Export to Kazakhstan instructions

Export to Kazakhstan. Step-by-step instruction

The general procedure regulating export operations is established by Federal Law dated November 27, 2010 No. 311-FZ “On customs regulation in the Russian Federation.”

The Republic of Kazakhstan is an important trading partner of the Russian Federation and ranks 2nd among the CIS (after Belarus) and 10th among the rest of the world.

The length of the Kazakh-Russian border is 7,000 km, which means there are many options for fast and inexpensive delivery of various goods from Russian regions, which ultimately contributes to the specifics of active trade. At the same time, there are a number of bilateral agreements that help simplify the process of documenting exports to Kazakhstan.

The basis of Russian exports to Kazakhstan are:

- Mineral products are mainly fuels;

- Chemical industry products;

- Metals and products made from them;

- Products of plant and animal origin;

- Food products;

- Various automobile and cargo transport;

- Wood, pulp and paper products;

- Textiles, footwear;

- Various industrial products.

Making a deal

The execution of an export transaction is carried out according to the accepted scheme, which is identical for all EAEU states. To import goods into the Republic of Kazakhstan for companies from the Russian Federation, the following types of documents are required:

- Foreign trade agreement

. On the basis of which goods are imported. The contract must be drawn up correctly, excluding any inaccuracies and corrections, all details and other essential points must be indicated legibly; - Application for export of goods and payment of VAT for import by the buyer

. A visa for this document from the tax service is very important. Moreover, the value added tax itself must be paid to the budget before the 20th of the next month. The exporter must have a copy of this form in his hands. - Transport documentation

. Export of goods from Russia is impossible without appropriate documentary evidence. This can be a waybill, UPD, which must be signed by the driver, and indicate the number of the car on which the goods were transported. - Other required documents.

Depending on the production area, additional licensing, certification or permitting documents may be required. These can be certificates of conformity, documents confirming safety: phytosanitary, veterinary, etc.

VAT

When selling goods within the Customs Union, a special procedure is in effect, regulated by the above legislative acts. According to Article 2 of the CU Agreement, when selling goods within the CU, subject to documentary confirmation, a zero VAT rate is applied.

Instructions

When shipping goods to Kazakhstan, a consignment note and invoice are drawn up, indicating the VAT rate of 0%. There is no need to mark these documents with the tax office. If previously, VAT on the shipped goods was offset, it must be restored. The VAT amount can be deducted, or VAT can be submitted for reimbursement only after the fact of export has been confirmed.

In order to confirm export, it is necessary to collect a complete package of documents for export shipment. The package of documents should be collected no later than 180 calendar days from the date of shipment. The date of shipment is the date the document is issued to the buyer or carrier.

You will need to collect the following documents:

- Agreement (contract) on the basis of which the goods were shipped;

- Application for the import of goods and payment of indirect taxes in the approved form;

- Bank account statement confirming the transfer of the corresponding amount according to the contract;

- Invoice with zero VAT rate;

- Packing list;

- Transport and shipping documents confirming the export of goods;

- Agreement with the transport company with attachments;

- Completed tax return. For this operation, Section 4 or 6 of the VAT declaration is completed. When filling out, you should indicate the export transaction code:

- if exported goods within the country are subject to VAT at a rate of 18% - 1010406;

- if exported goods within the country are taxed at a rate of 10% - 1010404;

Application.

Return mechanism

- It is necessary to complete and submit a declaration to the tax authority. It is important that there are no errors in the document. Otherwise, firstly, VAT will not be returned when exporting to Kazakhstan, and secondly, there is a risk of receiving a fine;

- Waiting for a desk check. It is carried out by an authorized employee of the tax authority.

- Return of funds to the account based on the results of a desk audit.

The VAT refund process may take 3-5 months.

It is important to know

All foreign trade agreements between the Russian Federation and the Republic of Kazakhstan are mostly concluded in US dollars. Accordingly, export relations are affected by the state of the international market, therefore, as soon as the US dollar undergoes certain changes, this is reflected in the turnover of goods between Russia and Kazakhstan.

It is necessary to take into account the fact that almost all goods that are sent to Kazakhstan - 90% - are those that have a dual purpose. In this case, it is necessary to conduct additional examination. Its necessity is explained by the fact that it is necessary to confirm that there is no need for additional licensing. It is desirable if confirmation of a 0 VAT rate for export to Kazakhstan is carried out, although it is not mandatory. If there is no such conclusion, problems may arise at the border.

To make it clearer, the dual-use goods that Russia exports to Kazakhstan include those that are used for civilian purposes, but can also be used to create military weapons. Most often this is equipment, raw materials, and individual information resources of a scientific and technical nature. Such goods are additionally subject to export controls. For this purpose, a special commission has been created in Russia.

How to sell your goods from Russia to Kazakhstan:

Are you planning to organize the export of your goods from Russia to Kazakhstan, but don’t know where to start? We will help you organize the entire process of processing and sending your cargo to Kazakhstan from any city in Russia.

