“Main production”: account 20 in accounting

The organization's expenses that are allocated to carry out operations on the main types of activities should be attributed to a special accounting account 20 “Main production”. It should not be assumed that such costs are associated only with production cycles. This accounting account is supposed to take into account the costs of selling products, performing work or providing services, which are enshrined in the constituent documentation as the main type of activity.

In other words, Accounting Account 20 for Dummies is used to record expenses for the activities for which the company was created.

Production

An enterprise engaged in production activities in its chosen area uses a classic tax and accounting system. Management certificates, diagrams and reports are generated in parallel according to a general principle in accordance with the requirements of the owners of the organization. When carrying out production activities, each company forms the cost of manufactured products. Account 20 is used to summarize costs. The presence of auxiliary production or an extensive system of production shops and administrative buildings requires the use of accounts 23, 26, 29, 25 in accounting, which collect all costs related to the cost of the main type of product.

Features of accounting on an account 20

All expenses that the company incurs on its main activities or production are accumulated on active account 20. When accepting expenses for accounting, the accounting account is debited; when releasing finished products or providing services, the entries are credited.

A feature of accounting account 20 is that debit turnover cannot be greater than credit turnover. This means that the company cannot consume more raw materials than were written out from warehouses for the production process. Similar conditions apply to other types of expenses.

Postings to account 20 collect information about the cost of OP for the reporting period. In addition to inventories, the following can be written off as main production:

- salaries of key personnel;

- depreciation of equipment;

- administrative staff salaries;

- expenses for renting premises, paying for utilities;

- other expenses.

Account correspondence

Account 20 can correspond with the following accounts.

From the debit of account 20 to the credit of accounts:

- Account 02 - regarding write-off of depreciation on fixed assets;

- Account 04 - when writing off depreciation of intangible assets without using account 05;

- Account 05 - regarding depreciation of intangible assets;

- Account 10 - regarding the write-off of materials for production;

- Account 11 - regarding the write-off of fallen or slaughtered animals;

- Account 16 - regarding the write-off of deviations in the cost of materials;

- Account 19 - regarding the write-off of non-refundable VAT;

- Count 20 - for internal movements of products in production;

- Account 21 - regarding the write-off of own semi-finished products for production;

- Account 23 - regarding the write-off of auxiliary production costs to the main production;

- Account 25 – regarding the write-off of general production costs for main production;

- Account 26 – regarding the write-off of general business expenses for the main production;

- Account 28 - regarding the return to production of products with corrected defects or the write-off of irreparable defects;

- Account 40 - when using products for the needs of main production;

- Account 41 – when using purchased goods for the needs of the main production;

- Account 43 – when using main products for the needs of main production;

- Account 60 - when included in the cost of suppliers' services;

- Account 68 - regarding the inclusion of certain taxes in the cost price;

- Account 69 - regarding accrued social contributions for key workers;

- Account 70 – regarding accrued wages for main employees;

- Account 71 - write-off of accountable amounts for production needs;

- Account 75 - in terms of acceptance as a contribution to the authorized capital of unfinished products;

- Account 76 - regarding the write-off of other services;

- Account 79 - when taking into account the costs of branches or separate divisions in the cost price;

- Account 80 - when contributing to a friend’s capital with products in the work-in-progress stage;

- Account 86 - in terms of receiving as targeted financing an object with work in progress;

- Account 91 - when accepting for accounting unfinished products identified by inventory;

- Account 94 - Regarding the write-off of identified shortages and losses for production;

- Account 96 - regarding the accrual of contingent liabilities;

- Account 97 - regarding the write-off of deferred expenses for production.

According to the credit of the account, it corresponds with the debit of the following accounts:

- Account 10 – regarding the return of materials from production to the warehouse;

- Account 11 - When reflecting the offspring of animals;

- Account 15 - when forming the cost of raw materials from own production;

- Count 20 – for internal movements of products in production;

- Account 21 - When reflecting semi-finished products of own production;

- Account 28 - when taking into account product defects;

- Account 40 - when posting products at planned cost;

- Account 43 - when recording products at actual cost;

- Account 45 - when writing off the cost of products, which in this case cannot be recognized in accounting;

- Account 76 - regarding the write-off of expenses due to other services;

- Account 79 - regarding the reflection of costs by structural divisions or branches;

- Account 80 - when returning a share to a friend at the expense of unfinished products;

- Account 86 - when writing off target financing funds after paying expenses;

- Account 90 - when writing off cost by direct sale;

- Account 91 - when writing off the cost of unfinished orders upon their cancellation;

- Account 94 - when identifying shortages and losses in production;

- account 99 - when writing off production costs in emergency situations.

