According to the Labor Code, the provision on remuneration of employees is not a document that must be present with the employer, since in general, issues related to remuneration are regulated by the employment contract. However, the adoption of a single local act, which would describe in detail all issues relating to the system of remuneration of workers, which is the provision on remuneration and material incentives, has a positive impact on the discipline of the team.

Labor legislation does not contain any specific or strict requirements for the content of the document. The following sections should be included in the wage regulations:

- A section with general provisions, in which the employer will outline the main goals of this document, the employees covered by the document, the requirements for employees for payroll, etc.

- The procedure for paying wages, payment terms;

- Description of the remuneration system used in the company;

- The minimum wage established by the company;

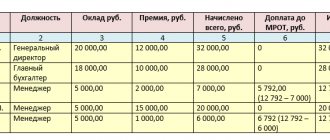

- Salary amounts established for certain company employees depending on the work performed or position held;

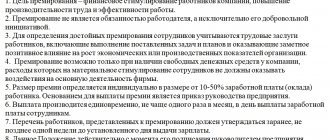

- Conditions for bonus payments to employees (if this issue is not regulated by a separate local act, for example, the Regulations on Bonuses);

- Conditions for withholding cash payments, limitations on the amount of withholding, rules, etc.;

- Other features that occur in this company.

The listed conditions are advisory in nature. The main thing that an employer must remember is that the provision on remuneration in no case should worsen the situation of the organization’s employees and should not contradict the law.

What it is

Regulations on remuneration of workers - a local regulatory act that includes the features, procedure and terms of payment of wages, wage systems established in the organization, mechanisms for calculating wages, the procedure for indexing and other significant issues related to the calculation and payment of all types of employees benefits, financial assistance, compensation, etc.

The wage regulation is not a mandatory document and its absence does not threaten the employer in any way, but in general it significantly makes life easier for both the employer and his employees.

The regulations do not have a unified form and are drawn up by each employer independently, taking into account legal norms and the specifics of the organization’s activities (IP).

Documents Statistics on documents and execution of orders

GOVERNMENT OF THE RUSSIAN FEDERATION

RESOLUTION

dated August 5, 2008 No. 583

Moscow

On the introduction of new systems of remuneration for employees of federal budgetary, autonomous and government institutions and federal government bodies, as well as civilian personnel of military units, institutions and divisions of federal executive authorities, in which the law provides for military and equivalent service, the remuneration of which is carried out on the basis Unified tariff schedule for remuneration of employees of federal government institutions

(As amended by the Decree of the Government of the Russian Federation of July 29, 2008 No. 725, dated December 17, 2010 No. 1045, dated 05.16.2012 No. 482, dated 09/26/2012 No. 975, dated 01/28/2013 No. 55, dated 14.01.2014 No. 20, dated, dated 01/14/2014, dated 12/10/2016 No. 1339, from 11/10/2017 No. 1349, from 11/09/2018 No. 1338, from 01/19/2019 No. 17)

The Government of the Russian Federation decides:

1. To introduce, from December 1, 2008, new remuneration systems for employees of federal budgetary institutions and federal state bodies, as well as civilian personnel of military units, institutions and divisions of federal executive authorities, in which the law provides for military and equivalent to it is a service whose remuneration is carried out on the basis of the Unified tariff schedule for remuneration of employees of federal government institutions (hereinafter referred to as employees, civilian personnel). (As amended by Decree of the Government of the Russian Federation dated December 17, 2010 No. 1045; from January 1, 2021 as amended by Decree of the Government of the Russian Federation dated December 10, 2016 No. 1339)

2. Establish that the introduction of new wage systems for workers and civilian personnel is carried out:

federal government bodies - in relation to employees of these bodies and institutions subordinate to them;

heads of institutions - the main managers of federal budget funds - in relation to employees of these institutions, as well as institutions subordinate to them; (As amended by Decree of the Government of the Russian Federation dated January 14, 2014 No. 20)

federal executive authorities, in which the law provides for military and equivalent service, and the Main Directorate of Special Programs of the President of the Russian Federation - in relation to civilian personnel.

