Characteristics of account 02

In the company's accounting, all operations of financial and economic activities are carried out in the appropriate accounts. The accountant approves the working chart of accounts of the enterprise in the annex to the accounting policies, depending on the economic sector of the business. To account for accrued depreciation amounts, account 02 is used - active or passive? Since depreciation is calculated on the loan in correspondence with cost accounts, and written off by debit, account. 02 is passive, unlike, for example, account 68. 02 – in accounting it is considered active-passive.

Account structure 02:

- Credit opening balance - the amount shows the amount of depreciation accumulated at the beginning of the period.

- Debit turnover means the amount of depreciation written off upon disposal/write-off of fixed assets.

- Loan turnover means the amount of accrued depreciation on fixed assets.

- Credit opening balance - the amount shows the amount of depreciation accumulated at the end of the period

At the same time, it is necessary to organize reliable analytical accounting of inventory items of property in order to obtain complete information about the wear and tear on the OS. To do this, sub-accounts are opened, then a balance sheet is generated for account 02, and the balance at the end of the reporting/tax period is reflected in the organization’s balance sheet in a special way. Despite the fact that 02 – passive, when filling out accounting statements, the account balance does not fall into the liability side of the balance sheet. The balance of the “Depreciation” account is taken into account when calculating the residual value of fixed assets = Initial cost (balance of account 01) – depreciation (balance of account 02).

Analysis of account 02 is also carried out for the purpose of calculating property tax when determining average annual value indicators (Article 375 of the Tax Code). In this case, the main register is the SALT for account 02 or the order journal.

Note! The count should not be confused. 02 and MC account 02. These are two different accounts. The first is intended to reflect depreciation, the second is considered off-balance sheet and is used to summarize information on workwear transferred into service. Keeping such additional records is due to the need to control the organization’s property, which has already been written off from the balance sheet, but is still used in its activities.

Accounting entries for account 02

See full 2021 chart of accounts.

Account 02 is involved in the following standard transactions.

Depreciation calculation based on the degree of participation of fixed assets in the production process

| Debit | Credit | Operation |

| 08 | 02 | Calculated depreciation on operating systems used when upgrading other operating systems |

| 08/3 | 02 | Depreciation was calculated for fixed assets used in the construction of one’s own fixed assets facility |

| 20 | 02 | Depreciation was calculated for fixed assets used in the main production |

| 23 | 02 | Depreciation was calculated for fixed assets used in auxiliary production |

| 25 | 02 | Calculated depreciation for fixed assets for general production needs |

| 26 | 02 | Calculated depreciation for fixed assets for general business needs |

| 29 | 02 | Depreciation was calculated for fixed assets used in maintenance services |

| 44 | 02 | Depreciation was calculated for fixed assets used in servicing the sales process |

| 79 | 02 | Depreciation was calculated for fixed assets received from another division or transferred there |

| 91/2 | 02 | Calculated depreciation for fixed assets leased |

| 97 | 02 | Depreciation was calculated for fixed assets used in processes, the costs of which will be taken into account in future periods |

Write-off of accrued depreciation

| Debit | Credit | Operation |

| 02 | 01/Disposal | Write-off of depreciation on fixed assets that were disposed of, sold, liquidated, etc. |

| 02 | 03 | Write-off of depreciation on fixed assets that were intended for rental |

| 02 | 79 | Write-off of depreciation on fixed assets that was received or transferred to another division |

Account 02 – typical transactions:

- D 20 (25, , 26, 44, 91) K 02 - depreciation was accrued on fixed assets used for production purposes (general production; auxiliary production; for management or general economic needs; in trading companies; for leased objects).

- D 02 K 01 – reflects the write-off of depreciation accrued during the operation of the fixed assets.

- D 02 K 83 - reflects the increase in the company’s additional capital due to the depreciation of fixed assets.

- D 02 K 84 - reflects the restoration of depreciation accrued in previous periods.

- D 02 K 91.1 – reflects the write-off of depreciation upon disposal of fixed assets.

- D 83 K 02 – additional depreciation accrual due to revaluation of fixed assets is reflected.

Postings to account “02.02”

By loan

| Debit | Credit | Content | Document |

| 08.03 | 02.02 | Calculation of depreciation on a fixed asset item, which is accounted for on account 03 and used in capital construction | Regular operation |

| 20.01 | 02.02 | Calculation of depreciation on a fixed asset item, which is accounted for on account 03 and is used in the main production | Regular operation |

| 23 | 02.02 | Calculation of depreciation on a fixed asset item, which is accounted for on account 03 and used in auxiliary production | Regular operation |

| 23 | 02.02 | Calculation of depreciation on a fixed asset item, which is accounted for on account 03 and used in auxiliary production | Regular operation |

| 25 | 02.02 | Accrual of depreciation on an object of fixed assets for general production purposes, which is accounted for on account 03 | Regular operation |

| 26 | 02.02 | Accrual of depreciation on an object of fixed assets for general economic purposes, which is accounted for on account 03 | Regular operation |

| 29 | 02.02 | Calculation of depreciation on a fixed asset item, which is accounted for on account 03 and is used in service industries and farms | Regular operation |

| 44.01 | 02.02 | Calculation of depreciation on an item of fixed assets, which is accounted for on account 03 and used in organizations engaged in trading activities | Regular operation |

| 44.02 | 02.02 | Calculation of depreciation on an item of fixed assets, which is accounted for on account 03 and is used in organizations engaged in industrial and other production activities | Regular operation |

| 91.02 | 02.02 | Additional accrual of the amount of depreciation for previous periods for an item of fixed assets, which is accounted for on account 03 | Regular operation |

How to close account 02 “Depreciation”

Account 02 is closed only when an asset is written off from the balance sheet, that is, when property is sold, transferred free of charge, liquidated and other disposals. Earlier than the specified moment. 02 will always have a balance, since the initial cost of the fixed asset is transferred to the company’s expenses not at once, but gradually. Since this account is passive, closing is carried out by debiting account 02 in correspondence with accounts 01 (if depreciation is fully charged) or 91 (if the object is not fully depreciated).

