The need to make payments under a writ of execution gives rise to disputes and misunderstandings between the debtor and accounting employees who are required to make deductions from wages. The former believe that the amount is large, the latter strive to fulfill the requirements of the law, exceeding the amount of payments established by the regulations. At the legislative level, the order of execution of writs of execution is regulated and cannot be interpreted arbitrarily. We must follow the letter of the law and there will be no disputes.

In what cases is a payment order necessary?

A payment order is a document in a prescribed form that regulates the account holder’s instructions to make non-cash transfers in favor of the recipient of funds.

The instruction has been sent to the bank that maintains the payer’s account. Funds are transferred from a deposit account. Individuals can also process payment orders without opening a bank account. In this case, an order to the bank from an individual can be drawn up in the form of an application, in which the following information must be indicated:

- payer details;

- details of the recipient of funds;

- bank details of the payer and recipient;

- amount of money;

- purpose or purpose of payment;

- other information established by the bank.

Based on the order, the bank employee generates a payment order.

How to transfer insurance premiums

After the entry into force of Chapter 34 of the Tax Code of the Russian Federation, insurance premiums directed to:

- compulsory pension insurance,

- compulsory health insurance,

- social insurance in case of temporary disability and in connection with maternity,

are paid to the tax authorities. Previously, they were transferred directly to the Pension Fund, Compulsory Medical Insurance Fund and Social Insurance Fund, respectively.

The rules for processing payment orders for tax payments are established by Order of the Ministry of Finance dated November 12, 2013 No. 107n.

All employers who hire employees pay contributions from the amount of wages paid. The transfer deadline is until the 15th day of the month following the billing month.

Features of filling out a payment order for payment of insurance premiums

SS in case of VNiM: 18210202090071010160.

TP - transfers of the current year.

ZD - voluntary repayment of debt.

TR - repayment of debt on demand.

AP - repayment of debt according to the inspection report.

In MS.month.year format.

For example, when paying for May 2021, you should indicate: MS.05.2018.

For current payments, “0” is entered.

If payment is made on demand, then the request number.

For current payments, “0” is entered.

If payment is made on demand, then the date of demand.

| On the forum since: 11/06/2014 Messages: 1,032 | On the forum since: 11/06/2014 Messages: 1,032 | On the forum since: 11/06/2014 Messages: 1,032 | On the forum since: 09.13.2017 Posts: 5 | On the forum since: December 14, 2006 Posts: 17,704 |

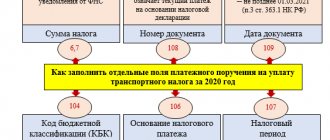

| Field | Field name | Specified value | ||

| 101 | Payer status | 01 | ||

| 104 | KBK | |||

| 105 | OKTMO | 8-digit code according to the classifier | ||

| 106 | Basis of payment | |||

| 107 | Taxable period | |||

| 108 | Document Number | |||

| 109 | Document date | |||

| 24 | Purpose of payment | Information about the type of payment and payment period. |

Samples of filling out payment orders for payment of insurance premiums:

When is a payment made to the FSSP?

To ensure the collection of certain payments ordered by the court, the bailiffs send the payer - the obligated person - a corresponding order, which contains the appropriate requirement and indicates the necessary details.

In essence, this order is a writ of execution, which gives it the necessary legal force.

A document demanding repayment of obligations under a court decision can be sent to the payer either at the place of his employment (in this case, the debt will be officially deducted from the payer’s earnings), or to the address of his actual residence (if the obligated person is not employed).

In the practice of bailiffs, it is customary to divide writs of execution into the following types:

- collection of tax debts;

- repayment of non-tax debt (loan obligations, housing and communal services payments, penalties, alimony payments, other penalties).

If, for example, a sum of money ordered by the court for payment is withheld according to a writ of execution from the salary of the obligated person (payer), the accountant of the employing organization draws up and sends a special payment to the bailiffs to the servicing bank.

