Comments

- 09/02/2015 Donatella

Good day, dear colleagues! I have the following question for you regarding losses: tell me, isn’t it dangerous to show Appendix 5 to Sheet 2 of the Income Tax Return if the current return contains losses? If it is not dangerous, then please tell me whether the specified Appendix must be filled out both in the declaration for the 1st quarter and for the year, or can we limit ourselves to the annual declaration? Thanks for your answer in advance.

Reply Link

- 09/03/2015 Elena Kurbatova, Lead Auditor, GSL Law & Consulting

Good afternoon, Donatella! Appendix No. 5 to Sheet 02 of the Tax Declaration for Corporate Profit Tax provides a calculation of the distribution of advance payments and corporate profit tax to the budget of a constituent entity of the Russian Federation by an organization that has separate divisions. In clause 1.1. Appendix No. 2 to the order of the Federal Tax Service of Russia dated November 26, 2014 No. MMB-7-3/ [email protected] “On approval of the form of the tax return for corporate income tax, the procedure for filling it out, as well as the format for submitting the tax return for corporate income tax in electronic form" it is stated that, in particular, Appendix No. 5 to Sheet 02 is included in the Declaration and is submitted to the tax authority only if the taxpayer has separate divisions. Thus, the submission of Appendix No. 5 to Sheet 02 depends on the presence/absence of separate divisions of the taxpayer, and not on the period for which the Tax Return is submitted and not on the financial result obtained in the reporting period.

Reply Link

Add a comment

The Secret of Bernard Baruch

Bernard Baruch was once an advisor to several American presidents, a position he achieved through his distinguished career as a stockbroker on Wall Street. It was Bernard Baruch who said that a stock speculator only needs to be right in 3-4 cases out of ten in order to become a wealthy person, if at the same time he is smart enough to cut off losses in time.

In fact, this means that success on the stock exchange is almost entirely based only on the ability to fix losses in a timely manner. Let's take a look at the market from the point of view of mathematical probability theory. If the selection of stocks is carried out according to the principle of random numbers, that is, completely randomly, then the probability of choosing those that will increase after some time is approximately equal to the probability of choosing those that will fall in price. In other words, on average, a trader will be right five times out of ten, and this, according to Bernard Baruch, is more than enough to achieve success (of course, provided that unprofitable shares are cut off in a timely manner).

Regardless of the level of intelligence, education, analytical skills and other undeniable advantages, no person can always be right. But this is not required.

You don't have to be right every time, you just need to try to reduce your losses when you are wrong

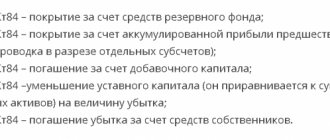

We reduce the loss in the “profitable” declaration for 2012.

You can either wait, allowing for some “profitable” expenses, or find some backup income. Of course, it would be better to do this before 2013. But even now you can:

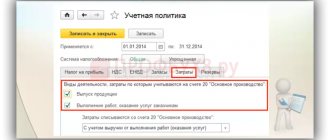

1) do not create reserves for 2013 to pay for vacations, to pay remuneration for long service, for OS repairs, for warranty repairs, for doubtful debts. Since their reflection in tax accounting is the right of the organization, and not the obligation. Unused balances of reserves as of December 31, 2012 will need to be taken into account in non-operating income. This can be done if you did not mention the creation of these reserves in your accounting policy for 2013 or mentioned , but for some reason they did not submit it to the Federal Tax Service and are now ready to “correct” it. After all, controllers oppose making such changes to tax policy within a year

2) abandon the use of bonus depreciation. Here, too, corrections in accounting policies will be required;

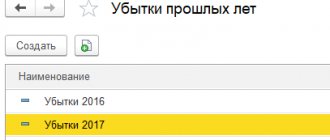

3) if there are losses from previous years, do not take them into account in expenses or take into account a small part of them. But the period for carrying forward losses is limited to 10 years

4) do not take into account some expenses for profit tax purposes at all or try to transfer them to the future.

The first three methods are your company's in-house methods, so they are relatively safe. And the last method, although available to everyone, is the riskiest when it comes to transferring costs.

Usually they try to transfer costs to the future by “creating” artificial errors. It seems like they didn’t notice the expenses then, but the next year, when income appeared, they saw the expenses. But, according to the Federal Tax Service, reflecting such emerging expenses as the current period is permissible only if it is impossible to determine the period of the error. But the Ministry of Finance is more loyal and believes that this can be done in the case when the period of the error is established, but due to the error there was excess tax has been paid. That is, it is necessary to ensure that the period from which the expense is transferred becomes not even “zero”, but profitable. Only then will it be possible to take advantage of this norm

In practice, organizations have already managed to successfully account for expenses in later periods. Thus, the company was able to prove that it had discovered an expense due to its prescription in the current period, since it had only now carried out a debt reconciliation with the counterparty, thanks to which it became known that the expense had not been taken into account. You can take this into account.

