Preparation of an advance report: general rules

The general rules for filling out an advance report are as follows:

- From November 30, 2020, this report is compiled within the number of working days established in the employer’s local regulations, from the moment:

- the expiration of the period for which the funds were issued, specified in the employee’s application for the issuance of money on account;

- the employee returning to work if the period for which the money was issued expired during his illness or vacation;

- the employee's return from a business trip.

The requirement for a 3-day period for submitting a report from November 30, 2020 is excluded by the Bank of Russia’s instruction dated October 5, 2020 No. 5587-U. What other innovations in the procedure for recording cash transactions have come into effect, ConsultantPlus experts told. Get trial access to the K+ system and go to expert comments on the Central Bank Directive No. 5587-U dated 10/05/2020 for free.

For violation of the deadline, the employee can be punished financially.

For more information about this, see the article “The employee delayed the primary work again? . "

- The report is drawn up in the unified form AO-1 or in the form adopted by the organization.

You can see the report on our website. .

- Filled out jointly by the employee and the accountant.

- Approved by the manager.

- Documents confirming expenses incurred by the employee - checks, invoices, tickets, etc. are required as attachments to the report.

In what cases is it necessary to renumber documents?

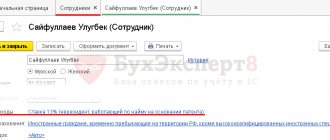

The 1C Accounting program is multifunctional. But there are times when errors appear that do not depend on the operation of the program. For example, a situation may occur in which the numbering of documents is violated. This error occurs, for example, due to the fact that the document number was manually corrected. If the user entered a document into the database on the previous date, or the document was deleted, then this also causes an error. Such manipulations in the database lead to the numbering sequence being broken. This situation is unacceptable. It is considered correct when all documents follow each other by number, there are no gaps, and numbers are not repeated. In this regard, there is a need to renumber documents.

How to fill out an advance report correctly

The advance report can be divided into 3 parts:

- The first (front) part is filled out by the accountant. Here the details of the document are reflected (its number and date), information about the organization and the accountable person, about the advance issued to him, summary information about the funds spent and accounting accounts that reflect their movement and write-off, as well as information about the issuance of overexpenditure to the employee or the receipt from him an unused advance.

- The second part is a tear-off receipt confirming the acceptance of the report for verification. The accountant fills it out, cuts it off and gives it to the accountant.

- The third part of the document (the reverse side of form AO-1) is filled out collectively. The reporting employee reflects in it line by line the details of the documents with which he confirms the expenses he has made, as well as the amount of the expense “according to the report.” And the accountant enters the amount accepted for accounting and the accounting account into which the expense will be “posted.”

The report is signed by the employee, accountant and chief accountant. Then it is submitted to the manager for approval - the corresponding stamp is on the front side of the document.

An advance report can be prepared not only in paper, but also in electronic form.

For more information about this, see the article “Advance report can be signed with an electronic signature” .

A line-by-line commentary on filling out advance reports was prepared by ConsultantPlus experts. Get free trial access to the system and proceed to the instructions.

Report-processing “Express check”

The 1C Accounting program has a built-in special processing report that will quickly check compliance with document numbering. In order to use it, you need to click on the “Reports” section in the main menu. Then, in the list of links, select the path “Accounting Analysis - Express Check”.

After clicking on this link, a window with an empty field will open. In the header of this window you need to fill in some details: the period for which the verification and organization is carried out.

If you click on the “Show settings” button, a list of possible checks will appear. By selecting items from this list, you can check for different sections of accounting. For example, identify shortcomings in accounting policies or check account balances as part of an accounting analysis. An express check also allows you to determine whether invoices have been issued or received in full, their timeliness, etc. Renumbering in the report is carried out only for invoices, incoming and outgoing cash orders, so the following items are checked with checkboxes:

- Cash transactions;

- Maintaining a sales book for value added tax;

If you click on the plus sign, a detailed check list will open. You should check the box next to the required item.

In order to select all available items, you need to press the button with checkmarks. This means that the Express check will be carried out in all possible areas of accounting. Accordingly, to deselect the entire list, you need to click the empty button.

If the user often uses the numbering check, then the report allows you to save the settings with the button of the same name. In the future, you will only need to click the “Select settings” button and specify the period to immediately download the report.

Thus, processing allows you to tailor the final report to the user's needs.

Attention! Renumbering cannot be used when counterparties have already reflected the documents in their accounting. Otherwise, there will be a discrepancy in the reconciliations of settlements between organizations. The tax office can also make comments if the time comes for a desk audit.

