Purpose of opening balance

Definition 1

The balance sheet is an economic model that links the assets, equity capital and liabilities of an organization and allows users of financial statements to assess the financial position of a business entity as of a certain date.

There are many types of balance sheets. The formation of a balance sheet of one type or another depends on the purpose pursued by the persons interested in this information. In the case when it is necessary to reflect data on the organization’s property and the sources of their origin at the time of the start of its activities, an opening balance sheet is formed.

Finished works on a similar topic

- Coursework Introductory balance sheet 490 rub.

- Abstract Opening balance sheet 230 rub.

- Test work Introductory balance sheet 190 rub.

Receive completed work or specialist advice on your educational project Find out the cost

The amount of debt is immaterial

In such circumstances, reflect the prepayment transferred to the supplier on line 1190 (for advances related to the acquisition of non-current assets, for example, construction or purchase of a building) or line 1230 (for other advances). In both cases, minus VAT, which can be deducted (or has already been deducted).

Essentially the same procedure applies to prepayment received from the buyer. Reflect it on line 1450 (for long-term advances) or line 1520 (for short-term advances) minus VAT, which is due to the budget.

Features of the opening balance

According to the provisions of Russian accounting standards, economic entities are required to form an opening balance sheet in the following cases:

- When creating a new legal entity.

- During reorganization, that is, the formation of a legal entity by:

- transformations;

mergers;

- discharge;

- divisions;

- accession.

The opening balance sheet, both when creating a new legal entity and its emergence as a result of the reorganization of two or more organizations, is compiled as of the date of state registration. This date is considered to be the date of entry of the relevant information into the Unified State Register of Legal Entities (USRLE).

Comparability of indicators

The balance sheet indicators for the reporting period and the two previous years must be comparable. That is, they must be formed according to the same rules. Incomparability of indicators may arise if significant errors from previous years were identified in the reporting period and (or) the organization’s accounting policies changed. In this case, in the Balance Sheet for the current period, last year’s indicators will have to be adjusted based on the current conditions. But the balance sheets themselves for previous periods do not need to be corrected.

Information about the adjusted indicators is reflected in the Explanations to the Balance Sheet and the Statement of Financial Results. This procedure follows from Part 1 of Article 13 of the Law of December 6, 2011 No. 402-FZ, paragraphs 10, 33 PBU 4/99 and paragraphs 14, 15 PBU 1/2008.

Opening balance when creating a new organization

When a new legal entity is formed, the first step is to form the authorized capital. Data on the size of the authorized capital and the property with which it was formed are reflected in the opening balance sheet.

Let's look at the formation of the authorized capital and its reflection in the opening balance sheet using an example.

Are you an expert in this subject area? We invite you to become the author of the Directory Working Conditions

Example 1

On July 3, 2017, an entry was made in the Unified State Register of Legal Entities about the state registration of Sever LLC. We have already completed a practice report

LLC "OMT" more details. The founders of Sever LLC were 3 individuals, who contributed the following property as their contributions on 07/03/2017:

- Ivanov I.I. – equipment worth 500 thousand rubles;

- Petrov P.P. – materials worth 250 thousand rubles;

- Sidorov S.S. – funds in the amount of 250 thousand rubles to the organization’s cash desk.

The accounting records should reflect the following facts of the economic life of Sever LLC as of 07/03/2017:

As of July 3, 2017, the opening balance sheet of Sever LLC was formed (simplified version):

Accounting is maintained without any pauses or omissions all the time during which the business structure carries out economic activities, right up to the liquidation of the enterprise.