As a rule, an authorized FSSP employee who supervises (conducts) a specific enforcement proceeding officially provides the employing organization with a sample of such an order, already containing all the necessary details.

Thus, the financial institution carries out the designated payment transactions according to these orders, transferring the money directly to the FSSP authorities.

Bailiffs accept the appropriate payment, register it in the prescribed manner, and then forward it to the actual (target) recipient, who is the beneficiary of the enforcement proceedings.

The funds from this payment can be sent to a budgetary structure, an economic entity, another organization or a specific individual.

Contributions for injuries

The Social Insurance Fund continues to administer mandatory payments for industrial accidents and occupational diseases. They are paid directly to the Fund by all organizations that employ hired workers in accordance with Federal Law No. 125-FZ.

The fee rate is set annually depending on the level of professional risk of the company from 0.2 to 8.5%. Its size is established by the Social Insurance Fund and indicated in the Notification sent in response to the application for confirmation of the main type of activity.

The deadline for paying the fee is similar to the deadline for transferring insurance premiums: until the 15th day of the month following the reporting month.

The differences between issuing a payment order are that:

- the recipient of the payment is indicated by the territorial body of the Social Insurance Fund;

- the payer status is set to code 08;

- Zeros are entered in fields 106-109.

How to fill out correctly when transferring according to a writ of execution?

Deductions directly addressed to bailiffs are transferred according to the writ of execution on the basis of the relevant payment orders, the execution of which must always be carried out properly.

For the FSSP, however, there is no special form of payment approved by any regulations.

Consequently, the payment order to the bailiffs is drawn up according to a standard template, usually used for any bank transfers.

When filling out such payments, it is important to take into account some differences between orders for tax collections and orders for non-tax withholdings.

Non-tax debts

If a payment directly addressed to the FSSP authorities is drawn up to collect non-tax debts, it does not provide for filling out the so-called tax fields.

In other words, it does not indicate the BCC, payer status, or other information related to tax specifics.

All key data characterizing a non-cash payment for the collection of non-tax debt is reflected in the payment purpose field.

The necessary information of the writ of execution, the paid period and other identifying information are indicated here.

Tax debts

If a payment order to bailiffs is issued for the purpose of collecting tax debts, it should be drawn up according to the rules provided for transfers to the budget.

So, when filling out the payment form, the following mandatory details must be indicated:

- If the amount of tax debt is withheld from the salary of the debtor employee, field 101 (user status) in the payment order is assigned the value 19.

- In field 60, where the payer’s TIN is indicated, the TIN of the citizen (employee) against whom enforcement proceedings are applied is entered. If this individual does not have a TIN, the value 0 is entered.

- In field 102, where the payer’s checkpoint is indicated, the value 0 is reflected, since the funds are transferred for the hired employee.

- The short name of the business entity (employer) withholding and transferring funds under the writ of execution is written in field 8 of the payment order, where the name of the payer is reflected.

- Field 22 is intended to indicate the UIN code (unique accrual identifier). If such a code is not included in the bailiff’s order, 0 is entered.

- In field 105 you should enter the OKTMO code, which determines the location of the territorial body of the FSSP, which collects the debt by court decision.

- Field 108 properly reflects the number of the document that uniquely identifies the payer (debtor employee). Before the identifying information, the identification code of the corresponding document is written in the line (for example, a civil passport - 01, a military ID - 05).

- In the KBK field (104) – value 0.

- In the fields of document date (109), tax period (107) and document basis (106) the value 0 is entered.

We invite you to read: Final registration of the purchase of an apartment

The maximum possible amount of deductions for IL

The main regulations governing the order of payments and the amount of funds from income for payments for compensation for damage, harm to life or health, for alimony obligations are:

- Labor Code of the Russian Federation (Article 138);

- Federal Law No. 229 “On Enforcement Proceedings” (Article 99);

- Explanation of the law, in the letter of Rostrud dated May 30, 2012 No. PG/3890-6-1.