3. Establish that the wages of workers and civilian personnel (excluding bonuses and other incentive payments), established in accordance with the new wage systems, cannot be less than the wages (excluding bonuses and other incentive payments) paid on the basis of the Unified tariff schedule for remuneration of employees of federal government institutions, provided that the scope of job responsibilities of employees (civilian personnel) is maintained and they perform work of the same qualifications.

4. Establish that the volume of budgetary allocations to ensure the performance of the functions of federal government institutions (determined taking into account the provisions of paragraphs 22 - 24 of the Regulations on the establishment of remuneration systems for employees of federal budgetary, autonomous and government institutions, approved by this resolution), military units, federal government institutions and divisions of federal executive authorities in which the law provides for military and equivalent service, in terms of remuneration of workers and civilian personnel, provided for the corresponding main managers of federal budget funds in the federal budget and the budgets of state extra-budgetary funds, as well as the amount of appropriations provided for in budget estimates of federal government institutions subordinate to them (determined taking into account the provisions of paragraphs 22 - 24 of the Regulations on the establishment of remuneration systems for employees of federal budgetary, autonomous and government institutions, approved by this resolution), military units, federal government institutions and divisions, can be reduced only if subject to a reduction in the volume of public services they provide. (As amended by Decrees of the Government of the Russian Federation dated December 17, 2010 No. 1045, dated January 19, 2019 No. 17)

5. Approve the attached Regulations on the establishment of remuneration systems for employees of federal budgetary, autonomous and government institutions. (As amended by Decrees of the Government of the Russian Federation dated December 17, 2010 No. 1045; dated January 14, 2014 No. 20)

6. To the Ministry of Health and Social Development of the Russian Federation:

a) before August 10, 2008, approve professional qualification groups and criteria for classifying blue-collar professions and employee positions into professional qualification groups, taking into account proposals from interested federal executive authorities, agreed upon with the relevant trade unions;

b) before August 15, 2008, approve:

recommendations for the development by federal government bodies and institutions - the main managers of federal budget funds - of approximate provisions on the remuneration of employees of institutions (including recommendations for differentiating wage levels depending on the qualifications and complexity of the work performed, the procedure for determining and the amount of compensation payments, as well as the procedure for determining incentive payments and criteria for their establishment);

recommendations for concluding an employment contract and its approximate form;

c) before September 1, 2008, approve methodological recommendations for the development by federal government bodies of wage conditions for workers working in them and in their territorial bodies;

d) before November 1, 2008, organize and conduct training for specialists from federal government bodies and institutions - the main managers of federal budget funds in connection with the introduction of new remuneration systems.

7. Federal state bodies and institutions - the main managers of federal budget funds (except for those specified in paragraph 8 of this resolution), in agreement with the Ministry of Health and Social Development of the Russian Federation, approve:

until August 15, 2008 - lists of key personnel by type of economic activity to determine the salaries of heads of relevant institutions;

before September 1, 2008 - approximate provisions on remuneration of employees of relevant institutions by type of economic activity, taking into account recommendations approved by the Ministry of Health and Social Development of the Russian Federation.

8. The federal executive authorities, in which the law provides for military and equivalent service, and the Main Directorate of Special Programs of the President of the Russian Federation, shall approve by September 1, 2008:

a) the procedure for approving staffing tables (staffing) of civilian personnel of military units, institutions and units;

b) the size of salaries (tariff rates) of civilian personnel, taking into account the requirements for professional training and skill level that are necessary to carry out the relevant professional activities (professional qualification groups), as well as the procedure for determining the official salaries of heads of military units, institutions and divisions, their deputies and chief accountants;

c) the conditions, amounts and procedure for making compensation payments to civilian personnel in accordance with the list of types of compensation payments approved by the Ministry of Health and Social Development of the Russian Federation, but not lower than the amounts established in accordance with the law;

d) the conditions and procedure for making incentive payments to civilian personnel, as well as their amounts in accordance with the list of types of incentive payments approved by the Ministry of Health and Social Development of the Russian Federation;

e) the procedure for the formation and use of the wage fund for civilian personnel, including the procedure for allocating funds to pay salaries (tariff rates) for civilian personnel, including official salaries of managers, as well as additional payments and allowances of a compensatory and incentive nature;

f) (Repealed on January 1, 2012 - Decree of the Government of the Russian Federation dated December 17, 2010 No. 1045)