The right balance sheet, which determines the amount of property of the newly created enterprise, is called the opening balance sheet. At the end of the next reporting period, based on the results of the transactions performed, a final balance sheet is drawn up, which, as it were, sums up the reporting period. It is compiled according to current entries in accounting accounts. All balances from these accounts are transferred to the closing balance. [p.43] Opening (organizational) balance - indicates the emergence of a new organization, i.e. Essentially, this is the balance sheet of the newly created organization. The property mass shown in it turns out to consist mainly of monetary contributions of the founders (participants) and organizational expenses. Drawing up the opening balance sheet essentially opens up accounting in a given organization. [p.60]

For what purpose is the opening balance drawn up [p.115]

Answers 1. 2. 3. 4. Introductory balance. Balance is gross. Final balance. Net balance. [p.115]

Information connections of financial statements in dynamics are characterized by continuity of balance sheet indicators, opening balances of certain forms of the annual report. In particular, the balances of the items of the opening balance sheet at the beginning of the year must coincide with the data of the same items of the final balance sheet at the end of the previous year. Possible discrepancies associated, for example, with changes in the nomenclature of balance sheet items, with changes in the methodology for calculating individual items, or with organizational restructuring of the organization, should be commented in detail in the explanations to the report. [p.13]

The opening balance is drawn up at the time of establishment of the organization. It determines the sum of values with which an organization begins its activities. [p.25]

Column 3 provides data at the beginning of the year on the opening balance, i.e. data in column 4 of the previous annual balance sheet, taking into account the reorganization carried out, as well as changes related to the application of the Regulations on accounting and financial reporting and PBU 1/98. [p.28]

Opening balances are drawn up at the time of organization of enterprises (registration of the charter). Accounting for a given business entity begins with the opening balance sheet. There are opening balance sheets of newly created enterprises and business units formed on the terms of succession of previously operating ones. In the first case, the opening balance sheet reflects the authorized capital registered in the charter of the enterprise, and inventory lists of actually contributed property and property (mainly monetary) obligations of the founders for contributions to the authorized capital. [p.282]

In the second case (the newly created enterprise is organized on the basis of a previously operating one), the opening balance sheet may correspond to the final liquidation balance sheet of the enterprise, of which the newly created enterprise is the legal successor, however, with clarification of the assessment of individual items of the liquidation balance sheet. Finally, when the opening balance sheet is prepared for a company acquired at auction at a price that exceeds (understates) the net value of identified tangible and intangible assets, it is necessary to enter into the opening balance sheet an indicator of the positive or negative reputation of the company. [p.282]

Current balances. Unlike opening balances, which are compiled only once (at the time of organization of the enterprise), current balances are developed in accordance with the principle of the accounting period periodically throughout the operation of the enterprise and are divided into initial (incoming), intermediate and final (outgoing). [p.282]

What is the difference between opening balances and incoming balances [p.296]

When constructing the static equation for the opening balance sheet, the balancing indicator is considered to be the advanced (initially invested) capital, or participant contributions (CAC). Consequently, at the stage of the opening balance sheet, the owner’s capital (OC) consists of only one component - the capital declared in the constituent documents (KSA), or [p.372]

At the stage of the opening balance sheet, the organization has no accounts payable (PS liabilities - 0), which allows equation (14.16) to be written as follows [p.372]

It seems appropriate to divide the stages of the procedure into one-time ones, performed at the time of organization of the enterprise and initialization of accounting (which, according to the principle of continuity, is maintained from the moment of the emergence of an economic entity - registration of the charter and until its liquidation without omissions or interruptions), aimed at building the opening (organizational) balance sheet ( i.e. inventory and opening balance), and the stages implemented and repeated from reporting period to period (the remaining stages). [p.486]

It is the value of net assets, calculated from inventory, that is used in the formation of opening balance sheets compiled for organizations that, for some reason, have not kept records since the start of their activities. Similarly, a recovery balance is constructed in cases where organizations violate the principle of accounting continuity and allow failures in the sequence of reflecting the facts of economic life, for example, loss, theft or destruction in the event of a fire or natural disaster of a significant number of supporting documents, the renewal of which does not seem realistic. [p.487]

In the above formula there are no obligations of the economic entity to second and third parties, since at this point in time production, economic and financial activities have not yet been carried out, the owners’ capital has not been contributed, but only declared, obligations (accounts payable) have not been formed and there are obligations (accounts receivable debt) of the founders for contributions to the authorized capital. Consequently, for organizations that build an opening balance sheet according to the charter at the time of organizing an economic entity, the inventory should contain only a list of obligations (debts to the organization) for the founders’ contributions to the authorized capital and a list of property actually contributed by the participants at the time of registration of the charter. The opening balance is constructed using a formula similar to (14.20) [p.487]

