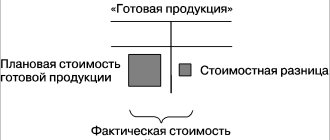

Account 40 in accounting to reflect production output

Account 40 is used to record the amounts of the planned cost of production (PlanSS) of products produced by the enterprise, as well as to reflect transactions on the actual cost of production (FactSS). Due to its specificity, the use of account 40 is carried out, as a rule, in enterprises that are engaged in mass production of products and goods with a large number of different items (wide range).

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

When calculating the actual cost indicator, carried out on account 40, use data on:

- consumption of materials and semi-finished products;

- cost of services (work) of third-party organizations;

- wage costs for production workers;

- fuel consumption;

- costs of maintaining production facilities, etc.

To find out what the planned cost will be, an organization can use data on similar products produced in the previous reporting period. Also, the planned cost can be calculated based on average consumption indicators.

Analytical monitoring

The main purpose of using the 40th account in accounting is to evaluate data on the normative and actual SS, which is necessary for making appropriate management decisions designed to ensure the efficient use of the resources of any company.

Saved resources, when a credit balance remains on account 40 at the end of the reporting period, must be reversed by Dt 90 position. If there is a debit balance, i.e. there is an overexpenditure of resources, it is written off to the debit part 90 of the account.

Such a comparison of data is observed, as a rule, in those companies where there are a huge number of product groups, and therefore the assessment of indicators is carried out in the context of structural divisions or product names.

Account 40: typical postings

The actual cost of manufactured products is reflected according to Dt 40. Kt 40 is used to reflect the write-off of cost calculated on the basis of planned indicators.

The operation of posting PlanSS amounts upon receipt of products from production is reflected in the following entry:

| Debit | Credit | Description | Document |

| 43 | 40 | Products produced from our own production are taken into account (PlanSS) | Certificate of release of finished products |

Read more about account 43 in the article: “Account 43. Finished products: postings, example.”

The write-off of FactSS is reflected in the following records:

| Debit | Credit | Description | Document |

| 40 | 20 | Write-off of the amount FactSS of manufactured products (main production) | Costing |

| 40 | 23 | Write-off of the amount FactSS of manufactured products (auxiliary production) | Costing |

| 40 | 29 | Write-off of the amount FactSS of manufactured products (service production) | Costing |

Read about the accounts used in the relevant articles: account 20 (production costs), account 23 (auxiliary production), account 29 (production services).

The use of products for production needs is reflected in the following entries:

| Debit | Credit | Description | Document |

| 20 | 40 | Manufactured products are written off for production needs (main production) | Limit fence card |

| 21 | 40 | Manufactured products are written off for production needs (use as semi-finished products) | Limit fence card |

| 23 | 40 | Manufactured products are written off for production needs (auxiliary production) | Limit fence card |

| 10 | 40 | Manufactured products are written off for production needs (use as materials) | Limit fence card |

If a defective product is detected, the following entry is made into accounting:

| Debit | Credit | Description | Document |

| 28 | 40 | Products released from production and rejected are written off | Write-off act |

Branches that the organization has placed on a separate balance sheet can use account 40 when recording the following transactions:

| Debit | Credit | Description | Document |

| 40 | 79.1 | The branch received products released from production from the head office | Transfer and acceptance certificate, invoice |

| 79.1 | 40 | The branch transferred products released from production to the head office | Transfer and acceptance certificate, invoice |

If the amount of excess of FactSS over PlanSS is identified, the amount of the difference is reflected in expenses. Also, the amount of previously written off expenses can be reversed based on the results of the reporting month:

| Debit | Credit | Description | Document |

| 90.2 | 40 | Overexpenditure is reflected: the difference between the actual SS of manufactured products and its planned indicator | Accounting certificate-calculation |

| 90.2 | 40 | Savings are reflected: the difference between the actual SS of manufactured products and its planned indicator is reversed | Accounting certificate-calculation |