We are offering to you . We will buy your goods and send them to Kazakhstan ourselves. It doesn't require much effort from your accounting department. Thus, we will complete the transaction on your behalf on our behalf, and you will save yourself from checks by tax and customs services. We will offer you a choice of several well-established and profitable logistics chains and take all the worries upon ourselves.

How to fill out VAT returns

The new reporting form from 2015 and the procedure for filling it out were approved by Order No. ММВ-7-3.558 dated October 29, 2014. It is submitted by the 20th day of the month following the end of the quarter. But since documents to confirm export are allowed to be submitted within 180 days after shipment, the question arises: how to correctly record the export transaction? Let's consider three situations that arise in practice.

Example 1 A complete package to justify the zero VAT rate was collected on time - before the expiration of the reporting period in which the delivery was made (Fig. 1).

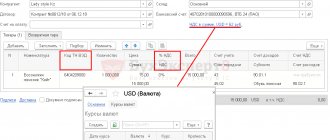

Phoenix LLC shipped goods under the contract on January 17, 2021 in the amount of $10,000, the exchange rate on this date was 76.56. The export price includes “input VAT” - 65,000 rubles. The organization collected all the necessary documents on March 20. When filing a declaration on April 20, 2021, Section 4 (1 reporting quarter) is completed. The figure indicated in column 030 is equal to the total amount of the tax reduction, and affects the calculation of columns 040 and 050 of section 1. Code 1010403 corresponds to VAT 18% (1010404 - 10%).

Figure 1. Filling out a declaration with timely confirmation of export to Kazakhstan.

Example 2 Under the same input conditions, the organization was unable to prepare documents within the required period of 180 days. Then, July 16, 2016 (181 days after the shipping date):

- you need to register the invoice in additional sheets of the sales and purchase books for the period when the delivery was made;

- calculate the tax and submit an updated return for the 1st quarter (Fig. 2);

pay tax and calculate penalties from the date of shipment for the entire missed period.

Figure 2. Calculation of the amount of tax payable to the budget in the absence of confirmation.

When calculating VAT in accordance with the Tax Code of the Russian Federation, the date of shipment is taken to be the day the primary accounting documents are issued for the buyer (waybill, invoice). On the other hand, according to the agreement between the CU countries, this is the last day of the quarter in which the entire package of documents is collected to justify the 0% rate. It follows that if, for example, this was done in April (the deadline has not passed), then it is enough to fill out the 4th section and submit the declaration before July 20. That is, when submitting reports for the second quarter.

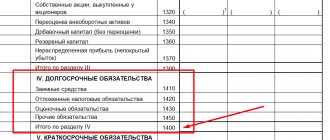

Example 3 Let's assume that the necessary documents were collected only in November 2021. This means that in fact the tax has already been paid, a declaration with completed section 6 has been submitted - for the reporting period, which covers 181 days.

Then in the declaration for the 4th quarter, the data in section 4 is entered as follows (Fig. 3). The total amount of compensation will be 137,808 rubles - tax without penalties. The latter, like fines, are not refundable.

Figure 3. Refund of export tax already paid.

The declaration has section 5, which is also intended to reflect foreign trade transactions. It is used when supporting documents have been collected, but the company did not have other necessary data on the day the report was submitted. For example, she did not have invoices for the tax that was previously included in the price. After receiving them, within 3 years you can claim the amount for a refund, and also take it into account as an overpayment against income tax.

What is the difference between a transaction through intermediaries?

In international trade, transactions involving third parties, especially transport companies, are very common. This is due to the fact that many Russian enterprises, especially representatives of small and medium-sized businesses, do not have a developed logistics infrastructure. The goods must be delivered exactly on time, and this requires the availability of transport, warehouses, and personnel. Usually one of three contract options is concluded:

- instructions - the attorney performs actions on behalf of the seller, and the exporter himself is responsible for everything; the scope of obligations depends on the contract, it may include delivery, transportation, filing claims, and so on;

- commissions - the commission agent most often concludes transactions for the exporter and at his expense, but on his own behalf: he is responsible to the buyer; may assume delcredero (guarantee) that the importer will not refuse the transaction;

- agency - the agent acts (concludes a transaction, stores, ships, delivers goods), both on his own behalf and on behalf of the seller; This determines who is responsible to the buyer.

When selling through an intermediary, the Federal Tax Service will additionally require the submission of a signed agreement with him, as well as transportation documents if the intermediate participant in the transaction is engaged in delivery. The buyer in Kazakhstan is also required to include his details in the application for the import of goods. Information about the agent and principal is reflected on a special page. If this data is not available, then it will be impossible to obtain VAT exemption when exporting to Kazakhstan. In conclusion, we note that trade transactions with partners from all EAEU countries are formalized in the same way.