All three documents duplicate a single rule. The total amount of payments should not exceed 20% of the payer’s total income. In cases specifically stipulated by law or when repaying under several documents, the amount of funds remaining to the debtor cannot be less than 50%. The largest amount of allowable payments is 70%, applies to persons:

- a crime that caused harm;

- serving sentences in places of deprivation of liberty;

- those paying compensation to persons who suffered harm to health;

- compensating for damage due to death due to their fault;

- having arrears in paying child support for minor children.

A closed list of income has been established, from which, under no circumstances, deductions can be made. It is contained in Art. 101 FZ-229 and includes 18 types of income; IL, court orders and notary inscriptions do not apply.

Withholding from any additional earnings and income other than wages, such as bonuses, payments for overtime work, on holidays, for shift work, compensation for the use of personal transport, vacation pay and voluntary health insurance does not encourage the debtor to look for additional sources of increasing well-being. If the FSSP bailiff finds out about them, he will demand an increase in the amount of payments, and payments that were not made due to receiving additional money will be added to the existing amount of debt. It is beneficial for the debtor to minimize the salary by declaring income in the amount of the minimum wage.

conclusions

The payment, through which tax/non-tax debts are collected by bailiffs, is drawn up according to the typical form of an order to transfer money from a bank account.

However, when filling it out, you should always follow certain rules. It is recommended that the details required to be reflected in such a payment order be clarified in advance with the FSSP authorities.

This will avoid problems with the correct formation and timely execution of the payment document.

If you don't pay on time: consequences

For each day of delay in transferring a tax payment, the company will be charged penalties in accordance with Article 75 of the Tax Code of the Russian Federation. In case of non-payment, the Federal Tax Service has the right to collect them. The collection procedure is as follows:

- A demand is issued to the defaulter indicating the deadline for payment.

- In case of non-receipt of funds to the budget, a collection order is issued to the company's current account. According to it, the debt is written off (Article 46 of the Tax Code of the Russian Federation).

- If there is a shortage of funds in the current account or if there is no information about current accounts, the debt is collected from other property of the company by sending a collection order to the bailiff (Article 47 of the Tax Code of the Russian Federation).

Questions and answers

- We hired an employee, and a week later we received a writ of execution for alimony. The problem is that this person does not have a Taxpayer Identification Number. What to do with a payment order?

Answer: Actually there is no problem with this. If an individual does not have a TIN, the value “0” is indicated in field 60. All necessary information is indicated in the “Purpose of payment” field, where information about the writ of execution and the purpose of payment (alimony) will be indicated.

- Is it necessary to indicate the short name of our organization when generating a payment order to bailiffs?

Answer: The short name of the organization is required to be indicated, because It is your organization that acts as the payer for the payment order.

Sample of filling out a payment order to bailiffs

For clarity, let’s look at filling out a payment slip to the FSSP using a conditional example.

Let’s say that ICS LLC, on the basis of writ of execution dated August 19, 2019 No. 1234/56789, withholds from its employee amounts to pay off his transport tax debt.

The organization will fill out the payment order as follows:

- will indicate the employee’s tax identification number, enter 0 in the checkpoint, and designate himself as the payer;

- will indicate 19 as the payer status;

- the individual’s identifier will be a passport, so in field 108 the organization will enter code 01 and, separated by a semicolon, the series and number of the employee’s passport;

- the recipient of the payment will be the department of the Federal Bailiff Service for Moscow;

- instead of UIN will put 0;

- payment order 4th;

- OKTMO - the one that is installed at the location of the FSSP management;

- fields 104, 106, 107 and 109 will contain 0.

You can view and download a completed sample payment order to bailiffs on our website.

Enforcement fee: payment order to bailiffs

In addition to the tax payments themselves, an enforcement fee is collected from the debtor in accordance with Article 112 of Federal Law No. 229-FZ of October 2, 2007. It is collected if the debtor refused to voluntarily fulfill the requirements of the writ of execution.