Regulatory framework

Count 40 is regulated by the following regulatory documents:

- No. 402-FZ, adopted on December 6, 2011, which determines the mandatory reflection of transactions in the balance sheet;

- The Civil Code of the Russian Federation, where parts 1 to 4 establish the rules for performing operations regarding material assets and inventories among legal entities or individuals;

- Regulations on filling out financial statements in the Russian state from the Ministry of Finance of the Russian Federation;

- Chart of accounts in financial statements for the financial and economic processes of the enterprise, as well as instructions for their implementation;

- PBU 5/01;

- Guidelines that take into account material and production inventories, as well as inventory of property or financial obligations.

Account 40 when accounting for product costs

At the end of January 2021, Syndicate JSC sold 124 sets of crystal tableware:

- sales price – 1040 rub./unit, VAT 159 rub.;

- PlanSS set of dishes - 825 rubles;

- FactSS set of dishes - 843 rubles.

According to the accounting policy, Syndicate JSC keeps records of finished products according to PlanSS.

The accountant of Syndicate JSC made the following entries:

| Debit | Credit | Description | Sum | Document |

| 43 | 40 | Sets of crystal glassware were received at the warehouse of Syndicate JSC (RUB 825 * 124 units) | 102,300 rub. | Certificate of release of finished products |

| 40 | 20 | The fact of the dishes is taken into account (843 rubles * 124 units) | RUR 104,532 | Costing |

| 62 | 90.1 | Revenue from the sale of tableware is taken into account (RUB 1,040 * 124 units) | RUR 128,960 | Packing list |

| 90.2 | 43 | PlanSS of sold crystal sets is reflected in expenses | 102,300 rub. | Costing |

| 90.3 | 68 VAT | VAT charged on sales (RUB 159 * 124 units) | RUR 19,716 | Invoice |

| 51 | Funds from the buyer are credited as payment for sold sets of dishes | RUR 128,960 | Bank statement | |

| 90.2 | 40 | The difference between FactSS and PlanSS of sold utensils is reflected in expenses (RUB 104,532 – RUB 102,300) | RUB 2,232 | Accounting certificate-calculation |

| 90.9 | The received profit was taken into account based on the results of January 2021 (RUB 128,960 – RUB 19,716 – RUB 102,300 – RUB 2,232) | RUB 4,712 | Turnover balance sheet |

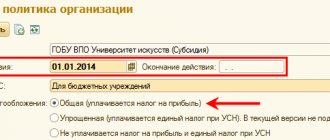

Creating an accounting policy in an organization

In this article we will take a closer look at accounting policies for accounting purposes. PBU 1/2008 does not contain detailed instructions on how to compose it and does not provide ready-made formulations. We can only find a list of information required for disclosure (clause 4 of section II) and principles of formation (clause 5 of section II).

What is included in the accounting policy:

- working chart of accounts;

- forms of primary accounting documents, documents for internal reporting;

- forms of accounting registers;

- inventory procedure;

- methods for assessing assets and liabilities;

- document flow rules and accounting information processing technology;

- the procedure for monitoring business operations;

- other solutions necessary for organizing accounting.

How exactly all this information will be described is a personal matter for the organization.

When drawing up an accounting policy, include in it only rules for those transactions that are currently occurring in the organization. For example, if you do not have intangible assets or financial investments, and this is also not planned in the near future, then there is no need to write about it.

Why? It is possible that by the time these operations finally appear in the organization, the accounting rules will change. Or in general, the option chosen in advance will not work. But if you haven’t chosen methods in advance, then when new operations appear, you can describe the rules for their reflection at the moment of their appearance. And this will not be considered a change in accounting policy (clause 10 of PBU 1/2008).

Account 40 when reflecting the cost of contract work performed

JSC “Advertising Project” is engaged in the installation and installation of advertising structures. Based on the results of July 2015, Advertising Project JSC:

- provided installation work to Modelier LLC in the amount of 54,200 rubles, VAT 8,268 rubles;

- The plan for installation work amounted to 33,250 rubles;

- Fact SS of completed installation work – RUB 36,420.