You might be interested in:

Postings for wages and taxes: how to reflect them correctly in 2021

Account 20: accounting entries

Let's look at typical accounting entries for recording operations related to core activities.

| Operation | Account debit | Account credit |

| Inventories were transferred to our own production | 20 | 10 |

| Salaries and insurance contributions of personnel directly involved in the main activities are included in the OP | 20 | 70 69 |

| Services of third-party companies are included in the costs of OP | 20 | 60 |

| Write-off of management expenses reflected | 20 | 26 |

| General production costs are written off to OP | 20 | 25 |

| Returns for reworking of finished products that were found to be defective are reflected. | 20 | 43 |

| Manufacturing defects identified prior to sale are sent for processing | 20 | 28 |

| Amounts of taxes and fees are allocated to production needs | 20 | 68 |

| Deficiencies and losses are reflected within the norms in the production process, without persons at fault | 20 | 94 |

| Downtime and claims against contractors | 20 | 76/2 |

| Semi-finished products are sent to the production process | 20 | 21 |

| The costs of auxiliary production are reflected in the OP | 20 | 23 |

| The goods were written off for the company's production needs | 20 | 41 |

| Reflects the report issued to the employee for production needs | 20 | 71 |

| The employee was compensated for costs associated with the production process (compensation for fuel and lubricants for the use of a personal car, for example) | 20 | 73 |

| Work in progress was accepted as part of targeted financing | 20 | 86 |

| Work in progress is reflected as a contribution to the authorized capital of the organization | 20 | 80 |

| Excess work in progress is taken into account | 20 | 91/1 |

| The share of deferred expenses was attributed to the OP | 20 | 96 |

Basic business operations

- Depreciation

Dt 23 Kr 02 – fixed assetsDt 23 Kr 05 – NMA;

- Write-off of inventory items

- Semi-finished products

Dt 21 Kr 23 – capitalization;Dt 23 Kr 21 – write-off

- Displaying the share of costs attributable to ancillary production activities

Dt 23 Kr 25 - productionDt 23 Kr 26 – household

- Settlements with employees

Dt 23 Kr 70 – for wagesDt 23 Kr 76 – insurance costs

- Displaying the cost of work performed

Dt 44 Kr 23 - as part of commercial costs;Dt 90 Kr 23 - as part of sales made;

Dt 91 Kr 23 – sale and disposal of fixed assets

- Display of identified shortages

- Detection of manufacturing defects

Victor Stepanov, 2016-12-21

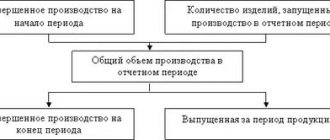

How to close a 20 account: 3 methods

At the end of the reporting period, for example a month, it is not necessary to close account 20. The debit balance in the account reflects the value of the company's work in progress. The company's accounting department needs to organize an inventory of work in progress while simultaneously checking workshops, warehouses and payroll records.

Postings for closing account 20 are generated when releasing finished products, when transferring produced material assets directly to customers, or when performing work or services.

Current accounting standards provide for three methods for closing accounting accounts 20:

- Direct method.

- Intermediate method.

- Direct sales of manufactured products.

IMPORTANT!

The company must independently determine the method of writing off costs from account 20. The decision must be documented, detailing the chosen method in the accounting policy.

Before closing account 20, the accountant must highlight the balances of work in progress. But only if there are such residues. If the production cycle does not include work in progress balances, account 20 is closed completely.

Dt 20 Kt 63

6. The amount of shortages of materials due to the fault of the supplier, in the event that a claim is made to him, is reflected in the posting

Dt 374 Kt 63

Accounting for the consumption of inventories

Primary documents on the movement of materials are received by the accounting department from the warehouse and workshops. Here they are grouped by warehouses, synthetic accounts, subaccounts and cost codes.

The results of grouping primary documents by receipt are reflected in the materials receipt statement. Similarly, an expense statement is drawn up based on expenditure documents.

The results of these statements are the basis for summarizing data on the movement of materials in the consolidated turnover sheet No. 10 “Movement of material assets in monetary terms.”

The statement consists of three sections. It generates indicators on the movement of materials in value terms in the context of individual groups, subaccounts and accounts, at accounting prices and at actual cost, i.e. taking into account TZR.

