 91 Kt 52, 62 or Dt 52, 62 Kt 91

Results

Reflection of export-related transactions in accounting occurs with certain features.

They are determined both by the need to use those accounting accounts (or analytics on them) that may not be in demand in the absence of exports, and by the special procedure for conducting transactions on VAT accounts. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Why is separate accounting of export transactions necessary?

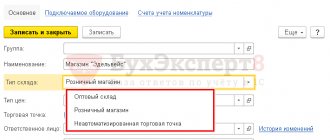

A separate account for accounting for export transactions is created to solve several problems:

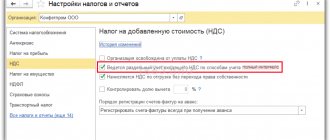

- separation of transactions in accordance with the tax rate applied to them: those subject to VAT at standard rates are separated from export transactions;

- exercising control over the completeness of payments by foreign counterparties - see paragraph 1 of Article 19 of Federal Law No. 173 “On Regulation” of December 10, 2003;

- monitoring the time limits allocated for the application of the 0% rate - see paragraph 9 of Article 165 of the Tax Code of the Russian Federation;

- control of the date of transfer of rights to the goods in the case when it does not coincide with the date of shipment.

A separate account for export transactions allows you not to charge VAT on advances from foreign counterparties - see paragraph 1 of Article 154 of the Tax Code of the Russian Federation.

Basic documents

An exporter's accountant, in the process of performing core functions, has to deal with a large number of specific documents. When registering them, you cannot do without the appropriate competencies.

The accountant's focus is primarily on the export contract. The document contains information about the goods exported outside the Russian Federation, its cost, delivery schedule and delivery time. The contract also provides information about the moment of transfer of ownership of the exported products. Tax officials carefully check export contracts. And this is a sufficient reason to spend resources and time on proper paperwork.

Another focal document for an accountant is the invoice extract. The latter, according to current legislation, is invoiced within 5 days from the date of shipment of the exported goods. The invoice indicates the current VAT rate. If the transaction requires an advance payment, an invoice will not be issued within the specified time frame.

The accountant will have to keep records of shipments of export goods separately from the accounting of product sales in the country. As for document flow, the primary source is the same. Shipments of goods sold in the Russian Federation and exported must be confirmed accordingly. If intermediaries are involved in transactions, payment for their services is reflected in accounting only if there is a confirming primary document.

Special mention should be made of export customs clearance. Several options are possible:

· documents are prepared by the exporter himself;

· the exporter delegates authority to the customs representative;

· the function is outsourced.

In the first case, the load on the accounting service increases significantly.

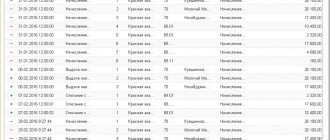

Postings for export transactions

When accounting for export transactions, the following entries are used:

| operation | wiring |

| duty calculations | DT 44 KT 76 and DT 76 KT 51, 52 |

| accounting for shipments when the date of transfer of ownership differs from the date of shipment | DT 90 DT 45 and DT 45 KT 41, 43 |

| VAT on export expenses | DT 19 KT 60 |

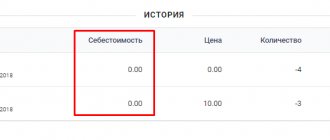

| restoration of tax previously accepted for deduction. The entry is made on the date of shipment of the goods | DT 19 KT 68 |

| tax on indirect expenses | DT 19 CT 19 |

| tax write-off on confirmed transactions | DT 68 CT 19 |

| taxes on unconfirmed exports | DT 19 KT 68 |

| deduction of tax previously assessed on unconfirmed exports | DT 68 CT 19 |

| accrual of VAT fines | DT 91 KT 68 |

| writing tax on other expenses in the case when the transaction remains unconfirmed | DT 91 CT 19 |

How to determine the place of implementation of auxiliary works (services)

Along with the main work (services), the organization can provide auxiliary work (services).

For example, when carrying out repair work, an organization can provide an additional service for the removal of construction waste.

Clause 3 of Article 148 of the Tax Code establishes that the place of implementation of auxiliary work (services) is recognized as the place of implementation of the main work (services). At the same time, only those works and services that are closely related to the main ones can be classified as auxiliary. If there is no connection between them, then the place of implementation of work (services) is determined as provided by the Tax Code for the corresponding types of work (services).

The norm of paragraph 3 of Article 148 of the Tax Code applies only if the main and auxiliary work is performed (services are provided) by the same organization.

EXAMPLE OF DETERMINING A LOCATION FOR IMPLEMENTING AUXILIARY WORKS (SERVICES)

The German company Bauer performs construction and installation work on a building located in Russia. The work is carried out by order of Importer LLC. In addition, Bauer provides the Importer with services for developing the interior design of this building. In this case, design services will be auxiliary in relation to construction and installation works. The place of implementation of construction and installation works is Russia (subject to VAT). The place of sale of building interior design services is Russia (subject to VAT).

"Around" VAT

When selling raw materials and goods abroad, tax registration of the transaction is of particular importance. The exporter charges and pays VAT at the normal rate. In this case, VAT is calculated from the amount:

- cost of products (according to the declaration);

- cost of duty;

- excise duties

Products on which VAT has not been paid cannot leave the temporary storage area at customs. If the tax is not paid on time, penalties are assessed on the unpaid amount.

When accounting for the export of goods using the simplified method, VAT is not applied to the deduction. Actions with VAT will depend on the object of taxation:

- if the object of taxation is “income”, VAT is included in the cost of the goods;

- if the “income minus expenses” scheme is used, the tax amount is included in the costs that reduce the tax base.

Accounting for auxiliary operations

Auxiliary operations need to be considered for the following:

- restoration of VAT accepted for deduction in the standard manner;

- determination of VAT penalties;

- write-off after 3 years of VAT on an unconfirmed transaction

How to determine the place of implementation of works (services) related to movable property

Works (services) directly related to movable property, aircraft, sea vessels and inland navigation vessels are subject to VAT if this property is located on the territory of Russia.

In particular, such works (services) include:

- installation and assembly;

- processing and processing;

- repair and maintenance.

EXAMPLE OF DETERMINING THE PLACE OF PROVIDING SERVICES RELATED TO REPAIR OF MOVABLE PROPERTY

Exporter JSC, under an agreement with a Hungarian company, repairs machine tools. The premises where the machines are installed are located in Hungary. Consequently, such work is not subject to VAT under Russian law.

Services for leasing movable property (except for land vehicles) are subject to VAT if the lessee operates in Russia.

EXAMPLE OF DETERMINING THE PLACE OF PROVIDING SERVICES RELATED TO THE RENTAL OF MOVABLE PROPERTY

JSC Exporter leased a Ukrainian tower crane.

Situation 1

If Kievstroy is registered in Russia (or operates in Russia through a permanent representative office), then the Exporter must charge VAT on rental payments.

Situation 2

If it is not registered in Russia (and does not have a permanent representative office, place of management or location of the executive body in Russia), then it is considered that the services are provided abroad. Consequently, the Exporter does not charge VAT on rental payments.

Services for leasing land vehicles are subject to VAT if the lessor operates in Russia.

EXAMPLE OF DETERMINING THE PLACE OF PROVIDING SERVICES RELATED TO RENTAL OF MOTOR VEHICLES

Exporter JSC leased a truck to a foreign company (the lessor operates in Russia, then the service is considered to be provided in Russia. Therefore, VAT must be charged on this.