What is a manufacturing defect?

Manufactured products that do not meet the basic standards of their analogues are considered defective. Defective goods are products of reduced quality, which may require additional financial investments to eliminate defects.

If a product is intentionally manufactured according to non-standard technical characteristics, then such types of products are not considered defective.

Depending on the existing characteristics, the following types of marriage are distinguished:

- External. Poor quality products put on sale or shipped to the buyer.

- Interior. Defective goods are identified at the production stage, found in workshops and warehouses of the organization.

- Correctable. Products of inadequate quality that can be brought to standard conditions. The cost of correction must be economically feasible to achieve a satisfactory result.

- Incorrigible. A defective product that cannot be repaired or is not economically viable. Recognized as a final marriage.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

Distribution of material costs (document “Distribution of materials for production”)

Important. Material costs in 1C:UPP can be included in the production cost either by the boiler method (distribution of costs according to a given distribution base), or distributed according to the share of each material according to the specification in the production cost.

In our example, consider the distribution of material costs according to specifications.

We will make a manual calculation of material costs included in the cost of manufactured products.

For example, 50 boards were written off in Workshop 1. To produce 1 cabinet according to specification, 10 boards are required. For the entire production of cabinets (including defective ones), the requirement is 10 * 11 = 110 pieces. According to the standard, 4 boards are required to produce one coffee table. Total planned requirement 4 * 20 = 80 pcs.

Let's assume that there was no work in progress at the end of the month.

When distributing, we find that 50 units were used to produce 11 cabinets. * (110/190) = 28,947 pcs.

The cost of 1 board is 300 rubles. Accordingly, the material costs for spent boards for the production of all cabinets (including defective ones) amount to 300 * 28.947 = 8684.10 rubles.

Total material costs:

- Wardrobe (11 pieces) – RUB 12,296.35.

- Coffee table (20 pcs.) – RUB 9,803.65.

In the program, material costs can be distributed to a specific output directly in the release document (“Production report for a shift”) or in a specialized document “Distribution of materials per output.”

The “Products” tab is automatically filled with the list of released finished products, including defective ones, using the “Fill” button. If necessary, the data can be edited:

The “Materials” tab is filled in with all material costs written off for the specified period for the department selected in the document header:

On the “Distribution of Materials” tab, the automatic distribution of material inventories to manufactured products occurs according to the specifications:

Thus, we see that the material component of the cost of defective products is calculated in exactly the same way as for suitable products.

Document flow for defective goods

In order to be able to take into account the expenses incurred in the future, as well as for the purpose of internal control, defective products must be documented. Primary documents must be drawn up regardless of the type of low-quality products produced. This confirms the manufacture of a low-quality product - correctable or irreparable.

In some cases, defects occur when receiving low-quality raw materials from suppliers. A report on defects detected during the acceptance of goods will help to file a claim against the counterparty.

The unified form of the document recording the presence of products of inadequate quality is recognized as the requirement - invoice in form No. M-11. The document is used to record the movement of defective products within the enterprise. Drawed up by the financially responsible person of the unit no later than 1–2 days from the moment the defect is discovered. Transferred to the accounting department for further accounting.

Organizations have the right to independently develop acts of accounting for products of inadequate quality, which will contain the following data:

- name and nomenclature number of the product;

- characteristics of marriage;

- type of marriage;

- number of defective products;

- perpetrators;

- cost of defective products, possible correction costs;

- amounts to be recovered from the guilty persons.

Conditions of the problem

Product output - Shop 1 (Table 1):

| № | Products | Issue volume | Quality | Planned price | Planned cost |

| 1 | Closet | 10 | Good products | 10 000 | 100 000 |

| 2 | Coffee table | 20 | Good products | 2500 | 50 000 |

| 3 | Closet | 1 | Marriage | 10 000 | 10 000 |

We will set specifications (material consumption standards) for manufactured products. Specifications are set in the item card on the “Specifications” tab:

Note. This tab is available only if the value “Production” is specified in the “Type of reproduction” field (the “Advanced” tab):

During the production process in Workshop 1, the following costs were collected:

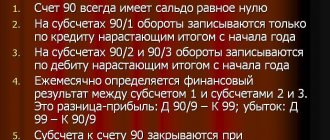

Account 28 in accounting: reflection of defective products. Postings

All information containing data on defective production and associated costs is reflected in accounting account 28 “Defects in production”. Information is collected on low-quality goods in general. Organizing analytical accounting with the opening of sub-accounts will help analyze data on the presence of defects and their cost in each department.

The debit of account 28 accumulates the cost of defective products and correction costs. Under loan 28 - amounts to be reimbursed from the perpetrators (suppliers, employees), as well as increasing the cost of goods.

The costs of defective products include the following components: the cost of spent raw materials, materials, labor costs, deductions to funds, transportation costs. Depending on the source of occurrence/receipt of substandard goods, costs may be reimbursed at the expense of the guilty parties by filing claims against suppliers. In other cases, a defective product released is a damage to the organization.