The distribution of the cost of consumed materials at accounting prices for synthetic accounts and sub-accounts is carried out in development table No. 1. The distribution of the amount of labor and production work is also shown here,

The indicators in development table No. 1 are the basis for drawing up entries for the write-off of materials and equipment.

These entries in the journal order form of accounting are reflected in journal orders No. 5 and 5-a (previously - 10 and 10/1).

All operations on the consumption of inventories and their write-off in connection with sales, gratuitous transfer and loss are reflected in large enterprises in class 9 accounts. The consumption of materials for technological purposes of main and auxiliary production is reflected in accounts 23, “Production”, 24 “Defects in production " Vacation is reflected at accounting prices:

1. Materials (raw materials, fuel) were supplied for technological purposes of the main and auxiliary production

Dt 23 Kt 20

2. Materials were released to correct defective products

Dt 24 Kt 20

3. Auxiliary materials (fuel, spare parts) were supplied for general shop needs

Dt 91 Kt 20

4. Material assets were released for the needs of general plant departments

Dt 92 Kt 20

5. Containers and packaging materials for packaging finished products in the warehouse were released

Dt 93 Kt 20

6. Materials were released for the social needs of the enterprise

Dt 94 Kt 20

Direct method of closing account 20

The direct method is used when the actual price of goods, works and services produced during the reporting period is unknown. Accounting is carried out according to conditional price indicators, for example, according to planned cost.

At the end of the reporting period, the cost of manufactured products is adjusted to actual cost figures.

Typical wiring:

| Operation | Account debit | Account credit |

| An adjustment to the cost of manufactured products is reflected | 43 | 20 |

| Identified deviations of the actual cost from the planned cost are written off to the cost of sales | 90/02 | 43 |

Postings Dt 20 and Kt 20, 10, 26, 25, 02, 60 (nuances)

: 20,000 rub. = 1.3.

Let's determine the amount of depreciation after revaluation:

6,000 rub. x 1.3 = 7,800 rub.

The amount of additional assessment of depreciation is:

7,800 rub. – 6,000 rub. = 1,800 rub.

Let's make accounting entries:

Debit 01 “Fixed assets” Credit 84 “Retained earnings (uncovered loss)”

- for the amount of revaluation of the object within the amount of the previously made depreciation - 3,000 rubles;

Intermediate method

When using the intermediate method of closing account 20, account 40 “Product Output” is additionally used as an auxiliary account. This account is used to record deviations of the planned cost from the actual cost. The credit of account 40 reflects the planned cost, and the debit shows the actual cost.

At the end of the reporting period, the balance is written off proportionally: part - to account 43 “Finished products” and part - to subaccount 90/02 “Cost of sales”.

Typical transactions during the month:

| Operation | Account debit | Account credit |

| The receipt of finished products at the planned cost is reflected | 43 | 40 |

| Products sold are written off at planned cost | 90/02 | 43 |

At the end of the month, the accounting records reflect:

| Operation | Debit | Credit |

| The write-off of the actual cost of manufactured products is reflected | 40 | 20 |

| Corrective entries are reflected that bring the planned cost to actual figures. | 43 | 40 |

| 90/02 | 40 |

Results

The credit of the 20th account shows the cost of the finished product, whether it is intended for sale or for one’s own needs, the cost of services sold, work performed.

This amount is transferred to the 40th, 43rd, 90th or other account, as required by the accounting policy of the enterprise and the nature of the transaction performed. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Method of direct sales of released products

This method of accounting is used when manufactured products are sold to customers immediately and are not stored at the enterprise. In this case, production costs are written off to cost of sales. For example, services provided by organizations are closed on account 20 using the direct sales method.

Typical wiring:

| Operation | Debit | Credit |

| The actual cost of services provided is written off to cost of sales | 90/02 | 20 |

What subaccounts are used?

Analytical accounting on account 20 is usually carried out by types of products produced, services provided, work performed, divisions existing in organizations, as well as by types of costs. For example, in agriculture it is customary to open sub-accounts “Crop production”, “Livestock production”, “Industrial production” and others.

Account 20 may have the following subaccounts by type of cost:

- "Depreciation".

- "Labor costs."

- "Material costs."

- “Deductions for social needs.”

- "Other expenses."

Attention! On account 20, it is possible to keep track of costs at standard cost with a separate accounting of excess costs. Then a sub-account “Excessive costs” can be opened.