When recording transactions, the accountant of Advertising Project JSC made the following entries:

| Debit | Credit | Description | Sum | Document |

| 62 | 90.1 | Revenue from installation work provided by Modeller LLC is taken into account | 54,200 rub. | Certificate of completion |

| 90.2 | 40 | PlanSS of installation work is reflected in expenses | RUB 33,250 | Costing |

| 90.3 | 68 VAT | The amount of VAT calculated on the cost of installation work carried out | RUR 8,268 | Invoice |

| 51 | Funds have been credited from “Modelier” LLC as payment for installation work performed | 54,200 rub. | Bank statement | |

| 40 | 20 | The amount of FactSS work on the installation of advertising structures is taken into account | RUR 36,420 | Costing |

| 90.2 | 40 | The difference between the actual and standard cost of installation work is reflected in expenses (RUB 36,420 – RUB 33,250) | 3,170 rub. | Accounting certificate-calculation |

| 90.9 | The profit received based on the results of July 2015 is taken into account (RUB 54,200 – RUB 8,268 – RUB 33,250 – RUB 3,170) | RUR 9,512 | Turnover balance sheet |

Who should be responsible for creating accounting policies?

Creating an accounting policy in an organization is a painstaking and extremely responsible process. It is best to have an experienced professional do this.

We suggest contacting us for accounting and tax services!

Why are we more reliable than in-house accountants?

- You have a whole team working for you, not just one person. Which means additional verification from experienced certified specialists.

- We have not only accountants, but also lawyers, so we know all the features of drawing up documents.

- Thanks to the extensive experience of our team and each individual employee, we can predict in advance possible errors in filling out 2nd personal income tax and promptly correct them before filing reports.

Fill out the feedback form or call us at the specified phone number to find out about the cost and procedure. Remember, it is easier to prevent mistakes than to correct them!

Account 40: accounting for sold products and warehouse balances

As of 08/01/2015, the Borodinsky bakery records the balance of finished products in the amount of 243,500 rubles. During August 2015:

- The bakery warehouse received products (bakery products) in the amount of 761,200 rubles. (normative cost);

- expenses incurred for bakery shops (main production) - 918,400 rubles;

- balance of work in progress – 123,500 rubles;

- products sold according to PlanSS - 514,700 rubles.

The following entries were made in the accounting of the Borodinsky plant:

| Debit | Credit | Description | Sum | Document |

| 20 | 10 (70, 69, 25, 26) | Costs for the production of bakery products in August 2015 are reflected as expenses | RUR 918,400 | Limit cards, payroll statements, invoices, certificates of services rendered, etc. |

| 40 | 20 | FactSS of bakery products is taken into account (918,400 rubles - 123,500 rubles) | RUR 794,900 | Costing |

| 43 | 40 | Bakery products (standard cost) were received at the Borodinsky warehouse warehouse | 761.200 | Certificate of release of finished products |

| 90.2 | 43 | PlanSS of sold bakery products is reflected in expenses | RUB 514,700 | Costing |

| 90.2 | 40 | The amount of identified overexpenditure between FactSS and PlanSS is reflected (RUB 794,900 – RUB 761,200) | 33,700 rub. | Accounting certificate-calculation |

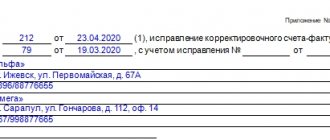

Forms of primary accounting documents

As can be seen from the list above, one of the components of the accounting policy is the approval of the forms of primary accounting documents. Law No. 402-FZ “On Accounting” gives the organization the right to use, at its discretion, standard forms approved by the State Statistics Committee or its own forms.

You can also use the forms recommended by the Federal Tax Service - UPD (universal transfer document) and UCD (universal adjustment document). But both those, and others, and the third should be approved in the accounting policy. All forms you use must be printed and attached. What does this look like in practice?