If the defect is irreparable and the amount is not refundable, its cost increases the costs by the following entry:

Dt 20 - Kt 28 - reflects the cost of defects included in the cost of goods.

Example. Due to the fault of the workers of workshop No. 2, a defective batch of goods was released. Poor quality products are subject to further correction. What accounting entries should be used to reflect the cost of defects, as well as to reimburse the costs at the expense of those responsible?

Dt 28 - Kt 10 (3,500 rubles) - the cost of raw materials spent to correct the defect.

Dt 28 - Kt 70 (2,000 rubles) - wages accrued to employees who are working to eliminate defects.

Dt 28 - Kt 70 (604 rubles) - insurance premiums are charged for payments to employees eliminating the consequences of defects.

Dt 28 - Kt 25 (312 rubles) - reflects the share of total costs spent on correcting low-quality products.

Dt 73 - Kt 28 (6,416 rubles) - an amount has been identified for further write-off from the perpetrators.

Dt 70 - Kt 73 (6,416 rubles) - the cost of the defect is withheld from those responsible.

Typical transactions for account 70

— in correspondence with account 84 “Retained earnings (uncovered loss).”

The basis for the posting is: a statement of accounting for semi-finished products, a statement of consolidated cost accounting, etc. Debit 20 – Credit 25 – the share of overhead costs is included in the costs of main production.

The debit of account 70 “Settlements with personnel for wages” reflects the paid amounts of wages, bonuses, benefits, pensions, etc., income from participation in the capital of the organization, as well as the amount of accrued taxes, payments under executive documents and other deductions. Amounts accrued but not paid on time (due to the failure of recipients to appear) are reflected in the debit of account 70 “Settlements with personnel for wages” and the credit of account 76 “Settlements with various debtors and creditors” (sub-account “Settlements for deposited amounts”). .

Analytical accounting for account 70 “Settlements with personnel for wages” is maintained for each employee of the organization. Contents of the business transaction Debit Credit Salaries were paid from the organization's cash register 70 50 Salaries were transferred from the current account 70 51 From a foreign currency account

Calculation of production costs

Let's manually calculate the cost of each unit of production (before including the costs of defects in the cost of producing cabinets):

Let's manually calculate the cost of manufactured good products:

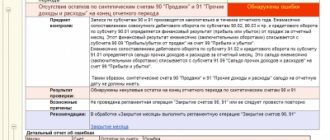

The formation of the cost of all manufactured products (including defective ones) in the program is carried out using the document “Cost Cost Calculation”:

When carrying out this regulatory document, entries will be generated to generate the actual cost of production (including defective products):

The cost of producing defective products is included in the cost of producing suitable products:

As a result, when carrying out the document “Calculation of cost”, we will obtain the cost of each type of manufactured product. This information can be analyzed using the “Output Costs” report:

The “Quantity” column indicates the amount of inventory written off as expenses.

In the “Cost” column we can see the cost of the entire production of suitable products received into the warehouse.

Note. The calculated cost of the defective cabinet (RUB 1,666.24) is included in the cost of production of products of the same name (cabinets).

The volume and cost of production, including defective products, can be analyzed using the “Product Output (Cost Estimation)” report:

Features of complex accounting for the release of defects at an enterprise

The enterprise uses a complex system for recording defects if different categories of defects are used: correctable and irreparable, external and internal, quantitative accounting is required, etc.

Let's consider a possible option for accounting for the release of defects without additional configuration modifications.

Example:

In Workshop No. 1, 11 cabinets and 20 coffee tables were produced.

Let's reflect the production output using the document “Production Report for a Shift”:

By default, each manufactured product is assigned the “New” quality. Let's assume that the QCD assessment occurs later (after the products are received into the warehouse).

In the “Quality” directory we will set possible options for the quality of products:

Example:

According to the QCD assessment, 1 cabinet was considered a final defect, 2 coffee tables - a correctable defect.

To reflect this operation, we will enter a document for changing the quality “Adjustment of the quality of goods”:

As a result, in the report “Statement of batches of goods in warehouses” we see all manufactured products in terms of quality, including in quantitative terms:

Example:

We write off as expenses products that are considered final defects.

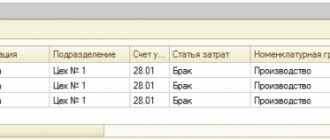

To reflect this operation, we will enter the document “Request-invoice”. We write off the final defect to the account. 28 “Defects in production”:

Pay attention to filling out the “Quality” field.

When posting the document, the following transactions will be generated:

Example:

Products recognized as correctable defects were sent to Workshop 1 for revision.

To reflect this operation, we enter the document “Request-invoice”:

When posting the document, the following transactions will be generated:

When carrying out the document “Calculation of the cost of production”, we will obtain the actual cost of each unit of output, taking into account the defects produced (both final and correctable). It is convenient to analyze the inclusion of costs for releasing defects (correctable and non-correctable) using the “Costs for Issue” report:

Accounting account 28 is the active account “Defects in production” and is used to account for losses from defects in manufactured products. Let's consider the use of account 28 in accounting, typical entries and examples of accounting for defects in production.