Advance reports in 2021 - 2021: where to see an example and fill out for free

There were no changes to advance reports in 2021 (as well as in 2019) - this document is still required to be completed. If the advance report is drawn up in electronic form, it is necessary to use an electronic signature by all employees involved in filling it out (letter of the Ministry of Finance dated August 20, 2015 No. 03-03-06/2/48232).

You can familiarize yourself with an example and sample of filling out an advance report on our website. Let's look at a hypothetical example.

Let’s say that on January 21, 2021, IKS LLC gave its employee O.D. Smirnov money in the amount of 20,000 rubles. for the purchase of 5 printer cartridges. There were no unused advances behind him. The purchase was made on the same day, and the employee submitted the report the next day, i.e. January 22.

The employee spent only 18,950 rubles. (The purchase was not subject to VAT because the seller applies the simplified tax system). Unused funds in the amount of RUB 1,050. he returned it to the cashier immediately upon submitting the report to the accounting department.

Here is a sample of filling out an advance report for this situation.

***

So, we found out that the advance report is used to confirm that accountable funds were spent as intended. The document is partially filled out by the employee and sent to the accounting department. The latter, when conducting the document, must put a number on it. Numbering is carried out in such a way that it is convenient for the business entity itself.

Similar articles

- How to correctly fill out an advance report - sample?

- Payment order number

- Sample advance report for a business trip

- Advance report on business trip 2016-2017 (sample)

Checking the sequence of PKO or RKO numbers

You need to start by opening the Express Check report. Then set the period, select an organization from the drop-down list and click the “Show settings” button. In the “Cash Transactions” section, check the boxes about and “Compliance with PKO numbering”. Then click the “Run check” button.

You need to wait some time for the report to be generated.

The test result will be displayed on the screen. If the system finds errors, the line with the accounting section will be colored orange.

To determine in which documents the numbering is incorrect, you need to expand “Cash Transactions” in more detail by clicking on the icon opposite the section. After this, a list of items with errors will appear.

As can be seen from the example, the system shows that the chronology in cash receipt documents is broken. Below is a hint on possible reasons for the errors. And in the next line recommendations are given for eliminating errors. In particular, the system offers to restore numbering using the “Automatic renumbering of documents” hyperlink.

To correct errors you must use this link.

You need to click on the link and a new window will open. The window that opens displays all documents for the selected period. The error is that document No. 4 is dated March 26, 2020, and document No. 5 is a day earlier. The adjacent column immediately indicates what number will be assigned to the documents after processing. If necessary, set the initial numbering number in the upper field. This is relevant if renumbering is carried out over a certain period.

In our example, you need to designate the starting number as the number of the first document of this period, that is, 4. Then click “Continue”. Processing will be completed and the result of the check will appear on the screen in a new window. As you can see, the system has corrected the numbering. Click “Close”.

Finally, you need to generate the “Accounting Express Check” report again to make sure that no errors are found.

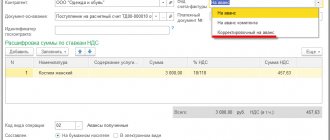

Checking the sequence of invoice numbers

To check compliance with the chronology of invoices, you need to open the “Express Check” report. Path: in the main menu, section “Reports - Accounting Analysis - Express Check”. Then in this processing, select the period, organization and click on the “Show settings” button. In the “Maintaining a sales book for value added tax” section, check the box “Compliance with the numbering of invoices”. Next, click the “Run check” button.

After this, a new tab will open, where you can see that there were errors during the check. In the line “Check Result”, cases of violation of the sequence of numbers in invoices were identified. The error is that document No. 22 is dated 02/21/2016, and document No. 21 is dated 02/22/2016. In the next line, the report tells you what caused the errors.

The line with recommendations suggests automatically renumbering documents. To do this, click on the hyperlink of the same name. After clicking on the hyperlink, a new window will open.

In it, the processing reflected all documents for the selected period. If necessary, you can specify the starting numbering number. This may be necessary when renumbering is carried out for a certain period, for example, a quarter.

After this, click the “Continue” button and processing will begin. When the renumbering process is completed, a new window will open.

As you can see, the documents have been assigned new numbers, and the chronology has been restored.

Attention! You should not use renumbering of invoices if they are already reflected in the accounting records of your counterparties. As a result, discrepancies may be identified in the Reconciliation Report between organizations and, when checking VAT, comments from the tax office may be possible.

After renumbering, you must again generate the “Express Check of Accounting” report to make sure there are no errors.

The regenerated report indicates that no errors were found.