The column At the beginning of the reporting year shows data at the beginning of the year (opening balance sheet), which must correspond to the data in the column At the end of the reporting period of the previous year (closing balance sheet), taking into account the reorganization carried out at the beginning of the reporting year, as well as changes in the assessment of financial reporting indicators related to with the application of the Regulations on accounting and financial reporting in the Russian Federation and the Regulations on accounting Accounting policy of the organization PBU 1/98. [p.341]

For Pacioli, there was no explicit opening balance. The initial records arose on the basis of [p.270]

Based on the Memorial, Journal articles were compiled reflecting the facts of economic life. They were located behind the articles, previously transferred from the Inventory and showing the state of affairs of the partnership at a certain moment. In our interpretation, these items, as stated earlier, are separated into a separate opening balance sheet. [p.273]

It is easy to see that one of the main functions of an accountant is recording the facts of economic life. He resorts to it when compiling inventory and the opening balance sheet, and the journal, and the General Ledger (in the latter case partially). The grouping is concentrated in the General Ledger and the turnover sheet, the interpretation is in the final balance sheet and partially in the General Ledger. [p.49]

With the opening of an enterprise, an opening balance sheet is drawn up, which is nothing more than converted inventory, but in a different form, more convenient for financial analysis, assessment of given resources and available opportunities. [p.51]

Qualification begins with posting the opening balance data to the accounts. If the data is taken from an asset, then it is recorded on the left side of the corresponding account - a debit, if from a liability - on the right side - a credit. [p.52]

Let's look at the opening balance sheet and try to understand (interpret) the economic situation reflected in it using three criteria: leverage, liquidity and profitability. [p.63]

Profitability. The opening balance sheet does not provide grounds for assessing profitability, since the economic activity of the enterprise has not yet begun. It can be stated that the owners, mainly at the expense of their own funds, having incurred huge initial costs, strive to obtain sufficient profit. [p.64]

When opening the General Ledger according to the opening balance sheet, the indicators of its asset are recorded in debit. [p.293]

The opening balance is evidence of the establishment of the company. It is drawn up either after registration of the company’s charter, or after adding assets to the authorized fund. [p.406]

The balancing indicator in the opening balance sheet is the authorized capital, since at this stage there is no other source of income due to the lack of economic activity. [p.66]

Inventory balances are compiled according to inventories (inventories) of individual assets and sources of their formation (for example, an opening balance sheet confirmed by the constituent documents of a legal entity). [p.74]

Opening balances are directly related to the acquisition of the status of a legal entity by an organization, i.e., after its state registration. [p.78]

Depending on the time of preparation, balance sheets can be opening, current, liquidation, separation and consolidation. The opening balance sheet is drawn up at the time of the company’s inception, or more precisely, after registration of its constituent documents. It records the amount of values and the sources of their formation with which a given company begins its activities. Current balances are compiled periodically throughout the existence of the organization. They are divided into initial (incoming), intermediate and final (outgoing). The concepts of initial and final most often refer to the annual balance sheet - the initial balance is formed at the beginning, and the final balance - at the end of the reporting year. Obviously, in dynamics over the years, any balance can be considered simultaneously both as final (in relation to the past year) and as initial (in relation to the coming year). Interim balances are compiled for a period of less than one year. The main difference between the interim and initial (closing) balance sheets is that interim balance sheets are compiled, as a rule, only on the basis of current accounting data, whereas before drawing up the final balance sheet, a complete inventory of all balance sheet items must be carried out, with its results reflected in the accounting and reporting, as a result of which the closing balances are more realistic. The liquidation balance sheet is formed during the liquidation of an organization. Most often, the liquidation balance sheet is compiled twice - at the beginning of the liquidation period (introductory liquidation balance sheet) and at the time of completion of the liquidation process (final liquidation balance sheet). The separation balance sheet is compiled at the time of division of a large organization into several smaller structural units or the transfer of one or more structural units of this organization another organ- [p.207]