81. The conditions for remuneration of civilian personnel of federal autonomous institutions, the functions and powers of the founders of which are exercised by the federal executive authorities, in which the law provides for military and equivalent service, and the Main Directorate of Special Programs of the President of the Russian Federation, are established by collective agreements, agreements, local regulations acts in accordance with labor legislation, other regulatory legal acts of the Russian Federation containing labor law norms, taking into account the remuneration systems established in accordance with paragraph 8 of this resolution, which are of a recommendatory nature for the specified federal autonomous institutions. (Added from January 1, 2021 - Decree of the Government of the Russian Federation dated December 10, 2016 No. 1339)

82. Federal executive authorities, in which the law provides for military and equivalent service, and the Main Directorate of Special Programs of the President of the Russian Federation in relation to the federal government, budgetary and autonomous institutions, military units (units) subordinate to them, establish the maximum level of the ratio of the average monthly salary managers, deputy managers, chief accountants and the average monthly wages of employees of these institutions, military units (divisions) (excluding the wages of the head, deputy heads, chief accountant) taking into account the peculiarities of staffing (military personnel and civilian personnel) and the level of remuneration for their labor (monetary allowance, salary). (Added from January 1, 2021 - Decree of the Government of the Russian Federation dated December 10, 2016 No. 1339)

9. Federal government bodies, in agreement with the Ministry of Health and Social Development of the Russian Federation, shall, by September 15, 2008, approve the terms of remuneration of workers working in them and in their territorial bodies (including the size of salaries (tariff rates), as well as the procedure and conditions for payment of compensation nature and procedure, conditions and amounts of incentive payments in accordance with the lists of types of compensation and incentive payments), introduced from December 1, 2008.

10. Financial support for the expenditure obligations of the Russian Federation related to the implementation of this resolution is carried out within the limits of budgetary allocations provided for in the established order to ensure the performance of the functions of federal government institutions, military units, institutions and divisions of federal executive authorities, in which the law provides for military and service equivalent to it, in terms of remuneration of workers and civilian personnel, as well as for the provision of subsidies to federal budgetary and autonomous institutions for the financial support of their fulfillment of the state task for the provision of public services (performance of work) to individuals and (or) legal entities, taking into account the increase the volume of these allocations from December 1, 2008 by 30 percent due to the introduction of new remuneration systems. (As amended by Decree of the Government of the Russian Federation dated December 17, 2010 No. 1045; from January 1, 2021 as amended by Decree of the Government of the Russian Federation dated December 10, 2016 No. 1339)

11. To the Ministry of Labor and Social Protection of the Russian Federation: (As amended by Decree of the Government of the Russian Federation dated September 26, 2012 No. 975)

give explanations on issues related to the application of this resolution, with the exception of the provisions provided for in paragraphs 22 - 24 of the Regulations on the establishment of remuneration systems for employees of federal budgetary, autonomous and government institutions, approved by this resolution; (As amended by Decree of the Government of the Russian Federation dated January 19, 2019 No. 17)

make proposals within a month in accordance with the established procedure to bring the regulatory legal acts of the Russian Federation into conformity with this resolution.

111. The Ministry of Finance of the Russian Federation must provide clarification on issues related to the application of paragraphs 22 - 24 of the Regulations on the establishment of remuneration systems for employees of federal budgetary, autonomous and government institutions, approved by this resolution. (Added by Decree of the Government of the Russian Federation dated January 19, 2019 No. 17)

12. The Ministry of Defense of the Russian Federation, together with interested federal executive authorities, in which the law provides for military and equivalent service, and the Main Directorate of Special Programs of the President of the Russian Federation, shall submit, within a month in the prescribed manner, proposals for bringing the normative legal acts of the Russian Federation on issues , assigned to their area of jurisdiction, in accordance with this resolution.

13. Federal government bodies should bring regulatory legal acts on issues within the scope of their jurisdiction into compliance with this resolution.

14. Recognize as invalid from December 1, 2008 the acts of the Government of the Russian Federation in accordance with the attached list.