Read more: Tax deduction when buying an apartment without a mortgage

At the same time, everyone knows the requirement of the Tax Code, according to which expenses must be recognized in the reporting period to which they relate. And for example, as follows from one court decision, the tax authorities did not like the fact that the contract for the work was concluded in 2009, and expenses for it were recognized only in 2010. The organization defended its case by only presenting an invoice and signed certificates of work performed, also dated

The main way to reduce tax is to convert capital costs into current ones

The company cannot immediately write off capital costs as cost. This applies to the acquisition of fixed assets, machinery, equipment, buildings and structures that the entrepreneur uses in commercial activities.

Read more: How long does it take to impose a disciplinary sanction?

In this case, capital costs are not written off as cost immediately, but gradually, over the useful life of this capital property.

This happens through depreciation. For example, if the service life of a building is 20 years, then the costs of its acquisition or construction will be written off as cost over the entire 20 years. Cars, equipment, and machines are usually written off within 5-10 years.

Convert major repairs to current ones

When it is necessary to carry out a major overhaul of an office space - change windows, add an entrance, redesign something, then the costs of this overhaul increase the cost of the building itself and will also be written off along with the cost of the building.

That is, if you spend a certain amount this month on major repairs, you can write it off as expenses over several years. Although it is economically feasible to write off immediately and, accordingly, receive a reduction in income tax in the current year, and not over the next few years.

This can be done, for example, by concluding an agreement with a construction (repair) organization to provide services not for capital repairs, but for current repairs.

It would seem that the amount spent on major repairs will in any case be written off as expenses and, in any case, will reduce the cost and it seems - what difference does it make when this happens? The general rule of the value of money applies here: money today is always more expensive than tomorrow.

Important! By saving money on income taxes now, you can use it for development tomorrow!

However, in the case of transferring “capital” into current expenses, you need to be careful: not all expenses can be written off as current expenses - there is a clear division of which expenses go where and the gap for making a decision “overhaul or routine repairs” is actually small.

The tax inspectorate may have questions that you will have to answer and prove the correctness of your actions.

Convert fixed assets into leased ones

To do this, you need to transfer (or sell) your fixed assets, including buildings and structures, to another company, and then rent them from that company.

You will continue to use your equipment in your normal activities, but you will write off its cost not in small parts over several years, but in the form of rental payments, which are significantly greater than depreciation amounts.

A company that you create yourself can act as a lessor; this company will operate under a simplified taxation system. In this case, it will not yet be subject to property tax paid on the residual value of fixed assets.

Of course, the amount of rental payments that you write off as the cost of your company will at the same time be the income of your other company operating under the simplified tax system. But even taking into account paying 6% on the income of that company, your savings will be impressive.

And if you transfer to that company fixed assets for which depreciation has already been completed, then you will receive a double benefit effect: you will write off as expenses the cost of renting property, the cost of which was already taken into account in the cost price and when reducing income tax.

When applying this scheme, it is necessary to take into account that all costs written off as cost and reduced by income tax must be economically justified.

The fact is that the tax service may recognize the transaction of transferring property to another company and leasing it back as imaginary and you will have to pay income tax “in full.” To prevent this from happening, you will need to prove that everything you did was justified.

To do this, you can make sure that the established company operating under the simplified tax system does something else besides renting out your property to you, and uses this property in this other activity.

How to reduce income tax for individual entrepreneurs

Tax reduction due to leasing

If you are going to purchase fixed assets or equipment, it is better to do it on lease. Leasing, or financial lease, allows you to apply accelerated depreciation to the acquired property, writing it off as expenses and thereby reducing income tax faster and in a larger amount than writing off the cost of fixed assets as expenses according to the usual depreciation scheme.

Read more: Restoring LLC documents step by step instructions

Accelerated depreciation is not applied by you, but by the leasing company from which you purchase the fixed asset. You write off the lease payments you make as expenses in the same period when you pay.

Using leasing, you write off the property as a cost during the term of the leasing agreement (usually 1-3 years). If you purchased the property yourself and wrote it off using normal depreciation rates, then this write-off would take you 10 years or more.

One of the advantages of using leasing is that you do not spend the entire amount necessary for this on purchasing property at once, but in parts. And even by paying the leasing company its commission (ensuring its profitability of work) and compensating it for the interest on the bank loan, which the leasing company most often uses, you still remain in the black.

A program for simplifying the financial reporting of a Business.Ru store has a wide range of capabilities and solutions for your business. You will be able to automate tax and accounting reporting, speed up the issuance of documents and eliminate possible errors when filling out. Try the full version of the program for automating the work of the Business.Ru store for free>>>