We will try to consider the various stages of the production, economic and financial functioning of an organization in the form of separate models (opening balance sheet, static-dynamic book accounting equation, closing balance sheet). [p.372]

Opening balance model. The opening balance at the beginning of the activity is characterized by limited capital of the owner, the absence of debt obligations to third parties and refers to inventory balances. It is built using two inventories [p.372]

According to prof. Y. V. Sokolova [99. P. 62], the procedure provides for the following stages: inventory, opening balance, journal, general ledger, turnover sheet and closing balance. -s- [p.486]

In parallel with the Journal, in which all entries are placed in chronological order, the General Ledger was maintained. In it, all the facts of economic life are systematized by grouping their data into accounts. The difference between the General Ledger described by Pacioli and a modern similar register is that the opening balances of accounts are not distinguished as such and are shown as account turnover1. The reason is the lack of an opening balance, which was already mentioned above. [p.282]

Line numbering

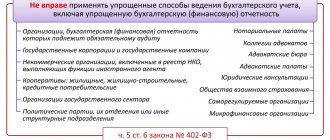

Fill out the “Code” column in accordance with Appendix 4 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010. You only need to number the lines if you submit reports to the statistics department and the tax office. However, there are specific features for certain categories of organizations. Thus, organizations that have the right to use simplified accounting methods (for example, small businesses) reflect aggregated indicators in the balance sheet, which include several indicators. In this case, enter the line code according to the indicator that is larger in value than others included in this line.

If you prepare reports for shareholders or other users who are not representatives of state control, it is not necessary to number the balance sheet lines.

This follows from paragraph 5 of the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n and part 4 of Article 6 of the Law dated December 6, 2011 No. 402-FZ.

Filling procedure

According to the procedure for filling out a balance sheet, first indicate the reporting date for which you are preparing the balance sheet. For example, if the balance sheet is drawn up for 2015, then the reporting date is December 31, 2015.

Then enter the full name of the organization in the same way as it appears in the constituent documents (in the charter).

In the “By OKPO” field, enter the code in accordance with the classifier of enterprises and organizations.

Please enter your Taxpayer Identification Number (TIN) in the line below. You can view it in the registration notice issued by the Federal Tax Service upon registration.

Enter the type of economic activity in accordance with the classifier approved by order of Rostekhregulirovaniya dated November 22, 2007 No. 329-st.

Next, enter the legal form, form of ownership and their codes. Determine the OKOPF code using the classifier approved by order of Rosstandart dated October 16, 2012 No. 505-st. Determine the OKFS code using the classifier approved by Decree of the State Standard of Russia of March 30, 1999 No. 97.

Enter the unit of measurement. Indicate the value of property and the sources of its formation either in thousands or millions of rubles without decimal places (Appendix No. 1 to Order of the Ministry of Finance dated July 2, 2010 No. 66n). These units of measurement correspond to OKEI codes 384 and 385, respectively. These codes are given in the classifier approved by Decree of the State Standard of Russia dated December 26, 1994 No. 366.

Indicate the address of the organization, the one that is stated in the charter and recorded in the Unified State Register of Legal Entities.

In the “Explanations” column, reflect the number from the explanatory note that corresponds to the line of explanation. This column is filled in only at the end of the year.

Rounding of indicators

Prepare financial statements in thousands or millions of rubles without decimal places. That is, all numerical indicators must be rounded to whole decimal places.

Rules for rounding reporting indicators are not prescribed by law. Therefore, an organization can establish them independently in its accounting policies for accounting purposes.

The best way is to round according to the rules established for calculating taxes. They are spelled out in paragraph 6 of Article 52 of the Tax Code of the Russian Federation. This norm provides that amounts less than 50 kopecks are discarded, and indicators valued at 50 kopecks or more are rounded up to the full ruble. This method is consistent with the rules of arithmetic.

For example, when compiling a balance in thousands of rubles, the balance on the subaccount “Additional capital (without revaluation)” of account 83, equal to 5,678,300 rubles, is reflected in section III of the balance sheet on line 1350 in the amount of 5678. If the balance on this subaccount is 5,678 629 rubles, then in section III of the balance sheet on line 1350 you need to indicate 5679.