Chairman of the Government

Russian Federation V. Putin

APPROVED by Decree of the Government of the Russian Federation of August 5, 2008 N 583

REGULATIONS on the establishment of remuneration systems for employees of federal budgetary, autonomous and government institutions

(As amended by the Decree of the Government of the Russian Federation of July 29, 2008 No. 725, dated December 17, 2010 No. 1045, dated 05.16.2012 No. 482, dated 09/26/2012 No. 975, dated 01/28/2013 No. 55, dated 14.01.2014 No. 20, dated, dated 01/14/2014, dated 12/10/2016 No. 1339, from 11/10/2017 No. 1349, from 11/09/2018 No. 1338, from 01/19/2019 No. 17)

1. Remuneration systems for employees of federal budgetary, autonomous and government institutions (hereinafter, respectively, employees of federal institutions, federal institutions), which include salary amounts (official salaries), wage rates, compensation and incentive payments, are established by collective agreements, agreements, local regulations in accordance with labor legislation, other regulatory legal acts of the Russian Federation containing labor law norms, as well as these Regulations. (As amended by Decrees of the Government of the Russian Federation dated December 17, 2010 No. 1045; dated January 14, 2014 No. 20)

This Regulation does not apply to civilian personnel of military units, federal institutions and divisions of federal executive authorities, in which the law provides for military and equivalent service, and the Main Directorate of Special Programs of the President of the Russian Federation, to employees of federal government bodies, the system and conditions of remuneration which are established in accordance with paragraphs 8, 81, 82 and 9 of the Decree of the Government of the Russian Federation of August 5, 2008 No. 583 and other regulatory legal acts of the Government of the Russian Federation, as well as for employees of federal institutions in which the regulatory legal acts of the Government of the Russian Federation define a different procedure for establishing remuneration systems. (As amended by Decree of the Government of the Russian Federation dated January 14, 2014 No. 20; from January 1, 2021 as amended by Decree of the Government of the Russian Federation dated December 10, 2016 No. 1339; from January 1, 2021 as amended by Decree of the Government of the Russian Federation dated 11/10/2017 No. 1349)

2. Remuneration systems for employees of federal institutions are established taking into account: (As amended by Decree of the Government of the Russian Federation of January 14, 2014 No. 20)

a) a unified tariff and qualification directory of works and professions of workers, a unified qualification directory of positions of managers, specialists and employees or professional standards; (As amended by Decree of the Government of the Russian Federation dated January 14, 2014 No. 20)

b) (Repealed - Decree of the Government of the Russian Federation dated January 14, 2014 No. 20)

c) state guarantees for wages;

d) a list of types of compensation payments in federal budgetary, autonomous and government institutions, approved by the Ministry of Labor and Social Protection of the Russian Federation; (As amended by Decrees of the Government of the Russian Federation dated December 17, 2010 No. 1045; dated September 26, 2012 No. 975; dated January 14, 2014 No. 20)

e) a list of types of incentive payments in federal budgetary and government institutions, approved by the Ministry of Labor and Social Protection of the Russian Federation; (As amended by Decrees of the Government of the Russian Federation dated December 17, 2010 No. 1045; dated September 26, 2012 No. 975)

f) (Repealed - Decree of the Government of the Russian Federation dated January 14, 2014 No. 20)

g) recommendations of the Russian Tripartite Commission for the Regulation of Social and Labor Relations;

h) the opinions of the representative body of employees.

21. Remuneration systems for employees of federal budgetary and autonomous institutions are established taking into account the approximate provisions on remuneration of employees of subordinate budgetary and (or) autonomous institutions by type of economic activity, approved by federal government bodies exercising the functions and powers of the founder of these institutions, and by federal institutions - the main managers of federal budget funds, which are in charge of federal budgetary and (or) autonomous institutions. These sample provisions are of a recommendatory nature for federal budgetary and autonomous institutions. (As amended by Decree of the Government of the Russian Federation dated December 10, 2016 No. 1339; from January 1, 2021 as amended by Decree of the Government of the Russian Federation dated November 10, 2017 No. 1349)