The fee is 7% of the amount to be collected, but not less than 1000 rubles. from an individual (citizen or individual entrepreneur). The executive fee goes to the federal budget.

Sometimes the payment details indicate a UIN (unique accrual identifier). It contains from 20 to 25 digits and is found only for payments in favor of government agencies. It must be indicated in field 22 of the payment order. If the UIN is unknown, then “0” is indicated in field 22.

Sequence of execution of executive documents

As soon as the company receives writs of execution from bailiffs, the employee must be notified of the upcoming deductions. Then the accountant must familiarize himself with the grounds for issuing and transferring writs of execution and determine the order of deduction:

| Queue | Type of debt |

| 1st | Alimony payments; compensation for moral damage; compensation for damage resulting from criminal acts; compensation for damages associated with the death of the breadwinner; compensation for damage caused to someone’s health (including cases of road accidents). |

| 2nd | Payment for the work of people who worked on the basis of an employment agreement; severance pay; payment of remuneration to the authors of the results of intellectual activity. |

| 3rd | Mandatory contributions to the state budget and extra-budgetary funds |

| 4th | Other debts (for example, bank loans, fines, legal costs) |

An accountant who makes deductions from wages must act according to the following scheme:

- Calculate the employee’s total earnings, taking into account only those payments from which deductions can be made.

- Withhold personal income tax at the standard rate of 13%.

- Calculate the total amount of debt based on writs of execution.

- Check the maximum possible amount of deductions.

- Calculate the amount of deductions, drawing up a proportion for the competent distribution of funds available for collection.

Question No. 1: The employer pays the employee an additional monthly allowance for caring for a newborn - this procedure is provided for by the local collective agreement of the enterprise. Can't deductions be made from such payments based on writs of execution?

Answer: Since the payment of this benefit is regulated by a local act of the enterprise, and not by federal law, funds can be withheld.

Question No. 2: When should I transfer the amounts of deductions from an employee’s salary based on writs of execution to the claimants?

Answer: It is necessary to transfer the withheld funds within 3 days from the date of payment of wages.

In the process of enforcement proceedings, creditors are often faced with the impossibility of collecting the entire debt from the debtor. However, an insufficient amount of funds or property in the defendant’s accounts does not mean exemption from satisfying the claims of counterparties.

Reimbursement of debts occurs in accordance with Art. 111 Federal Law “On Enforcement Proceedings”, which regulates the priority of satisfying the claims of claimants.

The priority of collection depends on the type of debt. The first stage includes:

- alimony payments;

- compensation for moral damage or harm caused to health;

- compensation for damage caused by the crime;

- compensation for damage due to actions that resulted in the loss of a breadwinner.

Participants of the second stage are:

- employees who have entered into an employment contract with the debtor;

- authors of works who have demanded remuneration for the results of intellectual activity;

- employees who did not receive timely severance payments.

Participants in the third stage of deductions are satisfied with their mandatory payment requirements. These are contributions to the state budget, as well as extra-budgetary funds.

The fourth stage includes other debts, including:

- fines;

- small bank loans;

- legal costs.

As soon as the accountant receives a writ of execution, he is obliged to warn the employee, and only then make deductions.

The employee may indicate consent to larger amounts of deductions. In this case, the accountant will need to carry out calculations in order to identify the balance amount. If, after all deductions, the employee receives a salary that is less than acceptable (less than 30%), the amount of payments is subject to additional discussion.

Federal Law No. 229-FZ contains a detailed explanation of the formation of the order of collection of funds from the debtor’s accounts in order to satisfy the claims of creditors.

If it is impossible to repay all debts in full, the available amount is distributed among creditors in a certain percentage, as well as in accordance with legislative priority.

In addition, the article specifies the unchangeable condition for the transfer of the queue for receiving payment from one creditor to another. Thus, the requirements of each subsequent queue are subject to satisfaction only after the absolute satisfaction of the requirements of the previous queue.