Conclusion - in this article we have decided which account 02 is active or passive, and how entries for depreciation of fixed assets are generated in the organization.

Depreciation of fixed assets in accounting and tax accounting

During use, OSs lose their value due to wear and tear. Depreciation is the inclusion by fixed assets of their value over a certain period of time in finished products, works, and services.

Fixed assets in accounting and tax accounting have different criteria for classifying objects according to their value.

In addition, not all methods of calculating depreciation can be used in tax accounting. For this reason, there may be discrepancies in the amount of depreciation in accounting and when determining taxes.

For tax accounting purposes

The Tax Code of the Russian Federation establishes that fixed assets will be objects with a long service life and a price of 100,000 rubles and more.

Depreciation of fixed assets is calculated based on the original cost and the depreciation rate, which is determined based on the period of operation of the object.

Objects priced below 100,000 rubles must be shown in accounting as materials, so their price is immediately included in the cost of finished products.

The same objects that are defined as basic in tax accounting must be depreciated either linearly or nonlinearly.

The first of them involves determining the depreciation rate based on the useful life. The depreciation rate per year is calculated by dividing the unit by the useful life and multiplying by 100%. This method can be applied in tax accounting to all fixed assets.

Attention! The nonlinear method is applied only to operating systems whose application period does not exceed 20 years (group 1-7). Depreciation is determined based on the residual value of the object and the depreciation rate, which is determined for each group based on the period of use of the asset.

For accounting purposes

PBU establishes that fixed assets in accounting include objects with a price of 40,000 rubles or more. Subjects have the right to charge objects with a price less than the established criterion as expenses as materials. For objects that are priced as fixed assets, depreciation charges must be calculated.

In this case, companies and individual entrepreneurs have the right to use one of certain methods:

- Linear - by multiplying the original cost by the depreciation rate calculated based on the useful life.

- Declining balance method (non-linear) - by multiplying the residual value by the depreciation rate calculated based on the useful life.

- Proportional to the number of remaining years of use - the initial cost is multiplied by a coefficient defined as the number of years of use of the OS by the sum of the number of years of use.

- Proportional to the volume of products produced - the initial cost is multiplied by the number of products produced and divided by the planned volume of products that can be produced at the facility for the entire period of its use.

You might be interested in:

Account 71 in accounting: what is it used for, correspondence, subaccounts, main entries

Account 02 “Depreciation of fixed assets”

Account 02 “Depreciation of fixed assets” is intended to summarize information on depreciation accumulated during the operation of fixed assets.

The accrued amount of depreciation of fixed assets is reflected in accounting under the credit of account 02 “Depreciation of fixed assets” in correspondence with the accounts of production costs (sales expenses). The lessor organization reflects the accrued amount of depreciation on leased fixed assets as a credit to account 02 “Depreciation of fixed assets” and a debit to account 91 “Other income and expenses” (if rent forms other income).

(as amended by Order of the Ministry of Finance of the Russian Federation dated September 18, 2006 N 115n)

Upon disposal (sale, write-off, partial liquidation, transfer free of charge, etc.) of fixed assets, the amount of depreciation accrued on them is written off from account 02 “Depreciation of fixed assets” to the credit of account 01 “Fixed assets” (sub-account “Disposal of fixed assets”). A similar entry is made when writing off the amount of accrued depreciation for missing or completely damaged fixed assets.

Analytical accounting for account 02 “Depreciation of fixed assets” is carried out for individual inventory items of fixed assets. At the same time, the construction of analytical accounting should provide the ability to obtain data on the depreciation of fixed assets necessary for managing the organization and drawing up financial statements.

Account 02 “Depreciation of fixed assets” corresponds with the accounts:

| by debit | on loan |

| 01 Fixed assets 02 Depreciation of fixed assets 03 Profitable investments in material assets 79 On-farm calculations 83 Additional capital | 02 Depreciation of fixed assets 08 Investments in non-current assets 20 Main production 23 Auxiliary production 25 General production expenses 26 General business expenses 29 Servicing production and facilities 44 Selling expenses 79 On-farm settlements 83 Additional capital 91 Other income and expenses 97 Deferred expenses |

Characteristics of account 02 “Depreciation of fixed assets”

Account 02 is used by all business entities that have expensive property: offices and production workshops, machinery and equipment. Its characteristics include the following:

- The account shows the depreciation of the company's fixed assets, i.e. elements of property that are acquired by it for its own use for at least 12 months, belong to the right of ownership and are used in many production cycles;

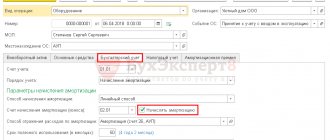

- within its framework, sub-accounts are opened in which depreciation is collected separately for each asset owned by the legal entity;

- sch. 02 corresponds with accounts that show different types of expenses of a business entity;

- it plays the role of a “transit zone”: the amounts collected on it upon disposal of fixed assets (regardless of the reason) are written off to the credit account. 01 and reduce the initial cost of the asset.

Account 02 “Depreciation of fixed assets” is passive. This means that the depreciation charge is shown on his loan. It reduces the value of the property and is written off when it is sold (liquidated). Thus, accounting reflects the process of transferring the value of the enterprise’s assets to finished products and assigning them to cost.

Account 01 in accounting