Remuneration systems for employees of federal government institutions are established by regulations on remuneration of employees of subordinate federal government institutions by type of economic activity, approved by federal government bodies exercising the functions and powers of the founder of these institutions. These provisions are mandatory for federal government institutions. (From January 1, 2017, as amended by Decree of the Government of the Russian Federation dated December 10, 2016 No. 1339; from January 1, 2021 as amended by Decree of the Government of the Russian Federation dated November 10, 2017 No. 1349)

(Clause supplemented by Decree of the Government of the Russian Federation dated January 14, 2014 No. 20)

22. Federal state bodies exercising the functions and powers of the founders of subordinate federal institutions, when approving provisions (model provisions) on the remuneration of employees of subordinate federal institutions by type of economic activity, provide for the condition that the estimated average monthly wage of employees of these institutions does not exceed the estimated average monthly level of payment labor of federal civil servants and workers holding positions that are not positions of the federal civil service, the specified federal state bodies in relation to institutions performing state functions, vested in cases provided for by federal laws, with the authority to carry out state functions assigned to the specified federal state bodies , as well as ensuring the activities of the specified federal government bodies (administrative and economic, information technology and personnel support, office work, accounting and reporting).

Upon approval

Features of compilation

When drawing up wage regulations, it is necessary to take into account the following features:

- it may include the procedure and features of paying bonuses to employees, and therefore there is no need to adopt a provision on bonuses;

- the document is drawn up by employees of the personnel service or accounting department, taking into account the opinion of the representative body of employees and approved by the head of the company (IP);

- if the wage provision contains norms that contradict current labor legislation, the employer faces a significant fine;

- The validity period of the provision, as well as the procedure for its mandatory revision, is not determined by law, therefore there is no need to draw up a new document unless necessary.

Who should make the position

Existing rules establish that the Regulation on remuneration or other local act in the field of regulating the calculation of wages becomes mandatory for development and adoption if a business entity has concluded employment contracts.

In general, the Regulations may also be an optional document if issues related to the regulation of wages are reflected in the Internal Regulations, the Collective Agreement and other regulatory documents.

Due to the fact that labor law provisions provide for several options for resolving issues, it must be established which of them is applied in a given organization. This can only be done by issuing an appropriate local regulatory act valid within the company.

Attention: the importance of specifying payroll is of particular importance when the working conditions of employees differ from normal ones.

The company administration makes the decision on which specific regulatory act and how many should be issued independently.

In addition, it is typical for small businesses to combine several in one act. For example, such an entity may have a Regulation on remuneration and bonuses for employees, which includes both the Regulation on payment and the Regulation on bonuses.

In large enterprises with a significant number of workers, similar regulations are issued separately. Therefore, a large company can simultaneously have a significant number of local regulatory documents.

Attention: in these cases, the rules of law for regulating wages may be contained in several acts at once. Therefore, when compiling them, it is important to check their consistency, since in case of contradiction, the documents may be declared invalid.

The development of the Regulations is carried out by specialists from the economic department, after which the project is agreed upon with the trade union bodies, etc.

Contents of the wage regulations

There are no clear indications of which sections must be included in the salary regulations, however, it is recommended to include the following information:

- General provisions (regulatory acts regulating the issues of remuneration in a company or individual entrepreneur, the circle of persons covered by this document, persons responsible for issuing wages and bonuses, the procedure for sending a pay slip to an employee).

- Information on the procedure for paying wages (the remuneration system used in the organization, the size of the salary, the procedure, place and deadline for paying wages, the specifics of paying salaries to seasonal workers, employees working in the Far North and other categories of workers whose working conditions deviate from normal).

Note: features of remuneration in conditions deviating from normal conditions can be separated into a separate section.

note

, that from October 3, the terms of payment of wages have changed. If previously the employer could issue it at any time, but at least 2 times a month, now the salary must be transferred to the employee no later than the 15th of the next month. The gap between the advance and salary should still not exceed 15 days. Penalties have also been increased for violation of salary payment deadlines.

- The procedure for bonuses for employees. This section is included in the Regulations if a separate document on bonuses for employees in the organization or individual entrepreneur is not established.

- Other terms of remuneration.